PDF Attached includes FI’s US acreage table that includes adjustments to canola (+) and spring wheat (-)

Note

due to US Veterans Day, EIA data will be released on Thursday am CT and USDA Export Sales on Friday.

Lack

of direction trade today as the wheat led feedgrains related markets lower.

MOST

IMPORTANT WEATHER IN THE WORLD

- Tropical

Storm Eta became a hurricane this morning and will move inland between Tampa Bay and Cedar Key, Florida Thursday - The

storm center at 0700 EST today was 130 miles south west southwest of Fort Myers, Florida moving north northeasterly at 15 mph and producing 75 mph wind speeds - Landfall

is expected Thursday morning as a tropical storm and quick weakening is expected - The

storm will be downgraded to depression status as it moves across northern parts of the Florida Peninsula - Damage

to citrus is expected to be minimal - Property

damage will be greatest along the coast from Tampa Bay to Cedar Key Florida, but it will be light - Tropical

Storm Theta remains a minimal threat to land in the eastern Atlantic Ocean - The

storm center was 740 miles southwest of the Azores - The

system will lose tropical characteristics and merge with a mid-latitude frontal system late in the weekend and more likely early next week

- Moisture

from the system will enhance rain in the United Kingdom next week - Tropical

disturbance over Puerto Rico today was producing heavy rain - This

system will become the next tropical depression after it moves into the Caribbean Sea over the next couple of days - The

system has potential to become Tropical Storm Iota during the weekend or early next week with movement toward Nicaragua and Honduras - Santiago

del Estero, Argentina received some beneficial rainfall overnight, but mostly in western parts of the province - Portions

of western and northern Argentina will get rain over the coming ten days while central and eastern Argentina remains dry

- Crop

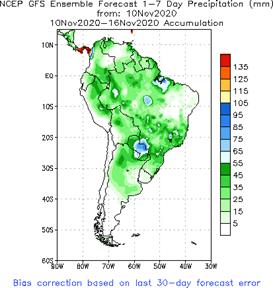

stress will continue to rise and worry over crop emergence and establishment will continue rising from Santa Fe into Entre Rios, Corrientes and parts of northeastern Buenos Aires - Brazil

weather Tuesday trended drier again except from Mato Grosso do Sul into western and southern Parana and Santa Catarina - Rain

was welcome in these southwestern crop areas with a few local totals of 1.00 to 2.00 inches in central Mato Grosso do Sul - Most

other areas only received light rainfall - The

remainder of Brazil’s crop country was left dry - Most

of Brazil excepting the far northeast and extreme south will get rain at one time or another during the next ten days to two weeks - The

precipitation will be greatest from Mato Grosso through Goias to Minas Gerais and most erratic and light from Rio Grande do Sul to southern Paraguay and southwestern Parana - South

Africa rainfall will continue concentrated on central and some eastern crop areas over the next ten days maintaining a very good outlook for summer coarse grain, oilseed and cotton planting and establishment - Greater

rain may be needed in western summer crop areas soon - Winter

wheat, barley and canola maturation and harvesting are advancing around the periodic rainfall - India

rainfall will continue most significant in the south and periodically in the far eastern states during the next ten days - Late

season summer crop development, maturation and harvesting will advance around the precipitation - Winter

crop planting will also continue to advance most significantly in the central and northern parts of the nation where winter crop establishment has been good thus far

- Eastern

China weather is expected to remain mostly very good for the next two weeks - Net

drying through the weekend will promote summer crop harvesting and late season wheat and rapeseed planting - Rain

expected next week from east-central China into the North China Plain and Yellow River Basin will be extremely well timed for winter crop establishment - Australia

precipitation over the next ten days will be erratic and mostly too light to have a big impact on agriculture - Dry

conditions will be perfect maturing winter crops and supporting their harvest - Dry

conditions will also support additional summer crop planting - Rain

is needed for dryland summer crops and not much is expected for a while - Russia’s

Southern Region will experience little precipitation of significance over the next ten days and temperatures will trend cooler - The

environment will push more winter crops from Ukraine and the Balkan Countries of Europe to Kazakhstan into a state of semi-dormancy - Recent

precipitation improved winter crop establishment in many areas, but snow cover will be needed to adequately protect the poorly established winter crops from damage due to periodic bitter cold this winter - Most

other areas in Russia, western Ukraine, Belarus and the Baltic States will have had a favorable winter crop establishment season this year and production potentials are good for the spring - Europe

weather remains unusually tranquil because of a dominating high-pressure ridge aloft that is keeping precipitation limited to northwestern parts of the continent - Winter

crops have established, and some are trending dormancy - Winter

crops in Spain are being planted and should be establishing relatively well - North

Africa is seeking greater rainfall to support the best possible wheat and barley planting this year - Some

planting is under way with late November and December most important for planting and establishment - U.S.

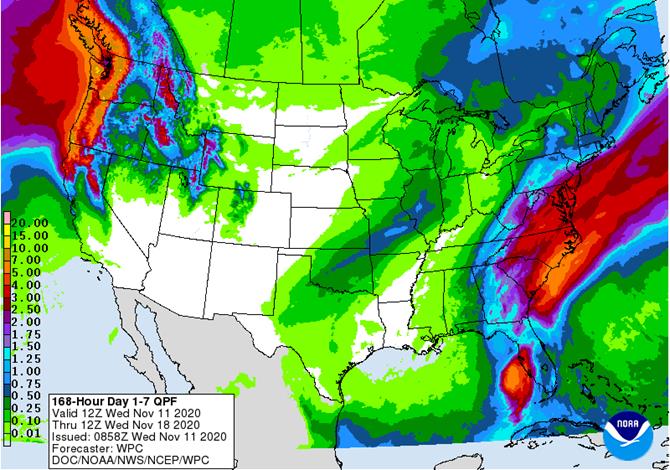

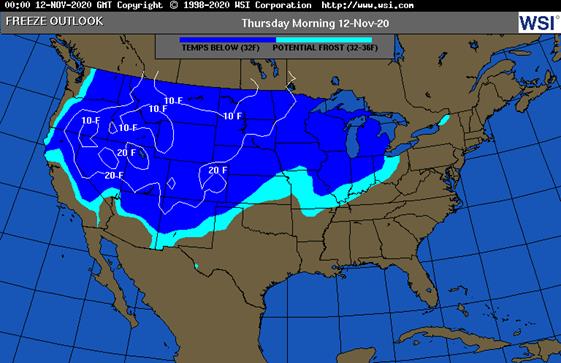

crop weather will be mixed for a while - No

major storm systems are expected for a while - Drying

is needed in the Midwest after abundant precipitation Tuesday - Snow

fell significantly Tuesday from northeastern Nebraska, northwestern Iowa and southeastern South Dakota into northeastern Minnesota with 3 to 7 inches common and local totals to 10 inches - Rain

will impact crops in the southeastern states through Friday - U.S.

hard red winter wheat areas will need more moisture especially in the west to ensure the best emergence and establishment - Rain

in central and eastern wheat areas of Kansas and Nebraska Monday was good for future crop establishment - Some

snow fell in the northwest part of wheat country overnight with accumulations light - Another

precipitation event will impact a part of the region Friday, but only light moisture is expected and areas from western Texas to southeastern Kansas will be wettest - U.S.

Northern Plains have snow on the ground in Most of Montana, northwestern most North Dakota and from central South Dakota into a part of west-central Minnesota - Snow

accumulations in the east Monday and overnight were mostly less than 3.50 inches

- U.S.

Delta weather will be good for fieldwork of all kinds during the next ten days - U.S.

Southeastern States will experience delays to farming activity through Friday because of expected rain, but drier weather will soon follow.

- Waves

of precipitation are expected in the Pacific Northwest and Great Basin during the next ten days with some rain in central and northern California as well

- The

moisture will be welcome and should improve soil moisture for better winter crop establishment - Mountain

snowpack should increase for better runoff in the spring - Southeast

Canada’s grain and oilseed areas will experience a little precipitation today and again Sunday into Monday; dry weather will occur most other days - The

environment will be good for harvesting - Typhoon

Vamco was located 110 miles east of Manila, Philippines today moving west northwesterly and will move across southern Luzon Island today

- Heavy

rain, flooding and damaging wind speeds are expected - More

Urban areas will be impacted by this storm than agricultural areas - The

storm will move across the South China Sea late this week with landfall in central Vietnam during the late weekend as a tropical storm or depression - Less

rain is now advertised for central Vietnam relative to that of recent past days - Damage

to crops and property is expected in both countries, although it may not be extensive - Vietnam’s

central coast will receive another 3.00 to 10.00 inches of rain this weekend as Tropical Cyclone Vamco moves across the region

- Flooding

has been and will continue a serious impact along the central Vietnam coast where impressive rain totals in the past 30 days - More

disruption to commerce and shipping will occur because of the additional rain - This

is the final tropical cyclone in a long series that has been impacting Vietnam; much improved weather will begin next week - Southern

Oscillation Index was +2.13 this morning; the index will rise later this week - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation and harvesting

- Portions

of Central America will remain wetter than usual into mid-month - Rain

will be greatest in Guatemala, El Salvador, Costa Rica, Nicaragua and Panama

·

West-central Africa will experience erratic rain through the next ten days favoring crop areas closest to the coast

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year

·

East-central Africa rain will be erratic and light over the coming week in Ethiopia while rain occurs frequently from Uganda and southwestern Kenya into Tanzania

- Ethiopia

will be wetter next week while showers and thunderstorms continue elsewhere

·

New Zealand rainfall will be near to above average in North Island while near to below average in South Island

- Temperatures

will be near to below average

Source:

World Weather Inc.

Wednesday,

Nov. 11:

- HOLIDAY:

U.S. (Veterans Day, federal govt closed, CME trading unaffected), France, Canada

Thursday,

Nov. 12:

- Port

of Rouen data on French grain exports - Vietnam

customs data on coffee, rice and rubber exports in October - EIA

U.S. weekly ethanol inventories, production - EARNINGS:

BayWa, Marfrig

Friday,

Nov. 13:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- NOTE:

CFTC Commitments of Traders report, usually released on Fridays, is scheduled for Monday, Nov. 16, due to U.S. federal holiday - FranceAgriMer

weekly update on crop conditions - New

Zealand Food Prices

Saturday,

Nov. 14:

- China

Animal Agriculture Association summit on hog recovery, ASF vaccine progress

Source:

Bloomberg and FI

Macros

OPEC

Sees 2020 World Oil Demand Falling By 9.75Mln BPD (prev 9.47Mln BPD Drop)

Corn.

-

Another

session of higher prices early on follow though buying was buoyed by lack of news and data along with lower wheat that sparked profit taking. You can argue soybean/corn spreading for today’s trade.

-

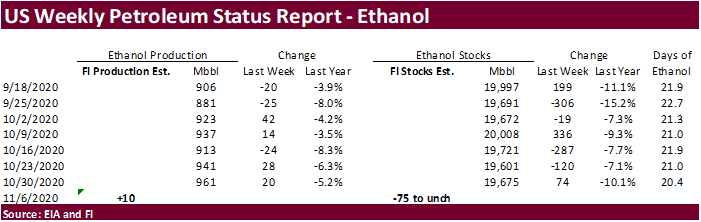

US

EIA data is delayed one day (out Thursday at 10:00 CT) likely due to Veterans Day.

-

The

December/March corn spread has collapsed over the past several sessions in part to fund rolling and anticipation US corn exports will surge after the end of the year. China commitments for US corn are running nearly 11 million tons (not including 6 million

tons for unknown). Of the nearly 11 million tons, shipments are running just over 2 million tons. Some think it’s a gamble to see if US corn exports reach USDA’s projection as there are differing opinions in China’s 2020 crop production. Yesterday in its

monthly S&D update, China said the typhoon storms had minimal impact on production while last week the USDA Attaché said they lost a large amount of the crop. USDA official raised China corn imports to 13 million tons, likely considering what is on the USDA

export sales book. Meanwhile China corn imports in the CASDE S&D updated were unchanged at 7 million tons. We are not siding with China’s outlook, just pointing out there is now a big variance in opinions.

-

Today

was day 4 of the GS roll.

·

Germany’s 2020 corn was projected to increase about 10% on the year to 4.03 million tons – Germany’s association of farm cooperatives. This has not slowed EU’s appetite for feedgrains demand.

-

Ukraine

corn prices are up $10/ton over the past few days to $235-$272/ton, according to APK-Inform.

·

Louis-Dreyfus agreed to sell a 45% indirect stake in Louis Dreyfus Co. to Abu Dhabi sovereign wealth fund ADQ.

·

The USDA Broiler report is delayed one day.

·

A Bloomberg survey calls for weekly ethanol production to be up to 975 thousand barrels from 961 thousand from the previous week, and stocks to end up at 20.114 million barrels, up from 19.675 million.

Corn

Export Developments

-

Results

awaited: Iranian state-owned animal feed importer SLAL seeks up to 60,000 tons of animal feed corn, 60,000 tons of feed barley and 60,000 tons of soymeal, on Wednesday, Nov. 11, for shipment in December 2020 and in January 2021.

Updated

11/10/20

March

corn is seen trading up into the $4.45-$4.55 area.