PDF Attached

The

USD gave back 219 points by 3:15 pm CT after a sharp rise on Thursday. This move today lifted US agriculture futures higher. More jobs were added in the US during the month of October. WTI crude oil was very strong, up $4.38. China was in focus, whether or

not they are reopening by relaxing rules on Covid-19 lockdowns. If China does reopen, some suggest a disinflationary environment through supply chains/commodities.

Weather

Rain

will fall across eastern NE, KS, OK and northeastern TX today, and again eastern NE on Tuesday. The Midwest will see rain across the west central areas today before moving into the central areas Saturday before drying down Sunday int Monday. Brazil’s weather

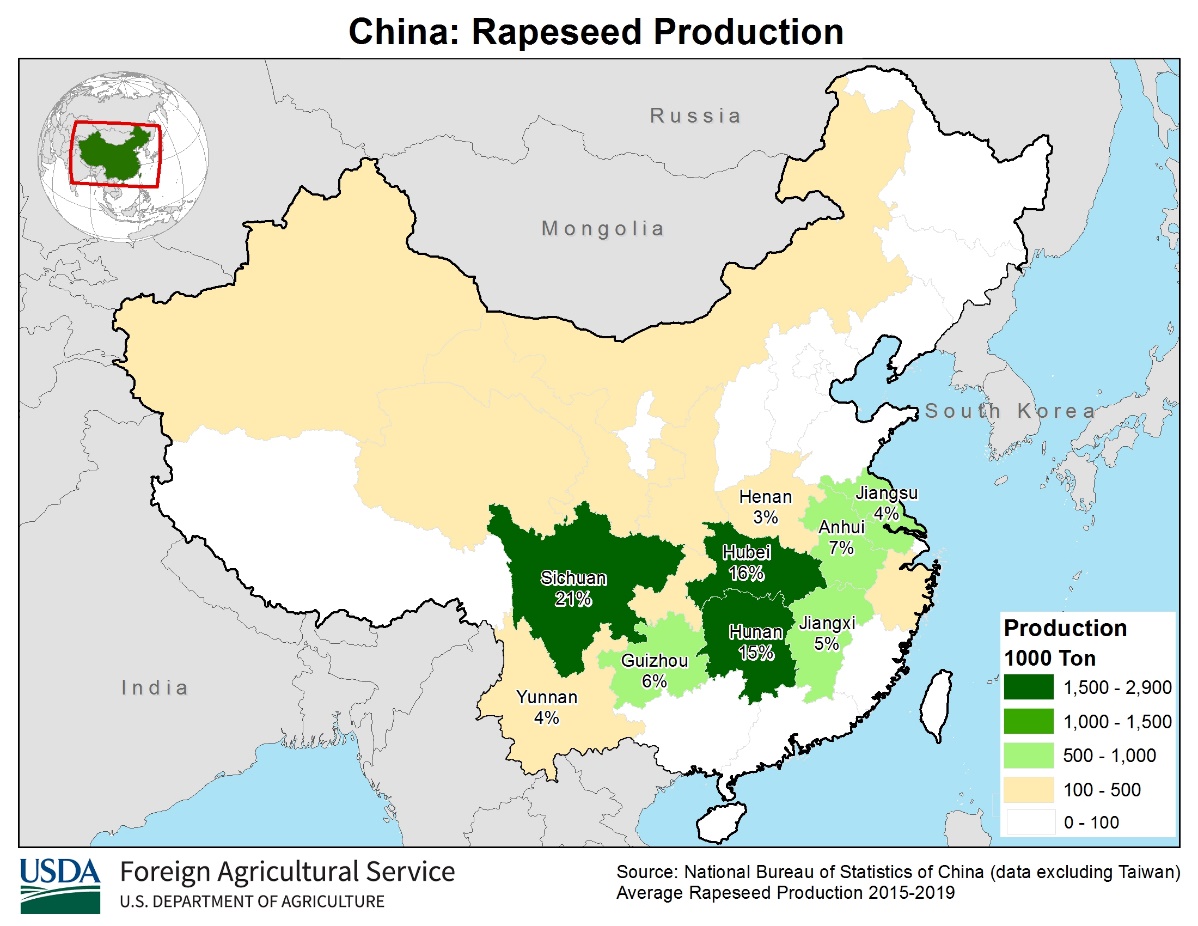

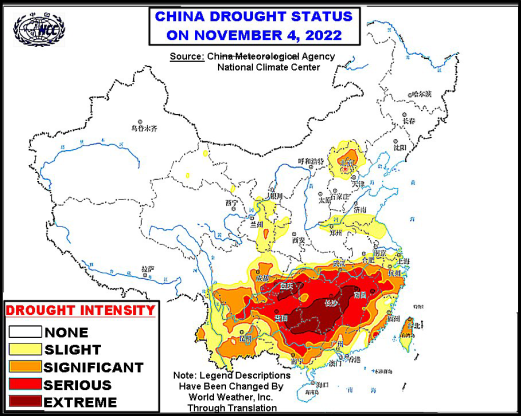

will be good for plantings over the next several days. There is still some concern for plantings across southern Brazil where rain is needed. Rain will favor Bahia and Minas Gerais. Argentina will be dry through Monday. China’s southern and central growing

areas are still experiencing drought and rain is needed for rapeseed development.

Source:

World Weather INC