Higher

trade for the CBOT complex (technical buying) and lower trade in corn (harvesting pressure and improved US production prospects). Wheat fell on lower corn and slowing global import demand.

7-day

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Tropical

Storm Rose remains over open water in the Atlantic Ocean and is not likely to pose a threat to land through the weekend

o

The storm was located 880 miles west northwest of the Cabo Verde Islands at 0500 EDT today

o

Weakening is expected with the system being downgraded to depression status Wednesday

-

Tropical

Storm Peter was located 105 miles north northwest of the northern Leeward Islands near 19.6 north, 63.8 west moving westerly at 12 mph and producing maximum sustained wind speeds of 50 mph near its center

o

The storm was producing tropical storm force wind out 175 miles from its center

o

Peter will pass north of the Virgin Islands and Puerto Rico later today

o

A turn to the north is also expected Wednesday into Thursday

o

Weakening is expected as the storm turns to the north northeast later this week and it may be downgraded to depression status relatively soon after turning in that direction

o

The storm may move to the southeast of Bermuda during the weekend

o

Peter should move erratically next week, but is expected to stay away from North America

-

A

tropical wave off the Africa west coast still has potential to become a tropical cyclone late this week over the eastern tropical Atlantic Ocean with movement toward the west northwest

o

The system should pass to the northeast of northern Leeward Islands and poses no threat to North America through at least the latter part of next week

o

Further intensification is possible once it becomes a tropical cyclone

-

Remnants

of Tropical Storm Odette in the northwestern Atlantic Ocean have “some” potential for redevelopment during mid-to late week this week as the system moves to lower Latitudes, but the storm poses no threat to North America -

Drying

in the central United States and areas north into Canada’s Prairies will prevail for the next ten days to two weeks

o

Any showers that occur will be brief and light resulting in only a minor disruption to the drying trend

o

Concern about wheat planting moisture as well as germination and emergence will rise this autumn as this drying trend prevails

-

U.S.

western Midwest will experience net drying for the next ten days to two weeks

o

The environment will be good for summer crop maturation and harvest progress

o

Some winter wheat areas in Missouri will dry down, but it will take a while for the region to become too dry

-

Eastern

U.S. Midwest will experience a good mix of weather over the next couple of weeks allowing fieldwork to advance, but not as aggressively as that in the western Corn Belt or Great Plains

o

Rain will fall heavily in Indiana, Ohio, eastern Michigan an d a part of northeastern Kentucky over the next two days

-

Rainfall

of 1.00 to 3.50 inches will result

o

Drying in the eastern Midwest will be brief, but late this week and into the weekend will be a better time for net drying outside of the Great Lakes region

-

U.S.

Delta will experience much needed drying after today

o

Improved summer crop maturation and harvest conditions should evolve, albeit rather slowly for a while

-

U.S.

southeastern states need to dry down especially after today and Wednesday’s rainfall

o

Savannah, GA reported 6.52 inches of rain Monday and additional 2.00 to 6.00 inches of rain will impact a part of North Carolina today and Wednesday

o

Drying is expected to follow Wednesday for a few days, but more showers will come and go periodically through next week and that will slow down the drying trend

-

West

Texas will experience net drying and mild to warm weather through the next ten days to two weeks favoring normal summer crop development, maturation and some field activities -

U.S.

far west will remain quite dry over the next ten days -

Canada

Prairies weather this week will be warmer and drier than usual, although totally dry conditions are unlikely

o

Despite the warm bias, frost and some freezes will be widespread in Saskatchewan and Manitoba Tuesday morning

-

Warming

is expected the remainder of this week

o

Warmer than usual conditions will continue next week as well

o

Precipitation will be restricted

-

Ontario

and Quebec, Canada weather will briefly turn wetter this week resulting in some summer crop maturation and harvest delays

o

Rainfall will be greater than usual this week and more seasonable next week

o

Temperatures will be near to above normal

-

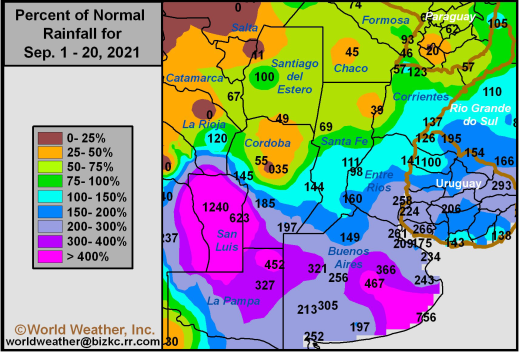

Argentina

weather was mostly dry Monday except for a few showers in the far north

o

Totally dry weather is not likely over the next seven days, but most of the precipitation that falls will be a little too sporadic and light for a serious change in topsoil moisture or crop conditions

– especially in the driest areas

-

The

areas that need moisture most will likely only experience light showers and minimal relief

o

Week two of the outlook will induce greater rainfall in southern and eastern parts of the nation, but the north and west-central parts will remain too dry

o

A moisture boost must occur soon in northern and western crop areas to support winter wheat and early season planting of spring crops

-

As

of Thursday, sunseed planting was 14% done compared to 23% last year. -

Brazil

weather Monday was mostly dry except in Rio Grande do Sul where rain produced up to 0.86 inch of moisture

o

Highest afternoon temperatures were in the 90s to 104 degrees Fahrenheit with extremes to 110 along the Paraguay/Mato Grosso do Sul border

-

Brazil

will continue very warm to hot in the center west and center south this workweek with minimal precipitation

o

Showers will occur in the far south, but significant moisture will not be very great

o

Showers will develop in center west and center south this weekend and continue periodically next week

-

Sufficient

rain will fall in “a few” areas to lift topsoil moisture for better early season soybean and early corn planting. Greater rainfall will still be needed before aggressive fieldwork can begin; however, any precipitation will be better than none.

-

Rain

is advertised to increase in many areas during the final days in September and early days in October -

Europe

weather this week is expected to be favorably mixed with a little rain and some sunshine. Southern parts of the continent will be wettest

o

Next week’s weather is expected to be wetter biased in France, the U.K., Germany and northern Italy

o

Eastern Europe will be drier than usual next week

o

Temperatures will be near normal this week and then cooler than usual in the west and warmer usual in the east

-

Belarus,

southwestern Russia and parts of Ukraine will continue to receive some needed showers over the next week

o

The precipitation will be lighter than that which has been occurring, but still beneficial in ensuring much improved winter wheat, rye and barley establishment in areas that were considered too dry

a week ago

-

Additional

rainfall will vary eastern China will experience too much rain again over this coming week

o

The Yellow River Basin and North China Plain will be wetter than usual this week with rainfall well above average varying from northeastern Sichuan and Shaanxi to the northeastern provinces during

the next ten days

-

Rain

today will be greatest in the North China Plain and northeastern provinces, but will be greatest in the second half of this week, into the weekend and early next week in the Yellow River Basin

-

Some

heavy rain is expected which may delay summer crop harvesting and early autumn wheat planting, but the moisture will be good for long term crop development during the balance of Autumn

o

Temperatures will be near to above normal

-

Rain

in China late next week will concentrate between the Yellow River and the southern Yangtze River Basin

o

Resulting rainfall will be greater than usual in that region while needed drying begins near and north of the Yellow River

o

Temperatures will be near to above average

-

India’s

monsoon will continue undaunted by seasonal weather changes this week or early next week

o

Rain will fall frequently most of the nation with the interior south staying driest this week, but getting a little wetter next week

o

Rainfall will be well above average this week in central and northwestern parts of the nation and neighboring Pakistan

o

Temperatures will be near normal with a slight cooler than usual bias in the wettest areas

-

Australia

rainfall will be restricted during this coming week, but it will increase in eastern crop areas after October 1

o

Southern coastal areas will get most of the precipitation

-

Central

Africa rainfall will occur favorably over the next two weeks

o

Sufficient rain will fall to support normal coffee, cocoa, sugarcane, rice and other crop development from Ethiopia to northern Tanzania and from Ivory Coast to Cameroon and Nigeria

-

South

Africa weather this week is not likely to have much precipitation in it, but showers may increase next week -

Southeast

Asia rainfall is expected to be frequent and sufficient to support long term crop needs and boost runoff for winter water supply

o

This is true for the mainland areas as well as Philippines and a part of both Indonesia and Malaysia

-

Mexico

precipitation will continue frequent this week, but it will turn drier next week

o

Most of this week’s rain will concentrate on western and southern parts of the nation while the northeast is dry biased.

o

Rain next week will be limited a few showers in the west and more generalized rain in the far south

-

North

Africa showers over the next ten days will be brief and light -

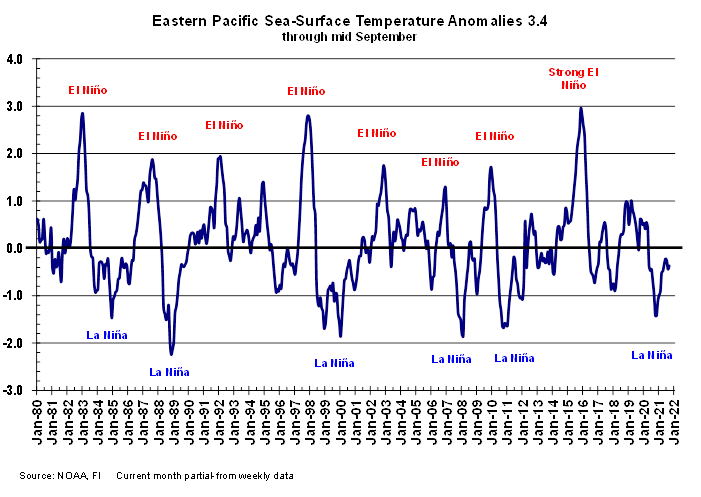

Today’s

Southern Oscillation Index was +10.70 and will likely vary erratically over the next several days

-

New

Zealand will include near to above normal rainfall in the next seven days in far northern and western crop areas in the nation

o

Eastern portions of South Island will receive less than usual rainfall

o

Temperatures will be near to below average

Source:

World Weather Inc.

Tuesday,

Sept. 21:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - HOLIDAY:

China, Korea

Wednesday,

Sept. 22:

- EIA

weekly U.S. ethanol inventories, production - U.S.

cold storage data – pork, beef, poultry, 3pm - HOLIDAY:

Hong Kong, Korea

Thursday,

Sept. 23:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Globoil

India – international vegetable oil conference, day 1 - The

UN Food Systems Summit - USDA

red meat production, 3pm - Port

of Rouen data on French grain exports - HOLIDAY:

Japan

Friday,

Sept. 24:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Globoil

India – international vegetable oil conference, day 2 - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed, hogs and pigs inventory, poultry slaughter, 3pm

Saturday,

Sept. 25:

- Globoil

India – international vegetable oil conference, day 3

Source:

Bloomberg and FI

·

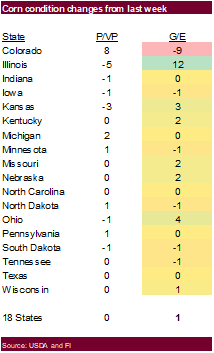

Corn traded lower for the fourth consecutive day on follow through selling and improvement in US crop conditions. With slow US corn exports and advancement in harvest progress, cash corn prices could trend lower in coming weeks.

·

The cost of shipping is getting more expensive. September Capsize shipping rates reached above the $50,000 level to an all-time high. The Baltic Dry Index reached a 12-year high.

·

Brazil may soon announce they plan to cut corn import taxes for 90 days.

·

Cattle on feed and the hogs & pigs reports will be released after the close on Friday.

·

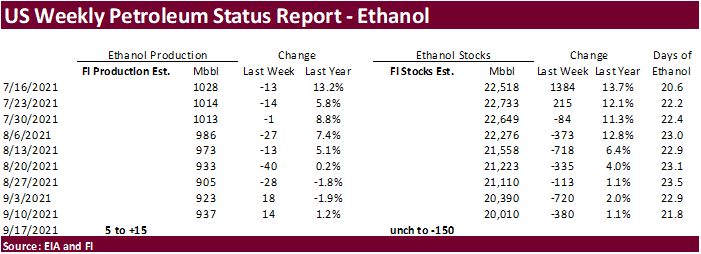

A Bloomberg poll looks for weekly US ethanol production to be up 4,000 barrels (923-955 range) from the previous week and stocks up 4,000 barrels to 20.014 million.

·

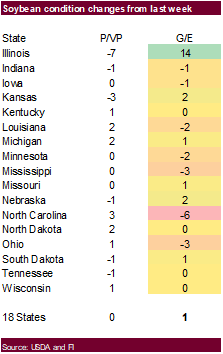

US corn and soybean conditions improved one point each, and both were one point above trade expectations. US corn harvest was 10% complete, up from 4% previous week and ahead of the five-year average of 9%. IA was 4% complete

and IL was at 11%. 57% of the US corn crop was mature, 10 points above average.

·

Shell plans to invest $565 million in renewable energy in Brazil through 2025.

·

Article: Shell announces $9.5 billion sale of West Texas oil field assets to ConocoPhillips

Export

developments.

-

None

reported

Updated

9/14/21

December

corn is seen in a $4.75-$5.75 range

Soybeans

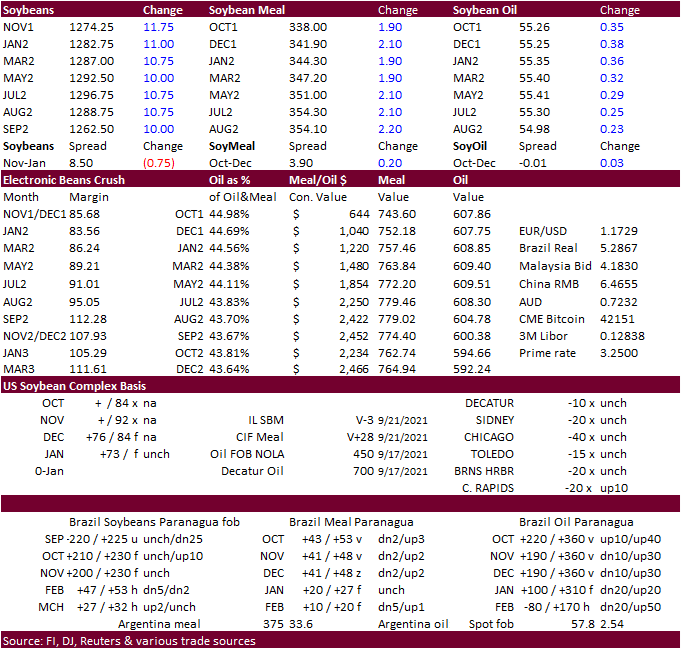

·

Soybeans, meal, and oil were higher led by soybeans that put pressure on CBOT crush values. November soybeans traded and settled above its 200-day MA of $12.6850. After a two-sided trade, soybean oil settled higher (bull spreading)

in part with bottom picking after prices traded near a late June level. Palm futures were higher and AgriCensus noted over the past week, Bulgarian sunflower oil prices rise 7 percent. Soybean meal was on the defensive earlier this morning but rallied as

soybeans gradually climbed higher.

·

European Union soybean imports from July 1 reached 2.86 million tons by Sept. 19, down from 3.42 million tons by the same week in the previous 2020-21 season. Soymeal imports totaled 3.10 million tons against 4.02 million a year

ago.

·

Argentina’s soybean crush fell 7% from July to 3.57 million tons but up 8% from August 2020. Jan-Aug crush is 29.5 million tons.

·

Weather over the next week will be mostly dry for the US Midwest. Note the fall season (US) official starts on Wednesday, September 22, 2021, at 3:21 p.m. EDT.

·

Malaysian palm oil futures rebounded from a 2-week low, settling at 4,192 ringgit, up 19. Cash palm fell $2.50/ton to $1,090.00/ton.

·

Southern Peninsula Palm Oil Millers’ Association estimated Malaysia’s palm oil production during Sept. 1-20 declined 4.5% from the same period during August.

·

Cargo surveyor SGS reported month to date September 20 Malaysian palm exports at 1,070,096 tons, 287,069 tons above the same period a month ago or up 36.7%, and 22,827 tons above the same period a year ago or up 2.2%.

·

China is returning from holiday tonight.

·

US soybeans are 6% harvested, in line with average. 58% of the soybean crop is dropping leaves, 10 points above average. This is concerning for some analysts as they believe a fast-maturing soybean crop will not be good for

test weights as the pods have not developed to their full potential. Yields could be good but look for scattered reports of low-test weights this fall.

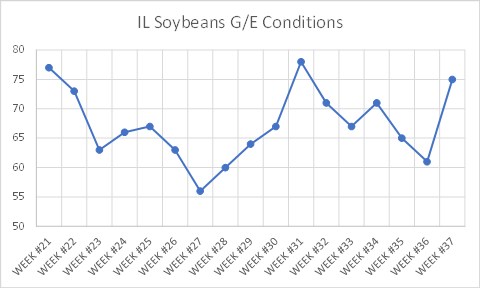

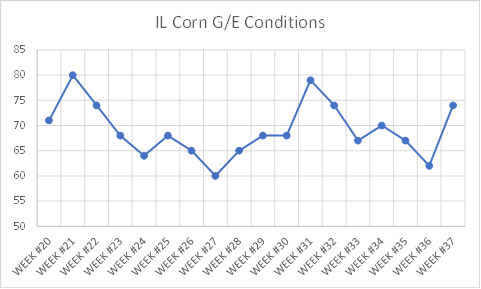

IL

corn and soybean crop ratings have been all over the place this crop season.

Source:

USDA and FI

Source:

USDA and FI

Export

Developments

- Egypt’s

GASC seeks 30,000 tons of soyoil and 10,000 tons of sunflower oil on Wednesday for arrival Nov. 15-30 and/or Dec. 1-15.

Updated

9/14/21

Soybeans

– November $11.75-$13.75 range, short term $12.70-$13.30.

Soybean

meal – December $310-$385

Soybean

oil – December 53-62 cent range

·

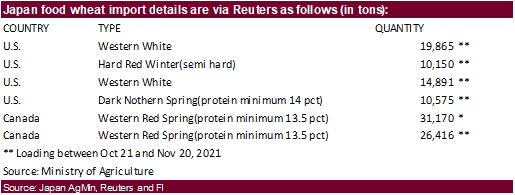

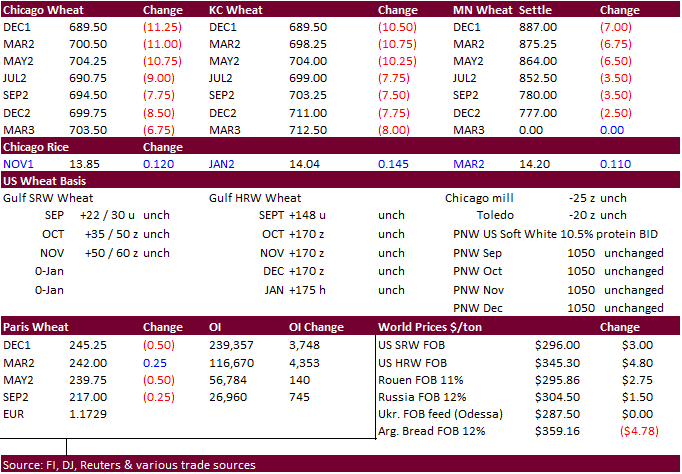

December Paris wheat was down 0.50 at 244.25 euros.

·

EU soft wheat exports since July 1 reached 6.53 million tons by Sept. 19, up from 4.58 million tons by the same week in 2020-21.

·

Ukraine winter grain plantings reached 17 percent complete.

·

Kazakhstan estimated their 2021 grain production at 16 million tons, up from 15.3 million tons last month. Kazakhstan lowered their grain export projection for 2021-22 to 6.0-6.5 million tons from 6.0-6.7 million previous.

·

India is expected to harvest a record 150.5 million tons of summer grains, up from 149.56 million tons previous year. This includes 107.04 million tons of rice, up from 104.41 million tons in 2020-21. Oilseed output is expected

to drop to 23.4 million tons against 24 million tons.

·

Argentina saw good rain across their wheat belt over the past week and the crop is thought to be in good shape.

·

US winter wheat plantings reached 21%, slightly below the average analyst estimate of 22%, but ahead of the five-year average of 18%.

·

We lowered our US all-wheat production estimate to 1.682 billion from 1.706 billion, based on minor adjustments to the spring wheat planted area and upward revisions to abandonment for the other spring and durum area. We took

down other spring wheat harvested area to 10.462 million acres from 11.215 million, and durum to 1.376 million from 1.444 million. Our spring wheat production is 322 million, down from 345 million previous and durum at 32 million from 34 million previous.

USDA is using 1.697 billion for all wheat, 343 million for spring and 35 million for durum.

·

The central US Great Plains will see favorable temperatures and dry conditions for hard red winter wheat planting progress this week.

Argentina’s

wheat crop is in good shape

Export

Developments.

·

Morocco received no offers for 363,000 tons of US wheat for arrival by the end of the year.

·

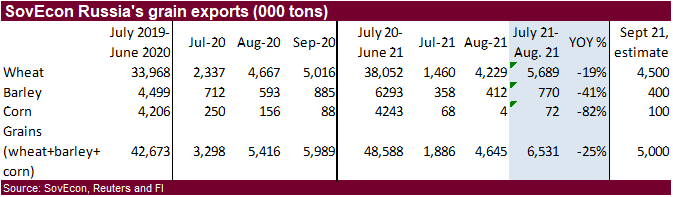

Japan seeks 113,067 tons of food wheat from the US and Canada, this week for October 21-November 20 loading.

·

Turkey bought 260,000 tons of feed barley for October 8-October 31 shipment at prices between $297.00-$312.90/ton.

·

Results awaited: Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

·

Pakistan’s lowest offer for 500,000 tons of wheat was $383.50/ton c&f.

·

Algeria seeks 50,000 tons of durum wheat on September 22 for November shipment.

-

Jordan

seeks 120,000 tons of wheat on September 22 for LH December through FH February shipment.

·

Jordan seeks 120,000 tons of feed barley on September 23 for Dec. 16-31, Jan. 1-15, Jan. 16-31, and Feb. 1-14.

-

Taiwan

seeks 49,580 tons of US wheat on September 23 between November 6 and November 20.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on September 23.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.