PDF Attached

Weather

and Crop Progress

TODAY’S

MOST IMPORTANT WEATHER

- Tropical

Storm Epsilon was 765 miles southeast of Bermuda this morning and will turn toward the northwest later today while intensifying - The

storm will become a hurricane and should pass to the east of the Bermuda and then move away from North America without incident.

- Russia’s

Southern Region received some rain Monday with a few showers lingering today, although data from the region will not be available until this afternoon - Some

improvement to topsoil moisture from Krasnodar to northwestern Kazakhstan should have resulted - Eastern

Ukraine and Kazakhstan will get a limited amount of rain for a while, although showers late this weekend will try to produce up to 0.25 inch of moisture in a few areas - Northern

parts of Russia’s key wheat production region will get periodic precipitation over the next couple of weeks; crop conditions are more favorable there than in the Southern Region - Some

light precipitation will fall in the west-central and southwestern U.S. Plains late this weekend and early next week - Up

to 0.25 inch of moisture is possible in parts of the region and that should help some crops establish a little better, but much more rain will be needed - Argentina

rainfall over the past two days has improved topsoil moisture for planting of corn, sunseed and eventually soybeans - Monday’s

rainfall varied from 0.20 to 0.85 inch with local totals of 1.00 to 2.75 inches from northeastern Buenos Aires and southern Entre Rios to central and northern Cordoba, southeastern Santiago del Estero and central and southern Santa Fe - The

rain will dissipate today, but some lingering showers will occur through Thursday - Argentina

will get follow up rainfall Friday through Sunday further improving crop and field conditions; another 0.50 to 2.00 inches will result in much of the nation - Brazil

rainfall will slowly be ramping up over the next two weeks in center west and center south crop areas improving soybean planting and establishment conditions - Eastern

Australia will get some good rainfall to improve dryland cotton, sorghum and other crop planting in the next two weeks - Western

Australia not likely to see much rain of significance during the next couple of weeks, although a few showers will occur briefly in the south - Cold

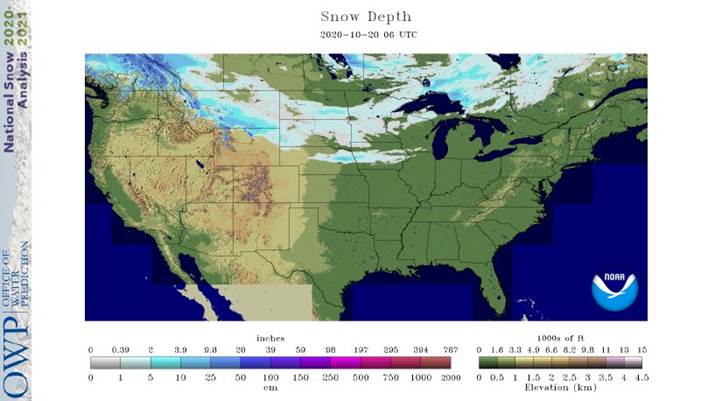

temperatures in the northern U.S. Plains and Canada’s Prairies this week will support waves of accumulating snow, but winter crops in Montana may be pushed into dormancy and not all planting and establishment was complete - Wheat

planting in Montana was only 77% done and only 57% emerged as of Sunday - Tropical

Storm Saudel formed near Luzon Island, Philippines Monday and will produce torrential rain over Luzon today - The

storm will move to northern Vietnam this weekend - Flooding

is expected in Luzon today - Some

flooding will resume along the upper central coast of Vietnam during the weekend where torrential rainfall has already occurred this month - U.S.

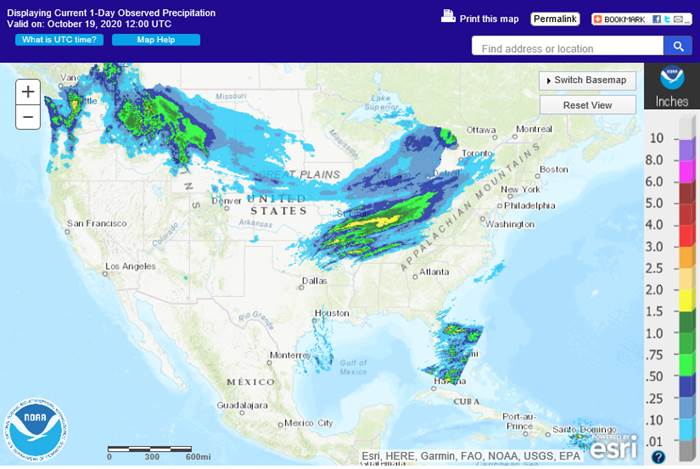

Midwest will experience periods of rain and some snow over the next week to ten days resulting in slower harvest progress, but some benefit to winter wheat in the lower Midwest where it has been drier than usual in recent weeks - West

Texas rainfall will be limited, but some is expected late this weekend and early next week to briefly slow harvesting without a serious impact on quality - Northern

U.S. Plains and upper Midwest will deal with a few more waves of snow during the coming week causing travel delays and inducing some livestock stress - Snowfall

of 2 to 6 inches and local totals to 9 inches may occur in the eastern Dakotas and Minnesota today and tonight with some of that moving to the upper Great Lakes region - Snowfall

of 3 to 10 inches may impact the northern Plains late Wednesday into Thursday - One

more snow event of 2 to 6 inches may impact areas from southeastern Montana and Wyoming to Nebraska, northeastern Colorado and western Iowa this weekend with some of that snow shifting south to the Texas Panhandle, Oklahoma and Kansas briefly Sunday into Monday - India

weather will be improving with less rain in west-central crop areas and most of the monsoonal precipitation will withdraw to the south as time moves along over the next two weeks - This

will improve summer crop maturation and harvest conditions - Winter

crop planting will accelerate as well - Australia’s

outlook favors rain in the east not the west - Western

Australia will receive some rain near the lower west coast and in southern coastal areas while interior crop areas get little to no rain - Other

showers will occur from South Australia to Victoria - Rain

will fall periodically from Queensland into northeastern New South Wales over the next ten days with this weekend and next week wettest - Enough

rain is expected to bolster soil moisture for improved spring and summer crop planting, emergence and establishment - China

will experience a very good mix of weather over the next two weeks with net drying occurring more often than rain which will support summer crop maturation and harvesting as well as winter wheat and rapeseed planting

- Sufficient

moisture will be present to support planting, emergence and establishment of winter crops - South

Africa weather will generate some scattered showers in the central and east over the next week to ten days improving spring planting conditions - U.S.

southeastern states will experience a mix of weather over the next couple of weeks slowing fieldwork at times, but some drier days will be around as well - U.S.

Delta weather will include a mix of rain and sunshine with seasonable temperatures causing some restricted precipitation - A

tropical disturbance is expected in the Caribbean Sea this week will be closely monitored but it will likely impact the Yucatan Peninsula without much incidence on key crop areas

- Southern

Oscillation Index fell during the weekend down to +8.59 and the index will begin to level off over the next few days with some additional falling today and Wednesday - Europe

weather will be drier biased this week in the eastern half of the continent, including Ukraine - Western

Europe will trend wetter in the second half of this week after a relatively dry start to the week - Western

Europe will continue wettest next week while precipitation in eastern Europe only slightly increases - Temperatures

will be near to slightly warmer than usual - Fieldwork

will improve in central and eastern Europe this week as drier weather dominates the region - Kazakhstan

remains too dry and little to no relief is expected for two weeks - Western

and northern Russia and parts of Belarus and the Baltic States will get most of this week’s precipitation outside of the band of rain noted above in Russia’s Southern Region that will end today - Winter

crops are well established in western and northern Russia, Belarus, western Ukraine and Baltic States, but eastern Ukraine, Kazakhstan and Russia’s Southern Region crops are not well established and may turn dormant will poor root and tiller systems raising

the risk of winterkill in times of harsh winter weather conditions - Southeastern

Canada and the U.S. Great Lakes region will continue to experience frequent rainfall this week causing additional delay to farming activity - Recent

precipitation frequency has been too high for much fieldwork and this trend will linger for a while longer.

- Southeast

Asia rainfall over the next two weeks will be erratic, but all areas will be impacted multiple times supporting most crop needs; some flood potentials will gradually rise in localized areas - Mexico

precipitation will be scattered over far southern crop areas during the coming week Net drying is expected for many other summer crop areas supporting crop maturation and harvest progress - Central

America will be sufficiently wet over the next ten days to two weeks to keep late season crop maturation and harvest progress slow, but the moisture is improving long term water supply.

·

West-central Africa will experience periodic rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - Cotton

areas will benefit from drier weather

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda and southwestern Kenya will be impacted while Tanzania and Ethiopia rainfall is erratic and light

- Some

heavy rain may fall in Uganda

·

New Zealand rainfall is expected to increase in North Island and western parts of South Island this week and then increase more broadly across the nation next week

- Temperatures

will be seasonable with a slight cooler bias in the south

Source:

World Weather Inc.

- Malaysia

Oct. 1-20 palm oil export data - Virtual

international palm oil sustainability conference, Q&A Session - USDA

total milk production, 3pm - New

Zealand global dairy trade auction

Wednesday,

Oct. 21:

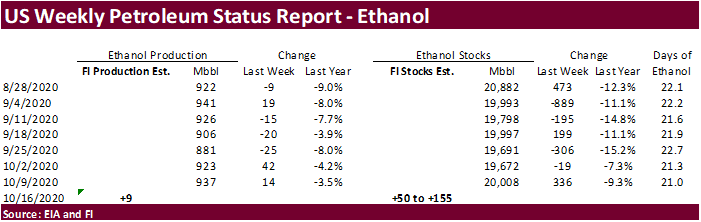

- EIA

U.S. weekly ethanol inventories, production, 10:30am

Thursday,

Oct. 22:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - USDA

red meat production, 3pm - U.S.

cold storage data – pork, beef, poultry

Friday,

Oct. 23:

- China

customs publishes trade data on imports of corn, wheat, sugar and cotton - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Unica

data on Brazil’s cane crush, sugar production (tentative) - U.S.

cattle on feed, poultry slaughter, 3pm - HOLIDAY:

Thailand

Source:

Bloomberg and FI

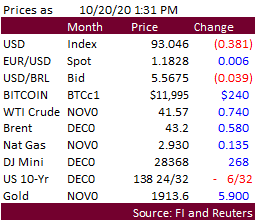

Macros

US

Senate Minority Leader Schumer: Will Move For Vote On Democrats’ Virus Relief Plan

US

House Speaker Pelosi: Democrats Are Still Fighting For Tax Credits

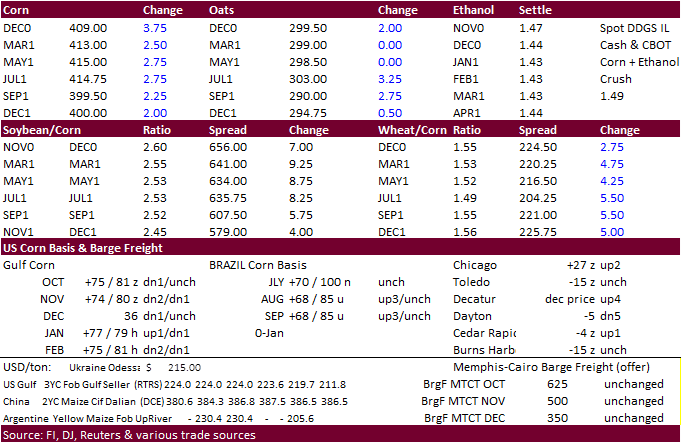

Corn.

-

Corn

futures traded higher on a lower USD, higher soybeans and steady US export demand. US harvest pressure and soybean/corn spreading limited gains.

-

5000

March 420/450 call spreads were bought from 8 1/4 to 8 7/8 -

Argentina

dryness and slower than normal soybean planting pace in Brazil potentially affecting second crop corn plantings are supporting US corn futures.

-

After

the close on Tuesday Conab said they don’t see significant changes in the corn import forecast for Brazil through January.

-

Germany

ASF: 1 new case; 71 cases since September 10 -

A

Bloomberg poll looks for weekly US ethanol production to be up 7,000 at 944,000 barrels (930-960 range) from the previous week and stocks up to 224,000 barrels to 20.232 million.

-

Iran

opened a new tender for 200,000 tons of barley, set to close October 21.

Updated

10/15/20

December

corn is seen in a $3.90-$4.20 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.

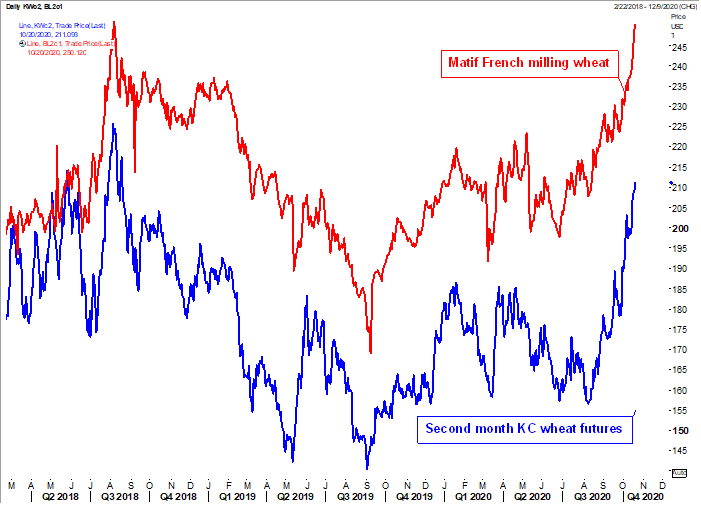

Soybeans

-

The

soybean complex was higher throughout most of the day. Soybean oil gained on soybean meal and the CBOT crush slipped after briefly peaking overnight to a fresh high basis the January. USDA announced 132k soybeans to unknown. Traders will be watching the

bull spreads as Brazil could come in anytime soon and buy US soybeans. So far, we are getting a 50/50 feedback this will happen, or above 200,000 ton amount we have been asking around. Some noted it’s not economical to import US soybeans but we could see

the occasional one off. -

After

the CBOT close on Tuesday Conab said they do not expect to import large quantities of soybeans in the short term after the suspension of import tariffs. They also don’t see a significant impact on soybean production from delays in soybean plantings.

-

There

was a rumor Brazil bought US soybeans, or 2 cargoes were switched internally by a company from US to Brazil. Brazil announced that the tariff free imports outside Mercosur will be extended to January 15 for soybeans and March until corn.

-

We

heard one China private crusher booked at least one Nov/Dec soybean shipment out of the Gulf and two January shipments out of the PNW. There was a March soybean shipment that traded hands but unclear with origin.

-

Decatur,

IL, corn basis was up 4 cents to option December and soybeans up 10 cents to 15 over November.

-

US

soybean harvest progress fell short of trade expectations by 4 points to 75 percent so some of the trade found this to be slightly bullish.

-

Under

the 24-hour announcement system, private porters reported to the U.S. Department of Agriculture export sales of 132,000 tons of soybeans for delivery to unknown destinations during the 2020-21 marketing year.

-

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on October 26 for delivery within four months of contract.

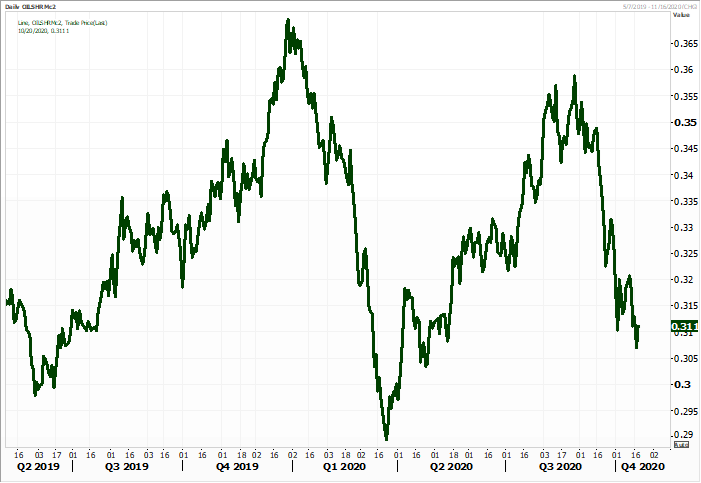

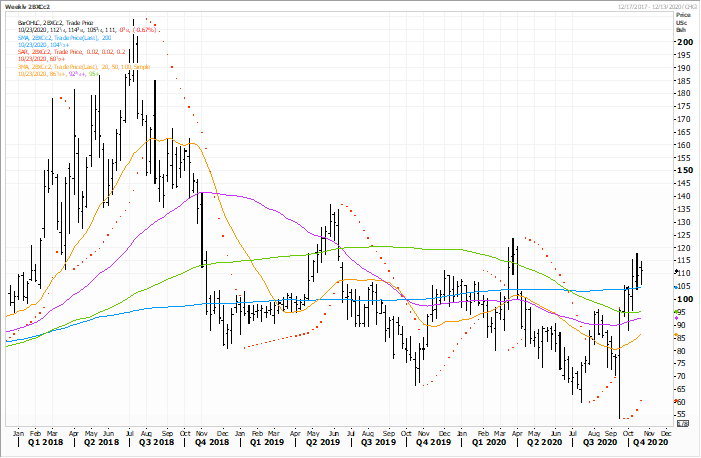

Second

month rolling soybean oil share

Source:

Reuters and FI

Second

month rolling weekly soybean crush

Source:

Reuters and FI

Updated

10/20/20

November

soybeans are seen in a $10.45-$10.90 range

December

soybean meal is seen in a $350-$3.90 range

December

soybean oil is seen in a 32.70-34.00 range

-

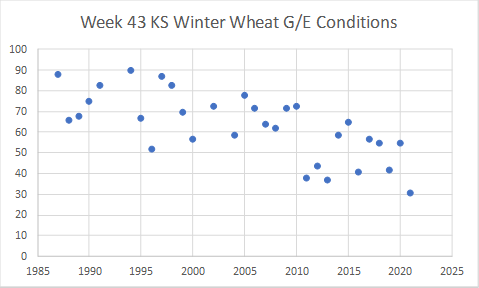

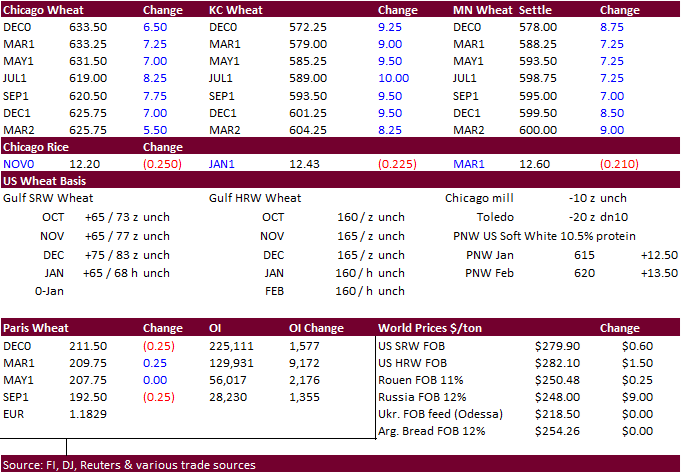

US

wheat traded higher on a lower USD, high global cash prices and strong global export developments.

-

Paris

(Matif) December wheat was down 0.50 at 211.25 euros on profit taking and uncertainty Algeria was interested on French wheat with their 50,000-ton import tender.

-

US

wheat

futures prices can easily continue to rally if the funds add to long positions. Historical CFTC Commitment of Traders data suggests money managers can easily add another net 20,000 contracts to their long position. Chicago wheat could trade up into the $6.60-$6.75

area, then rally to $7.00 if the US southern Great Plains see restricted precipitation through early November, leading to a very poor initial US winter wheat rating expected to be issued by USDA next week.

-

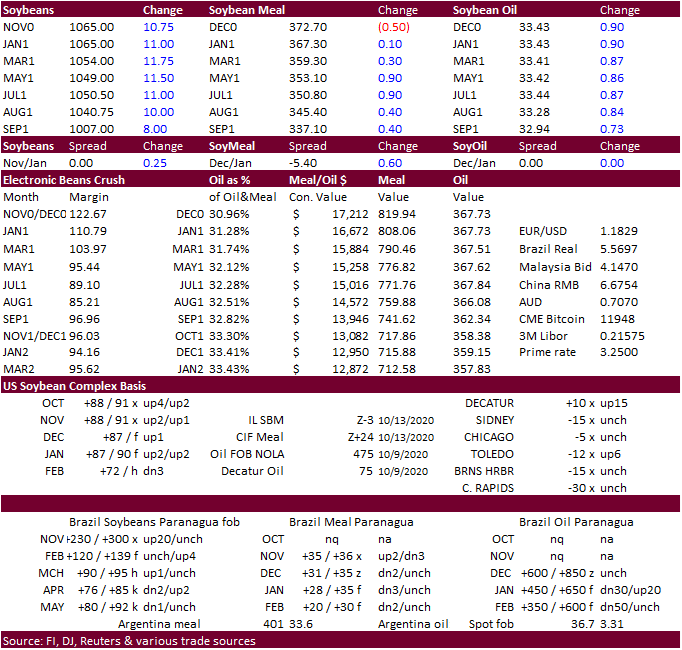

Selected

US individual state crop ratings yesterday showed the following: -

KS

31 good and excellent -

NE

59 good and excellent

Backing

up to KS, the 31 percent is the lowest level for year through at least 1987 for this time of year (week 41 through week 43 comparison). Comparable crop years for this time of year include 41 percent in week 43 of 2015 (2016-17 crop year), week 43 in 2012

(2013-14 crop year), and week 42 in 2020 (2011-12 crop year).

-

Somebody

is apparently bullish. WH 950c traded @ 1.125 200x. This could be part of a call spread.

-

APK-Inform

reported Ukraine wheat export prices hit a 21-month high of $255/ton fob.

-

SovEcon

raised their Russian wheat crop estimate to 84.4 million tons from 83.3 million tons, citing better yields in Siberia, for the 2020-21 crop year.

-

The

USDA Attaché sees Australia 2020-21 wheat crop at 28 million tons, 500,000 below the official USDA forecast.

Latest

is week 42 (10/18) KS 2020 rating for 2021-22 crop year. Source: USDA and FI

-

South

Korea’s MFG bought 130,000 tons of feed wheat from the US at $266.84/ton and $268.92/ton for LH March and April shipment.

-

Thailand

seeks 192,000 tons of feed wheat and 120,000 tons of feed barley, optional origin, for between Dec 2020 and March 2021 shipment.

-

Japan

seeks 80,526 tons of food wheat later this week including 29,217 tons from the US and 51,309 tons from Canada. -

Jordan

passed on 120,000 tons of barley. They saw 2 offers. -

Sudan

seeks 1 million tons of wheat through US assistance. Algeria bought about 30,000 tons of corn at about $239/ton c&f from EU or Black Sea region for shipment by November 20.

-

Algeria

seeks 50,000 tons of milling wheat on October 21, valid until October 22 for November and/or December shipment, depending on origin.

-

Jordan

issued a new tender for 120,000 tons of wheat set to close October 21. -

Japan

seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on October 21 for arrival by February 25.

-

Turkey

seeks 175,000 tons of wheat on October 22 for shipment between November 9 and November 24.

-

Egypt

said they have more than 1 million tons of sugar stocks to last over four months.

·

Mauritius seeks 5,500 tons of white rice on October 20 for Dec 15-Mar 15, 2021 delivery.

Paris

wheat vs. KC wheat – rolling daily

Source:

Reuters and FI

Updated

10/20/20

December Chicago wheat is seen in a $6.10-6.60 range

December KC wheat is seen in a $5.50-$6.10 range

December MN wheat is seen in a $5.55-$6.20 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.