PDF Attached

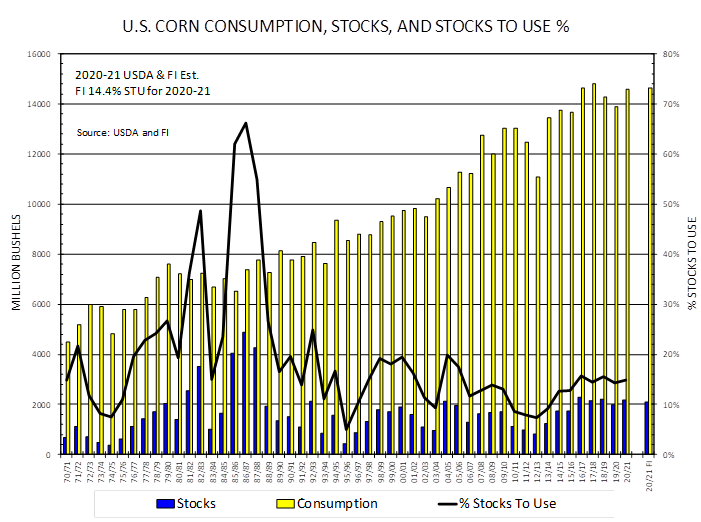

Attached

is the US corn balance sheet.

GREATEST

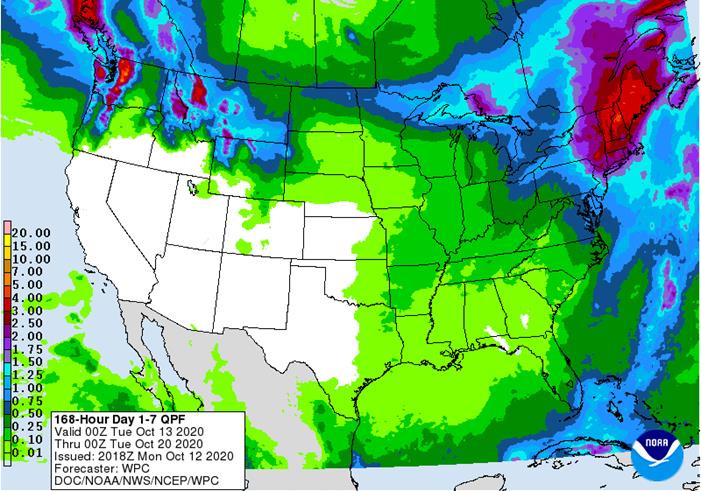

WEATHER ISSUES OF THE DAY

- Tropical

Storm Linfa formed east of Vietnam during the weekend and moved inland Sunday producing torrential rain along the central Vietnam Coast - The

storm produced exceptionally great rainfall along the coast with amounts to 27.16 resulting at Da Nang and 14.13 inches at Hue - Flooding

is quite serious in the region and damage to property and some crops has resulted - Queensland

and northeastern New South Wales, Australia has a good chance for rain periodically next week

- The

moisture may stimulate improved planting moisture for dryland cotton, sorghum and other crops - Western

Australia still has some “potential” to receive some needed rain next week. If the moisture evolves there would be at least a short term bout of improvement in topsoil moisture during reproduction and filling for wheat, barley and canola - The

moisture is badly needed to bolster soil moisture and to prevent any further decline in potential yields because of net drying - The

European model continues dry biased for the next ten days - Russia’s

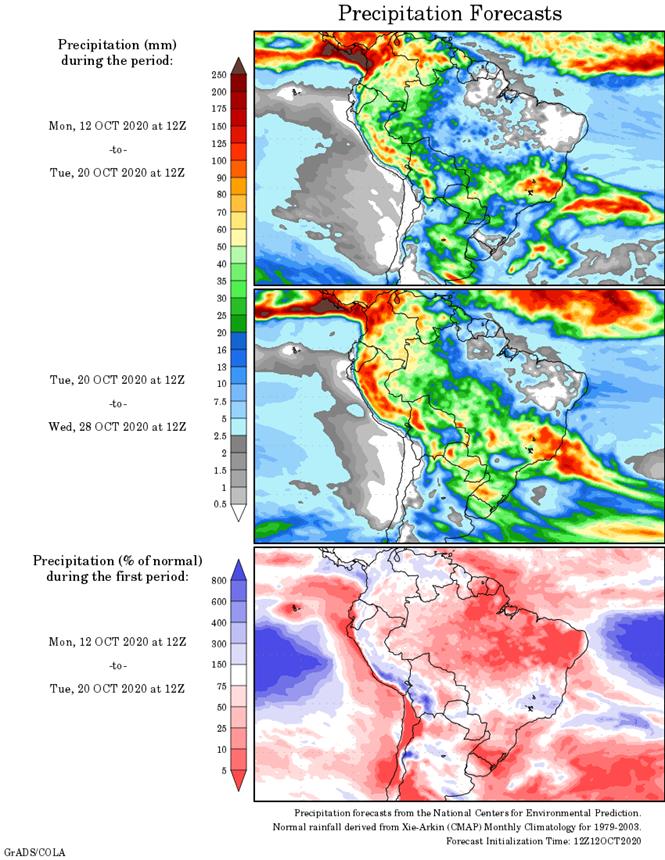

Southern Region is not expecting “meaningful” rainfall over the next ten days to two weeks and the same is true for Kazakhstan, although there may be a few spits and spats of moisture infrequently - Argentina’s

rain potential has improved in the north for mid-week this week and there is still at least one opportunity for rain in key grain and oilseed production areas next week - The

moisture is needed to improve early corn and sunseed establishment and to stimulate some new planting - The

moisture is also needed to maintain wheat production potentials and prevent any further decline

- Rain

is needed most in Cordoba, central and northern Santa Fe and Santiago del Estero - Brazil’s

center south and center west will encounter scattered showers and thunderstorms over the next ten days which should improve early soybean planting conditions for many areas, but not all.

- Greater

rain will still be needed in several areas - Corn,

rice and other crops will benefit from the moisture as well - Brazil’s

coffee areas from northern Parana to Zona de Mata should get rain later this week through next week to stop the decline in crop conditions and to induce some flowering - U.S.

Southern Plains have very little potential for “meaningful” rain over the next ten days leaving unirrigated crops stressed in dry soil - Some

delay in additional planting and germination is expected until rain falls - Recent

hot weather has been stressful for unirrigated seedlings raising the potential for crop failure - Cooling

this week will reduce some of the crop stress, but rain is needed - Dryness

in the U.S. Plains continues to expand quickly under high temperatures, low relative humidity and strong wind speeds - Livestock

stress in the U.S. Plains has been high recently, but cooling this week will reduce some of that stress - Northern

U.S. Plains will begin to receive some periodic rain over the coming week to ten days - The

region is quite dry and winter crops need moisture for improved establishment - The

precipitation advertised may be a little erratic and light - U.S.

harvest weather in the lower Midwest and Great Plains will be mostly good through the next ten days , despite a couple of cool fronts and brief bouts of rain - Rain

is expected in the northern Plains and upper Midwest most often causing some disruption to fieldwork, but progress will advance between events - Temperatures

will be warm early this week and then colder for the balance of this week and into the weekend - The

cool bias will slow evaporation rates which may delay drying rates for those areas that get periodic rain - Harvesting

in the drier areas will advance well, despite cooling - U.S

Delta and southeastern states will experience net drying conditions for at least ten days (after rain ends in the southeastern states Monday) - The

drying is needed to promote crop maturation and harvest progress - Several

days of drying will be needed before fieldwork can begin in those areas impacted by excessive rain from Hurricane Delta or other recent rain - Central

India rainfall will increase late this week through the weekend causing some delay in summer crop harvesting and raising a little crop quality concern for soybeans, pulse crops and cotton as well as a little mature rice - Drying

should evolve again next week

OTHER

WEATHER ISSUES OF INTEREST

- Hurricane

Delta moved into Louisiana Friday evening and moved as expected through the lower Mississippi River Basin to the Tennessee River Basin where it dissipated - Rainfall

of ranged from 8.00 to more than 20.00 inches in the interior southwestern part of Louisiana

- Rainfall

ranged from 4.00 to more than 8.00 inches in the remaining middle two thirds of Louisiana and ranged from 2.00 to 5.00 inches in southeastern Arkansas and west-central Mississippi while 1.50 to 3.00 inches occurred in many other areas in northeastern Arkansas,

southwestern Tennessee and northern Mississippi. - Rainfall

also ranged from 1.50 to more than 4.00 inches in central, east-central and northeastern Alabama and western and central North Carolina as well as northern South Carolina - Rainfall

of 3.00 to nearly 8.00 inches from north-central through northeastern Georgia

- Weekend

temperatures in the United States were unusually warm in the central states and seasonably warm elsewhere - Many

highs were in the 80s and lower 90s - Typhoon

Chan-Hom stayed south of Japan’s main islands during the weekend, but heavy rainfall occurred in southern Honshu with amounts of 1.34 to 3.50 inches with local totals of up to 7.00 inches

- Some

local flooding resulted - Crop

damage away from the coasts was minimal - The

typhoon has dissipated - A

previous tropical disturbance that was along the southern Vietnam coast Friday moved west northwesterly into the Andaman Sea produced local rain totals over 4.00 inches in a part of southwestern Thailand early in the weekend - Extreme

amounts reached 11.46 inches - Tropical

disturbance 205 miles southeast of Visakhapatnam in northeastern Andhra Pradesh at 0600 GMT today was moving westerly while producing wind speeds of up to 25 mph - The

system will continue to organize and intensify before moving inland through northeastern Andhra Pradesh later today and early Tuesday - The

storm will then move to Maharashtra after passing through Telangana during mid-week, but may linger along the west-central India coast during the balance of this week and into the weekend producing waves of rain - Rainfall

will be heavy this week varying from 2.00 to more than 6.00 inches with local totals approaching 10.00 inches in several locations resulting in some flooding - Tropical

Storm Nangka was located 277 miles south southeast of Hong Kong at 18.0 north, 115.1 east at 0900 GMT today moving westerly at 15 mph and producing maximum sustained wind speeds of 40 mph out 45 miles from the storm center - Nangka

will strengthen, but remain at tropical storm status over the next 24 hours before weakening - The

storm will move over Hainan, China late Tuesday and Wednesday before reaching northern Vietnam later this week - Some

flooding rain is expected in both areas - One

more tropical cyclone may evolve near the Philippines later this week before moving across the South China Sea and reaching central Vietnam at the end of this week and during the weekend - Some

heavy rain and flooding is expected in Vietnam’s Central Highlands possibly threatening some of its coffee production

- Another

tropical cyclone may evolve in the Bay of Bengal this weekend that could threaten the central east coast of India with more excessive wind, rain and flooding - Southern

Oscillation Index rises to highest level of the La Nina event at +12.34 and the index is expected to level off for a while this week - The

strongly positive index can be an early indicator of increasing rainfall for Southeast Asia, India and eastern Australia - Improved

South Africa rainfall is also a possibility as the SOI strengthens and then prevails, but today’s outlook is not offering much more than sporadic showers and thunderstorms

- Central

and eastern Europe rainfall will be abundant to excessive this workweek - Rain

totals of 2.00 to more than 6.00 inches will occur from the Adriatic Sea region to eastern Germany and Poland through Friday

- The

moisture will delay fieldwork and result in some flooding - Unharvested

summer crop quality may decrease - Improving

weather will occur across Europe for several days later this week through the weekend before a new stormy pattern evolves in western parts of the continent next week - Kazakhstan

remains too dry and no relief is expected for two weeks - South

Africa weather is slowly improving with recent rain in the south and east, but more rain is still needed to support spring planting and to ensure the best finish for winter crops - An

erratic precipitation pattern is expected over the next ten days resulting in some additional pockets of improvement, but more generalized rain will be needed - Southeastern

Canada and the U.S. Great Lakes region will continue to experience periodic rainfall during the coming week to ten days which may lead to some delay in farming activity - Drier

biased weather is needed to expedite fieldwork - Southeast

Asia rainfall over the next ten days will be erratic, but most areas will be impacted multiple times in the next two weeks supporting most crop needs - Mexico

precipitation will be most significant in the south of the nation over the coming week to ten days - Central

America will be sufficient wet over the next ten days to two weeks delaying early season crop maturation but favoring long term water supply.

·

West-central Africa will experience waves of rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

- Cotton

areas need some drier weather - Rainfall

will be well above average in areas from Ghana to Guinea, Sierra Leone and Liberia

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda, southwestern Kenya and portions of Ethiopia will be impacted while Tanzania receives restricted amounts of rain

·

Philippines rain will be widespread over the next ten days to two weeks maintaining a favorable outlook for crops

- Some

heavy rain will come with the next tropical cyclone later this week

·

New Zealand weather will be wetter than usual in North Island and western parts of South Island while below average in eastern parts of South Island

- Temperatures

will be below average

Source:

World Weather Inc.

Monday,

Oct. 12:

- EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysian

Palm Oil Board releases Sept. end- stocks, output, exports - SGS

releases Malaysia Oct. 1-10 palm oil export data - Cherkizovo

trading update - Vietnam

Customs data on coffee, rice and rubber exports in September - HOLIDAY:

Argentina, Brazil, Canada, Chile

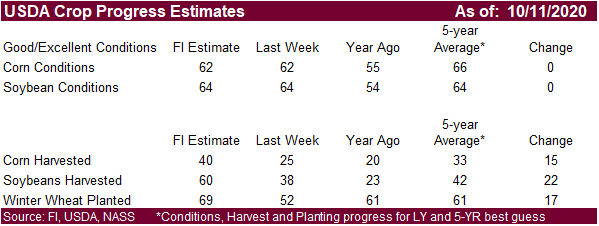

Tuesday,

Oct. 13:

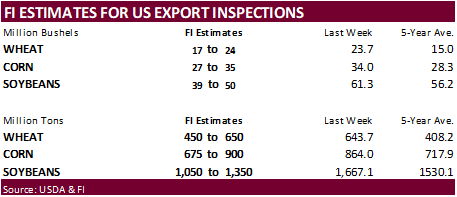

- U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm

- USDA

weekly corn, soybean, wheat export inspections, 11am - China

trade data on soybeans and meat imports - New

Zealand Food Prices - France’s

agriculture ministry crop estimates - U.K.’s

AHDB Grain Market Outlook Conference - U.S.

winter wheat planted, 4pm - HOLIDAY:

Thailand

Wednesday,

Oct. 14:

- Leman

China Swine Conference, Chongqing, day 1 - FranceAgriMer

monthly crops report - Global

Food Forum, Australia, day 1 - Malaysia

3Q cocoa grinding figures

Thursday,

Oct. 15:

- Malaysia

Oct. 1-15 palm oil export data - Port

of Rouen data on French grain exports - EIA

U.S. weekly ethanol inventories, production, 10:30am - Global

Food Forum, Australia, day 2 - Leman

China Swine Conference, Chongqing, day 2 - European

Cocoa Association grindings

Friday,

Oct. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Asia

3Q cocoa grinds - Cocoa

Association of Asia’s webinar on Asian cocoa demand - Leman

China Swine Conference, Chongqing, day 3

Source:

Bloomberg and FI

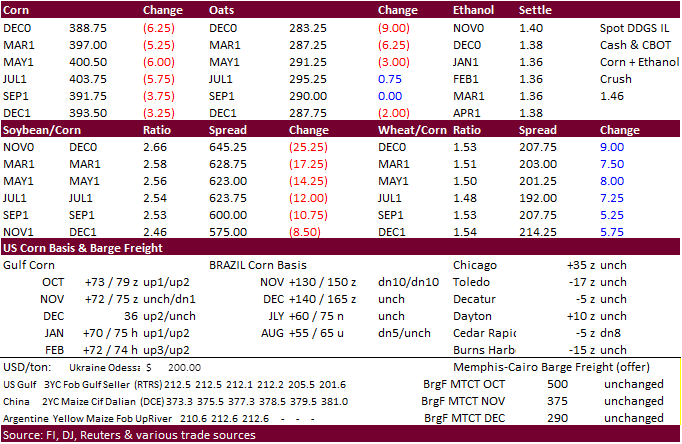

Corn.

-

Corn

futures traded two-sided, ending 4.0 to 6.0 cents lower. -

Funds

sold an estimated net 28,000 corn contracts. -

Ukraine’s

UGA lowered crop estimates for corn and wheat production to 32.5 million tons from 35.3 MMT previously and 25.3 million tons from 26.6 previous, respectively. Ukraine corn production was taken down 2 million tons to 36.5 million tons by USDA. Russian corn

was unchanged at 15 million tons. -

Germany

ASF: 10 new cases; 65 cases since September 10

Corn

Export Developments

-

Iran

seeks 200,000 tons of barley on October 14. -

Taiwan’s

MFIG seeks 65,000 tons of corn on October 14 for Dec/Jan shipment.

Updated

10/9/20

December

corn is seen in a $3.75-$4.10 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.