PDF Attached

December

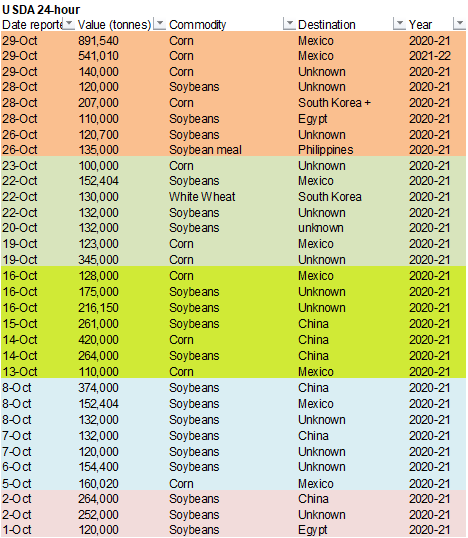

corn ended below $4.00. USDA reported 1,432,500 tons of 24-hour corn sales to Mexico and 140,000 tons of corn to unknown. This limited losses in corn prices. Soybeans and meal saw bear spreading as traders shored up long positions, and soybean oil was on

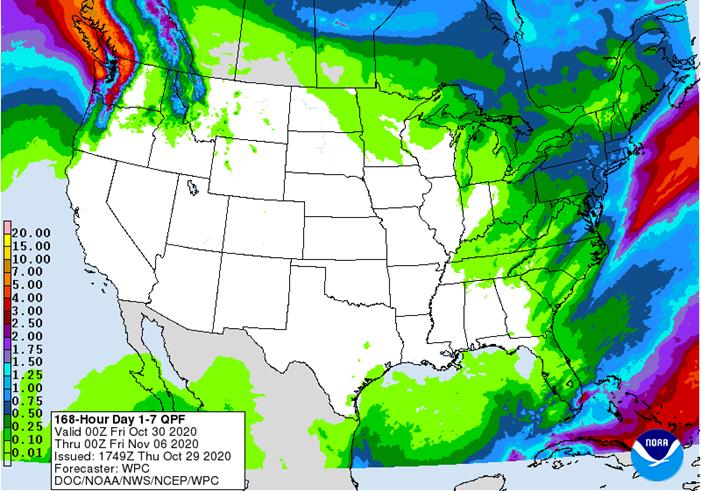

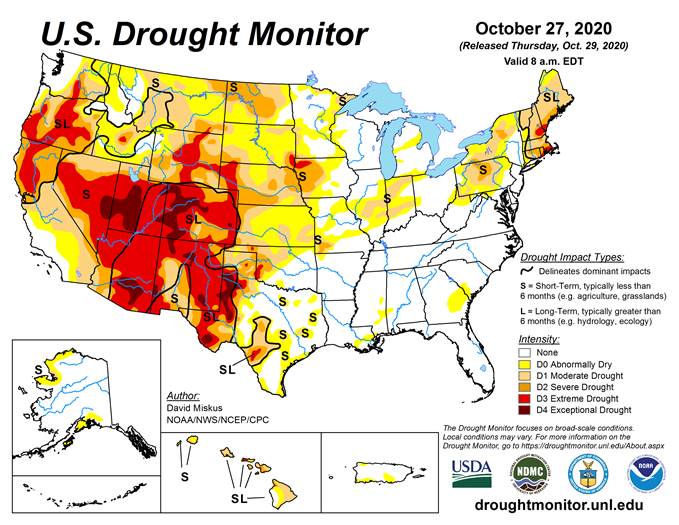

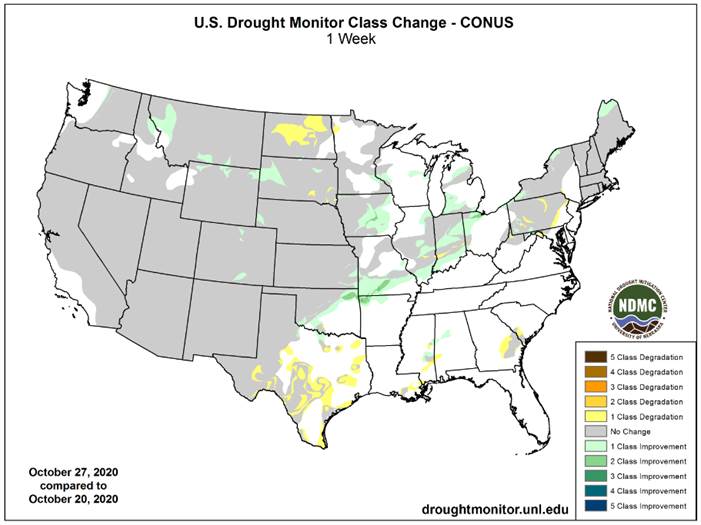

the defensive from lower energy markets. Wheat was under pressure after a multi-million-dollar rain event occurred across the Great Plains earlier this week.

![]()

Weather

and Crop Progress

- Hurricane

Zeta moved inland Wednesday evening in southeastern Louisiana and has raced across the southeastern U.S. overnight with its center at 0800 EDT today 50 miles west of Asheville, N.C. moving northeast at 40 mph while producing wind speeds of 60 mph.

- Zeta

produced 70-104 mph wind speeds from southeastern Louisiana to southern Mississippi and into the Mobile, Alabama area last evening

- Wind

speeds of 40 to 65 mph occurred from southwest to northeast across Alabama overnight with speeds to 55 mph in northwestern Georgia - Rainfall

varied from 2.00 to 4.24 inches with locally more suspected - Some

eastern sugarcane in Louisiana may have been negatively impacted - Cotton

may have been impacted most by the storm with too much wind and heavy rain impacting some of Alabama’s crop

- Zeta

will move out over the Atlantic Ocean this afternoon and be gone as quickly as it came with not much other adversity expected - Typhoon

Goni formed well east of Philippines overnight and was expected to become a super typhoon as it moves toward the Philippines this weekend - Landfall

is expected in Luzon Island late Sunday into Monday as a Category Two or Three hurricane equivalent storm, based on the Saffir-Simpson Wind Scale - Damage

over the Island will be possible with losses to personal property, infrastructure, rice, sugarcane and some tree crops – depending on the storm’s ultimate intensity - A

developing tropical disturbance near the Windward Islands was moving west northwesterly and will move into the Caribbean Sea Friday and during the weekend

- This

system is expected to evolve into a new named tropical cyclone by the end of the weekend and could move inland over Honduras or Nicaragua early to mid-week next week - Very

heavy rain and flooding will impact these areas with some property and crop damage possible - Russia’s

Southern Region and Ukraine will receive periods of rain Friday through much of next week

- Resulting

rainfall will improve winter crop establishment, although it is rather late in the season - Moisture

totals of 0.30 to 0.80 inch and local totals of 1.00 to 1.50 inches will result from Ukraine into western parts of Russia’s Southern Region - Eastern

parts of Russia’s Southern Region (including the lower Volga River Valley) and Kazakhstan will be left dry - Snow

totals in the U.S. southwestern Plains Thursday ranged from 1 to 5 inches with a local total to 8 inches west of Amarillo, Texas - Moisture

totals in the southern U.S. Plains from rain, freezing rain and snow Wednesday varied from 0.30 to 1.00 inch most often with local totals reaching 2.22 inches through 0100 CDT - Additional

rain will linger in southern Kansas and parts of Oklahoma today - Some

west-central U.S. Plains wheat areas did not receive quite as much moisture as hoped for this week, but big improvements did occur from southern Kansas through Oklahoma to north-central Texas and the Texas Panhandle - Southeastern

Colorado and west-central into far southwestern Kansas will need more moisture - Lower

U.S. Midwest, northern Delta and Tennessee River Basin will receive additional rain today

- Moisture

totals will be light, but enough will occur to maintain wet field conditions - U.S.

weather in the central and southwestern Plains, lower Midwest, Delta and southeastern states will improve greatly later today and Friday and last through next week as drier weather evolves - Temperatures

will trend warmer until late this weekend and early next week when a shot of colder air moves across the northern Plains throughout most of the eastern United States

- U.S.

temperatures in the western Plains and far western United States will rise above average next week after this week’s bitter cold - Snow

will melt from most areas during the week - Mild

to cool temperatures will occur in the eastern U.S. this weekend into early next week - Another

shot of cool air will push into the western and north-central U.S. during the second weekend of the two week outlook bringing colder temperatures and some rain and snow to the western and north-central states - Interior

portions of the U.S. Pacific Northwest will receive a limited amount of moisture during the coming week, although mountainous areas and coastal areas will see some periodic rain and snow - Some

forecast models are predicting a major winter storm for the central and eastern Canada Prairies and a part of the northern U.S. Plains for Nov. 7-8, the storm may be exaggerated today, but a significant event may be possible - California

and the southwestern United States will remain dry for much of the coming ten days

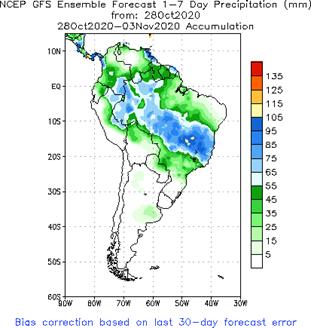

- Argentina

will see drier weather evolve over the coming week to ten days - A

few showers will be possible briefly in the south and east during mid-week next week - The

drier bias will excellent for soybean, corn and sunseed planting in areas that have just received significant moisture - Winter

crop conditions will continue to improve during this period of time - Rain

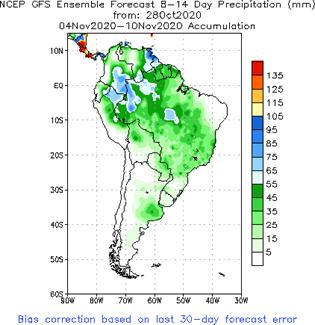

will be needed again at the end of this ten-day period - Brazil’s

rainfall outlook for the next ten days has not changed much from that of Wednesday - Rain

will fall in most of the nation at one time or another, but amounts will be least frequent and least significant in the interior south; including southwestern Sao Paulo, Parana and Santa Catarina

- None

of the drier areas will be a concern for now since planting will advance aggressively off of the lighter rain that falls in those areas - Portions

of central and northern Minas Gerais, Espirito Santo and immediate neighboring areas will be a little too wet in time - Summer

crop planting and early development should advance well - Eastern

Australia rainfall recently has raised some concern over winter wheat, barley and canola quality - Drier

weather is needed to protect crops until harvesting is complete - The

moisture was good for cotton, sorghum and other summer crops especially in unirrigated areas - Planting

will advance more aggressively after this week’s rain - Winter

wheat, barley and canola welcomed the rain in the south, but drier weather will soon be needed in the north to protect grain quality - World

Weather, Inc. does not believe a serious decline in crop conditions has occurred, but drying will be very important to protect crops and support harvesting - Eastern

Australia will get a mix of rain and sunshine over the next two weeks; rain frequency is not likely to be so great as to cause a serious change in crop quality, but the situation will be closely monitored - La

Nina conditions could present greater rainfall a little later this spring and early summer raising concern over crop conditions - Western

Australia may receive a little rain Sunday and Monday - Most

of the precipitation will be light, but welcome for late maturing winter crops - South

Africa received some rain in 10-15% of the summer crop region Wednesday - Greater

rain is needed throughout the nation to support better spring and summer crop planting and emergence conditions - An

erratic rainfall pattern is expected through Friday while temperatures are warm to hot - Some

greater rain will evolve during the weekend and next week that may be more beneficial in raising topsoil moisture for better planting, emergence and establishment of corn, soybeans, cotton, peanuts, sorghum, sunseed and other crops - India

weather will be favorable for late season crop development and widespread harvesting over the next ten days - Winter

crop planting, emergence and establishment will advance well too - Much

of China was dry Wednesday and more of the same will occur for a while in the coming week to ten days - A

few showers will occur periodically, but fieldwork will advance around them and the moisture will be good for winter crop planting, emergence and establishment - Waves

of rain will continue to impact parts of Southeast Asia that are not being impacted by tropical cyclones over the next ten days to two weeks; most crop conditions will remain favorable - Brief

periods of precipitation will move across the European continent over the coming week resulting in a favorable mix of moisture and sunshine for winter crops - Fieldwork

will advance around the precipitation - This

weekend and next week should trend drier - Temperatures

will be near to above average - Western

CIS precipitation (outside of Ukraine and Russia’s Southern Region) will be erratic and temperatures will be warmer than usual

- Winter

crops are turning dormant in the west and north which is normal - Kazakhstan

is unlikely to get meaningful moisture in the next ten days, although some sporadic showers may evolve late this week or during the weekend - Ontario

and Quebec, Canada harvest delays will slowly improve into next week because of less precipitation

- The

region needs to dry out - Canada’s

Prairies will experience some rain, freezing rain and snow early this week and then several days of drying are expected

- A

major winter storm might impact a part of the region Nov. 7-8 - Southern

Oscillation Index fell during the weekend down to +4.21 and the index may continue to drifting lower over the next couple of days; the index has fallen from a peak of +12.58 on October 13.

- Mexico

precipitation will be scattered over far southern crop areas during the coming week - Net

drying is expected for many other summer crop areas supporting crop maturation and harvest progress - Central

America will be wetter than usual over the next ten days to two weeks keeping late season crop maturation and harvest progress slow, but the moisture is improving long term water supply.

- Some

flooding is possible - A

tropical cyclone may impact Honduras or Nicaragua early to mid-week next week

·

West-central Africa will experience erratic rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - Cotton

areas will benefit from drier weather

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda and southwestern Kenya will be impacted while Tanzania and northwestern Ethiopia rainfall is erratic and light

- Some

heavy rain may fall in Uganda early this week

·

New Zealand rainfall will be near to above average in western areas of South Island over the coming week while below average elsewhere

- Temperatures

will be seasonable

Source:

World Weather Inc.

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Vietnam’s

General Statistics Office releases commodity trade data for October - International

Grains Council monthly report - EARNINGS:

ADM - HOLIDAY:

Indonesia, Malaysia

Friday,

Oct. 30:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Indonesia

Monday,

Nov. 2:

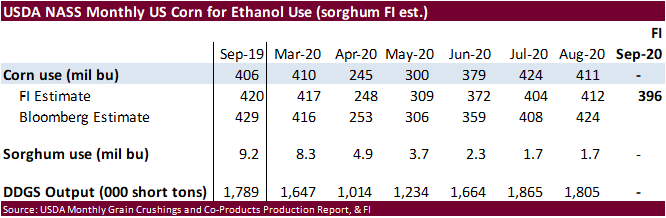

- USDA

weekly corn, soybean, wheat export inspections, 11am - USDA

soybean crush, corn for ethanol, DDGS output, 3pm - U.S.

crop conditions, harvest for soybeans, corn, cotton, 4pm - Costa

Rica, Honduras October coffee exports - Cotton

supply/demand outlook from International Cotton Advisory Committee - Australia

Commodity Index - Ivory

Coast cocoa arrivals - HOLIDAY:

Brazil

Tuesday,

Nov. 3:

- U.S.

Purdue Agriculture Sentiment, 9:30am - New

Zealand global dairy trade auction - FT

Global Food Systems conference - EARNINGS:

Andersons, AB Foods - HOLIDAY:

Japan

Wednesday,

Nov. 4:

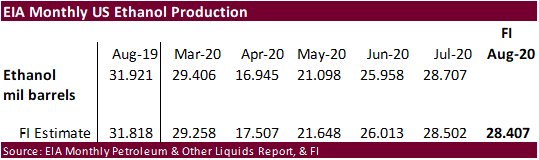

- EIA

U.S. weekly ethanol inventories, production, 10:30am - New

Zealand Commodity Price

Thursday,

Nov. 5:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish monthly soybean and corn reports - FAO

World Food Price Index - Guatemala

October coffee exports - Port

of Rouen data on French grain exports - Malaysian

Nov. 1-5 palm oil export data

Friday,

Nov. 6:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Argentina

Saturday,

Nov. 7

- China’s

trade data on soybeans and meat imports

Source:

Bloomberg and FI

USDA

Export Sales

·

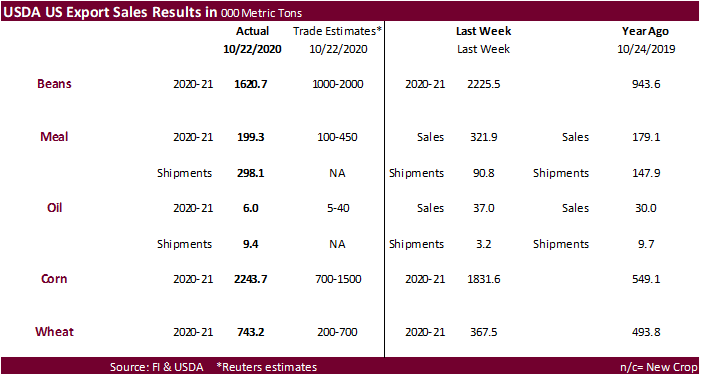

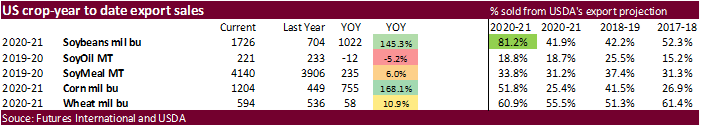

Export sales for the US soybean complex were withing expectations. Of the 1.621 million tons of soybeans, 1.074 million were for China. Soybean commitments are running 81 percent of USDA’s export

projection.

·

Corn export sales of 2.244 million tons were well above expectations and included 763,700 tons for unknown. Pork sales were 29,000 tons.

·

USDA export sales for all-wheat of 743,200 tons were above expectations.

US

GDP Annualized (Q/Q) Q3 A: 33.1% (est 32.0%; prev -31.4%)

US

Core PCE (Q/Q) Q3 A: 3.5% (est 4.0%; prev -0.8%)

US

GDP Price Index Q3 A: 3.6% (est 2.9%; prev -1.8%)

US

GDP Personal Consumption Q3 A: 40.7% (est 38.9%; prev -33.2%)

US

Initial Jobless Claims Oct 24: 751K (est 770K; prevR 791K; prev 787K)

US

Continuing Claims Oct 17: 7756K (est 7775K; prevR 8465K; prev 8373K)

Canadian

Building Permits (M/M) Sep: 17.0% (prev 1.7%)

Canadian

Payrolls Rise 303.2K In August – StatsCan

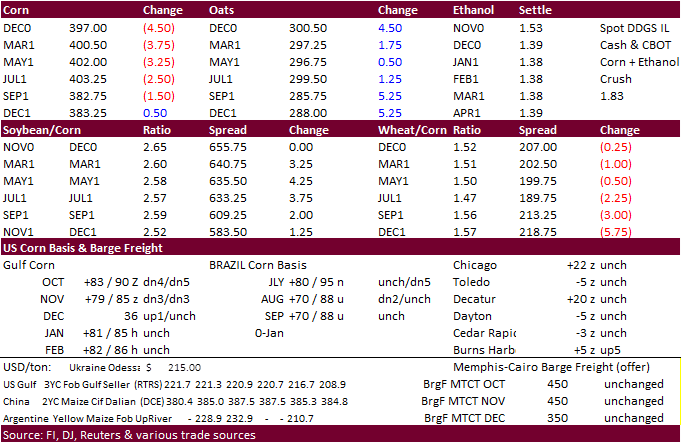

Corn.

-

December

corn futures ended at a 2-week low, down 3.00 cents to $3.9850. Strong South Korean demand (600 to 700k tons bought this week) and more than expected increase in US ethanol production limited losses. Three South Korean firms were again in for corn over the

past day. CZ is holding a 50% retracement of the up move that begun on Sept 28th at $3.9150, and today’s settlement was on the 38.2% retracement. Weather forecast for the US looks nice and clear over the next week for harvesting progress.

-

Brent

crude oil traded below $37/barrel, lowest since May. -

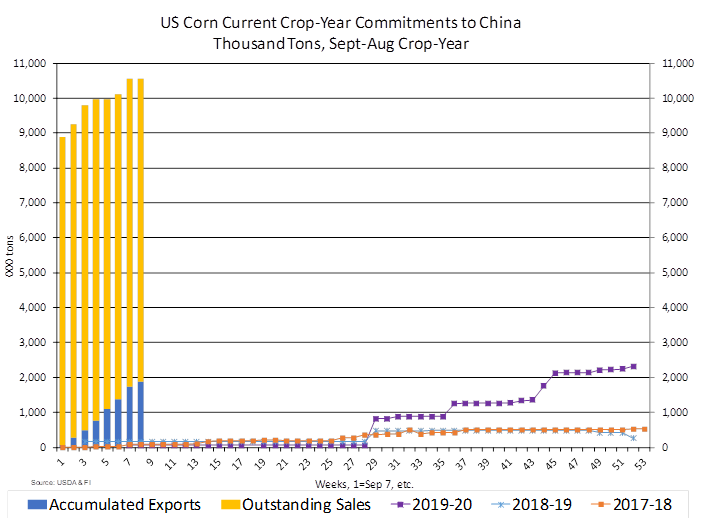

USDA

corn export sales of 2.244 million tons were well above expectations and included 763,700 tons for unknown. Sales to China were very minimal and total commitments are 10.551 million tons. Outstanding sales increased 764,000 tons to 4.427 million tons (China

+ unknown 155.0 million tons). -

USDA

export sales for pork were 29,000 tons. -

US

Gulf CIF corn basis broke 3-5 cents as the storm settled down for the coastal areas.

-

The

BA Grains Exchange reported Argentina was 30 percent complete on corn planting progress, up 2 points from the previous week and compares to 40 percent year ago.

-

Ukraine

fob corn prices reached $237/ton yesterday, up $3.00/ton from Tuesday, but some exporters lowered offers by late in the day.

-

China

corn futures ended higher by 13 yuan to 2,608 / ton. - Germany

ASF: 94 cases since September 10. Germany may see a supply of more than one million pigs by the end of the year. Current surplus is about 400,000.

-

India

approved an increase in ethanol procurement prices by 2.0-3.5 rupees a liter.

-

IGC

lower its estimate for global corn production due to smaller crop outlooks for the United States, Ukraine and European Union. They took it down 4 million tons to 1.156 million tons. They are at 33 million tons for Ukraine.

Corn

Export Developments

-

USDA

reported the following 24-hour sales: -

Export

sales of 1,432,550 metric tons of corn for delivery to Mexico. Of the total, 891,540 metric tons is for delivery during the 2020/2021 marketing year and 541,010 metric tons is for delivery during the 2021/2022 marketing year -

Export

sales of 140,000 metric tons of corn for delivery to unknown destinations during the 2020/2021 marketing year. -

South

Korea’s FLC bought 68,000 tons of corn, unknown origin, at $249.28 / ton for arrival around March 15.

-

South

Korea’s MFG bought 134,000 tons of US corn at $253.74/ton fob for Jan 10-29 shipment and $251.50/ton. The barley was bought in four consignments at about 230 euros ($269.3) a ton. Shipment had been sought in November and December 2020 and in January 2021.

-

South

Korea’s KFA bought 65,000 tons of corn, optional origin, at $252.25 / ton for arrival around April 15.

-

Iran’s

SLAL bought around 260,000 tons feed barley and passed on 200,000 tons of corn for Nov-Jan shipment.

Updated

10/29/20

December

corn is seen in a $3.90-$4.30 range (lowered 10 cents)