PDF Attached

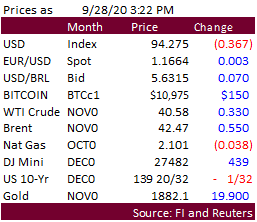

USD

was down 37 by 2:30 PM CT, WTI up $0.34, gold $20.20 higher and US equities higher. Lower trade for soybeans and meal, mainly positioning, while wheat corn and soybean oil were higher.

MOST

IMPORTANT WEATHER TO WATCH

- AREAS

OF CONCERN - U.S.

hard red winter wheat areas will be dry for the next ten days to two weeks and excessive heat and dryness has already depleted soil moisture - Montana

and South Dakota wheat areas need greater moisture too - Russia’s

Southern Region remains too dry for winter crop planting, although some brief showers will occur near the Ukrainian border over the coming week - Kazakhstan

wheat areas are still critically dry in unirrigated areas and rain is unlikely for the next two weeks - Northeastern

China continues to receive rain too frequently and summer crop maturation and harvesting remain slow, despite some weekend drying - South

Africa winter crop areas need rain as do future spring planting areas - Brazil’s

center west and center south crop areas will be dry into the middle of October further delaying the planting of early soybeans and some corn - Brazil

coffee areas will experience little to no rain of significance for the next ten days and possibly out two weeks - Brazil

temperatures will remain very warm to hot over the next ten days - Northwestern

and west-central Argentina will remain too dry over the next ten days - Flooding

rain may impact a part of far southern Mexico and Central America in the next ten days to two weeks - A

tropical cyclone may form in the Caribbean Sea later this week - Frost

and freezes occurred in a part of eastern Australia Sunday and today - AREAS

OF IMPROVEMENT - Southern

Argentina received significant weekend rain easing dryness and improving crop and field working potentials - Rain

fell in much of Europe easing long term dryness in several areas and more is expected - Ukraine

has received some rain and more will fall over the coming week to improve winter crop planting and establishment conditions - Net

drying is expected later this week in the U.S. Delta and southeastern states benefiting areas that have been too wet in recent weeks - Frost

and a few light freezes in eastern Australia wheat, barley and canola areas Sunday and today likely had low impact on the majority of crops, but an assessment of the impact will be needed - Most

lows were in the 30s and lower 40s Fahrenheit and some of the crop in New South Wales was in a sensitive state of development - World

Weather, Inc. anticipates a very low impact, but some negative impact cannot be ruled out of a few areas - Argentina

received some much needed rain late last week and during the weekend easing long term dryness in the south, but the north was left hot and dry - Rainfall

of 1.50 to 4.63 inches occurred Thursday through dawn today from a part of northern La Pampa and southeastern Cordoba to northern and central Buenos Aires, including southernmost Santa Fe and southernmost Entre Rios.

- Rainfall

farther south in southern Buenos Aires varied from 0.50 to 1.50 inches except near the coast of Buenos Aires east of Bahia Blanca where 0.35 to 0.50 inch resulted - The

rain was excellent in bolstering soil moisture for much improved wheat and barley development and improved early season corn and sunseed planting potentials - Northern

Argentina reported very little rain and was warm to hot temperatures with extreme highs in the 90s to 110 degrees Fahrenheit - The

heat accelerated drying and raised the need for significant rain in cotton, corn, sunseed and other crop areas - Argentina

rainfall over the next couple of weeks will favor the northeast part of the nation, although some other areas will get a few showers - Resulting

rainfall will not be very great in central, southern or western areas and more moisture will be needed

- Drought

will remain a serious concern in central and northern Cordoba, Santiago del Estero, parts of Santa Fe and neighboring areas - October

7-8 is the earliest opportunity for follow up rain in the previously driest areas in central and southern parts of the nation - Brazil

weekend temperatures were hot in the central and west with extreme highs in the 90s to 108 degrees Fahrenheit - Most

of the nation was dry except in central and southern Rio Grande do Sul where 0.15 to 1.10 inches resulting - Southern

corn and rice areas were wettest - Brazil

weather over the next ten days will be dry in the bulk of center west and center south production areas - Rain

will fall in northwestern Mato Grosso periodically and may benefit some early season soybean planting, but the bulk of the state will be left dry - Far

southern Brazil will continue to experience waves of rain during the next couple of weeks maintaining moisture abundance for reproducing and filling wheat and supporting early corn and rice planting and development - Some

wheat areas will be trending a little wet and need to dry down to protect crop quality - Europe

rainfall during the weekend increased as expected with precipitation noted from western Ukraine, Poland and parts of Romania west to France, far northern parts of Spain and Belgium - Sufficient

rain fell to improve soil moisture in many previously dry areas, but more rain is needed - Rain

is expected to fall additionally over the next ten days in most of Europe - France,

Belgium and the U.K. may experience heavy rainfall at times while Germany, western Poland and Czech Republic as well as the middle and lower Danube River Basin will receive the least amounts of rain - Planting

moisture will continue to increase - Some

dry time will be needed to promote autumn planting and summer crop harvesting - Ukraine

will get enough rain in the coming week to ten days to support planting of wheat, barley, rye and rapeseed - Improved

winter crop establishment is expected in those areas already planted - A

much improved winter crop production outlook will result, although more rain will be needed in October to ensure moisture deficits are significantly eased - Russia

weather over the next ten days will be drier biased except near the Baltic States, Belarus and Ukraine borders where some rain is expected - Showers

will also occur in the eastern New Lands - Net

drying is expected over most of the Volga River Basin, Ural Mountains region, Kazakhstan and Russia’s Southern Region - Good

harvest conditions will occur during this dry period and more autumn planting will take place, although the driest areas in southern areas will limit any new wheat and rye planting and emergence

- China

rain fell from Sichuan to Fujian and areas southwest into Indochina during the weekend - Moisture

totals were greatest from Sichuan to southern Jiangxi where 2.00 to 4.00 inches common and local totals to nearly 7.00 inches in Hunan - Net

drying occurred in other areas of China including east-central through northeastern areas - The

drying trend was welcome and beneficial, but it may be short-lived - Northeastern

China will be facing another week to ten days of frequent rainfall limiting summer crop maturation and harvest progress - Recent

drying was welcome, but returning rain, although not heavy, will prevent the region from drying out beneficially for aggressive fieldwork - A

more prolonged period of dry and warm weather is needed to get harvesting back on track after recent weeks of wet conditions - A

favorable mix of rain and sunshine will occur in the North China Plain and Yellow River Basin where good wheat planting and summer crop harvest progress is expected - Rain

will fall frequently in southern China maintaining wet conditions, but flood potentials should be low - Xinjiang

China weather contrasted greatly during the weekend with frost and freezes in the northeast where highs were limited to the upper 40s and lower 50s with very warm conditions elsewhere with peak temperatures reaching into the lower to middle 80s and lows in

the 50s Fahrenheit - Mostly

dry weather prevailed throughout the province - Xinjiang,

China weather this week will trend cooler farther to the south, but frost and freeze conditions will be limited to the northeast - The

cold is not a threat to cotton which has already been defoliated and the crop is being harvested - Rainfall

should be limited to spotty showers that will not harm fiber quality - Southeastern

Australia will experience waves of rain through the next two weeks benefiting long term wheat, barley and canola development - Queensland’s

greatest rain will occur next week - New

South Wales, Victoria and South Australia will be wettest and should have excellent long term crop prospects - Southern

portions of Western Australia will get some light rainfall early and again late this week, although moisture totals will not be more than 0.50 inch and the precipitation will not reach into northern crop areas - Greater

rain would be welcome, but sufficient amounts will occur to support favorable pre-reproductive crop development

- Northern

yield potentials may have slipped a little lower than usual, but losses are not dramatic - Australia’s

weekend rainfall varied from 0.05 to 0.50 inch in New South Wales, Victoria and southern parts of Western Australia - Several

local totals of 1.00 to 1.48 inches occurred from the southern border of New South Wales into Victoria - Queensland

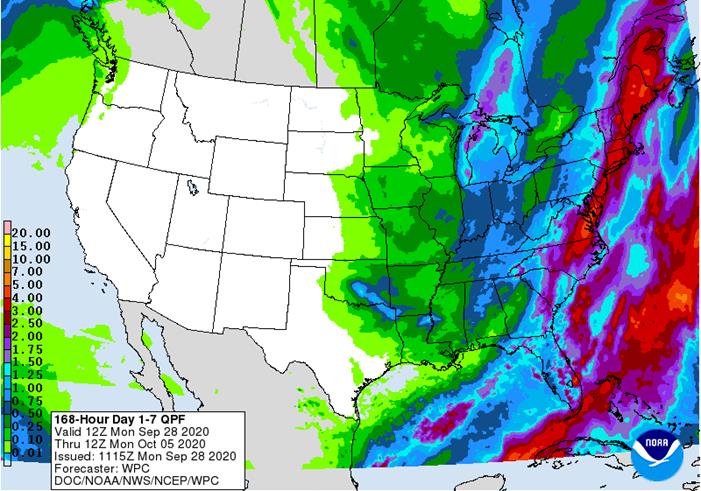

was dry along with minor crop areas in northern and eastern parts of Western Australia and western parts of South Australia’s crop region - U.S.

weather provided no surprises during the weekend - Rain

was limited to the northern and western parts of the Midwest - Moisture

totals through Sunday varied from 0.05 to 0.73 inch from northern Missouri through eastern and southern Iowa to parts of Wisconsin - Greater

rain fell in upper Michigan where 1.00 to 2.00 inches of moisture resulted - Greater

rain also occurred from northeastern Kansas through west-central Missouri where 1.00 to 2.00 inches resulted

- A

trace to 0.25 inch and a few local totals to 0.50 inch occurred in the upper Midwest and northern Plains, although many of these areas did not receive much meaningful rain - Dry

conditions occurred in the central and eastern Midwest and Delta - Some

welcome drying occurred in the southeastern states after rain from remnants of Tropical Cyclone Beta passed through the region early in the weekend - Rainfall

of 1.00 to 3.60 inches occurred from coastal areas of Georgia to central Virginia from rain Friday into Saturday - Mostly

dry weather occurred in other U.S. crop areas - Temperatures

were very warm to hot Friday into Saturday in the central and southwestern Plains with extremes of 95 to 102 degrees Fahrenheit which is well above normal for this time of year - Temperatures

were more seasonable in many other areas - U.S.

weather outlook has not changed for the coming ten days - Temperatures

will be quite cool in the eastern half of the nation over this coming week with the cool conditions lingering a total of ten days - Waves

of light rain and drizzle will impact the Great Lakes region during much of the forecast period - Rain

in the lower eastern Midwest and Delta will occur today and a few other showers will occur periodically in other days this week and early next week in Indiana, Ohio and eastern Illinois as weak disturbances occur periodically

- Summer

crop harvesting will be very slow in the Great Lakes region - Summer

crop harvesting will be disrupted periodically in the lower eastern Midwest - Best

crop maturation and harvest weather is expected in the Great Plains and Delta during the next ten days - Dry

weather will also occur in the far western United States during much of the coming ten days with temperatures well above average - Very

little rain of significance will impact western hard red winter wheat areas where temperatures will be mild early this week and then rising above average later this week into next week - Low

soil moisture is expected in most of the high Plains region during the next ten days raising concern over early wheat establishment in unirrigated fields - West

Texas cotton, corn, sorghum and peanut areas will not be impacted by much precipitation over the next ten days which should protect cotton fiber quality and support normal maturation

- GFS

and European forecast model runs are suggesting tropical cyclone development in the Caribbean Sea next week that might eventually threaten the southeastern United States and/or Cuba, but this event is too far out in the forecast for much confidence - No

active tropical cyclones are present in the world today - Western

South Africa received a few showers during the weekend benefiting some of the winter crops in that region - Rain

also occurred in eastern Natal - South

Africa weekend temperatures were very warm to hot in Limpopo while frost and freezes occurred in Free State, North West and other western parts of the nation - India’s

weekend rain was greatest in the far Eastern States and Bangladesh as well as in the interior south while net drying occurred elsewhere - Some

flooding occurred in northern Bangladesh and neighboring areas of India - The

drier bias was ideal for inducing some crop maturation - Temperatures

were very warm to hot in the interior north and northwest - Pakistan

weather was also mostly dry and warm to hot during the weekend - India

rain will continue to withdraw from central areas over the coming week while periods of rain prevail in the far eastern and extreme southern parts of the nation during the next ten days - Summer

crop maturation and early harvest progress will advance favorably - Ontario

and Quebec, Canada may get rain a little more frequently than desired this week and lasting at least a week and possibly for ten days resulting in some crop maturation and harvest delays - West-central

Africa will continue to experience periodic showers and thunderstorms over the next couple of weeks - Cotton

areas will need to dry out soon to protect fiber quality and promote maturation - Most

coffee, cocoa, rice and sugarcane crops receiving rain will likely benefit from the moisture

- Weekend

rain was most significant in Ghana, eastern Nigeria and Cameroon - East

central Africa rainfall has been and will continue to be erratic and mostly beneficial over the next ten days - Mainland

areas of Southeast Asia will experience periodic showers and thunderstorms over the next couple of weeks

- Late

season moisture boosting is extremely important since water supply has not been fully restored from last year’s low levels - Philippines

rainfall will continue periodically benefiting most crops. - Improving

rainfall in Indonesia and Malaysia is expected over the next two weeks with some locally heavy rain possible in random locations especially in the first week of October -

New

Zealand rainfall will be erratic over the next two weeks while temperatures are cooler than usual -

Soil

moisture is rated favorably -

Mexico

precipitation is expected to be confined to the far south over the next week while all other areas experience net drying -

Frequent

rain will continue in Central America maintaining good crop conditions over the next two weeks -

A

few areas will get too much rain resulting in local flooding -

Southern

Oscillation Index was +10.63 today and it will stay significantly positive throughout this week

Source:

World Weather Inc.

- USDA

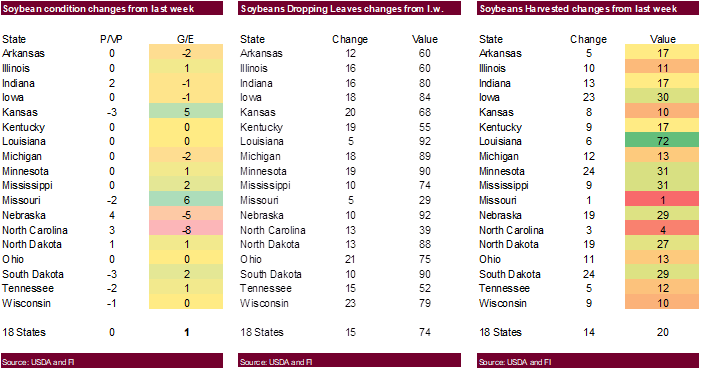

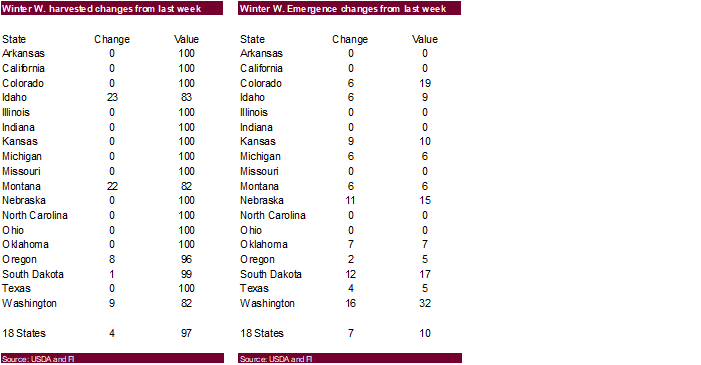

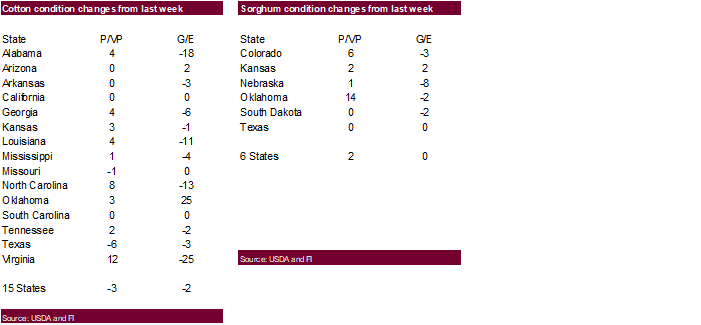

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm - FT

Commodities Global Summit (Sept. 28-30) - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - EARNINGS:

Louis Dreyfus

TUESDAY,

Sept. 29:

- Nothing

major scheduled

WEDNESDAY,

Sept. 30:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - USDA

quarterly corn, soybean, wheat, sorghum, barley and oat stocks - U.S.

wheat production for Sept. - Roundtable

on Sustainable Palm Oil virtual discussion on seasonal haze - Malaysia

Sept. 1-30 palm oil export data - U.S

agricultural prices paid, received for Aug., 3pm - Poland

to release grains output data - HOLIDAY:

Korea

THURSDAY,

Oct. 1:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - Australia

commodity index for Sept. - Webinar

on the effects of climate change on coffee production in Southeast Asia - Honduras,

Costa Rica coffee exports monthly stats - International

Cotton Advisory Committee releases monthly world outlook - HOLIDAY:

China, Hong Kong, Korea

FRIDAY,

Oct. 2:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

China, Hong Kong, India, Korea

USDA

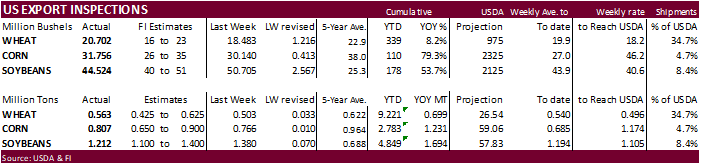

inspections versus Reuters trade range

Wheat

563,427 versus 400000-650000 range

Corn

806,639 versus 650000-900000 range

Soybeans

1,211,733 versus 1100000-1400000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING SEP 24, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 09/24/2020 09/17/2020 09/26/2019 TO DATE TO DATE

BARLEY

0 0 2,595 5,727 5,631

CORN

806,639 765,589 421,735 2,783,261 1,552,263

FLAXSEED

0 0 0 389 72

MIXED

0 0 0 0 0

OATS

0 48 0 996 798

RYE

0 0 0 0 0

SORGHUM

58,243 71,501 15,383 304,108 101,058

SOYBEANS

1,211,733 1,379,971 986,305 4,848,745 3,154,539

SUNFLOWER

0 0 0 0 0

WHEAT

563,427 503,034 502,915 9,220,833 8,521,565

Total

2,640,042 2,720,143 1,928,933 17,164,059 13,335,926

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Note

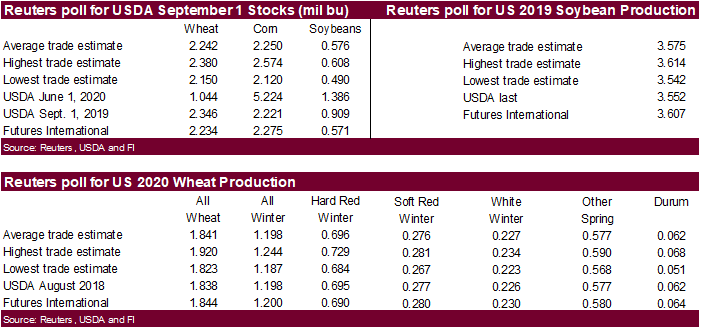

Reuters polled for 2019 corn production. We think it will be unchanged. Reuters average was 13.607 billion bu versus 13.617 USDA, so others also not looking for change (range 13.427-13.750 billion for those looking for a change).

Average

estimates for 2019-20 ending stocks for September 1 don’t deviate much from USDA

USDA

Aug 2019-20 corn carry 2.253 (ave. est. 3 bushels below USDA)

USDA

Aug 2019-20 soy carry 0.575 (ave. est. 1 bushel above USDA)

Macros

-

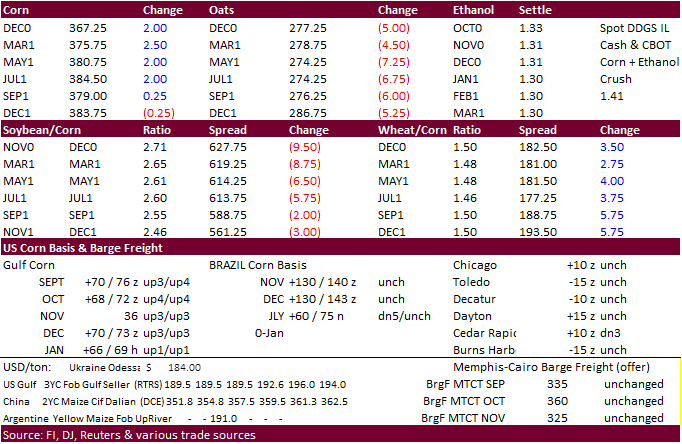

Corn

opened lower despite a lower USD. Selling started to dry up around 9:30 am and at 9:41 CT, 3,400 December corn contracts traded, and prices traded around unchanged. Prices increased following wheat and good export developments. December corn only ended

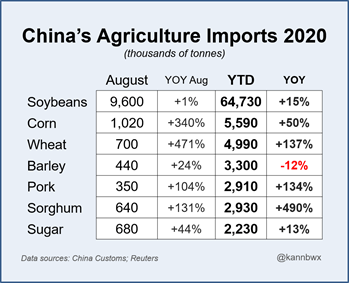

1.50 cents higher and March was up 2.25 cents. USDA posted corn sales to Japan and unknown destinations. Producers were busy selling soybeans but not so much for corn. China imported 5.59MMT of corn and 64.730 million tons of soybeans during Jan and Aug.

We look for Chinese corn imports to remain steady through the end of 2020. US CIF corn basis was firm on Monday. Friday’s USDA US hog inventory report was viewed as friendly for corn but for the second quarter in a row, USDA showed a contraction in the breeding

herd in response to low prices, a signal the industry may contract over the medium term. Note cold storage stocks of pork as of Aug 31 were up 2 percent from July but remain 23 percent below a year ago, thanks to an industry slowdown in slaughter due to COVID-19

earlier this year.

-

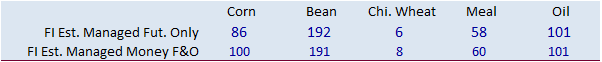

Funds

bought an estimated net 8,000 corn contracts.

-

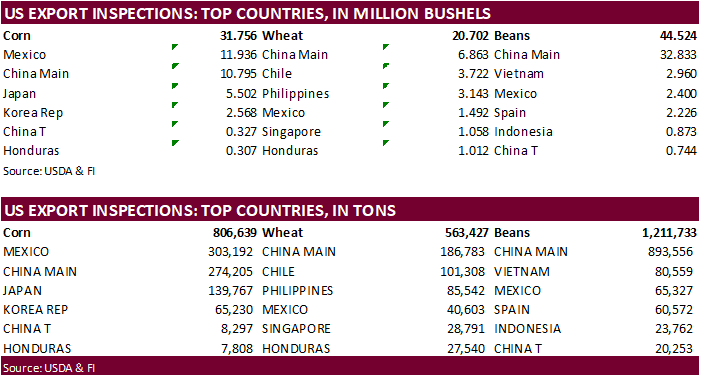

USDA

US corn export inspections as of September 24, 2020 were 806,639 tons, within a range of trade expectations, above 765,589 tons previous week and compares to 421,735 tons year ago. Major countries included Mexico for 303,192 tons, China Main for 274,205 tons,

and Japan for 139,767 tons. -

Look

for volatility ahead of the September 30 Grains Stocks report as we near an end to the month and quarter.

-

Argentina

saw welcome rains over the weekend. France as well. -

China

starts their weeklong holiday on Thursday so we will see if they visit the US market before then.

-

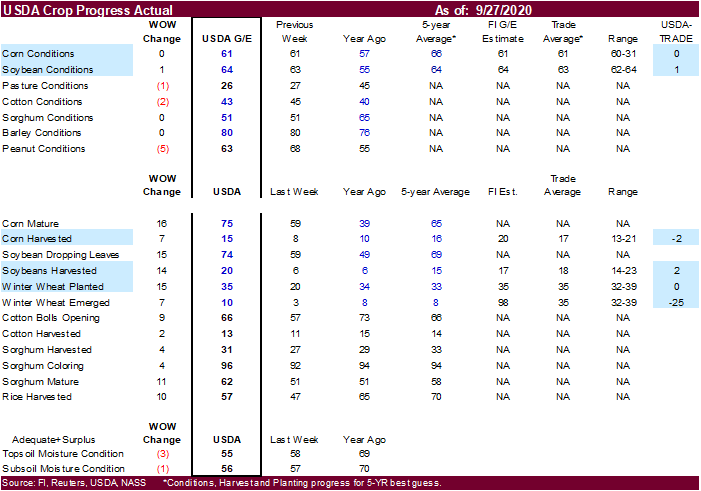

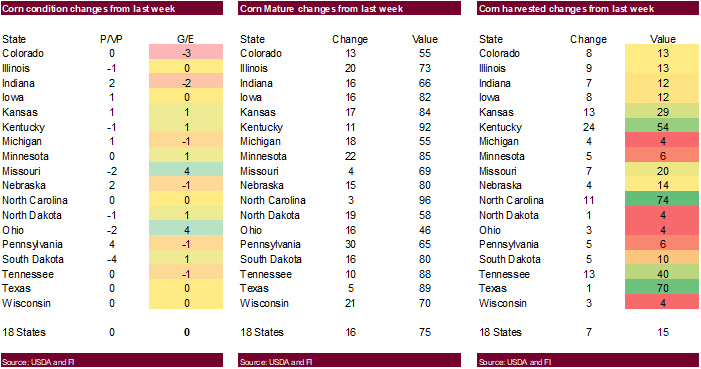

US

corn harvest progress was active over the weekend and may slow this week across the Great Lakes region where rain will occur. USDA reported 15 percent of the corn crop collected, up from 8 percent last week and compares to 10 percent year ago and 16 percent

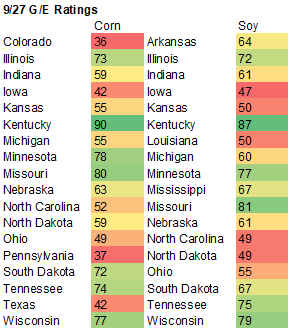

average. Traders were looking for 17 percent. 75 percent of the corn crop is mature, 10 points above year ago.

-

US

corn conditions were reported at 61 percent, unchanged from the previous week. Traders were looking for unchanged.

-

Germany

ASF: 2 additional cases reported over the weekend – 36 cases since September 10

Argentina

poultry and products annual

Franken,

J. “Many Market Ready Hogs with Industry Contraction to Follow.” farmdoc daily (10):173, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 28, 2020.

Corn

Export Developments

-

Iran

seeks 200,000 tons of corn feed and 200,000 tons of soybean meal on Sep 30 for OND shipment. The corn will be out of the Black or EU or South America.

-

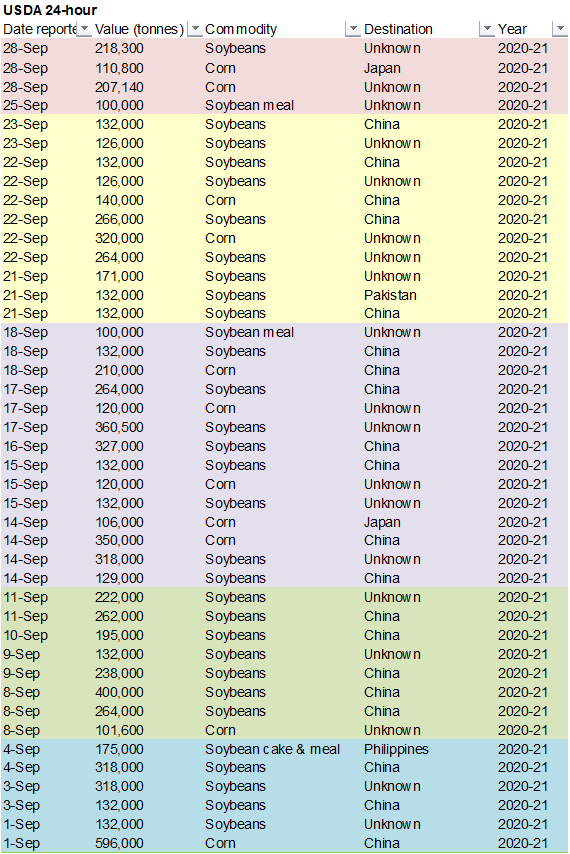

Under

the 24-hour reporting system, US exporters reported the following: -

Export

sales of 207,140 tons of corn received during the reporting period for delivery to unknown destinations during the 2020/2021 marketing year -

Export

sales of 110,800 tons of corn for delivery to Japan during the 2020/2021 marketing year

Updated

9/9/20

-

December

is seen in a $3.40-$3.85 range. 2020-21 to average $3.75 for corn and $2.85 for oats.