PDF Attached

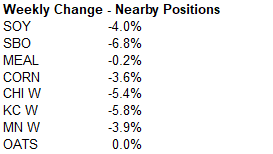

Soybeans,

meal, SBO and corn closed higher on Friday while wheat futures were lower.

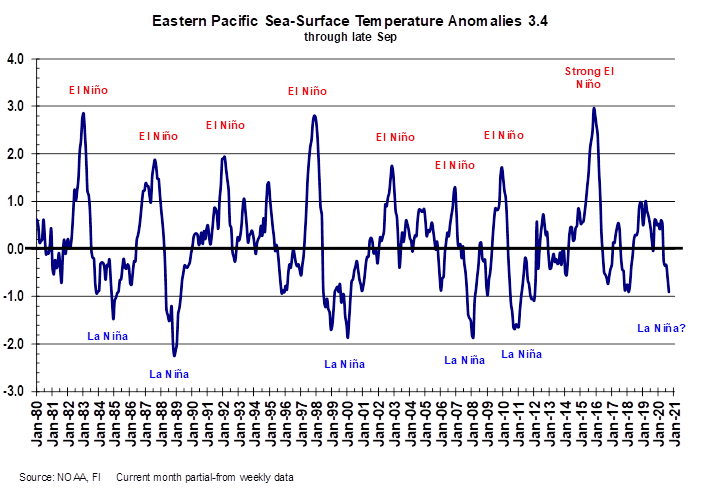

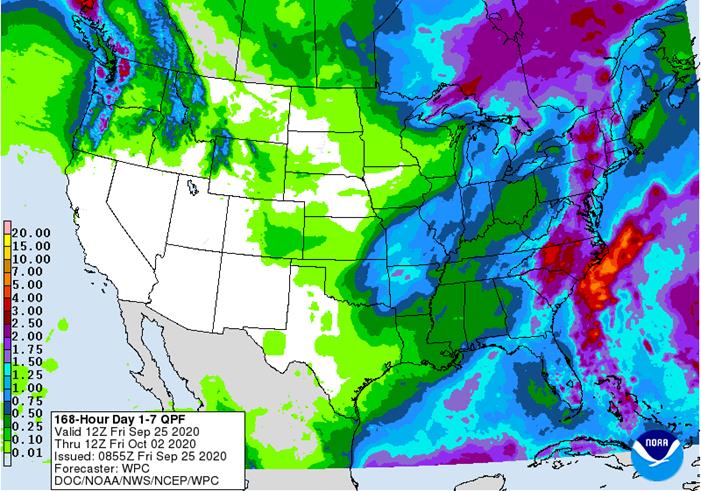

La

Nina is adding to the dry situation across US hard winter wheat country. US Great Plains tends to see drier than normal conditions. South America weather during La Nina events includes less than usual rainfall in eastern Argentina, Uruguay, southern Paraguay

and Rio Grande do Sul during the late spring and summer months.

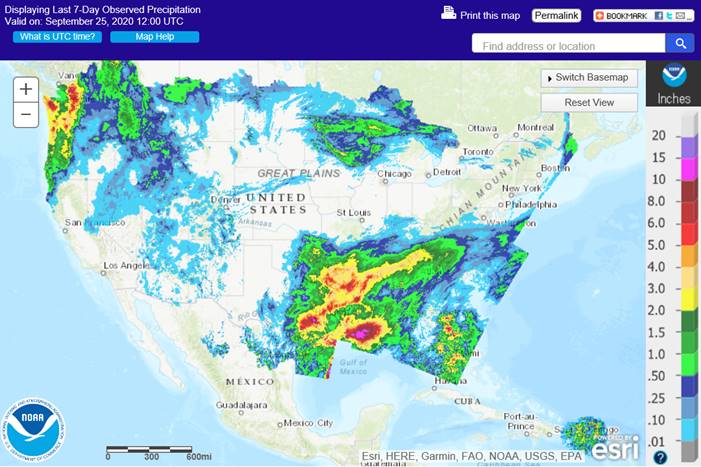

Last

seven days

MOST

IMPORTANT WEATHER TO WATCH

- Argentina

received some much needed rain overnight in interior northern parts of Buenos Aires where 0.30 to 1.00 was common and local totals over 2.00 inches - Lighter

rain fell in a few neighboring areas - Improved

soil moisture for wheat development and future planting of corn and sunseed resulted with more expected - Southern

and eastern Argentina will get some additional very important rain today into the weekend improving topsoil moisture in many areas from La Pampa and southern Cordoba to Buenos Aires and in portions of both Santa Fe and Entre Rios - Follow

up rainfall is not likely to be very frequent or significant leading to net drying conditions, but it may be a good opportunity for early season fieldwork and wheat development - Temperatures

will be mild to warm - Dryness

will continue in northern Cordoba, central and northwestern Santa Fe, Santiago de Estero and portions of western Chaco, Argentina during the next ten days to two weeks; some rain in northern cotton areas in the nation will allow some planting to begin - Central

and western Ukraine will receive some much needed rain in the coming week to ten days with some of it being heavy 1.00 to 3.00 inches and local totals over 4.00 inches will occur with far western areas and neighboring areas of southeastern Poland, eastern

Slovakia and northern Romania also being impacted with some potential for flooding

- Eastern

Ukraine will also get a some needed rain Sunday into Wednesday with rainfall of 0.20 to 0.70 inch and local totals to 1.50 inches

- Greater

rain will be needed in eastern Ukraine while western areas will see improved rapeseed, wheat, barley and rye planting and establishment, although some delay to fieldwork will be possible - Flooding

may occur in various locations in eastern Europe over the coming week because of heavy rain as noted above - High

pressure ridge aloft over the heart of Brazil will minimize rain potentials in much of center west through center south crop areas for at least the next ten days and perhaps for two weeks - Northwestern

Mato Grosso will be the only area that will see some periodic showers - Planting

moisture will be scarce outside of northwestern Mato Grosso preventing much early soybean or corn planting and conditions will be very poor for germination and emergence - Southern

Brazil wheat, corn and rice areas will receive periodic rainfall maintaining good conditions for planting, emergence and establishment of spring crops and supporting a very good wheat yield outlook - Beneficial

rainfall is coming to France, the United Kingdom, Germany and many other areas in central and western Europe over the coming week easing long term dryness in northwest - Spain

and Portugal will be left mostly dry - Some

rain already began in France and the U.K. overnight - Eastern

Bulgaria, Greece and southeastern Romania may not get much rain for a while - Northeastern

China continues to fight moisture surpluses that are keeping summer crop maturation and harvest progress very slow - The

situation will improve “very slowly” during the next two weeks and absolute dryness is needed - The

wet bias has been present in the region since mid-August - Some

fields in Jilin, eastern Liaoning and Heilongjiang may still have standing water from three tropical cyclones that impacted the region in recent weeks - Showers

are still expected periodically during the next ten days and that combined with mild temperatures will keep drying rates low and fieldwork progressing poorly - China’s

Yellow River Basin and North China Plain are experiencing nearly ideal conditions for wheat planting and summer crop maturation and early harvesting - Alternating

periods of rain and sunshine are expected to support wheat planting, emergence and establishment while supporting summer crop maturation and harvesting - Western

Australia drying remains a concern with northern crops reproducing in a declining soil moisture environment - Southern

crop areas in the state still have favorable soil moisture, but the region is drying and will need rain in October to support reproduction of wheat, barley and canola - Some

rain is expected in October to help ease the drying bias - Southeastern

Australia wheat, barley and canola prospects are looking extremely good with soil moisture in abundance and expected to prevail in New South Wales, Victoria and South Australia - Periodic

rainfall is expected to continue in these areas over the next two weeks - Queensland,

Australia has a large need for rain to support cotton and sorghum planting that will soon be starting; dryland areas need the moisture most significantly

- La

Nina should provide the necessary moisture boost later this spring - India’s

monsoon is withdrawing from central parts of the nation and will continue doing so over the next few days with a drying bias expected - The

nation’s rainy season has been very successful with the nation having 109% of the normal rainfall for the June 1-September 25 period - Drying

is needed in central areas to protect summer crop conditions and to promote crop maturation - South

Africa still needs significant rain to support winter crops especially in the east - Rain

is also needed to improve topsoil moisture for early corn planting that begins in early October and for all other summer crops that are planted from late October into December

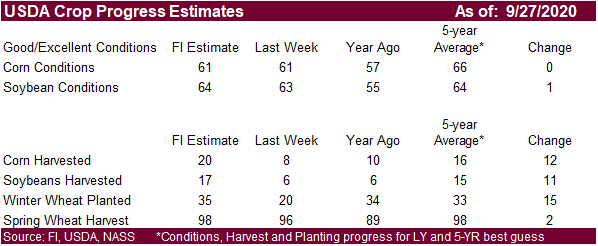

- U.S.

hard red winter wheat areas are drying down rapidly and significant rain is needed soon to bolster soil moisture for improved wheat planting, emergence and establishment - The

outlook is for poor rainfall and warmer than usual conditions during the next ten days and perhaps longer - Net

drying may eventually delay unirrigated wheat germination, emergence and establishment - U.S.

Midwest crop maturation and harvest conditions will be good through the weekend, but rain and cooling next week in the Great Lakes region southward into Ohio and parts of Indiana may slow that process - Rain

will first impact most of the lower and eastern Midwest early next week as the initial cool air arrives - Showers

during the middle to latter part of next week will occur with cool temperatures and will maintain a slow advancement in crop maturation and harvest progress especially in the Great Lakes region and lower eastern Midwest - Another

frontal system in the second weekend of the two week outlook may induce some additional showers in the Great Lakes region and lower eastern Midwest - Net

Drying will occur in the eastern Midwest after Oct. 4 - Western

Corn Belt will experience good harvest weather through much of the next ten days, although there will be a few brief periods of showers in a part of the region - Frost

and freezes may occur to help defoliate some soybeans in a part of the Midwest late next week and into the following weekend - Winter

wheat planting will advance favorably along with some summer crop harvesting - Some

wheat areas need rain - The

bottom line to the Midwest weather will be slow field work and crop maturation rates next week in the Great Lakes region and lower eastern Midwest where there will be a rising need for dry and warm conditions. The western Corn Belt will experience the best

harvest weather. - U.S.

Delta will experience some needed drying over the next ten days except Monday when rain is expected once again - Dry

weather will occur Friday through Sunday - Rain

Monday will be followed by mostly dry conditions the remainder of next week and into the following weekend - Improved

summer crop maturation and harvest conditions are likely during the middle and latter part of next week and into the following weekend - U.S.

southeastern states will experience some periodic showers and thunderstorms today and again Sunday through Tuesday keeping crop maturation and harvest progress slow - Better

drying conditions will evolve next week and last through the first week of October with only a few showers expected - West

Texas cotton, corn, sorghum and peanut conditions are mostly good for crop maturation and early season harvesting and this will last for at least the next ten days - U.S.

northwestern Plains need a boost in precipitation to induce better winter crop establishment and planting conditions - U.S.

far western states still need a generalized rain to ease long term dryness, but none is expected for a while - Canada’s

Prairies will experience a favorable weather pattern for fieldwork, despite some showers periodically - Weekend

rainfall will be greatest and cause the most disruption to fieldwork - Temperatures

will be near to above average - Ontario

and Quebec, Canada may get rain a little more frequently than desired beginning next week and lasting at least a week and possibly for ten days resulting in some crop maturation and harvest delays - Xinjiang,

China weather will continue favorable for cotton and other crop maturation and early harvest progress except in the northeast where showers and cold conditions are expected this weekend into next week - The

precipitation in northeastern Xinjiang will not be heavy, but enough to slow fieldwork for brief periods of time - Minor

changes in cotton fiber quality are expected - Cooling

during the weekend and next week will bring an increasing risk of frost and freezes to at least northern portions of the region, but cloud cover may keep the temperature up for a while - Freezes

would be not harm crops at this point in their development - Key

cotton areas in the west and south will not be as cold and should stay dry - West-Central

Africa will continue to experience periodic showers and thunderstorms over the next couple of weeks - Cotton

areas will need to dry out soon to protect fiber quality and promote maturation - Most

coffee, cocoa, rice and sugarcane crops receiving rain will likely benefit from the moisture

- East

central Africa rainfall has been and will continue to be erratic and mostly beneficial over the next ten days - Mainland

areas of Southeast Asia will experience periodic showers and thunderstorms over the next couple of weeks

- Late

season moisture boosting is extremely important since water supply has not been fully restored from last year’s low levels - Philippines

rainfall will continue periodically benefiting most crops. - Improving

rainfall in Indonesia and Malaysia is expected over the next two weeks with some locally heavy rain possible in random locations especially in the first week of October -

New

Zealand rainfall will be above average during the next week to ten days and temperatures a little cooler than usual -

Mexico

precipitation is expected to be confined to the far south over the next week while all other areas experience net drying -

Frequent

rain will continue in Central America maintaining good crop conditions -

Southern

Oscillation Index was +10.34 today and it will stay significantly positive into next week

Source:

World Weather Inc.

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China

customs publishes country-wise soybean and pork import data - S&P

Platts Sugar and Ethanol Conference, Sao Paulo - FranceAgriMer

weekly update on crop conditions - Malaysia

palm oil export data for Sept. 1-25 - U.S.

cattle on feed, 3pm

MONDAY,

Sept. 28:

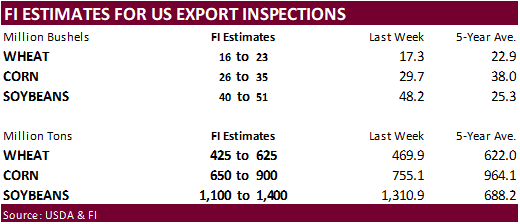

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm - FT

Commodities Global Summit (Sept. 28-30) - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - EARNINGS:

Louis Dreyfus

TUESDAY,

Sept. 29:

- Nothing

major scheduled

WEDNESDAY,

Sept. 30:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - USDA

quarterly corn, soybean, wheat, sorghum, barley and oat stocks - U.S.

wheat production for Sept. - Roundtable

on Sustainable Palm Oil virtual discussion on seasonal haze - Malaysia

Sept. 1-30 palm oil export data - U.S

agricultural prices paid, received for Aug., 3pm - Poland

to release grains output data - HOLIDAY:

Korea

THURSDAY,

Oct. 1:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - Australia

commodity index for Sept. - Webinar

on the effects of climate change on coffee production in Southeast Asia - Honduras,

Costa Rica coffee exports monthly stats - International

Cotton Advisory Committee releases monthly world outlook - HOLIDAY:

China, Hong Kong, Korea

FRIDAY,

Oct. 2:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

China, Hong Kong, India, Korea

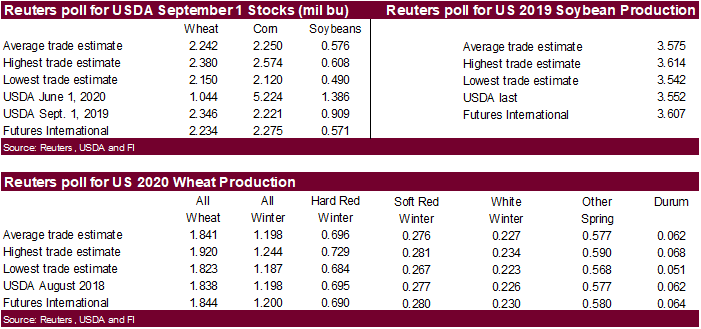

Note

Reuters polled for 2019 corn production. We think it will be unchanged. Reuters average was 13.607 billion bu versus 13.617 USDA, so others also not looking for change (range 13.427-13.750 billion for those looking for a change).

Average

estimates for 2019-20 ending stocks for September 1 don’t deviate much from USDA

USDA

Aug 2019-20 corn carry 2.253 (ave. est. 3 bushels below USDA)

USDA

Aug 2019-20 soy carry 0.575 (ave. est. 1 bushel above USDA)

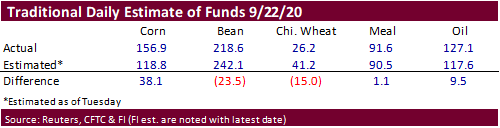

Index

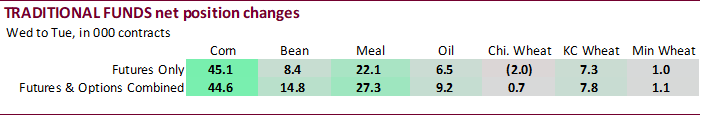

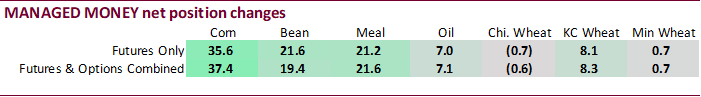

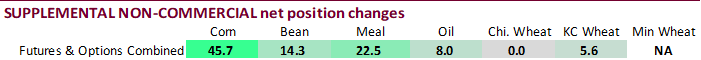

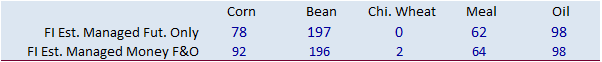

funds were very busy buying corn and soybean meal. Traders missed estimates for the net long corn position (more long than expected) for the week ending 9/22 and also missed in the other direction the soybean position.

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

95,912 37,356 179,215 5,992 -299,308 -35,471

Soybeans

211,143 19,369 122,210 3,247 -338,490 -13,692

Soymeal

65,248 21,550 77,182 610 -191,094 -25,940

Soyoil

101,702 7,139 89,707 -2,310 -232,384 -7,939

CBOT

wheat 14,543 -570 89,683 -8,110 -100,818 4,701

KCBT

wheat 18,463 8,272 44,006 -1,259 -64,594 -5,522

MGEX

wheat -2,298 710 2,313 154 -1,275 -1,395

———- ———- ———- ———- ———- ———-

Total

wheat 30,708 8,412 136,002 -9,215 -166,687 -2,216

Live

cattle 57,999 -1,622 79,898 -301 -141,469 1,652

Feeder

cattle 710 -800 4,680 510 -3,401 39

Lean

hogs 43,580 1,108 48,462 -171 -99,605 -3,192

Source:

Reuters and CFTC

Macros

US

Durable Goods Orders Aug P: 0.4% (est 1.4%; prevR 11.7%; prev 11.4%)

US

Durable Goods Ex Transportation Aug P: 0.4% (est 1.0%; prevR 3.2%; prev 2.6%)

-

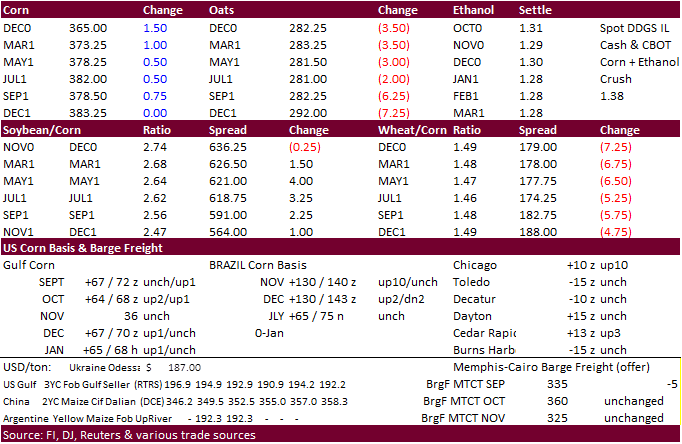

Corn

ended Friday higher on bull spreading. Technical buying was noted after December reached a one-week low yesterday. For the week corn was 3.6 percent lower. South Korea’s KFA passed on 68,000 tons of South American corn.

-

French

corn conditions declined one point for the week ending Sep. 21 to 58 percent and compares to 59 percent year earlier. 15 percent of the French corn crop had been harvested compared to 2 percent year ago.

-

Funds

bought an estimated net 15,000 corn contracts after selling 18k on Thursday.

-

China

planned to auction off 20,000 tons of pork from reserves today, taking the amount to 590,000 if all of it sold.

-

China’s

eastern city of Qingdao found coronavirus contamination on some packages stored by a seafood importer. -

Germany

ASF: 2 additional cases reported Friday – 34 cases since September 10 -

Germany

may roll out aid for producers that are affected with ASF repercussions.

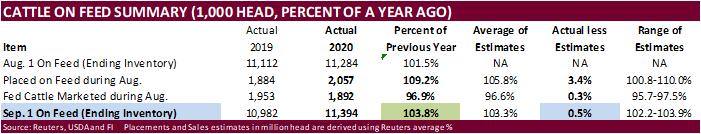

Placements

came in much higher than expected and on feed was a half percent above expectations at 11.394 million head. Placements are high due to very dry conditions across the southwest and west central US. The COF report is seen supportive for corn.

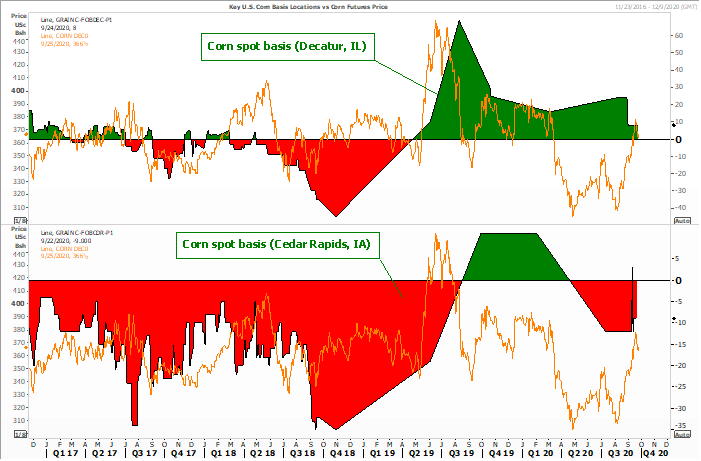

Corn

Export Developments

-

South

Korea’s KFA passed on 68,000 tons of South American corn (they were not in for US) due to high prices. Lowest offer was $224/ton. They were in for February 5 arrival.

Corn

ECB is firmer relative to WCB

Source:

Reuters and FI

Updated

9/9/20

-

December

is seen in a $3.40-$3.85 range. 2020-21 to average $3.75 for corn and $2.85 for oats.