Please

note I will be out of the office on Wednesday, October 28.

Grain

demand erosion fears from a second global covid outbreak wave setting in. Brazil corn prices hit a all time high and Anec downward revises Brazil’s October corn export projection. China corn buying may end up above 15 million tons in 2020-21.

Weather

and Crop Progress

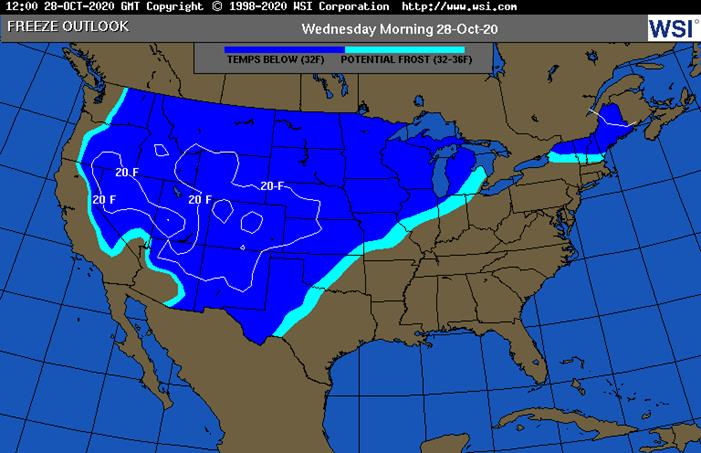

MOST

IMPORTANT WEATHER OF THE DAY

- Russia’s

Southern Region and Ukraine will receive rain from Friday through the first part of next week - Resulting

rainfall will improve winter crop establishment, although it is rather late in the season - An

ice storm will impact the southwestern U.S. Plains today resulting in serious livestock stress, travel delays and power outages from western Texas through south-central Kansas

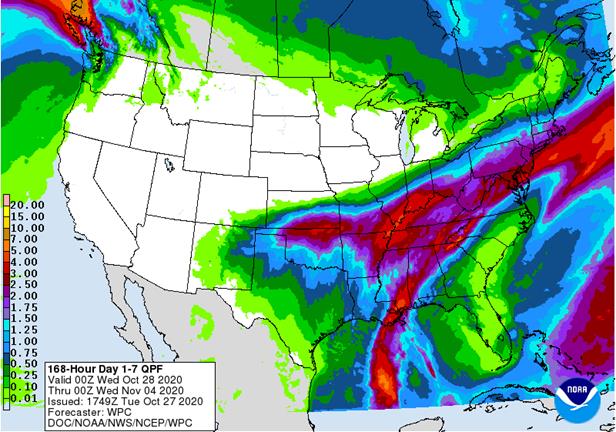

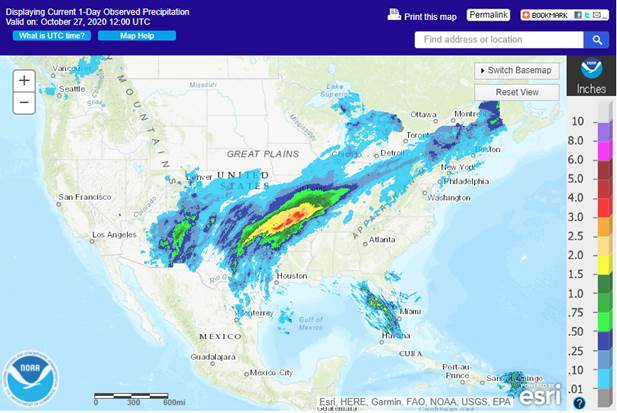

- Significant

moisture will fall from western Texas and north-central Texas through Oklahoma to south-central Kansas into Thursday morning seriously bolstering soil moisture for improved winter wheat development - Winter

crop ratings in the southern Plains were terrible in USDA’s crop progress report, but improvement is expected following this week’s precipitation - Temperatures

will trend warmer than usual in the first half of November (if not most of the month) and that will translate into better crop establishment after recent rainfall - Local

flooding is possible with moisture totals of 2.00 to 4.00 inches and locally more expected in the described region - Tropical

Storm Zeta will bring a band of heavy rain to the area from southeastern Louisiana through the northwest half of Alabama to Tennessee and the southern Appalachian Mountain region late Wednesday and Thursday - Rain

totals of 2.00 to 6.00 inches will result in some flooding - More

potential damage is possible for some unharvested cotton in the region - Zeta

will come ashore as a weakening hurricane with strong wind speeds in southeastern Louisiana, southeastern Mississippi and southwestern Alabama - Some

property damage is expected - Sugarcane

that has not been harvested in far southeastern Louisiana may be damaged by the storm - Lower

U.S. Midwest, northern Delta and Tennessee River Basin will receive significant rain and experience local flooding Wednesday and Thursday with much improved weather Friday into next week - U.S.

weather in the central and southwestern Plains, lower Midwest, Delta and southeastern states will improve late this week through next week as drier weather evolves - U.S.

temperatures in the Plains and western states will rise above average next week after this week’s bitter cold - Snow

will melt from most areas during the week - Cool

temperatures will occur in the eastern U.S. this weekend into early next week - Most

of the extreme cold in the northern Plains is abating today and that in the central Plains will abate in the second half of this week - U.S.

Pacific Northwest will be drier this week after receiving some rain and mountain snow during the weekend - Another

chance for rain and snow may evolve next week - California

and the southwestern United States will remain dry for much of the coming ten days

- Tropical

Storm Zeta produced heavy rain over the Yucatan Peninsula overnight resulting in some flooding and wind damage - The

storm will move over the Gulf of Mexico and early Wednesday helping the system become a hurricane once again - Central

Argentina will receive follow up showers today and Wednesday before dry weather occurs late this week and lasts through the first half of next week

- Next

rain opportunity will be Nov. 4-6 with a few showers in the far southwest Nov. 3 - The

drier biased weather will be fantastic for aggressive spring and summer crop planting after recent rainfall and associated moisture boost - Rain

was great for long term wheat and early season corn and sunseed development - Brazil’s

rainfall outlook for the next ten days has not changed much from that of Monday - Rain

will fall in most of the nation at one time or another, but rainfall will be least frequent and least significant in the interior south; including southwestern Sao Paulo, Parana and Santa Catarina

- None

of the drier areas will be a concern for now since planting will advance aggressively off of the lighter rain that falls in those areas - Portions

of central and northern Minas Gerais, Espirito Santo and immediate neighboring areas will be a little too wet in time - Summer

crop planting and early development should advance well - Eastern

Australia rainfall recently has raised some concern over winter wheat, barley and canola quality - Drier

weather is needed to protect crops until harvesting is complete - The

moisture was good for cotton, sorghum and other summer crops especially in unirrigated areas - Planting

will advance more aggressively after this week’s rain - Winter

wheat, barley and canola welcomed the rain in the south, but drier weather will soon be needed in the north to protect grain quality - Eastern

Australia will get a mix of rain and sunshine over the next two weeks; rain frequency is not likely to be so great as to cause a serious change in crop quality, but the situation will be closely monitored - La

Nina conditions could present greater rainfall a little later this spring and early summer raising concern over crop conditions - Western

Australia will continue to get very little rain for the next ten days, although totally dry weather is not expected - South

Africa received some rain in 25% of the summer crop region Monday - Greater

rain is needed throughout the nation to support better spring and summer crop planting and emergence conditions - An

erratic rainfall pattern is expected through the end of this week while temperatures are warm to hot - Some

greater rain will evolve during the weekend and next week that may be more beneficial in raising topsoil moisture for better planting, emergence and establishment of corn, soybeans, cotton, peanuts, sorghum, sunseed and other crops - India

weather will be favorable for late season crop development and widespread harvesting over the next ten days - Winter

crop planting, emergence and establishment will advance well too - Much

of China was dry Monday and more of the same will occur for a while in the coming week to ten days - A

few showers will occur periodically, but fieldwork will advance around them and the moisture will be good for winter crop planting, emergence and establishment - Typhoon

Molave was located 332 miles east southeast of Da Nang, Vietnam at 0900 GMT today moving westerly.

- Molave

has reached its peak intensity with wind speeds to 126 mph near its center

- Weakening

is expected as the storm approaches Vietnam - Landfall

will be near Da Nang, Vietnam once again and more torrential flooding is possible along with some damaging wind as the storm reaches the coast - Crops

and property will be damaged and the port of Da Nang and Hue, Vietnam will likely be shut down once again as the storm comes ashore - More

damage to the port is expected - This

month has been unusually stormy for the central Vietnam coast and damage to the ports of Da Nang and Hue has been significant - Another

tropical cyclone will form east of the Philippines this week and pass across central parts of the nation Friday

- Additional

heavy rain is likely and more flooding as well as possible wind damage - This

storm is expected to be weak relative to Molave which brought damage to the northern Visayan Islands earlier this week - Waves

of rain will continue impact parts of Southeast Asia that not being impacted by tropical cyclones over the next ten days to two weeks; most crop conditions will remain favorable - Brief

periods of precipitation will move across the European continent over the coming week resulting in a favorable mix of moisture and sunshine for winter crops - Fieldwork

will advance around the precipitation - This

weekend and next week should trend drier - Temperatures

will be near to above average - Western

CIS crop weather this week will bring erratic precipitation and warmer than usual temperatures - Winter

crops are turning dormant in the west and north which is normal - Kazakhstan

is unlikely to get meaningful moisture in the next ten days, although some sporadic showers may evolve late this week or during the weekend - Ontario

and Quebec, Canada harvest delays will slowly improve later this week and into next week because of less precipitation

- The

region needs to dry out - Canada’s

Prairies will experience some rain, freezing rain and snow early this week and then several days of drying are expected

- Southern

Oscillation Index fell during the weekend down to +5.83 and the index may continue to drift a little lower before leveling off this week - Mexico

precipitation will be scattered over far southern crop areas during the coming week - Net

drying is expected for many other summer crop areas supporting crop maturation and harvest progress - Central

America will be wetter than usual over the next ten days to two weeks keeping late season crop maturation and harvest progress slow, but the moisture is improving long term water supply.

- Some

flooding is possible

·

West-central Africa will experience erratic rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - Cotton

areas will benefit from drier weather

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda and southwestern Kenya will be impacted while Tanzania and northwestern Ethiopia rainfall is erratic and light

- Some

heavy rain may fall in Uganda early this week

·

New Zealand rainfall will be near to above average in North Island and western areas of South Island over the coming week

- Temperatures

will be seasonable with a slight cooler bias in the south

Source:

World Weather Inc.

- Virtual

Palm Oil Conference, day 1 - EARNINGS:

WH Group

Wednesday,

Oct. 28:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Virtual

Palm Oil Conference, day 2 - HOLIDAY:

Indonesia

Thursday,

Oct. 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Vietnam’s

General Statistics Office releases commodity trade data for October - International

Grains Council monthly report - EARNINGS:

ADM - HOLIDAY:

Indonesia, Malaysia

Friday,

Oct. 30:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Indonesia

Source:

Bloomberg and FI

Macros

US

Durable Goods Orders Sep P: 1.9% (est 0.5%; prevR 0.4%; prev 0.5%)

US

Durable Goods Orders Ex-Transportation Sep P: 0.8% (est 0.4%; prevR 1.0%; prev 0.6%)

US

Cap Goods Orders Nondef Ex-Air Sep P: 1.0% (est 0.5%; prevR 2.1%; prev 1.9%)

US

Cap Goods Ship Nondef Ex-Air Sep P: 0.3% (est 0.4%; prev 1.5%)

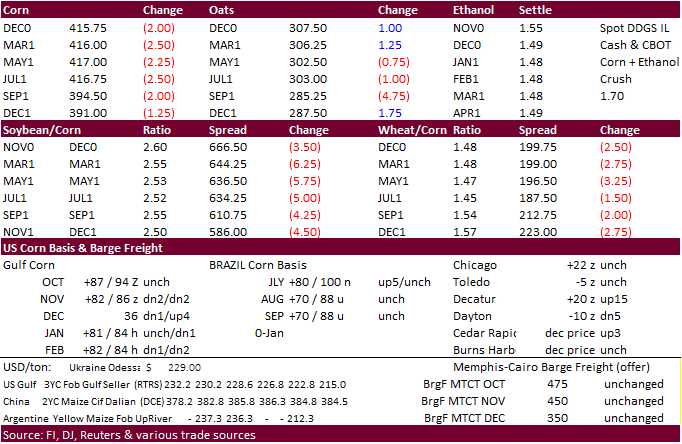

Corn.

-

Corn

futures hit a fresh 14-month high earlier on higher wheat futures, corn/soy spreading, and a large increase in South Korean buying, but fell to close 1.75 to 2.25 cents lower on light profit taking and US harvesting pressure.

-

Cofco

sees China corn imports possibly doubling to 17 million tons during the 2020-21 crop year from a decline in production (6-8 million tons less than last year) and increase in feed demand. 2019-20 corn imports were 7.6 million tons. China booked nearly 10.6

million tons of corn from the US, and that does not include the unknown category (nearly 3.7 million tons outstanding sales). Cofco estimates for a 60-million-ton corn deficit in 2020-21, but that will be partially offset by an increase in other feedgrains

such as sorghum, barley, and feed wheat. -

Traders

are waiting to see if Ukraine and Brazil will run out of corn by the end of 2020, which should shift good business to the US. Brazilian supplies are getting tight, although they have a good amount of corn left to export over the next couple of months.

-

Brazilian

agricultural think tank reported late on Tuesday that domestic corn prices hit a fresh record, rising above the previous 2007 record, by hitting 81.48 reais ($14.49) per sack, up 28 percent so far in October alone.

-

Brazil

October corn exports could end up at 4.95 million tons (down from 5.5 million tone projected last week), according to Anec, while October soybean exports could reach 2.38 million tons (up from 2.32 previous week).

-

Ukraine

grain exports were 15 million tons do far this season, down 16.4 percent from same period year ago. 1.54 million tons of corn was sold compared with 3.59 million tons last year. Wheat exports fell to 10.1 million tons from 10.9 million. Wheat exports will

be capped at 17.5 million tons this season. 57% of the quota has been used. APK-Inform lowered its Ukraine 2020 corn harvest to 33.8 million tons from 34.8 million tons. The pegged the corn yield at 6.6 tons per hectare compared with 7.2 tons in 2019.

-

Note

Ukraine harvested 84 percent of their 2020 grain crops, according to the Ministry of Economic Development. That includes 14.5 million tons of corn from an area of 3.07 million hectares (56%), 11.6 million tons of sunflower from 5.9 million hectares (92%),

2.2 million tons of soybeans from 1.08 million hectares (80%), 240,000 tons of millet from 147,700 hectares (98%) and- 99,000 tons of buckwheat from 76,500 hectares (97%) were harvested. (Reuters via Ukraine General Newswire).

-

The

Philippines see 2020 corn production at 8 million tons, up 4 percent from 7.7 million tons in 2019. 8 million tons is about 8 months of consumption.

- Russia

reported a H5N8 bird flu case. - Germany

ASF: 3 new cases; 94 cases since September 10 -

The

US EPA is considering changes to gas pump labeling for E15 ethanol blend as the biofuel industry believes the current labels are discouraging use of the fuel.

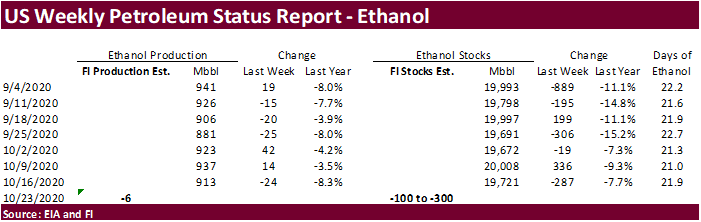

- A

Bloomberg poll looks for weekly US ethanol production to be up 12,000 at 925,000 barrels (900-942 range) from the previous week and stocks up to 56,000 barrels to 19.777 million.

Corn

Export Developments

-

South

Korea’s FLC bought 65,000 tons of corn, optional origin, at $264.41/ton c&f for arrival around February 15.

-

South

Korea’s NOFI bought 203,000 tons of corn, optional origin. -

One

was bought at $262.41/ton fob for arrival around March 5. -

Another

at $253.40/ton fob for arrival around March 15. -

Third

boat was bought at $250.20/ton fob for arrival around April 5. -

$271.73/ton

c&f for arrival in February. -

South

Korea’s KFA passed on 69,000 tons of corn, optional origin. Lowest price was $271.73/ton c&f for arrival in February.

-

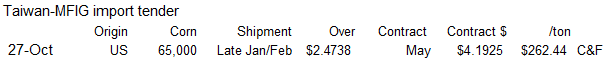

Taiwan’s

MFIG bought 65,000 tons of US corn at $2.4738 / bushel over the May for Jan/Feb shipment.

-

Iran’s

SLAL seeks 200,000 tons of corn and 200,000 tons of barley on October 28 for Nov-Jan shipment.

Updated

10/23/20

December

corn is seen in a $4.00-$4.40 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.