PDF Attached

Wide

trade in the agriculture markets after USDA released their November S&D updates. January soybeans traded in a 59.50 cent range, December corn in a 16.25 range and December Chicago wheat in an 18.75 cent range. Post report soybeans rallied about 45 cents,

and this stopped out many shorts.

USDA

released their November S&D and crop production reports

Reaction:

Bullish

out of the gate. We think traders oversold the market over the last week in anticipation for higher corn and soybean yields that likely failed to live up to expectations. The soybean yield of 51.2 was 0.7 bushels below trade expectations and corn yield 177.0

was only 0.1 bushel above an average trade guess. Looking at the changes in US soybean and corn demand, we don’t view this report this bullish. We need to see US export demand to improve for corn & wheat, and keep up with pace for soybeans, to get us back

into the buying camp.

USDA

NASS executive summary

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

The

US corn supply was taken up 43 million bushels with production standing at 15.062 billion, 12 million above trade expectations, and is 951 million bushels above 2020. USDA lowered its 2021-22 US corn carryout by only 7 million bushels to 1.493 billion, 13

million above trade expectations. US made a slight change to its 2020-21 corn for ethanol use, lowering it 4 million bushels to 5.025 billion. For 2021-22, USDA took corn for ethanol use up 50 million bushels, as expected, to 5.250 billion. They left the

other demand categories unchanged. As a result, stocks were taken down 7 million bushels. World corn production was increased 6.4 million tons to 1.205 billion tons, and stocks increased 2.7 million to 304.4 million. USDA increased Argentina’s corn production

by 1.5 million tons to 54.5 million (increase in corn area). EU corn was lifted 1.6 million tons to 67.9 million. Note 2020-21 world corn production was revised higher by 3.5 million tons (in part to upward revisions to Argentina (0.5) and other smaller

producing countries.

US

soybean production was lowered 23 million bushels from the previous month to 4.425 billion bushels and was 59 million below trade expectations. This was likely the bullish data point that allowed soybean futures to shoot up 45 to 50 cents out of the gate.

Since then, prices have settled down. Note US soybean production is 209 million bushels above 2020. USDA increased its carryout for the US soybean carryout by 20 million bushels to 340 million but was 22 million below trade expectations. USDA made no changes

to its 2020-21 US soybean balance sheet, as expected. For 2021-22, USDA lowered their export program by 40 million bushels, more than what we thought they would do, but justified as September exports were only 80 million bushels. They lowered seed use by

2 million bushels. With supply down 23 million, stocks were taken up 20. For the products, USDA made appropriate adjustments to accommodate for the NASS crush report for soybean meal and soybean oil ending stocks. 2021-22 meal and soybean oil demand was

left unchanged. Meal stocks were left at 400,000 short tons and soybean oil was boosted 114 million pounds to 1.912 billion. US crush was left unchanged. We don’t see much in the way of bullish sentiment for the changes in the US soybean complex. World

soybean production was reduced one million tons to 384 million and stocks were lowered 0.8 million to 103.8 million. Argentina soybean production was taken down 1.5 million tons to 49.5v million, at the expense to losing acreage to corn. Brazil exports were

taken up 1 million tons to 94 million and China imports were lowered 1 million tons to 100 (more in line with China CASDE), which are not bullish changes by USDA.

There

was no change to US all-wheat production. USDA increased the all-wheat carryout by 3 million bushels to 583 million, 2 million above an average trade guess. USDA lowered US imports by 10 million to 115 million and took food down 2 million. Exports were

revised lower by 15 million bushels. As a result, we saw ending stocks revised higher by only 3 million. By class, USDA reduced HRW stocks by 12, increased HRS by 14, took SRW down 1 million, increased white by 5 and lowered durum by 3 million. Global wheat

production was lowered 0.6 MMT to 775.3 million and stocks were taken down 1.4 million to 275.8 million. USDA did not make any changes to Canadian or Australian production, but they did lower the EU by 1 million and take Russia up 2 million.

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Far

southern Brazil will receive limited amounts of rain over the coming ten days leading to net drying in many areas from Sao Paulo into southern Mato Grosso do Sul and in Rio Grande do Sul as well as parts of southern Paraguay - Some

showers and thunderstorms will occur from Parana into southern Mato Grosso do Sul and southeastern Paraguay, but resulting rainfall may not be enough to counter evaporation - Sufficient

rainfall may occur to support crops, but the need for greater rain will be steadily rising as time moves along - Rio

Grande do Sul, Brazil will be driest with little to no rain until Tuesday and Wednesday of next week when 0.50 to 1.50 inches of rain is advertised with some locally greater amounts

- Confidence

in this rain event and another that occurs in far southern Brazil Nov. 21-22 is low and future model runs will be closely monitored - Center

west through center South Brazil and in a few northeastern areas will be frequently and abundantly wet during the next ten days to two weeks

- Rainfall

may be heavy at times from Mato Grosso to Minas Gerais, Tocantins and a part of southwestern Bahia - Rainfall

will vary from 3.00 to more than 6.00 inches during the next ten days in these areas - Most

of the precipitation will be spread out over multiple days limiting the occurrence of serious flooding, but some excessive moisture and minor flooding should be anticipated - Most

of Bahia, Piaui and Maranhao and Pernambuco will see 1.00 to 3.00 inches with local totals over 4.00 inches - Brazil

temperatures will be near to below average in this first week of the outlook and slightly warmer next week - Argentina

temperatures will be near normal this week and next week - Argentina

will see a good mix of rain and sunshine over the next two weeks with seasonable temperatures. - That

should prove to be supportive of winter crop development and summer crop planting and ongoing development

- The

bottom line for Brazil and Argentina during the next two weeks remains mostly favorable for summer crop development and field progress. Some areas in center west and northern parts of center south Brazil will be a little too wet at times while periods of drying

in southern Brazil, Uruguay, southern Paraguay and parts of extreme eastern Argentina will be closely monitored, but for now many of these areas get at least a little timely rainfall to stave off a more significant bout of dryness. Watch future forecast model

runs for signs of turning drier in eastern Argentina, Uruguay, southern Paraguay and southern Brazil, but for now crop conditions will stay favorable.

- A

mini-blizzard will evolve in the upper Midwest Wednesday into Friday of this week

- The

storm will produce 3 to 6 inches of snow and locally more in northern Minnesota, northeastern North Dakota and southern Manitoba, Canada as well as neighboring areas of western Ontario and northwestern Wisconsin - Snowfall

of a trace to 3 inches will occur in the remainder of North Dakota, southern Minnesota and eastern South Dakota as well as the remainder of Wisconsin - Strong

wind speeds of 25-35 mph and gusts to 45 will be possible during the height of the storm’s intensity Thursday and Friday - Rain

from the same blizzard noted above will move from west to east across the Midwest Wednesday into Friday causing a brief disruption to farming activity - U.S.

Midwest farming weather today will remain very good as it will be in the Delta and southeastern states - Moisture

in the Delta and southeastern states will occur Thursday and Friday - A

follow up storm in the northern U.S. Plains and Midwest this weekend will produce additional snow and rain - Snowfall

of 2 to 6 inches will occur from northwest to southeast across North Dakota and 2 to 5 inches in northeastern South Dakota, southern Minnesota and areas east into southern Michigan with a trace to 3 inches occurring immediately to the south into northern Illinois,

northern Indiana and northern Ohio - Rain

will fall to the immediate south from South Dakota and a part of Nebraska to the lower Midwest - Most

of the rain from this system will stay north of the Delta and southeastern states - A

couple of other U.S. storm systems are expected next week to bring additional bouts of light precipitation and maintaining a slower harvest pace for some areas - No

significant precipitation is expected in western U.S. hard red winter wheat production areas southward into West Texas during the next ten days - Rain

is expected in some eastern wheat areas Wednesday of this week only - Moisture

shortages in wheat areas from Colorado to the Texas Panhandle will maintain concern over unirrigated winter crop conditions - West

Texas harvest weather should be mostly good over the next week to ten days - U.S.

Pacific Northwest weather will remain active this week and into early next week before drier biased conditions evolve later next week - Northern

California stormy weather pattern will end after Wednesday with a period of more limited precipitation to follow for up to ten days - Most

U.S. crop areas were dry Monday, although rain continued from the north half of California into western parts of Washington and Oregon - Limited

precipitation is still expected in the northwestern U.S. Plains and central parts of Canada’s Prairies through the next ten days, but these areas will start seeing some periodic shots of snowfall - U.S.

temperatures this week will be near to below normal with the coolest bias expected from the northern Plains into the heart of the Midwest this weekend through early next week

- Today

will still be a warm biased day with the same will be true Wednesday in the eastern U.S.

- The

U.S. bottom line will be good for late season farming activity today and Wednesday and then there will be some disruption to fieldwork later this week and into next week. None of the delays are expected to become a serious threat to late season fieldwork.

Planting wheat and its establishment would improve with a longer period of dry and warm weather, but the situation is not critical at this point in time. Cotton harvest progress in West Texas will advance well, but progress in the Delta and southeastern states

may be briefly disrupted from time to time without seriously deteriorating the remaining crop conditions - Australia

weather is expected to be active for a few more days this week and then drier weather is expected during the weekend and next week

- Drier

weather will be needed to improve crop maturation and harvest conditions for wheat, barley and canola - The

rain in Queensland and some areas in New South Wales will be ideal for the advancement of summer crop planting, emergence and development especially in unirrigated areas - Livestock

conditions will be improving as well due to better grazing conditions resulting as soil moisture gets better and grass development accelerates - Precipitation

in Russia and Ukraine will be restricted for ten days from much of Ukraine into the Volga Basin north of Russia’s Southern Region and southeast of Russia’s Central Region - Moisture

will occur in all other areas and in sufficient amounts to bolster soil moisture for use in the spring - Some

significant snow will fall this week across northern Russia which should expand snow cover that has been mostly confined to areas east of the Ural Mountains recently - Winter

crops in Russia and Ukraine are adequately established even though there is need for more moisture in Ukraine and the middle and lower Volga Basin. As long as snow cover is present during extreme weather during the winter crops in these areas should perform

well in the spring as long as soil moisture has improved by that time. - China’s

big snowstorm in the northeast is winding down today - The

storm produced enough snow to stall transportation, close businesses and schools and may have come with some power outages and localized crop damage - Improving

weather is expected today into next week - Much

of eastern China will be dry biased from Wednesday of this week through the middle part of next week

- Cold

conditions will occur for the next couple of days and then some welcome warming is expected

- Temperatures

will become warmer biased this weekend into next week - Precipitation

is expected to be limited with areas south of the Yangtze River most likely to see a little rain

- Most

of China’s adverse weather has been confined to the northeast provinces and it will be ending today and early Wednesday. Late season fieldwork will be on hold with some unharvested crops buried in snow. Livestock stress will be reduced over time in the northeast.

Dry or mostly dry conditions in the Yellow and Yangtze River Basins will be very good for late season summer crop harvesting and the planting of rapeseed and a few other late season crops.

- A

weak tropical cyclone in the Arabian Sea this week will drift west southwesterly over open water and not have much impact on crops this week - Another

tropical cyclone will evolve in the southern Bay of Bengal today and move northwest while intensifying

- Landfall

is possible in southern Andhra Pradesh near the Tamil Nadu border Thursday

- Heavy

rain and flooding are expected in northeastern Tamil Nadu, southern Andhra Pradesh and southeastern Karnataka during the middle to latter part of this week - Some

damage to rice, cotton and a few oilseed crops might result from this event.

- A

few areas of flooding will also occur in sugarcane areas, but damage to that crop because of wind and flooding should be low - All

other areas in India will experience dry and warm conditions favoring fieldwork of all kinds - South

Africa rainfall Monday was scattered in south-central parts of the nation - Resulting

rainfall was greatest in Eastern Cape coastal areas - Key

summer crop areas were left with only a few light showers - Greater

rain is needed in South Africa to improve summer crop planting, emergence and establishment conditions

- Western

rainfall in the nation should be minimal for summer crops leaving a strong need for significant moisture over the next two weeks - Eastern

crop areas will see periodic rainfall and all of it will be welcome, but larger volumes of rain may still be needed - Good

harvest weather continues in winter crop areas - Europe

weather will be favorable for fieldwork of all kinds this week, although it will have to advance around brief bouts of light rainfall - Italy

and the Adriatic Sea region will see frequent bouts of rain this week with some of the moisture eventually pushing deeper into the Balkan Countries - Indonesia

and Malaysia weather will be wet biased over the next two weeks with frequent rain expected over saturated or nearly saturated soil causing some flooding - Coastal

areas of Central Vietnam will trend wetter than usual later this week through early next week resulting in some flooding from Da Nang and Hue southward to Nha Trang - Rain

totals in the coming week may range from 5.00 to 15.00 inches resulting in some flooding, but mostly along the coast - Some

of the heavy rain may eventually push into the Central Highlands of Vietnam, but confidence is low

- Philippines

weather will remain favorably mixed with rain and sunshine through the next two weeks - Central

parts of Algeria’s coastal region received heavy rainfall during the weekend with amounts pushing up to 5.00 inches through dawn Sunday

- Much

lighter rain fell in other areas in northern Algeria while Tunisia and Morocco were left mostly dry - Additional

rain will fall along the central Algeria coast periodically today and Thursday with another 1.00 to 2.00 inches - A

part of the region received excessive rain during the weekend - Tunisia

and Morocco will not likely get much rain from this event - Southwestern

Morocco remains in a multi-year drought with little rain of significance expected over the next couple of weeks - West-central

Africa will experience a good mix of weather during the next ten days to two weeks - Less

frequent rain in cotton areas will translate into better crop maturation conditions - Coffee,

cocoa, sugarcane and rice will also benefit from less frequent and less significant rainfall, although completely dry weather is not likely for a while - East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops - Mexico’s

weather will drier biased for the next ten days except along the lower east and southwestern coasts where periodic rainfall is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Costa Rica and Panama - Colombia,

northern Peru and Ecuador rainfall is expected to be light to moderate over the next week to ten days - Coffee,

sugarcane, corn and a host of other crops may have been impacted by too much rain earlier this season resulting in some harvest delay - Conditions

should be improving over the next ten days - Central

Asia cotton and other crop harvesting should be winding down, but late season fieldwork should advance well - Today’s

Southern Oscillational Index was +7.63 and it was expected to drift higher over the coming week - New

Zealand rainfall is expected to be near to above average except along the lower east coast of South Island where precipitation may be a little lighter than usual

- Temperatures

will be seasonable.

Tuesday,

Nov. 9:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - China

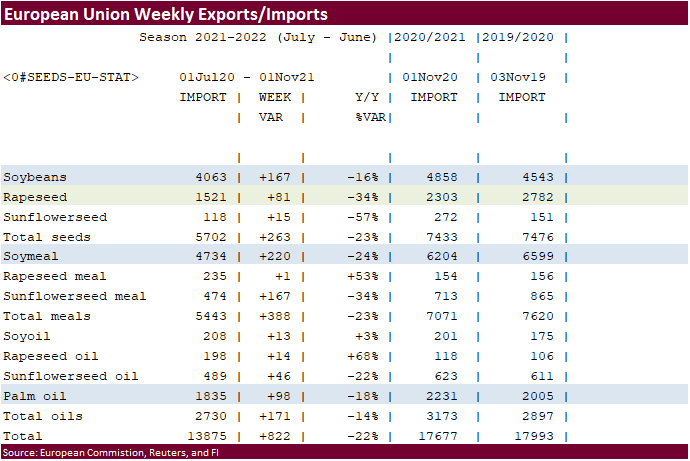

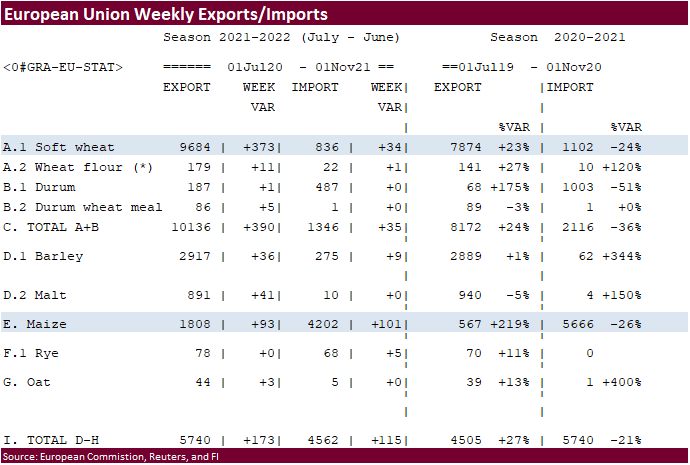

farm ministry’s CASDE outlook report - EU

weekly grain, oilseed import and export data - France

agriculture ministry crop production estimates - U.S.

Purdue Agriculture Sentiment, 9:30am

Wednesday,

Nov. 10:

- EIA

weekly U.S. ethanol inventories, production - Vietnam’s

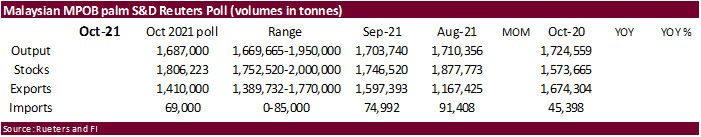

customs department publishes October commodity trade data - Malaysian

Palm Oil Board’s data on October output, exports and stockpiles, 12:30pm Kuala Lumpur - Malaysia’s

Nov. 1-10 palm oil export numbers by cargo surveyors - FranceAgriMer

monthly grains report

Thursday,

Nov. 11:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

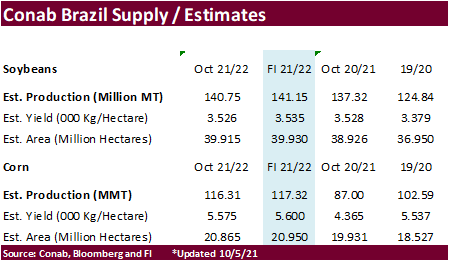

Conab releases data on yield, area and output of corn and soybeans (tentative) - New

Zealand Food Prices - HOLIDAY:

France

Friday,

Nov. 12:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

USDA

delayed the release of FSA prevented plantings until Wednesday.

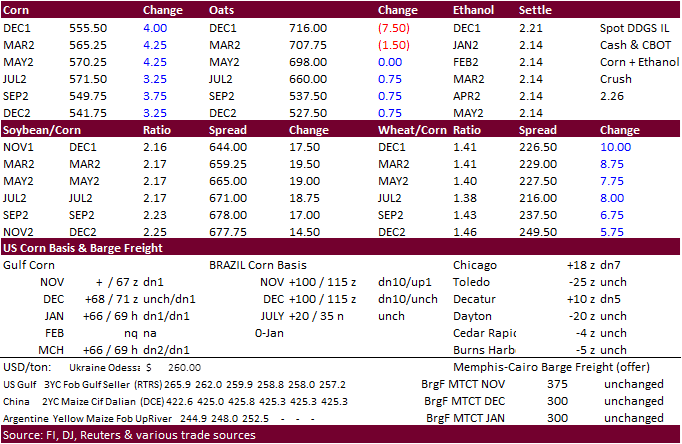

Corn

·

Corn futures ended higher on technical buying, higher soybeans and strength in wheat. Short covering post USDA report was observed after corn traded down five consecutive days. The USDA report confirmed expectations for a higher

US corn yield and increase in US corn for ethanol use projection. Today was the third day if the Goldman roll and there was some bull spreading before the USDA report. Yesterday’s harvest report came in slightly below expectations but favorable weather this

week should advance progress.

·

China issued its monthly S&D’s and they left the corn balance largely unchanged. They did raise old crop corn imports by 3.56 million tons to 29.56 million. USDA may adjust their China corn imports (currently 28MMT) thus reducing

global inventories. China in its monthly update took old crop soybean imports up by 1.2 million tons to 99.78, in line with other trade estimates. New crop corn and soybean S&D’s (2021-22) were left unchanged.

·

Germany reported another case of bird flu on another farm in the northeast.

·

China reported an outbreak of African Swine Fever on Hainan Island. The farm were the virus was found had 1,063 animals.

·

Heavy snow is impacting Northeast China and will last through November 11. Some are calling it a historical event and impact logistics.

·

Argentina producers sold 44.1 million tons of corn for the 2020-21 season, 4.3 million tons greater than this time last season.

·

US export developments are quiet.

·

Keep an eye on the Ukraine corn fob market. AgriCensus noted physical corn offers dropped by around $4/mt since the start of November to around $276-$280/ton FOB.

·

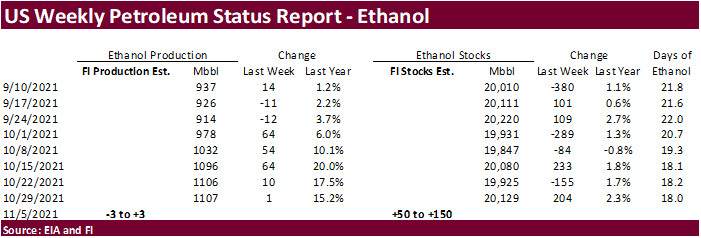

A Bloomberg poll looks for weekly US ethanol production to be down 10,000 barrels (1012-1120 range) from the previous week and stocks up 239,000 barrels to 20.368 million.

Export

developments.

-

Turkey

seeks 325,000 tons of corn on November 15 for shipment sought between Dec. 20 and Jan. 20.

Updated

11/01/21

December

corn is seen in a $5.30-$5.80 range

March

corn is seen in a $5.25-$6.00 range

·

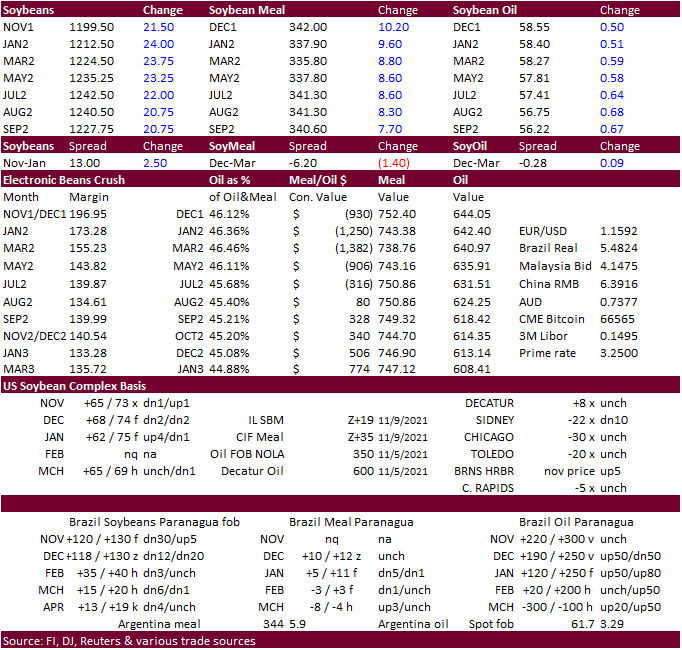

CBOT soybean

complex was the leader today after USDA surprised the trade by reporting production 59 million bushels below expectations. Keep in mind they lowered exports by 40. US soybean stocks were upward revised by a less than expected 20 million bushels (22 million

below trade average). Short covering post USDA report knocked many shorts out of the market. Soybean prices jumped about 45 cents. Prior to the report January soybeans fell to their lowest level since March 31 on Monday. Today January soybeans went off

23.50 cents higher at $12.12.

·

Soybean oil finished 42-44 points higher. It was lower earlier after palm oil traded little more than 100 points lower. We are hearing comments from several traders on soybean oil direction. Most of them remain bullish amid

renewable fuel feedstock demand. Bears noted the increase in soybean oil stocks by USDA of 114 million pounds to 1.912 billion pounds.

·

Soybean meal rallied led by December (bull spreading). Spreads were firm prior to the USDA report. The bull spreading could be related to the Goldman roll, unexpected downtime for a couple crush facilities (power and fire issues),

or crushers lifting hedges. January crush is sitting at $1.73, up 2.50 cents today.

·

Argentina producers sold 33.6 million tons of soybeans for the 2020-21 season, behind 34.8 million tons last season.

·

China issued its monthly S&D’s and they left the corn balance unchanged and raised soybean imports by 1.2 million tons to nearly 100 million tons, in line with other trade estimates.

·

It looks like some of the power issues in China are starting to ease. Zhejiang province ended electricity rationings on Monday.

·

Russia set its export tax for sunflower oil at $276.7 per ton for December, up from $194.5 per toe in November. The December tax is based on an indicative price of $1,395.4 per ton (Reuters).

Export

Developments

- South

Korea is in for 115,000 tons of GMO-free soybeans on November 17 for arrival in South Korea in 2023.

- Egypt

announced they seek vegetable oils for Jan 5-25 arrival.

Updated

11/8/21

Soybeans

– January $11.60-$12.50 range, March $11.50-$13.50

Soybean

meal – December $320-$340, March $310-$360

Soybean

oil – December 57-60 cent range, March 56-65

·

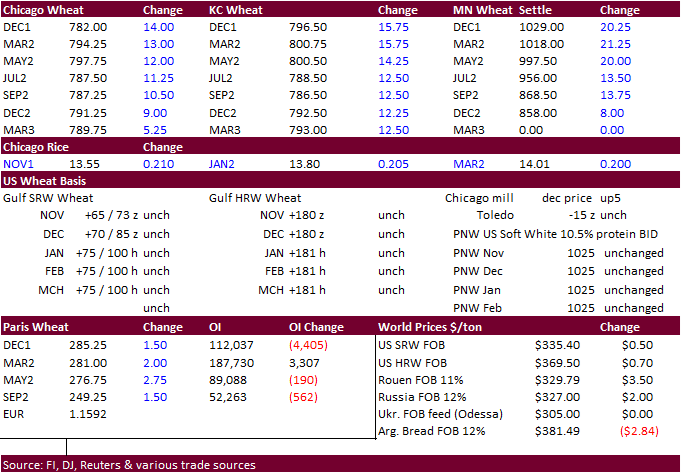

US wheat prices took off to the upside post USDA report, in part to sharply higher soybeans. USDA increased the US carryout by 3 million bushels, near expectations, but lowered EU wheat production by 1 million tons. They took

global ending stocks down 1.4 million tons.

·

Paris December wheat was up 1.50 euros at 286/ton.

·

The US weather forecast calls for a follow up snowstorm to fall across the northern Plains and upper Midwest this weekend. o Snowfall of 2 to 6 inches will occur from northwest to southeast across North Dakota and

2 to 5 inches in northeastern South Dakota, southern Minnesota, and areas east into southern Michigan, according to World Weather Inc.

·

Australia will see active weather for a few more days. Drier weather is seen this weekend into early next week which will be good for the wheat crop.

·

Ukraine is still in need of more precipitation.

·

(Reuters) – France’s farm ministry on Tuesday raised its estimate for 2021 soft wheat production in the European Union’s biggest grain grower to 35.5 million tons from the 35.2 million projected last month.

Export

Developments.

·

The UN is in for 110,000 tons of milling wheat for Ethiopia. 40,000 tons was for delivery between Dec. 20, 2021, and Jan. 5 2022, another 20,000 tons for delivery between Jan. 5–20, 2022, and 50,000 tons also for delivery between

Jan. 5–20, 2022.

·

Results awaited: Separate import tender. Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Jordan seeks 120,000 tons of animal feed barley on Nov. 10 for shipment combinations of March 1-15, March 16-31, April 1-15 and April 16-30.

·

Tunisia seeks 100,000 tons of wheat and 75,000 tons of barley on November 10.

The

wheat is sought for shipment between Dec. 1, 2021 and Jan. 15, 2022. The barley is sought for shipment between Dec. 15, 2021 and Jan. 20, 2022.

·

The Philippines bought 50,000 tons of feed wheat from Australia late last week at about $365 a ton c&f for shipment between December 2021 and January 2022.

·

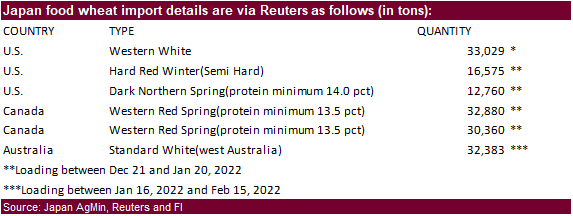

Japan seeks 157,987 tons of food wheat this week from the US, Canada, and Australia.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

·

None reported

Updated

11/01/21

December

Chicago wheat is seen in a $7.30‐$8.25 range, March $7.25-$8.40

December

KC wheat is seen in a $7.35‐$8.35, March $7.00-$8.50

December

MN wheat is seen in a $9.70‐$11.50, March $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.