PDF Attached

Wild

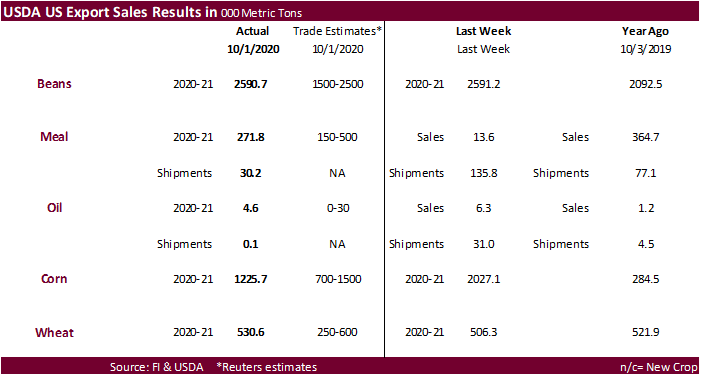

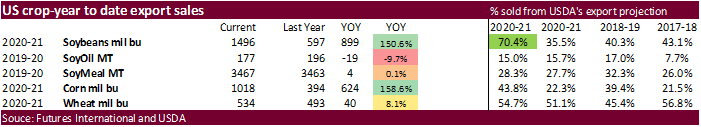

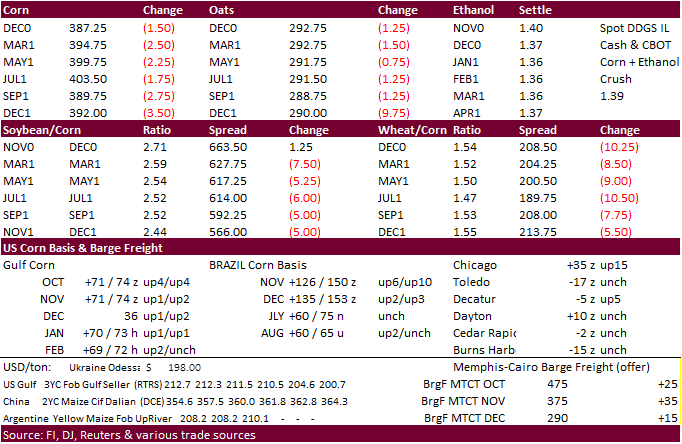

trade in US agriculture markets with wheat leading corn and soybeans lower. USDA reported additional 24-hour sales this morning.

USDA

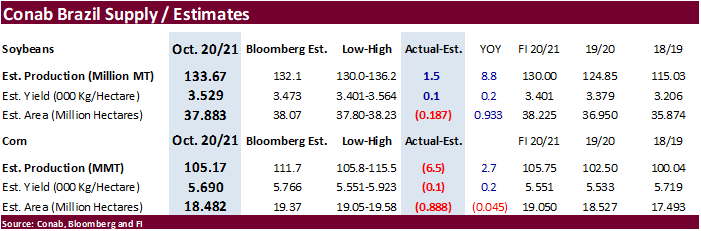

export sales were good for corn and soybeans. Conab surprised the trade by reporting a large soybean production and much smaller than expected corn output.

![]()

US

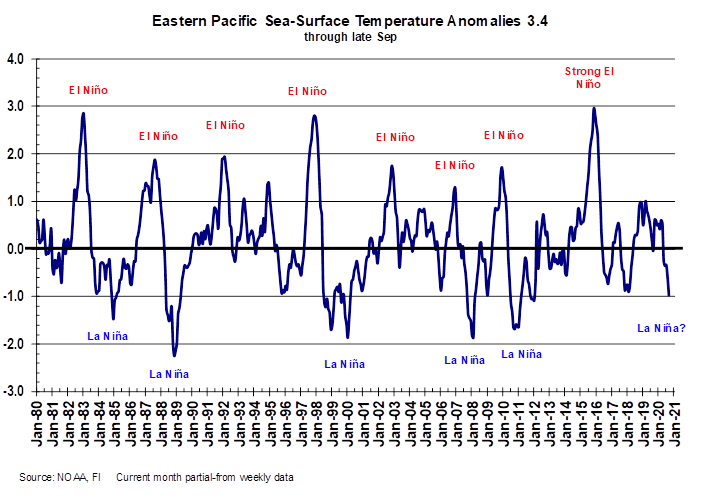

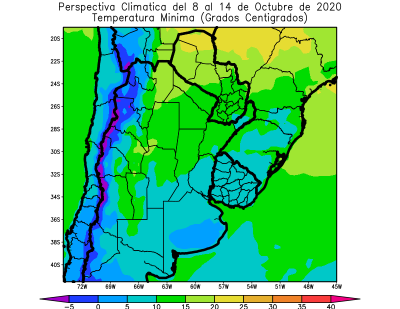

CPC: La Nina weather may intensify OND to a moderate or strong event, and peak between November and January, then weaken after April. South America weather during La Nina events includes less than usual rainfall in eastern Argentina, Uruguay, southern Paraguay

and Rio Grande do Sul during the late spring and summer months. US Great Plains tends to see drier than normal conditions.

FEW

CHANGES OF SIGNIFICANCE OVERNIGHT

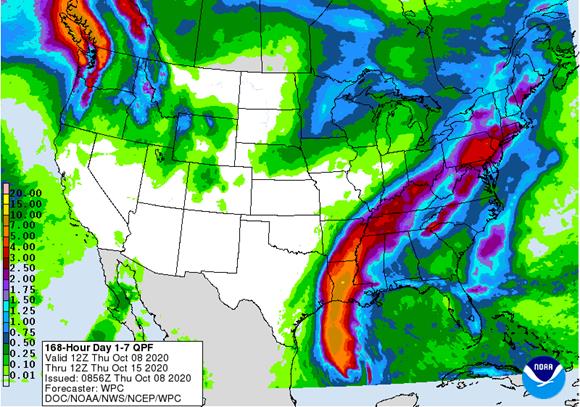

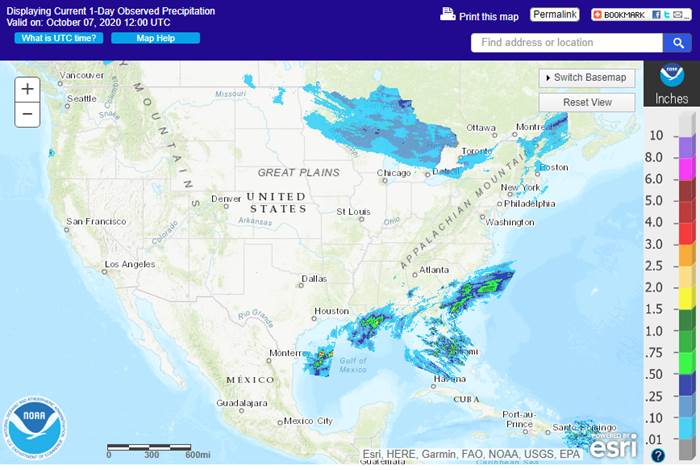

- Hurricane

Delta will have a big impact on the lower U.S. Mississippi River Basin Friday and Saturday - Torrential

rainfall is expected from Louisiana through western Tennessee and eastern Arkansas to areas south of the Ohio River from late tonight into Monday resulting in some flooding and crop damage - Sugarcane

in Louisiana will be damaged by high wind speeds with the western crop most seriously impacted - Cotton

damage is also possible with heavy rain occurring from Louisiana to western Tennessee that might string out some cotton - Losses

will be greatest where boll rot has evolved - Cotton

quality declines are expected - Quite

a bit of harvesting has occurred recently which should reduce losses - Hurricane

Delta will also be faster in diminishing which may help to reduce the threat of serious wind damage, but heavy rain is still expected - Unharvested

rice, sorghum and soybeans will also be negatively impacted, but not as severely as that of cotton or sugarcane - Harvest

delays for all crops in the Delta are expected, but drier weather will be back next week

- Center

west and center south Brazil will experience some periodic showers and thunderstorms during the next couple of weeks with the precipitation being a little sporadic and light through the weekend and again October 19-23 - Resulting

rainfall will vary greatly from one location to another and from one day to the next with mid-week next week wettest - Minas

Gerais will be wettest along with neighboring areas of Espirito Santo and Rio de Janeiro - Portions

of Mato Grosso do Sul, western Sao Paulo and northwestern Parana will be driest

- Moisture

totals may not be enough to counter evaporation raising some concern for crop in that area - Some

soybean planting is expected to occur - Coffee

in Minas Gerais, Espirito Santo and Rio de Janeiro will benefit greatly from next week’s rainfall - Excessive

heat in center west, and center south Brazil will be eased as rainfall increases - Tropical

Storm Chan-Hom will threaten Japan Friday into the weekend with some heavy rain and potential flooding; the storm will become a weak typhoon today and will weaken to a tropical storm after impacting parts of Kyushu and Shikoku Friday and Saturday - Landfall

is not expected, but the storm will be close enough to the main islands to induce some heavy rain and windy conditions - Minor

damage is expected to structures, but most crops are not likely to be seriously impacted - Tropical

disturbance moving through mainland areas of Southeast Asia today will generate additional rain today

- This

disturbance may reach the Bay of Bengal Friday into weekend and will contribute to greater rain in India Sunday through Friday of next week - Disturbed

tropical weather in the Philippines will generate greater rainfall today and Friday with two tropical cyclones coming from the disturbance - First

tropical cyclone will evolve west of the Philippines tonight and Friday and it will move to central and southern Vietnam next week possibly bringing heavy rain and windy conditions to some coffee production areas - A

second tropical cyclone of weaker intensity will move to Guangdong, China after evolving northeast of Luzon Island; landfall may occur in China early to mid-week next week - Northeastern

China will experience drier weather over the next couple of weeks and colder temperatures

BIGGEST

WEATHER ISSUES OF THE DAY

- Russia’s

Southern Region remains too dry with and no significant relief for at least ten days; there is some indication of possible rainfall after October 20.

- Kazakhstan

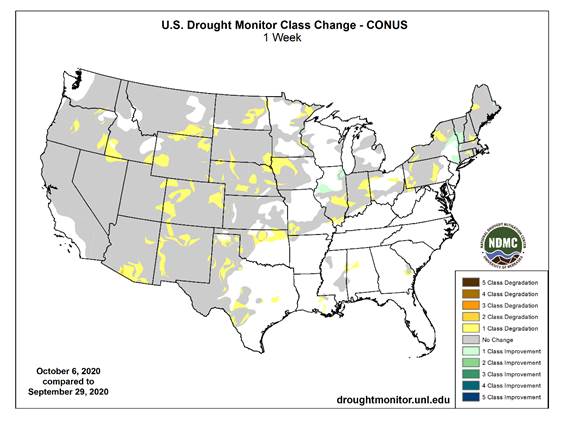

remains too dry and no relief is expected for two weeks - U.S.

west-central and southwestern hard red winter wheat areas in the Plains will be hot and dry this week and may cool down briefly this weekend only to heat back up again next week - Rainfall

continues minimal for the region through at least October 20 - Northwestern

U.S. Plains remain quite dry and winter crops are not establishing well; there is a chance for “some” showers briefly this weekend, but they will be light - No

change in Argentina dryness is expected for the next eight or nine days from central and northern Cordoba and parts of central Santa Fe to northwestern parts of the nation maintaining worry over winter and spring crops - Some

rain may evolve in parts of the dry region after October 17 - Rain

is expected in southern Buenos Aires, Argentina briefly this weekend with rainfall of 0.20 to 0.75 inch resulting - Western

Australia is still too dry, although some showers will occur in the far south part of the state today

- No

significant relief to dryness will occur through October 17 - Showers

may return to a few southern areas Oct. 18-22, but confidence is low - Queensland,

Australia still needs significant rain for summer crop planting; “some” rain is possible October 18-21, but mostly in the southeast where some cotton, sorghum and sugarcane areas might benefit - Central

India will trend wetter again next week after this week’s rain is greatest in the south and far eastern states - Too

much rain is expected in central India as a tropical cyclone moves into the region and has trouble ending rainfall

- Local

flooding and delays to harvesting will result - Worry

over summer crop quality will be rising - South

Africa weather is slowly improving with rain in the south and east with periods of rain continuing over the next couple of weeks - Southeastern

Canada and the U.S. Great Lakes region will experience a better mix of weather over the next week to ten days after frequent precipitation - U.S.

harvest weather in the Midwest and Great Plains will be good through Saturday - Rain

is expected in the northern Plains and upper Midwest late this weekend into early next week - Some

rain from Hurricane Delta may reach into the lower eastern Midwest this weekend causing delays to fieldwork briefly Sunday and Monday, but drying will evolve shortly thereafter - U.S

Midwest and Great Plains weather next week will be mostly good with only a brief period in which rain is expected to occur in association with frontal systems - U.S.

southeastern states harvest will advance well for a few more days, but some rain is expected this weekend into early next week that may slow fieldwork for a little while - U.S.

temperatures will trend warmer this week until the late weekend and early week frontal system arrives in the Plains and eventually moves through the Midwest during mid-week next week - Highs

in the Midwest will rise to the 70s and lower 80s through the weekend with gradual cooling expected next week and into the following weekend as a series of cool fronts move through the region - High

temperatures in the Plains will be in the upper 70s and 80s during much of this week with 90s in some southern locations - Cooling

will occur late this weekend and especially next week with a more seasonable range of temperatures expected over time - Cooling

is expected in the Pacific Northwest late this week and during the weekend after several more very warm days through Friday - No

threatening cold nighttime temperatures are expected in any part of the U.S. through the next ten days - Central

and western Ukraine and portions of southeastern Europe will receive waves of rain through most of next week - Sufficient

rain will fall to relieve some of the driest areas from dryness - Rainfall

of 0.50 to 2.50 inches and locally more by the end of next week - Temperatures

will be warmer than usual in much of the forecast period - Eastern

Ukraine, like Russia’s Southern Region and Kazakhstan, will get little to no rain for the next ten days - Europe

will continue to experience waves of rain over the next two weeks, but the intensity in western areas will be much less than that of this past weekend

- Spain

and Portugal will be driest in this first ten days of the outlook with some areas in the Iberian Peninsula getting rain after Oct. 18. - Temperatures

in western Europe will be near normal while those in the east are warmer than usual - South

America temperatures will be very warm to hot in center west and center south Brazil this week and then cooler next week - Argentina

temperatures will be seasonable during both weeks - Southeast

Asia rainfall over the next ten days will be erratic, but most areas will be impacted multiple times in the next two weeks supporting most crop needs - Mexico

precipitation will be most significant in the far south of the nation over the coming week to ten days - Central

America will be wetter biased over the next ten days to two weeks further easing long term dryness and possibly delaying early season crop maturation.

·

West-central Africa will experience waves of rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda, southwestern Kenya and portions of Ethiopia will be impacted while Tanzania is mostly dry

·

Philippines rain will be widespread over the next ten days to two weeks maintaining a favorable outlook for crops

·

New Zealand temperatures will be near to below average over the next seven days while precipitation is lighter than usual except along the lower west coast of South Island where rain will fall abundantly

-

Southern

Oscillation Index was +10.49 today and it will stay significantly positive through the coming week

Source:

World Weather Inc.

THURSDAY,

Oct. 8:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - UN

FAO World Food Price Index - India

SEA-Globoil webinar with Dorab Mistry, Thomas Mielke and James Fry - Brazil’s

Conab releases first report on 2020-21 planted area, output and yield of soy and corn - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana - HOLIDAY:

China

FRIDAY,

Oct. 9:

- USDA’s

WASDE report with world supply/demand crops update, stockpiles noon - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - China

agriculture ministry (CASDE) to release its monthly data on supply and demand - FranceAgriMer

weekly update on crop conditions - Brazil

Unica cane crush, sugar production (tentative) - HOLIDAY:

Korea

USDA

export sales were

very good for soybeans, substandard for meal and oil, good for corn and good for wheat. China took 1.538MMT of soybeans, but that included 449,000 switched from unknown destinations. Mexico and Egypt were good buyers of soybeans. Corn export sales of 1.226MMT

included Japan and Mexico as the largest buyers.

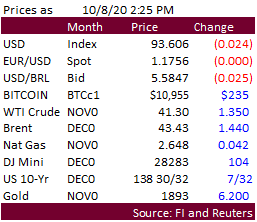

Macros

US

initial Jobless Claims: 840K (est 820K, prev 837K)

Corn.

-

Corn

started the day higher on expectations for China to eventually shift US buying focus from soybeans over to corn, but a dive in wheat prices erased gains. December corn fell 1.75 cents and March was off 2.50.

-

Conab

reported a much less than expected initial Brazil corn production of 105.2 million tons, 6.5 million below a Bloomberg trade average and 2.7 million tons above 2019-20. This is seen slightly supportive for CBOT corn.

-

China

is back from holiday Friday. -

When

China is done taking soybeans from the US, there is a possibility a good amount of Jan/Feb through July US corn could flow into China.

-

Germany

discovered three more ASF cases, and one German meat packing company was told to shut down from COVID-19 cases (in Soegel).

-

Germany

ASF: 3 additional cases; 53 cases since September 10 -

ProAgro:

Ukraine corn production cut to 31.7MMT from 34MMT earlier. -

Producers

in the far US south are bracing for another large tropical storm . Much of the corn had been collected but late planted summer crops may not fair to well.

-

USDA

weekly Broiler Report showed eggs set up slightly and chicks placed up 2 percent. Cumulative placements from the week ending January 4, 2020 through October 3, 2020 for the United States were 7.43 billion. Cumulative placements were down 1 percent from the

same period a year earlier. -

December

hog futures hit an 8-month high.

Corn

Export Developments

-

South

Korea’s KFA bought 131,000 tons of corn at $242.79/ton c&f from South America for Dec/Jan shipment.

Updated

9/30/20

-

December

corn is seen in a $3.60-$4.00 range. 2020-21 to average $3.75 for corn and $2.85 for oats.