PDF Attached

USDA

released its annual baseline S&D’s

-

USDA

FORECASTS 2021/22 U.S. CORN PLANTINGS AT 90.0 MILLION ACRES, CROP AT 14.890 BILLION BUSHELS -

USDA

FORECASTS 2021/22 U.S. SOYBEAN PLANTINGS AT 89.0 MILLION ACRES, CROP AT 4.465 BILLION BUSHELS -

USDA

FORECASTS 2021/22 U.S. ALL-WHEAT PLANTINGS AT 46.0 MILLION ACRES, CROP AT 1.890 BILLION BUSHELS -

USDA

PROJECTS 2021/22 U.S. CORN ENDING STOCKS AT 2.257 BILLION BUSHELS, SOY ENDING STOCKS AT 255 MILLION BU, WHEAT ENDING STOCKS AT 830 MILLION BU

Weather

and Crop Progress

MOST

IMPORTANT WEATHER IN THE WORLD

- Argentina

and Brazil received insignificant precipitation during the Friday through Sunday period and temperatures were warm enough to accelerate drying across both countries - Topsoil

moisture was already exhausted in Argentina Friday outside of Buenos Aires and immediate bordering areas.

- Topsoil

moisture in Brazil was already short to very short from western Rio Grande do Sul and Paraguay to western Sao Paulo, southwestern Minas Gerais and parts of southeastern Goias Friday with short topsoil moisture in Mato Grosso do Sul - Limited

rain and warm weather during the weekend has further depleted soil moisture and raised stress for recently emerged crops in all of the above areas - Soil

conditions are rated favorably in Bahia, northern and eastern Minas Gerais, Espirito Santo, Rio de Janeiro and eastern Mato Grosso, but timely rain must continue

- The

next ten days of rain will be of critical importance for grain, oilseeds, cotton, rice, sugarcane, citrus and coffee - Confidence

is high that all of these areas will get rain sufficient to maintain crop development except in far southern Brazil and eastern Argentina - Rain

did develop in Paraguay and a few immediate neighboring areas of Brazil Sunday and overnight along with a few random showers of limited significance in Argentina - South

America rainfall over the next ten days will be most significant from Mato Grosso, Bolivia, Paraguay and northern Argentina to Minas Gerais, Espirito Santo, Rio de Janeiro, Sao Paulo and Parana, Santa Catarina and northern Rio Grande do Sul - All

crops in these areas will receive enough rain for at least temporary improvement in topsoil moisture; however, some of the precipitation will be erratic and light leaving pockets of drier soil and leaving some concern in the long term outlook

- Northeastern

Brazil will be driest over the next ten days; including Bahia, Piaui and Tocantins in Brazil and from western and southern Rio Grande do Sul, Brazil into much of eastern Argentina - Net

drying is expected in these areas resulting in some crop stress - Temperatures

will be seasonable in the next two weeks - South

Africa’s topsoil moisture Friday was rated mostly favorable, but dryness was present in the far east and from the heart of Free State into southern Northern Cape and western parts of Eastern Cape - Recent

rain has improved crop and field conditions, but more is needed and more is coming - South

Africa will experience frequent rain in the central and east over the next ten days bolstering topsoil moisture and improving spring and summer crop planting and establishment conditions - Winter

wheat, barley and canola harvest progress may have been briefly slowed during the weekend due to showers in the west, but this week will be drier protecting grain quality and promoting fieldwork - Russia’s

Southern Region, Ukraine and Kazakhstan will receive minimal precipitation over the coming week - Soil

temperatures are still supportive of some crop development, but cooling is bringing down soil temperatures and crop dormancy is not far away - Recent

precipitation has improved topsoil moisture just enough to improve some crop establishment, but most wheat, barley, rye and rapeseed will be vulnerable to winterkill this year if temperatures drop to critical levels without sufficient snow on the ground

- There

is no threat of such conditions in the next couple of weeks, but time has mostly run out for better crop establishment prior to dormancy - Australia

weekend precipitation was infrequent and light allowing fieldwork to advance favorably - The

only exception was in central Queensland where locally strong thunderstorms produced 0.80 to 2.20 inches of rain benefiting a few summer grain, cotton and oilseed areas - Winter

grain and oilseed maturation and harvesting advanced well in the south - Soil

moisture was good for spring and summer crop planting in New South Wales, but there is still need for significant rain in Queensland - Weather

over the next ten days will be dry biased supporting winter crop maturation and harvest progress and summer grain and cotton planting - Rain

is needed in Queensland and parts of New South Wales and this need will increase for summer crops over the next ten days - China

weather during the weekend was mostly dry and temperatures were mild to warm - Soil

conditions have been drying out recently in the North China Plain and Yellow River Basin which is not unusual for this time of year, but winter crops would benefit from some rain - Dry

weather in much of eastern China recently has been great for winter crop planting and summer crop harvesting - Little

rain is expected over the next week - Rain

is expected to increase in parts of east-central China, the Yellow River Basin and North China Plain Nov. 16-20 - The

moisture boost should prove to be very well timed and beneficial to winter crop establishment - India

rain during the weekend was limited to the far south which is not unusual for this time of year. - The

moisture was good for winter crop planting and development, but a little disruptive to summer crop maturation and harvesting - Similar

conditions were expected for the next ten days - Harvesting

and planting should advance well around the showers - Europe

weekend weather was limited to southwestern France, Spain and Portugal and sufficient amounts resulted to support improved topsoil conditions - Soil

moisture Friday was rated mostly favorably for winter crops, but some dryness continues in pockets across the Mediterranean region - Soil

temperatures remain warm enough for additional winter crop development except from northeastern Romania into western Ukraine, Belarus and Baltic States where crops are becoming semi-dormant - Europe’s

weather over the next ten days will be limited on precipitation allowing late season farming activity to advance swiftly - Winter

crops will become a little better established as temperatures remain warmer than usual - North

Africa received a few erratic showers during the weekend, but the region still needs a general soaking in the next few weeks to bolster soil moisture for autumn planting of wheat and barley - Not

much rain is expected for a while - U.S.

weather during the weekend was dry east of the Rocky Mountains except in central Montana and in a parts of the northern Plains and upper Midwest where rain and snow evolved along

- Moisture

totals in central Montana ranged up to 0.86 inch through dawn today - Doppler

Radar suggested some locations in central Montana had received 0.50 to 1.50 inches through Sunday afternoon

- snowfall

ranged from 9 to 14 inches with local totals to 19 inches om interior northeastern and north-central Montana 1 to 3 and local totals to 8 inches in southern and interior southeastern parts of the state - Rain

and a some snow developed Sunday night and early today in Minnesota and the eastern Dakotas with moisture totals to 0.77 inch - Rain

also fell in the Pacific Northwest during the weekend with up to 0.77 inch in the Columbia River Basin with 1.34 inches of rain in northern Nevada - Weekend

temperatures were quite warm to hot for this time of year in the central and southern Plains with highs in the 70s and some 80s Fahrenheit - Windy

conditions also occurred in the central and southern Plains and western Corn Belt - Windy

conditions also occurred in the northern Plains during the weekend with speeds in 30 to 50 mph and some greater gusts - Montana’s

blizzard that occurred during the weekend extended into the central Canada Prairies and it will end today

- Moisture

totals in Canada reached 2.75 inches in southwestern Saskatchewan and 1.89 inches at Kindersley, SK (located in west-central parts of the province)

- Moisture

totals in Alberta ranged from 0.05 to 0.80 inch while Saskatchewan reported 0.25 to 0.80 inch outside of the areas noted above - Manitoba

precipitation was minimal with a trace to 0.15 inch - Travel

delays and livestock stress will continue today, although the worst weather is over - Rain

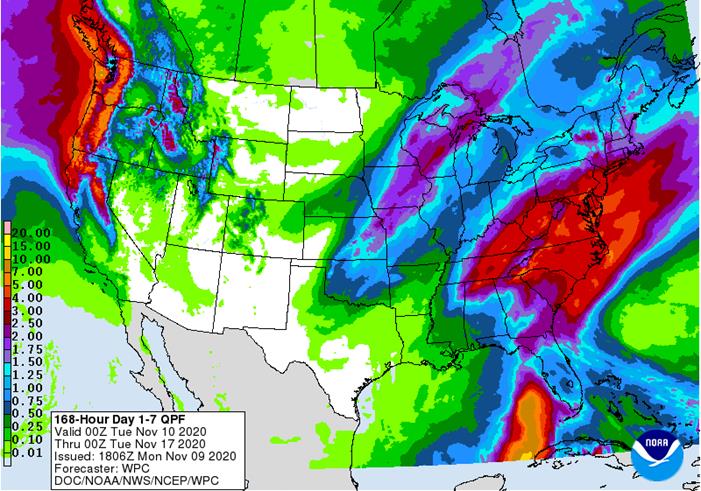

with some snow and sleet will occur in the western U.S. Corn Belt early this week before shifting to the Great Lakes region during mid-week - Moisture

totals will vary from 0.30 to 1.25 inches with local totals approaching 2.00 inches

- Southeastern

U.S. weather will be marred by periods of rain from Tuesday night through Friday with Virginia and the Carolinas wettest - Rain

totals of 1.00 to 4.00 inches and locally more will result - Very

little precipitation will occur in the Great Plains from the Dakotas through eastern Colorado and western Kansas to western Texas - These

areas will not be totally dry, but the light precipitation expected will be brief having little impact on winter crop conditions or establishment - These

areas will continue drier biased through Nov. 20 and perhaps into the week of Nov. 22 - Waves

of precipitation are expected in the Pacific Northwest and Great Basin during the next ten days with some rain in central and northern California as well

- The

moisture will be welcome and should improve soil moisture for better winter crop establishment - Mountain

snowpack should increase for better runoff in the spring - West

Texas precipitation will be quite limited through the next ten days especially in the high Plains region - Some

rain is expected in the Rolling Plains Thursday into Friday - U.S.

Delta weather will continue dry biased through the next ten days favoring fieldwork of all kinds - There

is some potential for precipitation in the north, but central and southern areas will be dry biased - U.S.

Corn and Soybean areas of the Midwest will experience alternating periods of rain and sunshine over the next couple of weeks which may slow some forms of fieldwork and a little drier weather might be welcome - However,

most of the rain will be great enough to seriously impact fieldwork for an extended period of time - Southeast

Canada’s grain and oilseed areas will experience a little precipitation Tuesday and during the coming weekend with good drying conditions most other days - The

environment will be good for harvesting - Tropical

Storm Eta may become a hurricane tonight and Monday - The

storm moved across central Cuba early Sunday with rain and wind from the storm impacting sugarcane and citrus areas - Damage

to citrus, sugarcane and unharvested rice may have occurred - Flooding

resulted - The

storm center at 0700 EST today was located 55 miles west northwest of Dry Tortugas, Florida or 80 miles west northwest of Key West, Florida moving northwesterly at 13 mph and producing maximum sustained wind speeds of 65 mph.

- Waves

of rain impacted Florida, the Bahamas and Cuba during the weekend and early today

- Damage

to Florida citrus and sugarcane is not expected to be significant, but a little citrus fruit droppage is possible in southwestern production areas

- Peak

wind speeds reported in the past two days have varied from 22 to 45 mph - Citrus

in the remainder of Florida’s peninsula will be impacted by occasional rain, but no damaging conditions - Broward

County Florida has received more than 12.00 inches of rain since Friday resulting in some significant flooding - Heavy

rain and flooding also occurred from southern Palm Beach County to Miami County and farther southwest through the Florida Keys where 3.00 to 6.00 inches resulted - Eta

will move westerly this morning and then west southwesterly this afternoon. The storm could move more to the southwest and might end up a short distance north of the western tip of Cuba in a couple of days - The

storm will then turn more to the north northeast during the balance of next week bringing the storm inland over the Cross City area of Florida at the end of this week or during the weekend - Eta

will weaken as it comes northward - Eta

may not be the last tropical cyclone to impact the Atlantic Ocean, Caribbean Sea or Gulf of Mexico - Another

disturbance may form in the southern Caribbean sea late this week and during the weekend - A

subtropical storm may also be forming in the central Atlantic Ocean, but it will move away from North America - Tropical

Storm Etau evolved over the South China Sea Sunday and was located 273 miles southeast of Da Nang, Vietnam at 12.5 north, 110.9 east. Movement was west southwesterly at 9 mph while maximum sustained wind speeds were reaching 46 mph - Etau

will move west southwesterly into southern portions of Central Vietnam tonight and Tuesday - The

storm will come inland as a weakening tropical storm producing heavy rain and moderate wind that might impact personal property, coffee and other crops produced from the coast into the Central Highlands through mid-week this week - Tropical

Depression Vamco east of Philippines will become a tropical storm today and a typhoon prior to hitting the Philippines Wednesday. The storm will move across southern Luzon Island Wednesday before moving farther to the west into central Vietnam during the coming

weekend - Excessive

rainfall may impact both northern parts of the Philippines and central Vietnam

- Damage

to crops and property is expected in both countries - Multiple

precipitation events impacting Vietnam’s central coast over the next week will result in rain totals of 6.00 to 15.00 inches and local totals in excess of 20.00 inches.

- Flooding

has been and will continue a serious impact along the central Vietnam coast where impressive rain totals in the past 30 days - More

disruption to commerce and shipping will occur because of the additional rain - Southern

Oscillation Index was +2.57 this morning; the index will rise later this week - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation and harvesting

- Portions

of Central America will remain wetter than usual into mid-month - Rain

will be greatest in Guatemala, El Salvador, Costa Rica, Nicaragua and Panama

- West-central

Africa will experience erratic rain through the next ten days favoring crop areas closest to the coast

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - East-central

Africa rain will be erratic and light over the coming week in Ethiopia while rain occurs frequently from Uganda and southwestern Kenya into Tanzania

- Ethiopia

will be wetter next week while showers and thunderstorms continue elsewhere - New

Zealand rainfall will be near to above average in North Island while near to below average in South Island - Temperatures

will be near to below average

Source:

World Weather Inc.

Monday,

Nov. 9:

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

winter wheat conditions; harvest for soybeans, corn, cotton, 4pm - Brazil

Unica cane crush, sugar production (tentative) - Ivory

Coast cocoa arrivals - EU

weekly grain, oilseed import and export data - EARNINGS:

BRF SA

Tuesday,

Nov. 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - China’s

agriculture ministry (CASDE) releases monthly report on supply, demand - Malaysian

Palm Oil Council webinar on China’s post-pandemic palm oil demand - Malaysian

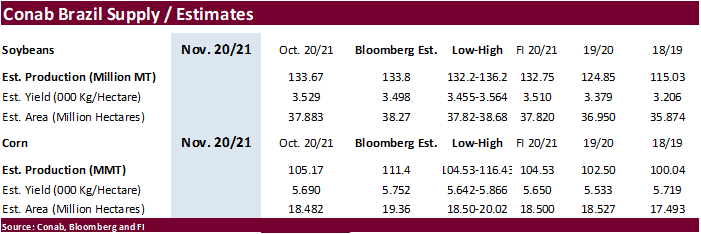

Palm Oil Board releases data on end-October stockpiles, exports, production - Conab’s

data on area, output and yield of soybeans and corn in Brazil - Malaysia

Nov. 1-10 palm oil export data from AmSpec, SGS

Wednesday,

Nov. 11:

- EARNINGS:

JBS, Barry Callebaut - HOLIDAY:

U.S. (Veterans Day, federal govt closed, CME trading unaffected), France, Canada

Thursday,

Nov. 12:

- Port

of Rouen data on French grain exports - Vietnam

customs data on coffee, rice and rubber exports in October - EIA

U.S. weekly ethanol inventories, production - EARNINGS:

BayWa, Marfrig

Friday,

Nov. 13:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- NOTE:

CFTC Commitments of Traders report, usually released on Fridays, is scheduled for Monday, Nov. 16, due to U.S. federal holiday - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FranceAgriMer

weekly update on crop conditions - New

Zealand Food Prices

Saturday,

Nov. 14:

- China

Animal Agriculture Association summit on hog recovery, ASF vaccine progress

Source:

Bloomberg and FI

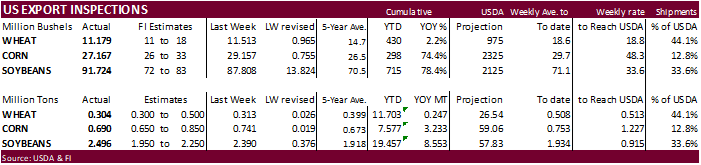

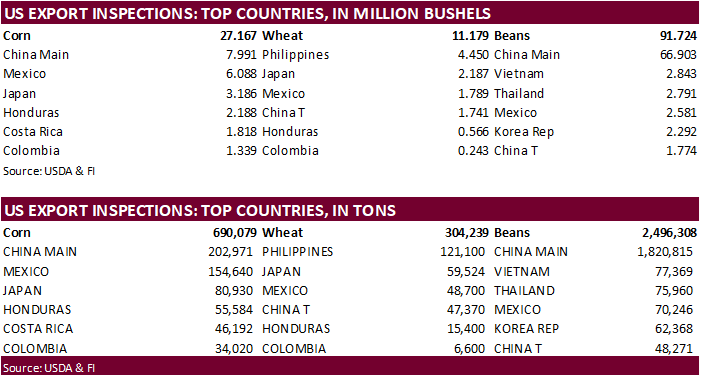

USDA

inspections versus Reuters trade range

Wheat

304,239 versus 250000-500000 range

Corn

690,079 versus 650000-1000000 range

Soybeans

2,496,308 versus 1950000-2250000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING NOV 05, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 11/05/2020 10/29/2020 11/07/2019 TO DATE TO DATE

BARLEY

2,295 0 3,593 12,162 15,401

CORN

690,079 740,612 581,856 7,576,894 4,344,347

FLAXSEED

24 0 0 413 172

MIXED

0 0 0 0 0

OATS

100 0 499 1,096 1,297

RYE

0 0 0 0 0

SORGHUM

72,005 103,320 25,486 717,970 401,016

SOYBEANS

2,496,308 2,389,742 1,348,193 19,457,451 10,904,221

SUNFLOWER

0 0 0 0 0

WHEAT

304,239 313,331 539,920 11,703,183 11,456,105

Total

3,565,050 3,547,005 2,499,547 39,469,169 27,122,559

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

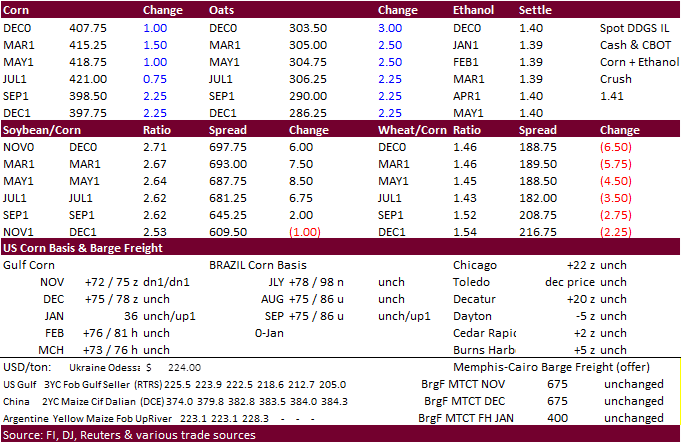

Corn.

-

US

CBOT corn futures traded two-sided, ending higher. Easing Covid-19 demand destruction fears and rally in outside markets supported prices. US cash markets were slightly softer. Rain is expected in Brazil during the next ten days, but Argentina’s weather

will continue to see ongoing dry conditions. After election results, there was talk China may try to renegotiate the Phase One US/China trade deal but it will take months for this to become realistic, in our opinion, and by the time it comes up, China will

have committed to most of the 40+ billion of US agriculture commitments. -

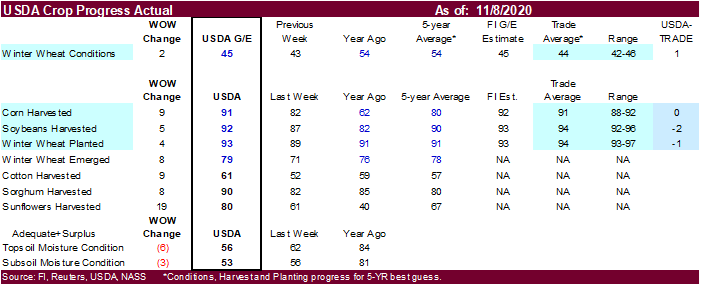

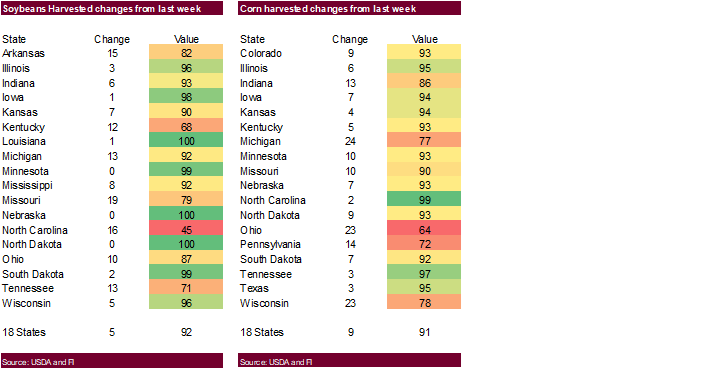

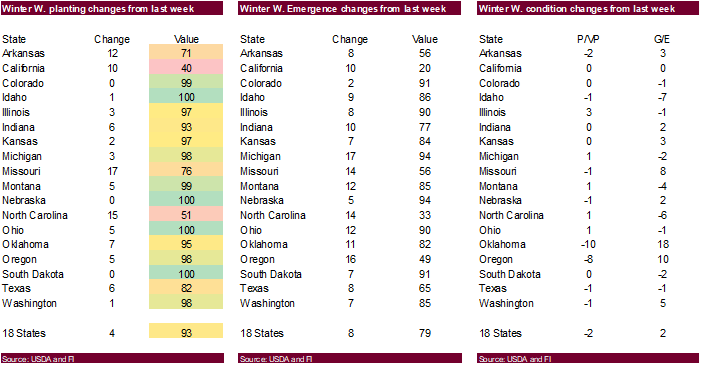

US

corn harvesting progress was reported at 91 percent, up 9 points from the previous week and compares to 62 percent year ago and 80 percent average. Traders were looking for 91 percent.

-

Today

was day 2 of the GS roll.

·

USDA US corn export inspections as of November 05, 2020 were 690,079 tons, within a range of trade expectations, below 740,612 tons previous week and compares to 581,856 tons year ago. Major countries

included China Main for 202,971 tons, Mexico for 154,640 tons, and Japan for 80,930 tons.

·

German confirmed a H5N8 bird flu case in the northern part of the country.

CME

Pork Cut Out futures began trading

Corn

Export Developments

-

Iranian

state-owned animal feed importer SLAL seeks up to 60,000 tons of animal feed corn, 60,000 tons of feed barley and 60,000 tons of soymeal, on Wednesday, Nov. 11, for shipment in December 2020 and in January 2021. -

Both

South Korea’s FLC and MFG bought a combined 268,000 tons of corn last week.

Updated

11/05/20

December

corn is seen in a $3.90-$4.25 range