PDF Attached

7-day

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Too

much rain will fall near and north of China’s Yellow River this week causing local flooding and threatening recently planted wheat with some damage

o

Some flooding is expected with total amounts of 2.00 to 6.00 inches expected

- Delays

in winter crop planting are expected, but the moisture will see to it that winter crops are well established later this autumn as long as warm weather prevails after the crop gets sown - Some

concern over unharvested summer crop quality is expected especially for cotton

o

Drier weather will evolve next week

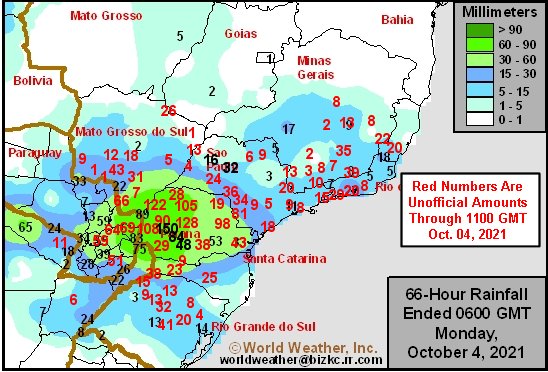

- Interior

southern Brazil is too wet after heavy rain fell late in the weekend and overnight from southeastern Paraguay and southern Mato Grosso do Sul through Parana

o

Rain totals varied from 2.00 to 5.00 inches and some of the soil was already saturated before the heavier rain began

- Concern

over unharvested wheat quality evolved - Planting

delays for soybeans, corn, rice, and cotton will occur for a while early this week

o

Follow up rain is expected lightly for a while this week, but another bout of heavy rain may evolve next week and the situation will need to be closely monitored

- Brazil

week two rainfall is expected to be a little more significant in parts of center west and center south Brazil bolstering soil moisture for more aggressive soybean, corn, rice, and cotton planting and citrus, sugarcane, and coffee development

o

The precipitation will be erratic and the need for more moisture will continue, but the increase will prove to be beneficial.

- Center

west and the remainder of center south Brazil will experience erratic rainfall for a while with precipitation always welcome, but probably a little too light and sporadic for a while to seriously improve soil moisture for soybean and other early season crop

planting

o

Greater rain may evolve in parts of the region next week

- Mato

Grosso, Goias and northern Mato Grosso do Sul are driest and would benefit most from rain - Argentina’s

rain in Buenos Aires Friday into Saturday was welcome and very good for wheat and early planting of spring crops, but many other areas in the nation needed rain and got none

o

Argentina’s weather is expected to be drier biased through the workweek and showers will be slow to evolve during the weekend and next week leaving need for greater rain in winter and spring crop area especially in the west-central

and north

o

Fieldwork will advance well in areas that have favorable soil moisture

- Argentina’s

bottom line remains one of concern over limited soil moisture and rainfall that may be stressing winter crops and especially early developing corn and sunseed which may not be planted as aggressively as it should because of dryness. A close watch on rainfall

during the next two weeks is warranted - Western

Australia will be dry biased over the next ten days except near the southwest coast.

- Eastern

Australia rainfall will be good for reproducing and filling winter crops and for future planting of spring and summer crops - Colombia

and western Venezuela may receive heavy rainfall at times in the next ten days impacting coffee, cocoa, sugarcane, rice, corn, and many other production areas - U.S.

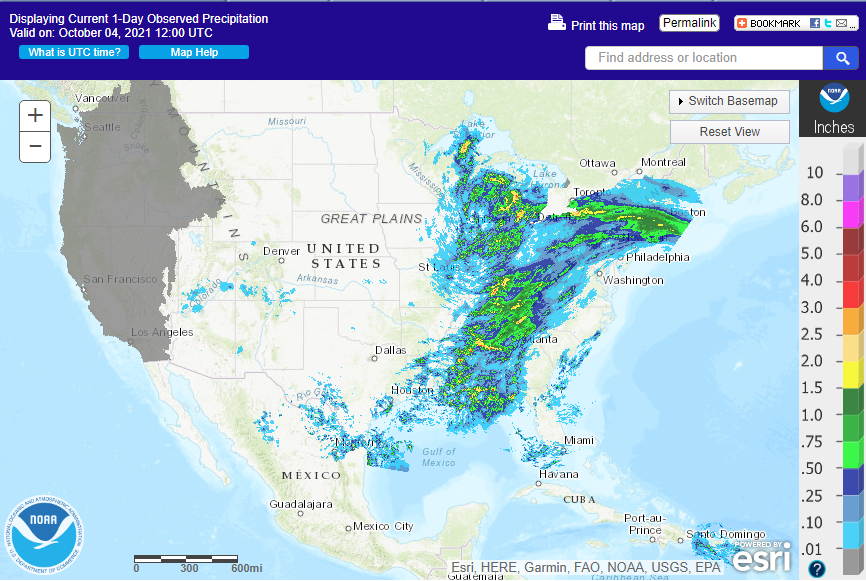

weather was mixed during the weekend with some disruption to fieldwork in parts of the U.S. Midwest, Delta, and southeastern states while other areas experienced net drying which favored fieldwork

o

Scattered showers and thunderstorms occurred in the U.S. Midwest during the weekend, but the rain was uneven with some areas in Missouri, Illinois, Indiana, eastern South Dakota, and Minnesota getting 1.00 to 2.00 inches while

others failed to get enough moisture to counter evaporation

- Iowa,

Nebraska, northern Missouri, northwestern Illinois, and northeastern Kansas were among the driest areas along with western Ohio and east-central Indiana.

o

U.S. Delta rainfall fell frequently with amounts from Arkansas into western Tennessee and southeastern Missouri ranged from 0.50 to 1.50 inches with Little Rock, Ark. getting 4.43 inches

- Parts

of the lower Delta were dry

o

Very little precipitation fell in the southeastern states with dry conditions from Florida and southeastern Alabama through Georgia to southeastern Virginia

o

Parts of West Texas received greater than expected rainfall during the weekend with numerous areas getting 1.00 to 2.00 inches, although other areas received less than 0.50 inch with a few staying dry

o

Texas coastal areas also reported periodic rainfall during the weekend with 1.00 to 2.20 inches resulting

o

Western U.S. weather during the weekend was dry

o

In hard red winter wheat production areas, scattered showers and thunderstorms occurred from southern Kansas southward into northern Texas with the southern Texas Panhandle wettest

o

Temperatures were warmer than usual in many areas across the nation during the weekend

- U.S.

weather during the coming ten days will disfavor rain in the Plains especially the central and southern Plains; including hard red winter wheat areas where planting will progress quickly along with harvest progress in summer crop areas

o

Periodic rain will continue in the Midwest, Delta and southeastern states during the same ten-day period keeping fieldwork sluggish

o

Showers in the western United States will be most significant in mountainous locations and in a part of the Great Basin

o

Temperatures will be warmer than usual in the Plains, Midwest and to a lesser degree in the Delta and southeastern states

o

Temperatures in the western U.S. will be warm, but not as far above average as those in the central states

o

Rain is expected in the northern Plains and upper Midwest next week that may improve topsoil moisture, although details of the event are not available in great confidence yet today

- The

bottom line for the United States will be good for summer crop maturation and harvesting in the central and southern Plains this week and in the western Corn Belt while rain in the eastern Midwest, Delta and southeastern states will disrupt farming activity

periodically. Drier weather might be best for eastern parts of the nation. Recent rain in hard red winter wheat areas was good for planting, emergence and establishment and the region will be closely monitored for follow up rain later this season. There is

still need for significant moisture in the northwestern Plains and the Pacific Northwest as well as Colorado and immediate neighboring areas and that may not evolve for a while. Next week could be a little wetter in the northwestern and west-central Plains

and Pacific Northwest with some showers in the Pacific Northwest this weekend.

- Some

forecast models are advertising a notable storm in the northern Plains and upper U.S. Midwest October 12-14

o

The event may be overdone, but colder air pooling in the northwestern states and western Canada will push into central North America to induce rain, thunderstorms, and some snow

- Confidence

in the details of this event is low, but it some precipitation is expected and the system will need to be closely monitored - Australia

reported rain in many winter crop areas from western Australia into Victoria and near the Great Dividing Range during the weekend

o

The precipitation was light and yet supportive for reproducing and filling winter crops

- Western

Australia is not likely to be significant in the next ten days while showers occur infrequently in eastern parts of the nation

o

The moisture will not be heavy, but will help to improve winter crops and raise soil moisture for summer crop planting and early development; however, there will be need for follow up precipitation because of the light and erratic

distribution of rain

- India’s

monsoon is withdrawing from the north where dry weather is expected most of this week and next week as well

o

Rain will fall in central and southern parts of the nation during the next ten days supporting late season crops in the south

o

Drying in the north will be good for crop maturation and harvest progress

- Too

much rain too late in the season this year hurt the quality of early maturing cotton and a few other crops in the north

- Punjab,

Haryana, and a few Rajasthan crops were most impacted by the wetter bias

o

Drying in Gujarat will be good for crops

- Late

season rainfall has been ideal for supporting crop production after planting got delayed in early summer by late arriving monsoonal rainfall - Southeast

Asia rainfall has been and will continue to be well distributed for rice, sugarcane, oil palm, coffee, cocoa, corn, and a huge range of other crops

o

Rainfall continues a little more erratic than usual in Sumatra and Java where there is need for greater rain, but the situation is not critical

- Tropical

Cyclone Shaheen, formerly Gulab, was over Oman and moving toward eastern Saudi Arabia late Sunday

o

The storm was dissipating this morning near the Saudi Arabia border

o

The storm produced flooding rain and damage to some personal property and infrastructure, but not too much agriculture

- A

tropical disturbance is over the Philippines and will linger today and as it moves to the west northwest Tuesday and Wednesday it will develop into a tropical cyclone that may bring heavy rain, flooding and strong wind speeds to southern China late this week

and into the weekend

o

There is still some potential this event might impact Vietnam and it should be closely monitored

o

Heavy rain will fall in the Philippines, but no damaging wind or serious flooding is expected

- Two

other tropical cyclones may form near the Philippines late this week with one in the Philippines Sea and the other evolving in the northeastern part of the South China Sea

o

Movement of these two systems will be closely monitored with possible impacts on China and Taiwan

- A

tropical disturbance is also possible in the Bay of Bengal this weekend and a close watch on the system is needed for possible impact on eastern India next week - Tropical

Depression Victor will remain over open water in the central Atlantic during the first half of this week and poses no threat to land

o

The system was located 1300 miles west of Cabo Verde Islands at 0500 EDT 0500 EDT today

- The

system will slowly weaken and may dissipate later today or Tuesday - Hurricane

Sam was located 465 miles south of Carpe Race, Newfoundland, Canada at 0500 EDT today

o

The storm was producing maximum sustained wind speeds of 105 mph while moving northeast at 30mph

o

The storm’s path is such that it should stay over open water in the northwestern Atlantic Ocean passing well to the southeast of Newfoundland, Canada

o

No major landmass will be impacted by the storm

o

Weakening is expected this week and it will likely become a mid-latitude storm system southeast of Greenland late this week

- Typhoon

Mindulle moved past Japan late last week and has dissipated - Russia,

Ukraine, the Baltic States and Kazakhstan will continue dry biased over the coming week with temperatures close to normal

o

The environment will be good for establishing winter crops and for additional harvesting of summer crops

- Europe

rain during the weekend developed in France, northwestern Spain, the U.K. and a few neighboring areas while other parts of the continent were mostly dry

o

Rainfall varied from 0.10 to 0.72 inch with local totals of 1.00 to nearly 4.00 inches in interior northwestern France and over 3.25 inches in far southeastern France.

o

Central and eastern Europe were left mostly dry, although a few showers were noted

o

The environment was good for fieldwork except in parts of the west where late season disruption to farming activity was noted

o

The moisture boost will be good for France, Germany, and the U.K. winter crop planting in future weeks.

- Southern

Europe still has some dryness issues in the lower Danube River Basin parts of southern Italy and in a part of the Iberian Peninsula

o

Relief will come to some crop areas in Italy and the Balkan Countries during the next week, although more rain will still be needed in lower Danube River Basin

- South

Africa rainfall in recent days has been good for improving topsoil moisture for spring planting and winter crop development, although more moisture is needed

o

Additional showers of light intensity will occur later this workweek while dry conditions occur prior to and after that period of time

- Central

Africa rainfall will continue periodic and timely for coffee, cocoa, sugarcane, cotton, and rice through the next two weeks - North

Africa showers will be limited to Tunisia and far northeastern Algeria during mid-week and again during the weekend with rainfall of 0.05 to 0.50 inch resulting

o

Dry weather will continue farther to the west

- Canada’s

Prairies will continue to be dry biased through Thursday, but a few showers of rain and snow will occur Thursday afternoon into the weekend, but resulting moisture will be light.

o

A more significant storm system “may” occur next week, although confidence is low

o

Most harvesting is complete and the moisture will be great for winter crops and for raising soil moisture for use next spring

- Southeastern

Canada weather this week will generate a limited amount of rain allowing corn and soybean harvesting to advance favorably.

o

Temperatures will be warmer than usual

- Mexico

weather will include erratic rainfall during the next week with some potential for tropical cyclone to impact west-central parts of the nation next week, although confidence is low - Central

America weather will see near to above normal precipitation - Near

to above average precipitation will also impact Colombia, Peru, and Venezuela over the next ten days - New

Zealand weather is expected to be well mixed over the next ten days with seasonable temperatures and precipitation - Southern

Oscillation Index was +9.81 Sunday morning and the index will slowly rise over the coming week - Xinjiang

China will cool with showers in the northeast Tuesday through Thursday

o

Western and central crop areas in the province will only receive a few sporadic showers and will be mild

Source:

World Weather Inc.

Tuesday,

Oct. 5:

- International

Trade (US data) - EU

weekly grain, oilseed import and export data - Moscow

Golden Autumn Agriculture conference (Oct. 5-8) - Malaysia

Oct. 1-5 palm oil exports - U.S.

Purdue Agriculture Sentiment, 9:30am - New

Zealand Commodity Price - New

Zealand global dairy trade auction - HOLIDAY:

China

Wednesday,

Oct. 6:

- EIA

weekly U.S. ethanol inventories, production - Agricultural

Technology and Food Salon, a virtual event organized by IFIC (Oct. 6-7) - HOLIDAY:

China

Thursday,

Oct. 7:

- FAO

Food Price Index & cereals supply/demand brief - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - Brazil’s

Conab report on yield, area and output of corn and soybeans - Port

of Rouen data on French grain exports - HOLIDAY:

China

Friday,

Oct. 8:

- Labor

Department’s September jobs report - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish supply-demand reports on corn, soybeans, and other commodities - FranceAgriMer

weekly update on crop conditions

Monday

- U.S.

crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm

Tuesday

- USDA

S&D’s, Crop production

Source:

Bloomberg and FI

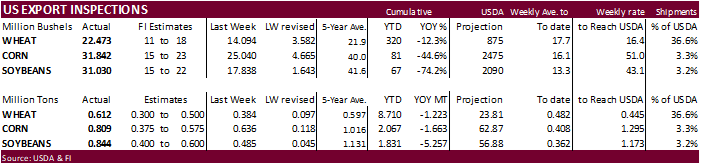

USDA

inspections versus Reuters trade range

Wheat

611,621 versus 250000-500000 range

Corn

808,814 versus 375000-700000 range

Soybeans

844,488 versus 400000-900000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED

IN WEEK ENDING SEP 30, 2021

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 09/30/2021 09/23/2021 10/01/2020 TO DATE TO DATE

BARLEY

0 0 1,397 6,550 7,124

CORN

808,814 636,037 910,973 2,066,892 3,729,562

FLAXSEED

0 0 0 24 389

MIXED

0 0 0 0 0

OATS

0 0 0 200 1,196

RYE

0 0 0 0 0

SORGHUM

77,392 136,758 158,333 229,200 396,430

SOYBEANS

844,488 485,469 2,083,224 1,831,037 7,088,214

SUNFLOWER

0 0 0 0 0

WHEAT

611,621 383,584 679,769 8,710,303 9,933,449

Total

2,342,315 1,641,848 3,833,696 12,844,206 21,156,364

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYB

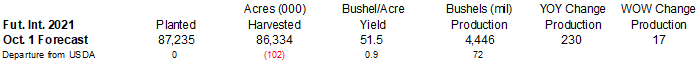

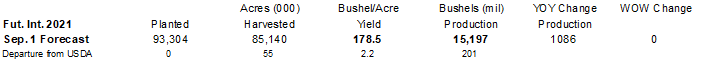

Crop

production estimates

FI

soybean estimate

FI

corn estimate

StoneX

estimated the US corn crop at 15.022 billion bushels and yield at 176.6 bushels/acre. The yield is down from 177.5 previously and production is up from 14.998 billion reported early September. StoneX estimated the US soybean crop at 4.436 billion bushels

and yield at 51.3 bushels/acre. In early September they had a 50.8 yield and production of 4.409 billion.

Macros

77

counterparties take $1.399 tln at Fed reverse repo operation.

US

Factory Orders (M/M) Aug: 1.2% (est 1.0%; prev R 0.7%)

–

Factory Orders Ex-Trans (M/M) Aug: 0.5% (est 0.4%; prev R 0.9%)

US

Durable Goods Orders (M/M) Aug F: 1.8% (est 1.8%; prev 1.8%)

–

Durables Ex-Trans: 0.3% (prev 0.2%)

–

Cap Goods Orders Nondef Ex-Air: 0.6% (prev 0.5%)

–

Cap Goods Ship Nondef Ex-Air: 0.8% (prev 0.7%)

Canadian

Building Permits (M/M) Aug; -2.1% (est 3.4%; prevR -4.1%; prev -3.9%)

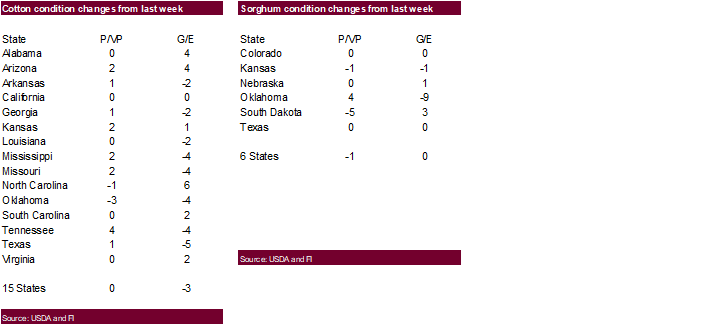

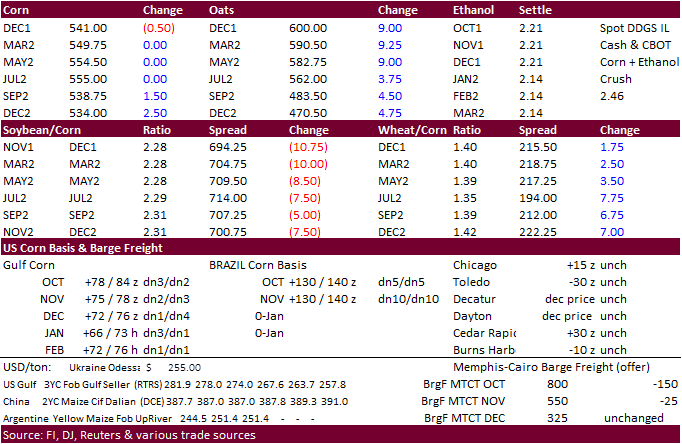

·

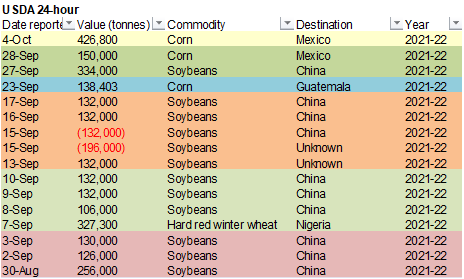

Corn traded two sided, ending mixed despite a lower USD. US weather looks favorable and Brazil is slated to see additional rain this week favoring plantings and recently planted corn. News was quiet.

426,800

tons of corn were reported for delivery to Mexico during the 2021-22 marketing year. Funds were flat today.

·

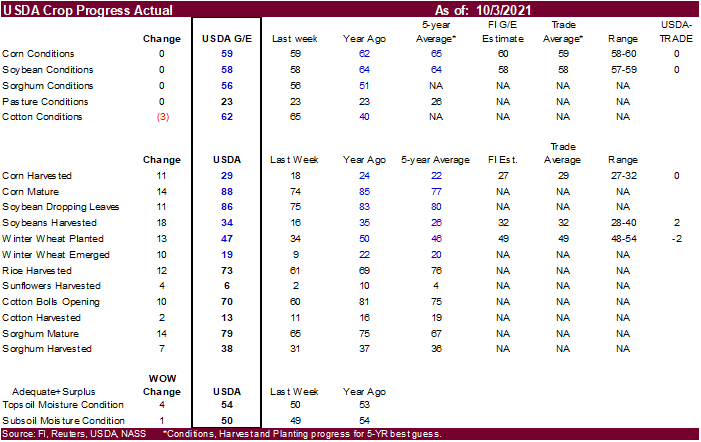

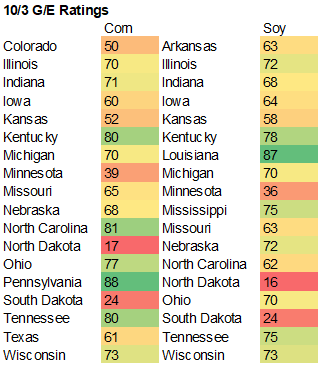

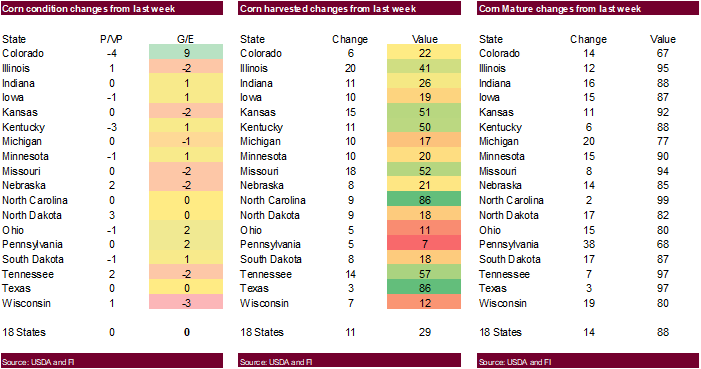

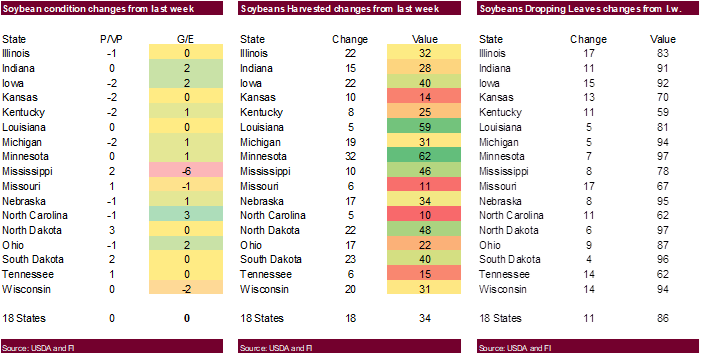

US corn conditions were unchanged in the combined good and excellent categories, at trade expectations. We left our US corn yield and production estimated unchanged from the previous week at 178.5 bu/ac and production at 15.197

billion bushels from the previous week. US corn harvest progress was reported at 29 percent complete, up from 18 last week and compares to 24 percent last year and 22 percent 5-year average.

·

China/US trade talks this week and comment from both countries should be monitored regarding long term grain commitments. Agriculture Secretary Tom Vilsack said China is about 5 billion short on buying US agriculture products.

·

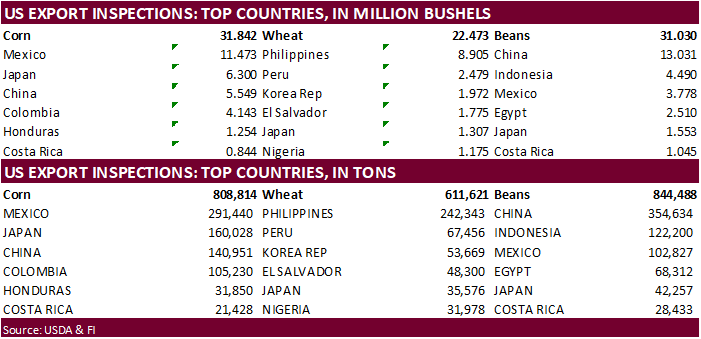

USDA US corn export inspections as of September 30, 2021, were 808,814 tons, above a range of trade expectations, above 636,037 tons previous week and compares to 910,973 tons year ago. Major countries included Mexico for 291,440

tons, Japan for 160,028 tons, and China for 140,951 tons.

·

Natural gas prices, basis the November, are back above $6.00.

·

WTI crude oil prices were up sharply on Monday after OPEC+ agreed to stick with a plan to gradually increase production. Reuters noted representatives “reconfirmed the production adjustment plan” previously agreed for adding

400,000 bpd in November. Crude oil prices (WTI) are up more than 60 percent in 2021 and RBOB is up nearly 65 percent. Ethanol is up about 53 percent while corn futures are up 13 percent.

·

Bloomberg noted their own commodity index hit a record high amid world supply shortages.

·

Companies are starting to get creative to avoid demand destruction from global shipping woes.

Export

developments.

-

Under

the 24-hour announcement system, private exporters reported sales of 426,800 tons of corn for delivery to Mexico during the 2021/2022 marketing year.

Updated

10/4/21

December

corn is seen in a $4.85-$5.65 range (up 5, up 20)

March

corn is seen in a $5.00-$5.80 range.

·

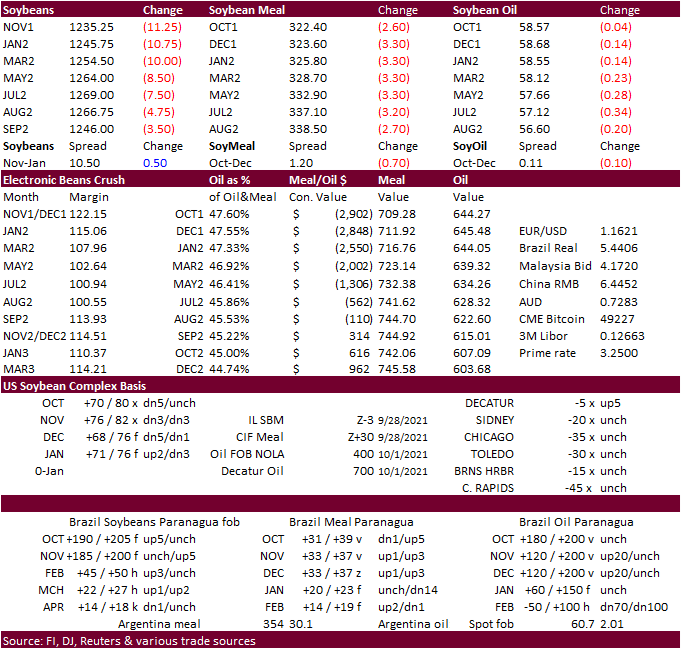

The soybean complex was mostly lower led by soybeans (9-month low). Soybean oil staged a good rebound from overnight lows, and traded two sided, settling mixed. Meal finished lower. Funds sold 7,000 soybeans, sold 3,000 soybean

meal and were flat in soybean oil.

·

US soybean conditions were unchanged in the combined good and excellent categories, at trade expectations, but we increased our US soybean yield and production estimated from the previous week to 51.5 bu/ac (+0.9 bu/ac) and production

to 4.446 billion bushels (up 17 mil bu). US soybean harvest progress was reported at 34 percent complete, up from 16 last week and compares to 35 percent last year and 26 percent 5-year average.

·

Chicago meal basis fell $4/short ton to 4 under the December. Mankato was up $2 to 18 under the Dec. Many other locations were steady.

·

China has been absent for several days from buying soybeans. Last 24-hour sale announcement was September 17. But soybean shipments to China have significantly increased over the past three weeks. Inspections to China increased

to 354,634 tons from 288,935 tons previous week.

·

USDA US soybean export inspections as of September 30, 2021, were 844,488 tons, within a range of trade expectations, above 485,469 tons previous week and compares to 2,083,224 tons year ago. Major countries included China for

354,634 tons, Indonesia for 122,200 tons, and Mexico for 102,827 tons.

·

Malaysian palm futures saw a 78-point increase on Monday as newswire polls for MPOB palm oil stocks for the month of September indicate a slight decline from August. Cash palm oil was up $25/ton to $1,177.50/ton.

·

Strategie Grains see the EU 2022 rapeseed area up 7 percent to 5.6 million hectares in part to high prices. 2021 EU rapeseed harvested area is seen at 5.23 million hectares with production at 17.03 million, up from 16.93 projected

a month ago.

·

The shortfall in the Canadian canola crop, projected to be the lowest in 13 years, is hammering the export market with only 388,000 tons exported from August 1 through mid-September, down 71 percent from year earlier.

·

Ukraine’s sunflower seed harvest progress is running well behind average. Producers gathered 5.9 million tons for 2021, 42% of the projected crop, which is down from 8.1 million tons a year ago (66%). The average for the previous

three years (2019-2020) is 73%.

·

The US midwestern central and eastern crop areas should see favorable rain through Thursday.

·

AgRural reported Brazil was 4% complete with soybean plantings vs. 2% year ago.

·

Brazil’s Mato Grosso, southern MGDS, Minas into Parana should see some rain this week.

·

Argentina will be mostly dry.

·

China is on holiday through October 7.

·

China cash crush margins were last 176 cents/bu on our analysis versus 159 cents late last week and 90 cents around a year ago.

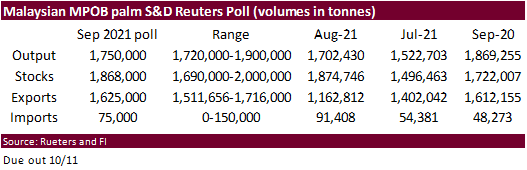

Bloomberg

Poll Sep vs Aug MPOB:

Production

1.75m vs 1.70m (+2.5%)

Imports

90k vs 91k

Exports

1.61m vs 1.16m (+38.0%)

Stocks

1.866m vs 1.875m (-0.5%)

Export

Developments

- Last

week USDA under the FAS’s Food of Education program bought 26,610 tons of soybeans at $528.55/ton.

- Egypt

seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil for November 25 and December 20 arrival.

Updated

9/30/21

Soybeans

– November $12.00-$13.50 range, March $12.00-$14.00

Soybean

meal – December $305-$360, March $300-$3.80

Soybean

oil – December 54-62 cent range, March 54-64

·

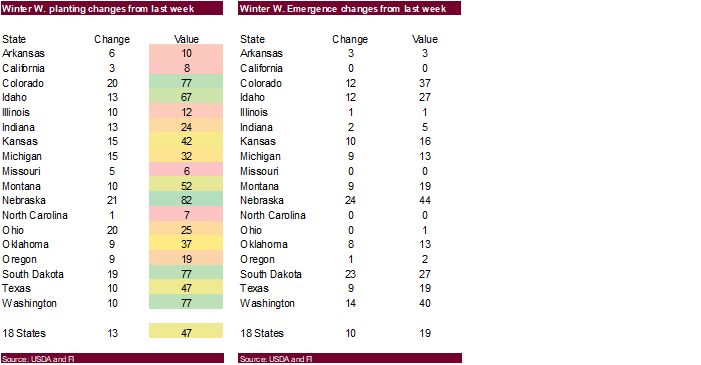

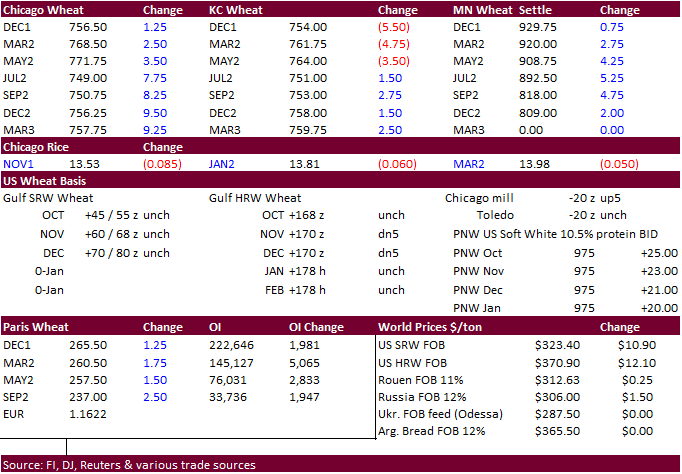

US winter wheat planting progress increased 13 points to 47 percent and compares to 50 percent year ago and 46 average. Winter wheat plantings were 2 points above trade expectations.

·

USDA US all-wheat export inspections as of September 30, 2021, were 611,621 tons, above a range of trade expectations, above 383,584 tons previous week and compares to 679,769 tons year ago. Major countries included Philippines

for 242,343 tons, Peru for 67,456 tons, and Korea Rep for 53,669 tons.

·

The USD was 28 points lower as of 1:48 pm CT.

·

Russian wheat prices are up for the 12th consecutive week with IKAR estimating 12.5% protein wheat at $307/ton, up $3.00/ton from previous week and SovEcon up $1.50 to $306/ton.

·

Russia may plant less winter wheat (0.7-1.2 million hectares) for 2022 harvest according to SovEcon, due to dry weather. IKAR looks for a 0.5-1.0 million reduction 17.8 million hectares year ago.

·

The US should see mostly dry weather across the Great Plains and western Corn Belt this week.

Export

Developments.

·

Taiwan seeks 48,000 tons of wheat on October 7 for November 25 and December 9 shipment.

·

Jordan seeks 120,000 tons of feed barley on October 7 and 120,000 tons of wheat on October 6.

·

Bangladesh plans to buy 100,000 tons of wheat from Russia in a government-to-government tender.

·

The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

·

Turkey seeks 310,000 tons of feed barley, on Oct. 8.

Rice/Other

·

Results awaited: Bangladesh seeks 50,000 tons of rice on October 4.

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December

MN wheat is seen in a $8.65‐$9.75, March $8.50-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.