PDF Attached

Fresh

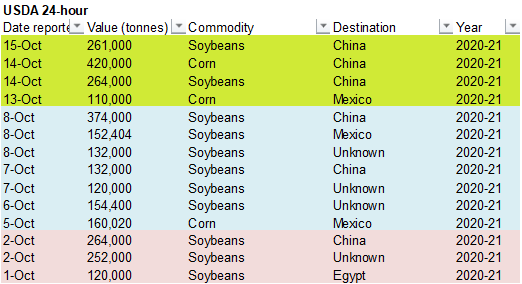

highs set in corn and Chicago wheat. USDA announced 261,000 tons of soybean to China. Soybean meal and wheat made impressive gains today on global weather problems. US meal basis firmed today.

![]()

MORNING

WEATHER MODEL COMMENTS

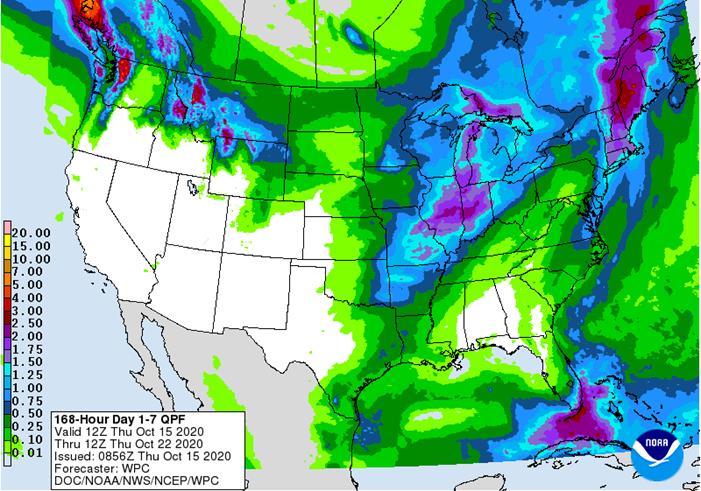

NORTH

AMERICA

- Some

increase in U.S. rainfall was suggested by the GFS model run overnight - The

change matches that of the European model of the past couple of days, although the European model is a little less intensive with its rain suggested for the period relative to Wednesday - GFS

increased rainfall from northern Illinois to northern Ohio and southern Michigan for Wednesday through Friday of next week

- The

increase was overdone - GFS

reduced rain from eastern U.S. hard red winter wheat areas of Kansas and north-central Oklahoma for late next week - Some

reduction was needed - GFS

increased precipitation from the Dakotas through Iowa to the Ohio and Tennessee River Basin Oct. 28-30 - This

event is overdone - GFS

reduced rain in New Mexico and western Texas as well as southeastern Colorado and southwestern Kansas Oct. 29-30, but it increased rain from Oklahoma into central and southwestern Texas and a part of the Delta Oct. 29-30 - The

reduction in rainfall was needed for West Texas and New Mexico, but the increase in rainfall was not likely to verify

Three

waves of cool air will occur in the central and eastern United States over the next two weeks each bringing a chance for rain to the Midwest. The moisture will improve field conditions for winter wheat in the lower Midwest, but the precipitation will briefly

disrupt farming activity occasionally. The first frontal system is in the eastern Midwest today and will produce the least amount of rain. A second frontal system is expected in the Midwest Sunday and Monday and will be swift moving to limit rain delays. The

last frontal system comes along Oct 22-24, but its precipitation is overdone. Temperatures will trend cooler during the coming ten days in the Plains and Midwest.

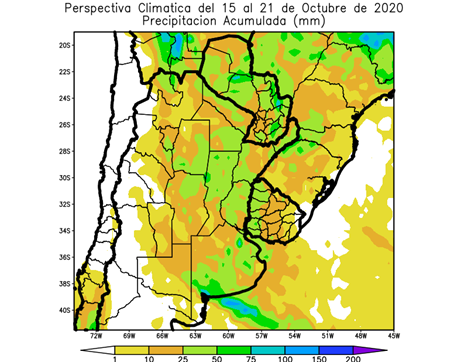

SOUTH

AMERICA

- No

theme changes were noted overnight - Argentina

rainfall will be mostly in north today and in the northeast Saturday and early Sunday - Much

of Argentina will receive rain starting late this weekend in the southwest and advancing northeast early next week - Sufficient

rainfall is expected to bolster topsoil moisture and improve early corn and sunseed planting and establishment conditions - Rainfall

will be highly variable with most of the driest areas getting 0.25 to 0.85 inch with local totals to 1.50 inches; greater rain will occur in other areas - Cordoba,

Santiago del Estero and Santa Fe’s drier biased areas will get rain to ease long term dryness - Argentina

follow up rainfall potentials are best for Oct. 23-24 when scattered showers occur across the nation again with lighter resulting rainfall - Rain

may return again Oct. 27-28, but confidence is low on its expected distribution - Brazil

rainfall is expected to be scattered erratically over the coming week with Mato Grosso expecting the least significant rainfall and will struggle for enough moisture to support planting and development - Follow

up rain will be very important - Brazil

rainfall in this first week will be greatest in Minas Gerais and immediate neighboring areas in Sao Paulo and Goias with lighter rainfall in Parana and Mato Grosso do Sul - The

precipitation will be beneficial and increased planting of grain and oilseeds is likely while there is support for coffee and citrus flowering as well as sugarcane development - Center

west and center south Brazil’s greatest rainfall boost is expected October 24-30

Overall,

the next couple of weeks seem to provide a little moisture for both Argentina and Brazil. However, Mato Grosso will not do well with rainfall for this first week of the outlook and neither will some of the immediate neighboring areas. Rain will improve in

interior southern Brazil and a portion of center south Brazil soil moisture and crop potentials. Rain will also evolve in Argentina early next week to bring relief to persistent dryness, but frequent follow up rain is needed. Today’s outlook for Argentina

does offer a little follow up rain event Oct. 23-24 and again Oct. 27-28, but confidence in the significance of these follow up rain events is a little low.

BLACK

SEA REGION

- GFS

model reduced rain potentials to eastern Ukraine, Russia’s Southern Region and Kazakhstan for the coming two weeks - The

changes were needed after the evening model run last night was too wet - Showers

are still expected in a narrow band in Russia’s Southern region briefly Monday into Tuesday - A

follow up rain event is possible Oct. 25-27 - Moisture

totals from these two events will vary from 0.10 to 0.60 inch except in that narrow band expected in Russia’s Southern region where a few locations could receive locally more - European

model run keeps the precipitation events very light

Overall,

the rain advertised for eastern Ukraine, Kazakhstan and Russia’s Southern region early next week and again Oct. 24-26 will be welcome, but much of it is expected to be brief and light leaving a limited response by crops in the region. A developing ridge of

high pressure that will follow these rain events will bring back another period of dry weather leaving winter crops poorly established into early November.

CHINA

- No

general theme changes were noted overnight - Restricted

rainfall is expected in northeastern China and in the northern Yellow River Basin as well as the North China Plain where summer crop harvest progress and winter crop planting and establishment will advance favorably - Rain

will continue periodically over the coming week in the Yangtze River Basin and southwestern crop areas in the nation - Net

drying is advertised for much of eastern China during the second week of the forecast

INDIA

- No

general theme changes were noted overnight - Rain

is expected to occur in central, southern and eastern India through early next week - Sufficient

amounts of rain will fall to stall summer crop maturation and harvest progress in central India while raising some crop quality issues for cotton, soybeans, pulse crops and some rice - The

rain will retreat to the south again during the second half of next week bringing back some improving weather

AUSTRALIA

- No

big changes were noted overnight in the coming ten days to two weeks - GFS

model continues to attempt to bring rain to southern parts of Western Australia during mid-week next week and again October 23-24 with one more event near the end of this month - Confidence

in these advertised rain events remains low because of drier biased conditions advertised by the European and Canadian model runs - Eastern

Australia rainfall is still advertised to steadily increase as time moves along with the second week of the outlook wettest.

There

is only a low potential for rain in a few of Western Australia’s winter crop areas during the coming ten days. Rain farther to the east will be good for spring planting as well as maintaining good winter crop conditions in the southeast.

Source:

World Weather Inc.

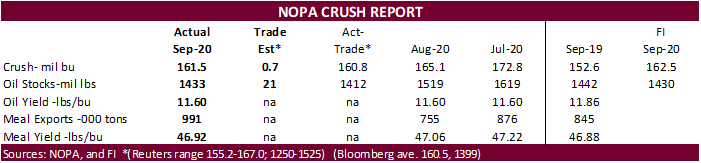

- NOPA

Crush - Malaysia

Oct. 1-15 palm oil export data - Port

of Rouen data on French grain exports - EIA

U.S. weekly ethanol inventories, production, 10:30am - Global

Food Forum, Australia, day 2 - Leman

China Swine Conference, Chongqing, day 2 - European

Cocoa Association grindings

Friday,

Oct. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Asia

3Q cocoa grinds - Cocoa

Association of Asia’s webinar on Asian cocoa demand - Leman

China Swine Conference, Chongqing, day 3

Source:

Bloomberg and FI

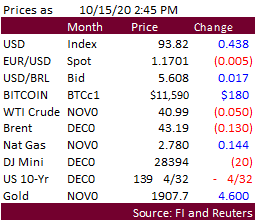

Macros

US

DoE Crude Oil Inventories (W/W) 09-Oct: -3818K (est -2100K; prev 501K)

–

Distillate Inventories (W/W): -7245K (est -1687K; prev -962K)

–

Cushing OK Crude Inventories (W/W): 2906K (prev 470K)

–

Gasoline Inventories (W/W): -1626K (est 1300K; prev -1435K)

–

Refinery Utilization (W/W): -2.00% (est -0.90%; prev 1.30%)

US

Initial Jobless Claims Oct-10: 898K (exp 825K; R prev 845K)

–

Continuing Claims Oct-3: 10018K (exp 10550K; R prev 11183K)

livesquawk

US Empire Manufacturing Oct: 10.5 (exp 14.0; prev 17.0)

US

Philadelphia Fed Business Outlook Oct: 32.3 (exp 14.8; prev 15.0)

US

Import Price Index (M/M) Sep: 0.3% (exp 0.3%; prev 0.9%)

–

Import Price Index Ex-Petroleum (M/M) Sep: 0.7% (exp 0.5%; prev 0.7%)

–

Import Price Index (Y/Y) Sep: -1.1% (exp -1.2%; prev -1.4%)

–

Export Price Index (M/M) Sep: 0.6% (exp 0.3%; prev 0.5%)

–

Export Price Index (Y/Y) Sep: -1.8% (prev -2.8%)

Canadian

ADP Nonfarm Payrolls Sep: -240.8K (R prev -770.6K)

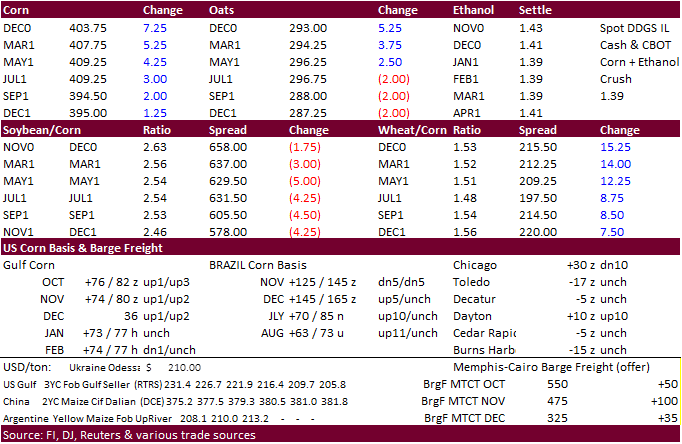

Corn.

-

Corn

ended higher (14-month high) following a sharply higher US wheat futures market and improvement in US ethanol production. December corn was up 7.25 cents and march up 5.50 cents. Corn was down earlier on macroeconomic concerns and ongoing South Korean buying

of South American corn. News was light. USD was up 47 by 2:00 pm CT. -

Funds

bought an estimated net 24,000 contracts. Note on October 6th they bought 40,000.

-

Strategie

Grains lowered their estimate for EU and British corn production to 62.7 million tons from 64.9 million last month.

-

Argentina’s

Rosario grains exchange left their corn production estimate unchanged at 48 million tons.

-

Anec

sees Brazilian corn exports during October to reach a record 5.237 million tons, up 670,000 tons from their previous estimate, and compares to 5.51 million tons from a year ago.

-

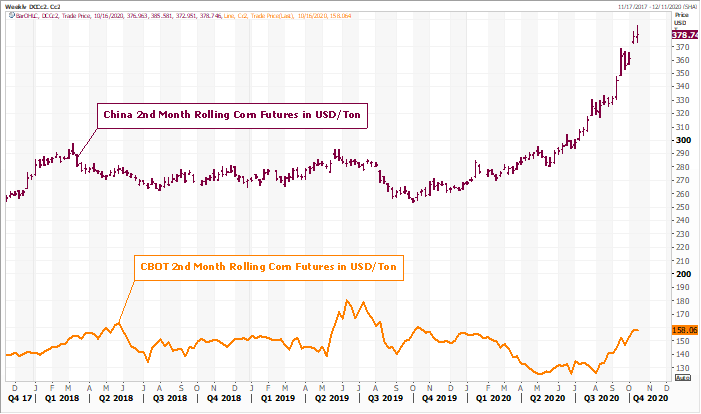

China

corn futures traded lower Thursday after establishing a record high of 2,595 yuan per ton on Wednesday.

-

Germany

ASF: 65 cases since September 10 -

The

USDA Broiler Report showed broiler-type eggs set in the United States up 2 percent and chicks placed down 3 percent. Cumulative placements from the week ending January 4, 2020 through October 10, 2020 for the United States were 7.61 billion. Cumulative placements

were down 1 percent from the same period a year earlier. -

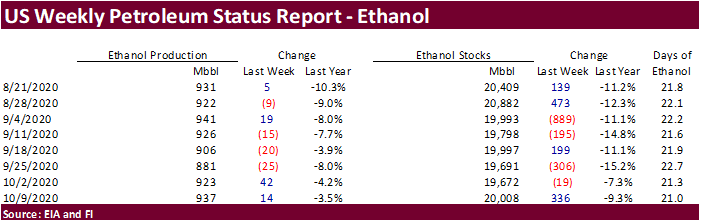

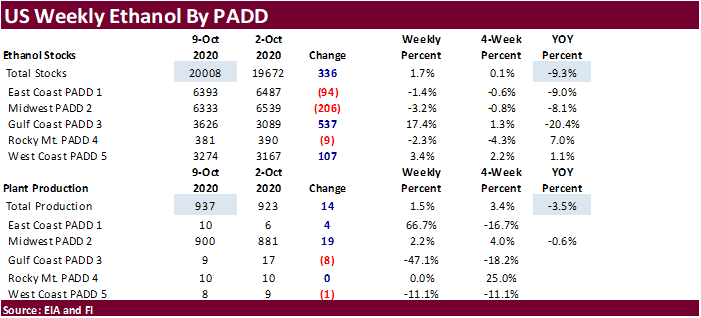

Weekly

US ethanol production increased a more than expected 14,000 to 937,000 barrels, highest since early September and stocks were also up a more than expected 336,000 barrels to 20.008 million. A Bloomberg poll looked for weekly US ethanol production to be up

6,000 and stocks to be up 124,000 barrels. Sep 1 to date production is down 6.5 percent compared to the same period year ago.

USDA

Attaché: Brazil Corn Ethanol Boom

Corn

Export Developments

-

Iran

passed on 200,000 tons of barley. -

South

Korea’s KOCOPIA group bought 60,000 tons of corn at $251.82/ton from Brazil for arrival by Jan 20.

-

South

Korea’s NOFI bought 13,000 tons of feed barley at $248.15/ton c&f for arrival around February 1. Yesterday KFA paid $247.69/ton for arrival around Jan 20.

-

Results

awaited: Algeria seeks 30,000 tons of feed corn and 25,000 tons of feed barley on October 15.

-

Iran

opened a new tender for 200,000 tons of barley, set to close October 21.

Updated

10/15/20

December

corn is seen in a $3.90-$4.20 range (up 15 cents for the top end of the range)

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.

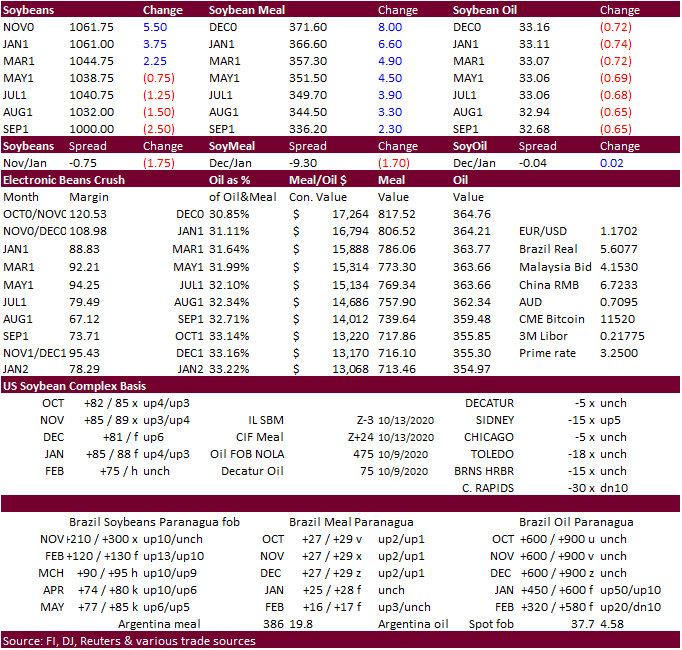

Soybeans

-

A

sharply higher trade in soybean meal futures led by the front months supported the three front month soybean contracts. November soybeans, in a wide trading range, finished 6.0 cents higher and March 3.0 higher, while July fell 1 cent. Soybean meal basis

December ended $8.50 higher and March was up $4.80. Soybean oil traded 66-71 points lower on lower outside markets and weakness in energy markets amid macroeconomic headwind concerns

Malaysian palm oil traded lower from a slowdown in October palm exports. Demand reignited from month buying in soybeans today after USDA announced 261,000 tons of soybeans were sold to China.

-

Funds

bought 6,000 soybeans and bought 7,000 soybean meal. They sold 6,000 soybean oil.

-

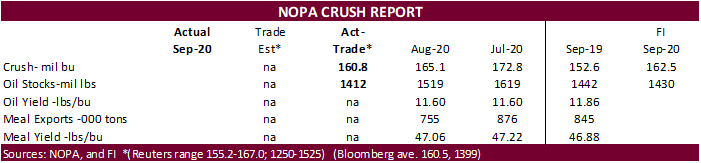

Both

September NOPA crush and soybean oil stocks came in slightly above expectations, but soybean meal exports were very good and supportive for meal futures.

-

We

were hearing China was quiet today after picking up a few Brazilian cargoes overnight. They might be about 75 percent covered for January and also 75 percent covered for February, but that would not include additional buying by the government, if any. Note

China imported 51 million tons of soybeans during the March through August 2020 period, including 43.7 million tons from Brazil.

They

have a long way to go to cover needs during that period. -

Brazil

soybean premiums for March through June positions were up about 5-11 cents.

-

Argentina’s

Rosario grains exchange left their soybean production estimate unchanged at 50 million tons.

-

IL

soybean meal firmed by $3.00 to 5 over the December and Gulf was unch/up $2.00 to +22/+30 over the December.

-

Strategie

Grains increased the EU (+ Britain ) soft wheat production to 129.5 million tons from 129.3 million last month. Then they increased 2020-21 soft wheat exports outside the EU and Britain by 2 million tons to 25.0 million tons from 23.0 million in September.

-

Malaysian

palm oil traded lower from a slowdown in October palm exports. -

AmSpec

reported Malaysian palm exports for first half October at 763,772 tons, down 2.1 percent from the same period last month. ITS reported October 1-15 palm exports at 760,082 tons, down 2.5 percent.

-

USDA

announced private exporters sold: 261,000 tons of soybeans for delivery to China during the 2020/2021 marketing year

-

Results

awaited: Iran’s SLAL seeks 200,000 tons of soybean meal and 200,000 tons of barley on October 14 for OND shipment.

-

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on October 26 for delivery within four months of contract.

Updated

10/12/20

November

soybeans are seen in a $10.25-$11.10 range

December

soybean meal is seen in a $345-$385 range

December

soybean oil is seen in a 32.50-35.00 range

-

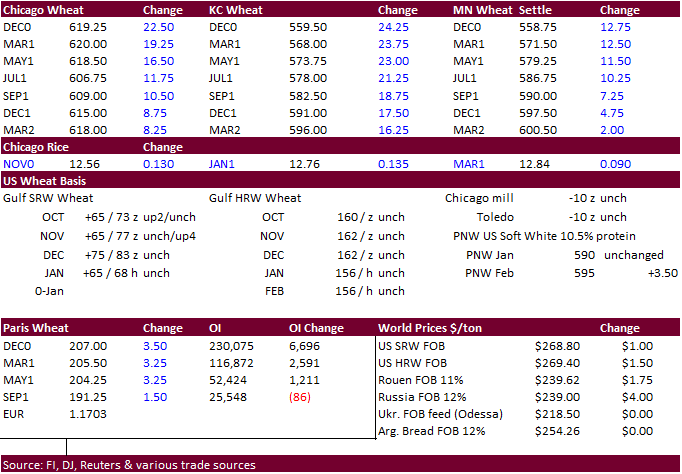

On

a rolling monthly chart, US Chicago wheat futures hit its highest level since December 2014. US wheat futures started mixed but fund buying amid global weather concerns and very good global demand supported all three US markets and the Paris futures. The

front month contracts led the rally. December Chicago was up 21.50 cents, December KC up 22.75 cents and December MN up 12.75 cents. We see Ukraine and Russia slowing wheat exports starting around January 2021, and global demand shifting to Argentina, Australia

and the Northern Hemisphere. With that said, we believe higher futures prices might entice US spring and durum producers to expand their area by roughly 6 percent from 2020. This increase may be at the higher end of trade expectations, but the landscape

has changed over the past month with major importers seeking out high protein wheat.

-

Funds

bought an estimated net 15,000 SRW wheat contracts, largest daily net buy since the day of USDA’s Grain Stocks report.

-

There

was talk some Asian importers were buying US wheat futures. Recall yesterday Gulf fob offers were up sharply.

-

Argentina’s

Rosario grains exchange cut their estimate for the Argentina wheat production by 1 million tons to 17 million tons for 2020-21, citing dryness and frosts. -

Strategie

Grains increased the EU (+ Britain ) soft wheat production to 129.5 million tons from 129.3 million last month. Then they increased 2020-21 soft wheat exports outside the EU and Britain by 2 million tons to 25.0 million tons from 23.0 million in September. -

Paris

(Matif) December wheat was 3.25 higher at 206.75 euros. -

French

soft-wheat sales to China have tripled so far this season – FranceAgriMer.

-

CPI

food inflation index for China increased 7.9% from the previous year thanks to tightening meat supplies

while nonfood inflation was unchanged.

-

Jordan

issued a new tender for 120,000 tons of wheat set to close October 21. -

Japan

bought 87,110 tons of food wheat from Canada (25k) and rest from the US. -

Japan

seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on October 21 for arrival by February 25.

-

Awaited:

Offers around $284/ton – Pakistan seeks 300,000 tons of wheat on October 14 for arrival by end of January.

-

Awaited:

5 participants – Ethiopia seeks 400,000 tons of wheat by October 13. -

Awaited:

(new 9/15) Ethiopia seeks about 200,000 tons of milling wheat on October 15. -

Turkey

seeks 175,000 tons of wheat on October 22 for shipment between November 9 and November 24.

·

Mauritius seeks 5,500 tons of white rice on October 20 for Dec 15-Mar 15, 2021 delivery.

Updated

10/9/20

December Chicago wheat is seen in a $5.70-$6.30 range

December KC wheat is seen in a $5.20-$5.70 range

December MN wheat is seen in a $5.35-$5.60 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.