PDF Attached

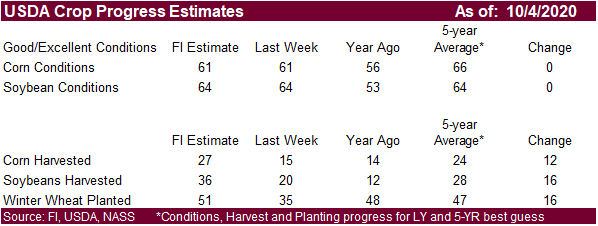

USDA

reported 264,000 tons of soybeans to China and 252,000 tons of soybeans to unknown. Volatile trade. Soybeans ended lower, meal higher and soybean oil sharply lower. Corn was lower and wheat higher basis Chicago. President Trump and the first lady tested

positive for coronavirus.

5-day

- Russia’s

Southern Region and Kazakhstan will continue quite dry through the middle part of this month and temperatures will be warmer than usual - U.S.

hard red winter wheat areas will be mostly dry through the first half of October as well, although a few showers will be possible close to mid-month - Western

Europe will continue to see waves of rain that will raise the potential for more flooding in France, parts of the United Kingdom, northern Spain and eventually in northern Italy.

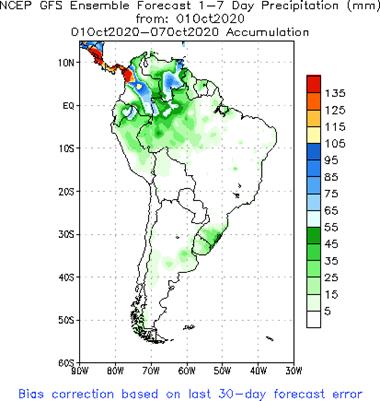

- Argentina

rainfall will continue erratic and mostly too light in the driest areas to seriously increase soil moisture for improved summer crop planting or winter crop development from central and northern Cordoba and central Santa Fe to western Chaco, Santiago del Estero

or Salta - Northeast

China will receive additional rain this weekend delaying fieldwork once again; the region has been too wet for weeks, although some improvement has occurred recently to induce a little harvesting - Northeastern

China weather will improve next week with better drying conditions supporting slowly increasing fieldwork - China’s

Yellow River Basin and North China Plain will experience nearly ideal field working conditions during the next two weeks with only a brief period of light rain expected - Southern

China has been too wet recently and frequent rain through the weekend will perpetuate the situation, but drying is expected late next week and into the following weekend to begin inducing some much-needed improvement - Western

Australia will continue drying down, despite some sporadic light showers from time to time - The

state needs significant rain to bolster soil moisture ahead of winter crop reproduction - Queensland,

Australia is not likely to get much rain until the second week of this month, but rain at that time might start to improve sugarcane conditions and prepare dryland cotton and sorghum fields for planting - South

Australia, Victoria and New South Wales Crops in Australia will remain in very good shape with yield potential for winter crops staying high - Brazil’s

center south and center west crop areas will begin to experience showers and thunderstorms after October 10 and the moisture will be extremely important for early soybean and corn planting, germination and emergence - Brazil

temperatures will continue hot through the next week with some cooling expected with the anticipated increased in rainfall during the period of October 10-16 - Central

India has experienced beneficial drying this week favoring better summer crop maturation and early harvest conditions, but rain will return late next week and it may fester for a full week and perhaps longer - Rain

in central India will disrupt summer crop maturation and harvest progress raising some quality concerns for some crops as well as delaying fieldwork - Tropical

depression development near the Yucatan Peninsula today will be closely monitored; the storm will produce heavy rain across the peninsula this weekend and then will be closely monitored for movement next week - The

system is most likely to turn toward the east coast of mainland Mexico, but there is still time for change in its movement therefore warranting a close watch - Tropical

wave moving into the southeastern Caribbean Sea this weekend will be closely monitored for development next week - The

system could threaten the Yucatan Peninsula, Cuba or Florida in a week to ten days from now - Hurricane

Marie in the eastern Pacific Ocean poses no threat to land - Central

America rainfall is expected to be frequent and heavy over the next two weeks thanks to La Nina - Long

term water supply improvements are expected for Honduras, Nicaragua and Panama - U.S.

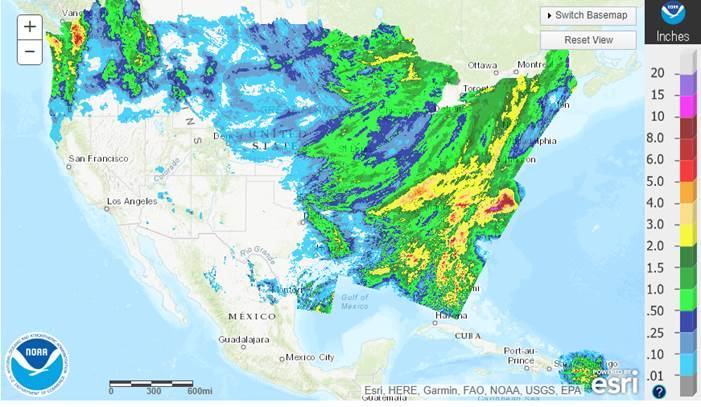

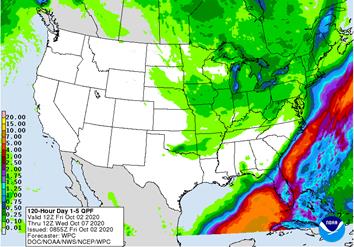

weather over the coming ten days will be good for harvesting in the Delta, southeastern states and most of the Great Plains - Relatively

good conditions will also occur in the western Corn Belt with a few showers briefly this weekend and greater rainfall Oct. 12 - Frequent

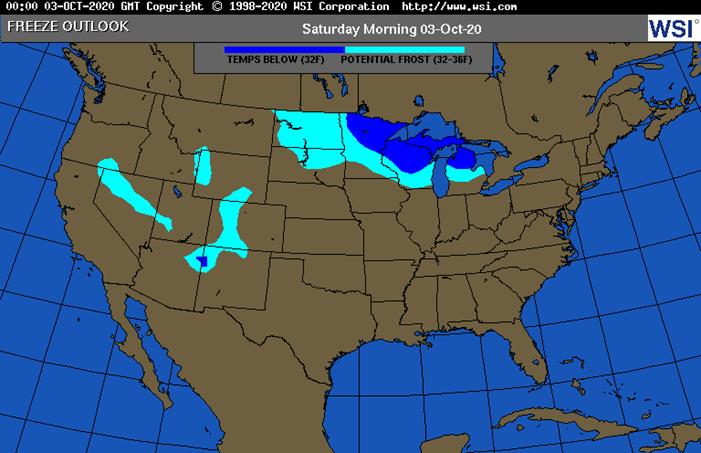

showers and drizzle in Great Lakes region into early next week will hinder field progress - Midwest

temperatures will be colder than usual into early next week and then trend warmer - West

Texas will be dry for the next ten days; some rain is possible near mid-month, but confidence is quite low and the impact is not expected to be very great on cotton or other unharvested crops in the region - U.S.

Pacific Northwest rainfall in the next couple of weeks will be greatest in the mountains, but a few showers may bring some needed moisture to the valleys - La

Nina will favor wetter conditions in these areas during the late autumn and winter - Southwestern

U.S. and most of the Rocky Mountain region will be dry biased along with the high Plains region through the next ten days and probably for upwards to two weeks in some areas - Warming

is expected in the eastern U.S. for a while next week and into the following weekend inducing faster drying rates and better harvest conditions for the Great Lakes region and lower eastern Midwest

·

Indonesia and Malaysia will receive some periodic rain over the next two weeks maintaining a mostly good environment for most crops

·

Mexico weather will be drier biased over the coming week, but eastern and southern crop areas may trend wetter in the second week of October

·

West-central Africa will experience waves of rain through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

·

East-central Africa rain will be erratic and light over the next couple of weeks, but most of Uganda, southwestern Kenya and portions of Ethiopia will be impacted while Tanzania is mostly dry

·

Philippines rain will be widespread over the next ten days to two weeks maintaining a favorable outlook for crops

·

Canada’s Prairies will experience infrequent showers and see warmer than usual temperatures during the next ten days

o

Showers are most likely in the eastern Prairies most often

·

Ontario and Quebec, Canada rainfall will occur frequently over the next week while temperatures are mild to cool resulting in delayed summer crop maturation and harvesting

o

Drier weather will evolve late next week to improve harvest potentials in the following weekend and on into mid-month.

·

New Zealand temperatures will be near to below average over the next seven days while precipitation diminishes and becomes mostly confined to the lower west coast of South Island

-

Southern

Oscillation Index was +9.92 today and it will stay significantly positive through the coming week

Source:

World Weather Inc.

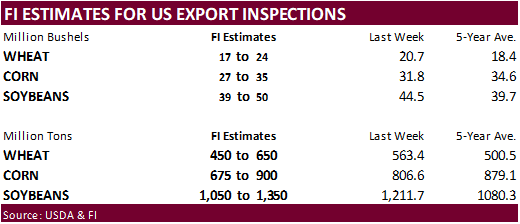

MONDAY,

Oct. 5:

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm - EU

weekly grain, oilseed import and export data - U.K.

wheat and barley production estimates - Ivory

Coast cocoa arrivals - Malaysia

Oct. 1-5 palm oil export data - ANZ

Commodity Price - HOLIDAY:

China, some states of Australia

TUESDAY,

Oct. 6:

- Purdue

Agriculture Sentiment - New

Zealand global dairy trade auction - HOLIDAY:

China

WEDNESDAY,

Oct. 7:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - HOLIDAY:

China

THURSDAY,

Oct. 8:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - UN

FAO World Food Price Index - India

SEA-Globoil webinar with Dorab Mistry, Thomas Mielke and James Fry - Brazil’s

Conab releases first report on 2020-21 planted area, output and yield of soy and corn - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana - HOLIDAY:

China

FRIDAY,

Oct. 9:

- USDA’s

WASDE report with world supply/demand crops update, stockpiles noon - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - China

agriculture ministry (CASDE) to release its monthly data on supply and demand - FranceAgriMer

weekly update on crop conditions - Brazil

Unica cane crush, sugar production (tentative) - HOLIDAY:

Korea

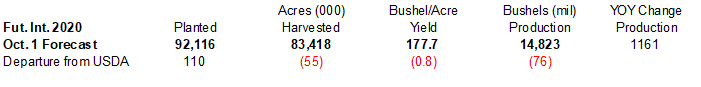

HIS

Markit October update (lower production)

U.S.

2020 corn yield 177.8 versus 179.0 August

Corn

production 14.812 versus 15.036 billion August

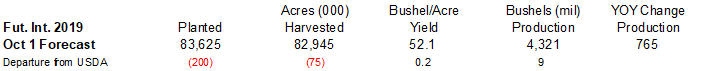

U.S.

2020 soybean yield 51.9 versus 52.5 August

Soybean

production 4.294 versus 4.355 billion August

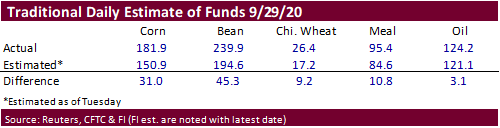

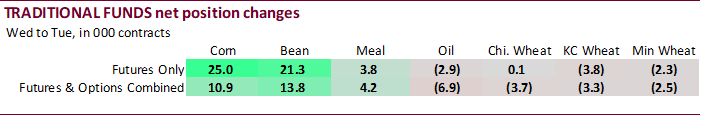

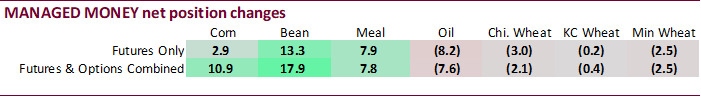

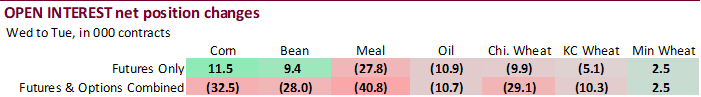

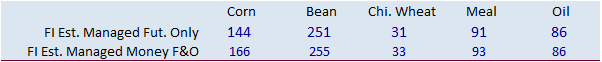

Traditional

funds and Managed Money were much more long for corn and soybeans, and more long for wheat, meal and oil. Selling last week from harvesting pressure and positioning ahead of the September 1 stocks was not as large as the trade expected. With fund positions

well more long than expected for corn and soybeans, prices are a little more vulnerable for movement to the downside if funds decide to liquidate positions. We see this as a bearish indicator.

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

106,820 10,908 177,381 -1,832 -307,243 -7,935

Soybeans

229,043 17,901 127,487 5,276 -351,874 -13,383

Soymeal

72,999 7,752 78,425 1,243 -195,229 -4,134

Soyoil

94,098 -7,604 89,780 73 -220,871 11,514

CBOT

wheat 12,424 -2,119 93,373 3,690 -100,222 596

KCBT

wheat 18,025 -438 42,785 -1,220 -58,714 5,880

MGEX

wheat -4,830 -2,532 2,801 488 524 1,799

———- ———- ———- ———- ———- ———-

Total

wheat 25,619 -5,089 138,959 2,958 -158,412 8,275

Live

cattle 62,924 4,925 79,198 -701 -144,287 -2,818

Feeder

cattle 875 165 4,547 -133 -4,188 -787

Lean

hogs 40,807 -2,773 48,597 135 -95,827 3,778

Source:

Reuters, CFTC, and FI

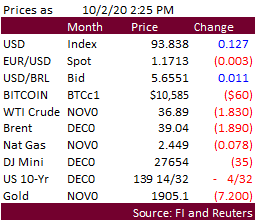

Macros

US

Aide: Tsy Sec Mnuchin Tests Negative For Covid-19

Trump

And The First Lady Have Tested Positive For Coronavirus

House

Democrats Pass $2.2T Stimulus Republicans Reject

US

Change In Nonfarm Payrolls Sep: 661K (est 850K; prevR 1489K; prev 1371K)

US

Unemployment Rate Sep: 7.9% (est 8.2%; prev 8.4%)

US

Average Hourly Earnings (M/M) Sep: 0.1% (est 0.2%; prevR 0.3%; prev 0.4%)

US

Average Hourly Earnings (Y/Y) Sep: 4.7% (est 4.8%; prevR 4.6%; prev 4.7%)

US

Univ. Of Michigan Sentiment Sep F: 80.4 (est 79.0; prev 78.9)

–

Current Conditions Sep F: 87.8 (prev 87.5)

–

Expectations Sep F: 75.6 (prev 73.3)

–

1 Year Inflation Expectations Sep F: 2.6% (prev 2.7%)

–

5-10 Year Inflation Expectations Sep F: 2.7% (prev 2.6%)

US

Factory Orders Aug: 0.7% (est 0.9%; prev R 6.5%)

–

Factory Orders Ex-Transportation Aug: 0.7% (est 1.1%; prev R 2.4%)

–

Durable Goods Orders Aug F: 0.5% (est 0.4%; prev 0.4%)

–

Durable Goods Orders Ex-Transportation Aug F: 0.6% (est 0.4%; prev 0.4%)

–

Cap Goods Orders Non-Defense Ex-Air Aug F: 1.9% (est 1.7%; prev 1.8%)

–

Cap Goods Ship Non-Defense Ex-Air Aug F: 1.5% (prev 1.5%)

-

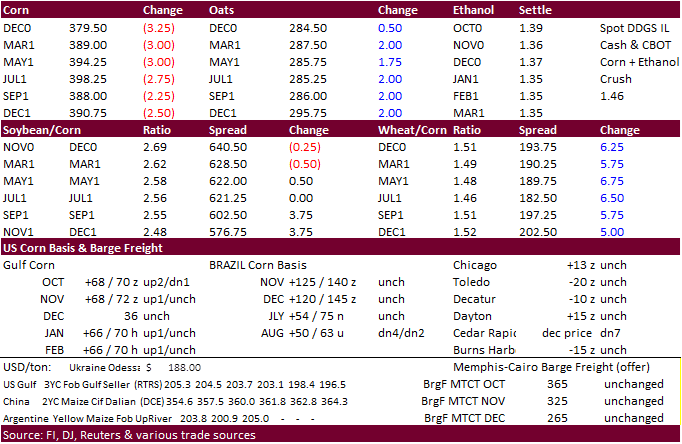

December

CBOT corn traded lower, settling down 3.00 cents (bear spreading) from multi highs from the higher USD and decay in the soybean complex. Profit taking was also a likely factor. The contract reached its highest level since March yesterday. News was light

for the corn market. US export developments were slow. -

French

corn crop ratings were unavailable due to a delay in reporting. -

Germany

ASF: 6 new cases; 46 cases since September 10 -

Argentina

corn export licenses jumped to 334,000 tons overnight, more than three times is average over the past ten days, according to AgriCensus.

-

Brazil

September corn exports were 6.6MMT and soybeans 4.5MMT, up 2 percent for corn year-on-year and slightly lower than 2019 for soybeans.

Corn

Export Developments

-

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on October 26 for delivery within four months of contract.

Updated

9/30/20

-

December

corn is seen in a $3.60-$4.00 range. 2020-21 to average $3.75 for corn and $2.85 for oats.