PDF Attached

Today

agriculture markets ended mostly higher on weather concerns and ongoing demand for US corn and soybeans. Commodity inflationary money inflow was noted.

![]()

NOT

MANY CHANGES OVERNIGHT/ISSUES OF THE DAY

- Russia’s

Southern Region is not expecting much “meaningful” rainfall over the next ten days to two weeks and the same is true for Kazakhstan, although there may be a few showers late this weekend into next week

- The

moisture will be welcome, but it may not have much influence on long term soil moisture or crop establishment potential - Argentina’s

rain potential remains good for rain in the north today into Thursday morning and there is still at least one opportunity for generalized rain in key grain and oilseed production areas early next week - The

moisture is needed to improve early corn and sunseed establishment and to stimulate some new planting - The

moisture is also needed to maintain wheat production potentials and prevent any further decline

- Rain

is needed most in Cordoba, central and northern Santa Fe and Santiago del Estero – all of which should get “some” rain - Cotton

will benefit from the moisture as well - Brazil’s

center south and center west will encounter Isolated to scattered showers and thunderstorms over the next ten days which should improve early soybean planting conditions for “some” areas, but not all.

- Greater

rain will still be needed in many areas - Any

rain that falls will be welcome, but it may not be uniform or substantial enough to induce widespread aggressive planting or generalized emergence, although some fieldwork and crop development will advance in the wetter areas - Corn,

rice and other crops will benefit from the moisture as well with Minas Gerais and areas southwest into eastern Mato Grosso do Sul and Sao Paulo to benefit most

- Brazil’s

coffee areas from northern Parana to Zona de Mata and Cerrado Mineiro should get enough rain over the coming week to stop the decline in crop conditions and to induce some flowering, but there will still be need for greater rainfall in “some” areas - Queensland

and northeastern New South Wales, Australia have a good chance for rain periodically next week and into the following weekend

- The

moisture may stimulate improved planting moisture for dryland cotton, sorghum and other crops - Western

Australia still has some “potential” to receive some needed rain in the far south next week. If the moisture evolves there would be at least a short term bout of improvement in topsoil moisture during reproduction and filling for wheat, barley and canola - The

precipitation is badly needed to bolster soil moisture and to prevent any further decline in potential yields because of net drying - The

European model continues dry biased for the next ten days and the Southern Oscillation Index remains strongly positive, both of which minimize the potential for significant relief - World

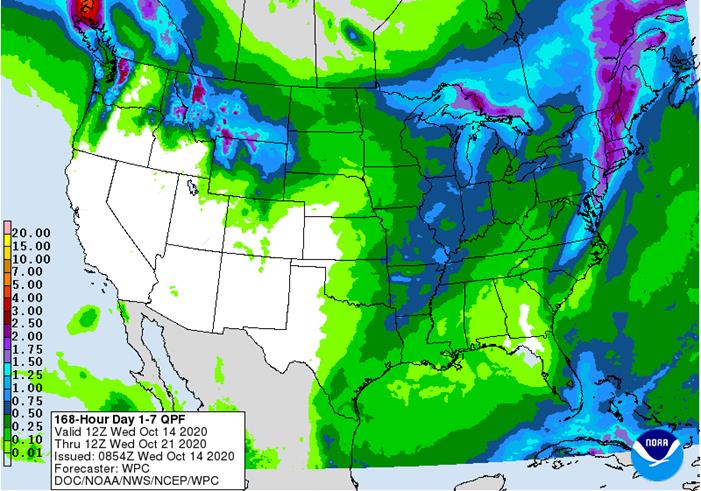

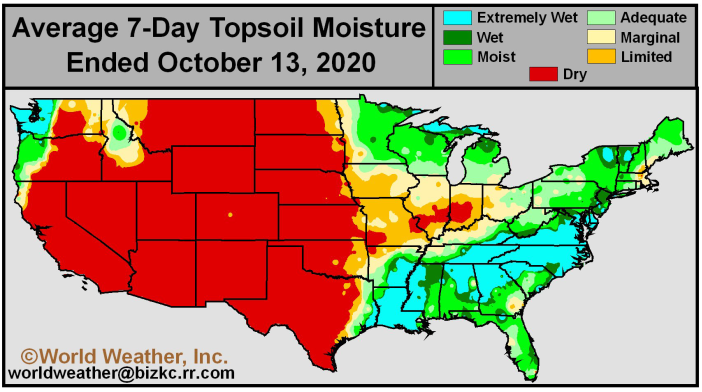

Weather, Inc. believes the European model is more correct than the GFS - U.S.

west-central and southwestern Plains have very little potential for “meaningful” rain over the next ten days leaving unirrigated crops stressed in dry soil - Some

delay in additional planting and germination is expected until rain falls - Recent

hot weather has been stressful for unirrigated seedlings raising the potential for crop failure - Cooling

this week will reduce some of the crop stress, but rain is needed - Rain

and snow will impact a part of Nebraska, northern Kansas and northeastern Colorado this weekend, but it will not reach any farther to the south - Eastern

fringes of crop country might also get a little rain next week, but only in minor production areas - Northern

U.S. Plains will begin to receive some periodic rain and snow over the coming week to ten days - The

region is quite dry and winter crops need moisture for improved establishment - The

precipitation advertised may be a little erratic and light - Friday

night and Saturday will be the first opportunity for rain and snow in Montana, North Dakota and northwestern South Dakota, although light showers will occur today as well. - U.S.

harvest weather in the lower Midwest and Great Plains will be mostly good through the next ten days , despite a couple of cool fronts and brief bouts of rain - Rain

is expected in the northern Plains and upper Midwest most often causing some brief disruption to fieldwork, but progress will advance between events - Lower

Midwest rainfall will occur Sunday into Monday and again Thursday and Friday, Oct. 22-23, but the precipitation will be brief - Temperatures

will be mild to warm early this week and then colder for the balance of this week through the middle part of next week - The

cool bias will slow evaporation rates which may delay drying rates for those areas that get periodic rain - Harvesting

in the drier areas will advance well, despite cooling - Dryness

in the lower U.S. Midwest will be eased by rain Sunday into Monday and again later next week - The

region is too dry for optimum wheat planting and establishment conditions, but great for harvest - U.S

Delta and southeastern states will experience net drying conditions for much of the next ten days, although a few showers will accompany a cool front Friday and another one early next week

- The

drying is needed to promote crop maturation and harvest progress - Several

days of drying will be needed before fieldwork can begin in those areas impacted by excessive rain from Hurricane Delta or other recent rain - Central

India rainfall will increase late this week through early next week causing some delay in summer crop harvesting and raising a little crop quality concern for soybeans, pulse crops and cotton as well as a little mature rice - Drying

should evolve again next week - Tropical

Storm Nangka moved through Hainan China Tuesday and has reached northern Vietnam today where some heavy rain is expected - The

storm will dissipate in northern Vietnam today - One

more tropical cyclone will evolve near the Philippines today before moving across the South China Sea and reaching central Vietnam at the end of this week and during the weekend - Some

heavy rain and flooding is expected in Vietnam’s Central Highlands possibly threatening some of its coffee production

- The

storm will also bring more flooding rain to coastal areas; including Da Nang and Hue where copious amounts of rain fell during the weekend. - Southern

Oscillation Index rises to highest level of the La Nina event at +12.44 and the index is expected to fall for a few days, but stay significantly positive - The

strongly positive index can be an early indicator of increasing rainfall for Southeast Asia, India and eastern Australia - Improved

South Africa rainfall is also a possibility as the SOI strengthens and then prevails, but today’s outlook is not offering much more than sporadic showers and thunderstorms

- Eastern

Europe rainfall will be winding down over the next several days - Many

areas have become quite wet from the Adriatic Sea region to eastern Germany and Poland and this region will get more rain through Friday - The

moisture will delay fieldwork and result in some flooding - Unharvested

summer crop quality may decrease - Improving

weather will occur across Europe for several days this weekend into early next week before a new stormy pattern evolves in western parts of the continent late next week and into the following weekend - Western

Europe will trend a little drier for a while the remainder of this week and into the weekend and then trend stormier again late next week and into the following weekend - Kazakhstan

remains too dry and no relief is expected for two weeks - South

Africa weather has been slowly improving with recent rain in the south and east, but more rain is needed to support spring planting and to ensure the best finish for winter crops - Net

drying is expected for a while in this coming week to ten days - Southeastern

Canada and the U.S. Great Lakes region will continue to experience periodic rainfall during the coming week to ten days which may lead to some delay in farming activity - Drier

biased weather is needed to expedite fieldwork - Southeast

Asia rainfall over the next ten days will be erratic, but most areas will be impacted multiple times in the next two weeks supporting most crop needs - Mexico

precipitation will be scattered over central and southern areas during the coming week

- Central

America will be sufficient wet over the next ten days to two weeks delaying early season crop maturation, but favoring long term water supply.

- West-central

Africa will experience waves of rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops - Cotton

areas need some drier weather - Rainfall

will be well above average in areas from Ghana to Guinea, Sierra Leone and Liberia

- East-central

Africa rain will be erratic and light over the next couple of weeks, but most of Uganda, southwestern Kenya and portions of Ethiopia will be impacted while Tanzania receives restricted amounts of rain - Philippines

rain will be widespread over the next ten days to two weeks maintaining a favorable outlook for crops - Some

heavy rain will impact the nation today and Thursday as a new tropical cyclone evolves.

- New

Zealand weather will be wetter than usual along the west coast of South Island while other areas receive near to below average precipitation - Temperatures

will be below average

Source:

World Weather Inc.

Source:

World Weather Inc.

Wednesday,

Oct. 14:

- Leman

China Swine Conference, Chongqing, day 1 - FranceAgriMer

monthly crops report - Global

Food Forum, Australia, day 1 - Malaysia

3Q cocoa grinding figures

Thursday,

Oct. 15:

- Malaysia

Oct. 1-15 palm oil export data - Port

of Rouen data on French grain exports - EIA

U.S. weekly ethanol inventories, production, 10:30am - Global

Food Forum, Australia, day 2 - Leman

China Swine Conference, Chongqing, day 2 - European

Cocoa Association grindings

Friday,

Oct. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Asia

3Q cocoa grinds - Cocoa

Association of Asia’s webinar on Asian cocoa demand - Leman

China Swine Conference, Chongqing, day 3

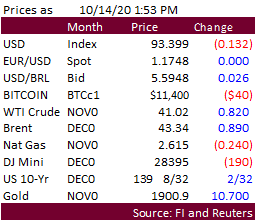

Macros

·

WTI Oil Settles Up 84 Cents (2.09Pct) At $41.04BBL

·

US Mortgage Applications Oct 9 -0.7% (prev 4.6%)

-US

30-Year Mortgage Rate Oct 9 3.00%

Education:

·

EIA: Handbook of Energy Modeling Methods

https://www.eia.gov/analysis/handbook/?src=email

·

USDA: Farm use of futures, options and marketing contracts

https://www.ers.usda.gov/webdocs/publications/99518/eib-219.pdf?v=4500.1

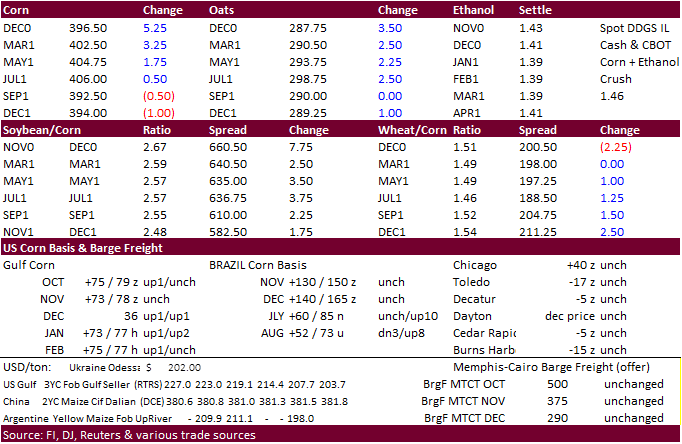

Corn.

-

Corn

traded two sided but rallied in the front month contracts to end 5.25 cents higher in the December and 3.25 cents higher in the March. A weaker USD and US corn conditions declining one point added to the support. SK and Taiwan bought corn from South America.

The lack of US corn buying by South Korea recently may change depending on quality of new-crop supplies. Harvest pressure and rain forecast for parts of South America weighed on back month futures prices.

-

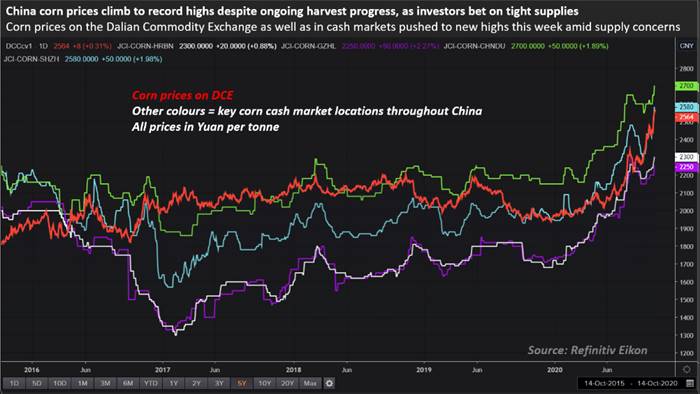

Meanwhile

China corn futures hit a record high of 2,595 yuan per ton ($385.14/ton). Domestic prices hist China will import a large amount of corn in 2021, more than 10 million tons, in our opinion. Note for soybean meal equivalent, USDA predicts China will made up

29 percent of the world market share (8 major oil meals). So, like any other major animal unit production country, China will need alternative feeds to mix for consumption, like corn, wheat and minor feedgrains.

-

Funds

bought and estimated net 16,000 corn contracts. -

Germany

ASF: 65 cases since September 10 -

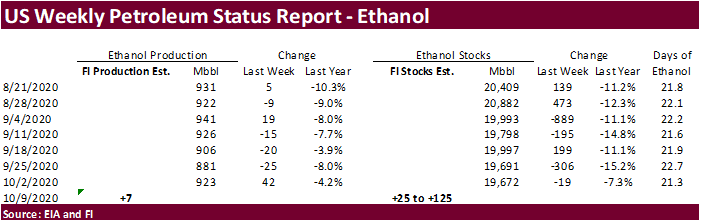

A

Bloomberg poll looks for weekly US ethanol production to be up 6,000 at 929,000 barrels (920-937 range) from the previous week and stocks up to 124,000 barrels to 19.796 million.

Corn

Export Developments

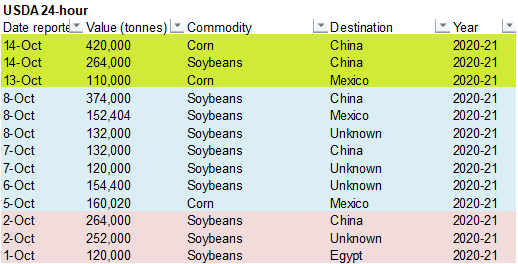

-

USDA

announced private exporters sold: 420,000 tons of corn for delivery to China during the 2020/2021 marketing year

-

South

Korea’s KFA bought 60,000 tons of South American corn at $247.69/ton for arrival around Jan 20.

-

Taiwan’s

MFIG bought 65,000 tons of Brazilian corn at 219.90 cents per bu over the March contract for Dec/Jan shipment.

-

Algeria

seeks 30,000 tons of feed corn and 25,000 tons of feed barley on October 15.

-

Results

awaited: Iran seeks 200,000 tons of barley on October 14.

Corn

Export Developments

-

Jordan

passed on 120,000 tons of feed barley for Jan/Feb shipment. -

Iran

seeks 200,000 tons of barley on October 14. -

Taiwan’s

MFIG seeks 65,000 tons of corn on October 14 for Dec/Jan shipment.

Updated

10/9/20

December

corn is seen in a $3.75-$4.10 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.

-

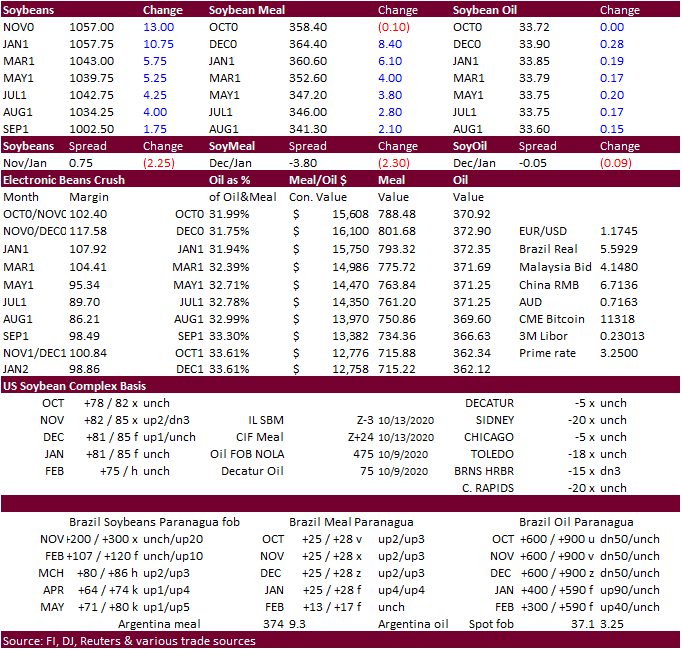

The

US soybean complex ended higher led by bull spreading amid strength in Brazil cash prices and slow planting progress in Mato Grosso. Local Brazil soybeans have been strong for months, thanks in large part to the in large move in the real. Sorriso, Mato Grosso,

soybeans are going for over $10/bu and Ponta Grossa, Paranagua, were around $12.50 per bushel. We heard China bought 5-6 cargoes of US soybeans for Nov-Dec shipment and at least one new crop Brazilian cargo. USDA announced 264,000 tons of soybeans to China.

Soybean meal was mostly higher throughout the day. Soybean oil started weaker from a lower lead in outside vegetable oil markets. Palm oil snapped their 7 day winning streak. Indonesia’s Energy and Mineral Resources Ministry warned biodiesel consumption

could end up 10 to 15 percent below its target. -

Funds

bought 10,000 soybeans, 6,000 soybean meal and 3,000 soybean oil.

-

Argentina

will continue to see rain late this weekend in the southwest and northeast early next week. Brazil will see scattered showers will increase today and last through Friday. Not all areas of Brazil will see good rain.

In Mato Grosso rain is expected to be weak over the next seven days, delating planting progress.

-

Oil

World estimated Brazil will import 80,000 tons of soybean oil during October, up from 11,000 year earlier and 15,000 tons during September 2020. Jan-Oct Brazil soybean oil imports projected at 117,000 tons versus 29,000 tons year earlier. We wonder what NDJ

imports will look like for Brazil. Brazil October soybean imports were projected at 104,000 tons, up from 1,000 year ago and Jan-Oct projected at 632,000 tons, up from 125,000 tons year ago.

-

Argentina

oilseed workers, led by the Argentina Federation of Oilseeds Workers, ended an open-ended strike launched Tuesday afternoon after the government stepped in. The group represents some crush workers of the Rosario area, but not the northern area.

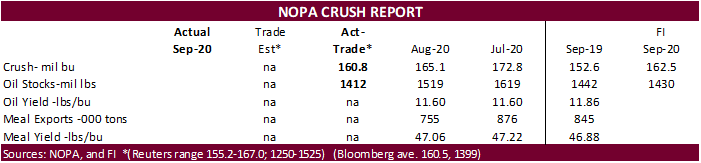

-

The

September NOPA crush is due out tomorrow with estimates at 160.8 million bushels and oil stocks of 1.412 billion pounds as last month did see some maintenance downtimes across the industry.

-

USDA

announced private exporters sold: 264,000 tons of soybeans for delivery to China during the 2020/2021 marketing year

-

China

resumed buying soybean cargoes this week, but daily amounts are lighter than the daily four week average leading up to their holiday. Results awaited: Iran’s SLAL seeks 200,000 tons of soybean meal and 200,000 tons of barley on October 14 for OND shipment.

-

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on October 26 for delivery within four months of contract.

Updated

10/12/20

November

soybeans are seen in a $10.25-$11.10 range

December

soybean meal is seen in a $345-$385 range

December

soybean oil is seen in a 32.50-35.00 range

-

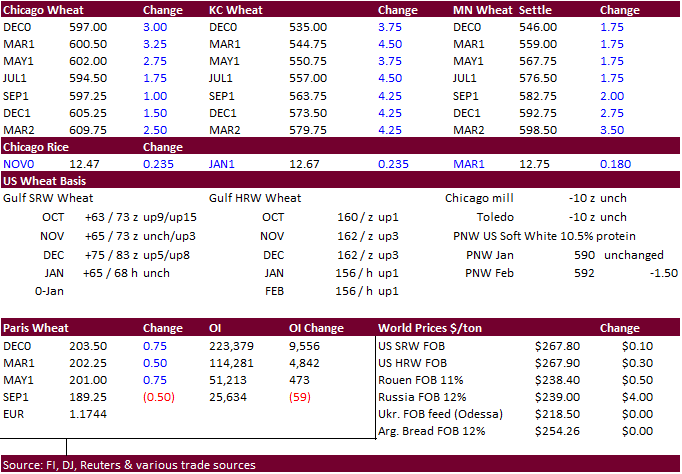

US

wheat futures traded two sided on lack of direction. Double digit gains in soybeans and a flurry of export announcements provided support. Chicago was up 2.75 cents basis December, up 4.0 cents in KC and 1.75 cents in MN. The lower USD is likely limiting

early losses. About half of Russia’s dry wheat area could see rain be end of next week. Late this week into the weekend Russia’s Central Region and Ukraine will see rain.

-

Brazil

flour millers will unlikely buy a specific Argentina GMO wheat variety HB4 because it has not been approved. We agree. Most countries reject GMO type wheat for food use consumption as it is.

-

Funds

bought an estimated net 4,000 SRW wheat contracts. -

US

Gulf wheat basis was up sharply. Might be a squeeze as exporters focus on soybean exports. Inspections were down from the previous week.

-

Paris

(Matif) December wheat was 0.75 higher at 203.50 euros.

-

Jordan

bought 60,000 tons of wheat at $272.00 per ton for FH February shipment. -

Thailand

passed on feed wheat and feed barley, optional origin, for Nov – Mar shipment.

-

Algeria

bought an estimated net 600,000 tons of milling wheat for Oct/Nov shipment at prices between $263.50 per ton and $264 with at least some of the wheat could originate from the Black Sea region.

-

Turkey

seeks 175,000 tons of wheat on October 22 for shipment between November 9 and November 24.

-

Japan

seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on October 21 for arrival by February 25.

-

Japan

seeks 87,110 tons of food wheat later this week from Canada (25k) and rest from the US.

-

Awaited:

Offers around $284/ton – Pakistan seeks 300,000 tons of wheat on October 14 for arrival by end of January.

-

Awaited:

2 offers – Jordan seeks 120,000 tons of wheat on October 14, optional origin, for Jan -late Feb shipment. -

Awaited:

5 participants – Ethiopia seeks 400,000 tons of wheat by October 13. -

(new

9/15) Ethiopia seeks about 200,000 tons of milling wheat on October 15.

·

Mauritius seeks 5,500 tons of white rice on October 20 for Dec 15-Mar 15, 2021 delivery.

Updated

10/9/20

December Chicago wheat is seen in a $5.70-$6.30 range

December KC wheat is seen in a $5.20-$5.70 range

December MN wheat is seen in a $5.35-$5.60 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.