PDF Attached

Most

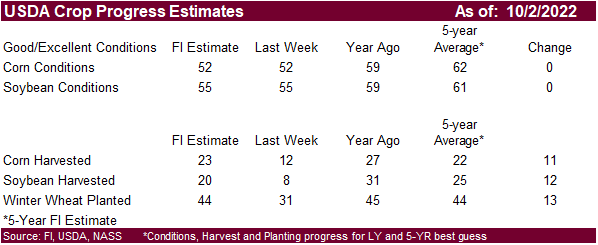

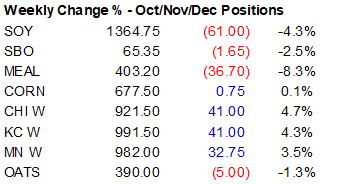

US agriculture markets started higher but ended mixed, with grains settling higher and soybean complex sharply lower.

USDA

released their August S&D report*

Reaction:

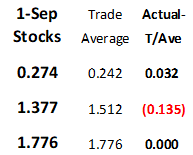

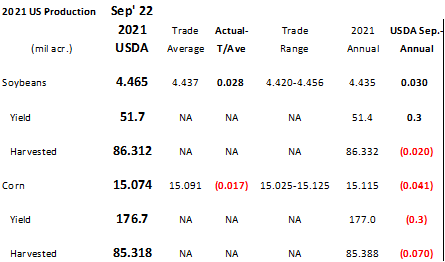

Bearish soybeans and bullish corn and wheat. US soybean production for 2021 was raised 30 million bushels while corn was taken down 41 million. USDA reported September 1 corn stocks 135 million below a trade guess, soybeans 32 million above, and wheat at trade

expectations.

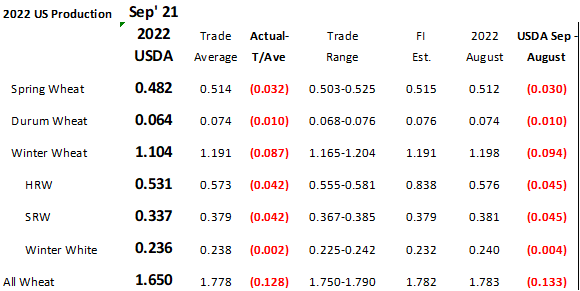

US

wheat production for the 3 classes of winter wheat, spring wheat, and durum, all came in below expectations. The US all wheat planted area was lowered from 46.992 million acres to 45.738 million acres. The winter wheat area was lowered 735,000 acres, spring

wheat was taken down 275,000 and durum was lowered 244,000 acres. The all-wheat harvested area was cut from 37.527 million acres to 35.480 million acres. For the yield, all wheat was reported at 46.5, down from 47.5 previous. If USDA were to leave its 2022-23

all-wheat US demand outlook unchanged in its October update, ending stocks would fall from 610 million bushels (31.4% STU) to 486 million bushels (25.0% STU). That would justify a crop-year average of $8.75 to $9.00 Chicago wheat. The 2021 US soybean planted

area was unchanged. The corn planted area was lowered to 93.252 million from 93.357 million.

The

tendency for USDA to surprise the trade at the end of September lives on. We like owning grains over soybeans, at least for the short term. USDA will likely leave US soybean demand unchanged next month for 2022-23, if the yield changes little from September.

USDA may raise corn for feed by 50 to 75 million bushels. Don’t discount a cut in US corn exports if the 2022 October yield is lowered 1-2 bushels. For US wheat, look for USDA to lower exports by at least 50 million bushels. Back to stocks, USDA made

no revisions to June 1 stocks for soybeans and corn, but upward revised wheat by 9 million to 699 million.

*corrects

changes to corn and soybean production from earlier text. Corn for feed change outlook was revised

Weather

improves a touch for the Midwest with mostly dry weather, favoring harvest but bad for river transportation. Some rain will fall across the southeastern areas Saturday and northwestern areas Sunday through Tuesday. Water levels for the Mississippi River are

not expected to improve over the next week. The Delta and southeast will see dry weather after the remnants of the hurricane exit the region. Argentina has a chance for rain Tuesday for La Pampa and southwest Buenos Aires.