PDF Attached

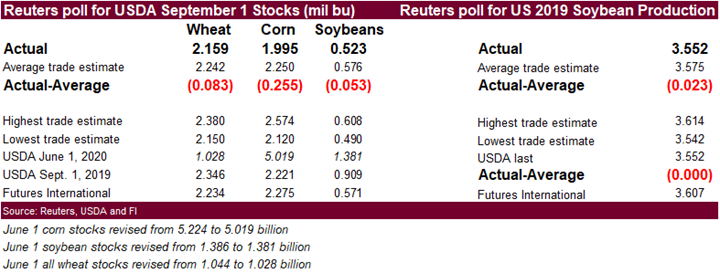

September

1 stocks were bullish and prices exploded to the upside. USDA export sales will be out Thursday and Friday COT.

![]()

USDA

released it September grain stocks update

Reaction:

Bullish.

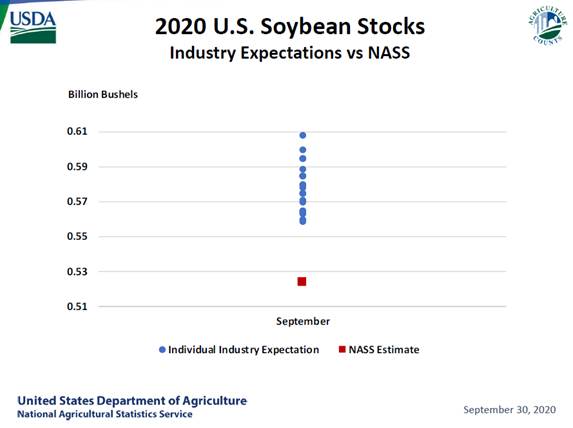

- September

one US soybean stocks were reported at 523 million bushels versus USDA’s S&D outlook of 575 million, a huge difference, and 53 million below an average trade guess. Our implied STU is 13.2 percent compared to USDA Sep S&D of 14.7 percent. It’s as if USDA

adjusted their stocks to reduce the negative residual after realizing an unchanged production estimate for 2019. June one soybean stocks were 1.381 billion bushels, 5 less than what was reported three months ago, so unlike corn, September one stocks deviations

from trade do not reflect previous quarters. The soybean stocks are a mystery, but regardless how one interprets it, stocks are tighter and that should reflect higher prices year over year. A 523 carry in for 2020-21, using USDA’s balance sheet, shrinks

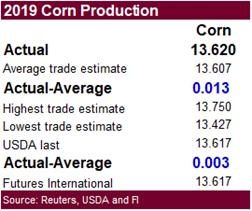

the carryout to 408 million bushels. - 2019

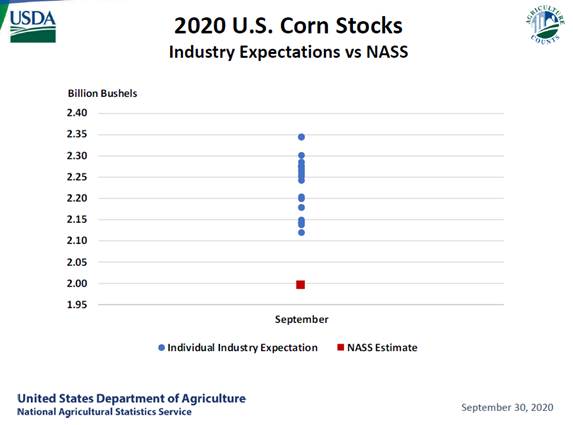

US corn production was upward revised 3 million bushels to 13.620 billion. Going forward USDA will revise previous year corn production in every September Grain Stocks report. Corn September one stocks of 1.995 billion bushels were reported 255 million below

trade expectations. Note USDA revised previous quarter June one corn stocks by 205 million bushels! A big explanation for the deviation in corn stocks from USDA’s S&D stocks projection of 2.253 billion. Therefore, the trade missed feed/residual demand by

roughly 50 million bushels, in our opinion. But what happened with the previous quarters? We will likely see that question come up in October when USDA typically hosts a statistical conference.

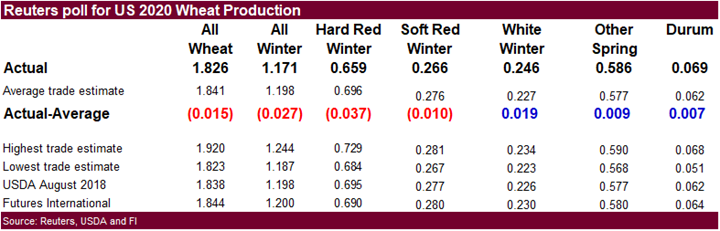

- US

wheat production came in lower than the trade estimate by 15 million bushels to 1.826 billion due to downward revision to winter wheat led by hard red winter. Wheat stocks came in much below trade expectations at 2.159 billion bushels, implying a potential

25 to 50-million-bushel upward revision by USDA to its feed demand in the upcoming supply and demand report.

- We

question both the US 2019 soybean and corn production figures. Corn is at least 200 mil bu too high and soybeans 5-15 million too low.

- FI

price projections were revised.

MOST

IMPORTANT WEATHER TO WATCH

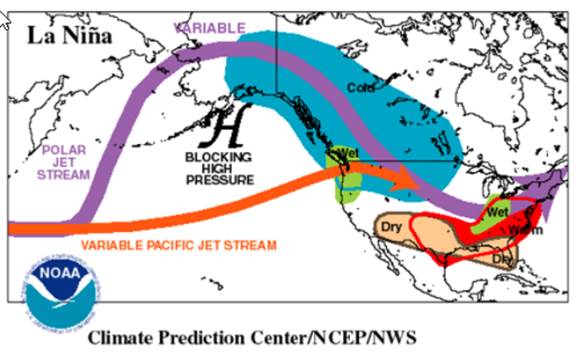

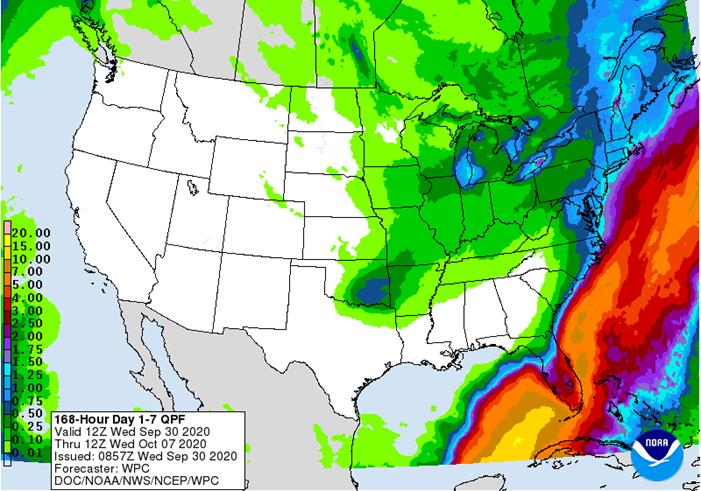

- AREAS

OF CONCERN - U.S.

hard red winter wheat areas will be dry for the next ten days to two weeks and temperatures will be warmer than usual - Montana

and South Dakota wheat areas need greater moisture too - Russia’s

Southern Region remains too dry for winter crop planting and will receive no significant moisture for the next ten days to two weeks, although some brief showers will occur near the Ukrainian border over the coming week - Kazakhstan

wheat areas are still critically dry in unirrigated areas and rain is unlikely for the next two weeks - Northeastern

China continues to receive rain too frequently and summer crop maturation and harvesting remain slow; this pattern will prevail through the weekend and then “some” improvement is expected next week - South

Africa winter crop areas need rain as do future spring planting areas; rain is expected in eastern parts of the nation, but not in the west - Brazil’s

center west and center south crop areas will be drier than usual into the middle of October further delaying the planting of early soybeans and some corn; however, some showers will occur October 10-14 - Brazil

coffee areas will experience little to no rain of significance for the next ten days; Some showers are expected October 10-14

- Brazil

temperatures will remain very warm to hot over the next ten days especially in center west crop areas where extremes of 100 to 110 Fahrenheit are expected - Northwestern

and west-central Argentina will remain too dry over the next ten days - A

tropical cyclone may form in the northwestern Caribbean Sea later this week and could threaten Mexico’s Yucatan Peninsula - AREAS

OF IMPROVEMENT - Ukraine

has received some rain and more will fall into the weekend to improve winter crop planting and establishment conditions - Northeastern

China has seen some net drying recently and fieldwork may be advancing at a “snail’s pace” with more rain coming - Net

drying will occur the remainder of this week in the U.S. Delta and southeastern states benefiting areas that have been too wet in recent weeks

UNITED

STATES

- Dryness

will continue in the U.S. Plains for at least ten days and probably longer - Rain

in the Midwest will be most frequent and significant in the Great Lakes region where field working delays will be most frequent - Improving

conditions are likely in the U.S. Delta and southeastern states - Rain

will fall briefly in the lower Midwest this weekend briefly disrupting fieldwork - Temperatures

are still expected to be cold in the heart of the Midwest into next week while the western U.S. is quite warm

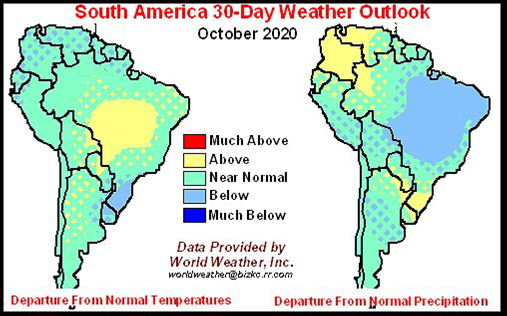

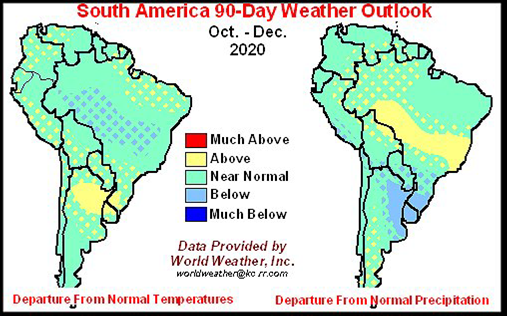

BRAZIL

- Worry

over dryness in center west and center south will continue with little to no rain for the next ten days - Some

showers may develop thereafter, but with restricted rainfall resulting for some areas into mid-month - Temperature

will continue hot in many areas

ARGENTINA

- Rain

is still not well distributed over the next two weeks, but there will be some precipitation - Central

and northern Cordoba, parts of Santa Fe, Santiago del Estero and other northwestern Argentina crop areas are unlikely to see much rain of significance for at least ten days - Temperatures

will be seasonable to slightly cooler biased

INDIA

- Rain

will be greatest in the west-central, south and far eastern parts of the nation - Net

drying in the north and central crop areas - Some

rain will return to central India briefly during the second half of next week

MAINLAND

SOUTHEAST ASIA

- Near

to above average rainfall is expected with northern Thailand to Myanmar and Bangladesh wetter than usual

CHINA

- Drier

weather occurred in the northeast Tuesday, but frequent showers today into next Monday will restrict harvest progress in a part of the region - Northeast

China will trend drier next week - Best

harvesting and planting weather is expected in the Yellow River Basin and North China Plain over next ten days with a mix of rain and sunshine - Southern

China will continue wet with frequent rain near and south of the Yangtze River over the next ten days

EUROPE

- Additional

waves of rain are expected in France and immediate neighboring areas in western Europe over the coming week - Excessive

wind and heavy rain will impact western France, northern Spain and western parts of the United Kingdom late today through the weekend

- Some

property damage may result - Additional

high wind speeds and rain may impact the U.K. and northern France late in the weekend and early next week - Flooding

rain may evolve in northern Poland this weekend into next week - Rain

will also fall frequently in western Ukraine, southern Poland and northern Romania into Friday bolstering soil moisture for much improved rapeseed and winter grain establishment

- A

favorable mix of showers and sunshine will occur elsewhere in Europe over the next two weeks

- Temperatures

will be mild to cool in the west and warm east

WESTERN

CIS

- Temperatures

will be warmer than usual in the coming week to ten days - Waves

of rain will be greatest in central and western Ukraine where some local flooding might eventually develop (mostly in the west) - Showers

in far western Russia, the Baltic States and Belarus will be a low impact on farming activity - Limited

rainfall is expected in the Middle and lower Volga River Basin, Russia’s Southern Region and Kazakhstan over the next ten days - Good

harvest weather In New Lands

AUSTRALIA

- Brief

periods of rain will impact Victoria, South Australia and New South Wales during the next ten days to two weeks maintaining good field moisture - Western

Australia will get some brief showers in southern crop areas Thursday into Friday, but more frequent and more significant rain throughout the state is needed to benefit crops

INDONESIA/MALAYSIA

- Periodic

rain is expected over the next two weeks maintaining a mostly good environment for most crops

MEXICO/CENTRAL

AMERICA

- Rain

will continue greatest from far southern Mexico into Central America - A

possible tropical cyclone in the northwestern Caribbean Sea by Friday may impact the Yucatan Peninsula this weekend

WEST-CENTRAL

AFRICA

- Waves

of rain will continue through the next ten days favoring coffee, cocoa, sugarcane, rice and other crops

EAST-CENTRAL

AFRICA

- Rain

will be erratic and light over the next couple of weeks

PHILIPPINES

- Rain

will impact most of the nation over the next ten days to two weeks maintaining a favorable outlook for crops

CANADA

PRAIRIES

- Showers

will occur most often in the eastern half of the Prairies leaving most other areas dry during the next week

- Temperatures

will be near to above average in the west and near to below average in the east

ONTARIO/QUEBEC

- Rain

will fall frequently over the next week to ten days while temperatures are mild to cool resulting in delayed summer crop maturation and harvesting

TROPICAL

STORM MARIE REMAINS WEST OF MEXICO

- The

storm will move away from North America and poses no threat to land

NEW

ZEALAND

- Conditions

will trend cooler this week while precipitation diminishes and becomes mostly confined to the west coast of South Island

-

Southern

Oscillation Index was +9.93 today and it will stay significantly positive throughout this week

Source:

World Weather Inc.

Source:

World Weather Inc.

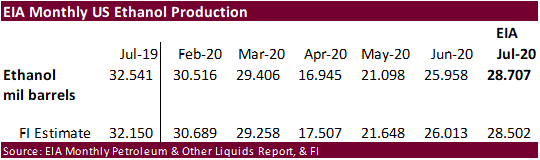

- EIA

U.S. weekly ethanol inventories, production, 10:30am - USDA

quarterly corn, soybean, wheat, sorghum, barley and oat stocks - U.S.

wheat production for Sept. - Roundtable

on Sustainable Palm Oil virtual discussion on seasonal haze - Malaysia

Sept. 1-30 palm oil export data - U.S

agricultural prices paid, received for Aug., 3pm - Poland

to release grains output data - HOLIDAY:

Korea

THURSDAY,

Oct. 1:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - Australia

commodity index for Sept. - Webinar

on the effects of climate change on coffee production in Southeast Asia - Honduras,

Costa Rica coffee exports monthly stats - International

Cotton Advisory Committee releases monthly world outlook - HOLIDAY:

China, Hong Kong, Korea

FRIDAY,

Oct. 2:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

China, Hong Kong, India, Korea

-

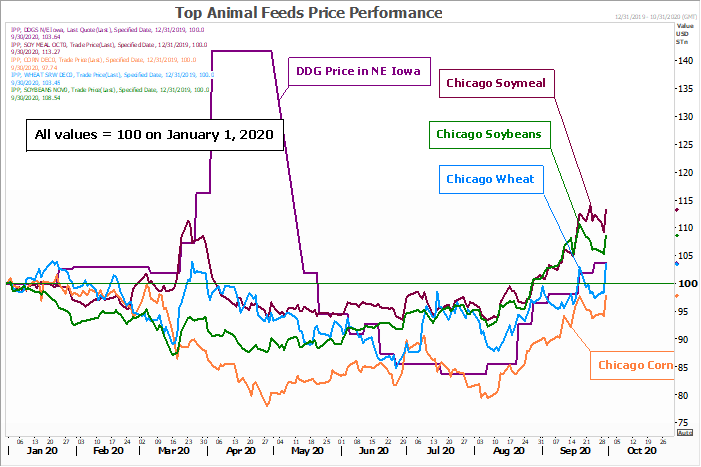

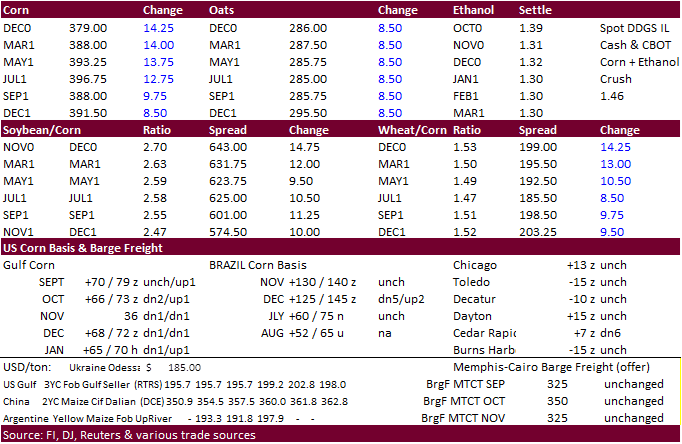

December

corn futures hit their highest level since March 6 on massive fund buying post bullish USDA September grain stocks. A massive 205-million-bushel reduction to June 1 corn stocks and better than expected feed usage for the summer quarter sent 2019-20 US ending

stocks below the psychological 2.0 billion mark. (see text page two) Funds ended up buying an estimated net 55,000 contracts. We raised our top end of the December corn trading range to $4.00. December finished today at $3.79, erasing two weeks of losses.

Going forward look for the trade to shift their attention back to weather. Corn contracts were lower to start on follow through harvest pressure. The US weather forecast looks mostly dry through mid-October.

-

Germany

ASF: 2 more cases; 38 cases since September 10 -

2020-21

Brazil corn production: 107 [95.0–111] million tons, unchanged from last update.

-

The

USDA weekly Broiler Report showed eggs set up 1 percent and chicks placed down 1 percent. Cumulative placements from the week ending January 4, 2020 through September 26, 2020 for the United States were 7.25 billion. Cumulative placements were down 1 percent

from the same period a year earlier. -

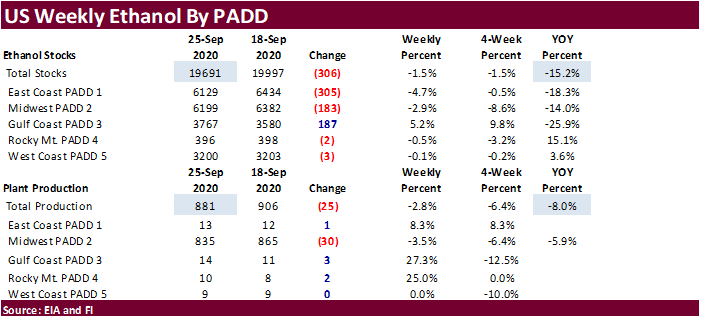

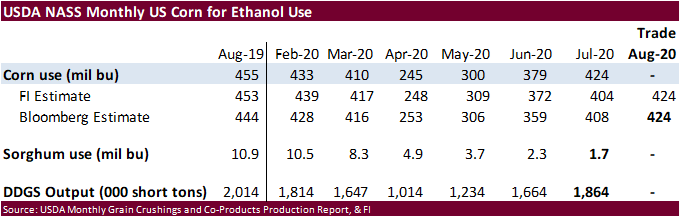

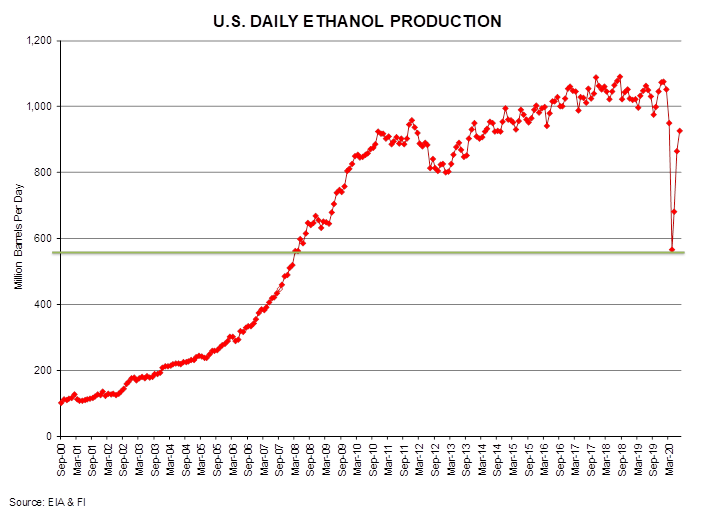

US

weekly ethanol production fell 25,000 barrels to 881,000 and stocks drew 306,000 to 19.691 million. Production was at its lowest since week ending June 12, but still up from the year to date low 537,000 barrels posted 4/24. The 4-week average change in stocks

is 298,000 barrels, a signal declining stocks could correct low production.

Note the 19.691 million-barrel stocks figure is at its lowest level since December 30, 2016.

A Bloomberg poll looked for weekly US ethanol production to be up 6,000 stocks to increase 139,000.

Corn

Export Developments

-

Results

awaited: Iran seeks 200,000 tons of corn feed and 200,000 tons of soybean meal on Sep 30 for OND shipment. The corn will be out of the Black or EU or South America.

Updated

9/30/20

-

December

corn is seen in a $3.60-$4.00 range. (up 20, up 15) 2020-21 to average $3.75 for corn and $2.85 for oats.