PDF Attached

Weather

and Crop Progress

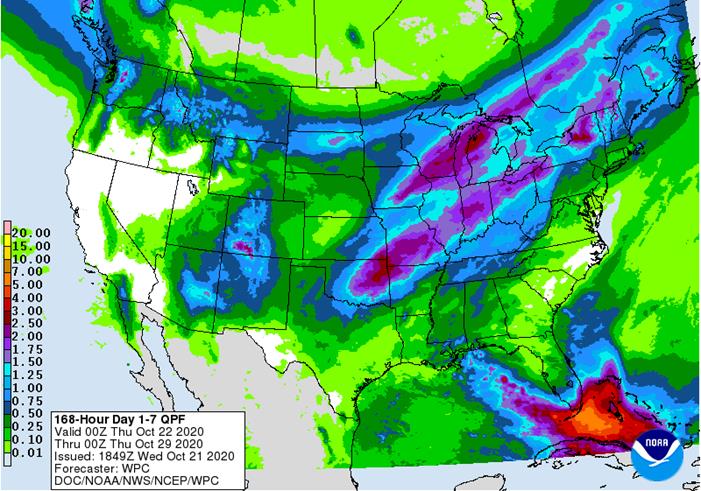

Rain

will increase in Brazil but there is now talk too much frequent rain could delay soybean plantings for some areas. Brazil rainfall will slowly increase over the next two weeks in center west and center south crop areas improving soybean planting and establishment

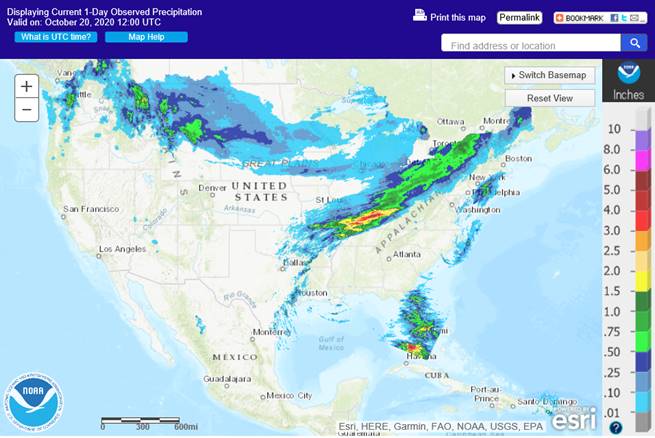

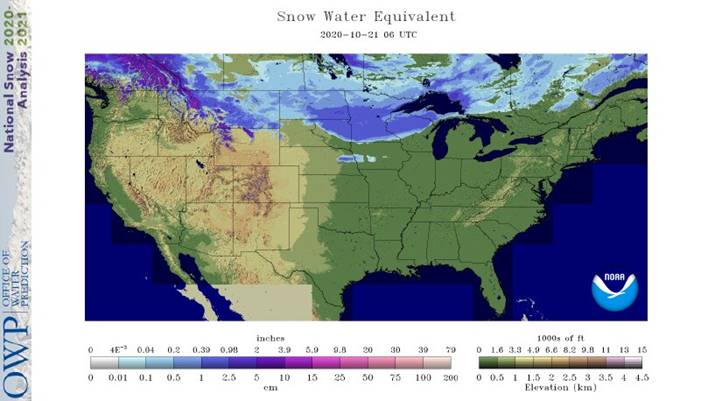

conditions. Argentina will see additional rainfall Friday through Sunday of another 0.50 to 2.00 inches. Northern US Great Plains saw snow over the past day, delaying fieldwork activity. Eastern Ukraine and Kazakhstan will see limited rainfall for a while.

TODAY’S

MOST IMPORTANT WEATHER

- Heavy

snow fell Tuesday from extreme eastern South Dakota through central and southern Minnesota where 4 to 10 inches resulted in travel delays and livestock stress - Some

of the snow shifted into Wisconsin and impacted western and northern parts of that state as well - A

new snowstorm of significance will occur today and Thursday from northern South Dakota and southern North Dakota to central and interior northern Minnesota as well as areas east northeast to the northern Great Lakes region - Accumulations

of 3 to 9 inches will be common with local totals of 10 to 14 inches; northern South Dakota and parts of central Minnesota will see the greatest amounts - Additional

travel delays and livestock stress will result - Late

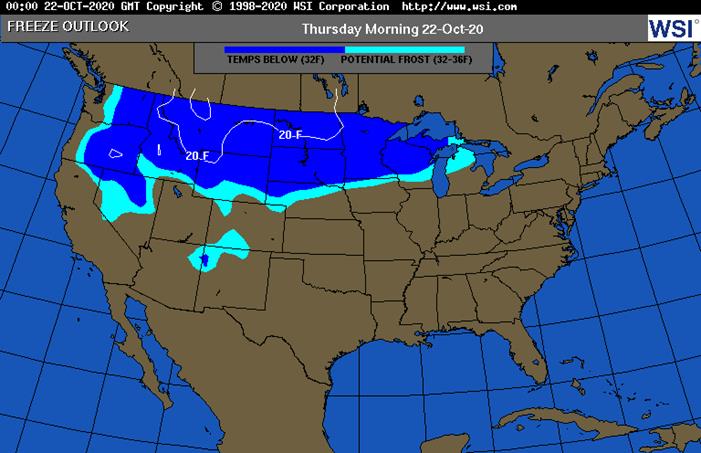

season corn, sugarbeet and other harvest progress will be delayed - Bitter

cold air is still expected in the northern U.S. Plains and a part of Canada’s Prairies over the next several days

- Extreme

lows in the negative and positive single digits will occur from Montana, northern Wyoming and the far western parts of the Dakotas northward into the heart of the Canadian Prairies - The

cold and snow that precedes it will stress livestock - Snow

will fall into the central Plains late Saturday into Monday with accumulations of 1 to 3 inches common from Nebraska to eastern Colorado with local totals of 4 to 5 inches probably favoring northeastern Colorado and far southwestern Nebraska, although confidence

is low - U.S.

hard red winter wheat areas will receive some needed moisture from the waves of snow, rain and freezing rain that will impact the central and southwestern Plains briefly from Thursday into Tuesday of next week - Most

of the precipitation will occur in the north and eastern parts of the region where moisture totals will vary from 0.10 to 0.50 inch and a few amounts as great as 0.70 inch - However,

moisture totals in the high Plains region will be less than 0.20 inch except in southwestern Nebraska, northeastern Colorado and possibly far northwestern Kansas where 0.20 to 0.35 inch “may” result - All

of the moisture will be welcome, but there will be need for more to ensure the best winter crop establishment when temperatures warm again - Montana

wheat planting and emergence is incomplete, and temperatures will be cold enough for a long enough period of time to raise concern about that planting getting completed - Warming

is expected late next week through the following weekend - U.S.

Midwest harvest delays will occur through early next week due to waves of rain and some snow - Drier

weather is expected in the following week to improve harvest progress, although a period of drying will be required after some significant moisture impacts the region - Snowmelt

will keep the upper Midwest wet for a longer period of time extending the harvest delays - West

Texas cotton and other summer crop harvesting will be delayed by precipitation during the late weekend through the first half of next week - Drier

and warmer weather will return late next week through the first week in November supporting better harvest conditions

- U.S.

Delta and southeastern states weather will be disrupted by periods of rain over the next two weeks - Some

of the advertised rain may be overdone and future model forecasts will bring some better field working conditions, but progress will still advance slowly.

- U.S.

Pacific Northwest precipitation will be limited to an event expected Friday into Saturday with drier biased conditions occurring in the following ten days - U.S.

far west will continue drier than usual through much of the next couple of weeks, especially south of the Columbia River Basin - Hurricane

Epsilon is a huge storm, but will pass to the east of Bermuda later this week and should then turn away from North America posing no land impact - Tropical

Storm Saudel was located west of the Philippines this morning and was becoming better organized after moving across Luzon Island Tuesday - Rainfall

over the island was not more than 4.00 inches - Saudel

will move west northwesterly today and Thursday and then turn to the west and slightly south of west the remainder of this week and into the weekend - Landfall

is expected in central Vietnam during the late weekend - Heavy

rain will bring on some additional flooding to water-logged areas of central Vietnam - Russia’s

Southern Region will continue quite dry along with eastern Ukraine and western Kazakhstan despite a few showers during the next two weeks - Greater

moisture is needed to bring on improved crop establishment before winter dormancy occurs to wheat, rye and barley - Eastern

Australia will soon experience periods of rain that will improve dryland cotton and sorghum planting conditions, but may raise some concern over winter wheat, barley and canola quality - Most

of the greatest rain will be in the Great Dividing range and in southeastern Queensland - Western

Australia is not likely to see much more than a few showers in the far south - South

Australia, Victoria and southern New South Wales winter crop conditions remain very good with little change likely - Argentina’s

recent rainfall and that expected through the weekend will ensure much improved planting conditions for corn, sunseed and eventually soybeans - Drier

weather expected for a week and possibly ten days following the rain event setting the stage for aggressive spring planting and quick germination - Improved

early planted crop establishment is expected, as well - Follow

up rain will be needed in early November to prevent dryness from returning again - Brazil’s

rainfall outlook over the next ten days continues to promote planting improvements for most of the nation - Seed

germination and plant emergence should occur readily - A

close watch on southern Brazil weather is warranted since that region will not get as much rain as other areas in the nation - South

Africa will experience showers erratically over the central and eastern parts of the nation during the coming week with some potential for greater rain in the following week - Generalized

rain is needed to support spring and summer planting - La

Nina should help ensure a good rainy season this summer - India’s

monsoon will start withdrawing a little faster over the next several days ending rain and harvest delays in Gujarat, northern Maharashtra, southern Rajasthan and western Madhya Pradesh over the next couple of days - Rain

will fall frequently in far southern India and in the extreme east for much of the coming week to ten days - Europe

will experience increasing precipitation in the west over this coming week while eastern areas are relatively dry biased and a little warmer than usual - Winter

crops are establishing well in much of the continent, despite less than ideal early season planting conditions - China

weather will be almost ideal for winter wheat and rapeseed planting and summer crop harvesting during the next ten days - Soil

moisture will be good for quick winter crop germination and plant emergence - Disturbed

tropical weather in the Caribbean Sea and southeastern Gulf of Mexico the remainder of this week will be closely monitored but there is no sign or tropical cyclone development for the next few days

- Southern

Oscillation Index fell during the weekend down to +8.23 and the index will level off over the next few days after a recent fall of significance.

- Southeastern

Canada and the U.S. Great Lakes region will continue to experience frequent precipitation over the coming week causing additional delay to farming activity - Recent

precipitation frequency has been too high for much fieldwork and this trend will linger for a while longer.

- Southeast

Asia rainfall over the next two weeks will be erratic, but all areas will be impacted multiple times supporting most crop needs; some flood potentials will gradually rise in localized areas - Mexico

precipitation will be scattered over far southern crop areas during the coming week - Net

drying is expected for many other summer crop areas supporting crop maturation and harvest progress - Central

America will be wetter than usual over the next ten days to two weeks keeping late season crop maturation and harvest progress slow, but the moisture is improving long term water supply.

- Some

flooding is possible

·

West-central Africa will experience erratic rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - Cotton

areas will benefit from drier weather

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda and southwestern Kenya will be impacted while Tanzania and Ethiopia rainfall is erratic and light

- Some

heavy rain may fall in Uganda

·

New Zealand rainfall will be increasing across North Island and western areas of South Island over the coming week

- Temperatures

will be seasonable with a slight cooler bias in the south

Source:

World Weather Inc.

- EIA

U.S. weekly ethanol inventories, production, 10:30am

Thursday,

Oct. 22:

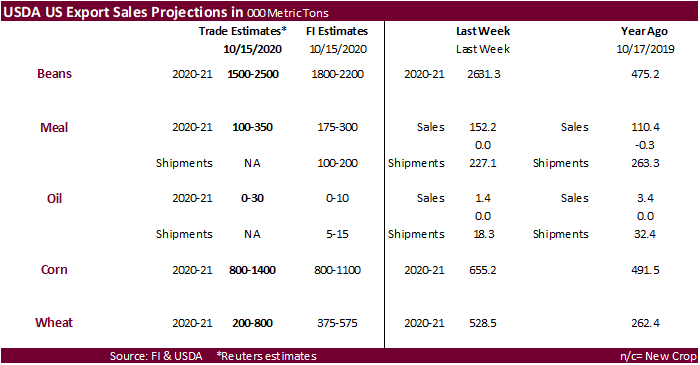

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - USDA

red meat production, 3pm - U.S.

cold storage data – pork, beef, poultry

Friday,

Oct. 23:

- China

customs publishes trade data on imports of corn, wheat, sugar and cotton - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Unica

data on Brazil’s cane crush, sugar production (tentative) - U.S.

cattle on feed, poultry slaughter, 3pm - HOLIDAY:

Thailand

Canadian

Retail Sales (M/M) Aug: 0.4% (est 1.1%; prev 0.6%)

Canadian

Retail Sales Ex Auto (M/M) Aug: 0.5% (est 0.9%; prev -0.4%)

Canadian

CPI NSA (M/M) Sep: -0.1% (est -0.1%; prev -0.1%)

Canadian

CPI (Y/Y) Sep: 0.5% (est 0.5%; prev 0.1%)

Canadian

CPI Core – Median (Y/Y) Sep: 1.9% (est 1.9%; prev 1.9%)

Canadian

CPI Core – Common (Y/Y) Sep: 1.5% (est 1.5%; prev 1.5%)

Canadian

CPI Core – Trim (Y/Y) Sep: 1.8% (est 1.7%; prev 1.7%)

Canadian

New Housing Price Index Sep: 1.2% (est 0.5%; prev 0.5%)

US

DoE Crude Oil Inventories (W/W) 16-Oct: -1002K (est -1375K; prev -3818K)

–

Distillate Inventories (W/W): -3832K (est -2000K; prev -7245K)

–

Cushing OK Crude Inventories (W/W): 975K (prev 2906K)

–

Gasoline Inventories (W/W): 1895K (est -1500K; prev -1626K)

–

Refinery Utilization (W/W): -2.20% (est 0.80%; prev -2.00%)

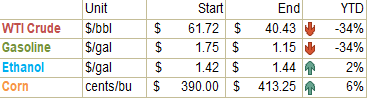

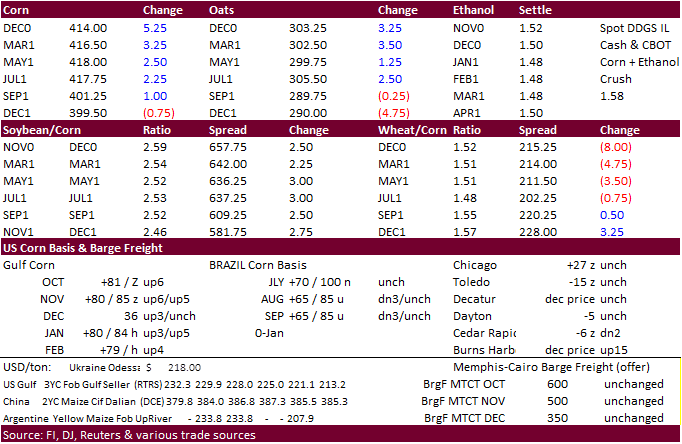

Corn.

-

Corn

futures hit an Aug 2019 high, ending 5.0 higher in the December (bull spreading), on a lower USD and strong global cash prices. Brazil’s local corn price is at multi month highs and tight supplies could shift demand to the US during the Nov-May period. Funds

bought an estimated net 18,000 corn contracts. -

Poor

US corn for ethanol demand likely kept back month corn prices limited to the upside.

-

Wear

hearing the corn is coming in dry across the Great Plains and WCB. There was one report WCB moisture content was 10-12 percent. Over the in the ECB, we heard corn 17 moisture percent central IN and 20-22 percent northern Indiana. But the beans came in a

little dry. -

South

American offers for corn are starting to dry up after South Korea is having one of their busiest months since April. AgriCensus noted Brazil October corn exports could reach 5.5 million tons and Cepea domestic Brazil corn price were up for the 15th

straight day. -

USD

was 46 lower as of 2:00 pm CT, and crude was $1.57 lower. -

China

expects pork supplies during the Lunar New year holiday will be 30 percent higher from the previous year, resulting in lower prices. Pork prices have fallen for seven consecutive weeks as more pigs are slaughtered, dropping to 50.56 yuan ($7.59) per kg. China’s

head of the development and planning division of the ministry noted pig producers have built 12,500 new large-scale pig farms in the first three quarters of the year and restarted more than 13,000 empty farms. China’s agriculture ministry had set a goal last

year of restoring the herd to 80% of normal levels by the end of 2020. 40% of China’s pigs were lost in 2019. September 30 pig stocks were 370 million, or 84% of the level in 2017 while breeding sows reached 38.22 million, or 86% of 2017 levels. (Reuters)

-

Germany

ASF: 71 cases since September 10 -

USDA’s

Broiler Report showed weekly eggs set in the US down 2 percent from last year and chicks placed down 1 percent. Cumulative placements from the week ending January 4, 2020 through October 17, 2020 for the United States were 7.79 billion. Cumulative placements

were down 1 percent from the same period a year earlier.

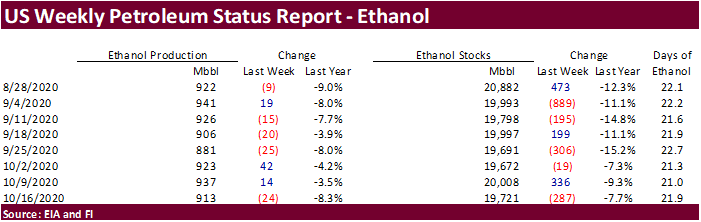

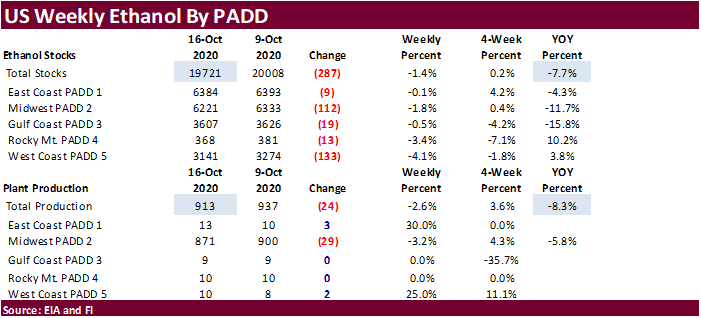

Weekly

US ethanol production fell 24,000 to 913,000 barrels from the previous week, which was unexpected as a Bloomberg poll called for a 7,000 increase. Ethanol stocks declined 287,000 barrels to 19.721 million. Traders were looking for stocks to increase 224,000

barrels. Early September to date ethanol production is running 6.4 percent below the same period a year earlier. Ethanol stocks are down 8.3 percent

from this time last year. US gasoline stocks of 227 million barrels are up 1.9 million from the previous week. Ethanol percent blended to conventional gasoline was 92.5%, up from 93.4% previous week.

Corn

Export Developments

-

Iran

opened a new tender for 200,000 tons of barley, set to close October 21.

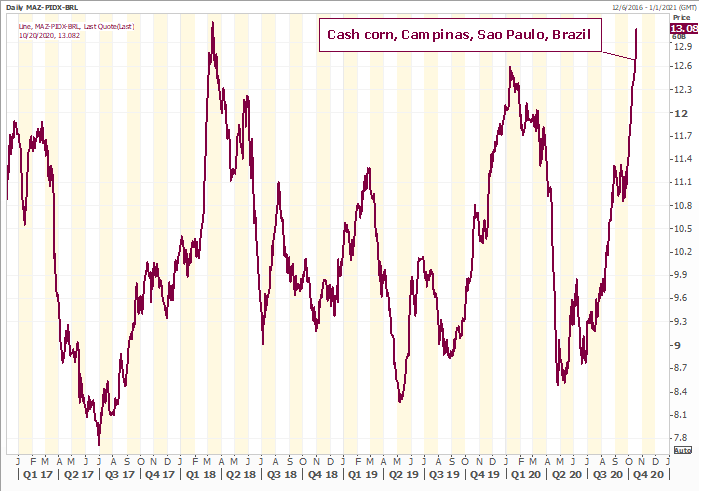

Domestic

Brazil cash corn, Campinas, Sao Paulo

Source:

Reuters and FI

Updated

10/15/20

December

corn is seen in a $3.90-$4.20 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.

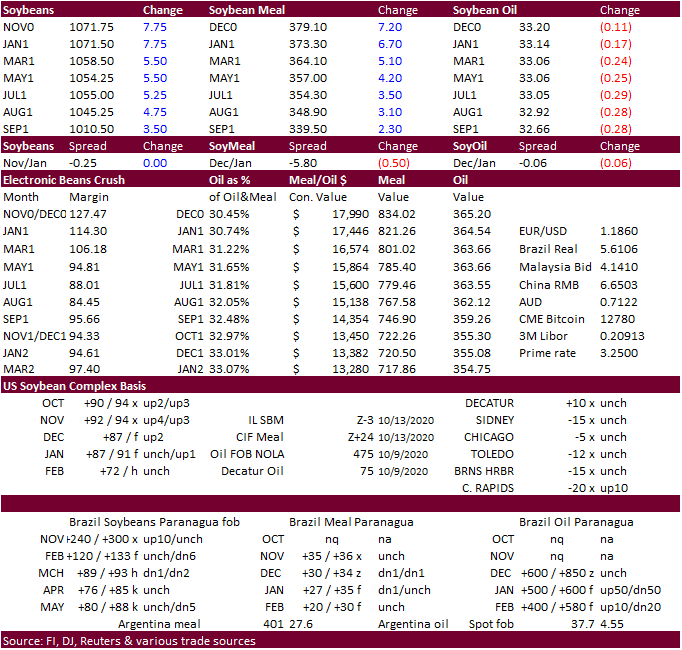

Soybeans

-

The

soybean complex traded higher led by soybean meal as there was talk there was big cash China soybean meal trade overnight, 1.2 million tons, all forward. Short soybean meal supplies in Argentina and lower USD underpinned prices. Traders were back buying

the meal and selling soybean oil. US soybean meal premiums were firm again today and the large drop in WTI crude oil, by more than $1.50, weighed on soybean oil. We also heard at least three soybean cargoes were sold to China out of the US Gulf late Tuesday.

Funds bought an estimated net 8,000 soybeans, bought 6,000 soybean meal and sold 1,000 soybean oil.

-

CIF

soybeans were up 3-6 cents in the nearby positions. Il soybean meal was up $5.00/short ton to 10 over the December. Traders will be watching to see if USDA reports 24-hour sales announcements ono Thursday.

-

We

hear much of the soybeans across parts of the Great Plains is nearly done harvesting soybeans.

-

An

explosion at an Argentine crush plant had soybean meal on a bid this morning with traders wondering if the lost capacity can be made up. We are unsure if a good amount of product volume will be lost, and for how long the plant might be down.

-

Anec

sees Brazil October soybean exports plunging to 2.32 million tons and corn exports at 5.5 million tons.

-

China

soybean oil was up 2 percent overnight. There was a rumor Sinograin may stock another 500,000 tons of soybean oil into reserves.

-

South

Korea’s MFG and KFA bought an unknown volume of soybean meal, origin unknown.

-

MFG

bought two consignments -

$461.70

a ton c&f for shipment between Feb. 1 and Feb. 28 -

$440.99

a ton c&f for shipment between March 12 and April 12 -

KFA

bought two consignments -

$466.99

a ton with unknown shipment period -

$438.97

a ton with unknown shipment period -

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on October 26 for delivery within four months of contract.

Updated

10/20/20

November

soybeans are seen in a $10.45-$10.90 range

December

soybean meal is seen in a $350-$3.90 range

December

soybean oil is seen in a 32.70-34.00 range

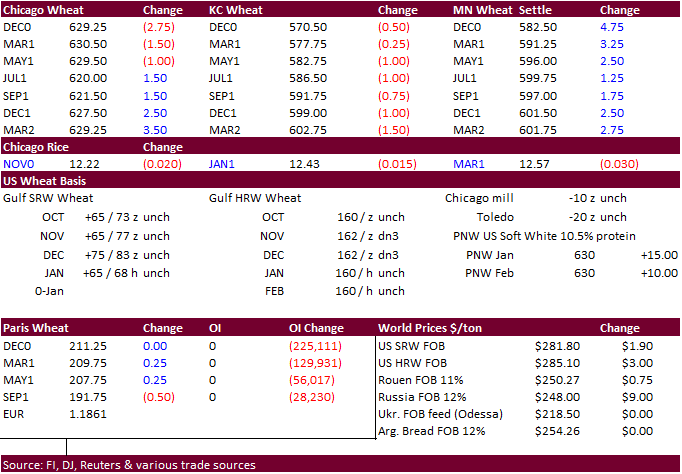

-

US

wheat

futures started higher on global weather concerns and firm global cash prices, but ended mixed in Chicago (bear spreading), KC lower, and Minneapolis higher. Earlier we thought

futures

prices had the potential to trade lower today as Japan received no offers for wheat and both Jordan and Thailand passed on wheat, a sign global prices are temporally too high.

-

Funds

sold an estimated net 1,000 SRW wheat contracts.

-

US

southern Great Plains see restricted precipitation through early November.

We look for the initial US winter wheat rating expected to be issued by USDA next week to end up near the lower end of 20-year range led by a multi decade lower combined good/excellent for Kansas.

-

Ukraine

used 57 percent of their wheat export quota, or 9.94 million tons so far this season (July-June), capped at 17.5 million tons for the crop year. 2019-20 wheat exports were 20.5 million tons.

-

Paris

(Matif) December wheat was up 0.25 at 211.25 euros. -

Turkey

removed duties on wheat, barley and corn imports. Import taxes were 45% for wheat, 35% for barley and 25% for corn.

-

Tunisia

seeks 50,000 tons of wheat and 50,000 tons of barley on October 22 for late November through December 15 shipment.

-

Taiwan

seeks 88,635 tons of US wheat on October 23 for Dec/Jan shipment. -

Japan

received no offers for 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 25.

-

Jordan

passed on 120,000 tons of wheat.

-

Thailand

passed on 192,000 tons of feed wheat and 120,000 tons of feed barley, optional origin, for between Dec 2020 and March 2021 shipment.

-

Results

awaited: Algeria seeks 50,000 tons of milling wheat on October 21, valid until October 22 for November and/or December shipment, depending on origin.

-

Japan

seeks 80,526 tons of food wheat later this week including 29,217 tons from the US and 51,309 tons from Canada.

-

Sudan

seeks 1 million tons of wheat through US assistance.

-

Turkey

seeks 175,000 tons of wheat on October 22 for shipment between November 9 and November 24.

-

China

plans to buy 500,000 tons of cotton for state reserves.

·

Results awaited: Mauritius seeks 5,500 tons of white rice on October 20 for Dec 15-Mar 15, 2021 delivery.

Updated

10/20/20

December Chicago wheat is seen in a $6.10-6.60 range

December KC wheat is seen in a $5.50-$6.10 range

December MN wheat is seen in a $5.55-$6.20 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.