PDF Attached

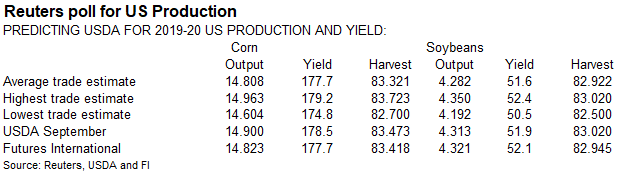

USDA

reported additional 24-hour sales this morning. USDA Attaché issued a bullish China corn S&D.

Weather

and Crop Progress

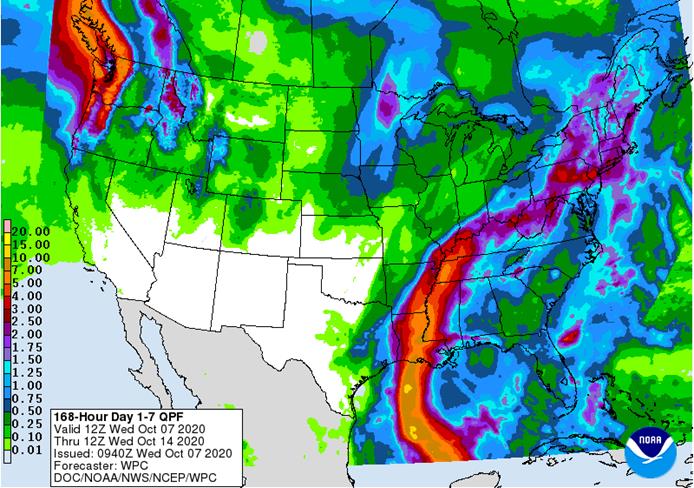

NORTH

AMERICA

- GFS

model removed much of the rain previously advertised from hard red winter wheat country during the next ten days, although a few showers remained - Some

of the reduction was needed - European

model has greater rain in northern and eastern portions of hard red winter wheat areas, as well as eastern Colorado leaving the southwest half of the region mostly dry - European

model is a little too wet in Colorado, Nebraska and northwestern Kansas - European

model has greater rain for the western and central Midwest next week while the GFS has limited rainfall in the region - The

lighter and more limited rainfall outlook is correct, although the region may not be completely dry - GFS

model rain was increased in the lower and eastern Midwest mostly from the Ohio River Valley because of Hurricane Delta - This

change was needed - European

model run was wetter over a larger part of the central and eastern Midwest from the hurricane and a mid-latitude frontal system that follows - The

model is too wet

Overall,

the bottom line today is rain in hard red winter wheat is expected to be restricted during the next ten days to two weeks as was the official World Weather earlier this week. The models have been periodically overdoing rainfall in the region and today’s

GFS model run is preferred, although additional changes are probable. The European model is too wet for the Midwest over the next ten days, but World Weather, Inc. agrees with bringing moisture from

Hurricane Delta farther north into the lower Midwest than advertised Tuesday.

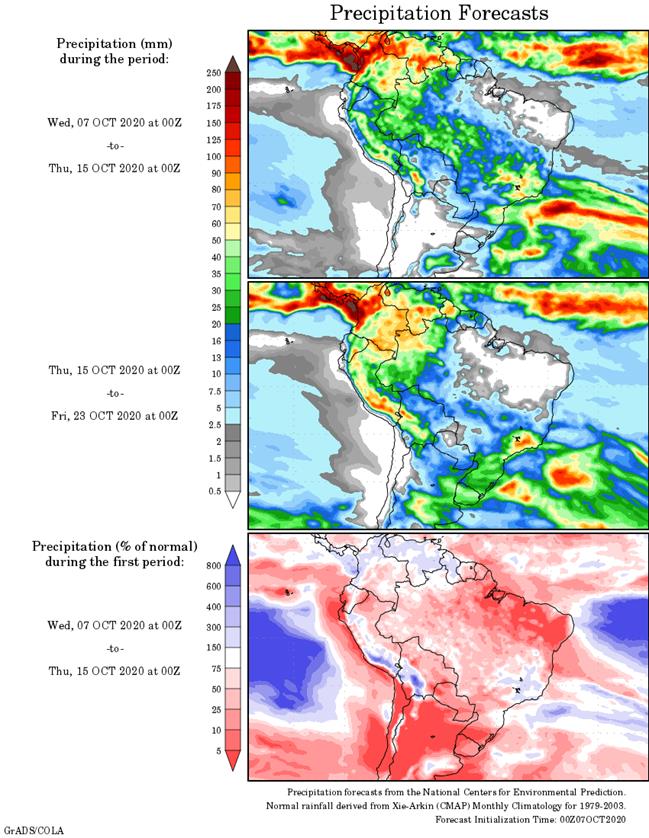

SOUTH

AMERICA

- GFS

model outlook has not changed greatly for center west into center south Brazil for next week with rain expected in many areas - Restricted

rainfall occurs in Mato Grosso do Sul, western Parana and western Sao Paulo,

although a little more rain falls in these areas than advertised Tuesday morning - Rain

in Brazil’s center south and center west crop areas is restricted from Friday of next week through October 21, although a few sporadic showers are expected – net drying is expected - Far

southern Brazil is still advertised to see a good mix of rain and sunshine during the next ten days to two weeks favoring crops and fieldwork - No

changes were noted in Argentina for the first ten days of the outlook with Buenos Aires and eastern La Pampa getting most of the nation’s significant rain – most of which occurs Saturday into Sunday of this week - Argentina

rainfall was advertised to increase Oct. 18-21, but the latest model run reduced rain in San Luis, La Pampa and western Cordoba relative to the 00z model run

- Some

of this reduction was needed

The

generalities of the South America outlook have not changed much today relative to the previous model run or the overall outlook suggested Tuesday. Argentina is not likely to see much rain for ten days except in Buenos Aires and eastern La Pampa where some

rain will fall this weekend to maintain a good outlook for crops in that region. In Brazil, a period of beneficial moisture will impact center west and center south crop areas next week; although portions of Mato Grosso do Sul and western and northern Parana

as well as western Sao Paulo may not get much rain and will need more soon.

EUROPE/BLACK

SEA REGION

- Some

rain fell in western Ukraine overnight with amounts to 0.75 and local totals to 1.34 inches, but this moisture did not reach into eastern areas - No

significant theme changes occurred overnight - Rain

will fall in most of Europe over the coming week to ten days to two weeks - Areas

from the Adriatic Sea region to southeastern Germany, western and southern Poland and parts of western Europe will be wettest - Eastern

Ukraine will continue to receive little to no - Kazakhstan.

The middle and lower Volga River Basin and Russia’s Southern Region will continue very dry

CHINA

- No

general theme changes noted overnight - Northeastern

China may not get rain every day, but its frequency will still be high enough along with seasonably milder temperatures to slow the region’s needed drying and further delaying some of the region’s summer crop maturation and harvest progress - A

good mix of rain and sunshine in the Yellow River Basin and North China Plain will be perfect for wheat planting, germination and emergence while allowing some of the region’s summer crops to mature and be harvested - Frequent

rain near and south of the Yangtze River will slow farming activity and maintain some concern over crop conditions

China

still needs drier weather in most areas in the nation to promote summer crop maturation and harvesting and to support early season wheat and other winter crop planting. The northeastern Provinces are still much too wet, although the region has seen a little

less frequent and less significant rainfall recently.

INDIA

- No

general theme changes were noted overnight - A

better mix of rain and sunshine will occur in northeastern China during the next two weeks allowing for better harvest progress - The

best weather will continue in the Yellow River Basin and North China Plain where a favorable mix of rain and sunshine is expected to support winter crop planting and summer crop harvest progress

AUSTRALIA

- No

big changes were noted overnight in the coming ten days - Western

Austr4alia is still not advertised to receive much significant rain - Only

a few showers near the southern and lower western coasts are expected - Rain

will fall often enough in Victoria, South Australia and southern New South Wales to maintain a very good crop outlook - Rain

was increased in southeastern Queensland and northeastern New South Wales after October 18 and through Oct. 21 - Some

of this increase was needed, but it might also be a little overdone

Limited

rainfall in Western Australia continues to raise worry over potential wheat, barley and canola yields in unirrigated areas away from the coasts where reproduction might occur without sufficient moisture to support the best yields. There is still time for improved

rain, although none is expected for the next two weeks. Rain in southeastern Queensland and northeastern New South Wales should translate into favorable sorghum and cotton planting conditions, but the event is still more than ten days away which warrants

a little caution since changes can still occur over time.

Source:

World Weather Inc.

WEDNESDAY,

Oct. 7:

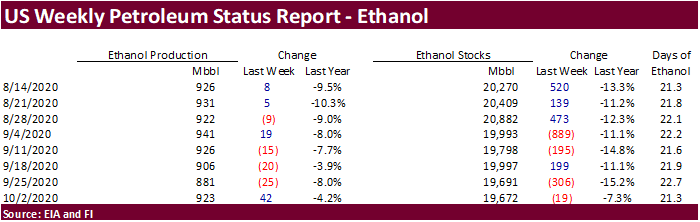

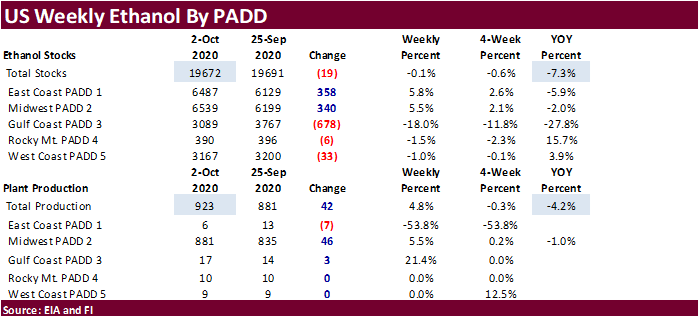

- EIA

U.S. weekly ethanol inventories, production, 10:30am - HOLIDAY:

China

THURSDAY,

Oct. 8:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - UN

FAO World Food Price Index - India

SEA-Globoil webinar with Dorab Mistry, Thomas Mielke and James Fry - Brazil’s

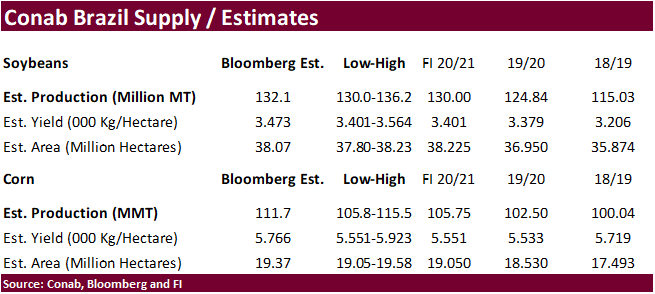

Conab releases first report on 2020-21 planted area, output and yield of soy and corn - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana - HOLIDAY:

China

FRIDAY,

Oct. 9:

- USDA’s

WASDE report with world supply/demand crops update, stockpiles noon - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - China

agriculture ministry (CASDE) to release its monthly data on supply and demand - FranceAgriMer

weekly update on crop conditions - Brazil

Unica cane crush, sugar production (tentative) - HOLIDAY:

Korea

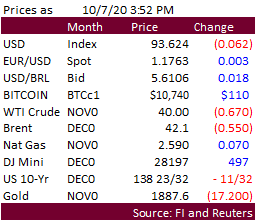

Macros

US

DoE Crude Oil Inventories (W/W) 02-Oct: 501K (est -1200K; prev -1980K)

–

Distillate Inventories (W/W): -962K (est -1100K; prev -3184K)

–

Cushing Inventories (W/W): 470K (prev 1785K)

–

Gasoline Inventories (W/W): -1435K (est -500K; prev 683K)

–

Refinery Utilization (W/W): 1.30% (est 0.10%; prev 1.00%)

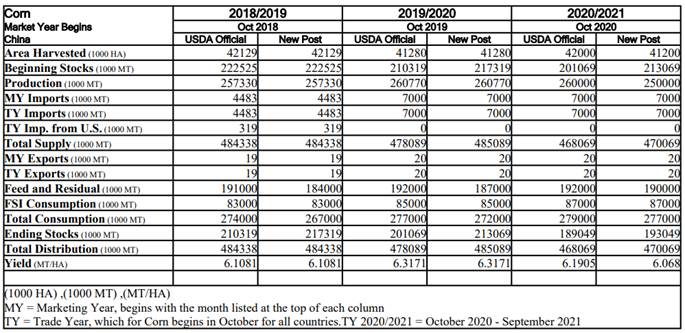

Corn.

-

CBOT

corn was higher Wednesday on technical buying and sharply higher wheat. December corn is at its highest level since January 2020. USDA Attaché issued a bullish China corn S&D earlier.

-

Funds

bought an estimated net 15,000 corn contracts. -

Producers

in parts of the Delta are bracing for another large tropical storm this week. Much of the corn down there had been collected but late planted summer crops may not fair to well.

-

China

bought $10.7 billion of US agriculture and related products during the first eight months of 2020. Yet the US trade deficit is at a 14-year high.

-

China

feedgrains update. The USDA Attaché sees 2020-21 China corn production at a low 250 million tons, well below 260 million tons for USDA’s official forecast and below 260.77 million tons in 2019-20. On the demand side, they see corn for feed at 190 million

tons, up from 187 million in 2019-20 and 184

Million

previous season.

-

Brazil

domestic corn prices reached record highs for some locations, according to Sao Paulo university price index.

-

Germany

ASF: 49 cases since September 10

Corn

Export Developments

-

SK’s

NOFI bought 59,000 tons of soybean meal at $451.49/ton c&f for Dec shipment and 206,000 tons of corn, expected to be from South America, at $239.80/ton c&f for LH No/FH Dec shipment.

Updated

9/30/20

-

December

corn is seen in a $3.60-$4.00 range. 2020-21 to average $3.75 for corn and $2.85 for oats.