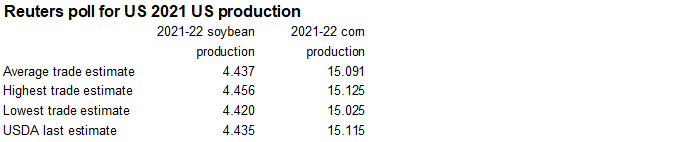

PDF Attached includes updated corn and soybeans production estimates for US

Calls

Outside

markets will dictate, but from what we know as of this afternoon:

Soybeans

steady to 4 higher

Meal

steady to $0.50 higher

Oil

10-25 higher

Corn

1-3 higher

Wheat

steady to 4 higher

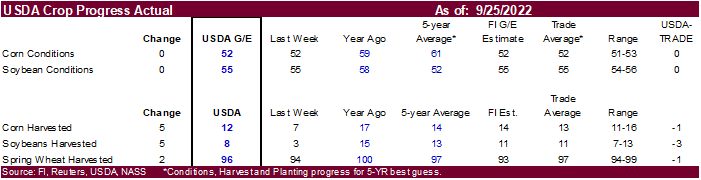

Harvest

running a touch behind for US corn and soybeans. US winter wheat plantings are in good shape but dry across the SW growing areas. Spring wheat is done. US soybean and corn conditions unchanged for combined good and excellent but don’t discount lower yields

reported by USDA next month after last week’s decline.

Grains

and soybean complex ended lower. US harvest pressure was weighing on CBOT ag futures on Monday, for the day session.

USD

was up sharply.US WTI crude oil was lower and US equities mixed, ending lower. US weather forecast improved for the Midwest and Delta than that of Friday. The upper Great Plains will see rain during the second half of the week. The Midwest will see rains for

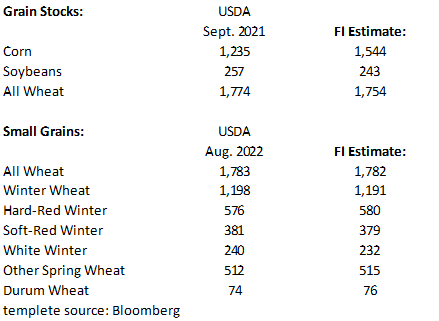

the northeastern areas today and Tuesday, and far northwestern areas Thursday. Mostly dry weather is seen for the Delta and southwestern Great Plains all this week. USDA on Friday releases Grain Stocks and Small Grains Summary. Some analysts are looking for

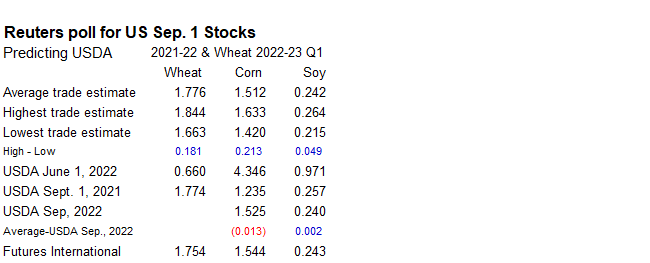

price volatility. We are looking for small changes for Sep 1 corn/soybean stocks.

if

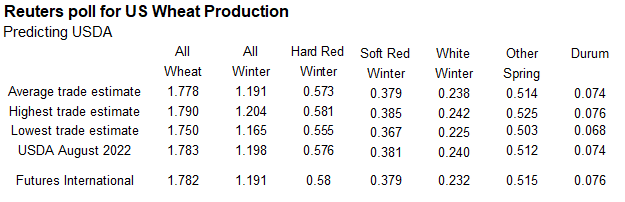

the trade is correct, then a non-eventful report for nearby corn and soybean contracts. Wheat could be a surprise if we are close to what USDA reports. See below.

Link

to the USDA historical track records for soybean production (and other commodities)…page 194 for soybeans

https://downloads.usda.library.cornell.edu/usda-esmis/files/c534fn92g/g158cn09g/zc77tv62q/croptr22.pdf