PDF Attached includes end of month price performance

Choppy

end of the week for CBOT agriculture futures but prices are generally higher week over week. Over the weekend Egypt announced they seek more wheat for December 11-20 shipment. This may support US wheat futures Sunday night. Traders need to monitor the USD

as this has been widely ignored over the past week and with appreciation seen next week, it could send a negative sentiment to US agriculture markets. We also caution the record highs in the US stocks markets as a setback could also have negative consequences

for commodities.

USDA:

Private exporters reported sales of:

279,415

metric tons of corn for delivery to Mexico during the 2021/2022 marketing year

132,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year

222,350

metric tons of soybeans received during the reporting period for delivery to unknown destinations during the 2021/2022 marketing year.

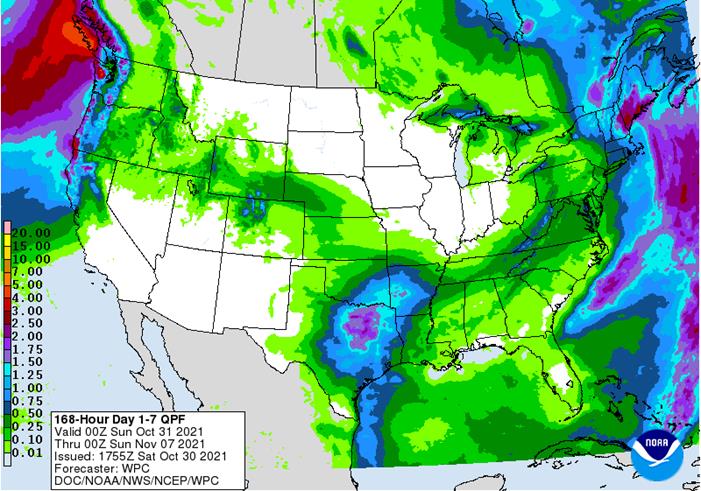

Weather

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Argentina

crops were stressed this week by high temperatures in the 90s to slightly over 100 Fahrenheit and little to no rain - Winter

wheat, corn, sunseed and cotton all would benefit from rain - Soybean

planting begins next week and moisture is needed for that crop as well - Argentina

will see rain in much of the nation Sunday through Tuesday with a few showers occurring in the northwest today and into the Saturday and in the southwest beginning Saturday - The

moisture will be welcome, but not enough to fully remove concern about dryness and crop development out more than a week - Frequent

follow up rain is still needed in the driest areas - Over

time, a traditional La Nina pattern is expected to evolve favoring timely rain in western crop areas while the east gets less than usual precipitation - This

this trend will evolve later in November - Brazil

crop weather has been and will continue nearly ideal for much of the nation over the next two weeks - Some

lighter and more erratic rainfall than usual will impact the far south and in southern Paraguay and Uruguay over time and these areas will need to be watched for dryness later in the growing season - For

now, the bottom line remains highly favorable for planting and early season crop development - Drying

in southern Brazil will be good for wheat maturation and harvesting - Coffee,

citrus and sugarcane conditions are rated favorably along with grains and oilseeds - U.S.

harvest delays will continue through the weekend and into early next week for the wettest areas due to cool temperatures slowing drying rates - Additional

rain in the eastern Midwest today and Saturday will perpetuate the delays longer than in the western Corn Belt - U.S.

Delta and southeastern states experienced rain delays to fieldwork this week and the some of that delay will linger through the weekend - Slowly

improving crop and field conditions are expected later this weekend and next week allowing harvest progress to gradually resume - Western

portions of U.S. hard red winter wheat production areas will be dry biased for the next week, despite a few brief showers - The

region is in need of rain especially in unirrigated fields in the high Plains region - These

areas will likely remain drier biased well into the winter, although not completely dry - The

high Plains region “may” get “some” rain and snow briefly during the second weekend of the two week outlook, but confidence in its significance is low - Eastern

wheat areas have plenty of moisture and are experiencing a good establishment environment

- Recent

rain and mountain snow in the U.S. Pacific Northwest has helped improve water supply and runoff potentials - However,

there is still a huge need for greater moisture in the Yakima Valley, Columbia River Basin and Snake River Valley - Some

additional precipitation will impact these areas periodically over the next two weeks with mountains getting far greater precipitation than the valleys - Northern

California will see some periodic light precipitation over the next ten days, but no more heavy, soaking, rainfall is expected for a while - Runoff

form the recent excessive precipitation event is raising water reservoir levels in many areas, but much more precipitation is needed - Southern

California remains drought ridden and needs significant rain that is not likely to occur anytime soon - Montana

and neighboring areas of Canada’s Central Prairies will experience some brief bouts of rain and snow today into Saturday morning as colder air arrives - The

moisture will be good for surface moisture boosting, but much more is needed to ensure better winter crop establishment - Some

of Montana and southern Alberta should see improved soil moisture later this autumn and winter - Ontario

and Quebec, Canada will receive less frequent and less significant rainfall after this weekend, but ideal harvest conditions are still unlikely - Ontario

has been frequently wet this autumn slowing harvest progress for corn and soybeans - Some

wheat planting has also been slowed - Quebec

weather has not been nearly as wet - Vietnam’s

central coast will see improving weather during the next ten days - Rainfall

of 20 to more than 50 inches has impacted central coastal areas of Vietnam this month and flooding has been quite serious at times - Drier

weather is expected, but completely dry weather is unlikely with a new period of rainy weather possible next week - Western

and northern Colombia agricultural areas will be closely monitored over the next few weeks as the potential for flooding increases.

- The

risk may be greatest starting in the second week of the forecast and continuing into mid-November.

- Coffee,

sugarcane, corn and a host of other crops may eventually impacted by too much rain - Western

Venezuela may also be involved with the excessive moisture - South

Africa received some shower and thunderstorm activity Thursday and it will linger today before a week of drying follows - The

moisture will help moisten up the topsoil for more aggressive spring planting, but more rain is needed

- India’s

greatest rain will be in the southern one-third of the nation for a while - Some

heavy rain may fall along the lower east coast in this coming week - Some

showers will occur in the far eastern states of India as well - The

greatest drying in India will be in the central and north which will translate into a very good environment for winter wheat, rapeseed, millet, sorghum and pulse crop planting as well as supporting summer crop harvesting - Northern

and east-central China weather will be favorably mixed over the next ten days supporting summer crop maturation and harvest progress and some winter crop planting - Winter

grain and rapeseed planting will advance around brief bouts of rain - Rain

in southwestern China may disrupt farming activity for a while, but no serious harm will come to unharvested crop quality - Central

and western Xinjiang, cotton, corn and other crop harvesting is advancing relatively well while periodic showers in northeastern production areas have slowed fieldwork at times and raised some cotton quality concerns as well - Western

Europe weather will trend wetter from the northwest half of the Iberian Peninsula through France and into western Germany this weekend into next week - The

moisture will be well timed for the recently planted winter crops and should help them emerge and establish favorably - Fieldwork

will be disrupted for a while - Some

of the precipitation will advance into eastern Europe next week as well - Eastern

Europe will remain in a dry weather mode into early next week along with Ukraine and much of Russia’s winter crop region in the Volga River Basin - Most

of the crops in these areas should be established well enough to get through winter, but snow cover will be needed in parts of the region during extreme cold to protect crops – especially those that may not be as well established as they should be

- A

boost in eastern Europe and western CIS precipitation is expected in the second week of the outlook, Nov. 3-9 - Tropical

Storm Malou was located 402 mild east southeast of Yokosuka, Japan near 33.1 north, 148.3 east moving northeasterly at more than 30 mph and producing wind speeds to 69 mph near the storm center - The

storm will stay to the southeast of Japan and will pose no threat to land while losing its tropical characteristics today and Saturday - Australia

weather continues nearly ideal for the development of winter wheat, barley and canola - A

boost in rainfall is needed in the interior east to support better spring planting for cotton and sorghum - Some

welcome rain occurred Thursday in southern Queensland and northern New South Wales - Most

winter wheat, barley and canola production areas will continue to experience highly favorable weather conditions, although there is some concern over the potential for wet harvest conditions in a part of the east. - Southeast

Asia will see routinely occurring rainfall maintaining moisture abundance in Indonesia, Philippines, Malaysia and the mainland areas of Southeast Asia. - A

deep low pressure center in the south-central Mediterranean Sea will move erratically over the next few days possibly producing some heavy rain in Sicily and neighboring southern Italy - The

storm is a “Medicane” and it has produced heavy rain and strong wind speeds in Sicily and far southwestern Italy in the past couple of days with more likely today - The

storm will move away from Sicily and Italy this weekend moving to the southeast where it should slowly dissipate over open water - North

Africa showers will develop during the middle to latter part of next week after several days of dry conditions - Central

Africa will see drier weather in some cotton, coffee and cocoa areas this weekend into next week

- The

change will be welcome especially in cotton areas - Frequent

rain has slowed crop maturation in some areas - Southern

Mexico will be wetter than usual over the next ten days causing some delay to fieldwork - Central

America rainfall will be greater than usual in El Salvador and Guatemala and near to below average elsewhere - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Today’s

Southern Oscillational Index was +8.71 and it was expected to drift lower a little further over the next few days - New

Zealand weather is expected to be a wetter biased in North Island over the next week and drier than usual in most other areas

- Temperatures

will be seasonable.

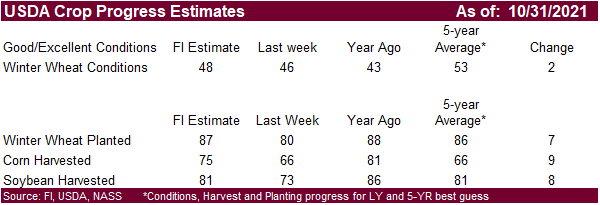

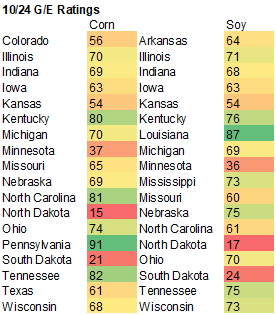

Last

ratings of the season by state

- Australia

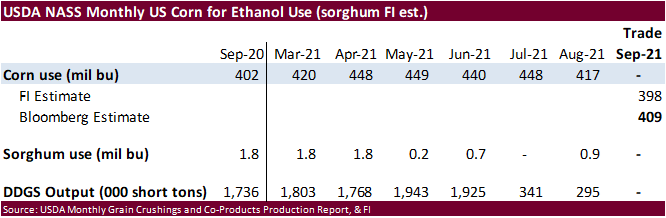

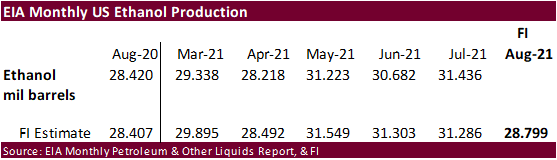

Commodity Index, 1:30am - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

corn for ethanol, DDGS production, 3pm - USDA

soybean crush, 3pm - U.S.

cotton condition; corn, soy and cotton harvesting; winter wheat planting, 4pm - Malaysia’s

October palm oil export data from AmSpec and SGS - Honduras

and Costa Rica monthly coffee exports - Global

cotton balance report from International Cotton Advisory Committee - Ivory

Coast cocoa arrivals - HOLIDAY:

France, Italy, Spain, Ivory Coast

Tuesday,

Nov. 2:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - HOLIDAY:

Brazil

Wednesday,

Nov. 3:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

Japan

Thursday,

Nov. 4:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price, 8pm Wednesday ET time - Port

of Rouen data on French grain exports - HOLIDAY:

India, Malaysia, Singapore

Friday,

Nov. 5:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish demand-supply reports on corn, soy and other commodities - FranceAgriMer

weekly update on crop conditions - Malaysia

Nov. 1-5 palm oil exports - HOLIDAY:

India

Source:

Bloomberg and FI

Macros

US

Personal Income Sep: -1.0% (est -0.3%; prev 0.2%; prevR 1.0%)

–

Personal Spending Sep: 0.6% (est 0.6%; prev 0.8%)

–

Real Personal Spending Sep: 0.3% (est 0.3%; prev 0.4%)

US

PCE Core Deflator (M/M) Sep: 0.2% (est 0.2%; prev 0.3%)

–

PCE Core Deflator (Y/Y) Sep: 3.6% (est 3.7%; prev 3.6%)

–

PCE Deflator (M/M) Sep: 0.3% (est 0.3%; prev 0.4%)

–

PCE Deflator (Y/Y) Sep: 4.4% (est 4.4%; prev 4.3%)

US

Employment Cost Index Q3: 1.3% (est 0.9%; prev 0.7%)

Canadian

GDP (M/M) Aug: 0.4% (est 0.7%; prev -0.1%)

–

GDP (Y/Y) Aug: 4.1% (est 4.3%; prev 4.7%)

Canadian

Industrial Product Price (M/M) Sep

US

Chicago PMI Oct: 68.4 (est 63.7; prev 64.7)

US

Crude Oil Production Fell By 185,000 BPD In Aug To 11.141 Mln BPD (VS Revised 11.326 Mln BPD In July) – EIA

–

July Oil Production Revised Up By 19,000 BPD To 11.326 Mln BPD

·

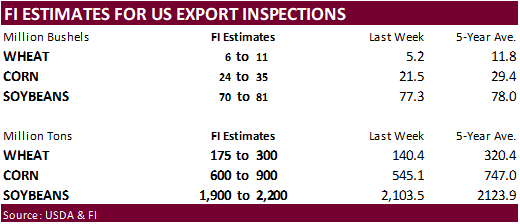

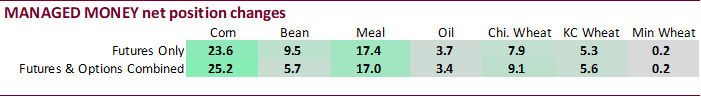

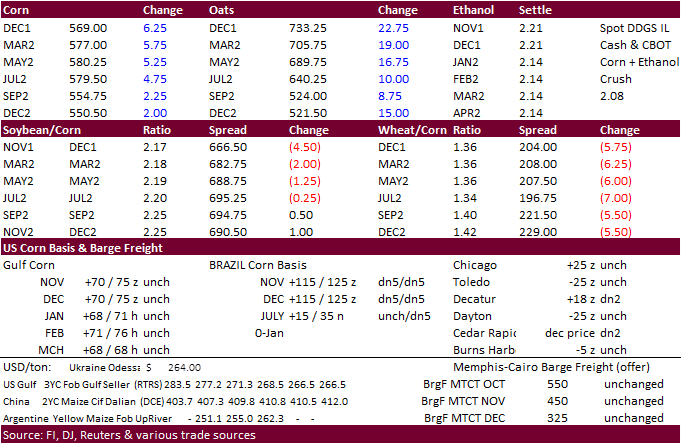

Corn futures ended sharply higher led by the nearby months on speculation US domestic demand, which has been improving, will support prices over the long term. We caution the slow start to the US export campaign. Without substantial

US export corn developments, we can’t see this market hold these levels without wheat prices trading near a three month high (Chicago). Therefore, an appreciating USD coupled with profit taking in wheat could send corn down next week.

·

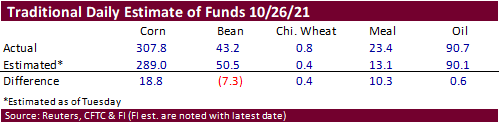

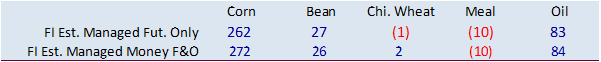

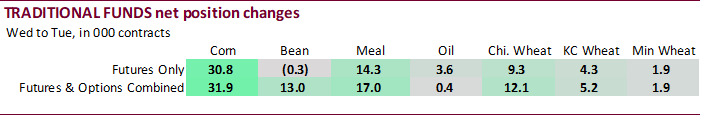

Funds bought an estimated net 8,000 corn contract on Friday.

·

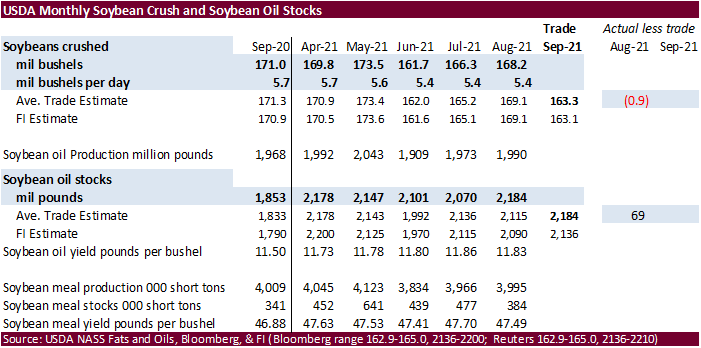

USDA will be releasing their monthly S&D update on November 9. November and December updates are typically benign months for major US and world changes but this year we could see downward adjustments to corn and soybean exports

as they are lagging well behind a year ago. Soybean inspections to date are running 45 percent below the Sep through October 21 period year ago level and corn is running 24 percent below year ago. Note the November updates will include slight adjustments,

is necessary, to US corn and soybean harvested area, yield and production. For this report we look for minor changes. Our bias is to see a slightly upward revision to yields.

·

Wet weather was seen across the ECB Thursday into Friday, delaying harvesting activity.

·

The US weather forecast has not changed much and look for stress to build up across parts of the southern Great Plains with lack of rain and ongoing harvest progress bias Corn Belt with persistent rains.

·

France harvested 54 percent of their corn crop as of October 25, up from 32 percent week earlier and well down from a dry season of 87 percent around that time year ago.

Export

developments.

-

USDA:

Private exporters reported sales of: -

279,415

metric tons of corn for delivery to Mexico during the 2021/2022 marketing year -

132,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year -

222,350

metric tons of soybeans received during the reporting period for delivery to unknown destinations during the 2021/2022 marketing year.

Updated

10/27/21

December

corn is seen in a $5.10-$5.80 range

March

corn is seen in a $5.00-$6.00 range

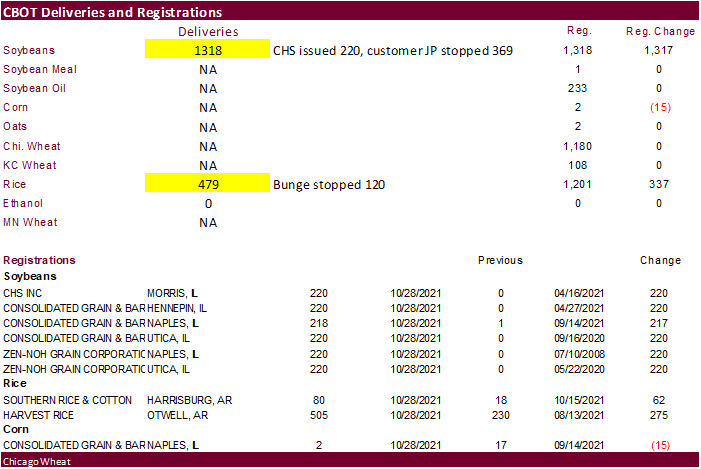

·

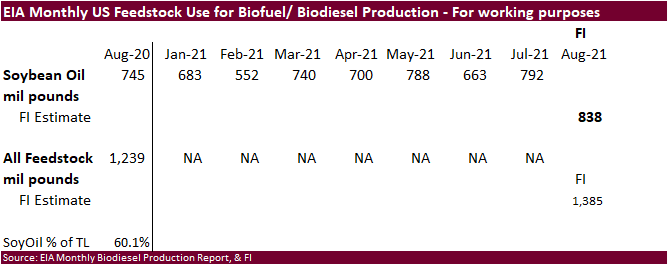

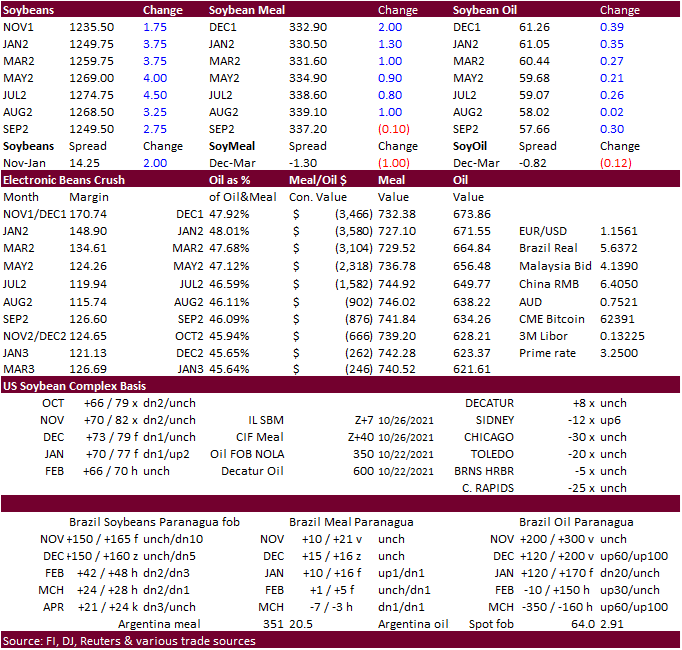

CBOT soybeans closed higher despite a sharply higher USD. Soybean meal rallied but kept under key MA’s. Soybean oil has been puzzling as it should be higher with rising global vegetable prices.

·

Private exporters reported the sale of 132,000 tons of soybeans to unknown destinations for delivery in the 2021-22 marketing year. Separate sales of 222,350 tons of soybeans for delivery during unknown time periods also were

reported. (Reuters).

·

Funds bought an estimated net 2,000 soybeans, bought 2,000 soybean meal and bought 3,000 soybean oil.

·

First Notice Day deliveries for soybeans were a large 1,318 contracts, with nearly all of them fresh registered contracts. Remember a week ago there were a bunch of EFPs done and open interest dropped about 132k since then.

Soybean open interest fell 23,367 on Thursday alone.

·

China vegetable oil futures rallied overnight and with palm higher, that might be supporting CBOT soybean oil.

·

(Reuters) – Top palm oil exporter Indonesia set its crude palm oil reference price at $1,283.38 a ton for November, raising the export tax to the maximum level, Musdhalifah Machmud, a deputy minister at the Coordinating Ministry

of Economic Affairs.

Export

Developments

·

The USDA seeks 20 tons of vegetable oil in 4-liter cans for Dec 1-13 shipment on November 2.

·

See corn export developments for USDA 24-hour announcements on soybeans

Updated

10/18/21

Soybeans

– November $11.50-$13.00 range, March $11.50-$13.50

Soybean

meal – December $295-$335, March $300-$360

Soybean

oil – December 59-65 cent range, March 56-65

·

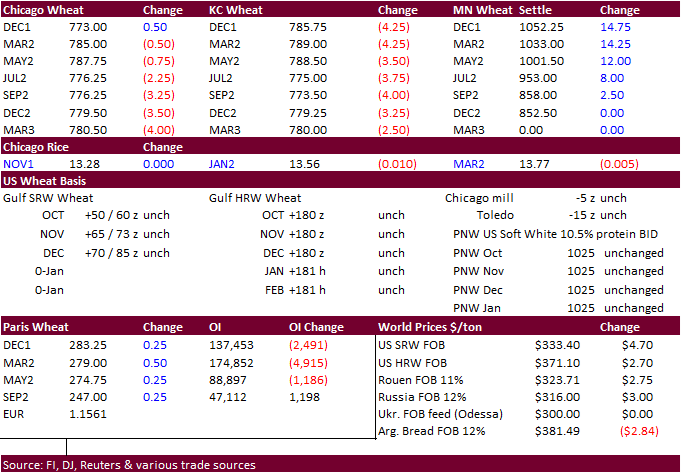

US wheat futures ended mixed on profit taking in Chicago and KC but made a big move higher in Minneapolis. Egypt over the weekend announced they seek wheat, and this is seen supportive for US wheat futures. But don’t discount

profit taking next week if the USD rallies.

·

Funds for Chicago wheat were estimated net even on the day.

·

The US Great Plains was Friday and will remain that way through the weekend, adding stress to the recently planted winter wheat crop.

·

Rain is expected to occur across western NE Sunday, then spread to KS and northeast CO early next week.

·

Paris December wheat was up 0.25 euro at 283.25.

·

Ukraine harvested 81 percent of their grain crop or 60.7 million tons, according to the AgMin. 80.3 MMT total is seen.

Export

Developments.

·

Egypt’s GASC seeks wheat on Monday for December 11-20 shipment.

·

Saudi Arabia seeks 655,000 tons of wheat on October 29.

·

Pakistan issued an import tender for 90,000 tons of wheat set to close Nov. 4 for Jan through April shipment.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

·

Results awaited: Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

Updated

10/26/21

December

Chicago wheat is seen in a $7.15‐$7.90 range, March $6.75-$8.00 December KC wheat is seen in a $7.10‐$7.95, March $6.82-$8.25

December

MN wheat is seen in a $9.45‐$10.50, March $9.00-$10.50.

some are calling for $11 MN wheat

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.