PDF Attached

WASHINGTON,

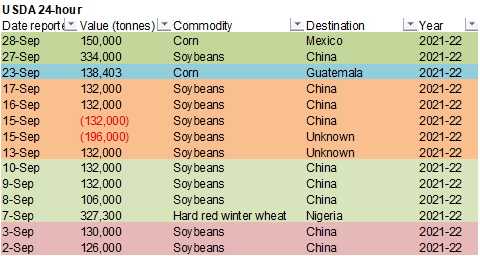

September 28, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 150,000 metric tons of corn for delivery to Mexico during the 2021/2022 marketing year.

Lower

trade across the agriculture space on widespread commodity selling and US economic uncertainty.

7-day

World

Weather Inc.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Southern

and eastern Australia will receive welcome rain over the next week

o

Queensland needs the moisture for future cotton and sorghum planting

o

The moisture comes too late to improve Queensland winter crops and may interfere with maturation and harvesting

o

Rain in New South Wales will replenish soil moisture for reproducing and filling winter crops

o

Rain in Victoria will maintain good soil moisture for future winter crop use

o

Western Australia rain will also support reproducing winter crops

-

China’s

weather will be mixed over the next ten days with a little too much rain falling periodically north of the Yellow River and from Liaoning to southern Jilin

o

The wetter areas in the north will experience delays in summer crop maturation and harvest progress, but the moisture will be good for wheat emergence and establishment later this season

-

Planting

delays are expected during the wetter periods

o

East-central and southeastern China will experience a good mix of weather supporting crops and fieldwork

-

Xinjiang

China will be trending colder with harvest disruptions in the northeast because of frequent precipitation over the next several days

o

Western and central crop areas will not be as cold or wet as the northeast, but some frost will be possible next week

-

Remnants

of Tropical Cyclone Gulab will produce additional heavy rain across Maharashtra and into Gujarat during the next few days

o

Some flood damage to crops is possible

o

Rain totals of 3.00 to more than 8.00 inches will result

o

Rainfall Monday was not much more than 3.00 inches in Telangana, but Sunday’s rainfall reached over 10.00 inches along the Andhra Pradesh coast

-

Other

areas of India will experience a good mix of rain and sunshine

o

Worry remains over the condition of some northern crops where seasonal drying normally occurs at this time of year

-

Today’s

forecast has removed some rain from Rajasthan, Punjab and Haryana and that change was needed and should bode well for cotton in the open boll stage of development

-

Russia’s

winter crop areas will be cool with limited shower activity for a while

o

Warming is needed for improved wheat establishment and that should occur next week

o

Precipitation should be limited for about ten days, although it will not be completely dry

-

Harvest

progress for summer crops in the western CIS will advance around brief showers during the next ten days -

Europe

weather will trend wetter in the western half of the continent resulting in some summer crop harvest delays

o

The moisture will ease dryness in some areas and help improve planting and emergence moisture for winter crops

o

Eastern Europe will experience good field working conditions, although a few showers might disrupt progress infrequently

-

North

Africa rainfall is not likely to be significant over the next ten days, although a few showers are likely -

U.S.

hard red winter wheat areas will receive some welcome rainfall over the next week with sufficient amounts of moisture to improve planting, emergence and establishment for many areas

o

The precipitation may not be as well distributed as advertised in some of the computer weather forecast models and the situation will be closely monitored, but a short term improvement is certainly

expected

-

West

Texas weather will deteriorate over the coming week with less sunny and warm weather expected

o

Cooling with showers and thunderstorms will occur periodically

o

The coolest and most unsettled weather is expected after Friday, but there has already been some rainfall

-

Northwestern

most counties in West Texas reported up to 1.57 inches of rain overnight due to a cluster of thunderstorms

-

U.S.

Delta weather will become wetter biased once again later this week through much of next week causing some delay in summer crop maturation and harvest progress

o

Open boll cotton fiber quality and boll rot issues will resume

-

U.S.

southeastern states will see more sunshine than rain over the next week ten days which should bode well for summer crop maturation and harvest progress -

U.S.

northwestern Plains and much of Canada’s Prairies will remain drought ridden with very little opportunity for relief in the next ten days

o

Temperatures were unseasonably warm to hot Monday with extreme highs reaching into the 80s and 90s

-

Temperatures

in southeastern Canada’s Prairies reached into the lower 90s

-

Interior

parts of the U.S. Pacific Northwest and California will continue mostly dry for an extended period of time, despite a few showers infrequently

-

Southern

Brazil will be wettest into the end of this week

o

Wheat and corn in the far south will benefit most from the rain, although some of the moisture will be good for rice planting as well.

-

Center

west and center south Brazil showers will become more significant again during the weekend and especially next week

o

Planting moisture will increase in pockets, but no general soaking is expected

-

Argentina’s

weather is not likely to bring much rain to the northwest or west-central parts of the nation during the next ten days which are still too dry for spring planting or winter crop development

o

Rain will fall periodically in the south and some eastern crop areas

-

Category

Four Hurricane Sam was located 610 miles east of the northern Leeward Islands at 0500 EDT today moving northwesterly at 9 mph and producing maximum sustained wind speeds of 130 mph.

o

The storm’s path is such that it should stay over open water in the Atlantic passing to the northeast of the northern Leeward Islands early during the middle part of this week and then pass to the

east of Bermuda late this week or early into the weekend

-

A

wave coming away from the West Africa coast will become a tropical cyclone soon

o

The system will likely move to the central Atlantic and pose no threat to land

-

Another

disturbance in the central tropical Atlantic will also be monitored for possible development this week

o

It will move toward the Leeward Islands, but may dissipate to a tropical wave after briefly becoming a tropical cyclone

-

Typhoon

Mindulle was located 360 miles west southwest of Iwo To, Japan at 22.0 north, 135.6 east moving north northwesterly at 9 mph and producing maximum sustained wind speeds of 109 mph near its center.

o

Mindulle should move north northwesterly over the next couple of days before turning to the northeast during the second half of this week

o

If this path verifies, Japan should be spared from the storm’s intense wind and torrential rainfall, but it will need to be closely monitored

o

The storm will intensify a little more early this week and then begin weakening as it turns to the northeast

-

Central

Africa rainfall will occur favorably over the next two weeks

o

Sufficient rain will fall to support normal coffee, cocoa, sugarcane, rice and other crop development from Ethiopia to northern Tanzania and from Ivory Coast to Cameroon and Nigeria

-

South

Africa weather will trend wetter in the next couple of weeks and that should prove beneficial for future spring and summer crop planting and for reproducing winter crops. -

Indonesia

and Malaysia rainfall is expected to be frequent and sufficient to support long term crop needs

o

This is true for the Philippines as well as with a tropical cyclone possible next week threatening the archipelago

-

Mexico

precipitation will be greater than usual this week in most of the south and east followed by drier conditions next week

o

The moisture will be good for late season crop development

o

Dryness in the northeast part of the nation will be briefly eased by this week’s rain

-

Today’s

Southern Oscillation Index was +9.35 and will likely move high over the next few days

-

New

Zealand weather will be wetter biased in North Island and below average in South Island

o

Temperatures will be near to below average

Source:

World Weather Inc.

Tuesday,

Sept. 28:

- EU

weekly grain, oilseed import and export data

Wednesday,

Sept. 29:

- EIA

weekly U.S. ethanol inventories, production - Vietnam’s

General Statistics Office releases Sept. trade data - Brazil’s

Unica releases sugar output and cane crush data (tentative)

Thursday,

Sept. 30:

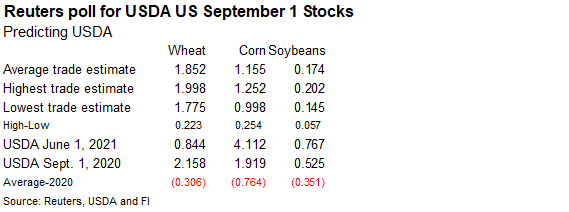

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

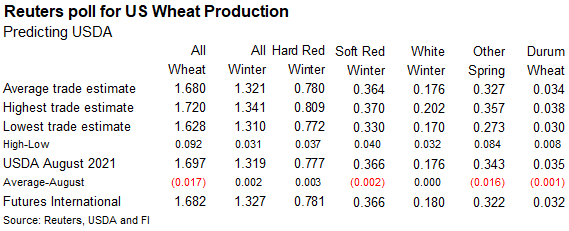

quarterly stocks – corn, soy, wheat, barley, oat and sorghum, noon - U.S.

wheat production, noon - U.S.

agricultural prices paid, received, 3pm - Ivory

Coast farmgate cocoa prices to be announced - Malaysia

September palm oil exports - Port

of Rouen data on French grain exports - HOLIDAY:

Canada

Friday,

Oct. 1:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

cocoa season in Ivory Coast starts - U.S.

DDGS production, corn for ethanol - USDA

soybean crush, 3pm - Australia

commodity index - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

China, Hong Kong

Source:

Bloomberg and FI

Macros

Natural

gas is at its highest level since 2014.

US

Wholesale Inventories (M/M) Aug P: 1.2% (est 0.8%; prev 0.6%)

US

Retail Inventories (M/M) Aug: 0.1% (est 0.5%; prev 0.4%)

US

Advance Goods Trade Balance (USD) Aug: -87.6B (est -87.3B; prev -86.4B)

US

CB Consumer Confidence Sep: 109.3 (est 115; prev 113.8)

–

Expectations: 86.6 (prev 91.4)

–

Present Situations: 143.4 (prev 147.3)

83

Counterparties Take $1313.657 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1297.050 Bln, 77 Bidders)

·

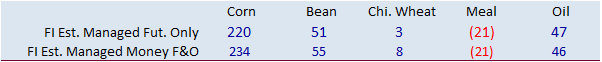

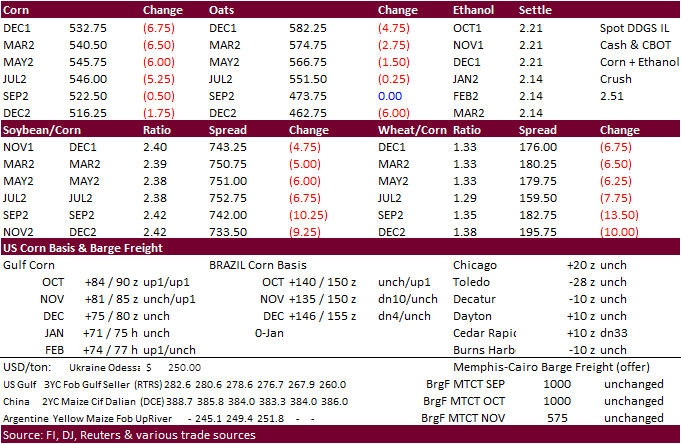

Funds sold an estimated net 5,000 corn contracts.

·

US crop progress was at or near expectations yesterday with US corn and soybean conditions unchanged. Corn and soybean harvesting progress are both running 3 points above average.

·

The US Corn Belt will see favorable harvest weather this week.

·

CNGOIC sees China’s corn prices falling in 2021-22 on large production prospects. They look for corn prices to hit a bottom between end of December and Chinese Spring Festival. CNGOIC looks for imports of corn at 20 million

tons, down from 29 million tons in 2020-21.

·

A group of Democrats lawmakers asked the White House to halt a plan to lower biofuel blend mandates. Some of the trade is getting tired that the updated mandates have not been released, and it is starting to reflect in corn and

soybean oil prices.

·

Argentina corn sales for 2020-21 reached 40.9 million tons as of the third week of September, up 3.7 million tons from this time last year. Argentina produced about 50.7 million tons of corn in 2020-21.

·

Brazil corn imports reached 1.2 million tons Jan-Aug according to IMEA. Nearly 4 million tons could be imported in 2021, which would be a record.

·

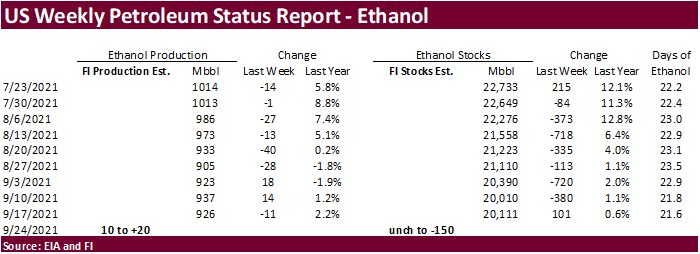

A Bloomberg poll looks for weekly US ethanol production to be up 13,000 barrels (920-953 range) from the previous week and stocks up 84,000 barrels to 20.195 million.

Export

developments.

-

Under

the 24-hour reporting system, private exporters sold 150,000 tons of corn to Mexico for 2021-22 delivery.

-

Taiwan’s

MFIG bought 65,000 tons of Brazil corn for shipment between Dec. 6 and Dec. 25, 2021, or later if from the PNW, at an estimated premium of 292.00 U.S. cents a bushel c&f over the Chicago March 2022 corn contract.

Updated

9/27/21

December

corn is seen in a $4.95-$5.60 range

March

corn is seen in a $5.00-$5.80 range.

Soybeans

·

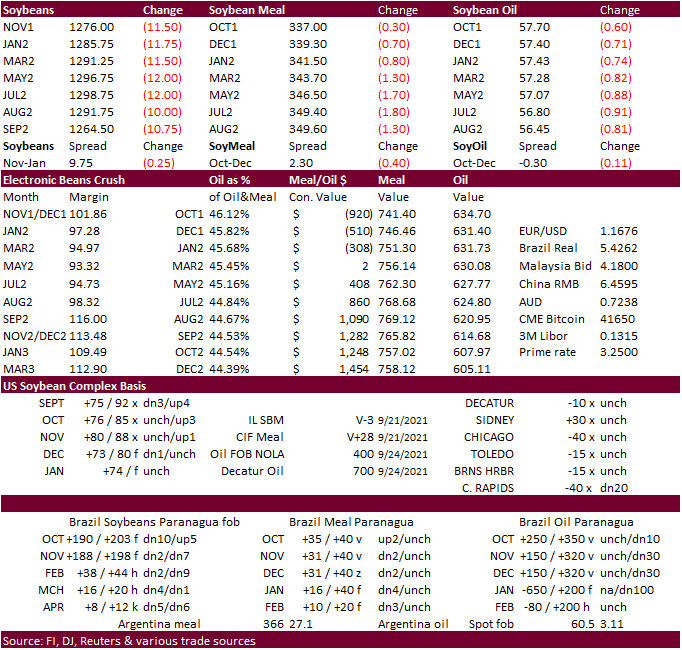

Soybeans, meal, and soybean oil were weaker on a higher trade in the USD, reversal in WTI crude oil, lack of fresh news, and weakness in China soybeans. Soybean oil traded two-sided and was heavily influenced by WTI crude. Ironically

palm futures ended higher overnight follow mineral oil.

·

November EU rapeseed traded 9.25 euros higher at a record 633 euros. This might have limited losses in CBOT soybeans.

·

Funds sold an estimated net 5,000 soybeans, 1,000 meal and 3,000 soybean oil.

·

We lowered our US September soybean exports to only 60 million bushels from around 110 million previous and down from record for that month of 264.2 million during September 2020, due to slow USDA export inspections. This October

we think much of the Gulf will be nearly back to normal and see soybean exports around 360 million, down from record 427.6 million posted October 2020. 2021-22 US soybean exports are projected at 2.040 billion bushels, down from our previous estimate of 2.065

billion, and compares to USDA’ current 2.090 billion estimate.

·

Argentine producers sold 30.5 million tons of soybeans from the 2020-21 crop, after adding nearly 500,000 for the week ending September 22, according to the AgMin. Last season they were at 32.2 million tons. About 43 million

tons of soybeans were produced in 2020-21.

·

Cargo surveyor SGS reported month to date September 25 Malaysian palm exports at 1,409,718 tons, 410,050 tons above the same period a month ago or up 41.0%, and 88,769 tons above the same period a year ago or up 6.7%.

·

Cargo surveyor SGS reported month to date September 25 Malaysian palm exports at 1,409,718 tons, 410,050 tons above the same period a month ago or up 41.0%, and 88,769 tons above the same period a year ago or up 6.7%.

·

CHS’s Myrtle Grove, LA, grain export terminal resumed operations.

Export

Developments

·

None reported

Updated

9/27/21

Soybeans

– November $12.15-$13.50 range, March $12.00-$14.00

Soybean

meal – December $320-$360, March $300-$3.80

Soybean

oil – December 54-62 cent range,

March 54-64

·

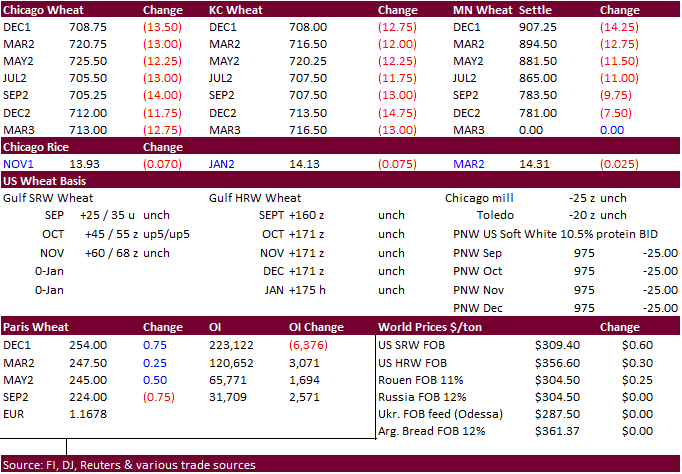

Wheat traded lower on widespread commodity selling and sharply higher USD. There were no new export developments. Algeria started buying wheat today. The central and lower Great Plains will see rain this week.

·

Funds sold an estimated net 9,000 Chicago wheat.

·

Paris December wheat was up 0.75 at 254 euros, in part to new record high in November EU rapeseed.

·

The USD was 37 points higher as of 1 pm CT.

·

Ukraine planted 1.95 million hectares of 2022 winter wheat as of Sept 27 or 29% of the expected area of 6.68 million hectares (AgMin).

Export

Developments.

·

Algeria started buying wheat, optional origin, at prices around $364/ton c&f for November 1-15 and November 16-30 shipment. Volume were rumored at around 500,000 tons. Results will likely be out September 29.

·

AgriCensus mentioned Japan bought 231,838 tons of food wheat, consisting of 114,502 tons US, 87,196 Canadian and 30,140 tons Australian.

·

Pakistan seeks 640,000 tons of wheat on Sep. 29

for

shipment between January and February 2022.

·

Jordan seeks 120,000 tons of wheat on September 29.

Jordan

seeks 120,000 tons of feed barley on September 30 for Dec-Feb shipment.

·

The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on October 4.

Updated

9/27/21

December

Chicago wheat is seen in a $6.80‐$7.50 range, March $6.50-$7.75

December

KC wheat is seen in a $6.75‐$7.60, March $6.50-$7.75

December

MN wheat is seen in a $8.45‐$9.50, March $8.50-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.