PDF Attached

Developing:

Reports Railroad Union Has Rejects The Tentative Labor Deal Backed By US Pres. Biden. This raises a potential rail strike.

Grains

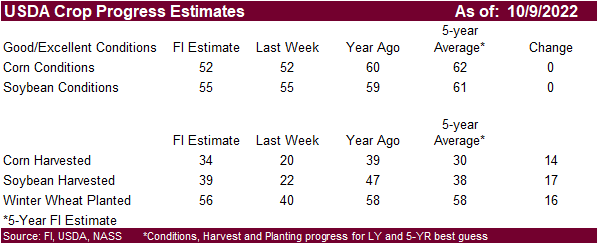

were up sharply on Black Sea shipping concerns despite a higher USD and lower WTI crude oil market. The soybean complex sold off well from session higher. We think the reopening of two Miss. River points and currency strength pressured the complex. It was

a light trade. US government offices and banks were closed today for Columbus Day. US export inspections and crop progress will be released Tuesday. Russia threatened Ukraine with more strikes after a key bridge linking Crimea was blown up over the weekend.

Bloomberg noted infrastructure facilities in eight Ukraine regions were hit in the missile strikes Sunday into early Monday, including the city of Odessa, a major grain hub.

Mississippi

River water levels are still low. The back end of the US Midwest forecast calls for rain. Weekend weather for the US was as expected for the US, with some rain falling across NE, KS, parts of TX and OK, followed by MN and other upper Midwestern areas. Parts

of the Midwest will see rain mid this week, bias southwestern areas. Brazil will see widespread rains this week while Argentina will dry down again after seeing some rain over the weekend. India and eastern Australia saw flooding over the weekend.