PDF Attached

Please note I will be out the balance of the week, attending the AFOA conference in Nashville.

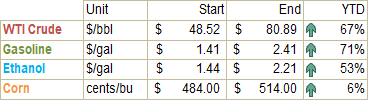

Higher trade across the board on technical buying. The USD is lower and WTI higher. Outside markets were mixed. Paris rapeseed was up 8 euros or 1.24% and Paris wheat up 4.00 euros or 1.5%.

7-day

WORLD WEATHER HIGHLIGHTS FOR OCTOBER 14, 2021

- Argentina is back to a drier bias today after rain fell Wednesday.

- Brazil will experience a good mix of rain and sunshine through the weekend and then most of next week will be drier biased in southern parts of the nation.

- The next more active period of weather for southern Brazil will be after October 23.

- Brazil’s bottom line remains very good for coffee, citrus and sugarcane development and for the advancement of corn, soybean, rice, cotton and other crop planting.

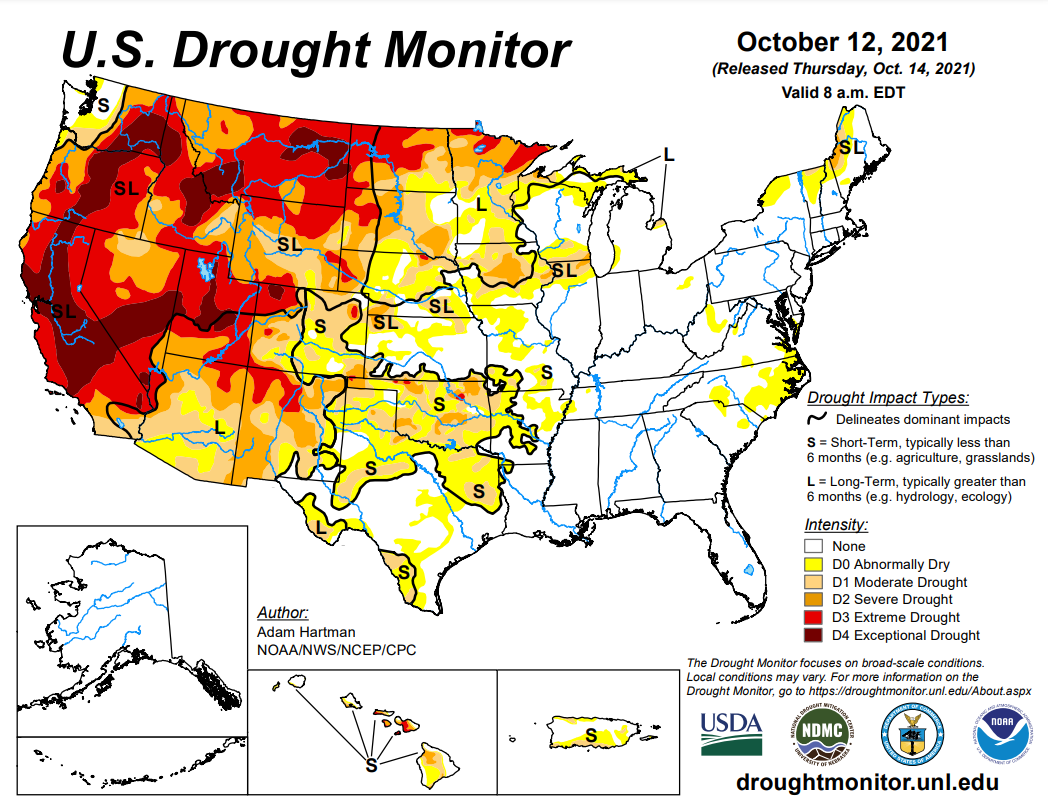

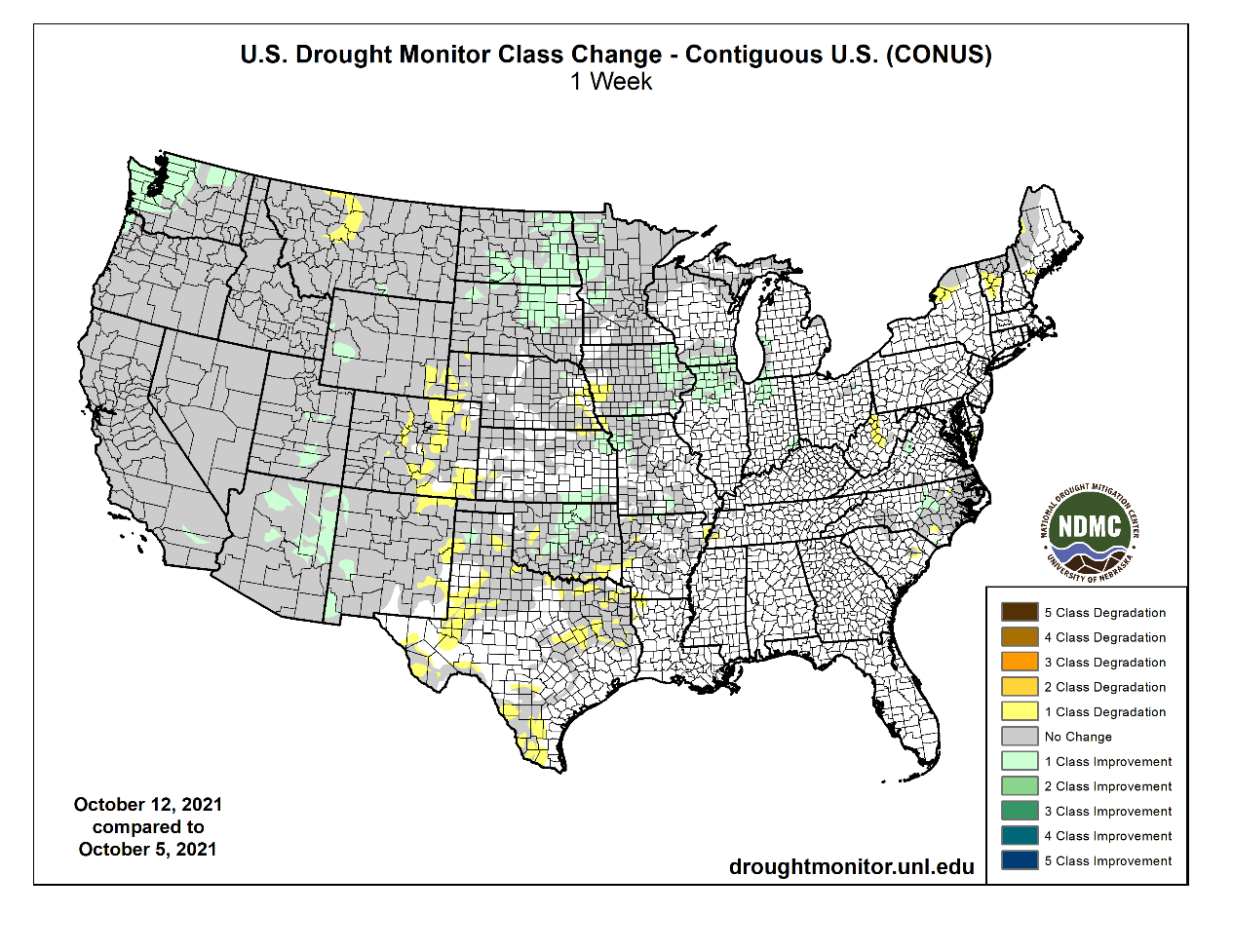

- U.S. harvest weather will improve over the coming ten days with only brief periods of rain and more abundant periods of sunshine expected.

- The environment will be better for supporting harvest progress.

- U.S. hard red winter wheat areas will trend drier for a while, but recent rain has supported good planting and emergence conditions.

- Recent rain and snow in the northern Plains was a boon to winter wheat emergence and establishment in some areas, but Montana and central parts of Canada’s Prairies are still too dry.

- Europe and northern Russia weather will trend more active in the next ten days while southern wheat areas in Russia and across Ukraine are dry biased for a while.

- Rain in Europe’s Balkan Countries will end this weekend after a significant turnaround in soil conditions. Northern China will be drier biased for a while improving harvest conditions

- Australia will see a good mix of weather supporting its reproducing winter crops.

- One to two inches of rain fell across parts of North Dakota and southern Manitoba, Canada Wednesday and overnight

- Snowfall reached 27 inches in Black Hills of South Dakota Wednesday, 15 inches in southeastern Montana and 1 to 5 inches in far westernmost parts of North Dakota

- Wind speeds gusted to more than 50 mph in the northern U.S. Plains Wednesday in association with the rain and snow event

- Tropical Depression Kompasu was moving into northern Vietnam today and will produce some heavy rainfall

- Another tropical disturbance will produce excessive rain along the central Vietnam coast Friday through Monday with amounts of 4.00 to 15.00 inches resulting in some serious flooding

- Excessive rain is expected to develop along the lower coast of Myanmar Friday and advance up the entire west coast Saturday through Monday producing 5.00 to more than 12.00 inches of rain and resulting in serious flooding

- Damage to rice and some sugarcane will be possible

- Some of the greatest rain will occur in the important rice production region in Irrawaddy and Yangon

- Less rain was suggested for Bangladesh in the coming week because of the shift eastward in the greatest rainfall impacting Myanmar

Friday, Oct. 15:

- ICE Futures Europe weekly commitments of trader’s report (6:30pm London)

- CFTC commitments of trader’s weekly report on positions for various U.S. futures and options, 3:30pm

- U.S. monthly data on green coffee stockpiles

- Malaysia Oct. 1-15 palm oil exports

- FranceAgriMer weekly update on crop conditions

- HOLIDAY: India

Source: Bloomberg and FI

Macros

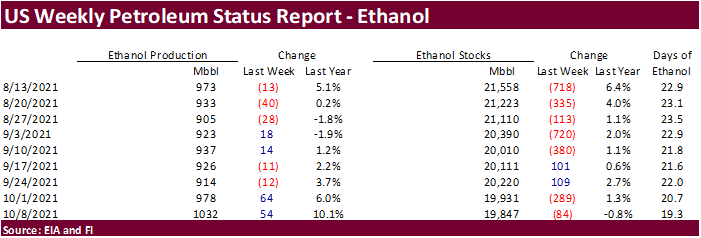

US DoE Crude Oil Inventories (W/W) Oct-08: +6088K (est +1050K; prev +2345K)

– Distillate: -24K (est -1000K; prev -396K)

– Cushing OK Crude: -1968K (prev +1548K)

– Gasoline: -1958K (est +1000K; prev +3256K)

– Refinery Utilization: -2.90% (est 0.30%; prev 1.50%)

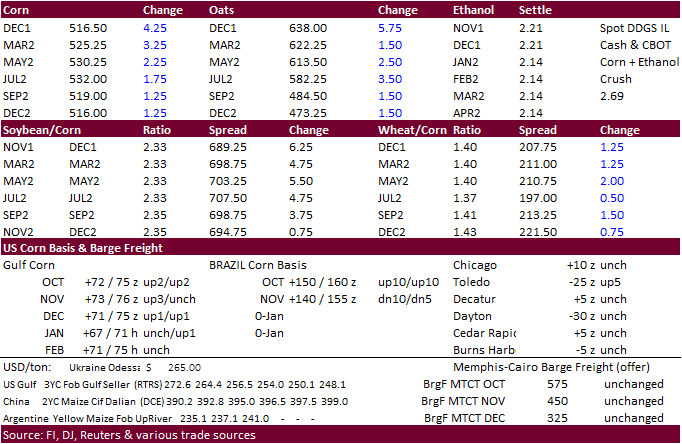

· Corn ended higher this morning as the depressed prices following this week’s USDA report found support and export demand.

· The US Midwestern central and southeastern areas saw rain today, and southern and eastern areas Friday.

· Germany reported a case of atypical bovine spongiform encephalopathy (BSE) in a cow in south of the country.

· USDA FSA Acreage is delayed. When updated, it will be posted here https://www.fsa.usda.gov/news-room/efoia/electronic-reading-room/frequently-requested-information/crop-acreage-data/index

Year to date

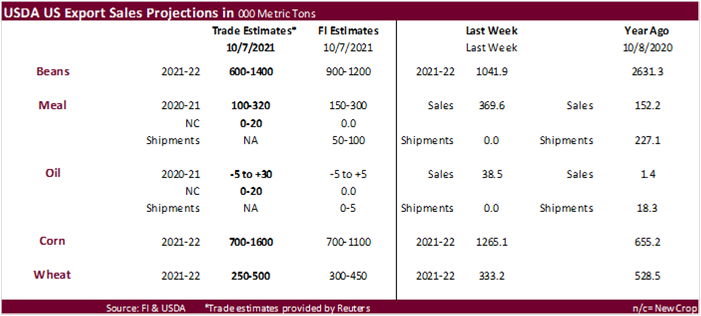

Export developments.

- Turkey bought 325,000 tons of animal feed corn, optional origin for shipment between Nov. 15 and Dec. 6. Prices ranged from $307.40 to $319.25/ton.

Updated 10/12/21

December corn is seen in a $4.85-$5.55 range

March corn is seen in a $5.00-$5.70 range

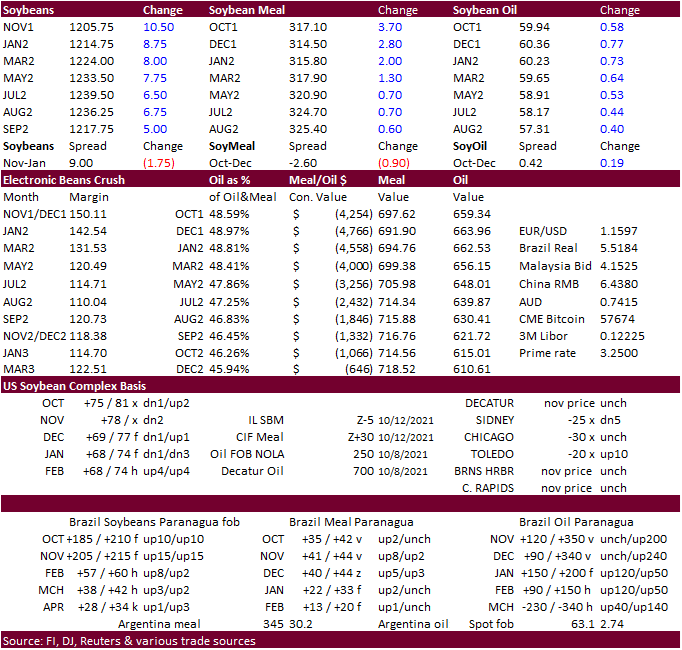

· Soybeans closed higher today as price found support following the selloff from the USDA on Tuesday. Soybean oil and meal both settled higher.

· A Reuters poll calls for the NOPA September US crush at 155.1 million bushels, down 2.4% from 158.8 million bushels processed in August and down 4% from September 2020. Soybean oil stocks were pegged at 1.663 billion pounds, down 0.3% from 1.668 billion at the end of August. We are at the high end of a very large range at 162.8. Lowest estimate was 148.0 million bushels.

· UK’s AgMin sees the rapeseed crop down 5.9% at 977,000 tons. The planted area decreased 20% and average yield was 3.2 tons/hectare vs. 2.7 year earlier.

· Australia may see a record canola crop of 5 million tons, a welcome relief for producers that have been impacted by China’s tariffs on Australian barley.

· Malaysia maintained its November export tax for crude palm oil at 8% but increased the reference price, to 4,523.29 ringgit ($1,088.64) per ton for November. October reference price was 4,472.46 ringgit a ton.

Export Developments

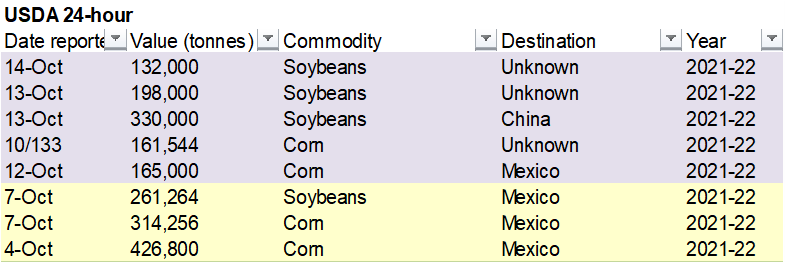

- Under the USDA 24-hour announcement system, private exporters reported sales of:

- 132,000 metric tons of soybeans for delivery to unknown during the 2021/2022 marketing year.

Updated 10/12/21

Soybeans – November $11.50-$13.00 range, March $11.50-$13.50

Soybean meal – December $295-$335, March $300-$360

Soybean oil – December 57-63 cent range, March 56-65

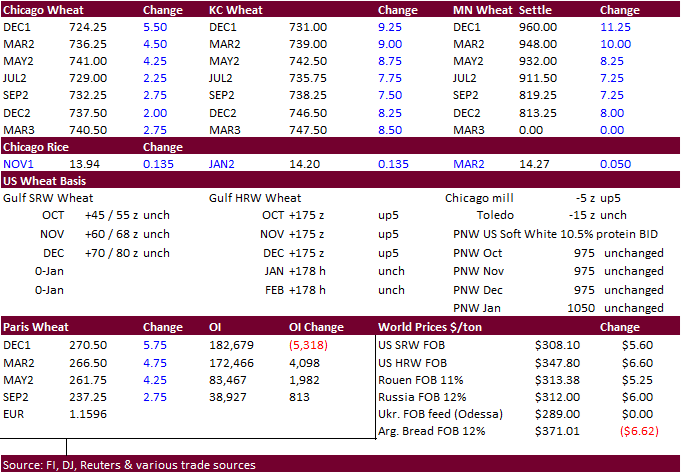

· US wheat traded higher from dry weather expected for the US HRW wheat country, a lower USD and light technical buying.

· December Paris wheat was 5.75 euros higher at 270.50 euros a ton. There was talk that China bought French wheat today.

· US hard red winter wheat areas will trend drier for at least more than a week, good for harvest progress but bad for recently emerged wheat.

· China raised their minimum prices for wheat in 2022 at 2,300 yuan ($357) per ton, up from 2,260 yuan per ton in 2021.

Export Developments.

· Jordan bought 60,000 tons of barley at $329.75 a ton, including cost and freight, for shipment during LH January.

· Jordan seeks 120,000 tons of wheat on October 20.

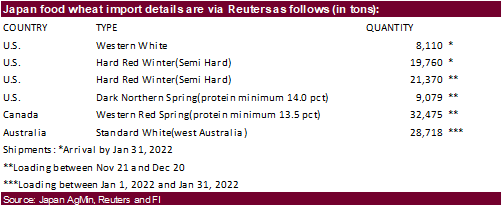

· Japan bought 119,512 tons of food wheat on Thursday for arrival by January 31.

· Pakistan’s lowest offer for 90,000 tons of optional origin wheat was $388.83 a ton c&f.

· Turkey seeks 300,000 tons of wheat on Oct. 21 for shipment between Dec. 10 and Dec. 31.

· Ethiopia seeks 300,000 tons of milling wheat on November 9.

Rice/Other

· Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

December Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December MN wheat is seen in a $9.00‐$9.75, March $9.00-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.