PDF Attached

Weather

and Crop Progress

Rice

traders and grain exporters among others should note that a super typhoon headed to the Philippines may have a large impact on crops this weekend.

MOST

IMPORTANT WEATHER TO WATCH

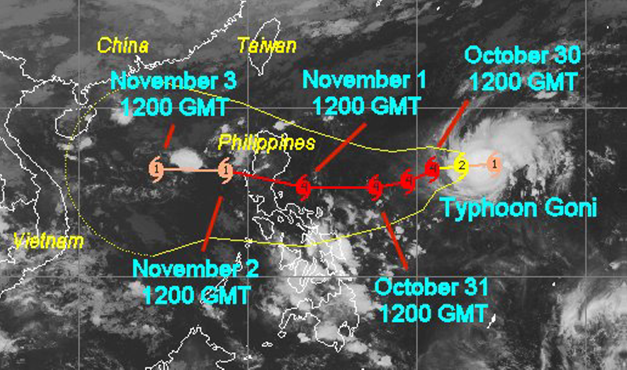

- Typhoon

Goni is a super typhoon over open water well east of the Philippines, but was producing sustained wind speeds of 172 mph and was moving toward the nation

- Landfall

is expected in Luzon Island Sunday into Monday as a Category Two or Three hurricane equivalent storm, based on the Saffir-Simpson Wind Scale - Damage

over the Island will be possible with losses to personal property, infrastructure, rice, sugarcane and some tree crops – depending on the storm’s ultimate intensity - Landfall

is expected over the heart of Luzon Island - The

storm size is relatively small which may limit the path of destruction, but it will need to be closely monitored - The

storm may continue west to Vietnam next week with landfall near Da Nang or Hue during mid-week

- A

developing tropical disturbance near the Windward Islands was moving west northwesterly into the Caribbean Sea today and it will become a tropical storm during the weekend - Landfall

is expected over Nicaragua and/or Honduras early next week - Very

heavy rain and flooding will impact these areas with some property and crop damage possible - Russia’s

Southern Region and Ukraine will receive periods of rain Friday through early next week

- Resulting

rainfall will improve winter crop establishment, although it is rather late in the season - Moisture

totals of 0.30 to 0.80 inch and local totals of 1.00 to 1.50 inches will result from Ukraine into western parts of Russia’s Southern Region - Eastern

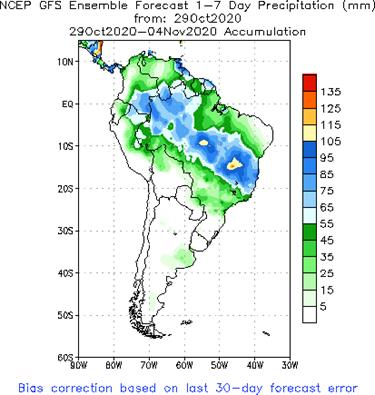

parts of Russia’s Southern Region (including the lower Volga River Valley) and Kazakhstan will be left mostly dry - Argentina’s

outlook for the next ten days is drier biased - Rain

advertised for mid-week next week was reduced overnight - The

ten days will be a great opportunity for planting and new crop development - Some

forecast models are suggesting scattered showers and thunderstorms will return during the week of November 9; that rain will prove to be very important after the coming week of dry and mild to warm weather - Rain

scattered across much of Brazil Thursday - Areas

from eastern Santa Catarina to northern and western Minas Gerais, Goias and Mato Grosso reported rain with amounts of 0.10 to 0.62 inch common - Local

totals reached over 1.00 inch with southern Mato Grosso and central Goias among the wetter areas - Mostly

dry weather occurred from Rio Grande do Sul to southwestern Parana, Paraguay and southwestern Mato Grosso do Sul

- Southern

and west-central Brazil crop areas, as well as Paraguay and Uruguay, will experience net drying conditions for the next ten days - This

includes Sao Paulo, Parana, Rio Grande do Sul, Santa Catarina, western and central Mato Grosso do Sul and southwestern Mato Grosso

- Net

drying in these areas will deplete topsoil moisture and raise some potential for stress in those areas that have not received good rainfall this week - The

greatest rain this week fell in Mato Grosso do Sul and crops there will likely stay in favorable shape despite net drying - Crops

from Rio Grande do Sul to southwestern Parana and Paraguay are expected to be quite dry by Nov. 9 - Scattered

showers and thunderstorms advertised for the Nov. 9-14 period will prove to be extremely important after the coming ten days of drying - Brazil

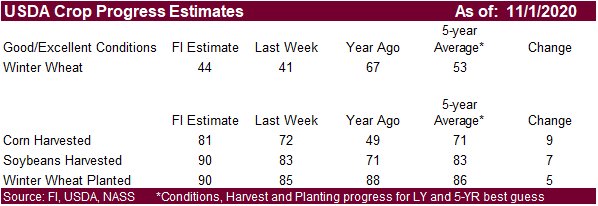

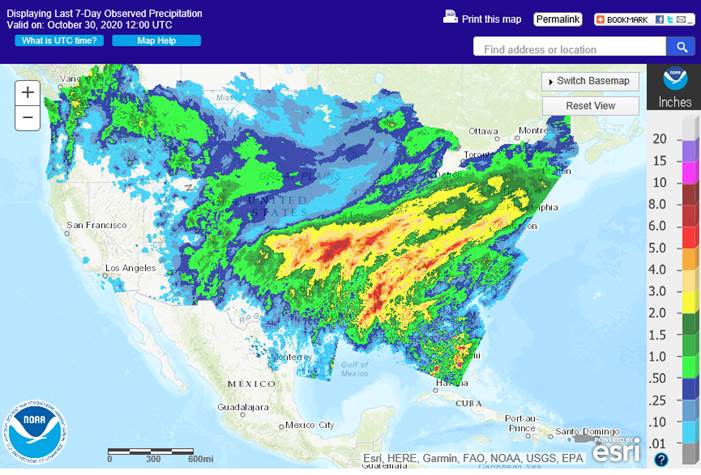

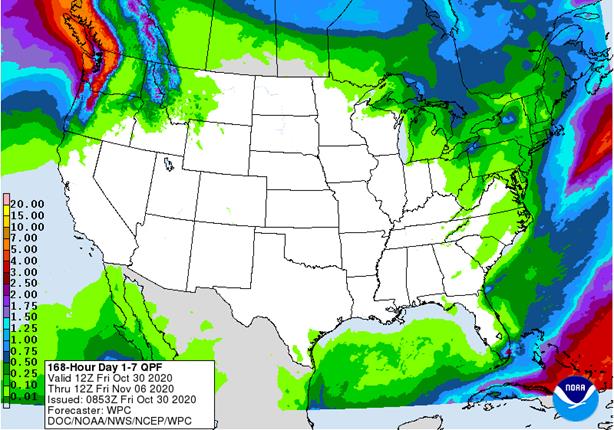

crop areas from the central and northeast parts of Mato Grosso to Minas Gerais and Bahia will be frequent over the next couple of weeks maintaining a good outlook for summer crop development - U.S.

crop weather will be good in the coming week with little to no precipitation - Temperatures

will trend a little colder in the in the north-central and eastern parts of the nation briefly this weekend - Strong

warming is likely in most crop areas east of the Rocky Mountains next week with some areas in the Plains experiencing well above average temperatures - The

heat will shift east while moderating late next week and into the following weekend - Western

U.S. temperatures will trend colder than usual late next week and into the following weekend - Next

round of storminess is expected in the northern Plains and northern Midwest as well as Canada’s eastern Prairies Nov. 7-10 - Cooling

will follow that period of storminess into the central U.S. - The

next opportunity for “some” rain in hard red winter wheat areas will occur during the week of Nov. 9 - U.S.

hard red winter wheat areas will experience net drying and warmer temperatures through the coming week

- The

next good chance for precipitation may hold off until after Nov. 11 - West

Texas will experience dry and warmer weather over the next ten days and that will translate into better harvest conditions - Cotton

fiber impacted by recent rain and snow will be bleached white once again - U.S.

Delta and southeastern states will experience an extended period of dry weather improving crop and field conditions for better harvesting - U.S.

Midwest harvest conditions will be great though the end of next week and probably through Nov. 9 as well

- The

exception may be in the northern and eastern Great Lakes region where brief periods of precipitation are possible - Winter

wheat establishment will improve and some additional planting will occur in time - U.S.

Pacific Northwest will see precipitation along the coast in the northern Rocky Mountains, but crop areas will not see much precipitation for the next ten days - Some

precipitation will be possible in the week of Nov. 9 - California

may get a few showers in the week of Nov. 9, but resulting moisture will be light - Southeastern

Canada corn and soybean harvest weather is improving with rain and snow limited to Sunday and Monday

- Western

Australia will get some rain late Sunday into Tuesday morning lifting topsoil moisture for some late maturing winter grain and oilseed crops - Most

of the precipitation comes rather late in the season, but a little benefit will result - Northern

harvest progress will be briefly disrupted, but no crop quality decline is expected - Portions

of eastern Australia will receive some rain into the weekend, but much drier weather is expected next week - The

drier outlook will favor improved winter wheat, barley and canola maturation and harvest conditions - Sufficient

soil moisture will remain to support ongoing winter crop development in the south - Planting

of cotton, sorghum and other summer crops should advance aggressively in areas that have received rain recently - Rain

is still needed in western dryland crop areas of Queensland and some in north-central New South Wales - South

Africa will receive some welcome rain during the next ten days to two weeks improving planting conditions for most summer grain, oilseed and cotton crops - Late

maturing winter wheat and canola might also benefit from some of the rain, but most winter crops are a little too far advanced to fully benefit - India

weather will be favorable for late season crop development and widespread harvesting over the next ten days - Winter

crop planting, emergence and establishment will advance well too - Rain

will be confined to the far south and few areas in the far Eastern States - Much

of China was dry Thursday and more of the same will occur for a while in the coming week to ten days - A

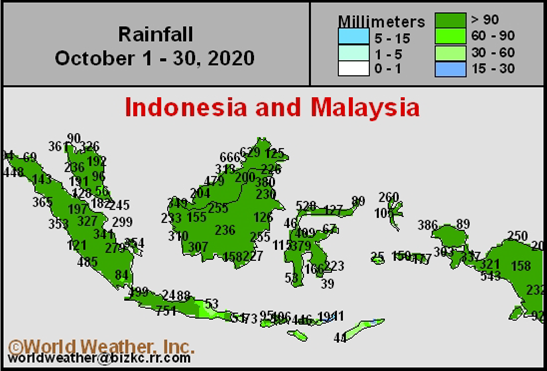

few showers will occur periodically, but fieldwork will advance around them and the moisture will be good for winter crop planting, emergence and establishment - Waves

of rain will continue to impact parts of Southeast Asia that are not being impacted by tropical cyclones over the next ten days to two weeks; most crop conditions will remain favorable - Central

Vietnam will likely be impacted by Typhoon Goni during the first half of next week with additional heavy rain and strong wind speeds possible near Da Nang, Hue and Quang Tri - Northeastern

Vietnam and southwestern China may be impacted by another tropical cyclone during the weekend of Nov. 7-8 - Brief

periods of precipitation will move across the European continent over the coming week resulting in a favorable mix of moisture and sunshine for winter crops - Fieldwork

will advance around the precipitation - This

weekend and next week should trend drier - Temperatures

will be near to above average - Western

CIS precipitation (outside of Ukraine and Russia’s Southern Region) will be erratic and temperatures will be warmer than usual

- Winter

crops are turning dormant in the west and north which is normal - Kazakhstan

is unlikely to get meaningful moisture in the next ten days, although some sporadic showers may evolve late this week or during the weekend - Canada’s

Prairies will experience some significant snowfall in northern Saskatchewan today and tonight with brief bouts of light precipitation elsewhere periodically over the next week - A

major winter storm might impact a part of the region Nov. 7-8 - Southern

Oscillation Index fell during the weekend down to +3.84 and the index may continue to drifting lower over the next couple of days and then level off; the index has fallen from a peak of +12.58 on October 13.

- Mexico

precipitation will be scattered over far southern crop areas during the coming week - Net

drying is expected for many other summer crop areas supporting crop maturation and harvest progress - Central

America will be wetter than usual over the next ten days to two weeks keeping late season crop maturation and harvest progress slow, but the moisture is improving long term water supply.

- Some

flooding is possible - A

tropical cyclone will impact Honduras or Nicaragua early next week

·

West-central Africa will experience erratic rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - Cotton

areas will benefit from drier weather

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda and southwestern Kenya will be impacted while Tanzania and northwestern Ethiopia rainfall is erratic and light

- Some

heavy rain may fall in Uganda early this week

·

New Zealand rainfall will be near to above average in western and northern parts of the nation through the coming week while drier than in eastern South Island

Friday,

Oct. 30:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Indonesia

Monday,

Nov. 2:

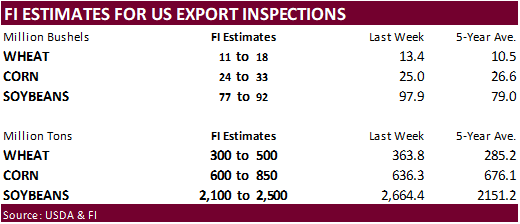

- USDA

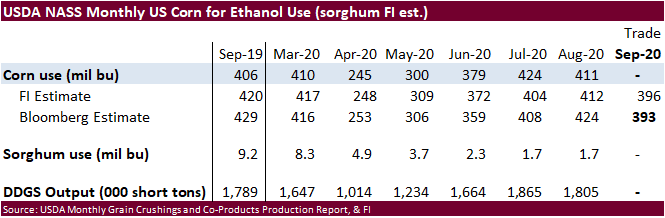

weekly corn, soybean, wheat export inspections, 11am - USDA

soybean crush, corn for ethanol, DDGS output, 3pm - U.S.

crop conditions, harvest for soybeans, corn, cotton, 4pm - Costa

Rica, Honduras October coffee exports - Cotton

supply/demand outlook from International Cotton Advisory Committee - Australia

Commodity Index - Ivory

Coast cocoa arrivals - HOLIDAY:

Brazil

Tuesday,

Nov. 3:

- U.S.

Purdue Agriculture Sentiment, 9:30am - New

Zealand global dairy trade auction - FT

Global Food Systems conference - EARNINGS:

Andersons, AB Foods - HOLIDAY:

Japan

Wednesday,

Nov. 4:

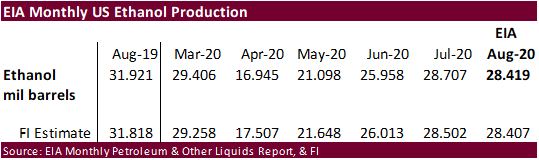

- EIA

U.S. weekly ethanol inventories, production, 10:30am - New

Zealand Commodity Price

Thursday,

Nov. 5:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish monthly soybean and corn reports - FAO

World Food Price Index - Guatemala

October coffee exports - Port

of Rouen data on French grain exports - Malaysian

Nov. 1-5 palm oil export data

Friday,

Nov. 6:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Argentina

Saturday,

Nov. 7

- China’s

trade data on soybeans and meat imports

Source:

Bloomberg and FI

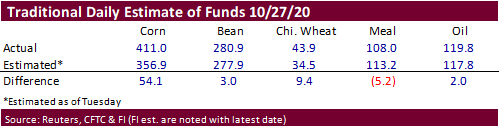

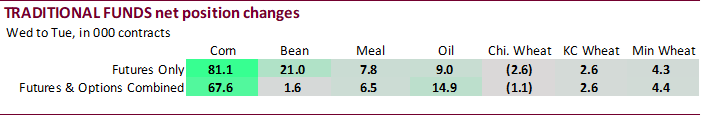

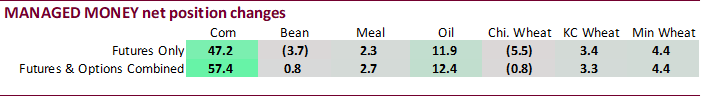

The

much more longer fund position in corn might become a bearish factor when trading resumes Sunday evening.

CME

will revise their futures price limits effective February 2. Details can be found in the PDF after the wheat section.

US

Chicago PMI Oct: 61.1 (est 58.0; prev 62.4)

US

University Of Michigan Consumer Sentiment Oct F: 81.8 (est 81.2; prev 81.2)

US

University Of Michigan Current Conditions Oct F: 85.9 (est 84.9; prev 84.9)

US

University Of Michigan Expectations Oct F: 79.2 (est 78.8; prev 78.8)

US

University Of Michigan 1 Year Inflation Oct F: 2.6% (prev 2.7%)

US

University Of Michigan 5-10 Year Inflation Oct F: 2.4% (prev 2.4%)

US

Employment Cost Index Q3: 0.5% (est 0.5%; prev 0.5%)

US

Personal Income Sep: 0.9% (est 0.4%; prevR -2.5%; prev -2.7%)

US

Personal Spending Sep: 1.4% (est 1.0%; prev 1.0%)

US

Real Personal Spending Sep: 1.2% (est 0.8%; prev 0.7%)

US

PCE Deflator (M/M) Sep: 0.2% (est 0.2%; prev 0.3%)

US

PCE Deflator (Y/Y) Sep: 1.4% (est 1.5%; prevR 1.3%; prev 1.4%)

US

PCE Core Deflator (M/M) Sep: 0.2% (est 0.2%; prev 0.3%)

US

PCE Core Deflator (Y/Y) Sep: 1.5% (est 1.7%; prevR 1.4%; prev 1.6%)

Canadian

GDP (M/M) Aug: 1.2% (est 0.9%; prevR 3.1%; prev 3.0%)

Canadian

GDP (Y/Y) Aug: -3.8% (est -4.2%; prev -5.0%)

Canadian

Industrial Product Price (M/M) Sep: -0.1% (est 0.1%; prev 0.3%)

Canadian

Raw Materials Price Index (M/M) Sep: -2.2% (est 0.3%; prev 3.2%)

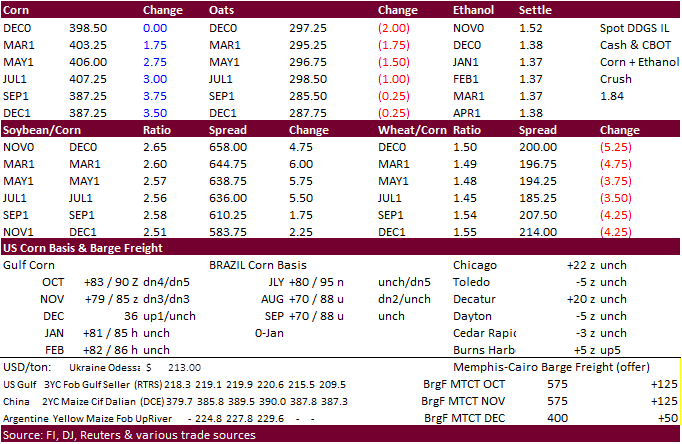

Corn.

-

December

corn futures were mostly higher (bear spreading) on technical buying, another record high in China corn futures, and positioning ahead of the weekend. Global demand remains robust but some fear it will slow as covid cases rise across the globe. Meat traders

should monitor rural America as the virus is spreading at an alarming rate. South Korea bought at least 1.7 million tons of corn during the month of October.

-

There

was heavy spreading in the CZ/CH overnight and during the day session. Some traders are getting ahead of the GS roll. Nearly 68k traded Friday.

-

Why

the volatility on Dec/Mar spread? We believe the considerable amount of spread rolling this week is in part to the Rogers Roll currently underway and some traders are getting out of spot long positions ahead of the Goldman Roll slated to start next week.

In addition China has booked a very large amount of corn that could easily be front loaded and bull traders looking for 2021 China TRQ’s to increase are banking on US corn export volume to increase during FH 2021, meaning US export demand could increase after

the New Year, setting the stage for another leg up in corn futures. -

We

are short term bearish on corn amid to uncertainty over the US election and Covid-19 economic demand destruction. Northern IL, for example, is back on partial lockdown, with no indoor restaurant service for at least three weeks.

-

Not

up until three days ago I received one question on US election outcomes and impact on agriculture futures. Looking at long-term history, it’s easy to say everyone needs to eat. Short term we are unsure. A shock in the equities market could bring money inflow

into commodities (inflation hedging), or nothing happens, or it can go the other way. There are too many variables to consider. But US farm income remains an uncertainty. Producers saw some support during the trade spat. Looking at present day. we think

regardless who wins, US producers should remain in better shape than a year ago with higher cash prices. Ultimately global and US export demand will remain key factors going forward. If China and other major meat consumption countries economic situations

continue to improve and flourish, so should the world agriculture trade, and that will in the end help support the US producer balance sheets.

-

Safras

& Mercado estimated the Brazil corn crop at 116.4 million tons, up from 115.5 million tons previously.

-

Ukraine’s

grain harvest is 86 percent complete, -

French

corn harvesting as of October 26 was 88 percent complete, up from 77 percent previous week and above 60 percent year ago.

- Germany

ASF: Cases reached a second state in eastern Germany. 11 new cases; 114 cases since September 10. Germany may see a supply of more than one million pigs by the end of the year. Current surplus is about 400,000.

- South

Korea banned poultry imports from the Netherlands on bird flu concerns.

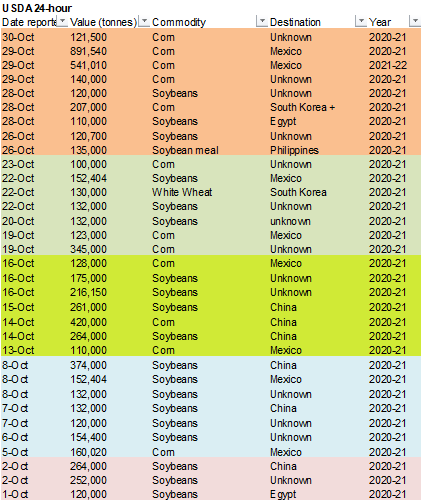

Corn

Export Developments

-

Updated:

South Korea’s MFG bought 196,000 tons of US corn at $245.74 / ton for shipment between February 5 and February 24 for arrival around March 31, $238.57 / ton c&f for arrival around April 26 and another 65,000 tons at $239.99 / ton c&f for LH February through

March 10 shipment out of the US. -

South

Korea’s FLC bought 65,000 tons of optional origin corn at $245.95 / ton c&f for arrival around March 15.

Updated

10/29/20

December

corn is seen in a $3.90-$4.30 range