PDF Attached

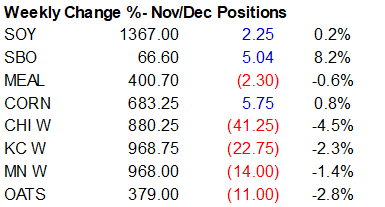

Calls for tonight vary on Black Sea trade concerns and US harvest weather. We have a lower bias for the soybean complex and grains after the rally on Friday.

For now, we are looking at soybeans 3-5 lower, corn 1-3 lower and wheat 3-6 lower.

US

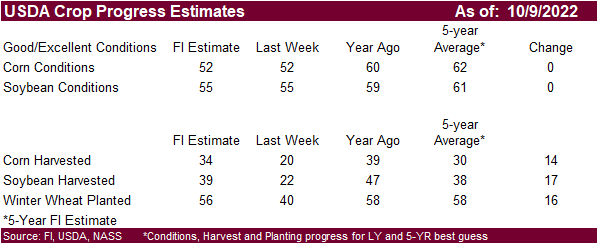

CBOT agriculture commodities rallied despite heavy selling in equities and a USD up nearly 49 points. Otherwise, it was a slow trading day for the ags. Volume was down and fundamental news was light post US jobs report. Many traders were focused on the $4.75

per barrel increase in WTI and weaker US stocks. Look

for some harvest pressure to hit the US ag markets next week. The US weather outlook will be ideal for harvesting progress. Mississippi River water level problems are expected to continue over the next 7-10 days, at least. No deliveries were posted for meal

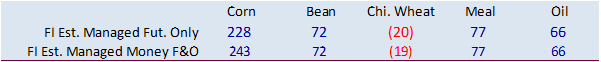

Friday night and registrations were unchanged. Note Reuters corrected their USDA trade estimates for US production and stocks. The investment fund positions as of last Tuesday were not as long as expected.