PDF Attached

Lower

trade in soybeans, meal and oil. Corn was also lower. Good US harvesting weather and positioning pressured prices. Wheat traded higher. We are hearing some US producers are giving up on planting winter wheat across the northern ECB due to slow harvest

progress of soybeans. USDA will update their balance sheets on Tuesday. Calls are steady to moderately higher for tonight (Monday evening).

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- A

blizzard will evolve in the upper Midwest Wednesday into Friday of this week

- The

storm will produce 3 to 6 inches of snow and locally more in northern Minnesota, northeastern North Dakota and southern Manitoba, Canada as well as neighboring areas of western Ontario and northwestern Wisconsin - Snowfall

of a trace to 3 inches will occur in the remainder of North Dakota, southern Minnesota and eastern South Dakota as well as the remainder of Wisconsin - Strong

wind speeds of 25-35 mph and gusts to 45 will be possible during the height of the storm’s intensity late Wednesday night and Thursday - Rain

from the same blizzard noted above will move from west to east across the Midwest Wednesday into Friday causing a brief disruption to farming activity - U.S.

Midwest farming weather today and Tuesday will remain very good as it will be in the Delta and southeastern states - A

follow up storm in the far northern U.S. Plains and northern Midwest this weekend will produce additional snow and rain, but the lower Midwest will not be impacted by much moisture - A

couple of other U.S. storm systems are expected next week to bring additional bouts of light precipitation and maintaining a slower harvest pace for some areas - No

significant precipitation is expected in western U.S. hard red winter wheat production areas southward into West Texas during the next ten days - Rain

is expected in some eastern wheat areas Wednesday of this week and possibly again in the second half of next week - Moisture

shortages in wheat areas from Colorado to the Texas Panhandle will maintain concern over unirrigated winter crop conditions - West

Texas harvest weather should be mostly good over the next week to ten days - Less

frequent and less significant precipitation will occur in the U.S. Pacific Northwest and northern California after this workweek with next week expected to be drier biased for a while - U.S.

weekend rainfall was minimal in key grain, oilseed and cotton production areas

- The

only exception was in Florida, southeastern Georgia and the coastal Carolinas where significant rain fell - Rainfall

reached 6.28 inches at Daytona Beach, Florida with many other areas from central through northeastern Florida to southeastern Georgia reported 2.00 to more than 4.00 inches - A

notable warming trend occurred in the central United States - Highest

temperatures occurred in the northern Plains Saturday with readings in the 60s and 70s and Sunday was warmest in the central and southwestern Plains where highs were in the 80s - Liberal,

Kansas, Guymon, Oklahoma and both Pampa and Perryton, Texas reached 88 Fahrenheit during the middle of Sunday afternoon - Relative

humidity in the central and southwestern Plains Sunday afternoon was varying from 8-25% suggesting strong evaporation for the region - Rain

also fell along the coast of Washington and Oregon and into the Cascade Mountains where moisture totals of 0.57 to 1.35 inches resulted - Some

lighter rain fell in the northern Rocky Mountains as well - Limited

precipitation is still expected in the northwestern U.S. Plains and central parts of Canada’s Prairies through the next ten days, but these areas will eventually have some potential for rain and snow as La Nina becomes more significant - The

precipitation potentials should begin to improve late this month and especially in December and January - U.S.

temperatures this week will be near to above normal with the warmest bias expected in the northeastern and southwestern parts of nation - Temperatures

next week will average near normal except in the Great Basin, southwestern states and central and southern Rocky Mountain region where readings will be above normal - The

U.S. bottom line will be good for late season farming activity early this week and then there will be some disruption to fieldwork a little later this week and into next week. None of the delays are expected to become a serious threat to late season fieldwork.

Planting wheat and its establishment would improve with a longer period of dry and warm weather, but the situation is not critical at this point in time. Cotton harvest progress in West Texas will advance well, but progress in the Delta and southeastern states

may be briefly disrupted from time to time without seriously deteriorating the remaining crop conditions - Southern

Brazil will receive limited amounts of rain over the coming week leading to net drying in many areas from Sao Paulo into southern Mato Grosso do Sul and in Rio Grande do Sul as well as parts of southern Paraguay - Some

showers and thunderstorms will occur from Parana into southern Mato Grosso do Sul and southeastern Paraguay, but resulting rainfall may not be enough to counter evaporation - Sufficient

rainfall may occur to support crops, but the need for greater rain will be steadily rising as time moves along - Rio

Grande do Sul, Brazil will be driest with little to no rain until late Sunday and Monday of next week when 0.50 to 1.50 inches of rain will occur with some locally greater amounts

- Confidence

in this rain event and another that occurs in far southern Brazil late next week is low and future model runs will be closely monitored - Center

west through center South Brazil and in a few northeastern areas will be frequently and abundantly wet during the next ten days to two weeks

- Rainfall

may be heavy at times from Mato Grosso to Minas Gerais, Tocantins and a part of southwestern Bahia - Rainfall

will vary from 3.00 to more than 7.00 inches during the next ten days in these areas - Most

of the precipitation will be spread out over multiple days limiting the occurrence of serious flooding, but some excessive moisture and minor flooding should be anticipated - Most

of Bahia, Piaui and Maranhao and Pernambuco will see 1.00 to 3.00 inches with local totals over 4.00 inches - Brazil

temperatures will be near to below average in this first week of the outlook and slightly warmer next week - Argentina

temperatures will be near normal this week and next week - Brazil

rainfall Friday through Sunday was greatest from Mato Grosso through Goias and Mato Grosso do Sul to portions of Minas Gerais with amounts of 0.20 to 0.88 inch occurring most often with local amounts of 1.00 to 2.25 inches - Showers

elsewhere were sporadic and light with less than 0.30 inch of moisture in Parana - Sao

Paulo was left mostly dry along with southern Minas Gerais and most of Rio Grande do Sul - Temperatures

were seasonably warm with highs in the lower to middle 90s except near the coast and in the far south where 80s and a few upper 70s were noted - Argentina

weekend rainfall was limited resulting in net drying for many areas - The

exception was in a few Santa Fe, western Entre Rios and Formosa locations where more than 0.50 inch of rain resulted.

- Temperatures

were seasonable - The

bottom line for Brazil and Argentina during the next two weeks remains mostly favorable for summer crop development and field progress. Some areas in center west and northern parts of center south Brazil will be a little too wet at times while periods of drying

in southern Brazil, Uruguay, southern Paraguay and parts of extreme eastern Argentina will be closely monitored, but for now many of these areas get at least a little timely rainfall to stave off a more significant bout of dryness. Watch future forecast model

runs for signs of turning drier in eastern Argentina, Uruguay, southern Paraguay and southern Brazil, but for now crop conditions will stay favorable.

- Australia

rainfall during the weekend was scattered in many crop areas, but the precipitation was greatest in the Great Dividing range outside of winter crop areas - This

protected wheat, barley and canola quality and maintained a nearly ideal outlook for production

- Australia

weather is expected to be more active this week with rain falling more frequently, but it is still questionable over whether it will be wet enough to harm the quality of winter crops - Drier

weather is expected for a while this weekend into the middle part of next week before rain resumes again after that

- Drier

weather will be needed to improve crop maturation and harvest conditions for wheat, barley and canola - The

rain in Queensland and some areas in New South Wales will be ideal for the advancement of summer crop planting, emergence and development especially in unirrigated areas - Livestock

conditions will be improving as well due to better grazing conditions resulting as soil moisture gets better and grass development accelerates - Western

parts of Russia received rain and some snow during the weekend - Moisture

totals varied from 0.05 to 0.70 inch with a few amounts over 1.00 inch - Most

of this stayed out of the lower half of the Volga Bain and Ukraine where dry conditions prevailed - Highest

temperatures were in the 40s and lower 50s Fahrenheit with lows in the 30s and 40s - Colder

air was noted east of the New Lands, but there are few to no winter crops produced in that region.

- Precipitation

in Russia and Ukraine will be restricted for ten days from central Ukraine into the Volga Basin north of Russia’s Southern Region and southeast of Russia’s Central Region - Moisture

will occur in all other areas and in sufficient amounts to bolster soil moisture for use in the spring - Some

significant snow will fall this week across northern Russia which should expand snow cover that has been mostly confined to areas east of the Ural Mountains recently - Winter

crops in Russia and Ukraine are adequately established even though there is need for more moisture in Ukraine and the middle and lower Volga Basin. As long as snow cover is present during extreme weather during the winter crops in these areas should perform

well in the spring as long as soil moisture has improved by that time. - China

began to experience the season’s first significant snow event of the season during the weekend and it will continue into Tuesday in the northeast - Beijing

reported its first snow 23 days earlier than usual and temperatures early this week were expected to be the coldest in ten years - Much

more snow will fall, although areas from Liaoning to central Heilongjiang will be most impacted with another 4 to 12 inches of accumulation expected.

- Travel

delays have already occurred and many businesses and schools will be close into Tuesday

- Bitter

cold temperatures will follow the snow event - Concern

over livestock in the region remains, although Inner Mongolia missed the greatest snow and concern over livestock losses had been greatest for that region - Snow

will linger in northeastern China through mid-week this week - China

will see net drying during the middle to latter part of this week with some light snow returning to northeastern China this weekend

- Unusually

cold temperatures early this week will give way to more seasonable conditions this weekend into next week - Freezes

will occur southward to the northern Yangtze River Valley Tuesday and Wednesday - Most

of China’s adverse weather will be confined to the northeast provinces early this week. Late season fieldwork will be on hold with some unharvested crops to be buried in snow. Livestock stress will be reduced over time. Dry or mostly dry conditions in the

Yellow and Yangtze River Basins will be very good for late season summer crop harvesting and the planting of rapeseed and a few other late season crops.

- A

weak tropical cyclone in the Arabian Sea this week will drift west southwesterly over open water and not have much impact on crops this week - Another

tropical cyclone will evolve in the southern Bay of Bengal today and move northwest while intensifying

- Landfall

is possible in southern Andhra Pradesh near the Tamil Nadu border Thursday

- Heavy

rain and flooding are expected in northeastern Tamil Nadu, southern Andhra Pradesh and southeastern Karnataka during the middle to latter part of this week - Some

damage to rice, cotton and a few oilseed crops might result from this event.

- A

few areas of flooding will also occur in sugarcane areas, but damage to that crop because of wind and flooding should be low - South

Africa rainfall was scattered in eastern parts of the nation during the weekend, but much of it was not enough to counter evaporation or seriously change crop or field conditions - Greater

rain is needed in South Africa to improve summer crop planting, emergence and establishment conditions

- Western

rainfall in the nation should be minimal for summer crops leaving a strong need for significant moisture over the next two weeks - Eastern

crop areas will see periodic rainfall and all of it will be welcome, but larger volumes of rain may still be needed - Good

harvest weather continues in winter crop areas - Europe

weather will be favorable for fieldwork of all kinds this week, although it will have to advance around brief bouts of light rainfall - Italy

and the Adriatic Sea region will see frequent bouts of rain this week with some of the moisture eventually pushing deeper into the Balkan Countries - Indonesia

and Malaysia weather will be wet biased over the next two weeks with frequent rain expected over saturated or nearly saturated soil causing some flooding - Coastal

areas of Central Vietnam will likely trend wetter than usual this week resulting in some flooding from Da Nang southward to

- Rain

totals in the coming week may range from 5.00 to 15.00 inches resulting in some flooding, but mostly along the coast - Some

of the heavy rain may eventually push into the Central Highlands of Vietnam, but confidence is low

- Philippines

weather will remain favorably mixed with rain and sunshine through the next two weeks - Central

parts of Algeria’s coastal region received heavy rainfall during the weekend with amounts pushing up to 5.00 inches through dawn Sunday

- Much

lighter rain fell in other areas in northern Algeria while Tunisia and Morocco were left mostly dry - Additional

rain will fall along the central Algeria coast periodically this week with another 1.00 to 4.00 inches - Some

additional flooding is possible, but enough of a break from the weekend heavy rain before the next wave of heavy rain arrives to help reduce the severity of new flooding

- Tunisia

will also receive some light rainfall - Southwestern

Morocco remains in a multi-year drought with little rain of significance expected over the next couple of weeks - West-central

Africa will experience a good mix of weather during the next ten days to two weeks - Less

frequent rain in cotton areas will translate into better crop maturation conditions - Coffee,

cocoa, sugarcane and rice will also benefit from less frequent and less significant rainfall, although completely dry weather is not likely for a while - East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops - Mexico’s

weather will drier biased for the next ten days except along the lower east coast where periodic rainfall is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Costa Rica and Panama - West-central

and southwestern Colombia, Ecuador and northern Peru agricultural areas will be closely monitored over the next few weeks as the potential for flooding increases.

- Coffee,

sugarcane, corn and a host of other crops may eventually impact by too much rain in Colombia

- Harvest

delays have already occurred and there is more coming - Central

Asia cotton and other crop harvesting will advance normally as dry and warm conditions prevail - Much

of these crops are already harvested - Today’s

Southern Oscillational Index was +6.80 and it was expected to drift higher over the coming week - New

Zealand rainfall is expected to be near to above average except along the lower east coast of South Island where precipitation may be a little lighter than usual

- Temperatures

will be seasonable. - A

mid-latitude low pressure center off the lower east U.S. coast today has some potential to acquire subtropical characteristics over the next few days as it moves east northeasterly

- The

storm will impact Bermuda Tuesday into Wednesday bringing some heavy rainfall - The

system will move away from North America

Monday,

Nov. 8:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

cotton condition; corn, soy and cotton harvesting; winter wheat planting, 4pm - Ivory

Coast cocoa arrivals

Tuesday,

Nov. 9:

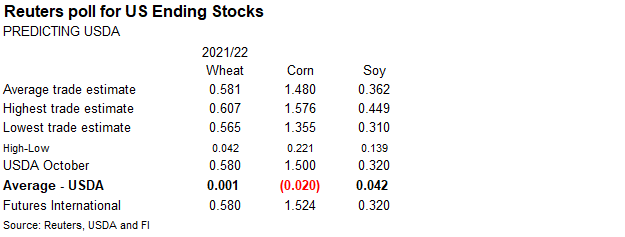

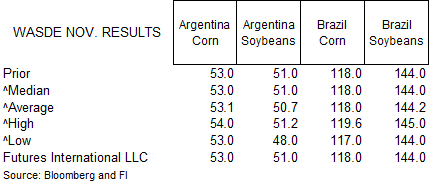

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - China

farm ministry’s CASDE outlook report - EU

weekly grain, oilseed import and export data - France

agriculture ministry crop production estimates - U.S.

Purdue Agriculture Sentiment, 9:30am

Wednesday,

Nov. 10:

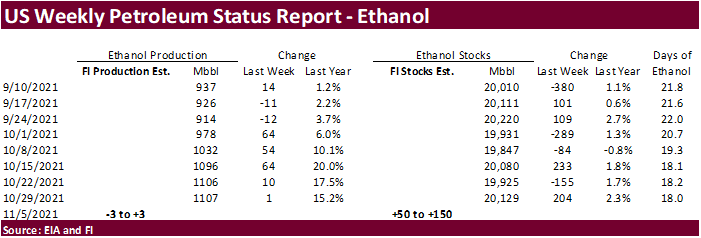

- EIA

weekly U.S. ethanol inventories, production - Vietnam’s

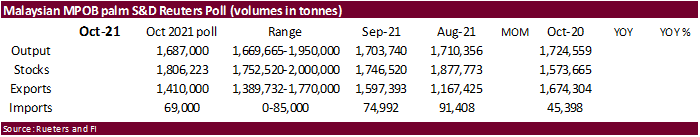

customs department publishes October commodity trade data - Malaysian

Palm Oil Board’s data on October output, exports and stockpiles, 12:30pm Kuala Lumpur - Malaysia’s

Nov. 1-10 palm oil export numbers by cargo surveyors - FranceAgriMer

monthly grains report

Thursday,

Nov. 11:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

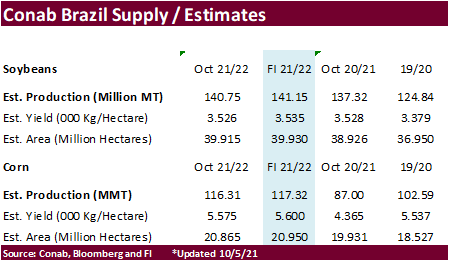

of Rouen data on French grain exports - Brazil’s

Conab releases data on yield, area and output of corn and soybeans (tentative) - New

Zealand Food Prices - HOLIDAY:

France

Friday,

Nov. 12:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

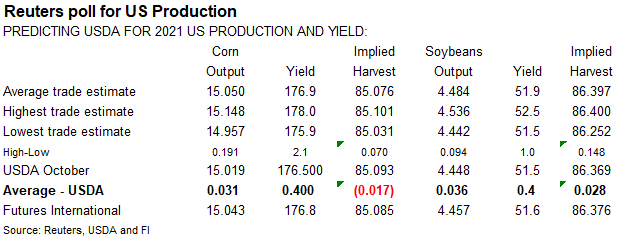

On

Friday USDA released their early baseline tables

and they see US plantings of corn to decline from 2021 and wheat & soybeans to expand. 92.0 million acres of corn was seen, down from 93.3 million in 2021-22. Soybeans were seen at 87.5 million acres, from 87.2 million this year. For wheat, USDA sees 49.0

million acres, up from 46.7 million acres in 2021-22.

https://www.usda.gov/oce/commodity-markets/baseline

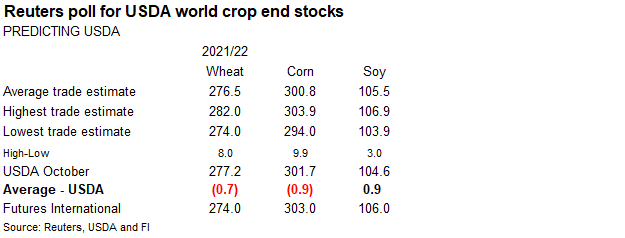

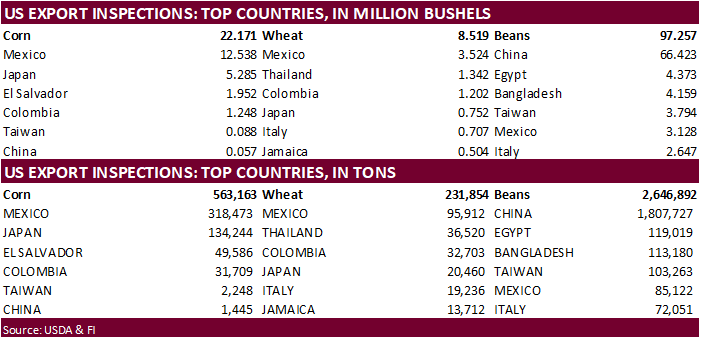

USDA

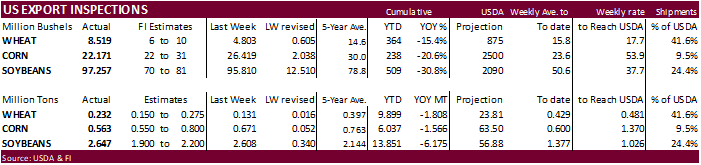

inspections versus Reuters trade range

Wheat

231,854 versus 150000-400000 range

Corn

563,163 versus 550000-1000000 range

Soybeans

2,646,892 versus 1100000-2515000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING NOV 04, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 11/04/2021 10/28/2021 11/05/2020 TO DATE TO DATE

BARLEY

0 1,596 2,295 9,743 12,162

CORN

563,163 671,085 692,565 6,037,008 7,602,804

FLAXSEED

0 0 24 24 413

MIXED

0 0 0 0 0

OATS

0 0 100 200 1,296

RYE

0 0 0 0 0

SORGHUM

7,698 77,108 141,650 504,072 790,064

SOYBEANS

2,646,892 2,607,534 2,852,420 13,851,236 20,025,864

SUNFLOWER

0 96 0 432 0

WHEAT

231,854 130,721 304,239 9,899,442 11,707,368

Total

3,449,607 3,488,140 3,993,293 30,302,157 40,139,971

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

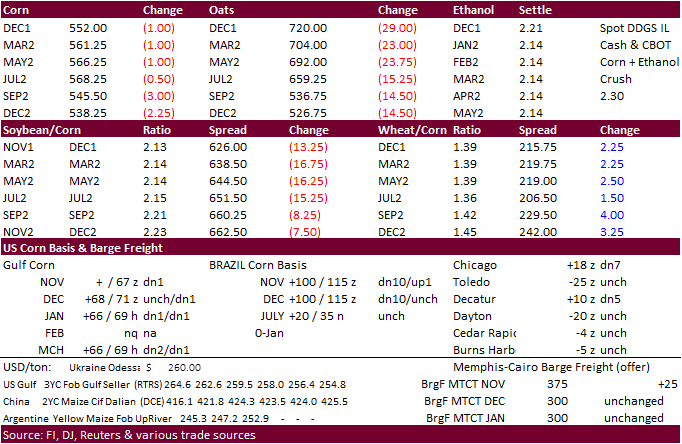

Corn

·

Corn futures were 0.50-2.50 cents lower from good US harvesting weather and lack of bullish news. A sharply lower USD may have limited losses. The funds position in corn as of last Tuesday was more long than expected. Today

the funds sold an estimated net 3,000 contracts (4 straight days of selling).

·

US corn harvest progress was up 10 points last week to 84 percent after dry weather occurred across the heart of the Midwest. Trade was looking for 85 percent. This compares to 90 year ago and 78 average.

·

Today was the second day for the Goldman roll for December contacts.

·

Export developments were quiet.

·

Bird flu continues to spread across Europe. Poland reported an outbreak of H5N1 (at least 5 outbreaks), impacting 650,000 birds. Last week France raised their alert status on bird flu.

·

USDA US corn export inspections as of November 04, 2021, were 563,163 tons, within a range of trade expectations, below 671,085 tons previous week and compares to 692,565 tons year ago. Major countries included Mexico for 318,473

tons, Japan for 134,244 tons, and El Salvador for 49,586 tons.

·

Corn processing basis was up 8 cents to 18 over the December for Decatur, IL and up 7 cents to 2 over for Cedar Rapids, IA. Basis for the river terminals were mixed.

Export

developments.

-

Turkey

seeks 325,000 tons of corn on November 15 for shipment sought between Dec. 20 and Jan. 20. -

USDA:

Private exporters reported sales of 150,000 metric tons of corn for delivery to Colombia during the 2021/2022 marketing year.

Updated

11/01/21

December

corn is seen in a $5.30-$6.10 range

March

corn is seen in a $5.25-$6.25 range

·

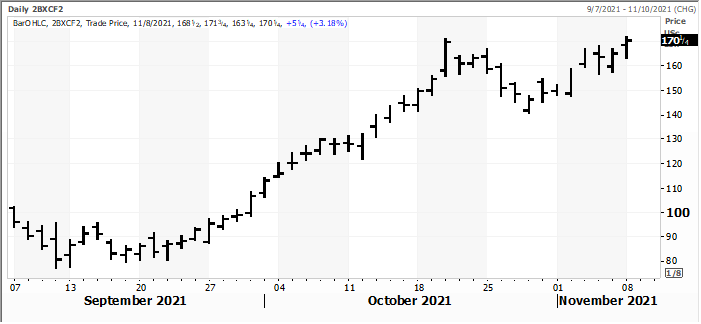

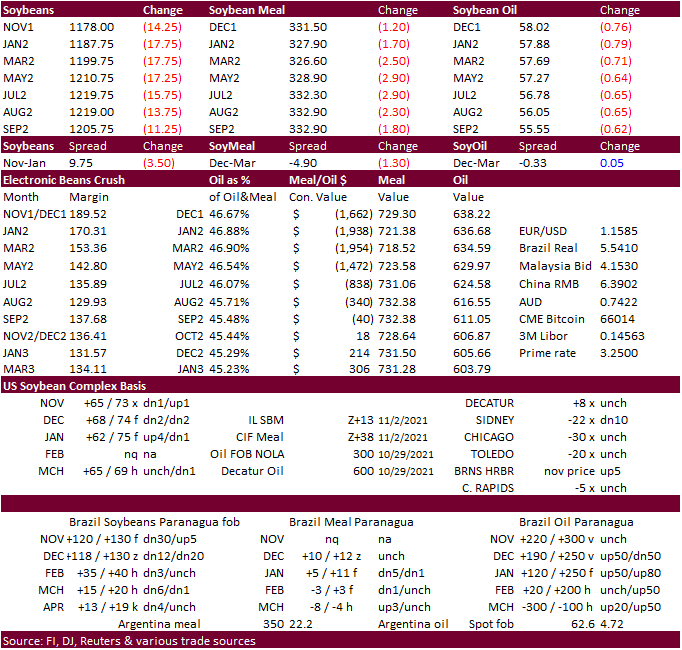

CBOT soybeans,

meal and oil were lower from positioning, despite a lower USD. Export inspections looked healthy with China the dominant taker. Soybeans were down for the fourth straight trading session. January soybean soybeans took out their mid-October low and traded

at its lowest level since March 31, ending 17 cents lower. December soybean oil fell 73 points and January soybean meal was down $1.30. After the close Egypt announced they seek vegetable oils for Jan 5-25 arrival.

·

Funds sold an estimated net 11,000 soybeans, 2,000 soybean meal and 4,000 soybean oil.

·

Soybean oil was under pressure from weakness in Chinese vegetable oils, talk of further delaying RVO decisions, product spreading and lower soybeans. With soybean meal seeing limited losses today, January soybean oil share was

under pressure, trading below 47 percent. Selected cash US soybean meal basis locations were weaker this morning (Decatur, IL down $3 to 20 over the December.).

·

US soybean harvest was 87% complete. Trade was looking for 89 percent. This compares to 91 year ago and 88 average.

·

USDA US soybean export inspections as of November 04, 2021, were 2,646,892 tons, above a range of trade expectations, above 2,607,534 tons previous week and compares to 2,852,420 tons year ago. Major countries included China for

1,807,727 tons, Egypt for 119,019 tons, and Bangladesh for 113,180 tons.

·

China soybean imports of 5.11 MMT during October were lowest since March 2020. Year ago, they were 8.69 million tons. They slow Chinese imports are thought to be weighing on prices earlier in the session.

·

In a ceremonial deal, China committed to 8.4 MMT of US soybeans, about 20 percent higher than last year. The USDA Attaché sees imports around 101 million tons for 2021-22, up moderately from last year.

·

We see no major issues with weather for NA and SA but keep an eye on eastern Australia as they received more rain over the weekend. However, weather forecaster Climatempo mentioned Brazil’s northern region will see excessive

rain over the next ten days along with below average temperatures in the next ten days. Mato Grosso, Goias, Rondonia and Minas Gerais states may see around 6 inches of rain. Some of the southern areas will be dry. They warned for the medium term that too

much rain will increase the chance for diseases for November and December.

·

Brazil is 67 percent complete on soybean plantings as of Thursday according to AgRural, above 56 percent year earlier.

January

crush hit a new intraday contract high. It hit $1.7175.

Export

Developments

-

Egypt

announced they seek vegetable oils for Jan 5-25 arrival.

Updated

11/8/21

Soybeans

– January $11.60-$12.50 range,

March $11.50-$13.50

Soybean

meal – December $320-$340,

March $310-$360

Soybean

oil – December 57-60 cent range (down 150, down 100),

March 56-65

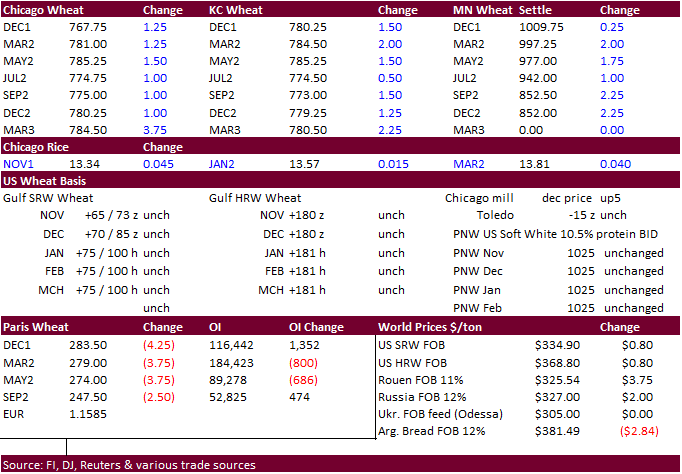

·

US wheat started mixed then traded higher, in part from a lower USD. Positioning ahead of the USDA report was noted. The CFTC report showed longs holding a good position for the KC and MN markets. December soft wheat ended 1.50

cents higher, December KC up 2.0 cents, and December Minneapolis unchanged (back months higher). Funds bought an estimated net 1,000 Chicago wheat contracts.

·

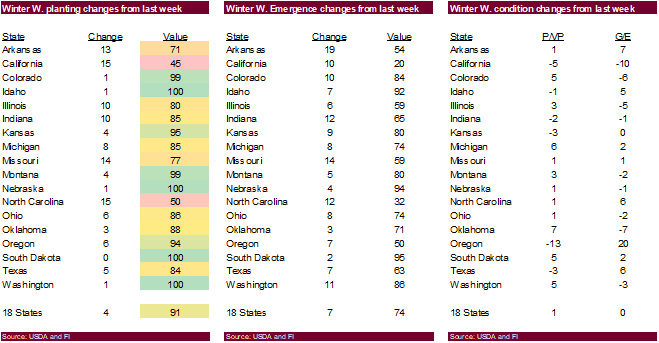

US winter wheat was rated 45% good/excellent condition, unchanged from 45% a week earlier. The trade was looking for 46%. Estimates ranged from 45% to 47% good-to-excellent. By class there was not much change from the previous

week.

·

US winter wheat planting were reported at 91% complete, up from 87% the previous week. The trade was looking for 93%. This compares to 92 year ago and 91 average.

·

USDA US all-wheat export inspections as of November 04, 2021, were 231,854 tons, within a range of trade expectations, above 130,721 tons previous week and compares to 304,239 tons year ago. Major countries included Mexico for

95,912 tons, Thailand for 36,520 tons, and Colombia for 32,703 tons.

·

Paris December wheat was down 4.25 euros at 283.75/ton.

·

Ukraine’s AgMin showed the winter wheat planting area down 8.5% at 6.09 million hectares, down from 6.11 million in 2020-21, and well below the 6.66 million projected before sowings started.

·

Russian wheat prices increased last week. IKAR consultancy reported 12.5% protein wheat from the Black Sea was up $2/ton from the previous week to $326/ton. SovEcon reported at $2/ton increase to $327/ton. The Russian export

tax increases to $69.90/ton for the November 10-16 period from $67 for the October 27-November 9 period. Russian wheat exports so far this season are running 32 percent below the same period last season.

·

Egypt approved Latvian wheat imports. The two countries seek to increase agriculture trade, including to other Balkan countries.

Export

Developments.

·

Jordan seeks 120,000 tons of animal feed barley on Nov. 10 for shipment combinations of March 1-15, March 16-31, April 1-15 and April 16-30.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

·

None reported

Updated

11/01/21

December

Chicago wheat is seen in a $7.30‐$8.25 range, March $7.25-$8.40

December

KC wheat is seen in a $7.35‐$8.35, March $7.00-$8.50

December

MN wheat is seen in a $9.70‐$11.50, March $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.