PDF Attached

Private

exporters reported sales of 136,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year.

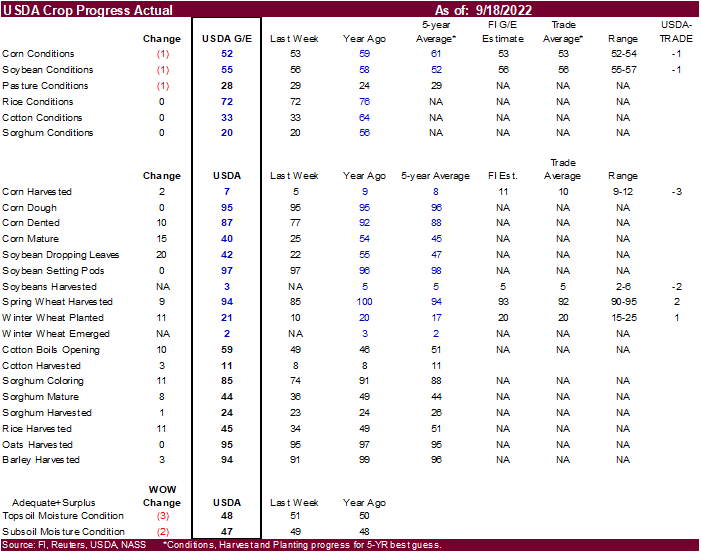

USDA

US crop conditions

US

CORN – 52 PCT CONDITION GOOD/EXCELLENT VS 53 PCT WK AGO (59 PCT YR AGO) -USDA

US

CORN – 7 PCT HARVESTED VS 5 PCT WK AGO (8 PCT 5-YR AVG) -USDA

US

CORN – 87 PCT DENTED VS 77 PCT WK AGO (88 PCT 5-YR AVG) -USDA

US

CORN – 40 PCT MATURE VS 25 PCT WK AGO (45 PCT 5-YR AVG) -USDA

US

SOYBEAN – 55 PCT CONDITION GOOD/EXCELLENT VS 56 PCT WK AGO (58 PCT YR AGO)

US

SOYBEANS – 3 PCT HARVESTED (5 PCT YR) (5 PCT 5-YR AVG) -USDA

US

SOYBEANS – 42 PCT DROPPING LEAVES VS 22 PCT WK AGO (47 PCT 5-YR AVG) -USDA

US

WINTER WHEAT – 21 PCT PLANTED VS 10 PCT WK AGO (17 PCT 5-YR AVG) -USDA

US

WINTER WHEAT – 2 PCT EMERGED (3 PCT YR) (2 PCT 5-YR AVG) -USDA

US

SPRING WHEAT – 94 PCT HARVESTED VS 85 PCT WK AGO (94 PCT 5-YR AVG) -USDA

US

COTTON – 11 PCT HARVESTED VS 8 PCT WK AGO (11 PCT 5-YR AVG) -USDA

US

COTTON – 33 PCT CONDITION GOOD/EXCELLENT VS 33 PCT WK AGO (64 PCT YR AGO)

US

COTTON – 59 PCT BOLLS OPENING VS 49 PCT WK AGO (51 PCT 5-YR AVG) -USDA

US

RICE – 72 PCT CONDITION GOOD/EXCELLENT VS 72 PCT WK AGO (76 PCT YR AGO) -USDA

US

RICE – 45 PCT HARVESTED VS 34 PCT WK AGO (51 PCT 5-YR AVG) -USDA

Soybeans,

meal and corn ended higher. Soybean oil and wheat traded lower. US harvesting is expected to ramp up this week bias Delta and lower Midwest with a weather outlook calling for mostly dry conditions. Hot and dry conditions are seen for the southwestern hard

red winter wheat growing areas over the next two weeks. Brazil will see widespread rains this week, favoring early development for recently planted corn and lessor extent soybeans. Argentina is still battling a drought and we could see the local exchanges

start to lower their estimates for soybeans and corn planting areas.