7-day

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- U.S.

harvest weather was good in much of the nation Tuesday, but not necessarily in the southeastern states

o

Rain continued in Alabama, Georgia and South Carolina and some of those areas reported significant rain earlier this week extending harvest delays and raising a little more concern over crop quality (especially cotton)

- U.S.

temperatures Tuesday continued unseasonably warm to hot in the northern Plains where highs reached into the 80s and lower 90s Fahrenheit

o

Normal temperatures at this time of year are in the 50s and 60s with lows in the 30s and 40s

- U.S.

weather will continue a little showery in the eastern Midwest and southeastern states for a while resulting in some harvest delays

o

Short term breaks from the rain are expected, but no extended period of rain-free weather is expected which may keep fieldwork advancing slowly

o

West Texas maturation weather will remain mostly good over the next ten days, despite a few showers of limited significance

o

U.S. Delta weather will see more drier days than days of rain which should improve crop conditions and fieldwork after an extended period of rainy weather

o

California and interior portions of the Pacific Northwest will continue to receive very little rain of significance for at least the next ten days

- U.S.

Northern Plains, upper Midwest and Canada’s Prairies have opportunities for rain this weekend into next week

o

A first storm system will occur across the eastern Dakotas and into western and northern Minnesota and Manitoba Canada Friday through Sunday with a few showers possible as early as Thursday night

- Rainfall

of 0.25 to 0.75 inch and local totals of 0.50 to 1.50 inches will result - Some

GFS model runs have been advertising too much rain in this first storm system

o

A second storm of greater size and intensity is expected during mid-week next week that will impact most of the northern Plains and Canada’s Prairies

- Confidence

in this storm system is still a little low, but over its occurrence, but over its general size and direction of movement - A

close watch on future model runs is warranted for signs of change

o

Sufficient moisture will fall from these two storm systems to bolster topsoil moisture and finally ease months of dryness in the western Dakotas, eastern Montana and Saskatchewan

- Cooling

will impact the north-central and western United States starting this weekend and extending through the second weekend of the forecast with temperatures falling from the 80s and lower 90s in the northern Plains and 70s and 80s in Canada’s Prairies down to

the 40s and 50s in Canada and the 50s and 60s in the northern Plains

o

Freezing nighttime temperatures will occur in many of these areas during the second half of next week after the second storm passes

- Brazil

precipitation Tuesday was minimal resulting in a good day of runoff from previous rain in the south and a good day for some planting and germination

o

Temperatures continued very warm to hot from northeastern through center west crop areas

- Most

of Brazil’s agricultural areas except the far northeast will get rain over the next two weeks

o

Amounts will be erratic and often light in parts of center west and center south production areas, but enough should occur to support a boost in planting, seed germination and plant emergence over time

o

Greater rain would be best for the most aggressive planting and establishment, but that is not likely to occur for a while

- The

best rainfall in the near-term part of the outlook will be from southern Minas Gerais to southern Mato Grosso do Sul, Parana and Paraguay this weekend into Monday and again at the end of next week and into the second weekend of the two-week outlook - Center

west and northern parts of center south crop areas will get their greatest rain during the second week of the forecast - Argentina

will continue to get a poor distribution of rainfall during the coming week resulting in ongoing concern over dryness in west-central and northwestern parts of the nation

o

Some of the drier areas will continue to experience slow winter crop development and a poor environment for early corn and sunseed germination and emergence

- Early

season planting of corn and sunseed will advance swiftly in the wetter areas of the east and south, but poorly in the north and west-central crop areas - Southeast

Canada crop areas will see a mix of precipitation and sunshine over the next two weeks with the drier days more numerous than the wet ones

o

Harvest progress should advance well around the precipitation

- Too

much rain will fall near and north of China’s Yellow River Basin through the weekend possibly causing some local flooding and delaying fieldwork

o

Additional rainfall of 1.00 to 3.00 is expected with local totals to 6.00 inches in southern Liaoning and far southwestern Jilin

- Areas

near and north of the Yellow River will be wettest along with southern Liaoning - Delays

in winter crop planting are expected, but the moisture will see to it that winter crops are well established later this autumn as long as warm weather prevails after the crop gets sown - Some

concern over unharvested summer crop quality is expected especially for cotton, but the weather will improve after mid-week next week

o

Drier weather will evolve next week

- Western

Australia will be dry biased over the next ten days except near the southwest coast.

- Eastern

Australia rainfall this weekend and early next week will be good for reproducing and filling winter crops in New South Wales and for future planting of spring and summer crops in both New South Wales and Queensland - Colombia

and western Venezuela may receive heavy rainfall at times in the next ten days impacting coffee, cocoa, sugarcane, rice, corn and many other production areas - India’s

monsoon is withdrawing from the north where dry weather is expected most of this week and next week as well

o

Rain will fall in central and southern parts of the nation during the next ten days supporting late season crops in the south

- Some

of the rain will be heavy from Maharashtra to Telangana, Andhra Pradesh and southern Odisha

o

Drying in the north will be good for crop maturation and harvest progress

- Too

much rain too late in the season this year hurt the quality of early maturing cotton and a few other crops in the north

- Punjab,

Haryana, and a few Rajasthan crops were most impacted by the wetter bias

o

Drying in Gujarat will be good for crops

- Late

season rainfall has been ideal for supporting crop production after planting got delayed in early summer by late arriving monsoonal rainfall - Southeast

Asia rainfall has been and will continue to be well distributed for rice, sugarcane, oil palm, coffee, cocoa, corn and a huge range of other crops

o

Rainfall continues a little more erratic than usual in Sumatra and Java where there is need for greater rain, but the situation is not critical

- A

tropical disturbance east of the Philippines will begin evolving into a tropical cyclone today over the South China Sea

o

The system will be closely monitored for possible impact on Vietnam and/or southern China during the weekend and early part of next week

o

Rain will continue abundantly in the Philippines for another day or two as the storm evolves and pulls away from the nation, but no damaging wind or serious flooding is expected

- Another

tropical cyclone will form east of the Philippines late this week

o

Movement will be to the northwest initially and then to the north or northeast

- This

storm system could become a large tropical cyclone and it should be closely monitored once it evolves

- Landfall

would not likely occur prior to mid-week next week - The

system may threaten Taiwan, southeastern China, South Korea and western Japan and it needs to be closely monitored - A

tropical disturbance is also possible in the Bay of Bengal next week and a close watch on the system is needed for possible impact on eastern in the following weekend - Russia,

Ukraine, the Baltic States and Kazakhstan will continue dry biased over the coming week with temperatures close to normal

o

The environment will be good for establishing winter crops and for additional harvesting of summer crops

o

Warming would be better for late season winter crop establishment

- Europe

rain into the weekend will occur mostly in south-central and southeastern parts of the continent, although some showers will occur briefly in Germany and immediate neighboring areas - Southern

Europe still has some dryness issues in the lower Danube River Basin parts of southern Italy and in a part of the Iberian Peninsula this late summer and early autumn

o

Relief will come to some crop areas in Italy and the Balkan Countries during the next few days, although more rain will still be needed in lower Danube River Basin

- South

Africa rainfall in recent days has been good for improving topsoil moisture for spring planting and winter crop development, although more moisture is needed

o

Additional showers of light intensity will occur later this workweek while dry conditions occur prior to and after that period of time

- Central

Africa rainfall will continue periodic and timely for coffee, cocoa, sugarcane, cotton and rice through the next two weeks - North

Africa showers will be limited to Tunisia and far northeastern Algeria today and again late this weekend into early next week with rainfall of 0.05 to 0.35 inch resulting

o

Dry weather will continue farther to the west

- Mexico

weather will include erratic rainfall during the next week with some potential for tropical cyclone to impact west-central parts of the nation next week, although confidence is low - Central

America weather will see an erratic rainfall distribution for a while with most areas getting at least some rain periodically - Near

to above average precipitation will also impact Colombia, Peru and Venezuela over the next ten days - New

Zealand weather is expected to be well mixed over the next ten days with seasonable temperatures and precipitation - Southern

Oscillation Index was +10.04 this morning and the index will move erratically over the coming week - Xinjiang

China will quite cool with showers in the northeast through Thursday

o

Western and central crop areas in the province will only receive a few sporadic showers and will be mild to cool

Bloomberg

Ag Calendar

Thursday,

Oct. 7:

- FAO

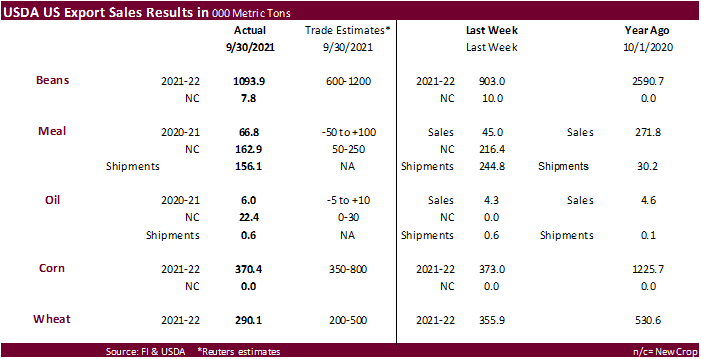

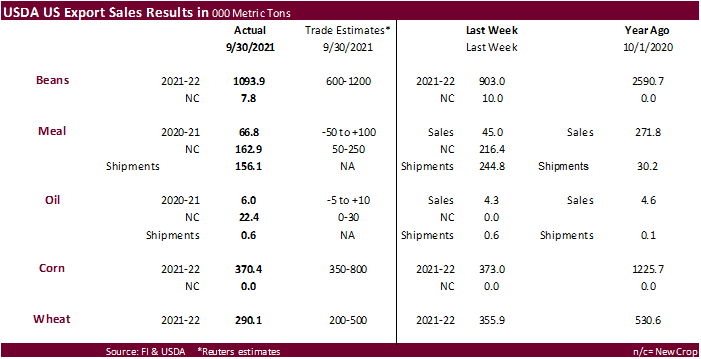

Food Price Index & cereals supply/demand brief - USDA

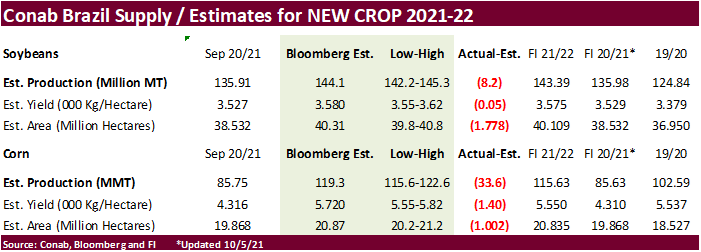

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - Brazil’s

Conab report on yield, area and output of corn and soybeans - Port

of Rouen data on French grain exports - HOLIDAY:

China

Friday,

Oct. 8:

- Labor

Department’s September jobs report - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish supply-demand reports on corn, soybeans, and other commodities - FranceAgriMer

weekly update on crop conditions

Monday

- U.S.

crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm

Tuesday

- USDA

S&D’s, Crop production

Source:

Bloomberg and FI

Macros

US

ADP Employment Change Sep: 568K (est 430K; prev 374K)

US

Considers Releasing Emergency Oil Reserves To Tame Fuel Price Surge – FT

·

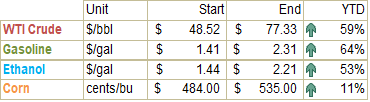

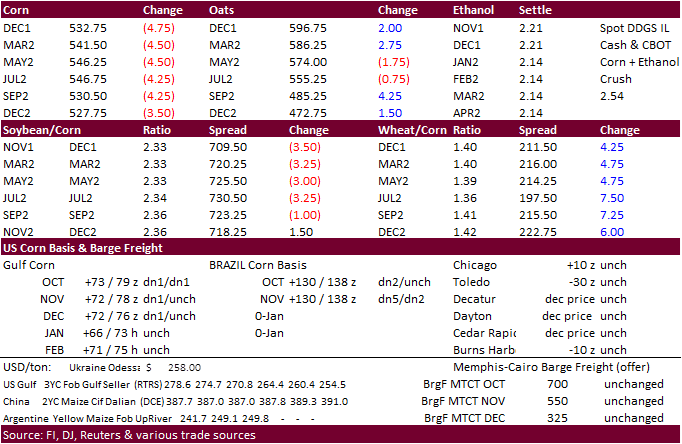

Corn started

higher following a mostly higher trade in wheat but turned lower from weakness in energy prices and fund selling. US harvesting pressure and a higher USD added to the negative undertone. US ethanol production jumped last week and was seen supportive for

corn.

·

News for corn was light. Tender announcements have been quiet so far this week, outside of Turkey’s import announcement.

·

Trade estimates for the weekly USDA export sales report indicate some analysts are looking for low commitments. The range is from 300,000 and 800,000 tons.

·

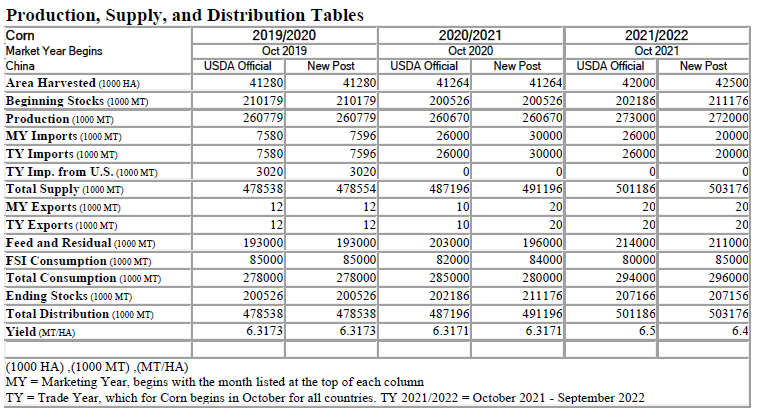

The USDA Attaché updated their China corn balance and they show corn imports for this crop year at 20 million tons from 30 million tons for 2020-21. Corn production for 2021-22 is forecast at 272 MMT, 1 MMT lower than USDA’s

official projection. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Update_Beijing_China%20-%20People%27s%20Republic%20of_09-27-2021

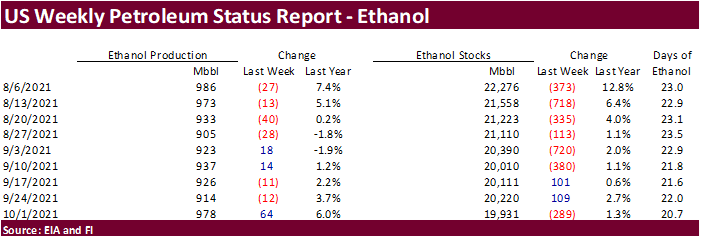

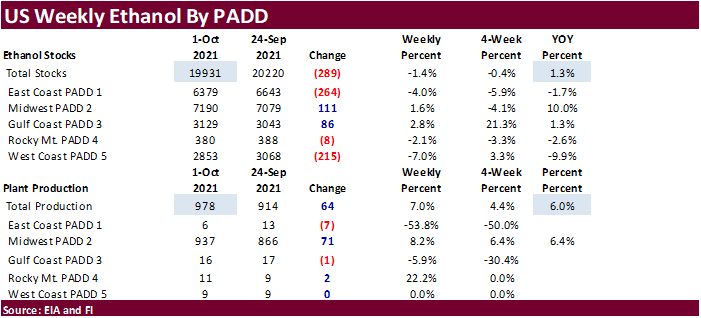

Weekly

US ethanol production was up a large 64,000 barrels or 7% (trade was looking for up 10,000) from the previous week to 978,000 barrels per day, highest since early August. Stocks were down 289,000 barrels (trade was looking for up 26,000) to 19.931 million

barrels. Stocks are at their lowest level since May 28, 2021. Ethanol production over the past 5 weeks is running 2.2% above the same period a year ago. Gasoline product supplies to the marketplace improved 28,000 barrels to 9.427 million barrels, up 6

percent from the same period a year ago. The ethanol blend rate was 92.4%, slightly higher than the previous week.

2020

Incomes and Capital Expenditure

Schnitkey,

G., K. Swanson, N. Paulson and C. Zulauf. “2020 Incomes and Capital Expenditure.” farmdoc daily (11):142, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 5, 2021.

Export

developments.

-

Turkey

seeks 325,000 tons of feed corn on October 14 for November 14 through December 6 shipment.

Updated

10/4/21

December

corn is seen in a $4.85-$5.65 range

March

corn is seen in a $5.00-$5.80 range.

·

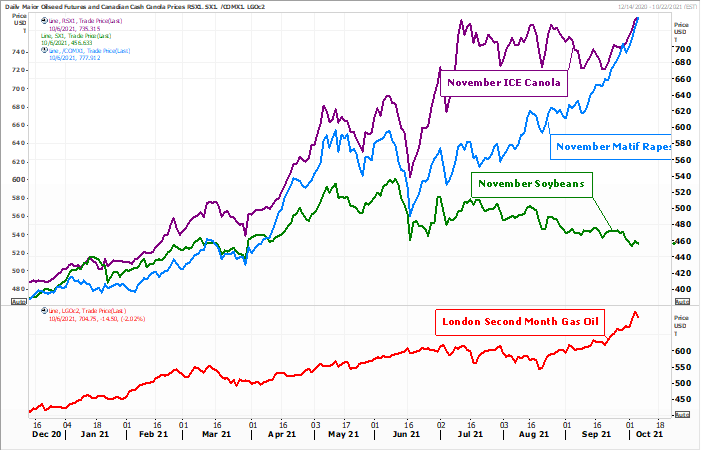

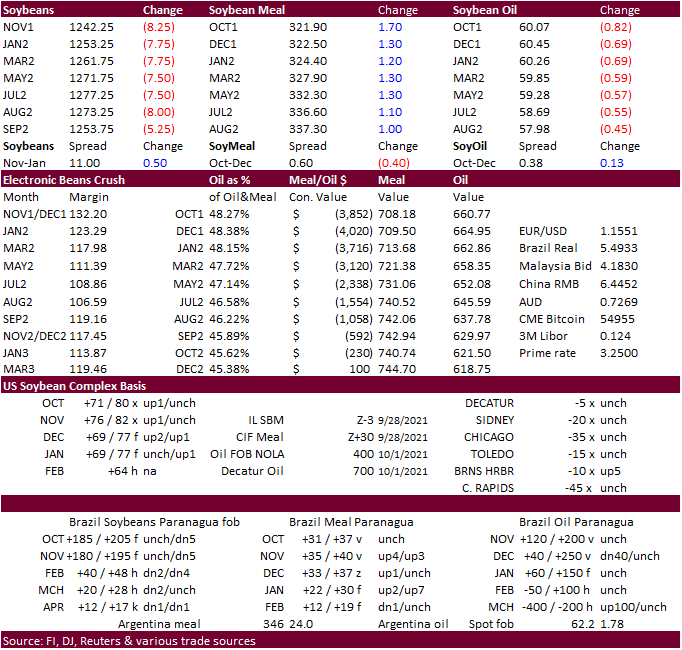

The soybean complex was mixed. Soybeans turned lower on US harvest pressure and a reversal to the downside in soybean oil. Soybean oil so far this week has closely tracked the energy markets, which were lower on Wednesday.

December soybean failed to test the 100-day MA of 60.20 but came close to it. Note earlier Malaysian palm futures settled at a record high. Soybean meal was higher from unwinding of oil/meal spreading.

·

Trade estimates for USDA’s export sales report range from 600,000 to 1,200,000 for soybeans.

·

Argentina may see drier than normal conditions in the coming months, according to Maxar Technologies via a Bloomberg article. Dry conditions are seen in October across much of country and in northern and eastern areas in November.

·

China is back from holiday on Friday.

·

We are hearing some EU rapeseed crushing plants are struggling with production due to the surge in energy prices over the past week.

Source:

Reuters and FI

Export

Developments

- None

reported

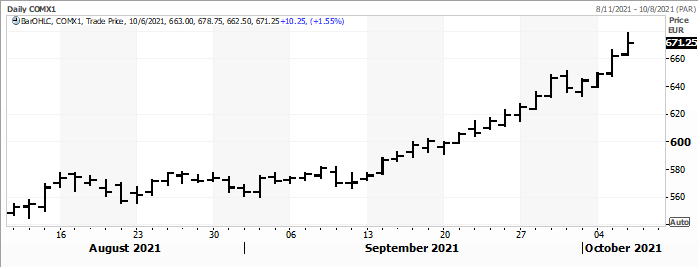

November

Paris rapeseed is at a contract high

Source:

Reuters and FI

Updated

10/05/21

Soybeans

– November $12.00-$13.50 range, March $12.00-$14.00

Soybean

meal – December $305-$360, March $300-$3.80

Soybean

oil – December 60-67 cent range, March 58-67.50

·

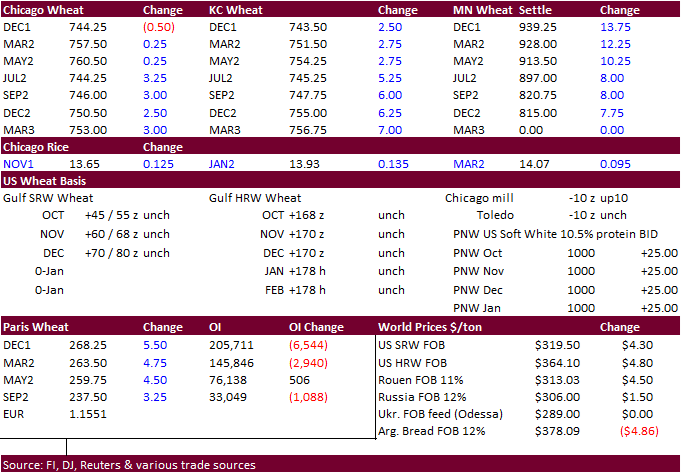

December Paris wheat settled up 5.50 euros, or 2.1%, at 268.25 euros ($309.69) a ton.

·

Some of the US HRW wheat areas are still in need of rain, specifically southern and far western Great Plains (eastern Colorado, western Oklahoma, and northern Texas).

·

Trade estimates for all-wheat export sales range from 200,000 and 500,000 tons.

·

Ukraine’s AgMin lowered their projection for the Ukraine grain production to 80.25 million tons from 80.63 million previous, but increased exports to 24.51 million tons from 23.8 million previously.

·

Russia harvested 108.4 million tons of wheat as of October 5 on 41.3 million hectares, down from 125.2 million around that time last year on 43.9 million hectares. Wheat harvest is 75.1 million tons versus 86.4 million a year

ago (26.7 vs. 28.5 million a year ago).

·

A Reuters article citing industry officials calls for India wheat exports during the 2021 calendar year could end up near 4.2 to 4.4 million tons versus 1.1 million in 2020. That would be the highest since 2013. Jan-Aug wheat

exports stand at 3.07 million tons. India recently sold wheat to the Philippines and Indonesia. Prices were about $10-$15/ton cheaper than Russian origin.

Export

Developments.

·

Egypt bought 240,000 tons of wheat (180,000 ton of Russian wheat and 60,000 tons of Ukrainian). Lowest offer was $319.97 for November 11-30 shipment and lowest offer was $321.35/ton for November 21-30 shipment.

·

Tunisia seeks 100,000 tons of durum wheat on October 7 for November 1-December 20 shipment.

·

Pakistan seeks 90,000 tons of optional origin wheat on October 13. They already bought 550k and 575k since September 23.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on October 13 for arrival by February 24.

·

Jordan passed on 120,000 tons of wheat.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

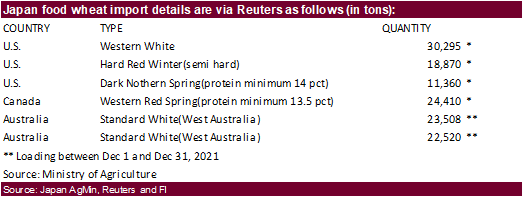

Japan seeks 130,963 tons of food wheat from the US, Canada, and Australia for December loading.

·

Taiwan seeks 48,000 tons of wheat on October 7 for November 25 and December 9 shipment.

·

Jordan seeks 120,000 tons of feed barley on October 7.

·

The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

·

Turkey seeks 310,000 tons of feed barley, on Oct. 8.

Rice/Other

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December

MN wheat is seen in a $8.65‐$9.75, March $8.50-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.