PDF Attached

Today

we saw a higher trade with exception of soybean meal (product spreading). Soybean oil traded in a wide range after Reuters published a bearish article on US mandates.

FOMC

Benchmark Interest Rate Unchanged; Target Range Stands At 0.00% – 0.25%

–

Interest Rate On Excess Reserves Unchanged At 0.15%

Reuters

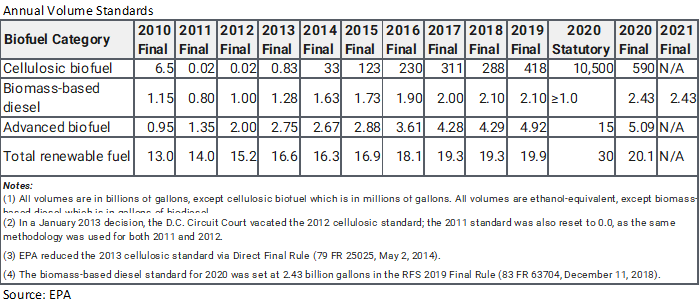

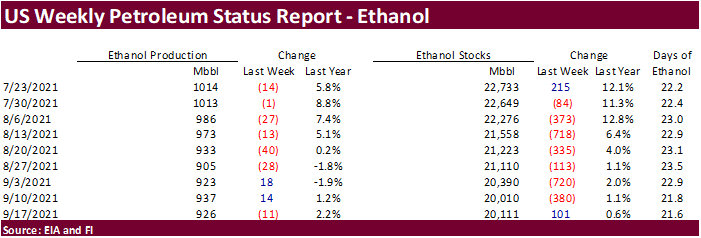

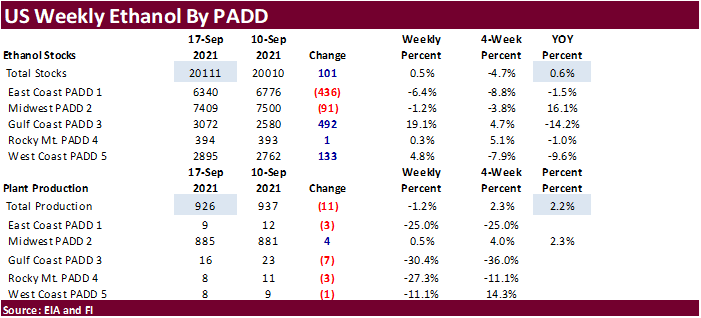

noted the EPA may reduce blending mandates for 2020 and 2021 to about 17.1 billion gallons and 18.6 billion gallons, respectively. That’s below 20.1 billion gallons the previous 2020 target. 2022 was rumored at about 20.8 billion gallons. Ethanol could be

reduced from 15 billion gallons to about 12.5 billion gallons in 2020, 13.5 billion gallons in 2021 and 14.1 billion gallons in 2022. Note this has not been officially released and traders should take caution. Some posts called this fake news.

2020

official RVO for reference when officially released.

7-day

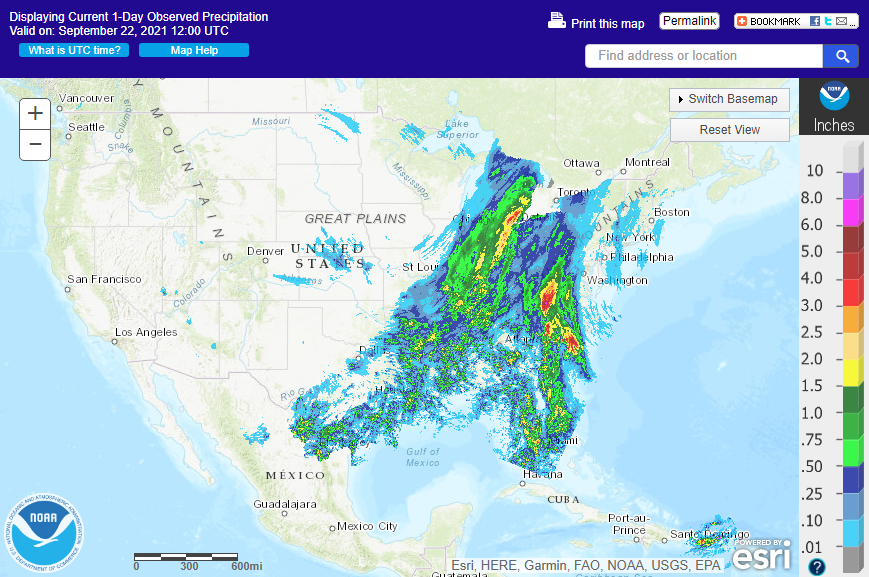

WORLD

WEATHER HIGHLIGHTS FOR SEPTEMBER 22, 2021

- U.S.

hard red winter wheat areas were advertised to get significant rain during the middle and latter parts of next week in some of the model forecast runs Tuesday and early today, but this precipitation was overdone and future model runs will back off of the potential.

- The

region will get some showers, but no big soaking. - Eastern

Australia reported some frost again today, but mostly in and near the Great Dividing Range in New South Wales resulting in no significant crop impact.

- There

is still need for rain in much of the nation, but especially Queensland. - South

America’s forecast did not change much overnight maintaining a restricted rainfall pattern for Argentina and slowly increasing shower activity in parts of Brazil.

- Russia’s

recent rain has proven beneficial for wheat areas that were too dry previously and some additional rain is still expected in the drier areas.

- China

has taken a short-term break from rain, but will get too much in the Yellow River Basin and North China Plain during the coming week raising some concern over field working delays.

- A

tropical disturbance in the eastern part of the South China Sea will become better organized and will move through central Vietnam to Thailand producing widespread rain in both of those countries and both Laos and northeastern Cambodia possibly inducing local

flooding - Another

tropical cyclone will evolve near Guam over the next few days, but it will turn away from the eastern Asian Nations while intensifying during the coming week - Dryness

and warmer than usual conditions will continue in Canada’s Prairies and the northern U.S. Plains as well as much of the interior western U.S.

- Europe

weather will be favorably mixed - Northern

Algeria received some significant rain Tuesday and early today, but that comes too early in the season to be of much use to planting of winter crops - India’s

monsoon continues to show little sign of withdrawing, although the far north will see more sporadic rainfall for a while

Source:

World Weather Inc.

Wednesday,

Sept. 22:

- EIA

weekly U.S. ethanol inventories, production - U.S.

cold storage data – pork, beef, poultry, 3pm - HOLIDAY:

Hong Kong, Korea

Thursday,

Sept. 23:

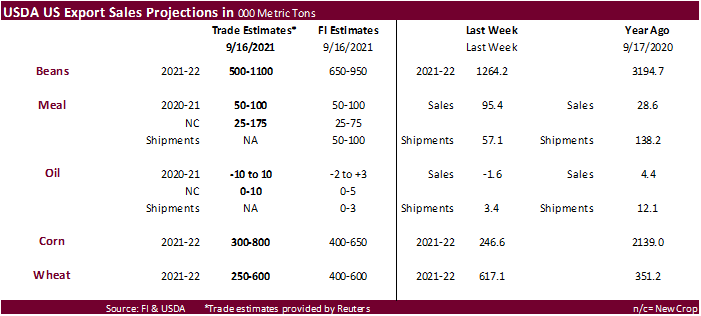

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Globoil

India – international vegetable oil conference, day 1 - The

UN Food Systems Summit - USDA

red meat production, 3pm - Port

of Rouen data on French grain exports - HOLIDAY:

Japan

Friday,

Sept. 24:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Globoil

India – international vegetable oil conference, day 2 - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed, hogs and pigs inventory, poultry slaughter, 3pm

Saturday,

Sept. 25:

- Globoil

India – international vegetable oil conference, day 3

Source:

Bloomberg and FI

Macros

FOMC

Benchmark Interest Rate Unchanged; Target Range Stands At 0.00% – 0.25%

–

Interest Rate On Excess Reserves Unchanged At 0.15%

Fed

Funds Futures Raise Chances Of Fed Rate Hike By Dec 2022 To More Than 80% Following FOMC MonPol Statement

77

Counterparties Take $1283.281 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1240.494 Bln, 78 Bidders)

US

MBA Mortgage Applications Sep 17: 4.9% (prev 0.3%)

US

Existing Home Sales Change Aug: 5.88M (est 5.89M; prev R 6.00M)

–

Existing Home Sales (M/M): -2.0% (est -1.7%; prev R 2.2%)

–

Median Home Price (USD) Aug: 356.7K or +14.9% (prev 359.9K or +17.8% From Jul 2020)

US

DoE Crude Oil Inventories (W/W) Sep-17: -3481K (est -2450K; prev -6422K)

–

Distillate Inventories: -2554K (est -1100K; prev -1689K)

–

Cushing OK Crude Inventories: -1476K (prev -1103K)

–

Gasoline Inventories: +3474K (est -1472K; prev -1857K)

–

Refinery Utilization: 5.40% (est 2.00%; prev 0.20%)

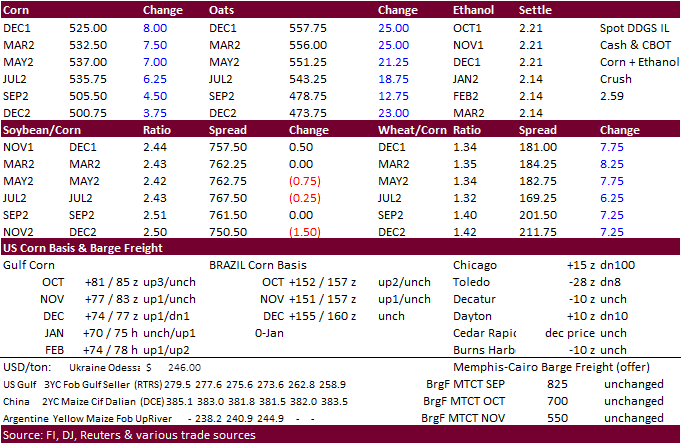

Corn

·

Corn ended sharply higher on commercial & fund buying, unwinding of soybean/corn spreads, after the December contract hit a one-week low. Outside markets lent support. WTI crude was up about $1.50.

·

Funds bought an estimated net 9,000 contracts.

·

Oats were limit up. Reuters chat mentioned “US buyers looking for 3 x 10-15kT vessels of Scandinavian/UK oats and no offer.”

·

There is already talk of US acreage decisions for 2022 and latest word was producers plan to slightly scale back on corn plantings due to high fertilizer prices. Meanwhile spot fertilizer is expensive and, in some areas, hard

to find for winter wheat producers after imports of the key ingredients dropped amid hurricane Ida logistical problems.

·

Haiti reported an outbreak of African swine fever. Dominican Republic reported an outbreak last July, which borders Haiti.

·

China hog futures made new contract lows today.

·

The USDA Broiler Report showed eggs set in the US up 2 percent and chicks placed down 2 percent. Cumulative placements from the week ending January 9, 2021, through September 18, 2021, for the United States were 6.91 billion.

Cumulative placements were up slightly from the same period a year earlier.

·

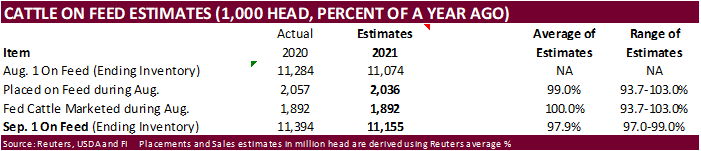

Cattle on feed and the hogs & pigs reports will be released after the close on Friday.

Export

developments.

-

None

reported

Updated

9/14/21

December

corn is seen in a $4.75-$5.75 range

Soybeans

·

Soybeans ended higher on commercial buying and China returning from holiday. Overnight there was talk of Chinese soybean interest. However, no 24-hour sales were reported.

·

Funds bought an estimated net 6,000 soybeans, were even in meal and bought 2,000 soybean oil.

·

Meal was on the defensive. Soybean oil ended 103-108 points higher after palm oil rallied and bottom picking. Soybean oil traded is a very wide range on talk the EPA may lower mandates. “Credible” sources confirmed this with

newswires but later some industry groups shunned unofficial announcements. The EPA did not respond to several inquiries.

·

Reuters cited a letter/note or source that the EPA is considering cuts to biofuel blending obligations for 2020, 2021, and 2022. Reuters noted the EPA may reduce blending mandates for 2020 and 2021 to about 17.1 billion gallons

and 18.6 billion gallons, respectively. That’s below 20.1 billion gallons the previous 2020 target. 2022 was rumored at about 20.8 billion gallons. Ethanol could be reduced from 15 billion gallons to about 12.5 billion gallons in 2020, 13.5 billion gallons

in 2021 and 14.1 billion gallons in 2022. Note this has not been officially released and traders should take caution.

·

Many industry people think lower mandates will have little impact on ethanol related products but could have a bearish implication for biodiesel. When reviewing consumption for 2020 and 2021, it makes sense to lower the ethanol

mandate to align with gasoline consumption, but many trucks during the pandemic were still on the roads, so biodiesel mandates may see a less percentage reduction than conventional fuels, in our opinion.

·

Earlier we heard US biofuel blending proposals will be out on Friday.

·

Argentine producers sold 30 million tons of soybeans from the 2020-21 crop through mid-September, up 650,200 tons from the previous week. Last year they were 31.6 million tons through Sept. 15.BA Grans Exchange is using a 43.1-million-ton

production, compared with 49 million tons in 2019-20 (40.4MMT sold). They look for new-crop 2021-22 production to be around 44 million tons.

·

Germany plans to phase out palm oil as a feedstock for biodiesel production from 2023. They are a minor player when it comes to this feedstock (about 4% palm, rapeseed is 60%).

·

Globoil India edible oil conference will run from Thursday to Saturday. Look for direction for price projections for various vegetable oil.

·

The Malaysian Palm Oil Association estimated palm production during Sept. 1-20 fell 0.55% from the same week in August.

Export

Developments

- Egypt’s

GASC passed on soybean oil and bought 12,000 tons of sunflower oil (10k they sought) for arrival Nov. 15-30 and/or Dec. 1-15. They bought the sunflower oil at around

at

$1,288 a ton c&f with immediate payment terms. They were in for at last 30,000 tons of soybean oil and lowest offer for soyoil was $1,340 a ton c&f. Egypt last paid about $1304 to $1310/ton for soybean oil and $1240/ton on September 2.

Updated

9/14/21

Soybeans

– November $11.75-$13.75 range, short term $12.70-$13.30.

Soybean

meal – December $310-$385

Soybean

oil – December 53-62 cent range

·

Wheat futures traded higher, snapping a four-day losing streak. There was not much news for the wheat market. Technical buying was confirmed after funds bought an estimated net 10,000 contracts.

·

December Paris wheat was up 5.50 at 249.50 euros.

·

US weather looks favorable over the next two weeks.

·

The USD was 13 points higher as of 2:20 pm CT, reversing from a lower trade earlier today.

Export

Developments.

·

The Philippines bought an estimated 112,000 tons of feed wheat. Two 56,000-ton consignments for shipment in December 2021 and January 2022 were bought near $350/ton c&f and thought to originate from Australia.

·

Pakistan seeks 640,000 tons of wheat on Sep. 29

for

shipment between January and February 2022.

·

Pakistan’s lowest offer for 500,000 tons of wheat was $383.50/ton c&f.

·

Jordan passed on 120,000 tons of wheat for

LH December through FH February shipment.

·

Morocco received no offers for 363,000 tons of US wheat for arrival by the end of the year.

·

Results awaited: Algeria seeks 50,000 tons of durum wheat on September 22 for November shipment.

·

Results awaited: Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

·

Japan seeks 113,067 tons of food wheat from the US and Canada, this week for October 21-November 20 loading.

·

Jordan seeks 120,000 tons of feed barley on September 23 for Dec. 16-31, Jan. 1-15, Jan. 16-31, and Feb. 1-14.

-

Taiwan

seeks 49,580 tons of US wheat on September 23 between November 6 and November 20.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on September 23.

·

Bangladesh seeks 50,000 tons of rice on October 4.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.