PDF Attached

USDA

will release its annual baseline S&D’s Friday at 2 p.m. CST

![]()

AREAS

OF GREATEST MARKET INTEREST

- Russia’s

Southern Region will be trending cooler over the next week to ten days limiting the potential for additional crop improvement from any new moisture that occurs - Recent

precipitation gave some crops in western parts of Russia’s Southern Region and a part of Ukraine a late season lift in soil moisture that will help improve crops in the spring - Some

improvement has occurred recently, but much of the precipitation in eastern Ukraine and western parts of Russia’s Southern Region was too late to induce better crop establishment prior to dormancy - That

leaves crops more vulnerable to winterkill this year if there is not substantial snow on the ground during periods of harsh temperatures - Eastern

portions of Russia’s Southern Region and Western Kazakhstan failed to get significant moisture this autumn raising worry over small grain production next spring

- Overall,

World Weather, Inc. believes enough of Ukraine and Russia’s Central Region received sufficient moisture this autumn to leave crops poised for improvement in the spring as long as winterkill is kept to a minimum. Crops in Russia’s Southern Region got their

moisture much later and the risk of loss during the winter is higher than in production areas to the west and north.

- Argentina’s

dryness in central and eastern summer crop areas during the next ten days to two weeks will maintain worry over summer crop emergence, establishment and late planting - Fieldwork

should advance well for a little while longer, but once the ground dries out fieldwork may slow and there will certainly be delays in crop emergence and establishment - There

is still time for improvement, but there is not much rain in the pipeline today - Center

west and southern Brazil will continue dry through the weekend, but scattered showers and thunderstorms expected next week will bring timely relief to many crop areas - Improved

emergence and establishment conditions will occur to many areas that have been quite dry recently from southern Minas Gerais to Rio Grande do Sul and a few areas into Mato Grosso do Sul and Paraguay - A

close watch will be needed on the distribution of rain next week to make sure all crop areas get needed moisture - There

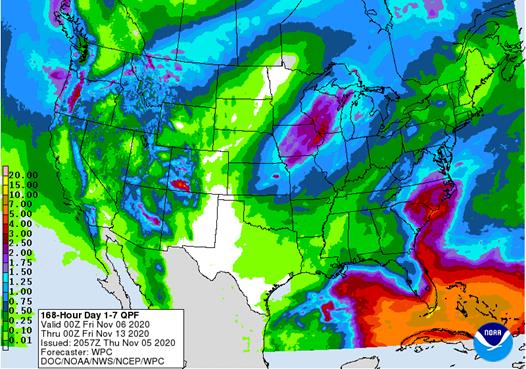

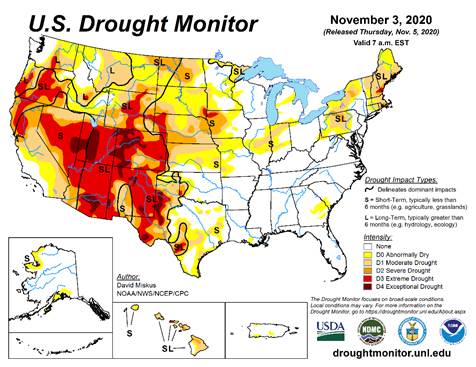

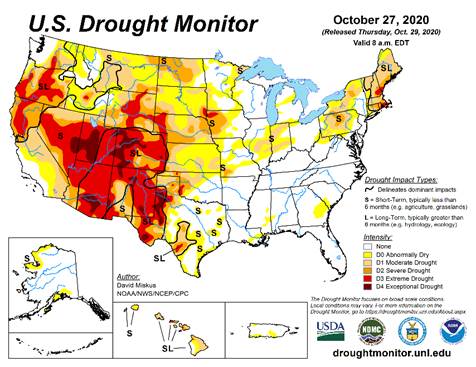

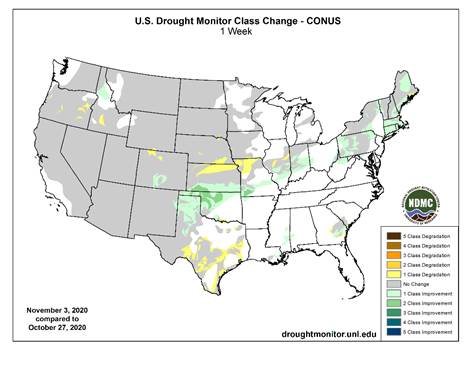

will be an ongoing need for more precipitation, however - U.S.

high Plains region will not get much precipitation of significance for a while especially not in the southwestern Plains - Winter

crop conditions have been improving after recent precipitation, but some areas still need greater precipitation - Tropical

Depression Eta was located over central Honduras early this morning - The

storm may dissipate to a remnant low pressure center later today and tonight, but once that circulation center moves over the northwestern Caribbean Sea Friday it will re-develop into a tropical storm - Landfall

in Cuba is expected Sunday or Monday and then a turn to the northwest into the southeastern Gulf of Mexico is expected - Today’s

longer range models have been suggesting a threat to the southeastern United States near mid-month from this storm; the European model run suggests Louisiana might be at risk again - Tropical

Storm Goni will weaken to a depression as it moves into central Vietnam tonight and Friday and the system is not expected to produce nearly as much damaging wind and flooding as once feared - Landfall

is expected near Qui Nhon - Goni

was 216 miles east southeast of Da Nang, Vietnam this morning - Rainfall

of 3.00 to more than 8.00 inches will accompany the storm inland over a large part of the middle Vietnam coast

- Tropical

Storm Astani will move through the Bashi Channel Friday, move to a position south of Hong Kong Saturday and then turn to the southeast toward central Vietnam during the latter part of the weekend with landfall early next week - Astani’s

landfall may be south of Qui Nhon, Vietnam this weekend not far from where Tropical Storm Goni is expected to make landfall - The

storm was 399 miles south of Okinawa, Japan this morning - Rainfall

will be less than 4.00 inches at the time of landfall - Another

tropical weather system will impact Luzon Island and the northern Visayan Islands of the Philippines this weekend and then it will move toward southern Vietnam with some impact there possible early to mid-week next week - One

more tropical disturbance will become a strong storm next week and may threaten northern Luzon Island, Philippines and/or Taiwan near late next week and into the following weekend respectively - Unusually

warm to hot air will impact the U.S. Plains and Midwest through the weekend and early next week respectively

- Precipitation

will be kept to a minimum until early next week when Thunderstorms, rain and a little snow evolves briefly - U.S.

Midwest drying through the weekend will be ideal for late summer crop harvesting and winter grain planting and establishment - U.S.

Delta and southeastern states will also experience net drying into early next week with temperatures slowly warming favoring all kinds of fieldwork and supporting winter crop establishment - Some

showers will occur in the northern Delta during mid-week and in the Carolinas, Virginia and possibly a part of Georgia Wednesday into early Thursday - Bitter

cold air will return to the northwestern U.S. Plains, northern and central Rocky Mountain region and interior parts of the Pacific Northwest next week with cooling likely in the northwest half to two-thirds of the Great Plains, as well - A

winter storm will evolve this weekend and early next week in the northwestern U.S. Plains/Canada’s Prairies

- Very

heavy snow, some rain, thunderstorms, sleet and a little freezing rain will be possible - Snow

accumulations will be greatest from Montana to northwestern Manitoba and Saskatchewan this weekend and early next week with 8 to 16 inches and possibly as much as 20 inches occurring surrounded by lighter snow - U.S.

hard red winter wheat areas with have opportunity for some precipitation during the late weekend and first half of next week, but the west-central and southwestern Plains will not likely be seriously impacted with precipitation - Nebraska,

northeastern Colorado and eastern Kansas into eastern Oklahoma will likely receive most of the precipitation - Snow

totals will vary from a dusting to 3 inches from northeastern Colorado and northwestern Kansas into central Nebraska - Moisture

totals will vary from 0.05 to 0.15 inch in the northwest, 0.20 to 0.70 inch in the east with a couple of extreme amounts near 1.00 inch on the eastern fringe of crop country - West

Texas precipitation will be minimal through the weekend, but some rain might occur briefly next week

- The

moisture will have a minor impact on the region - The

impact on harvesting will be minimal - U.S.

Delta will be impacted by some rain next week, but it should be brief and light enough to restrict the impact on fieldwork and crop conditions - U.S.

southeastern states will receive periods of rain from mid- to late-week next week with some heavy amounts possible in the eastern Carolinas and southeastern Virginia - Rain

totals of 1.00 to 3.00 inches will be possible - Another

wave of heavy rain may impact the southeastern states if Tropical Storm Eta moves into a part of the region at it may in the second weekend of the two week outlook - U.S.

Pacific Northwest will experience a few waves of rain and mountain snow over the next ten days - Blizzard

from Montana to northwestern Manitoba this weekend into early next week will slow travel and stress livestock, but the moisture resulting from melting snow should help improve soil moisture for use in the spring - Rain

will impact eastern Australia today benefiting spring and summer crops, but keeping winter crops moist and briefly slowing crop maturation and harvest progress - Southeastern

Australia will be dry late this week and into early next week and then may be bothered again by rain during mid-week next week

- The

moisture will raise a little concern about the overall condition of wheat, barley and canola - Another

wave of showers may occur during the following weekend - Most

of the winter crops will likely manage the periodic precipitation relatively well, although longer periods of drying will be needed to protect grain and oilseed quality - Queensland,

Australia dryland summer crop areas will get some rain this weekend and it will continue infrequently through the following ten days

- The

moisture will be good for dryland cotton, sorghum and other summer crop planting, emergence and establishment, although greater moisture will be needed in many areas to ensure the best soil moisture - Fieldwork

will be slowed by the precipitation periodically - Unharvested

winter grains could be negatively impacted, but much of the harvest should be complete - Western

Australia should get some showers today and Friday and then trend dry again for a while - No

serious impact on harvesting or unharvested crop quality is expected. - Brazil

weather through Sunday will not change much with rain continuing in the northeastern one-third of the nation; including areas from northern and eastern Minas Gerais through Tocantins and parts of Goias to Bahia, Espirito Santo and northern Minas Gerais - Sufficient

amounts of rain will fall to maintain wet field conditions in many areas and to bolster soil moisture in other areas - Net

drying is expected elsewhere – not only in Brazil, but in Paraguay and Uruguay as well - Nov.

8-15 weather will continue drier than usual in Uruguay, southern Rio Grande do Sul and a few other random locations in southern Brazil and Paraguay, but most other areas in center west and interior southern Brazil will encounter scattered showers and thunderstorms

that will benefit many areas; Resulting rainfall may be a little light and erratic in some areas - Concern

will evolve over soil moisture and long-term crop development in portions of far southern Brazil, Paraguay, Uruguay and eastern Argentina through the first half of November and perhaps all month, but some relief from dryness is expected from next week’s showers - Temperatures

will be seasonable with a slight cooler bias this week and with a slight warmer bias next week - Argentina

weather over the coming week will be mostly dry with the few showers that erupt briefly being light and resulting in no serious boost in topsoil moisture - Argentina

rainfall Nov. 8-15 will be a little better with scattered showers and thunderstorms expected in the west and south - The

precipitation will be greatest in the west leaving eastern areas with a drier bias - This

pattern is classic La Nina - Enough

rain may fall in western crop areas to induce some crop improvement especially in Santiago del Estero and northern Cordoba where the driest weather has been prevailing for months - Some

forecast model runs have advertised rain in the east, too, but it if it occurs it is expected to be more sporadic and light - Temperatures

will be seasonable over the next two weeks - The

bottom line remain good for this week because most of the nation has favorable soil moisture for recent past rainfall - Northwestern

areas will be driest - Rain

next week will be very important as more of the nation becomes too dry once again - Some

rain of significance will fall in Georgia and extreme southern parts of Russia’s Southern Region again Friday and possibly again a week later - China

weather will remain favorably dry over the next ten days favoring winter crop planting and establishment as well as summer crop harvesting - Any

showers that occur will be brief and light causing only a limited amount of disruption to fieldwork - Not

much precipitation fell during the weekend - South

Africa rain will increase today - Sufficient

rainfall will fall to bolster soil moisture for better spring and summer crop development - Some

winter crops might benefit from the moisture, but those crops are needing drier weather to promote maturation and harvesting soon - Friday

and Saturday will be dry and then scattered showers and thunderstorms will resume again Sunday through next week providing a very good mix of weather for the nation’s spring and summer crops - India

weather will be favorable for late season crop development and widespread harvesting over the next ten days - Winter

crop planting, emergence and establishment will advance well - Rain

will be confined to the far south and a few areas in the far Eastern States - Waves

of rain will continue to impact parts of Southeast Asia that are not being impacted by tropical cyclones over the next ten days to two weeks; most crop conditions will remain favorable - Brief

periods of precipitation will move across the European continent over the coming week resulting in a favorable mix of moisture and sunshine for winter crops - Fieldwork

will advance around the precipitation - This

weekend and next week should trend drier - Temperatures

will be near to above average - Ontario

and Quebec, Canada will experience limited precipitation through early next week improving harvest progress in the region after abundant moisture in October - Some

rain will fall briefly during mid-week next week followed by some additional net drying and then another storm in the second weekend of the outlook - Southern

Oscillation Index was +4.04 this morning; the index vary in a narrow range over the next week - Mexico

precipitation will be quite limited this week with showers mostly in the far south - Central

America will be wetter than for another couple of days because of Tropical Depression Eta’s remnants

- Flooding

has been extensive in Nicaragua and parts of Honduras this week

·

West-central Africa will experience erratic rain through the next ten days favoring crop areas closest to the coast

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - Cotton

areas are benefiting from drier weather

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda and southwestern Kenya will be impacted while Tanzania and northwestern Ethiopia rainfall is erratic and light

- Some

heavy rain may fall in Uganda early this week

·

New Zealand rainfall will be near to above average in North Island and northern parts of South Island while near to below average in southern South Island

- Temperatures

will be near to below average

Source:

World Weather Inc.

Thursday,

Nov. 5:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish monthly soybean and corn reports - FAO

World Food Price Index - Guatemala

October coffee exports - Port

of Rouen data on French grain exports - Malaysian

Nov. 1-5 palm oil export data

Friday,

Nov. 6:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Argentina

Saturday,

Nov. 7

- China’s

trade data on soybeans and meat imports

Monday,

Nov. 9:

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

winter wheat conditions; harvest for soybeans, corn, cotton, 4pm - Brazil

Unica cane crush, sugar production (tentative) - Ivory

Coast cocoa arrivals - EU

weekly grain, oilseed import and export data - EARNINGS:

BRF SA

Tuesday,

Nov. 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - China’s

agriculture ministry (CASDE) releases monthly report on supply, demand - Malaysian

Palm Oil Council webinar on China’s post-pandemic palm oil demand - Malaysian

Palm Oil Board releases data on end-October stockpiles, exports, production - Conab’s

data on area, output and yield of soybeans and corn in Brazil - Malaysia

Nov. 1-10 palm oil export data from AmSpec, SGS

Wednesday,

Nov. 11:

- EARNINGS:

JBS, Barry Callebaut - HOLIDAY:

U.S. (Veterans Day, federal govt closed, CME trading unaffected), France, Canada

Thursday,

Nov. 12:

- Port

of Rouen data on French grain exports - Vietnam

customs data on coffee, rice and rubber exports in October - EIA

U.S. weekly ethanol inventories, production - EARNINGS:

BayWa, Marfrig

Friday,

Nov. 13:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- NOTE:

CFTC Commitments of Traders report, usually released on Fridays, is scheduled for Monday, Nov. 16, due to U.S. federal holiday - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FranceAgriMer

weekly update on crop conditions - New

Zealand Food Prices

Saturday,

Nov. 14:

- China

Animal Agriculture Association summit on hog recovery, ASF vaccine progress

Source:

Bloomberg and FI

USDA

Export Sales

·

Soybeans came in at the higher end of expectations at 1.531 million tons, slightly below the previous week and included 810,700 tons for China.

·

Soybean meal export sales of 331,400 tons were ok and soybean oil of 6,800 tons were again low. Shipment so products slowed for soybean meal but improved for soybean oil.

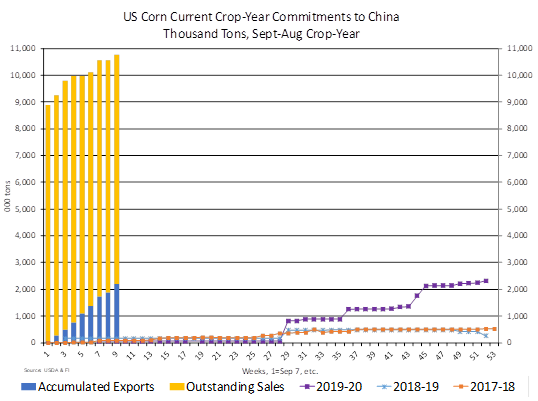

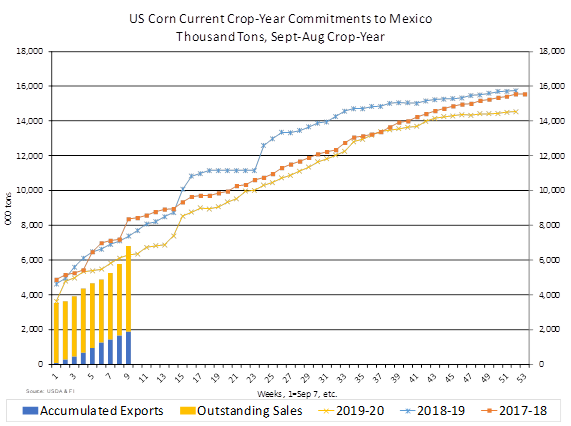

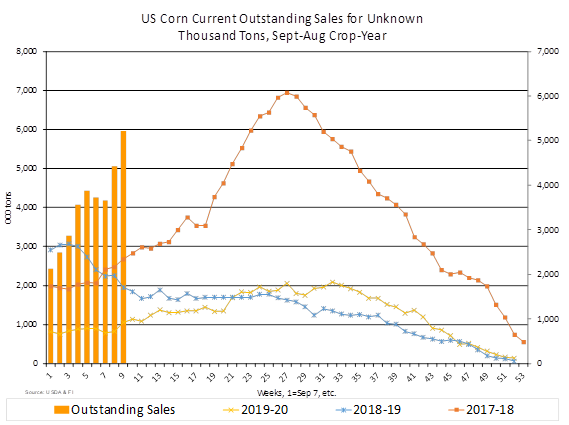

·

USDA export sales for corn of 2.611 million tons topped expectations and included 1.063 million tons for Mexico and 212,300 tons for China. Sorghum sales hit it out of the ballpark with 365,000

tons, including 340,000 tons for China. Pork sales were an excellent 42,200 tons and included 10,300 tons for China.

·

All-wheat export sales of 597,100 tons were within expectations.

US

Initial Jobless Claims: 751K (est 735K, prevR 758K)

US

Continuing Claims: 7.285Mln (est 7.2Mln, prevR 7.823Mln)

US

Initial Jobless Claims 751K A Decrease Of 7,000 From Previous Week’s Revised Level – Official

US

Non-Farm Productivity (Q3P): 4.9% (est 5.6%, prev 10.1%)

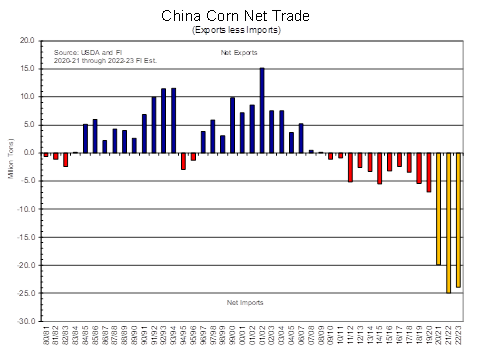

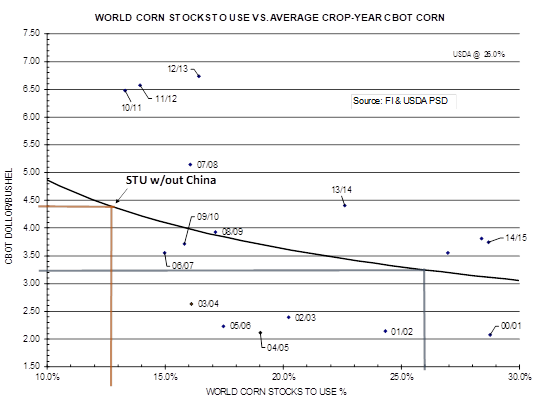

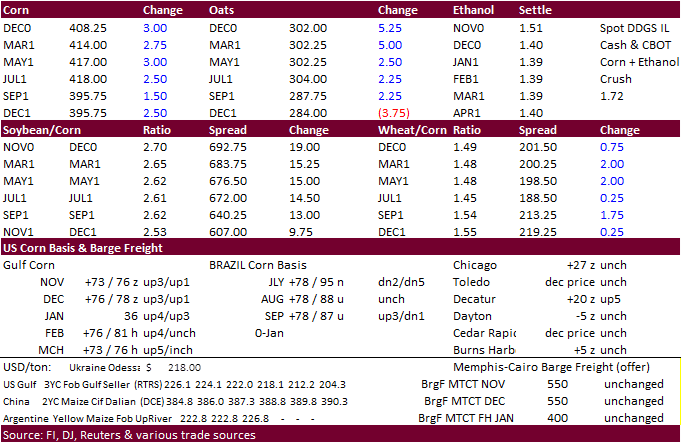

Corn.

-

What

I have predicted would happen 4 years ago, is finally getting recognition by USDA. China is expected to buy more than 20 million tons in a single crop year. If this occurs, corn prices are expected to average $4.40 or higher for the 2020-21 crop-year. See

below.

-

CBOT

corn traded higher following strength in soybeans and renewed hopes China will by US DDGS and ethanol. US export sales for corn were excellent and sorghum sales to China topped 300,000 tons. The USD traded at an October low.

-

Ukraine

corn production estimates widely vary between 26 and 33 million tons, down from 35.9 million tons in 2019.

-

Goldman

Roll starts Friday, the fifth business day of the month. -

The

weekly USDA Broiler report showed eggs set in the US down 3 percent and chicks placed down slightly. Cumulative placements from the week ending January 4, 2020 through October 31, 2020 for the United States were 8.14 billion. Cumulative placements were down

1 percent from the same period a year earlier.

China’s

Corn Imports Estimated to Hit 22 Million Metric Tons – USDA Attaché

The

forecast for China’s corn imports for Marketing Year (MY) 2020/2021 is increased from 7 million metric tons (MMT) to 22 MMT. The jump is attributed to depleted stocks and high domestic prices. – Attaché

This

comes after USDA said at the data user conference last week that they have not increased their China corn import number because China has not amended their TRQ import requirement of 7.2 million tons. The Attaché estimated China corn production at 250 million

tons, 10 million tons below USDA official.

Corn

Export Developments

-

Under

the 24-hour announcement system, private exporters reported export sales of 106,000 tons of sorghum for delivery to China during the 2020/2021 marketing year.

Updated

11/05/20

December

corn is seen in a $3.90-$4.25 range