PDF Attached

KEY

WEATHER ISSUES AROUND THE WORLD

- Western

portions of Russia’s Southern Region, Ukraine and Russia’s Central region received precipitation during the weekend with lingering showers early this week - Moisture

totals varying from 0.30 to 1.25 inches occurred in Ukraine while 0.05 to 0.84 inch occurred in western parts of Russia’s Southern Region - The

moisture was welcome and a few areas in southern parts of Russia’s Central Region (immediately north of the central Ukraine border) ranged from 1.00 to 2.00 inches - Most

of the precipitation has come too late in the autumn season to induce good stands in the driest areas, but there will be potential for crop improvement in the spring “if” winterkill is kept to a minimum this winter - Eastern

parts of Russia’s Southern Region, the lower Volga River Basin and western Kazakhstan received no appreciable moisture and most of these areas will stay dry this week

- Western

Kazakhstan may get a little light rain and rain changing to snow briefly Friday into the weekend, but resulting moisture will not be significant enough to change unirrigated winter crop conditions - Winter

crops in western Kazakhstan and eastern parts of Russia’s Southern Region are poorly established in unirrigated areas because of drought - Western

Australia received widespread “light” rain during the weekend slowing harvest progress in some areas, but possibly benefiting the latest developing winter crops - A

few follow up showers are possible briefly Thursday, but the impact will be low - Rain

will develop in southeastern Australia during mid-week this week benefiting spring and summer crops, but keeping winter crops moist and briefly slowing crop maturation and harvest progress - Southeastern

Australia will be dry late this week and into next Monday and then may be bothered again by rain early to mid-week next week

- The

moisture will raise a little more concern about the overall condition of wheat, barley and canola, but drier weather does return late in the week next week and lasts into the following weekend - Most

of the winter crops will likely manage the periodic precipitation relatively well, although longer periods of drying might be welcome - Queensland,

Australia dryland summer crop areas will get some rain late this week through the weekend and into early next week - The

moisture will be great for dryland cotton, sorghum and other summer crop planting, emergence and establishment - Hurricane

Eta will move into northeastern Nicaragua tonight and Tuesday and will impact both Nicaragua and Honduras into Friday - Heavy

rain expected in Honduras, northern Nicaragua and El Salvador - Rainfall

of 5.00 to 15.00 inches and local totals to 25.00 inches will result in notable flooding, landslides and considerable personal property, agriculture and infrastructure damage.

- Rice

and sugarcane will be most vulnerable to damage, but some corn, sorghum, coffee and other crops will also be impacted - At

0700 CDT today was located 140 miles east of Cabo Gracias A Dios, on the Nicaragua/Honduras border, at 14.8 north, 81.1 west moving westerly at 10 mph and maximum sustained wind speeds were reaching 90 mph with tropical storm force wind occurring out 125 miles

from the storm center and hurricane force wind out 25 miles - Worry

over the remnants of Tropical Storm Eta returning to the Caribbean Sea late this week and during the weekend will be rising - Many

computer forecast model runs are advertising such an event with the tropical system returning to the northwestern Caribbean Sea late this week and moving easterly during the weekend - The

storm is advertised to move erratically with Cuba, the Yucatan Peninsula, Florida and the Bahamas all at risk of some influence from the storm through next week - Brazil

rainfall during the weekend was most significant from northern and eastern Mato Grosso through Goias and Tocantins to Bahia, Minas Gerais and Espirito Santo - Moderate

to heavy rain fell in parts of the region especially in Espirito Santo and east-central through northern Minas Gerais where 2.00 to more than 5.00 inches resulted - Net

drying occurred in other Brazil locations especially in the west and south while temperatures were seasonable - Brazil

weather in this coming seven days will not change much with rain continuing in the northeastern one-third of the nation; including areas from northern and eastern Minas Gerais through Tocantins and parts of Goias to Bahia, Espirito Santo and northern Minas

Gerais - Sufficient

amounts of rain will fall to maintain wet field conditions in many areas and to bolster soil moisture in other areas - Net

drying is expected elsewhere – not only in Brazil, but in Paraguay and Uruguay as well - Nov.

8-15 weather will continue drier than usual in Uruguay, southern Rio Grande do Sul and a few other random locations in southern Brazil and Paraguay, but most of the region is expected to encounter scattered showers and thunderstorms that will benefit many

areas, but resulting rainfall may be a little light - Concern

will evolve over soil moisture and long-term crop development in portions of southern Brazil, Paraguay, Uruguay and eastern Argentina through the first half of November and perhaps all month - Temperatures

will be seasonable with a slight cooler bias this week and with a slight warmer bias next week - Argentina

weather during the weekend was dry and temperatures were mild - Argentina

weather this week will be mostly dry with the few showers that erupt being very brief and light resulting in not serious boost in topsoil moisture - Argentina

rainfall Nov. 8-15 will be a little better with scattered showers and thunderstorms expected - The

precipitation will be greatest in the west leaving eastern areas with a drier bias - This

pattern is classic La Nina - Enough

rain may fall in western crop areas to induce some crop improvement especially in Santiago del Estero and northern Cordoba where the driest weather has been prevailing for months - Some

forecast model runs have advertised rain in the east, too, but it if it occurs it is expected to be more sporadic and light - Temperatures

will be seasonable over the next two weeks - The

bottom line remain good for this week because most of the nation has favorable soil moisture for recent past rainfall - Northwestern

areas will be driest - Rain

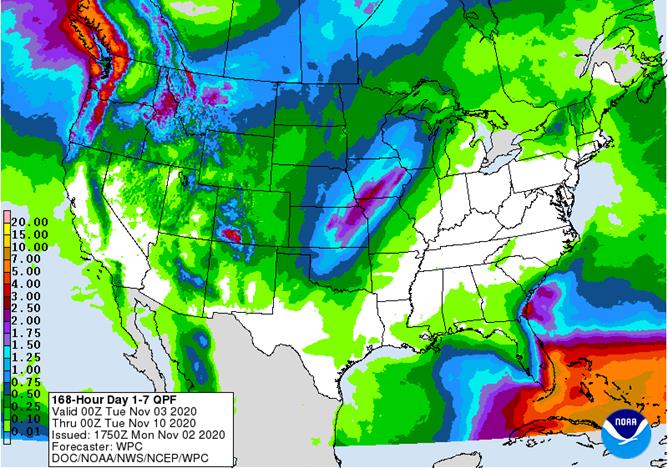

next week will be very important as more of the nation becomes too dry once again - U.S.

weather trended drier biased during the weekend with some warming followed by a new bout of cooling - The

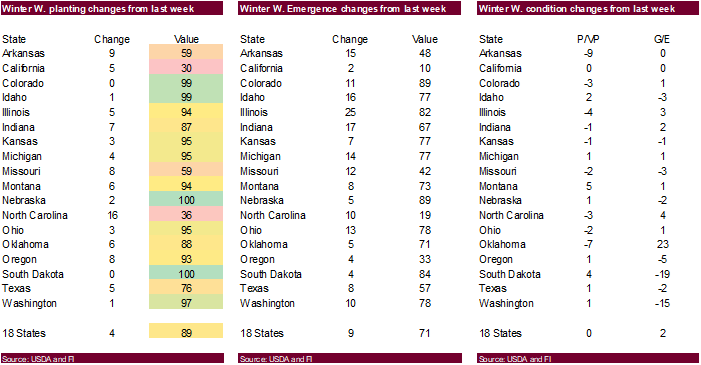

environment was improving for more aggressive harvesting in the lower Midwest, Delta and southeastern states, although more drying was needed and should evolve this week - Winter

crop planting likely resumed in some areas and should increase as drier weather continues this week.

- Temperatures

are expected to be notably warmer than usual this week, but much colder next week in the Plains and far western states - U.S.

cooling is likely in far western U.S. this weekend and two storm systems will then evolve in the central United States - Storm

number one occurs during the weekend (Nov. 6-8) - Rain

changing to snow and then blizzard conditions may evolve in the northwestern Plains and a part of Canada’s Prairies - Moisture

totals will vary from 0.20 to 0.80 inch with a few amounts to 1.35 inches - Heavy

snow will fall from Montana and western North Dakota to Saskatchewan and a part of Manitoba - Storm

number two evolves in the central Plains Sunday into next Monday and then advances to the upper Midwest during the early part of next week with a trailing cold front bringing some rain to the eastern Midwest next week - Moisture

totals Nov. 8-10 will vary from 0.20 to 0.80 inch with a few amounts of 1.00 to 1.50 inches from eastern portions of the central Plains to the western Great Lakes region and Minnesota - Eastern

Kansas to Minnesota and Wisconsin will be wettest - Heavy

snow will fall from north-central and northeastern Kansas through Iowa to Wisconsin and Minnesota - Remnants

of Hurricane Eta could impact Florida later next week, although confidence is low - U.S.

hard red winter wheat areas will get additional precipitation this weekend into early next week with the southwestern and west-central Plains getting the lightest amount of moisture - West

Texas could receive a few showers late this weekend into early next week, but resulting amounts will be brief enough to limit the impact on cotton and other summer crop harvesting - U.S.

Pacific Northwest will receive some rain and mountain snow late this workweek and again briefly next week - Moisture

totals are not likely to be very great - The

moisture will be welcome, but not enough on its own for a serious improvement in soil moisture, but water supply and mountain snowpack for 2021 may begin to improve - U.S.

Delta and interior southeastern states will be dry for much of the coming week with a brief bout of rain coming with a frontal system during mid-week next week - A

close watch on the remnants of Hurricane Eta will be warranted for possible impact on Florida or perhaps a few areas farther north, but not before the second half of next week - Other

precipitation in western portions of the Commonwealth of Independent states will be light and helpful for maintaining favorable soil moisture for use in the spring. - Some

rain of significance will fall in Georgia and extreme southern parts of Russia’s Southern Region early this week and again Friday into the weekend - China

weather will remain favorably dry over the next ten days favoring winter crop planting and establishment as well as summer crop harvesting - Any

showers that occur will be brief and light causing only a limited amount of disruption to fieldwork - Not

much precipitation fell during the weekend - Typhoon

Goni moved into the central Philippines during the weekend and was downgraded to tropical storm status while moving into the South China Sea Sunday and today - The

storm produced nearly 11.00 inches of rain in southeastern Luzon Island and nearly 7.00 inches in Samar with lighter rain to the west - Tropical

Storm Goni is not expected to regain typhoon intensity as it races to central Vietnam early this week - Landfall

in central Vietnam is expected late Wednesday or Thursday as a tropical storm and will bring very heavy rain and windy conditions to Vietnam’s Central Highlands - Some

negative impact is possible on coffee and other crop production areas in the Central Highlands, but damage should be low - Landfall

should be between Qui Nhon and Quang Ngai around 1200 GMT Thursday - Heavy

rain from the storm will push across Vietnam’s Central Highlands and then into Cambodia where flooding has already been a problem at times in the past 30 days - Tropical

Depression Astani will remain northeast of the northern Philippines for a while this week, but the storm will likely pass to the north of Luzon Island Thursday and Friday and then move toward southern China with landfall in Guangdong or Guangxi late this week - Astani

will become a tropical storm and possibly a typhoon for a little while before it comes close to any landmass

- Weakening

is expected prior to landfall in China - Another

tropical cyclone may form east of the Philippines late this week and move toward Luzon Island with landfall possible during the weekend

- South

Africa weekend rain was greatest from western and central North West through central and eastern Free State to western and southern Natal and eastern parts of Eastern Cape - Moisture

totals varied from 0.60 to 3.25 inches with amounts of 2.00 to 3.25 inches common in eastern Free State and Natal

- Additional

rain is needed nationwide to support summer crop planting - South

Africa rain will be erratic until Wednesday when a general increase in rain occurs across the nation through Thursday - Sufficient

rainfall will occur to bolster soil moisture for better spring and summer crop development - Some

winter crops might benefit from the moisture, but those crops are needing drier weather to promote maturation and harvesting soon - Friday

and Saturday will be dry and then scattered showers and thunderstorms will resume again providing a very good mix of weather for the nation’s spring and summer crops - India

weather will be favorable for late season crop development and widespread harvesting over the next ten days - Winter

crop planting, emergence and establishment will advance well - Rain

will be confined to the far south and a few areas in the far Eastern States - Waves

of rain will continue to impact parts of Southeast Asia that are not being impacted by tropical cyclones over the next ten days to two weeks; most crop conditions will remain favorable - Central

Vietnam will likely be impacted by Tropical Storm Goni during mid- to late week this week with additional heavy rain and strong wind speeds possible near Da Nang, Hue and Qui Nhon - Southern

China may be impacted by Tropical Storm Astani during mid-week before moving toward northern Vietnam later in the week - Central

Vietnam is advertised to be hit by 5 tropical weather systems over the next two weeks perpetuating its excessive moisture and flood problems - The

nation has already been impacted adversely by frequent tropical weather systems since October 5 - Brief

periods of precipitation will move across the European continent over the coming week resulting in a favorable mix of moisture and sunshine for winter crops - Fieldwork

will advance around the precipitation - This

weekend and next week should trend drier - Temperatures

will be near to above average - Ontario

and Quebec, Canada will experience limited precipitation over the coming week to ten days greatly improving harvest progress in the region after abundant moisture in October - Southern

Oscillation Index leveled off and began to rise a little during the weekend. The index was +4.62 this morning; the index fell from a peak of +12.58 on October 13 to a low of +3.83 Saturday - The

index will rise this week - Mexico

precipitation will be quite limited this week - Central

America will be wetter than usual this week especially in Nicaragua and Honduras because of Hurricane Eta moving inland and not completely dissipating - Flooding

is likely along with some crop and property damage

·

West-central Africa will experience erratic rain through the next ten days favoring crop areas closest to the coast

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - Cotton

areas are benefiting from drier weather

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda and southwestern Kenya will be impacted while Tanzania and northwestern Ethiopia rainfall is erratic and light

- Some

heavy rain may fall in Uganda early this week

·

New Zealand rainfall will be near to above average in North Island and northern parts of South Island while below average in southern South Island

Temperatures

will be near to below average

Source:

World Weather Inc.

Monday,

Nov. 2:

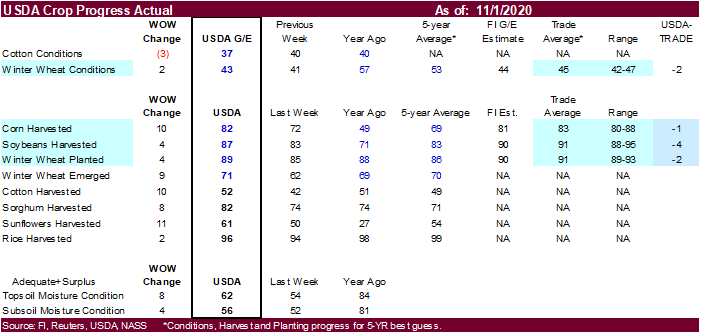

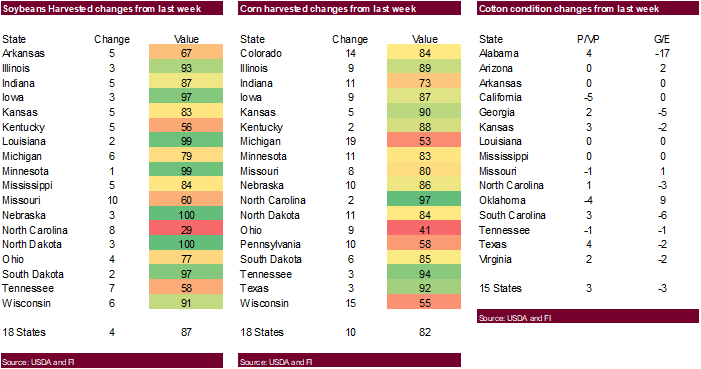

- USDA

weekly corn, soybean, wheat export inspections, 11am - USDA

soybean crush, corn for ethanol, DDGS output, 3pm - U.S.

crop conditions, harvest for soybeans, corn, cotton, 4pm - Costa

Rica, Honduras October coffee exports - Cotton

supply/demand outlook from International Cotton Advisory Committee - Australia

Commodity Index - Ivory

Coast cocoa arrivals - HOLIDAY:

Brazil

Tuesday,

Nov. 3:

- U.S.

Purdue Agriculture Sentiment, 9:30am - New

Zealand global dairy trade auction - FT

Global Food Systems conference - EARNINGS:

Andersons, AB Foods - HOLIDAY:

Japan

Wednesday,

Nov. 4:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - New

Zealand Commodity Price

Thursday,

Nov. 5:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish monthly soybean and corn reports - FAO

World Food Price Index - Guatemala

October coffee exports - Port

of Rouen data on French grain exports - Malaysian

Nov. 1-5 palm oil export data

Friday,

Nov. 6:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Argentina

Saturday,

Nov. 7

- China’s

trade data on soybeans and meat imports

Source:

Bloomberg and FI

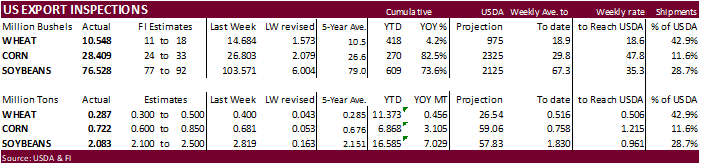

USDA

inspections versus Reuters trade range

Wheat

287,059 versus 300000-500000 range

Corn

721,623 versus 600000-1100000 range

Soybeans

2,082,741 versus 1500000-2500000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING OCT 29, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN

10/29/2020 10/22/2020 10/31/2019 TO DATE TO DATE

BARLEY

0 798 3,134 9,867 11,808

CORN

721,623 680,823 283,704 6,867,630 3,762,491

FLAXSEED

0 0 0 389 172

MIXED

0 0 0 0 0

OATS

0 0 0 996 798

RYE

0 0 0 0 0

SORGHUM

94,454 73,531 67,048 637,099 375,530

SOYBEANS

2,082,741 2,818,734 1,483,653 16,584,920 9,556,028

SUNFLOWER

0 0 0 0 0

WHEAT

287,059 399,645 293,971 11,372,672 10,916,185

Total

3,185,877 3,973,531 2,131,510 35,473,573 24,623,012

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

CME

will revise their futures price limits effective February 2.

StoneX

US yield/production estimates

Corn

November 178.9/14.762; October 179.0/14.942

Soybeans

November 52.1/4.291; October 52.4/4.351

Canadian

Markit Manufacturing PMI Oct: 55.5 (prev 56.0)

US

Markit Manufacturing PMI Oct F: 53.4 (est 53.3; prev 53.3)

US

ISM Manufacturing Oct: 59.3 (est 55.8; prev 55.4)

–

ISM New Orders Oct: 67.9 (est 62.0; prev 60.2)

–

ISM Prices Paid Oct: 65.5 (est 60.5; prev 62.8)

–

ISM Employment Oct: 53.2 (prev 49.6)

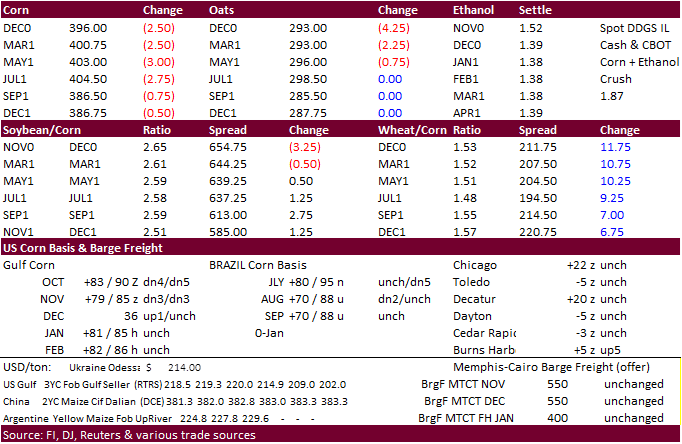

Corn.

-

December

corn futures traded lower on long liquidation and Covid-19 fears that could again impact global ethanol demand. Traders were busy shoring up positions ahead of the US election set for Tuesday. Funds as of last Tuesday were 54,100 contracts more long than

expected for the traditional funds. December corn failed to test its psychological $4.00 level, a bearish indication.

-

Some

believe US ethanol demand will slow as more and more states go back on partial lockdown. Parts of Europe are headed back to lockdown, which is viewed bearish for Brent Crude oil, but that product traded higher on Monday.

WTI

crude oil fell to a 5-month low earlier but rebounded by early afternoon.

-

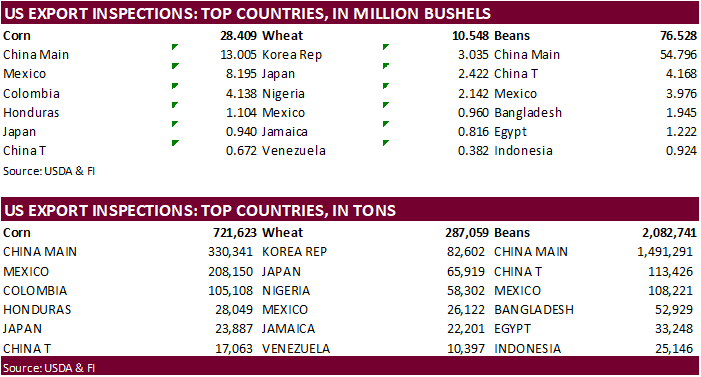

USDA

US corn export inspections as of October 29, 2020 were 721,623 tons, within a range of trade expectations, above 680,823 tons previous week and compares to 283,704 tons year ago. Major countries included China Main for 330,341 tons, Mexico for 208,150 tons,

and Colombia for 105,108 tons. -

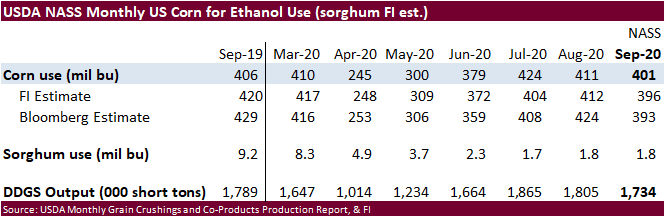

The

US corn for ethanol use during the month of September came in slightly above trade expectations.

-

Decatur

corn basis fell 5 cents to 15 over the Dec. -

Brazil

domestic corn prices were a little weaker as 54% of the first corn crop is planted (AgRural). We are picking up that South Korea was in the market for a corn cargo for LH April arrival, and it could originate from the US (not South Africa as earlier reported).

- Germany

ASF: 114 cases since September 10. - South

Korea banned poultry imports from the Netherlands on bird flu concerns. -

Ukraine

grain exports fell 15.8 percent so far in 2020-21 to 16.5 million tons, including 2.5 million tons of corn (4.4MMT year earlier).

Corn

Export Developments

-

Under

the 24-hour announcement system, private exporters sold 204,000 tons of corn to unknown.

Updated

11/02/20

December

corn is seen in a $3.85-$4.10 range