PDF Attached includes updated US soybean complex S&D’s. Crop progress headlines are below USDA recap, tables out later this week.

Please

note I will be out the balance of the week, attending the AFOA conference in Nashville.

CBOT

soybean complex, corn and oats ended lower. Wheat was higher. Our bias is for soybeans and corn to continue to trend lower and wheat to trade two-sided over the short term.

USDA

released their October S&D and crop production reports

Reaction:

Bearish

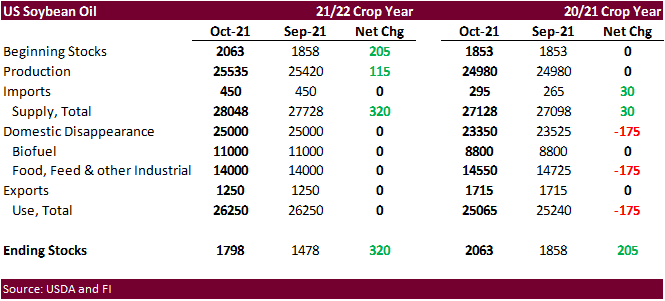

corn and soybeans, neutral to slightly friendly wheat. USDA’s 2021-22 US soybean oil stocks were revised up a large 320 million pounds, and soybean oil prices naturally traded sharply lower. Soybean meal stocks were cut 100,000 short tons, triggering meal/oil

spreading. We lowered our trading range projections for the soybean complex.

USDA

NASS executive summary

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

following

the release of the report soybean prices dropped and corn followed. Wheat traded two-sided post USDA report and then trended higher in part to wheat/soybean and wheat/corn spreading. 2021 US soybean production was upward revised 74 million bushels after

the USDA raised the US yield by 0.9 bu/ac to 51.5, 0.4 bu/ac above an average trade guess. There were no changes to the US harvested area for soybeans and corn. USDA increased the 2021-22 US soybean carryout to 320 million bushels, 20 million above the trade

average. USDA made some adjustments to their old crop balance sheet, including the 81 million bushels increase in ending stocks per September 1 stocks (2020 upward revision to production). For this crop year, USDA increased soybean production by 74 million

bushels. They lowered imports by 10 million. For US crush, USDA increased it by 10 million bushels, and increased residual by 1 million. We still think USDA is too low on 2021-22 US crush. What was interesting to see was USDA’s adjustments to old-crop

soybean oil. They decided to lower food use by 175 million pounds and left unchanged soybean oil for biodiesel. We thought they would adjust lower SBO for biofuel. They took SBO 2020-21 imports up 30 million pounds and raised the end of October ending stocks

by 205 million pounds to 2.063 billion, well above the 1.2-1.3 billion the trade was looking for about six months ago. New-crop SBO production was raised 115 million pounds (higher crush) to 25.535 billion, above 24.980 billion produced in 2020-21. USDA

cut old-crop soybean meal ending stocks by 50,000 short tons to 400,000 (we were looking for an upward revision). They lowered old-crop exports by 200,000, raised domestic use by 175,000, took production down 55,000, and lowered imports by 20,000 short tons.

For new-crop USDA raised production by 250,000 short tons and raised domestic use by 300,000 short tons, resulting in a 400,000 short ton carryout, 100,000 less than the previous month. World soybean production was revised higher by 0.7 million tons to 385.1

million, 5.4% above the previous year. World ending stocks were reported at 104.6 million tons, 3.9 million above an average trade guess, 5.7 million above the previous month and 5.5% above 2020-21.

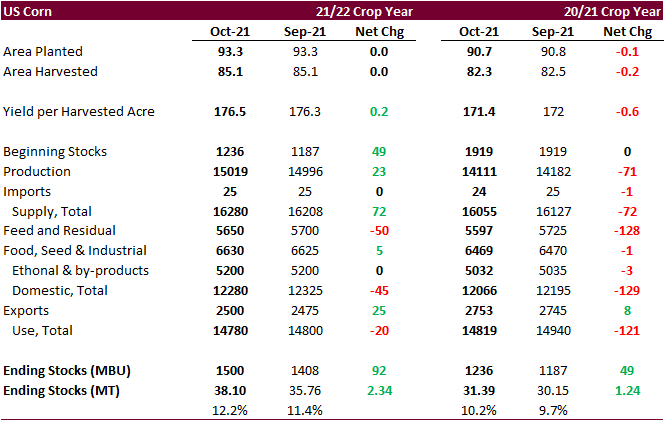

USDA

lifted the 2021 US corn yield by 0.2 bu/ac to 176.5 bushels per acre. The trade was looking for a slight decrease. As a result, US corn production increased 23 million bushels to 15.019 billion bushels. USDA increased the 2020-21 US corn carryout by 92

million bushels to 1.500 billion, 68 million above an average trade guess and 21 percent above the 2020-21 crop year. USDA made several adjustments to the old-crop US corn balance sheet, as expected per September 1 grain stocks. For new-crop, USDA lowered

feed use by 50 million bushels to 5.650 billion, above 5.597 billion in 2020-21. USDA increased corn exports by 25 million to 2.50 billion for 2021-22, below 2.753 billion in 2020-21. The US stocks to use for corn is now projected at 12.2%, up from 11.4%

previous month and above 10.2% for 2020-21. World corn production was raised 0.5 million tons from the previous month and stocks were lifted 4.1 million tons to 301.7 million, a 4 percent increase from previous season. USDA took 2020-21 corn imports up 2

million tons to 28 million tons, resulting in a boost to the China corn carryout by a like amount.

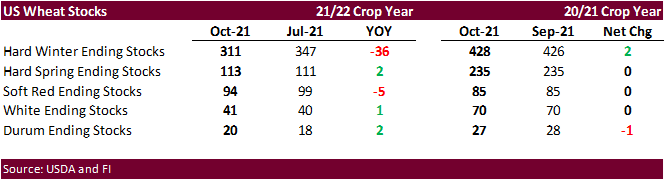

After

adjusting for a lower all-wheat crop production per Small Grains Summary, USDA cut the 2021-22 US stocks by 35 million bushels to 580 million, about in line with trade expectations, and down 31 percent from last season. USDA lowered its outlook for HRW wheat

stocks by 36 million bushels and SRW by 5 million, and slightly raised the other three classes of wheat. USDA’s 51-million-bushel reduction to 2021-22 all-wheat production forced them to trim the feed use by 25 million bushels. They also lowered imports

by 10 million, possibly by recognizing a short Canadian wheat crop (was taken down 2MMT this month). USDA lowered world wheat production by 4.4 million tons and world ending stocks by 6.0 million tons (3.6 million more than what the trade was looking for).

US

CORN – 60 PCT CONDITION GOOD/EXCELLENT VS 59 PCT WK AGO (61 PCT YR AGO) -USDA

US

COTTON – 64 PCT CONDITION GOOD/EXCELLENT VS 62 PCT WK AGO (40 PCT YR AGO) -USDA

US

SOYBEAN – 59 PCT CONDITION GOOD/EXCELLENT VS 58 PCT WK AGO (63 PCT YR AGO) -USDA

US

WINTER WHEAT – 60 PCT PLANTED VS 47 PCT WK AGO (60 PCT 5-YR AVG) -USDA

US

WINTER WHEAT – 31 PCT EMERGED VS 19 PCT WK AGO (35 PCT 5-YR AVG) -USDA

US

SOYBEANS – 49 PCT HARVESTED VS 34 PCT WK AGO (40 PCT 5-YR AVG) -USDA

US

CORN – 41 PCT HARVESTED VS 29 PCT WK AGO (31 PCT 5-YR AVG) -USDA

US

COTTON – 20 PCT HARVESTED VS 13 PCT WK AGO (26 PCT 5-YR AVG) -USDA

US

RICE – 81 PCT HARVESTED VS 73 PCT WK AGO (85 PCT 5-YR AVG) -USDA

US

SOYBEANS – 91 PCT DROPPING LEAVES VS 86 PCT WK AGO (89 PCT 5-YR AVG) -USDA

US

CORN – 94 PCT MATURE VS 88 PCT WK AGO (86 PCT 5-YR AVG) -USDA

US

COTTON – 78 PCT BOLLS OPENING VS 70 PCT WK AGO (82 PCT 5-YR AVG) -USDA

Weather

7-day

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Brazil

will see a good distribution of rain over the next ten days to two weeks - Southern

parts of the nation will dry down next week and that will be good for wheat maturation and harvesting and good for corn and soybean planting progress after recent rain - Most

of Brazil’s coffee, citrus and sugar crops are expected to benefit greatly from the continuation of periodic rain over the next week - Follow

up rain will be needed later this month, but the drier weather next week will be good as well - Argentina’s

rain expected through Thursday will be welcome and good for all crops, but not likely enough to fix long term moisture deficits and greater rain will be needed later this month to protect production potential and to support planting progress - U.S.

northern Plains and Canada’s Prairies will get some significant moisture later today through Thursday - The

Dakotas, eastern Montana and Minnesota will be wettest through Wednesday with 0.40 to 1.50 inches of moisture expected and local totals over 2.00 inches in western most parts of the Dakotas - Snow

accumulation in the westernmost Dakotas and eastern most Montana will range from 4 to 10 inches with a few greater amounts in a narrow band

- Livestock

stress and some travel disruption is expected - Canada’s

eastern Prairies will be wettest late Wednesday and Thursday at which time 0.40 to 1.50 inches of moisture will result - Manitoba

and southeastern Saskatchewan will be wettest - Snow

accumulations in Saskatchewan will range from 1 to 4 inches with a few amounts as great as 6 inches - The

snow will melt quickly - Colder

air will settle south and east across the Great Plains late this week and into the weekend - Frost

and freezes will be most significant in the northwestern Plains where a few upper teens are expected while most readings will be in the 20s and lower 30s - Low

temperatures in West Texas will slip to the middle and upper 30s this weekend with a patch or two of soft frost possible in the far northwestern most counties of cotton country - The

impact of frost would be minimal if it occurs - A

reinforcing shot of cold air comes into the Midwest early to mid-week next week chilling down a part of the region and generating a few showers of light rainfall as it arrives - Excellent

drying conditions are expected in many U.S. crop areas during the weekend and next week - The

exception will be in the southwestern Plains where some upslope precipitation might occur briefly during mid-week - Warming

will return to much of the central and western United States this weekend into next week - Other

than brief showers expected in the U.S. Delta and southeastern states this weekend the region should be relatively dry until late next week with showers are possible near the Gulf of Mexico coast. - California

and the interior Pacific Northwest and a part of the far northwestern U.S. Plains will continue dry for the next ten days - Canada’s

Prairies from southern and eastern Alberta into western and some central Saskatchewan locations will remain quite dry for the next couple of weeks - Europe

weather will remain tranquil into the weekend except in the southern Balkan Countries where periods of rain are expected - The

moisture will be great for easing long term dryness and supporting winter crop planting - Some

harvest delay is expected - Western

CIS crop areas will experience a restricted amount of rain during the balance of this week and into the weekend, but precipitation will slowly increase next week - Totally

dry weather is not expected through the weekend with at least a little precipitation expected - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Northeastern

Xinjiang, China will continue wet and cool today and Wednesday and then drier weather is expected and it should last into next week greatly improving harvest progress after an extended period of wet and cold weather - Western

Xinjiang cotton harvest progress will continue to advance favorably - India

crop weather will be good through the weekend with rain in the south and east leaving the central and north dry - Rain

is expected in Uttar Pradesh next week, but it should not get into Punjab or Haryana which will help protect unharvested cotton and other crops in that area - Northwestern

and north-central India will continue dry for the next couple of weeks supporting fieldwork and crop development - China’s

Northeastern Provinces and North China Plain will experience net drying conditions for a while and that will be good for drying out crops after a wet early autumn - Harvesting

may be a little behind schedule because of the frequent precipitation and wet field conditions - Much

of the Yellow River Basin will also experience net drying - East-central

China will be wettest beginning late this week and lasting through much of next week possibly bringing too much moisture into summer crop harvest areas resulting in field working delays - Some

concern over crop quality might evolve if the rain prevails too long - Southern

and easternmost Australia will receive rain during the next week to ten days supporting crop development and some spring planting in eastern Queensland, but grater rain is needed in western Queensland crop areas due to ongoing drought - Tropical

Storm Kompasu was located 276 miles southeast of Hong Kong near 18.8 north, 116.6 east moving westerly at 17 mph and producing maximum sustained wind speeds of 63 mph - Kompasu

will move westerly today and Wednesday reaching Hainan, China Wednesday, and northern Vietnam by the end of this week - Strong

wind and heavy rain will accompany the storm with Hainan, China most impacted along with a part of northern Vietnam possibly - Rice

and sugarcane may be impacted due to flooding rainfall - Tropical

Storm Namtheun was located far out into the western Pacific Ocean over open water and poses no threat to eastern Asia

- The

storm will pass well to the east of Japan this weekend and early next week - Hurricane

Pamela was located 280 miles southwest of Mazatlán, Mexico at 0700 CDT today, but was expected to turn to the northeast soon and reach land in southern Sinaloa Wednesday - Moisture

from the storm will stream to the northeast across central Mexico and into a part of central Texas - The

storm will move across Mexico and diminish to tropical storm status relatively quickly after moving inland, but may be a dissipating depression near the Texas border Thursday - Moisture

will not only stream across Texas from this storm, but into a parts of the Midwest, as well - Crop

damage is possible near the coast, but conditions will improve with distance away from the coast - Corn,

sorghum, some dry beans, and a few other crops will be impacted, but losses are expected to be low - Southeast

Asia rainfall is expected to be greatest from the northern Philippines through Hainan, China and into much of Vietnam, Laos, Cambodia, and Thailand during the next week to ten days - Rain

will also fall in Indonesia and Malaysia, although it will be a little more erratic and light - Central

Africa will continue to experience periodic rainfall during the next ten days maintaining good coffee, cocoa, sugarcane, rice, cotton, and other crop conditions - Drier

weather will soon be needed in some cotton areas - North

Africa is not likely to see much rain for a while, but that is not unusual for this time of year - South

Africa rainfall will be restricted for a while, but totally dry weather is not expected - Many

areas away from the coast will be left dry or experience net drying conditions - Winter

crops will develop favorably following previous rainfall and some early spring planting will be starting soon if it has not already begun - Rain

will be needed later this month to ensure good maize and other early season crop planting

- Today’s

Southern Oscillational Index was +10.32 and it was expected to move erratically during the coming week - New

Zealand weather is expected to be a little wetter and cooler biased this week and then drier and warmer next week - Mexico

rainfall will be restricted this week except for the heavy rain associated with Tropical Storm Pamela - Central

America rainfall will be below average this week except in Costa Rica, Panama, and El Salvador where rainfall will be near to above normal

Bloomberg

Ag Calendar

Tuesday,

Oct. 12:

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - USDA

export inspections – corn, soybeans, wheat, 11am - China

farm ministry’s CASDE outlook report - U.S.

crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm - AHDB

grain market outlook conference - French

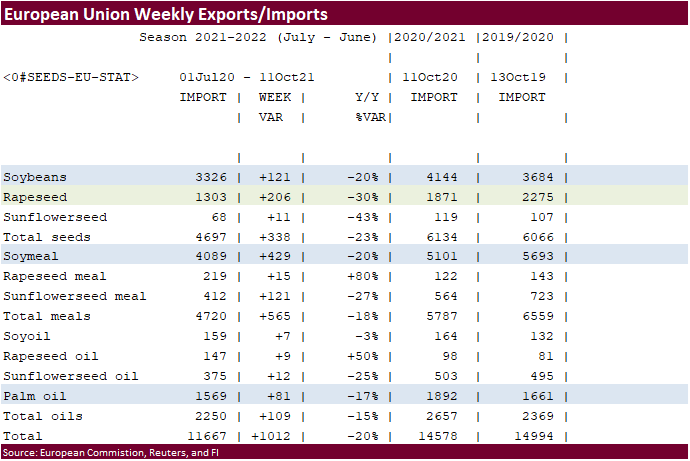

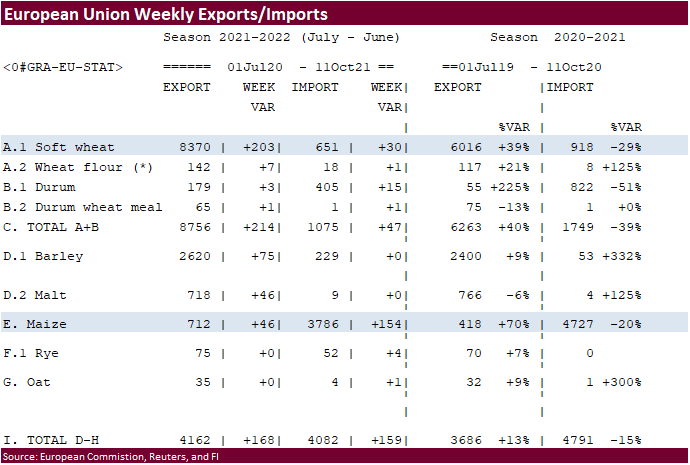

agriculture ministry’s crop production estimate - EU

weekly grain, oilseed import and export data - Vietnam

customs to release September commodity trade data - HOLIDAY:

Brazil

Wednesday,

Oct. 13:

- China’s

first batch of September trade data, including imports of soybeans, meat, and edible oils - New

Zealand food prices - France

AgriMer monthly grains report - European

cocoa grindings - Brazil

Unica cane crush, sugar output data (tentative) - HOLIDAY:

Thailand

Thursday,

Oct. 14:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - EIA

weekly U.S. ethanol inventories, production - Port

of Rouen data on French grain exports - North

America cocoa grindings - Suedzucker

half-year earnings - Agrana

half-year earnings - HOLIDAY:

Hong Kong

Friday,

Oct. 15:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

monthly data on green coffee stockpiles - Malaysia

Oct. 1-15 palm oil exports - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Source:

Bloomberg and FI

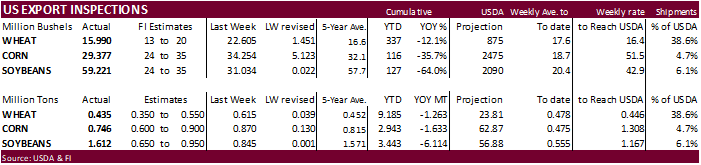

USDA

inspections versus Reuters trade range

Wheat

435,173 versus 300000-650000 range

Corn

746,200 versus 600000-1000000 range

Soybeans

1,611,731 versus 650000-1200000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING SEP 30, 2021

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 09/30/2021 09/23/2021 10/01/2020 TO DATE TO DATE

BARLEY

0 0 1,397 6,550 7,124

CORN

808,814 636,037 910,973 2,066,892 3,729,562

FLAXSEED

0 0 0 24 389

MIXED

0 0 0 0 0

OATS

0 0 0 200 1,196

RYE

0 0 0 0 0

SORGHUM

77,392 136,758 158,333 229,200 396,430

SOYBEANS

844,488 485,469 2,083,224 1,831,037 7,088,214

SUNFLOWER

0 0 0 0 0

WHEAT

611,621 383,584 679,769 8,710,303 9,933,449

Total

2,342,315 1,641,848 3,833,696 12,844,206 21,156,364

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macro

79

Counterparties Take $1.367 Tln At Fed’s Fixed-Rate Reverse Repo ($1.371 Tln, 77 Bidders)

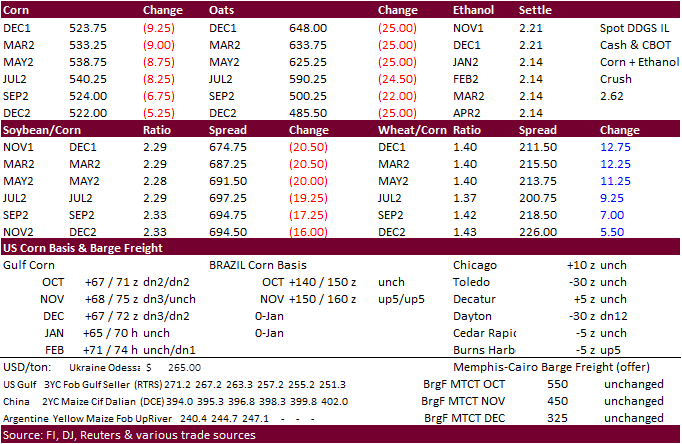

·

Corn ended lower on a bearish USDA report, weaker soybeans, and higher USD. December corn hit a three-week low.

·

USDA reported a slight increase in the US yield while the trade was looking for a slight decrease.

·

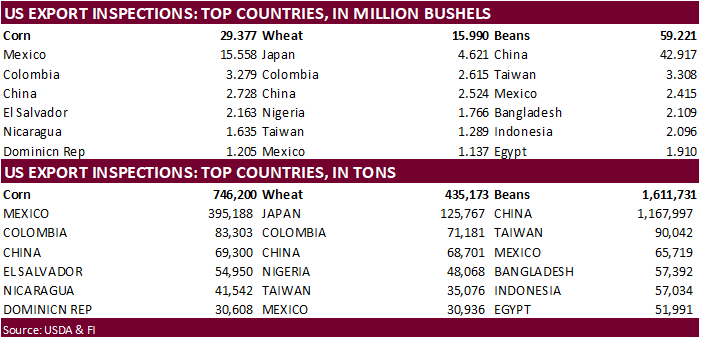

USDA US corn export inspections as of October 07, 2021, were 746,200 tons, within a range of trade expectations, below 870,085 tons previous week and compares to 846,596 tons year ago. Major countries included Mexico for 395,188

tons, Colombia for 83,303 tons, and China for 69,300 tons.

·

Rain this week will fall across northern and eastern Plains and most of the Midwest, delaying harvest progress, particularly across North Dakota, eastern Iowa, and Missouri.

·

We look for US corn harvest progress to be reported around 40 percent as of last Sunday, 9 points above average. Harvesting delays this week should be uneventful.

·

Argentina’s AgMin created a rule that forces producers to sell old crop corn (recently harvested) before they can register new-crop sales (corn that is going into the ground now). The AgMin put out a follow up statement today

and mentioned the export market remains “open.” A lot of new-crop corn had already been sold. The Reuters article that covered this topic mentioned Argentina producers already sold 38.5 million tons of the expected upcoming 55-million-ton crop.

·

France’s AgMin raised their corn production estimate by 900,000 tons to 13.9 million tons, up 4.3 percent from 2020.

·

China in its monthly supply and demand update lowered their corn production by 850,000 tons to 271 million after cutting the yield due to recent heavy and persistent rain that impacted quality. Corn acreage, imports and consumption

remain unchanged.

·

China hog futures appreciated 3 precent on Tuesday. China unveiled plans to buy pork from the reserves to support prices.

·

USDA Attaché: Brazil Grain and Feed update (new-crop stocks are expected to swell)

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Update_Brasilia_Brazil_09-27-2021.pdf

Export

developments.

-

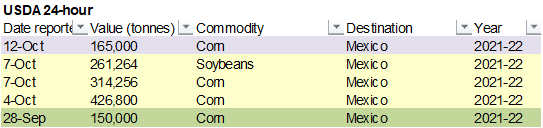

Under

the 24-hour announcement system, USDA reported 165,000 tons of corn sold to Mexico.

-

Turkey

seeks 325,000 tons of feed corn on October 14 for November 14 through December 6 shipment.

Updated

10/12/21

December

corn is seen in a $4.85-$5.55 range (unch, down 10)

March

corn is seen in a $5.00-$5.70 range (unch,

down 10)

·

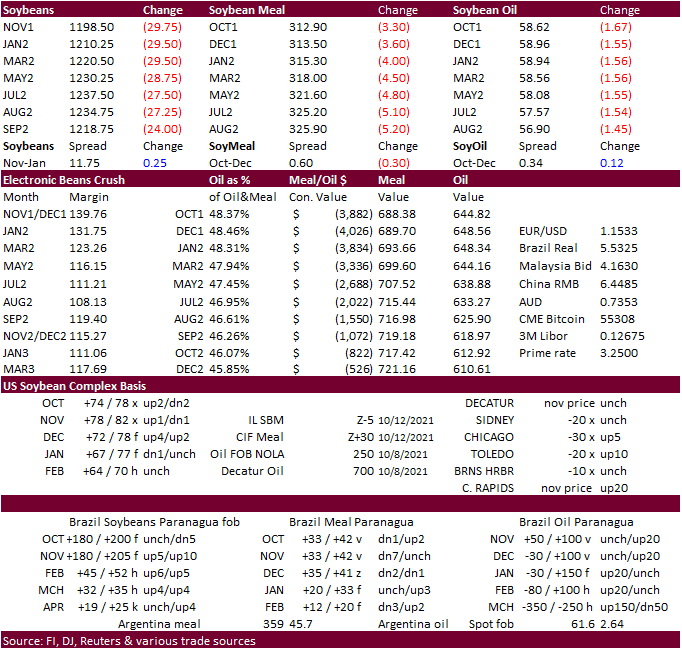

Soybeans ended lower (near session lows) from a bearish USDA report and weaker soybean oil. Soybeans fell 27.25-30.00 cents. November soybeans remained at their lowest level since March 31, but on a rolling basis soybeans reached

their lowest level since December 2020. Soybean oil gave up 155-167 points on a higher outlook for new-crop ending stocks. Global vegetable oil prices eased overnight led by palm oil. Meal dropped $3.30-5.20/short ton. Meal/oil spreading was noted.

·

Prior to the report we heard China bought about 8 cargoes of US PNW soybeans at around 310 over the Jan. This did little to generate buying interest.

·

USDA US soybean export inspections as of October 07, 2021, were 1,611,731 tons, above a range of trade expectations, above 844,610 tons previous week and compares to 2,469,405 tons year ago. Major countries included China for

1,167,997 tons, Taiwan for 90,042 tons, and Mexico for 65,719 tons.

·

Soybean inspections included 52k shipped out of the Texas Gulf. Yesterday Reuters noted Cargill’s Texas terminal was up and running after getting damaged from Ida.

·

France’s AgMin left unchanged their rapeseed production estimate at 3.3 million tons.

·

November Paris rapeseed futures were down 4.25 to 641.25 euros at the time this was written.

·

Cargo surveyor SGS reported month to date October 10 Malaysian palm exports at 496,696 tons, 51,724 tons below the same period a month ago or down 9.4%, and 66,154 tons below the same period a year ago or down 11.8%. There was

an unusual volume of CME palm oil block trades overnight. Normally we see this type of volume on Sunday night. Malaysian palm oil futures declined 2 percent on Tuesday.

·

China in its monthly supply and demand update raised its domestic edible oils consumption and imports in for 2021-22 year from the previous month.

Export

Developments

-

None

reported

Updated

10/12/21

Soybeans

– November $11.50-$13.00 range (down 50), March $11.50-$13.50 (down 50)

Soybean

meal – December $295-$335 (down 10, unch), March $300-$360

Soybean

oil – December 57-63 cent range (down 300, down 200), March 56-65 (down 200, down 200)

·

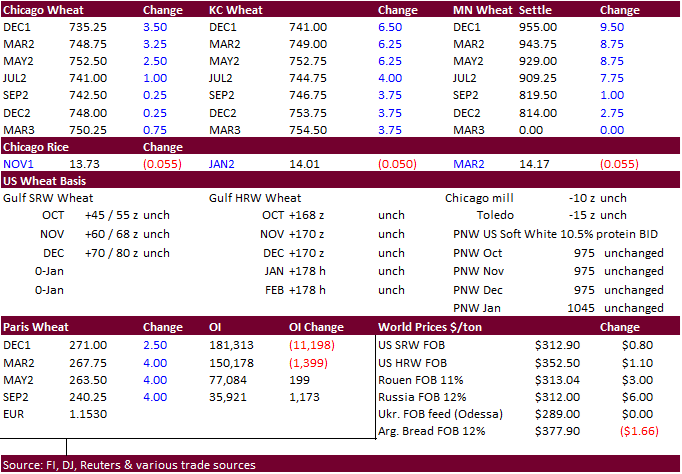

US wheat ended higher led by the Minneapolis contract after USDA reported a neutral to slightly friendly S&D report. MN wheat rallied 9-11 cents in the nearby position. Chicago and KC ended 0.75-5.25 cents higher. Wheat spreading

against soybeans and corn should not be discounted. USDA cut the Canadian wheat production estimate by 2 million tons.

·

Egypt’s GASC cancelled their wheat import tender due to high prices offered. It was intended for Nov. 23-Dec. 3 shipment. Lowest offer was believed to be $325.25 a ton fob from Ukraine.

·

USDA US all-wheat export inspections as of October 07, 2021, were 435,173 tons, within a range of trade expectations, below 615,213 tons previous week and compares to 514,673 tons year ago. Major countries included Japan for 125,767

tons, Colombia for 71,181 tons, and China for 68,701 tons.

·

The US Great Plains will see rain developing across the eastern areas Wednesday. The southern areas will see rain Thursday and Friday.

·

December Paris wheat was 2.50 euros higher at 271.50 euros a ton.

·

France’s AgMin lowered the soft wheat production estimate by 900,000 tons to 35.2 million tons, up nearly 21 percent from 2020.

Export

Developments.

·

Egypt’s GASC cancelled their wheat import tender due to high prices offered. It was intended for Nov. 23-Dec. 3 shipment. Lowest offer was believed to be $325.25 a ton fob from Ukraine.

·

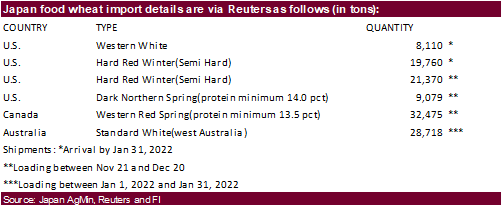

Japan seeks 119,512 tons of food wheat on Thursday for arrival by January 31.

·

Jordan seeks 120,000 tons of wheat set to close October 13.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on October 13 for arrival by February 24.

·

Pakistan seeks 90,000 tons of optional origin wheat on October 13. They already bought 550k and 575k since September 23.

·

Jordan seeks 120,000 tons of barley on October 14 for LH December through FH February delivery.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

Rice/Other

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December

MN wheat is seen in a $9.00‐$9.75, March $9.00-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.