PDF Attached

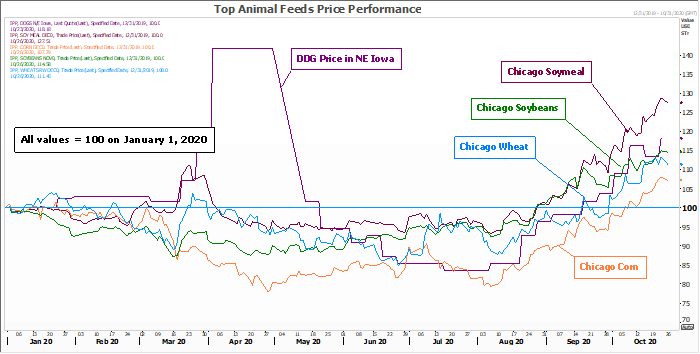

Corn

futures traded near their respected 14-month high overnight but lower wheat weighed on prices. Losses were limited after it was announced by the CBOT that there were 1600 November 420 calls exercised on Friday. Soybeans traded two-sided but remained at more

than a 4-year high. US wheat futures traded lower on improving weather across Russia and US Great Plains.

Weather

and Crop Progress

MORNING

WEATHER MODEL COMMENTS

NORTH

AMERICA

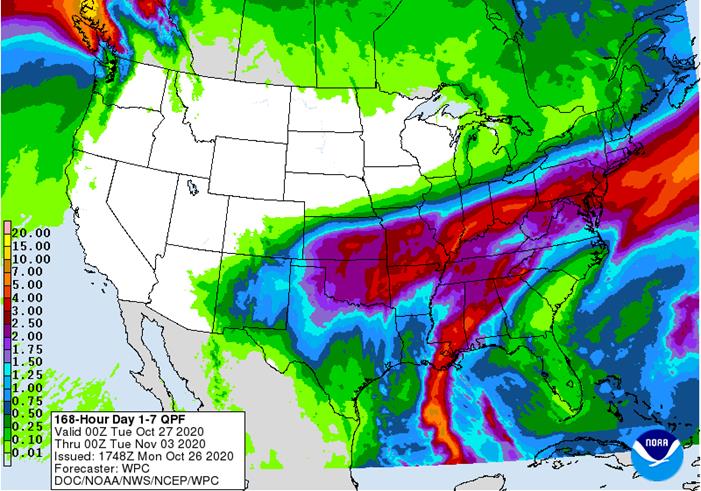

- Significant

precipitation will be falling across hard red winter wheat production areas through Thursday - Moisture

totals of 2.00 to 4.00 inches and locally more (possibly getting to 6.00 inches) will occur from the Texas Rolling Plains into central Kansas with interior western and central Oklahoma wettest along with north-central Texas - Moisture

totals of 0.50 to 1.50 inches will occur in west Texas while the Texas Panhandle gets 1.00 to 2.25 inches - Snowfall

of 1 to 3 inches Nebraska to northeastern Colorado, 3 to 8 inches western Kansas to southeastern Colorado with local totals of 8 to 12 inches in southeastern Colorado (near the mountains) - Snowfall

of 4 to 10 inches and local amounts to 13 in the Texas Panhandle and immediate neighboring areas with greatest amounts near the New Mexico border - West

Texas snowfall of 2 to 6 inches and locally more in the far northwest

- Tropical

Storm Zeta will become a hurricane today and clip the northeast corner of Yucatan Peninsula and then move on to southeastern Louisiana (weakening to tropical storm status as it nears the coast) Wednesday afternoon - Landfall

Wednesday afternoon - The

storm will turn through Alabama Thursday and to Virginia Thursday night and Friday - Heavy

rain will fall with 2.00 to 4.00 inches and local totals to 6.00 inches possible - Storm

will move fast through the region - Georgia

and northeastern Florida to eastern Carolinas will not get much threatening rain, although a few showers possible

- U.S.

Weather will trend drier and warmer this weekend through next week - Bitter

cold conditions will occur early to mid-week this week in the Plains

SOUTH

AMERICA

- Rain

fell in most of Argentina during the weekend - Santiago

del Estero and northern Cordoba were missed while restricted rainfall occurred in northwestern Santa Fe - Rainfall

of 1.00 to 2.50 inches with local totals to 3.00 inches were noted elsewhere - The

moisture was a big boost to summer crop development and future planting and supportive of winter wheat development, as well - Argentina

will see less rain in the coming week to ten days with a few showers in central areas Tuesday and Wednesday and then dry until Nov. 4 and 5 when rain will impact some southern and eastern crop areas - Excellent

drying conditions will occur to support all kinds of fieldwork and crop development - Winter

wheat growth should advance aggressively

Overall,

Argentina will see a tremendous change in crop conditions, but there is still need for more rain from northern Cordoba to Santiago del Estero and in northwestern Santa Fe as well as in a few La Pampa locations. Weather conditions will be favorably mixed for

the next two weeks, despite the ongoing need for greater rain in the drier areas noted above.

BLACK

SEA REGION

- Rain

is advertised for Friday through Monday of next week in Russia’s Southern Region - Amounts

of 0.20 to 0.75 inch with a few totals over 1.00 inch will be possible - Areas

near the Kazakhstan border and near the lower Volga River will see the least rain and may have ongoing dryness issues - Areas

near the Ukraine and Krasnodar border will be wettest - Eastern

Ukraine will also get a little rain from this event - Otherwise,

the ten-day forecast does not bring much change to the region

Improvement

is expected to Russia’s Southern Region. The moisture will help induce improved crop and field conditions, although it comes rather late in the autumn season. Winter crops will still need more moisture and there will continue to be need for a close watch

on snow cover and bitter cold periods this winter because some of the winter crops may not be well established.

CHINA

- No

general theme changes were noted over the weekend - A

favorable mix of sunshine and showers will occur over the next two weeks allowing fieldwork of all kinds to advance - Winter

wheat and rapeseed establishment should advance favorably along with the harvest of summer crops

INDIA

- No

general theme changes were noted during the weekend - Rain

will be limited to far southern and extreme eastern parts of the nation over the next couple of weeks favoring fieldwork of all kinds

AUSTRALIA

- No

big changes were noted during the weekend for the coming two weeks - Rain

fell in eastern parts of the nation during the weekend benefiting spring planting in dryland areas and boosting soil moisture for late reproductive winter crops - Scattered

showers in eastern parts of the nation during the next two week should not harm the majority of winter crops, but the region will need to be closely monitored for too much rain that might harm grain and oilseed quality during the maturation and harvest season - Western

Australia will remain mostly dry for an extended period of time

Spring

and summer planting will advance well in eastern Australia while winter crops in the south continue to fill and mature. Harvesting in northern areas will advance around scattered shower s and thunderstorms with the need for drier weather greatest in northern

New South Wales wheat, barley and canola areas.

Source:

World Weather Inc.

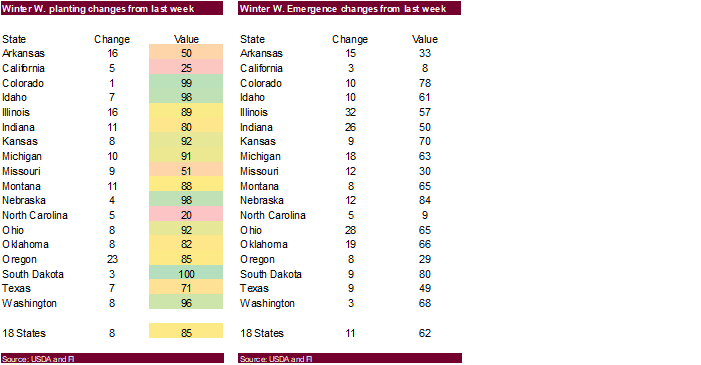

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm - EU

weekly grain, oilseed import and export data - Monthly

MARS bulletin on crop conditions in Europe - Malaysian

Oct. 1-25 palm oil export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Hong Kong, New Zealand

Tuesday,

Oct. 27:

- Virtual

Palm Oil Conference, day 1 - EARNINGS:

WH Group

Wednesday,

Oct. 28:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Virtual

Palm Oil Conference, day 2 - HOLIDAY:

Indonesia

Thursday,

Oct. 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Vietnam’s

General Statistics Office releases commodity trade data for October - International

Grains Council monthly report - EARNINGS:

ADM - HOLIDAY:

Indonesia, Malaysia

Friday,

Oct. 30:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Indonesia

Source:

Bloomberg and FI

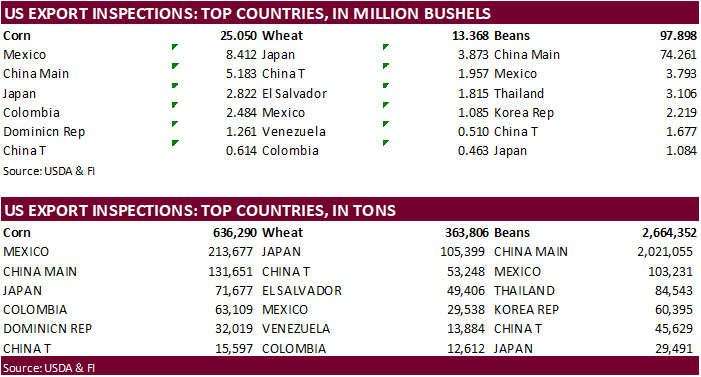

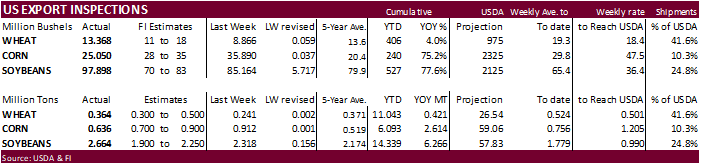

USDA

Export inspections

Note

there were no estimates provided by Reuters

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING OCT 22, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 10/22/2020 10/15/2020 10/24/2019 TO DATE TO DATE

BARLEY

798 0 49 9,867 8,674

CORN

636,290 911,648 391,231 6,093,191 3,478,787

FLAXSEED

0 0 0 389 172

MIXED

0 0 0 0 0

OATS

0 0 0 996 798

RYE

0 0 0 0 0

SORGHUM

65,007 74,655 58,320 533,835 308,482

SOYBEANS

2,664,352 2,317,798 1,578,604 14,338,789 8,072,375

SUNFLOWER

0 0 0 0 0

WHEAT

363,806 241,283 543,166 11,042,799 10,622,214

Total

3,730,253 3,545,384 2,571,370 32,019,866 22,491,502

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

US

New Home Sales Sep: 0.959M (est 1.025M; prevR 0.994M; prev 1.011M)

US

New Home Sales (M/M) Sep: -3.5% (est 1.4%; prevR 3.0%; prev 4.8%)

Corn.

-

December

corn futures traded near its respected 14-month but ended 1.50 cents lower as wheat weighed on prices. Corn was up the previous five trading session, so some of the bearish undertone was technical. Export inspections were just over 900,000 tons, but half

the volume posted for soybeans. -

Losses

were limited after CBOT announced that there were 1600 November 420 calls exercised on Friday.

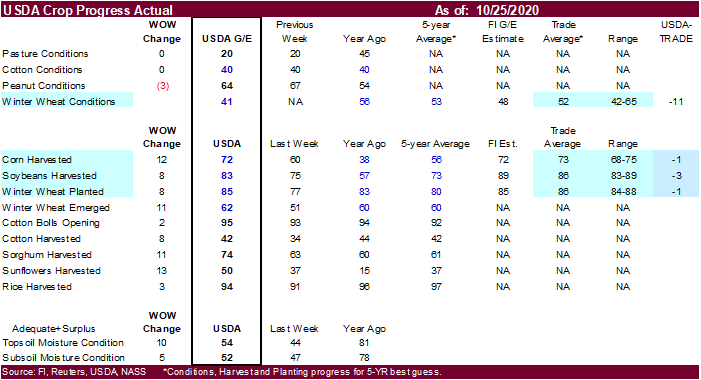

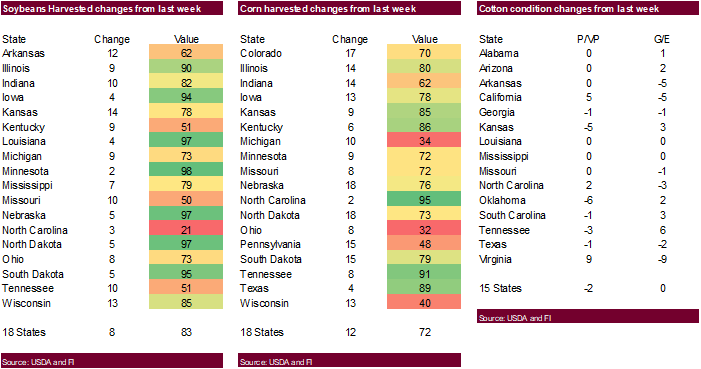

-

US

corn harvesting progress was reported at 72 percent, one point below expectations, up from 60 previous week, and compares to 38 percent year ago and 56 percent average.

-

USDA

US corn export inspections as of October 22, 2020 were 636,290 tons, below 911,648 tons previous week and compares to 391,231 tons year ago. Major countries included Mexico for 213,677 tons, China Main for 131,651 tons, and Japan for 71,677 tons.

-

Toledo,

OH corn was up 10 cents to 5 under and Davenport, IA was up 4 to 6 under.

-

China

imported 846,498 tons of US corn from the US in September, highest monthly import figure since 2008. Ukraine corn imports were 200,382 tons, up 63 percent from August. China 2020 corn imports are expected to be the highest in 15 years.

-

Ukraine

corn export prices were up $20/ton over the last week to $233-$237/ton fob, according to APK-Inform.

-

Ukrainian

grain traders union UGA sees Ukraine’s 2020 corn harvest falling to 30 million tons from 35.9 million tons in 2019 because of poor weather. -

APK-Inform

agriculture consultancy said earlier on Monday a possible sharp decline in the 2020 corn harvest combined with rising global prices had raised Ukrainian corn export prices by $20 per ton over the past week.

-

Ukraine’s

Economic Minister left their 2020-21 corn production unchanged at 33 million tons, and exports were projected at 26 million tons. 36 million tons were produced last year.

-

South

Africa Reuters poll: New crop corn area 2.64 million hectares (2020-21), up 8.3 percent, or 2.4 million hectares. White was estimated at 1.6 million for 2020-21. The poll also called for 2019-20 South African corn production to end up near 15.353 million

tons, down from 15.422 million tons projected in September. -

The

EU crop monitor lowered its estimate for 2020 corn yield to 7.42 tons per hectares from 7.83 tons in September, 2.1 percent below the five year average.

-

Germany

ASF: 91 cases since September 10

Corn

Export Developments

Updated

10/23/20

December

corn is seen in a $4.00-$4.40 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.