PDF Attached

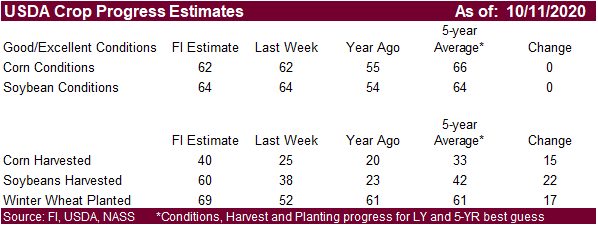

USDA

released their October S&D report

Reaction:

Bullish bias soybeans, neutral corn, and slightly bearish Chicago wheat but friendly for KC type wheat.

USDA

NASS and OCE executive summaries

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

https://www.usda.gov/oce/commodity/wasde/Secretary_Briefing/index.htm

MORNING

WEATHER MODEL COMMENTS

NORTH

AMERICA

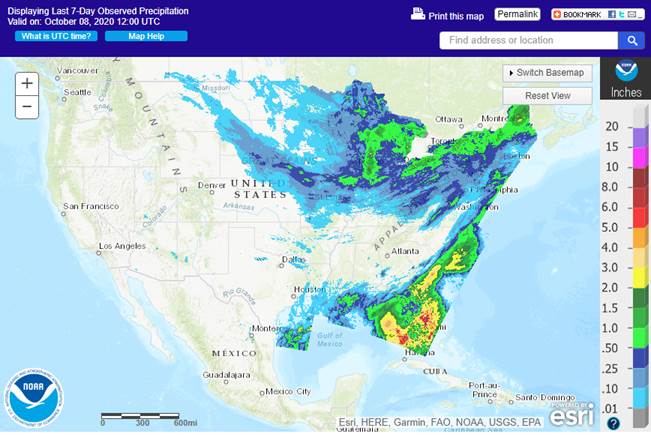

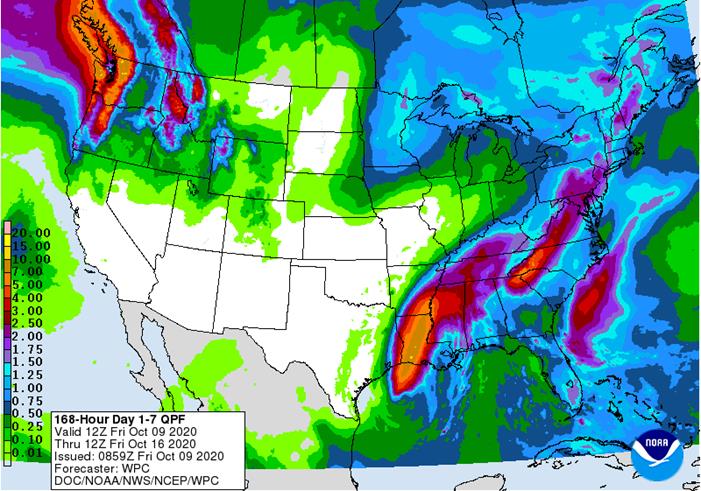

- No

significant changes were noted to the outlook overnight - Hurricane

Delta will come ashore into Louisiana as expected with the remnants of the system moving through the heart of the lower Mississippi River Valley and then from Tennessee to the middle Atlantic Coast states over the weekend and into Monday - A

mid-latitude frontal system will move across the central and eastern states Sunday into Tuesday generating a little rain in the northern Midwest - Cooling

will follow the early week frontal system with a couple of reinforcing shots of cool air expected in the following week bringing a few sporadic showers with each occurrence - Most

of hard red winter wheat country will remain dry or nearly dry - Northwestern

U.S. Plains are not likely to see much moisture - Some

rain will fall in the Pacific Northwest, but will favor the mountains and not the valleys

The

00z GFS model run was too wet in the central and southern Plains. The drier 06z and especially the European model runs are preferred.

SOUTH

AMERICA

- No

theme changes were noted overnight - GFS

model outlook has not changed greatly for center west into center south Brazil for next week and the following weekend with rain expected in many areas - Restricted

rainfall occurs in Mato Grosso do Sul, western Parana and western Sao Paulo through October 19 - Rain

this weekend will occur mostly from eastern Santa Catarina to Rio de Janeiro and southeastern Minas Gerais - Far

southern Brazil is still advertised to see a good mix of rain and sunshine during the next ten days to two weeks favoring crops and fieldwork - No

changes were noted in Argentina for the first 8-9 days of the outlook with southern Buenos Aires most of the nation’s significant rain – most of which occurs Saturday into Sunday of this week - Argentina

rainfall was still advertised to increase Oct. 18-21, but the 06z GFS was much too wet suggesting a widespread general soaking of rain - However,

some increase in rainfall is expected during this period of time, but it is too far out in time to get specific and have high confidence

The

generalities of the South America outlook have not changed much today relative to the previous model run or the overall outlook suggested Tuesday. Argentina is not likely to see much rain until October 18 except in Buenos Aires where some rain will fall this

weekend. The potential for at least some dryness relief is improving for the Oct. 18-21 period, but confidence in its significance is still low. In Brazil, a period of beneficial moisture will impact center west and center south crop areas next week and the

following weekend; although portions of Mato Grosso do Sul and western and northern Parana as well as western Sao Paulo may not get much rain and will need more soon.

EUROPE/BLACK

SEA REGION

- Some

additional rain fell in western Ukraine overnight with amounts to 1.14 inches, but this moisture did not reach into eastern areas - No

significant theme changes occurred overnight, although World Weather, Inc. still believes there is some “potential” for one of the many weather disturbances in Europe to spin out into some of the drier areas of eastern Ukraine, Russia’s Southern Region and

neighboring areas during the coming week to ten days - If

this occurs it would not be a general soaking and certainly would not be signaling the start of a rainier weather pattern - A

trough of low pressure in Europe that has been drifting east recently will eventually retrograde back to the west ending this “potential” for rainfall in the drier areas of the western CIS and once the retrograding is complete Russia’s Southern Region, eastern

Ukraine and Kazakhstan crop areas will be right back into the dry and warm bias for a while longer

CHINA

- No

general theme changes noted overnight - Northeastern

China will not be completely dry, but less frequent and less significant rain is expected and that will translate into much better grain and oilseed maturation and harvest progress over the next two weeks - A

good mix of weather is also expected in the Yellow River Basin and North China Plain where wheat planting, germination and emergence will occur while summer crops continue to mature and be harvested with little weather disruption.

- Periodic

rain near and south of the Yangtze River will slow farming activity occasionally and maintain some concern over crop conditions, but the environment in general is expected to improve slowly

PLEASE

NOTE THAT CHINA WEATHER OBSERVATIONS HAVE NOT BEEN AVAILABLE FOR THE PAST TWO DAYS

INDIA

- No

general theme changes were noted overnight - Concern

will be rising over frequent rainfall in central India during the week next week and into the following weekend - Delays

in harvest progress and concern over some crop quality will likely increase - Weather

this weekend is expected to remain mostly good as it has been in the past week

AUSTRALIA

- No

big changes were noted overnight in the coming ten days to two weeks - Western

Australia is still not advertised to receive much significant rain - Only

a few showers near the southern and lower western coasts are expected - There

is some “potential” for short term bout of rain in the southwest of the state October 20-22, but confidence is low today - Rain

will fall often enough in Victoria, South Australia and southern New South Wales to maintain a very good crop outlook - Rain

was increased in southeastern Queensland and northeastern New South Wales after October 18 to Oct. 21 on the 06z GFS model run - Some

of this increase would be welcome, but it might also be a little overdone - Some

increase in rainfall is possible during this period of time, but further adjustments in the outlook are expected during the weekend.

The

advertised potential rain events in southwestern Australia and Queensland during the second week of the forecast today has been showing up in the model data a little more routinely recently, but the systems advertised are not quite right and additional adjustments

will occur during the weekend and we will be watching these areas closely for Sunday’s weather update.

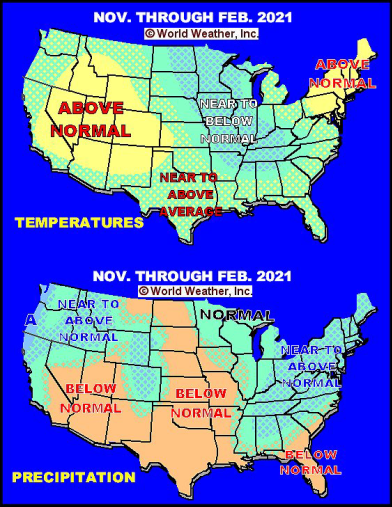

Source:

World Weather Inc.

FRIDAY,

Oct. 9:

- USDA’s

WASDE report with world supply/demand crops update, stockpiles noon - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - China

agriculture ministry (CASDE) to release its monthly data on supply and demand - FranceAgriMer

weekly update on crop conditions - Brazil

Unica cane crush, sugar production (tentative) - HOLIDAY:

Korea

Monday,

Oct. 12:

- U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysian

Palm Oil Board releases Sept. end- stocks, output, exports - SGS

releases Malaysia Oct. 1-10 palm oil export data - Cherkizovo

trading update - Vietnam

Customs data on coffee, rice and rubber exports in September - HOLIDAY:

Argentina, Brazil, Canada, Chile

Tuesday,

Oct. 13:

- USDA

weekly corn, soybean, wheat export inspections, 11am - China

trade data on soybeans and meat imports - New

Zealand Food Prices - France’s

agriculture ministry crop estimates - U.K.’s

AHDB Grain Market Outlook Conference - U.S.

winter wheat planted, 4pm - HOLIDAY:

Thailand

Wednesday,

Oct. 14:

- Leman

China Swine Conference, Chongqing, day 1 - FranceAgriMer

monthly crops report - Global

Food Forum, Australia, day 1 - Malaysia

3Q cocoa grinding figures

Thursday,

Oct. 15:

- Malaysia

Oct. 1-15 palm oil export data - Port

of Rouen data on French grain exports - EIA

U.S. weekly ethanol inventories, production, 10:30am - Global

Food Forum, Australia, day 2 - Leman

China Swine Conference, Chongqing, day 2 - European

Cocoa Association grindings

Friday,

Oct. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Asia

3Q cocoa grinds - Cocoa

Association of Asia’s webinar on Asian cocoa demand - Leman

China Swine Conference, Chongqing, day 3

FSA

US Acreage

U.S.

corn and soybean plantings

Prevented planting

(thousands of acres)

Crop

Oct 2020 Sept 2020 Oct 2019

Corn

6,177 6,078 11,420

Soybeans

1,476 1,451 4,459

Wheat

1,270 1,268 2,215

Rice

494 493 752

Barley

32 31 33

Sorghum

298 296 172

Cotton-Upland

402 400 494

U.S.

corn and soybean plantings

Plantings

(thousands of acres)

Crop

Oct 2020 Sept 2020 Oct 2019

Corn

88,212 87,560 86,974

Soybeans

81,854 81,455 74,956

Wheat

46,100 45,947 46,705

Rice

2,986 2,982 2,504

Barley

2,524 2,467 2,623

Sorghum

5,304 5,237 4,822

Cotton-Upland

11,667 11,630 13,223

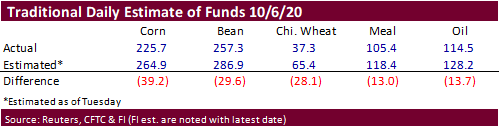

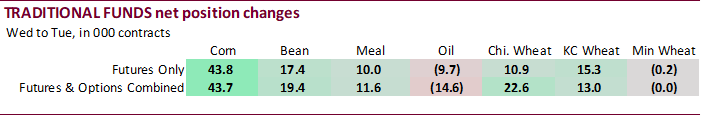

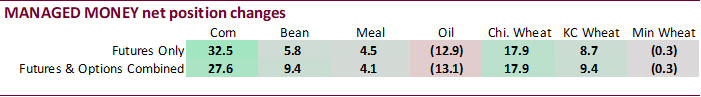

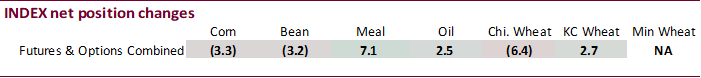

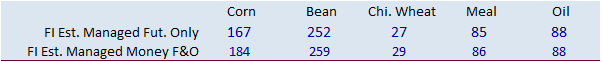

Traders

missed the long positions for all 5 commodities in this weeks CFTC COT report.

Macros

WH

Kudlow: Pres. Trump Has Cleared Relatively Broad-Based Deal

US

Gulf Shuts In 1.69M Bpd Or 91.55% Oil Production – BSEE

–

Shuts In 1,684.9 Mmcf/D Or 62.17% Gas Production

Canadian

Net Change In Employment Sep: 378.2K (exp 150.0K; prev 245.8K)

–

Unemployment Rate Sep: 9.0% (exp 9.8%; prev 10.2%)

–

Participation Rate Sep: 65.0% (exp 64.7%; prev 64.6%)

–

Full Time Employment Change Sep: 324.0 (prev 205.8)

–

Part Time Employment Change Sep: 44.2 (prev 40.0)

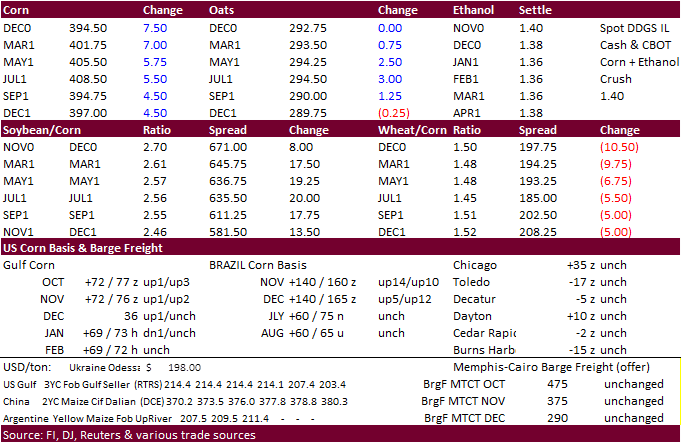

Corn.

-

A

higher than expected US corn carryout projection by USDA triggered soybean/corn spreading, but corn prices still rallied on sharply higher soybeans, and fund buying in wheat. December corn hit its highest level since late January. We raised our December

trading range (see below). -

Funds

bought an estimated net 40,000 corn contracts, 15,000 less than what they bought on September 30 (Grain Stocks Day).

-

USDA

reported the USDA corn yield at 178.4 bushels per acre, down 0.1 from the previous month. The trade was looking for 177.7. The harvested area was lowered 946,000 acres to 82.527 million, resulting in a 178-million-bushel reduction in production to 14.722

billion bushels. Production for US corn and soybeans came in below trade expectations.

-

USDA

lowered the US corn carryout by 336 million bushels, in part to adjusting for September 1 stocks, to 2.167 billion bushels, yet 54 million bushels above trade expectations.

-

With

a lower 2020-21 carry in stocks and reduction in production, USDA lowered feed use by 50 million bushels and corn for ethanol use by another 50 million.

-

US

corn exports were left unchanged at 2,325 million bushels, above 1,778 million in 2019-20. Note record US corn exports were 2,437.5 million in 2017-18 followed by 2,437.4 million in 2007-08 (100 difference). In 2017-18 combined Ukraine and Russia corn production

fell 6 million tons from the previous year. This year combined corn production for those two countries are expected to increase to 51.5 million tons from 50.2 million tons in 2019-20. For Brazil, USDA estimates 2020-21 corn exports will reach 39 million

tons, up from 34 million tons in 2019-20. The import demand increase for 2020-21 is most notable for the EU (24MMT) and SE Asia.

USDA

Export Sales Commitments As Of Early October:

2020-21

= 25.848 million tons – a record

2017-18

= 12.095 million tons

2007-20

= 23.785 million tons

-

Global

corn production was lowered 3.6 million tons to 1.159 million, 4 percent above last year. Stocks were taken down 6.3 million tons. With the US stocks lowered 8.5 million tons, this was partially offset by ending stocks by major importing countries.

-

Ukraine

corn production was taken down 2 million tons to 36.5 million tons by USDA. Russian corn was unchanged at 15 million tons.

-

There

were no major changes to China’s corn balance sheet for 2020-21, other than a smaller carry in.

-

CASDE:

China raised their 2020-21 corn import projection by 2 million tons to 7 million. We think it could end up to more than 9 million tons. CNGOIC sees a 25 million ton shortage in China’s corn supply.

-

China

discovered ASF in piglets in Chongqing, first outbreak since July 25. -

Germany

ASF: 53 cases since September 10 -

Ukraine

EconMin sees grain exports so far this season down 11.8 percent to 13.02 MMT, including 774,000 tons of corn (2.33 MMT same period year ago).

Corn

Export Developments

-

None

reported

Updated

10/9/20

December

corn is seen in a $3.75-$4.10 range

China

could easily change the global balance sheet if they boost corn imports above 15 million tons in 2021.