PDF Attached

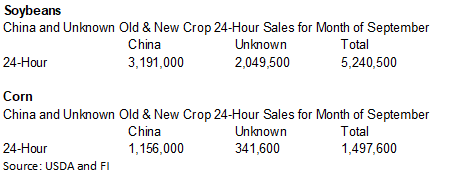

USDA

reported additional corn and soybean flash sales this morning. See both sections for September totals.

- Some

greater rain was suggested for southern Argentina late this week and into the weekend - This

change comes from The European Model run mostly with greater coverage of rain and amounts from La Pampa into all of Buenos Aires instead of mostly northern areas as advertised Monday - Rainfall

of 1.00 to 3.00 inches has been advertised and locally more - GFS

model run also has good coverage in the region - Cordoba

rainfall is advertised to be significant in the south, but more limited in the north along with central Santa Fe and all of northwestern Argentina still gets sporadic rainfall of light intensity - The

recent changes will prove to be highly beneficial for Argentina winter crop conditions and help improve early corn and sunseed planting potentials from La Pampa and Buenos Aires into Entre Rios and Corrientes.

- Eastern

Ukraine rain prospects are improving for mid-week next week with the European model now suggesting rainfall to 1.25 inches

- Confidence

is still a little low, but all of the models are promoting this opportunity - All

of Ukraine is now advertised to get rain next week and if the forecast verifies it would be a boon for wheat, barley, rye and rapeseed planting and establishment - Tropical

Storm Paulette was reincarnated Monday and was located southwest of the European Continent and northwest of Africa while 295 miles southeast of the Azores - Paulette

is unlikely to impact land and will actually turn back to the west in a couple of days and likely lose its tropical characteristics again over time - Tropical

Storm Beta was located 10 miles east southeast of Victoria, Texas at 28.8 north, 96.8 west moving northwesterly at 3 mph and producing maximum sustained wind speeds of 40 mph - Beta

was expected to be nearly stationary along the central Texas coast today and then move east northeast along the Texas upper coast and then across southern Louisiana to central Mississippi - Rainfall

will be heavy along the central Texas coast today and early Wednesday with rainfall of 2.00 to 6.00 inches and local totals to 10.00 inches - Rainfall

along the path of the storm Wednesday through Friday will range from 2.00 to 6.00 inches as well with some greater amounts in southeastern Louisiana and southern most Mississippi - The

storm will be downgraded to tropical depression status later today - Hurricane

Teddy was racing toward Nova Scotia Canada and will reach that area Wednesday before moving to Newfoundland Thursday - The

storm will produce damaging wind, a significant storm surge and very heavy rain even though it will lose its tropical characteristics as it approaches southeastern Canada

OTHER

AREAS OF INTEREST

- Central

and Western Europe is still expected to trend wetter later this week through the weekend with most areas west of Ukraine, Belarus, central Romania and Bulgaria getting rain - Southern

Spain and Southern Portugal will be drier biased - Additional

rain will fall in far northwestern Europe during the first half of next week while drier weather occurs farther to the east - Russia’s

Northeastern New Lands will not be impacted by significant precipitation over the next ten days

·

The environment will be very good for spring and summer crop maturation and harvest progress

·

Showers will occur in the central New Lands and in a few of the Ural Mountains region where rainfall over by September 30 will vary from 0.30 to 1.00 inch and locally more

- East-central

China received widespread rain Monday - Most

of this occurred south of the Yellow River and rainfall from southern Shaanxi to southern Henan and northern Hubei ranged from 1.00 to nearly 4.00 inches - Very

little rain fell in the Yellow River Basin, North China Plain or Northeast Provinces - Scattered

showers and thunderstorms occurred in other areas with locally heavy rain in northern Guangxi and southern Hunan - China

will experience alternating periods of rain and sunshine over the next two weeks - The

best mix of weather will be in the North China Plain and Yellow River Basin while rain continues to fall a little too often in the far northeast part of China - Northeastern

China will not be quite as wet as it has been, however - Abundant

to excessive rain will fall in the south from Sichuan and southern Hubei to Fujian, Guangdong, Guangxi and Yunnan - Inner

Mongolia and northern Heilongjiang, China may experience a little frost early next week with a more significant bout of cold expected later next week - First

frost and freezes normally occur in Northeast China during the last days of September and early October making this a seasonable event - Southeastern

Australia will receive periods of rain through Friday and into Saturday resulting in wet field conditions from southeastern South Australia and Victoria into southern New South Wales - Queensland

will receive some rain today and then will be dry for a while - Southern

parts of Western Australia will receive rain late this week into next week, but northern and eastern crop areas of the state may not get much moisture leading to some crop stress - Canada’s

Prairies will experience infrequent precipitation and mild to warm temperatures through the next ten days resulting in relatively good harvest progress - The

moisture either has or will disrupt crop maturation and harvest progress briefly, but the moisture will be help improve topsoil conditions for use in the spring - Drier

weather will occur the remainder of this week favoring the resumption of aggressive fieldwork - Temperatures

will be warmer than usual most of this week and slightly cooler next week - Ontario

and Quebec, Canada are expecting relatively good crop maturation and harvest conditions for a while this week, but it will trend wetter this weekend into next week - Some

delay to fieldwork is expected - Brazil

rain Monday fell across Sao Paulo and northeastern Mato Grosso do Sul into southern Minas Gerais - Amounts

varied from 0.05 to 0.60 inch with a few totals to 1.00 inch - Mostly

dry weather occurred elsewhere - Brazil

weather over the next few days will bring showers across Mato Grosso and into Mato Grosso do Sul, Goias and Minas Gerais as well as Sao Paulo - Resulting

rainfall is expected to be erratic and light, however, resulting in only pockets of improved soil moisture great enough for early soybean planting - Some

rain will induce some coffee and citrus flowering, but most of the precipitation will be a little too light for a serious change in soil and crop conditions - Southern

Brazil rice, corn and wheat areas will get periodic rainfall through the next two weeks - Crop

and field conditions will either improve or continue good through the end of this month - South

Africa still needs significant rain for its winter wheat, barley and canola crops, especially those in eastern production areas - Not

much rain is expected over the coming week, although a few sporadic showers are anticipated - No

precipitation fell in South Africa during the weekend - Temperatures

were warm and will continue warmer than usual - Xinjiang,

China weather will continue favorable for cotton and other crop maturation and early harvest progress except possibly in the northeast where showers are expected this weekend into next week - The

precipitation will not be heavy, but enough to slow field work for brief periods of time - Minor

changes in cotton fiber quality are expected - Cooling

during the weekend and next week will bring an increasing rise of frost and freezes to at least northern portions of the region, but cloud cover may keep the temperature up - Freezes

would be not harm crops at this point in their development - India

weather will continue wettest in central, southern and far eastern parts of the nation this workweek while net drying occurs in the north - Monsoonal

precipitation will continue without much withdrawal through the workweek, but a more significant withdrawing trend is expected in the last week of September and early October improving crop maturation conditions in central parts of the nation

- Remnants

of Tropical Storm Noul will into India from Southeast Asia this week and will bring some enhanced rainfall to parts of India

- Once

this disturbance dissipates monsoonal rainfall will begin to withdraw once again - Next

week’s weather will trend drier in central parts of the nation - Weather

conditions in most of India are still favorable, but drying will soon be needed in Gujarat as more rain falls this week

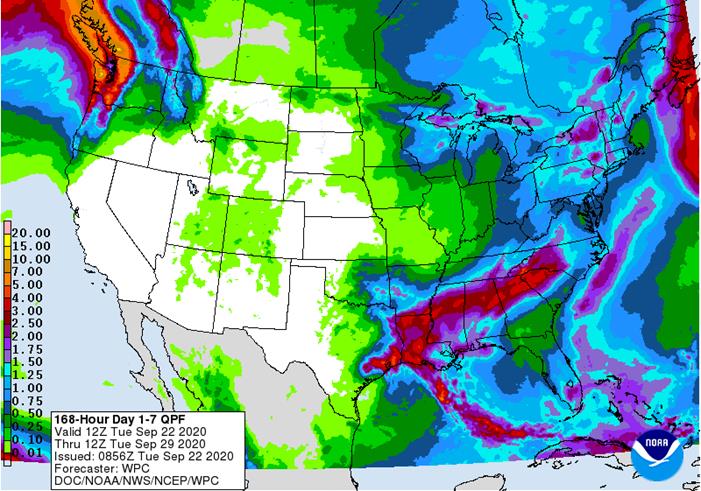

- U.S.

weather over the next two weeks - Net

drying is expected over the coming ten days in most of the Great Plains and across portions of the Midwest - Some

rain will fall in northern and eastern parts of the Midwest, but each event will be brief and light enough to have a low impact on crop maturation and early season harvest progress - Rain

will fall in the Delta and southeastern states from mid- through late week this week ending during the weekend all of which will come from Tropical Storm Beta - Rainfall

will range from 2.00 to 6.00 inches from southeastern Texas through the lower Delta to central Mississippi with 0.50 to 2.50 inches in Tennessee, northern Georgia and the Carolinas; however, rainfall will be most significant in Louisiana and southern Mississippi

where some flooding is expected - A

few areas in southeastern Louisiana will receive 6.00 to 10.00 inches of rain resulting in some local flooding

- Cotton

quality, late season rice and a few other crops will be negatively impacted by the heavy rain in the lower Delta - Crops

elsewhere are not likely to be significantly impacted by rain from the storm, although wet conditions will induce some harvest delays and could raise the potential for boll rot in the southeastern states - Some

rain will fall in the Pacific Northwest Wednesday through Friday, although mountainous areas will be wettest and the impact on soil moisture in crop areas will not be very great - Most

other areas in the western United States will be dry and warm through October 2

- Rain

will impact the northern Midwest late Wednesday and Thursday, the eastern Midwest late this weekend and shift to the northeastern and middle Atlantic Coast states early next week - Amounts

in the eastern Midwest will vary from 0.20 to 0.75 inch with a few totals to 1.50 inches - Showers,

drizzle and cool temperatures will occur in the Great Lakes region and eastern Midwest most of next week

- Dry

weather will occur from mid-week next week through the first week in October in the Delta and southeastern states - A

new frontal system will move across the central Plains October 2-4 and into the Midwest Oct 3-6 producing rainfall of 0.10 to 0.60 inch and local more - Confidence

in this event is low - Summer

crop maturation and harvest progress will be good in the Great Plains and western Corn Belt this week through the first half of next week - Good

harvest progress is also expected in the lower eastern Midwest through this workweek and again during next week’s workweek - West

Texas will be dry through the next ten days - Temperatures

will be warmer than usual in the western and northern United States while near average in lower Midwest, Delta and southeastern states - Cooling

is expected in the eastern one-third of the nation next week - West-central

Africa will continue to experience periodic showers and thunderstorms over the next couple of weeks - Additional

improvement is expected to coffee, cocoa, rice and sugarcane production areas after rain fell significantly during the weekend - Cotton

areas will also continue to receive some rain for a while longer, but need to begin drying out - Most

crops receiving rain will likely benefit from the moisture - East

central Africa rainfall has been and will continue to be erratic and mostly beneficial over the next ten days - Mainland

areas of Southeast Asia will experience periodic showers and thunderstorms over the next couple of weeks

- Late

season moisture boosting is extremely important since water supply has not been fully restored from last year’s low levels - Weekend

rainfall was increased briefly by the passage of Tropical Storm Noul and its remnants - Philippines

rainfall will continue periodically benefiting most crops. - Improving

rainfall in Indonesia and Malaysia is expected over the next two weeks with some heavy rain possible in random locations -

New

Zealand rainfall will be above average during the next week to ten days and temperatures a little cooler than usual -

Southern

Oscillation Index was +9.12 today and it will stay significantly positive into next week

Source:

World Weather Inc.

- U.S.

cold storage data – pork, beef, poultry, 3pm - HOLIDAY:

Japan

WEDNESDAY,

Sept. 23:

- China

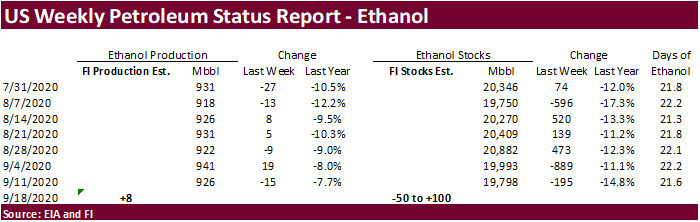

customs publishes data on imports of corn, wheat, sugar and cotton - EIA

U.S. weekly ethanol inventories, production, 10:30am

THURSDAY,

Sept. 24:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Unica to release cane crush and sugar output data during the week (tentative) - USDA

data on hogs and pigs inventory, red meat production, poultry slaughter, 3pm - International

Grains Council monthly report

FRIDAY,

Sept. 25:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China

customs publishes country-wise soybean and pork import data - S&P

Platts Sugar and Ethanol Conference, Sao Paulo - FranceAgriMer

weekly update on crop conditions - Malaysia

palm oil export data for Sept. 1-25 - U.S.

cattle on feed, 3pm

Macros

Philadelphia

Fed Non-Mfg Regional Business Activity Index Sep: 8.0 (prev 1.6)

Philadelphia

Fed Wage And Benefit Cost Index 13.1 In Sept Vs 14.6 In Aug

Firm-Level

Business Activity Index 20.4 In Sept Vs 17.9 In Aug

New

Orders Index 8.5 In Sept Vs 11.6 In Aug

Full-Time

Employment Index 5.1 In Sept Vs -3.0 In Aug

-

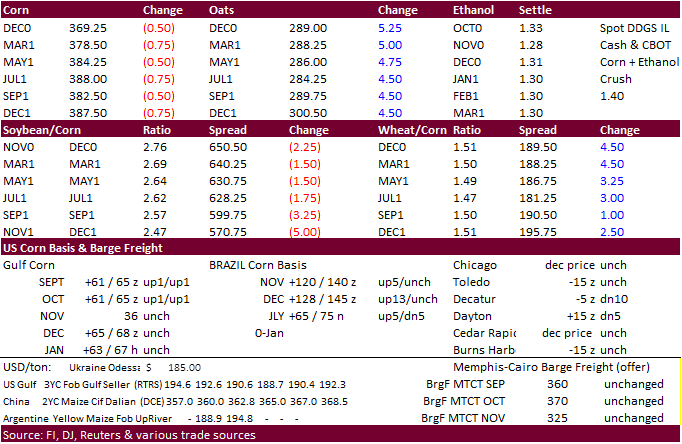

December

and March corn was settled 0.50 cent lower in part to favorable US harvesting weather. Trade is shifting talk back to the strong Chinese corn demand after USDA announced additional corn sales this morning. South Korea’s NOFI and KFA bought South American corn.

Brazil corn exports may reach 7.5 million tons for the month of September, up roughly a million from Sep 2019.

-

The

USD was about 30 points higher and WTI $0.24 higher as of 1:45 PM CT. -

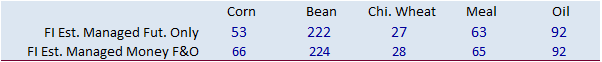

Funds

sold an estimated net 1,000 corn contracts.

-

The

US White House dropped its plans to roll out a plan to aid oil refineries denied biofuel waivers. At least $300 million from potentially the USDA CCC program was to be granted to the refineries.

-

Harvesting

delays will occur to in the Delta and southeastern states due to remnants of Tropical Storm Beta, but the rest of the country will see mostly dry weather.

-

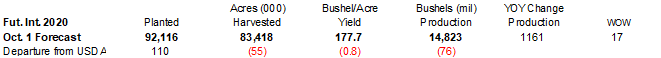

Soybean

and Corn Advisory: US corn yield unchanged at 176.0 bu/ac.

-

Brazilian

producers started corn plantings in RGDS, Minas Gerais and Parana. It’s been slowed recently by cold weather. In Argentina corn plantings started bias eastern areas where rains occurred.

-

Note

the probability of La Nina during the OND period is nearly 80 percent.

-

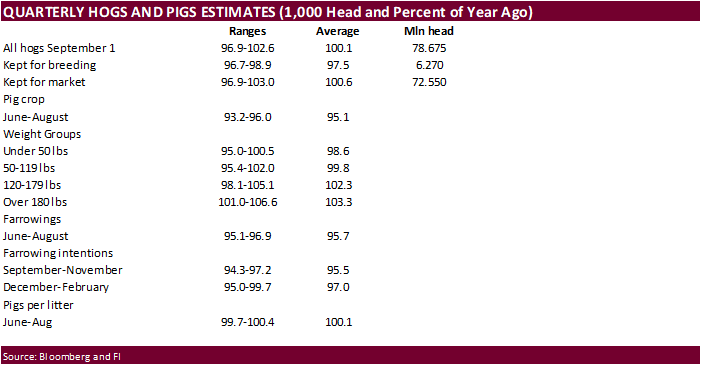

CME

hog futures traded limit up. -

China

plans to buy 7,700 tons of beef and mutton for state reserves on September 24.

-

China

will auction off 20,000 tons of pork from reserves on Sep 25, taking the amount to 590,000 if all of it sold.

-

Reuters

poll for South Africa’s Sep 29th crop year 2020 corn crop: 15.271MMT (8.877 white & 6.493 yellow) vs. 15.537 by CEC in August and compares to 11.275MMT in 2019.

-

A

Bloomberg poll looks for weekly US ethanol production to be down 2,000 at 924,000 barrels (890-943 range) from the previous week and stocks to increase 218,000 barrels to 20.016 million.

-

Under

the 24-hour announcement system, private exporters reported to the U.S. Department of Agriculture the following activity: -

Export

sales of 140,000 metric tons of corn for delivery to China during the 2020/2021 marketing year -

Export

sales of 320,000 metric tons of corn for delivery to unknown destinations during the 2020/2021 marketing year -

South

Korea’s KFA bought 60,000 tons of Brazilian corn at $229.00/ton for Oct 15-Nov 15 shipment -

South

Korea’s NOFI bought 202,000 tons of SA corn at between $228.45 & $228.90/ton for Jan/Feb arrival.

-

December

is seen in a $3.40-$3.85 range. 2020-21 to average $3.75 for corn and $2.85 for oats.