PDF Attached

USDA

reported 160,020 tons of corn to Mexico. Traders were are, and still mulling over the data due out this week. Wildcard is what will USDA report for soybean and corn production at the end of this week, which could trump the recent rally post stocks report.

With China on holiday, news is steady. SA weather turned slightly unfavorable and more rain is needed for Argentina.

|

Category |

Analyst |

Analyst |

USDA |

USDA |

|

Corn |

26 |

23-28 |

15 |

25 |

|

Corn |

61 |

61-61 |

61 |

62 |

|

Soybeans |

36 |

32-40 |

20 |

38 |

|

Soybean |

64 |

63-64 |

64 |

64 |

|

Winter |

50 |

46-53 |

35 |

52 |

|

*Percent |

(Reporting

by Julie Ingwersen in Chicago

Editing by Matthew Lewis and Richard Pullin)

- Russia’s

Southern Region remains too dry and no relief is likely for two weeks - Kazakhstan

remains too dry and no relief is expected for two weeks - U.S.

hard red winter wheat areas will be hot and dry this week and may cool down this weekend into next week, but western areas are unlikely to get much rain - Northwestern

U.S. Plains remain quite dry and winter crops are not establishing well - No

change in Argentina dryness is expected from central and northern Cordoba and parts of central Santa Fe to northwestern parts of the nation maintaining worry over winter and spring crops - Brazil

heat and dryness will last through Friday and then some relief is expected during the weekend and especially next week in center west and center south crop areas - Western

Australia is still too dry, although some showers will occur in the far south part of the state late Wednesday into Thursday - Queensland,

Australia still needs significant rain for summer crop planting - Tropical

Storm Gamma will move into the northwestern coast of Yucatan Peninsula during mid-week and will likely dissipate there - Heavy

rain is expected to cause some flooding, but not much crop of world interest comes from the region - Tropical

Storm Delta formed between Jamaica and the Cayman Islands this morning and will move across western Cuba late Tuesday or early Wednesday, become a hurricane in the central Gulf of Mexico later this week and then move inland through southeastern Louisiana Friday - The

system was expected to become a Category Two hurricane by the time it approaches the Louisiana coast - The

storm will move through Alabama and Mississippi and impact parts of Tennessee, Virginia and North Carolina during the weekend - China

will experience less rain this week; including the water logged northeast - Central

India will trend wetter again next week after this week’s grain is greatest in the south and far eastern states - South

Africa weather is slowly improving with rain in the south and east - Southeastern

Canada and the U.S. Great Lakes region will continue wetter biased for several more days and then get a brief break from rain

WEATHER

TO WATCH IN MORE DETAIL

- U.S.

harvest weather will remain good for the coming week in the Midwest and Great Plains - Southeastern

states harvesting will advance well through mid-week, but could deteriorate with the onset of tropical moisture during the end of this week and the weekend - Lower

and eastern portions of the Delta, Alabama and the remainder of Mississippi as well as eastern Louisiana will be impacted by Tropical Storm Delta eventually - The

storm will damage some additional cotton in Alabama and parts of Mississippi and could negatively impact eastern sugarcane in Louisiana - Flooding

will be widespread from southeastern Louisiana into northern Alabama and southern Tennessee - Frontal

system will bring rain to the Pacific Northwest this weekend and across the Great Plains Sunday into early next week and in the heart of the Midwest during early to mid-week next week.

- Rain

totals in the eastern Midwest will range from 0.25 to 0.75 inch with a few totals to 1.00 inch - Rain

totals in hard red winter wheat areas will be 0.20 to 0.75 inch in the east while many areas in the high Plains region will be dry. - Moisture

totals in the eastern Dakotas, Minnesota and the western Corn Belt will range from 0.30 to 0.80 inch with a few totals of 1.00 to 2.00 inches; wettest in the upper Midwest - Rainfall

in the Pacific Northwest will be less than 0.50 inch in key crop areas while much greater precipitation occurs in western Washington State and in the northern Rocky Mountain region - Second

frontal system will pass through the northern Plains and Midwest mid- to late-week next week

- Moisture

totals will vary from 0.10 to 0.60 inch in the Great Lakes region and eastern Midwest while limited rain occurs in the Great Plains and Delta - Temperatures

will turn much colder behind the event - U.S.

temperatures will trend warmer this week until the weekend frontal system arrives - Highs

in the Midwest will rise to the 70s and lower 80s Tuesday into Wednesday - Slight

cooling will occur during the latter part of the week with greater cooling early next week after unusually warm conditions occur briefly during the weekend - High

temperatures in the Plains will be in the 70s and 80s during much of this week with a few 60s briefly Monday, Wednesday and Thursday - Extremes

over 90 will occur daily in the southern half of the Plains during much of this week - Cooling

is expected in the Pacific Northwest late this week after very warm conditions occur early to mid-week

- No

threatening cold nighttime temperatures are expected - Russia’s

Southern Region is still advertised to be mostly dry for the next ten days, but some showers will be possible October 15-22; confidence is very low

- Most

of the region was dry during the weekend and very little precipitation was expected in the next week to ten days - Ukraine

and portions of southeastern Europe will receive waves of rain later this week through most of next week - Sufficient

rain will fall to relieve some of the driest areas from dryness - Rainfall

of 0.75 to 2.50 inches and local totals over 4.00 inches may occur by the end of next week - Temperatures

will be warmer than usual in much of the forecast period

- Europe

will continue to experience waves of rain over the next two weeks, but the intensity in western areas will be much less than that of this past weekend

- Spain,

Portugal, Bulgaria and southeastern Romania will be driest with some areas in the Iberian Peninsula staying dry - Temperatures

in western Europe will be near normal while those in the east are warmer than usual - Europe

weekend rainfall was moderate to heavy in the U.K., western and southern France and northern Italy where rain totals varied from 1.00 to 3.00 inches and locally more - More

than 5.00 inches of rain fell in northeastern Italy - Much

of eastern Europe was dry - Temperatures

were mild to cool in the west and warm east - Western

CIS weather during the weekend was largely dry with frost and freezes scattering across western and central Russia and northern Kazakhstan - The

freezes were non-threatening - Australia

is not expecting any surprises relative to Friday’s or Sunday’s forecast through the coming week - Dry

weather is expected in much of Western Australia and in the majority of interior Queensland and some locations in northeastern New South Wales - Some

showers will occur in southwestern parts of Western Australia briefly late Wednesday and Thursday - Rain

will fall from eastern South Australia through Victoria and western and southern portions of New South Wales where moisture totals will vary from 0.75 to 1.50 inches and a few totals over 3.00 inches - Victoria

will be wettest - Temperatures

will be seasonable - Australia’s

weekend precipitation was minimal in key crop areas and temperatures were warm

- Highest

weekend afternoon temperatures were in the 80s and a few lower 90s Fahrenheit in Queensland, New South Wales and South Australia while cooler with highs in the 60s and 70s in Western Australia - Some

frost may have occurred in southwestern most Western Australia as low temperatures slipped into the 30s and lower 40s Fahrenheit, but no permanent crop damage resulted - China’s

Yangtze River Basin reported excessive rainfall during the Friday through Sunday morning period with 3.25 to more than 9.00 inches from eastern Sichuan through Hubei to Jiangsu - 11.14

inches of rain occurred in eastern Hubei - Dry

weather occurred in the Yellow River Basin and North China Plain as well as the southeastern coastal areas - Showers

occurred in the Northeast Provinces, but rainfall was not more than 0.25 inch through dawn Friday - Temperatures

were very warm to hot in the southeastern provinces while frost and freezes occurred in most of central and western Inner Mongolia - China

weather will improve this week with more limited rainfall in the Northeastern Provinces, Yellow River Basin, North China Plain, east-central provinces and southeastern crop areas - Totally

dry weather is not expected, but rain amounts will be light and infrequent enough to allowing summer crops to mature and for some harvesting and planting to take place - Next

week’s weather will trend wetter in the south of China and in some east-central and northeastern areas, but not in the Yellow River Basin or North China Plain - Temperatures

will be seasonable this week with a slight warmer bias in the northeast and slight cooler bias in the southeast - India

rain during the weekend was greatest in eastern parts of the nation and along the central west coast and temperatures were warm to hot in the northwest and more seasonable elsewhere - India

will experience frequent rain in the east and south over the next week with central areas trending wetter again next week as well - Some

crop maturation and harvest disruption is expected - Northern

India will continue to be mostly dry favoring summer crop maturation and harvest progress and some winter crop planting - Brazil

rainfall during the weekend occurred from eastern Parana through Rio Grande do Sul into northeastern Santa Fe Argentina with rainfall varying from 0.25 to 1.25 inches; some data from South America was missing during the weekend - Argentina

temperatures were mild to warm and Brazil continued hot in many areas except the far south - Extreme

highs in center west and center south Brazil ranged from 100 to 108 degrees Fahrenheit with an extreme of 110 in Paraguay - Brazil

weather will be dry biased in center west and center south crop areas through Saturday - Scattered

showers develop Sunday and continue daily through most of next week - Daily

rainfall will vary from 0.20 to 0.75 inch with a few 1.00 to 2.00-inch totals - The

greatest rain is expected in Minas Gerais, southern Espirito Santo, Rio de Janeiro and areas south into northeastern Parana - A

few locations in Mato Grosso could also receive a few daily rain totals over 1.00 inch - Improved

soil moisture should support at least some improved topsoil moisture for better soybean and corn planting - Some

improved coffee flowering and pollinating conditions will also occur - Citrus

will flower additionally - Sugarcane

development will become more aggressive as topsoil moisture improves - Argentina

rainfall is expected to be limited over the coming week to ten days with rain most likely in Buenos Aires early and late this week and again early next week - Crop

moisture stress will continue in the driest areas of Cordoba, Santa Fe, Santiago del Estero, western Chaco and areas northwest to Salta - South

America temperatures will be very warm to hot in center west and center south Brazil this week and then cooler next week - Argentina

temperatures will be seasonable during both weeks - Southeast

Asia rainfall during the weekend and that which is expected over the next ten days has been and will be erratic, but all areas will be impacted multiple times in the next two weeks supporting most crop needs - Ontario

and Quebec, Canada reported additional rain during the weekend maintaining wet field conditions - Drying

is needed to promote summer crop maturation and harvest progress and to support wheat planting and establishment - Southeastern

Canada will experience additional rain early this week and then may experience a full week of net drying; temperatures will be seasonable - Mexico

precipitation will be most significant in the far south of the nation over the coming week to ten days - Central

America will be wetter biased over the next ten days to two weeks further easing long term dryness and possibly delaying early season crop maturation.

- South

Africa weekend weather brought showers to the south and east parts of the nation while dry weather occurred in many other areas - Temperatures

were seasonable - Additional

rain will impact southern and western South Africa over the coming week - The

precipitation will begin to improve topsoil moisture for spring planting and winter crop reproduction, but greater rain will still be needed

·

West-central Africa will experience waves of rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda, southwestern Kenya and portions of Ethiopia will be impacted while Tanzania is mostly dry

·

Philippines rain will be widespread over the next ten days to two weeks maintaining a favorable outlook for crops

·

New Zealand temperatures will be near to below average over the next seven days while precipitation is lighter than usual with the greatest amounts likely along the lower west coast of South Island

-

Southern

Oscillation Index was +9.90 today and it will stay significantly positive through the coming week

Source:

World Weather Inc.

MONDAY,

Oct. 5:

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm - EU

weekly grain, oilseed import and export data - U.K.

wheat and barley production estimates - Ivory

Coast cocoa arrivals - Malaysia

Oct. 1-5 palm oil export data - ANZ

Commodity Price - HOLIDAY:

China, some states of Australia

TUESDAY,

Oct. 6:

- Purdue

Agriculture Sentiment - New

Zealand global dairy trade auction - HOLIDAY:

China

WEDNESDAY,

Oct. 7:

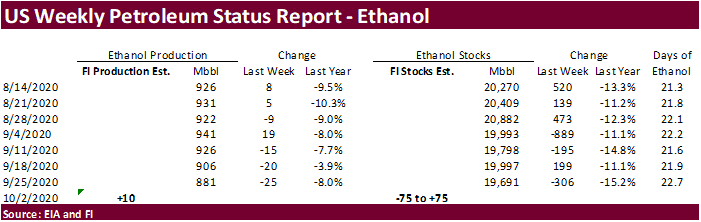

- EIA

U.S. weekly ethanol inventories, production, 10:30am - HOLIDAY:

China

THURSDAY,

Oct. 8:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - UN

FAO World Food Price Index - India

SEA-Globoil webinar with Dorab Mistry, Thomas Mielke and James Fry - Brazil’s

Conab releases first report on 2020-21 planted area, output and yield of soy and corn - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana - HOLIDAY:

China

FRIDAY,

Oct. 9:

- USDA’s

WASDE report with world supply/demand crops update, stockpiles noon - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - China

agriculture ministry (CASDE) to release its monthly data on supply and demand - FranceAgriMer

weekly update on crop conditions - Brazil

Unica cane crush, sugar production (tentative) - HOLIDAY:

Korea

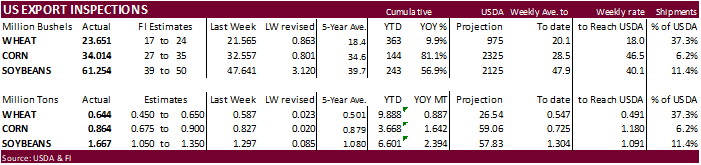

USDA

inspections estimates via Reuters

USDA

inspections versus Reuters trade range

Wheat

643,671 versus 400000-650000 range

Corn

863,995 versus 650000-1100000 range

Soybeans

1,667,068 versus 1050000-1550000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING OCT 01, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 10/01/2020 09/24/2020 10/03/2019 TO DATE TO DATE

BARLEY

1,397 0 2,994 7,124 8,625

CORN

863,995 826,995 473,409 3,667,612 2,025,672

FLAXSEED

0 0 0 389 72

MIXED

0 0 0 0 0

OATS

0 0 0 996 798

RYE

0 0 0 0 0

SORGHUM

157,647 58,243 88,293 461,755 189,351

SOYBEANS

1,667,068 1,296,568 1,052,267 6,600,720 4,206,806

SUNFLOWER

0 0 0 0 0

WHEAT

643,671 586,916 479,335 9,887,993 9,000,900

Total

3,333,778 2,768,722 2,096,298 20,626,589 15,432,224

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

US

Markit Services PMI Sep F: 54.6 (est 54.6; prev 54.6)

–

Markit Composite PMI Sep F: 54.3 (prev 54.4)

-

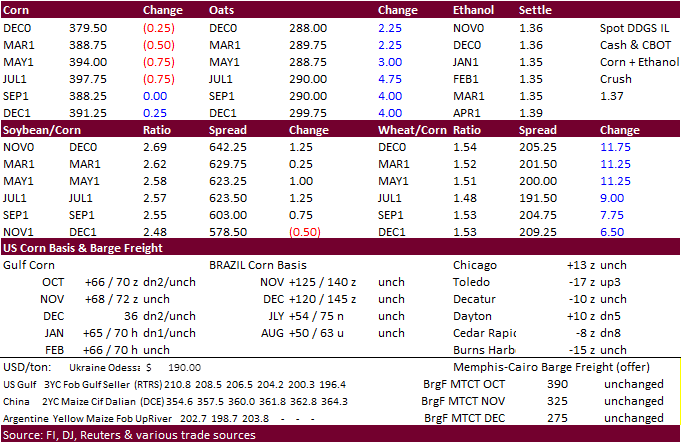

CBOT

corn ended unchanged to mixed, on lack of direction. -

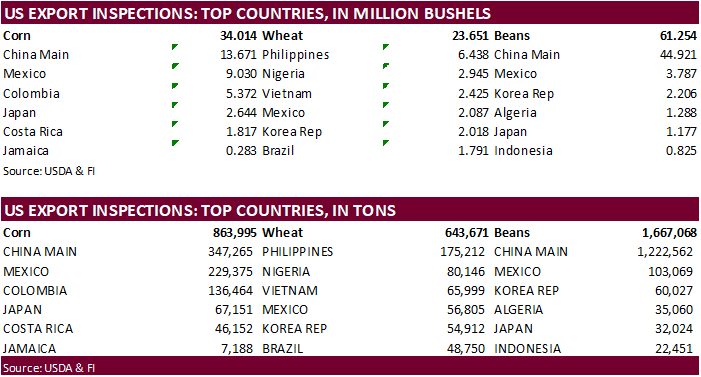

USDA

US corn export inspections as of October 01, 2020 were 863,995 tons, within a range of trade expectations, above 826,995 tons previous week and compares to 473,409 tons year ago. Major countries included China Main for 347,265 tons, Mexico for 229,375 tons,

and Colombia for 136,464 tons. -

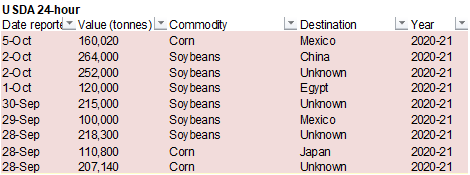

USDA

reported 160,020 tons of corn to Mexico but that is seen as routine. -

Corn

OI was up 18,478 on Friday. -

USD

was 41 lower as of 9:30 am CT and that is supportive for exports. -

French

corn crop ratings, delayed in reporting, were 58% as of Sep 28, unchanged from previous week (same as year ago). 32 percent of the crop had been harvested.

-

Germany

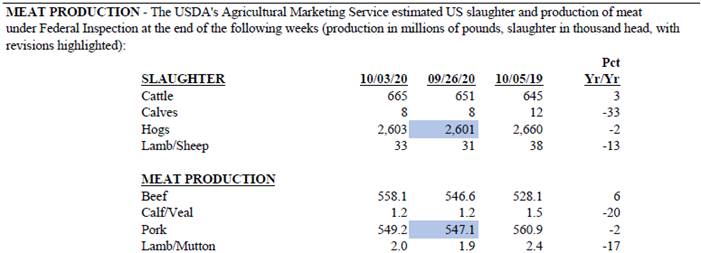

ASF: 3 new cases; 49 cases since September 10

USDA

Attaché on Brazil Grain & Feed

Corn

Export Developments

-

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on October 26 for delivery within four months of contract.

-

USDA

reported 160,020 tons of corn for Mexico.

Source:

Trade News Service

Updated

9/30/20

-

December

corn is seen in a $3.60-$4.00 range. 2020-21 to average $3.75 for corn and $2.85 for oats.