PDF Attached

Higher

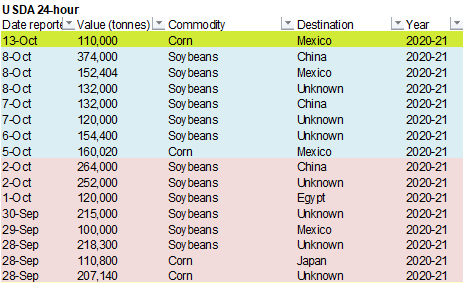

trade in soybeans and corn while wheat was mixed. USDA announced 110,000 tons of corn to Mexico. USDA export inspections were very good for soybeans, withing expectations for wheat and below expectations for corn.

MORNING

WEATHER MODEL COMMENTS

NORTH

AMERICA

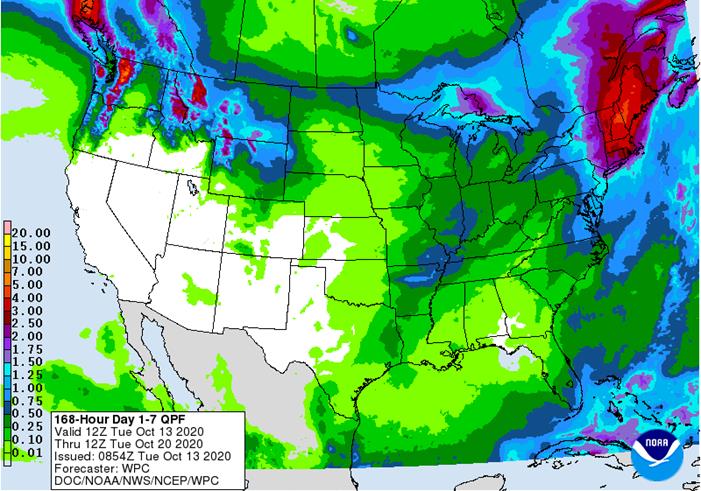

- No

general theme changes were noted overnight - Restricted

precipitation is expected through the balance of this week in key crop areas - A

reinforcing shot of cold air expected this late weekend and early next week will induce some rain and snow across in a part of the central Plains and Midwest inducing some short term disruption to fieldwork.

- GFS

model may be overdoing precipitation in the central Plains - European

model keeps precipitation limited in hard red winter wheat areas - Canadian

model run favors precipitation in Nebraska, northern and eastern Kansas and northeastern Colorado – similar to the GFS during this same time period - Southwestern

U.S. Plains are unlikely to see any precipitation - Drier

weather evolves again shortly after the early week precipitation event for the latter part of next week and into the following weekend.

The

earliest possible time for significant precipitation to fall in hard red winter wheat areas will be after the current succession of cold surges is over. At that time (late next week and more likely in the second weekend of the outlook) some moisture from the

Gulf of Mexico “may” be allowed to stream north into the region. However, World Weather, Inc. is not very confident that “meaningful” rain will occur during this period of time. The situation will be closely monitored.

SOUTH

AMERICA

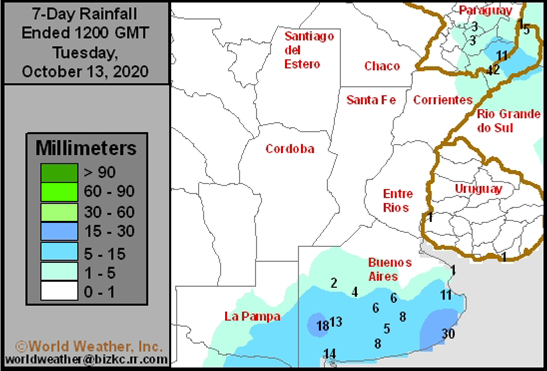

- No

theme changes were noted overnight - Argentina

rainfall is expected in the north through mid-week this week - Much

of Argentina will receive rain starting late this weekend in the southwest and advancing northeast early next week - Sufficient

rainfall is expected to bolster topsoil moisture and improve early corn and sunseed planting and establishment conditions - Cordoba,

Santiago del Estero and Santa Fe’s drier biased areas will get rain to ease long term dryness - Argentina

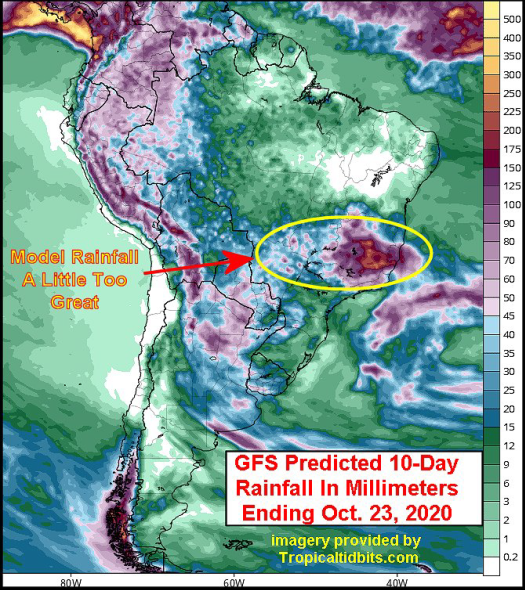

follow up rainfall potentials late next week and into the following weekend will be limited - Brazil

scattered showers and thunderstorms will increase in number today through Friday, but rain intensity will be light benefiting some crop areas much more than others - Follow

up rain will be very important - Brazil

rainfall will diminish Friday through early next week especially in center west crop areas while scattered showers and thunderstorms continue periodically in Minas Gerais and some immediate neighboring areas - Brazil’s

greatest rainfall boost is expected late next week and into the following weekend

The

generalities of the South America outlook have not changed much today relative to that of Monday. Northern Argentina will get some rain over the next couple of days and the best generalized rain seen in a few weeks may occur late this weekend into early next

week offering some short term improvements in soil moisture benefiting winter wheat and barley as well as supporting more planting and establishment of early corn and sunseed. Follow up rain will be very important, but it is not expected to occur for a while

and net drying should be quick to resume later next week that might last into late October.

BLACK

SEA REGION

- Light

rain is advertised this weekend for eastern Ukraine and a few areas in Russia’s Southern Region early next week - The

change was expected and should verify, although resulting rain will be mostly light - Additional

showers will be possible in Russia’s Southern Region, eastern Ukraine and western Kazakhstan during mid- to late-week next week - This

rainfall is expected to be quite light and will likely fail to seriously change soil moisture - Net

drying will occur in the balance of October in eastern Ukraine, Russia’s Southern Region and western Kazakhstan, although the 06z GFS model run suggested more rain was possible near the end of this month

- The

return of drying is expected and the return of rain on the 06z GFS model run for late this month will not likely verify - Waves

of rain will continue to impact southeastern Europe including the southern Balkan Countries and the western Black Sea region during the next ten days to two weeks - This

is no change from previous forecasts

Overall,

the rain advertised for eastern Ukraine, Kazakhstan and Russia’s Southern region this weekend and next week fits very well with World Weather, Inc.’s previous comments of last week. The moisture will be welcome, but not nearly enough to seriously bolster soil

moisture or change the long term outlook for winter small grains. Follow up rain will be needed as soon as possible to induce good stands.

CHINA

- No

general theme changes noted overnight - Restricted

rainfall is expected in northeastern China and in the northern Yellow River Basin as well as the North China Plain where summer crop harvest progress and winter crop planting and establishment will advance favorably - Rain

will continue periodically over the coming week from Shaanxi and Shanxi southward to Guangxi and Guangdong - Net

drying is advertised for much of eastern China during the second week of the forecast

INDIA

- No

general theme changes were noted overnight - Rain

is expected to occur significantly in interior southern India over the next several days - Rain

is expected to develop in central India late this week and into early next week - Sufficient

amounts of rain will fall to stall summer crop maturation and harvest progress while raising some crop quality issues for cotton, soybeans, pulse crops and some rice - The

rain will retreat to the south again during the second half of next week bringing back some improving weather

AUSTRALIA

- No

big changes were noted overnight in the coming ten days to two weeks - GFS

model continues to attempt to bring rain to southern parts of Western Australia during mid-week next week and again October 27-28 - Confidence

in these advertised rain events remains low because of drier biased conditions advertised by the European and Canadian model runs

The

very strongly positive Southern Oscillation Index (+12.58) today may be providing some evidence that rain may not evolve in Western Australia because there is a tendency for strongly positive SOI values are associated with greater rain potentials in eastern

Australia and less rain potential in the west.

Source:

World Weather Inc.

Tuesday,

Oct. 13:

- USDA

weekly corn, soybean, wheat export inspections, 11am - China

trade data on soybeans and meat imports - New

Zealand Food Prices - France’s

agriculture ministry crop estimates - U.K.’s

AHDB Grain Market Outlook Conference - U.S.

winter wheat planted, 4pm - HOLIDAY:

Thailand

Wednesday,

Oct. 14:

- Leman

China Swine Conference, Chongqing, day 1 - FranceAgriMer

monthly crops report - Global

Food Forum, Australia, day 1 - Malaysia

3Q cocoa grinding figures

Thursday,

Oct. 15:

- Malaysia

Oct. 1-15 palm oil export data - Port

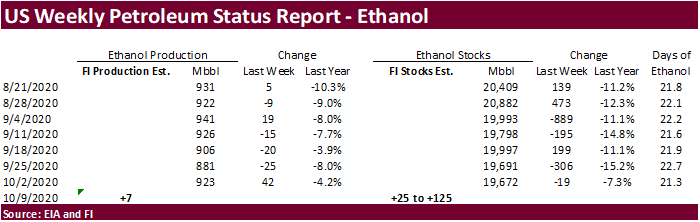

of Rouen data on French grain exports - EIA

U.S. weekly ethanol inventories, production, 10:30am - Global

Food Forum, Australia, day 2 - Leman

China Swine Conference, Chongqing, day 2 - European

Cocoa Association grindings

Friday,

Oct. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Asia

3Q cocoa grinds - Cocoa

Association of Asia’s webinar on Asian cocoa demand - Leman

China Swine Conference, Chongqing, day 3

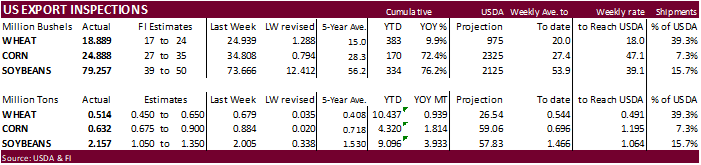

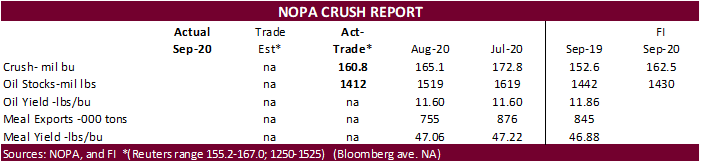

USDA

inspections versus Reuters trade range

Wheat

514,086 versus 400000-650000 range

Corn

632,184 versus 650000-900000 range

Soybeans

2,157,012 versus 1200000-2200000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING OCT 08, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 10/08/2020 10/01/2020 10/10/2019 TO DATE TO DATE

BARLEY

1,896 1,397 0 9,020 8,625

CORN

632,184 884,157 480,647 4,319,958 2,506,319

FLAXSEED

0 0 100 389 172

MIXED

0 0 0 0 0

OATS

0 0 0 996 798

RYE

0 0 0 0 0

SORGHUM

192 157,647 38,825 461,947 228,176

SOYBEANS

2,157,012 2,004,867 956,056 9,095,531 5,162,862

SUNFLOWER

0 0 0 0 0

WHEAT

514,086 678,715 497,468 10,437,123 9,498,368

Total

3,305,370 3,726,783 1,973,096 24,324,964 17,405,320

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

US

CPI (M/M) Sep: 0.2% (exp 0.2%; prev 0.4%)

–

CPI Ex Food And Energy (M/M) Sep: 0.2% (exp 0.2%; prev 0.4%)

–

CPI (Y/Y) Sep: 1.4% (exp 1.4%; prev 1.3%)

–

CPI Ex Food And Energy (Y/Y) Sep: 1.7% (exp 1.7%; prev 1.7%)

IMF

Sees 2020 World GDP Shrinking 4.4% Vs -5.2% Estimate In June

Citigroup

Q3 20 Earnings:

–

Revenue: $17.3B (exp $17.2B)

–

Adj EPS: $1.40 (exp $0.93)

–

Banking Revenue: $5.1B

–

Net Credit Losses: $1.92B

USDA:

Farm use of futures, options and marketing contracts

https://www.ers.usda.gov/webdocs/publications/99518/eib-219.pdf?v=4500.1

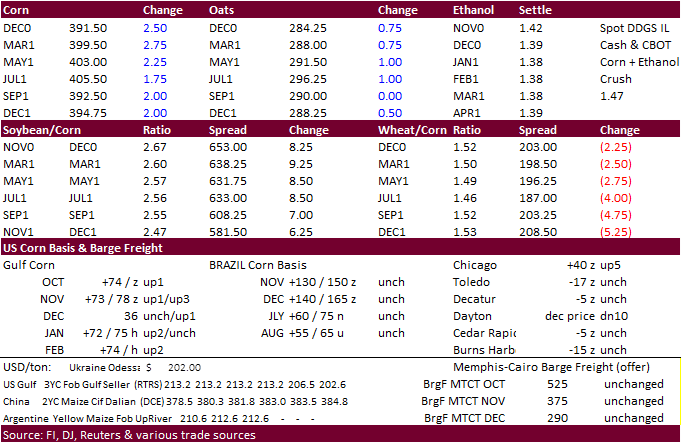

Corn.

-

US

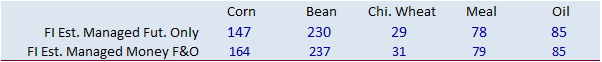

corn futures turned slightly lower on US harvest pressure and lack of changes in the global weather forecast. Funds bought and estimated net 8,000 corn contracts. There was talk of China’s slow harvest progress pulled China corn futures to new highs.

-

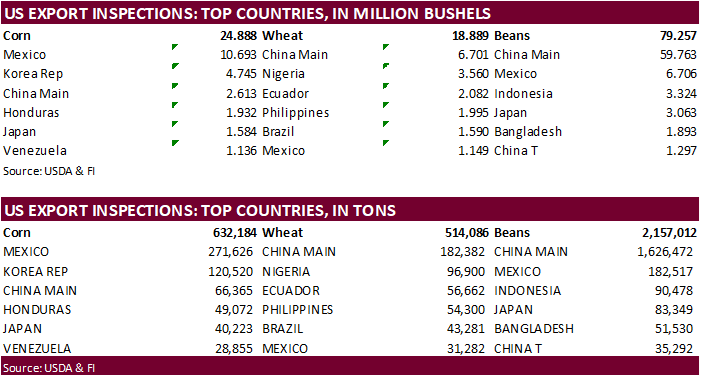

USDA

US corn export inspections as of October 08, 2020 were 632,184 tons, below a range of trade expectations, below 884,157 tons previous week and compares to 480,647 tons year ago. Major countries included Mexico for 271,626 tons, Korea Rep for 120,520 tons,

and China Main for 66,365 tons. -

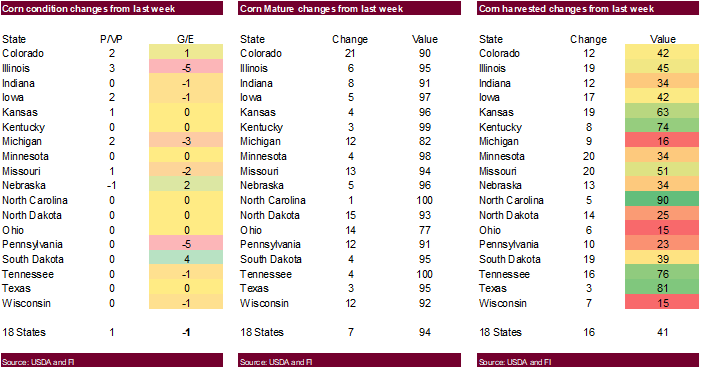

US

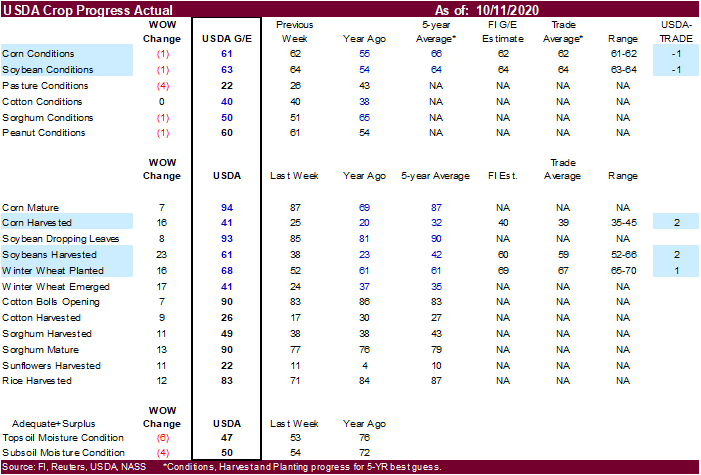

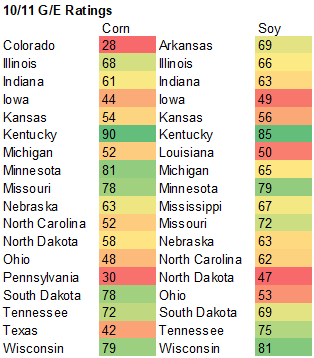

corn crop conditions were reported by USDA at 61 percent for the combined good and excellent categories, down 1 from previous week and compares to 55 year ago and 66 for the 5-year average. A Reuters trade average was looking for 62 percent. -

US

corn harvest progress was reported at 41 percent complete, up from 25 percent last week and compares to 20 year ago and 32 average. 94 percent of the corn crop is mature.

-

APK-Inform:

Ukraine grain crop 70 million tons, down 2 percent from last month and exports at 50.9MMT. The corn crop was estimated at 34.8 million tons. UGA has corn at 36.5 million tons. APK has wheat at 25.1 million tons.

-

Germany

ASF: 65 cases since September 10

Corn

Export Developments

-

USDA

announced 110,000 tons of corn to Mexico. -

Jordan

passed on 120,000 tons of feed barley for Jan/Feb shipment. -

Iran

seeks 200,000 tons of barley on October 14. -

Taiwan’s

MFIG seeks 65,000 tons of corn on October 14 for Dec/Jan shipment.

Updated

10/9/20

December

corn is seen in a $3.75-$4.10 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.

-

The

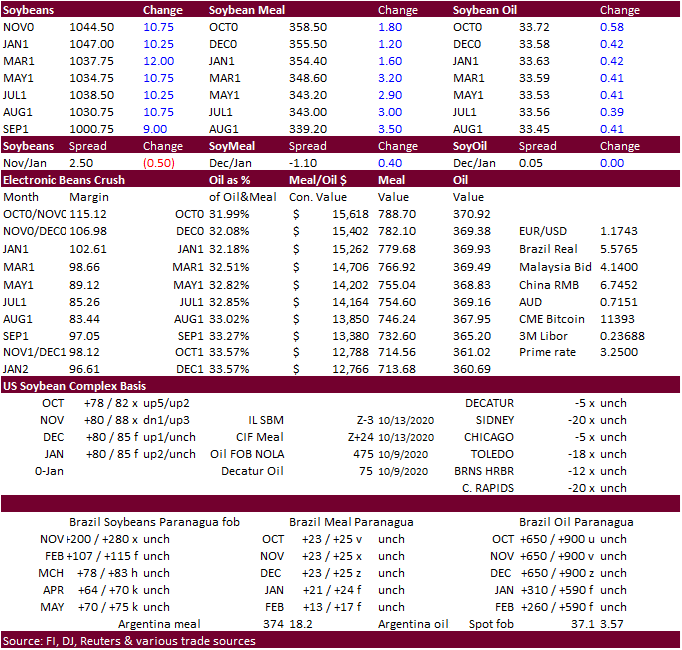

US soybean complex traded two-sided, ending higher in part to strength in outside markets, Argentina workers launching a strike this afternoon, and technical buying after selling off hard on Monday. Many hedge funds returned to work today after some of the

US markets were on holiday Monday. We were a little taken back from the late session rally with the USD trading more than 45 points higher. WTI rallied 86 cents by just before 2:00 PM CT. September China soybean imports were larger than expected. USDA

export inspections for soybeans were excellent. Offshore values this morning were leading US products higher, led by soybean oil. Palm futures advanced for the seventh consecutive session.

-

Funds

bought 8,000 soybeans, 3,000 soybean meal and 4,000 soybean oil. -

Argentina

oilseed workers, led by the Argentina Federation of Oilseeds Workers, plan to start an open-ended strike at 2 PM today. The group represents some crush workers of the Rosario area, but not the northern area. We don’t see significant impact on Argentina’s

soybean and product export pace as October is typically slow and strikes are generally short lived. -

USDA

US soybean export inspections as of October 08, 2020 were 2,157,012 tons, within a range of trade expectations, above 2,004,867 tons previous week and compares to 956,056 tons year ago. Major countries included China Main for 1,626,472 tons, Mexico for 182,517

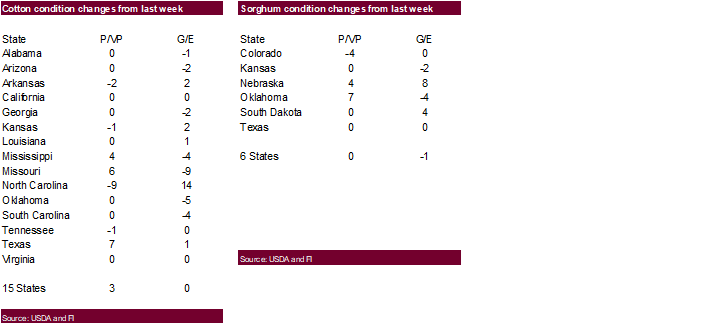

tons, and Indonesia for 90,478 tons. -

US

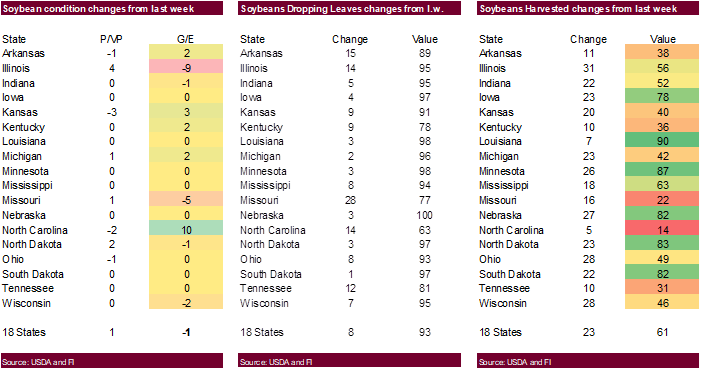

soybean crop conditions were reported by USDA at 62 percent for the combined good and excellent categories, down 1 from previous week and compares to 54 year ago and 64 for the 5-year average. A Reuters trade average was looking for 64 percent. -

US

soybean harvest progress was reported at 61 percent complete, up from 38 percent last week and compares to 23 year ago and 42 average. Soybeans dropping leaves was reported at 93 percent.

-

There

were no major changes to the South American weather forecast. Argentina will continue to see rain late this weekend in the southwest and northeast early next week. Brazil scattered showers will increase today and last through Friday.

-

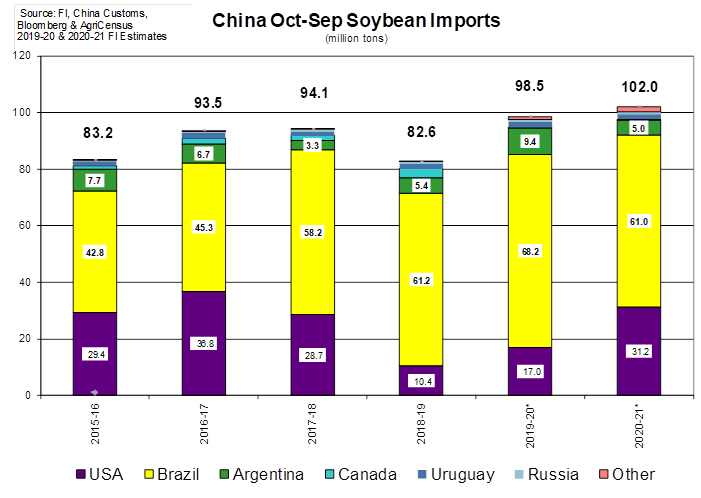

China

imported a record 9.8 million tons of soybeans during September, higher than expected, and closes the Sep-Oct period at 98.5 million tons. At this time last year, we were forecasting less than 90 million tons. China hog and breeding sows are back to 80 percent

normal within China. Note we are at 102 million tons for 2020-21 China soybean imports. China cash crush margins improved from the previous session.

-

Indonesia’s

President told his ministers to prepare for the potentially hazardous impact of an upcoming La Nina event. Above normal rainfall is associated with La Nina.

-

China

committed to buy 1.7 million tons of Malaysian palm oil through 2022.

-

Iran’s

SLAL seeks 200,000 tons of soybean meal and 200,000 tons of barley on October 14 for OND shipment.

-

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on October 26 for delivery within four months of contract.

Updated

10/12/20

November

soybeans are seen in a $10.25-$11.10 range

December

soybean meal is seen in a $345-$385 range

December

soybean oil is seen in a 32.50-35.00 range

-

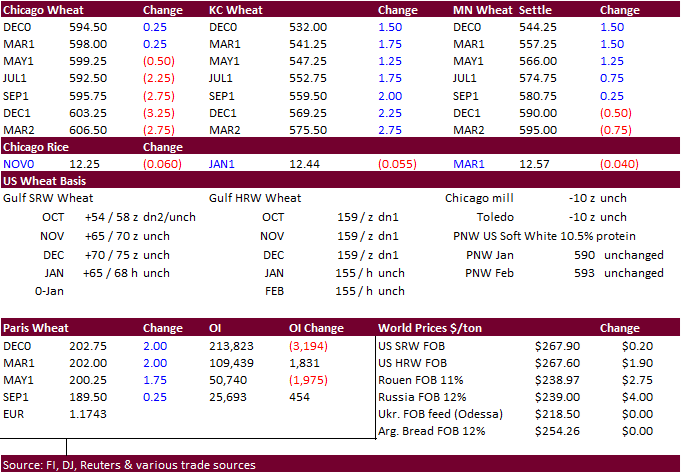

Chicago

wheat ended 0.25 to 2.75 cents lower. The USD was up 47 as of 2:00 pm CT. KC and MN were mostly higher. Ongoing dry weather for the US Great Plains is again gaining attention from delays in winter wheat seedings bias southern areas. Some traders are no

longer looking for the general 2.5 percent increase in US winter wheat expectations. US wheat inspections were ok. Funds bought an estimated net 1,000 SRW wheat contracts.

-

USDA

US all-wheat export inspections as of October 08, 2020 were 514,086 tons, within a range of trade expectations, below 678,715 tons previous week and compares to 497,468 tons year ago. Major countries included China Main for 182,382 tons, Nigeria for 96,900

tons, and Ecuador for 56,662 tons.

-

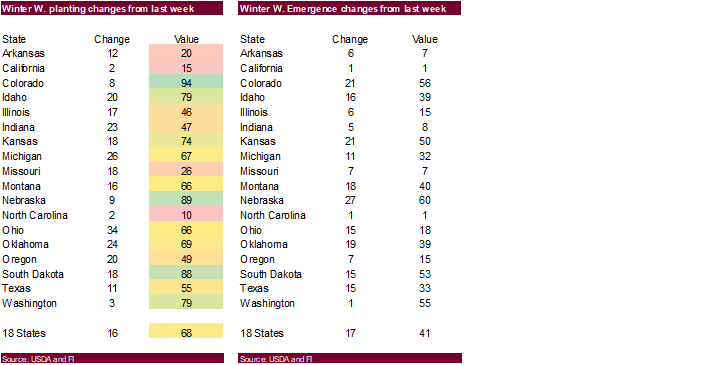

US

winter wheat planting progress was reported at 68 percent complete, one point above trade expectations, up from 52 percent last week and compares to 61 year ago and 61 average. 41 percent of the US winter wheat crop is emerged.

-

Paris

(Matif) December wheat was 2.00 higher at 202.75 euros. -

France’s

AgMin lowered its estimate for soft wheat to 29.2 million tons from 29.5 million in Sep due to a reduction in harvested area and yields.

-

Algeria

started buying wheat for Oct/Nov shipment. One trader noted around $263.50 per ton at least some of the wheat could originate from the Black Sea region.

-

Japan

seeks 87,110 tons of food wheat later this week from Canada (25k) and rest from the US.

-

Pakistan

seeks 300,000 tons of wheat on October 14 for arrival by end of January. -

Jordan

seeks 120,000 tons of wheat on October 14, optional origin, for Jan -late Feb shipment. -

Ethiopia

seeks 400,000 tons of wheat by October 13. -

(new

9/15) Ethiopia seeks about 200,000 tons of milling wheat on October 15.

·

Mauritius seeks 5,500 tons of white rice on October 20 for Dec 15-Mar 15, 2021 delivery.

Updated

10/9/20

December Chicago wheat is seen in a $5.70-$6.30 range

December KC wheat is seen in a $5.20-$5.70 range

December MN wheat is seen in a $5.35-$5.60 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.