PDF Attached

We

moved to a new office!

Futures

International

One

Lincoln Center

18

W 140 Butterfield Rd. Suite 1450

Oakbrook

Terrace, Il. 60181

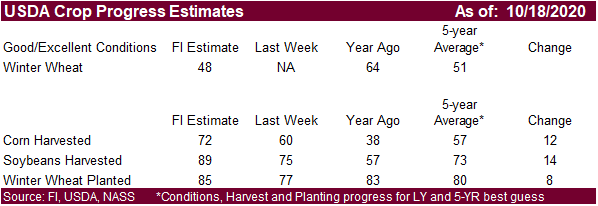

Grains

and oilseeds ended the week on a high note. Corn

and soybeans were up five consecutive days.

Weather

and Crop Progress

EARLY

MORNING WEATHER UPDATE

CHANGES

OVERNIGHT

- European

forecast model greatly increased precipitation in U.S. hard red winter wheat areas for next week - The

increase was overdone and unlikely to verify - European

forecast model increased precipitation in Russia’s Southern Region Oct. 30-Nov 2 - This

increase was overdone - The

first week of the outlook remains mostly dry - European

model run is a little wetter in Brazil through Monday, but rain in Parana, Sao Paulo and neighboring areas is still advertised to be limited thereafter - U.S.

hard red winter wheat areas will receive some needed precipitation during the late weekend through early part of next week easing dryness, but follow up moisture will still be needed

MOST

IMPORTANT WEATHER TO CONSIDER FOR WEEKEND

- Dryness

will continue for much of the next week in Russia’s Southern Region - Some

showers are possible infrequently, but the amount of relief will be restricted - Remember

that a part of this region did get some relief from dryness earlier this week

- Temperatures

will remain warmer than usual over the next week to ten days maintaining a favorable environment for winter crop establishment for those areas with topsoil moisture - There

is potential for rain in the Oct. 30-Nov. 3 period, but it will be light - Ukraine

precipitation will be limited through the next ten days, but recent moisture has been helpful for winter crop establishment except in the far east where there is still a pressing need for significant moisture - Kazakhstan

is unlikely to get meaningful moisture in the next ten days, although some sporadic showers may evolve after the end of next week - Argentina

has received beneficial rain this week and more will occur this weekend - Rainfall

Saturday and Sunday will range from 0.50 to 2.00 inches with local totals to 3.00 to 4.00 inches favoring the south and east - Follow

up showers will produce 0.15 to 0.70 inch of moisture Tuesday and Wednesday

- Mostly

dry thereafter until Nov. 5 when showers develop in the far south and possibly shift to east-central areas Nov. 6-7 (confidence is low on this event) - Argentina

rain Thursday was not very great with amounts to 0.25 inch; however, some rain overnight in northeastern Santa Fe, southern Corrientes and southern Chaco varied from 0.35 to 0.68 inch with one location in southern Corrientes reporting an unconfirmed 3.06 inches

through dawn - Brazil

will see rain in most of the nation during the coming ten days - Interior

southern areas will receive the lightest amounts and may experience the most aggressive planting, although will have need for more rain in November - Center

west into Minas Gerais and southern Bahia will receive frequent rainfall especially next week and into the first week of November possibly slowing fieldwork at times - Rain

will be heaviest and most frequent from Goias into Minas Gerais where some farming activity could be slowed - Brazil

rainfall Thursday was erratic with northeastern Minas Gerais, central Goias, northwestern Mato Grosso, eastern Santa Catarina and southern Rio Grande do Sul reporting the most significant amounts - Moisture

totals were rarely more than 0.60 inch through dawn today with as much as 1.00 inch in central Goias - U.S.

hard red winter wheat areas will receive snow, freezing rain, sleet and rain at various times from Sunday into Tuesday - Moisture

totals will be light in western Kansas, southeastern Colorado, northwestern Texas Panhandle and more significant in other areas - The

lighter precipitation areas will receive up to 0.20 inch of moisture - Southwestern

Nebraska to northeastern Colorado will receive up to 0.35 inch of moisture - Southeastern

Texas Panhandle and western Oklahoma will receive 0.20 to 0.60 inch of moisture - Central

Oklahoma to central and eastern wheat areas of Kansas will receive 0.25 to 0.75 inch of moisture with a few amounts over 1.00 inch - Greatest

rain will be in north-central Texas to southeastern wheat areas in Oklahoma where 1.00 to 3.00 inches of rain may fall - Snowfall

will range from 3 to 6 inches and local totals to 8 inches from southwestern Nebraska to northeastern Colorado and 1 to 3 inches with local amounts of 4-5 inches elsewhere in the wheat region - Some

snow will fall as far south western Texas and southwestern Oklahoma - U.S.

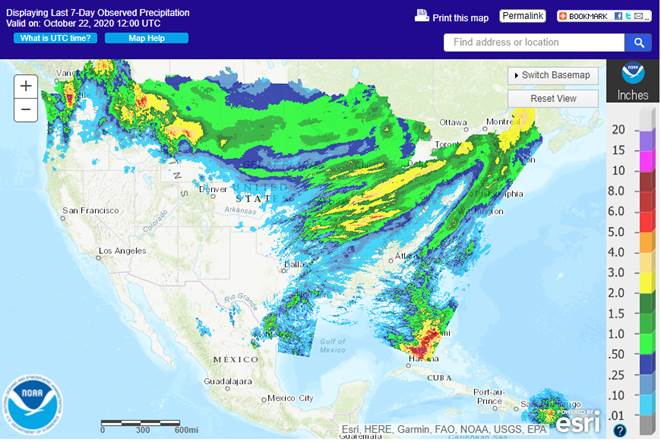

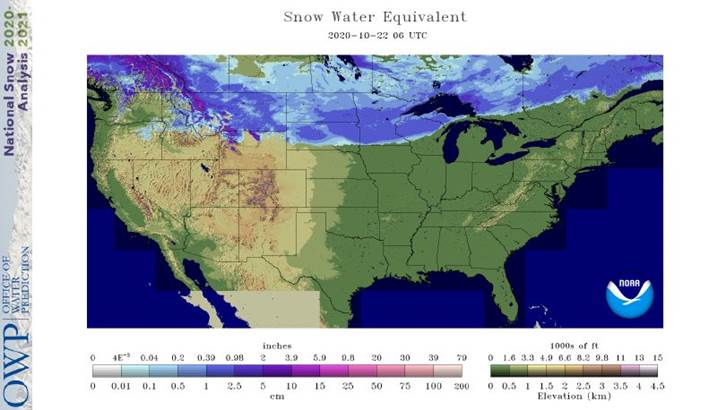

northern Plains and upper Midwest snow event Thursday produced 4 to 10 inches of snow with local totals to 12 inches from northern and central South Dakota and southern North Dakota into central and interior northern Minnesota - U.S.

Livestock stress will be ongoing this weekend in the northern Plains and will develop in the central Plains as temperatures plummet and snow begins to fly - Extreme

cold temperatures will occur in the Great Plains this weekend and early next week with lows in the negative and positive single digits into western Nebraska, northeastern Colorado and far northwestern Kansas - U.S.

harvest weather will deteriorate over the coming week due to waves of rain and some snow - Harvest

delays are expected in the Dakotas, Minnesota and Wisconsin through most of next week and possibly into the first days of November because of the region’s deep snowpack and expected wet field conditions that will follow the snow melt - North

America warming is expected is the second half of next week through the first week in November and precipitation should be more limited favoring better harvest progress in areas that are not too wet - Some

drying is needed before fieldwork can resume in the central Midwest as well as the northwestern Corn Belt - U.S.

Delta and southeastern states will experience waves of rain over the coming week the greatest of which will occur during the workweek next week - Delays

in harvest progress will result - Drier

weather will occur in the following week - Some

heavy rain might evolve if tropical moisture streams north to merge with a mid-latitude storm system as advertised in some models today - U.S.

Pacific Northwest will receive rain and snow this weekend bringing a moisture boost to some crop areas while boosting mountain snowpack - California

and the southwestern United States will remain dry for much of the coming ten days

- Ontario

and Quebec, Canada harvest delays will continue for one more week because of frequent precipitation - The

region needs to dry out - Canada’s

Prairies will experience a notable rain, freezing rain and snow event early next week, but most of this year’s harvest is done - Eastern

Australia will be closely monitored for too much rain over the next few weeks, but for now most of the wheat, barley and canola is still rated favorably and rain expected will benefit the planting and emergence of dryland summer crops - Western

Australia is not likely to see much more than a few spotty showers in the far south over the next ten days - South

Australia, Victoria and southern New South Wales winter crop conditions remain very good with little change likely - Hurricane

Epsilon has passed to the east of Bermuda and should turn to the northeast away from North America this weekend posing no land impact - Typhoon

Saudel was located in the central South China Sea today and will move westerly through Saturday while slowly weakening

- Landfall

is expected in central Vietnam north of Hue late Sunday or early Monday - Heavy

rain will bring on some additional flooding to water-logged areas of central Vietnam - Follow

up rainfall in Vietnam from a tropical wave early next week and another tropical cyclone during mid-week will result in total rainfall of 6.00 to 20.00 inches of rain by the latter part of next week along nearly all of the central Vietnam Coast - Damage

to infrastructure, personal property and agriculture will continue with each of the three systems noted above - A

new tropical cyclone will form east of the Philippines this weekend and move across the heart of the nation Sunday and Monday before moving to Vietnam Tuesday and Wednesday - A

third tropical cyclone may evolve east of the Philippines late next week and into the following weekend that will threaten the nation; the first storm to impact the nation this week was Tropical Storm Saudel - South

Africa will experience showers erratically over the central and eastern parts of the nation during the coming week with some potential for greater rain in the following week - Generalized

rain is needed to support spring and summer planting - La

Nina should help ensure a good rainy season this summer - India’s

monsoon will start withdrawing a little faster over the next several days ending rain and harvest delays in the west-central crop areas

- Rain

will fall frequently in far southern India and in the extreme east for much of the coming week to ten days - Europe

will experience increasing precipitation in the west over this coming week while eastern areas are relatively dry biased and a little warmer than usual - Winter

crops are establishing well in much of the continent, despite less than ideal early season planting conditions - China

weather will be almost ideal for winter wheat and rapeseed planting and summer crop harvesting during the next ten days - Soil

moisture will be good for quick winter crop germination and plant emergence - Disturbed

tropical weather in the Caribbean Sea and southeastern Gulf of Mexico the remainder of this week will be closely monitored for possible tropical cyclone development over the next week

- Two

systems may come out of the region with one moving over western Cuba and then moving to the Bahamas and then farther out to sea in the Atlantic next week

- A

second storm system may evolve and move across the Yucatan Peninsula and then into the central Gulf of Mexico where it might merge with a mid-latitude storm over the lower Mississippi River Basin next week - Southern

Oscillation Index fell during the weekend down to +8.18 and the index may begin to rise this weekend - Southeast

Asia rainfall over the next two weeks will be erratic, but all areas will be impacted multiple times supporting most crop needs; some flood potentials will gradually rise in localized areas - Mexico

precipitation will be scattered over far southern crop areas during the coming week - Net

drying is expected for many other summer crop areas supporting crop maturation and harvest progress - Central

America will be wetter than usual over the next ten days to two weeks keeping late season crop maturation and harvest progress slow, but the moisture is improving long term water supply.

- Some

flooding is possible

·

West-central Africa will experience erratic rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - Cotton

areas will benefit from drier weather

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda and southwestern Kenya will be impacted while Tanzania and Ethiopia rainfall is erratic and light

- Some

heavy rain may fall in Uganda

·

New Zealand rainfall will be increasing across North Island and western areas of South Island over the coming week

- Temperatures

will be seasonable with a slight cooler bias in the south

Source:

World Weather Inc.

- China

customs publishes trade data on imports of corn, wheat, sugar and cotton - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Unica

data on Brazil’s cane crush, sugar production (tentative) - U.S.

cattle on feed, poultry slaughter, 3pm - HOLIDAY:

Thailand

Sunday,

Oct. 25:

- China

customs publishes country-wise soybean and pork import data

Monday,

Oct. 26:

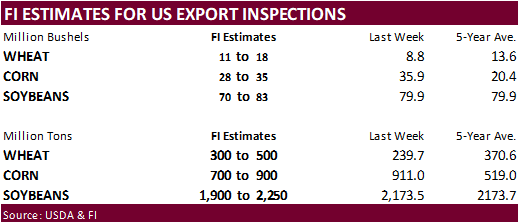

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm - EU

weekly grain, oilseed import and export data - Monthly

MARS bulletin on crop conditions in Europe - Malaysian

Oct. 1-25 palm oil export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Hong Kong, New Zealand

Tuesday,

Oct. 27:

- Virtual

Palm Oil Conference, day 1 - EARNINGS:

WH Group

Wednesday,

Oct. 28:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Virtual

Palm Oil Conference, day 2 - HOLIDAY:

Indonesia

Thursday,

Oct. 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Vietnam’s

General Statistics Office releases commodity trade data for October - International

Grains Council monthly report - EARNINGS:

ADM - HOLIDAY:

Indonesia, Malaysia

Friday,

Oct. 30:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Indonesia

Source:

Bloomberg and FI

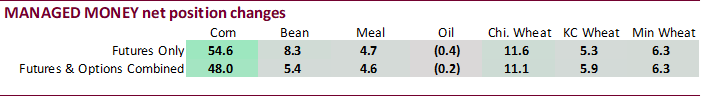

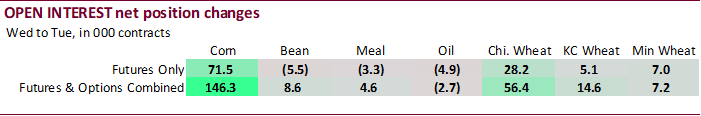

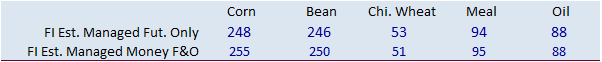

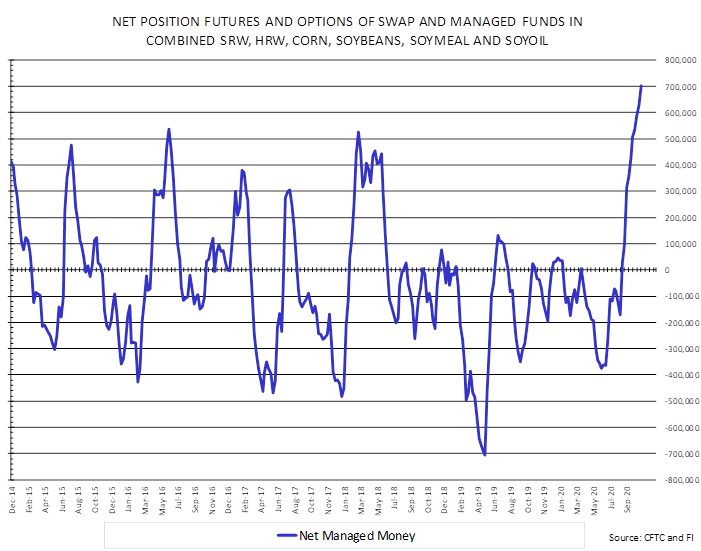

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

240,281 64,948 330,383 4,791 -509,863 -78,208

Soybeans

189,163 1,535 199,492 -1,813 -380,294 -6,238

Soyoil

66,521 695 114,420 17 -196,837 2,070

CBOT

wheat 23,860 7,435 127,962 -2,117 -131,799 -5,144

KCBT

wheat 16,563 4,200 65,859 822 -83,334 -6,137

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

218,825 47,956 173,633 6,944 -469,159 -80,191

Soybeans

231,892 5,447 122,303 -3,408 -373,040 -7,461

Soymeal

81,624 4,555 86,614 2,700 -216,733 -10,109

Soyoil

82,034 -154 97,291 3,276 -214,368 -1,099

CBOT

wheat 49,728 11,138 73,154 -6,462 -112,499 -184

KCBT

wheat 38,146 5,950 45,977 270 -83,138 -6,521

MGEX

wheat 4,492 6,266 2,291 47 -12,422 -9,005

———- ———- ———- ———- ———- ———-

Total

wheat 92,366 23,354 121,422 -6,145 -208,059 -15,710

Live

cattle 34,941 -21,096 73,330 -2,124 -117,732 17,050

Feeder

cattle -8,531 -4,696 6,286 1,168 262 2,986

Lean

hogs 42,058 4,905 52,430 1,092 -97,034 -2,009

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

137,501 16,821 -60,800 8,469 2,150,651 146,249

Soybeans

27,205 -1,095 -8,359 6,517 1,326,365 8,562

Soymeal

22,345 309 26,151 2,545 522,739 4,604

Soyoil

19,149 760 15,896 -2,782 526,968 -2,692

CBOT

wheat 9,640 -4,317 -20,025 -175 592,895 56,386

KCBT

wheat -1,897 -815 911 1,116 279,840 14,610

MGEX

wheat 3,176 653 2,464 2,040 74,258 7,179

———- ———- ———- ———- ———- ———-

Total

wheat 10,919 -4,479 -16,650 2,981 946,993 78,175

Live

cattle 19,851 3,407 -10,389 2,763 316,579 1,228

Feeder

cattle 1,647 -1,169 337 1,711 51,454 3,710

Lean

hogs 14,392 -2,688 -11,847 -1,299 270,736 -20,520

Source:

Reuters, CFTC and Reuters

Macros

US

Markit Manufacturing PMI Oct P: 53.3 (est 53.5; prev 53.2)

–

Services PMI Oct P: 56.0 (est 54.6; prev 54.6)

–

Composite PMI Oct P: 55.0 (prev 54.3)

Corn.

-

Corn

futures traded at a fresh 14-month high bias the nearby contract and December closed 3.0 cents higher at $4.1925/bu. Looks like the December/March corn contracts may soon trade inverse. As it should. We see much of the US corn export demand during the late

December through April period. -

Chatter

overnight was a Reuters story talking about China imports of grains may surge as the government may increase corn import quotas. Set at 7.2 million tons, it could rise to at least 15 million tons, in our opinion, after China booked 12 million tons of US corn

and 5 million tons from Ukraine and other countries. -

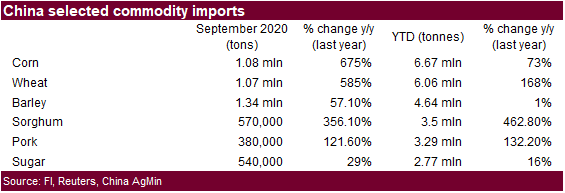

China

corn imports were 6.7 million tons during the first 9 months of 2020. That’s the highest in 15 years. September corn imports were 1.08 million tons.

-

China

corn futures rose to a 14-month high. -

USD

was 18 lower as of 1:26 pm CT, and crude was $0.73 lower. -

US

corn basis was up 5 cents at Seneca, IL to option, Cedar Rapids up 3 to option, and Blair, NE up 5 to 11 under.

-

French

corn harvesting progress was running at 77 percent as of October 19, up from 64 percent previous week and compares to 42 percent year ago. AGPM, a French growing group, warned of disappointing French corn crop, at 13.6 million tons, below the AgMin estimate

of 13.8 million tons. -

Ukraine

harvested 83 percent of their grain crop, or 48.8 million tons from 12.7 million hectares.

-

Germany

ASF: 5 new cases; 91 cases since September 10 -

South

Africa Reuters poll: New crop corn area 2.64 million hectares (2020-21), up 8.3 percent, or 2.4 million hectares. White was estimated at 1.6 million for 2020-21. The poll also called for 2019-20 South African corn production to end up near 15.353 million

tons, down from 15.422 million tons projected in September. -

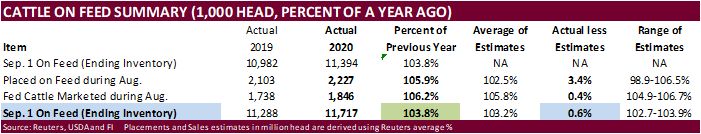

USDA

Cattle on Feed report showed a huge year over year increase in placements and fed placements. September 1 on feed was slightly above expectations. That’s supportive corn.

RFA

letter to recommend reciprocal tariffs on ethanol imports from Brazil

Corn

Export Developments

-

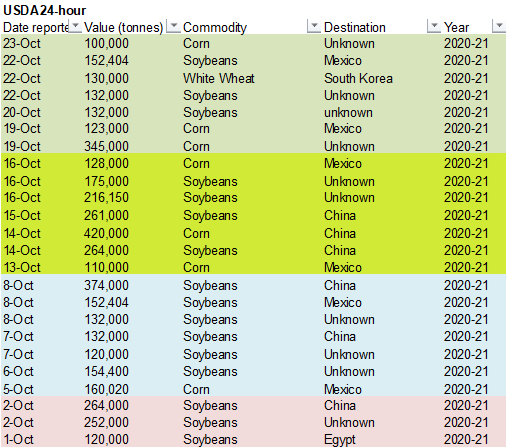

Under

the 24-hour announcement system, private exporters sold 100,000 tons of corn to unknown.

-

Iran

passed on 200,000 tons of barley and 200,000 tons of corn due to high prices.

Updated

10/23/20

December

corn is seen in a $4.00-$4.40 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.