PDF Attached

Attached

are our revised crop-year price projections and US S&D’s.

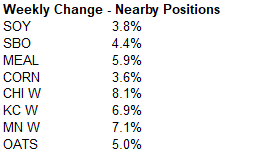

Another

big move to the upside for soybeans. Corn and wheat ended higher. USDA announced sales of soybean, meal and corn. China Dalian corn hit a fresh five-year high with January gaining 55 yuan (about 8.14 U.S. dollars) at 2,484 yuan per ton.

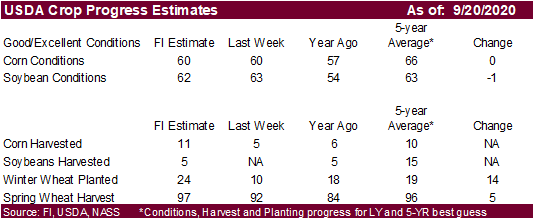

Weather

and Crop Progress

CHANGES

OVERNIGHT

- Argentina’s

drought stricken areas may have a good chance for rain in the latter part of next week and into the following weekend - No

rain is expected through Wednesday - The

precipitation advertised for next week should offer a well-timed bout of needed moisture to improve early corn and sunseed planting in parts of Cordoba and Santa Fe, but much more rain will still be needed - This

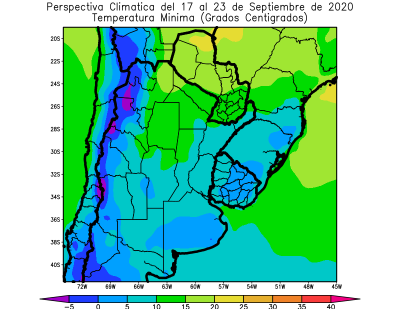

event is far enough out in time that some caution is advised over the potential for some changes in the outlook - Temperatures

will be near average over the coming week and a little colder than usual in the last days of September - Other

areas in eastern Argentina will also get rain late next week and into the following weekend maintaining good wheat conditions and supporting a favorable lift in topsoil moisture for future corn and sunseed planting - Tropical

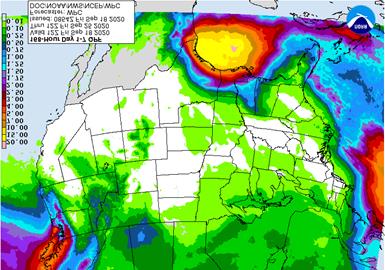

Depression Twenty-Two formed in the Gulf of Alaska this morning and was expected to reach the west-central Gulf by Sunday before turning toward Texas - The

depression will likely become Tropical Storm Wilfred later today or Saturday and may become a hurricane Sunday - The

storm will likely threaten the Texas coast early next week - Heavy

rain and windy conditions will begin impacting the lower and middle Texas coast late Monday night and Tuesday - A

highly debated and speculative landfall forecast along the upper Texas coast is being suggested for Tuesday or Wednesday, but confidence is low - Remnants

of the storm may pass through the Delta and into the southeastern U.S. during the middle and latter parts of next week possible producing some significant rain

- Flooding

is possible along the Texas coast and possibly in some areas in western Louisiana

- Tropical

Storm Sally dissipated over the southeastern U.S. Thursday - Additional

heavy rain fell with amounts of 1.00 to 3.00 inches and locally more than 4.00 inches - Preliminary

estimates of crop damage have been low, but some loss is expected for cotton in the Florida Panhandle and possibly extreme southern Alabama - Other

crops likely survived the storm relatively well, although some cotton fiber quality declines were suspected and the threat of boll rot may be rising - Tropical

Storm Vicky dissipated Thursday over open water in the Atlantic - Hurricane

Teddy has reached a Category Four on the Saffir Simpson wind scale - The

storm was more than 900 miles away from Bermuda this morning - Teddy

may pass east of Bermuda early next week as a strong Category 2 storm and after that the storm may threaten Nova Scotia and Newfoundland, Canada with heavy rain and high wind speeds late next week.

- A

tropical wave south southwest of the Cabo Verde Islands may become a tropical depression today or Saturday while moving west northwesterly over open water in the central tropical Atlantic Ocean

- This

system is advertised to stay northeast of the Leeward Islands and may weaken after a few days of intensification - Tropical

Storm Noul has reached the coast of Vietnam this morning - The

center of the storm was 174 miles west of Da Nang at 0900 GMT today moving westerly at 31 mph and producing maximum sustained wind speeds of 46 mph - Landfall

was expected around 0800 GMT today north of Hue, Vietnam - Heavy

rain and flooding will accompany the storm inland - Crop

damage will be low because the area impacted is not a very important rice production area - Remnants

of the system will move through southern Laos today and across northern Thailand Saturday - Remnants

of Noul may reach the eastern Bay of Bengal later in the weekend and could bring rain to India next week

OTHER

WORLD WEATHER ISSUES

- Dryness

continues to threaten winter crop planting and establishment in the drier areas of southeastern Europe, central and eastern Ukraine, western Kazakhstan and parts of Russia’s Southern Region - No

relief from drought will occur in these areas for another ten days, but conditions may begin to improve in early October - France,

Spain and Portugal will receive rain this weekend and during much of next week resulting in some improved topsoil moisture - More

rain will be needed in these previously dry areas, but the precipitation will help to improve pre-planting and early planting moisture for autumn crops - The

U.K. and Germany will also get rain during the middle to latter part of next week - Parts

of Italy will also receive rain during mid- to late-week next week and some of this moisture may begin to push into eastern Europe during the second weekend of the two week outlook - Western

Australia will receive some rain during mid- to late-week next week, but amounts will be lightest in the interior crop areas where greater rainfall will still be needed - Net

drying in northern parts of Western Australia’s wheat and barley production region may be cutting into yields as reproduction is under way - These

areas will get “some” rain during the second half of next week - Southern

and western crop areas will get just enough moisture to maintain a good production outlook - Australia’s

crop areas from South Australia to Queensland, New South Wales and Victoria will get needed rain by Sunday and sufficient amounts will occur to support better winter crop conditions - Additional

rain will still be needed to restore soil moisture after prolonged drought in South Australia, Queensland and some western and northern New South Wales crop areas, but crops will certainly benefit from the moisture - South

Africa still needs significant rain for its winter wheat, barley and canola crops, especially those in eastern production areas - Not

much rain is expected over the coming week, although a few sporadic showers are anticipated - Center

West and southern parts of center south Brazil are advertised to receive scattered showers and thunderstorms Sunday into Wednesday Morning with some follow up rain late this month and into October 2 - The

precipitation might eventually help lift topsoil moisture for “some” early season soybean planting, but much more rain will be needed - Coffee

and citrus flowering “may” occur in a few areas from Sao Paulo into southern Minas Gerais and Rio de Janeiro while sugarcane and early corn experience a moisture boost to improve crop development; however, most of the region will fail to get quite enough moisture

to make big changes in crop or soil conditions without follow up moisture - Southern

Brazil rice, corn and wheat areas will get periodic rainfall through the next two weeks - Crop

and field conditions will either improve or continue good through the end of this month - China

rain Thursday was greatest in the lower Yangtze River Basin where 2.75 to 8.79 inches resulted

- Some

flooding occurred - Rain

also fell significantly in Guizhou and northern Yunnan where local totals of more than 5.00 and 8.00 inches resulted respectively - Northeastern

China rainfall diminished Thursday with rainfall of 0.05 to 0.40 inch in Heilongjiang and northern Jilin where up to 2.12 inches occurred in northeastern Inner Mongolia - Net

drying occurred in the southern coastal provinces - China

weather over the next two weeks - Rain

will continue to impact portions of Heilongjiang and Jilin periodically over the next week to ten days resulting in further delays to crop maturation and harvesting through the balance of this month; some crop quality declines are expected to continue especially

for soybean, rice and some groundnuts - A

good mix of rain and sunshine will impact the middle and lower Yellow River Basin and portions of the North China Plain over the next ten days resulting in relatively good summer crop maturation and harvest conditions while improving future wheat planting

potentials - Rain

will fall frequently near and south of the Yangtze River Basin as well as Yunnan and Guangxi during the next two weeks to maintain soggy field conditions - Much

of eastern China needs to dry down in support of summer crop maturation and harvesting as well as support for winter crop planting that occurs from late this month through October and into November - Xinjiang,

China weather will continue favorable for cotton and other crop maturation and early harvest progress - Alternating

periods of warm and cool weather will occur through the next week to 8 or 9 days with restricted rainfall expected - The

environment will support crop maturation, leaf defoliation and early harvesting - High

temperatures Thursday were in the 70s and 80s Fahrenheit and lows today in the upper 40s and 50s - Frost

and freezes may occur in northeastern Xinjiang After Sep. 27 - India

weather over the next two weeks will continue wettest in central, southern and far eastern parts of the nation while net drying occurs in the north - Monsoonal

precipitation will continue without much withdrawal through early next week, but a more significant withdrawing trend is expected in the last week of September and early October improving crop maturation conditions in central parts of the nation

- Remnants

of Tropical Storm Noul will move through Southeast Asia this weekend and could bring some enhanced rainfall to parts of India next week - Weather

conditions in most of India are still favorable, but drying is needed in Gujarat and that may not come for another week - U.S.

weather over the next ten days - Favorable

summer crop maturation and harvest weather is expected due to restricted rainfall and mild to warm temperatures for the next ten days including the Midwest Corn and Soybean Belt - Southeastern

U.S. rainfall will be winding down after today with a developing drier bias expected during the weekend and early to mid-week next week - The

change will result in better conditions for summer crops not seriously impacted by Tropical Cyclone Sally - Some

of the rain from Tropical Depression Twenty-Two may reach into the Delta during mid-week next week and into the southeastern states shortly thereafter, but confidence in this event is still low today - U.S.

hard red winter wheat areas will receive limited rainfall which may be good for summer crop maturation and harvest progress - Wheat

planting and emergence will continue, although there is need for greater rain to induce better emergence and establishment in the driest areas - The

bulk of additional planting will occur in October - West

Texas rainfall will be limited enough to support favorable crop maturation

- There

is some potential for rain briefly late next week or in the following weekend

- Northern

Plains will receive restricted rainfall and experience warm temperatures favoring a good crop maturation and harvest environment for the coming week and only brief rainfall is possible in the following week - U.S.

temperatures slipped to the frost and freeze level this morning in the upper Midwest and the cold will shift to the east this weekend impacting the northern Great Lakes region this weekend with lows in the 30s Fahrenheit and with a few colder readings near

the Canada border - Some

of this cold will also impact Ontario and Quebec, Canada - Overall

U.S. temperatures in the coming week will be warmer than usual from the central and northwestern Great Plains through most of the western states while near to below average farther to the east - The

coolest conditions relative to normal through the weekend will be in the eastern Midwest through the Atlantic Coast states - Temperatures

next week will be similar to those of this week, although a little warmer in the eastern Midwest and a little milder in the central Plains - Some

minor cooling is also expected in the Pacific Northwest and Rocky Mountain region - West-central

Africa will continue to experience periodic showers and thunderstorms over the next couple of weeks - Additional

improvement is expected to coffee, cocoa, rice and sugarcane production areas after rain fell significantly during the weekend - The

next wave of greatest rain will occur next week - Cotton

areas will also continue to receive some rain for a while longer - All

crops receiving rain will likely benefit from the moisture - East

central Africa rainfall has been and will continue to be erratic and mostly beneficial over the next ten days - Canada

Prairies will experience some weekend rain (mostly in Saskatchewan), but good harvest weather is expected prior to and after that period of time for a few days - Additional

rainfall is expected in the last week of this month - Harvesting

and crop maturation should advance relatively well during the period with only a few delays likely - Mainland

areas of Southeast Asia will experience periodic showers and thunderstorms over the next couple of weeks

- Late

season moisture boosting is extremely important since water supply has not been fully restored from last year’s low levels - Tropical

Storm Noul will bring significant rain to the region from central Vietnam into Thailand today and Saturday - Philippines

rainfall will continue periodically benefiting most crops. - Improving

rainfall in Indonesia and Malaysia is expected over the next two weeks with some heavy rain possible in random locations - Ontario

and Quebec rainfall will occur periodically over the next ten days alternating with periods of rain and sunshine - Net

drying is expected during much of this first week of the outlook - Temperatures

will be slightly cooler than usual through the weekend with some frost and freezes likely -

New

Zealand rainfall will be above average on the west coast of South Island and below average elsewhere; temperatures will be near to below average -

Southern

Oscillation Index was +9.72 today and it will stay significantly positive into next week

Source:

World Weather Inc.

It’s

going to be cold over the next week for Argentina.

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

MONDAY,

Sept. 21:

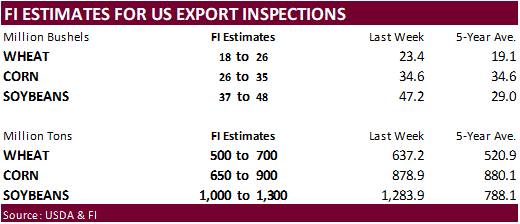

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions, harvesting progress for soybeans, corn, cotton, 4pm - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia

Sept. 1-20 palm oil export data - HOLIDAY:

Japan

TUESDAY,

Sept. 22:

- U.S.

cold storage data – pork, beef, poultry, 3pm - HOLIDAY:

Japan

WEDNESDAY,

Sept. 23:

- China

customs publishes data on imports of corn, wheat, sugar and cotton - EIA

U.S. weekly ethanol inventories, production, 10:30am

THURSDAY,

Sept. 24:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Unica to release cane crush and sugar output data during the week (tentative) - USDA

data on hogs and pigs inventory, red meat production, poultry slaughter, 3pm - International

Grains Council monthly report

FRIDAY,

Sept. 25:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China

customs publishes country-wise soybean and pork import data - S&P

Platts Sugar and Ethanol Conference, Sao Paulo - FranceAgriMer

weekly update on crop conditions - Malaysia

palm oil export data for Sept. 1-25 - U.S.

cattle on feed, 3pm

IHS

Markit 2021 US acreage

Corn

93.7 vs. 2020 USDA 92.006

Soybeans

87.1 vs. 2020 USDA 83.825

All

wheat 45.4 vs. 2020 USDA 44.250

Winter

wheat 30.9 vs. 2020 USDA 44.250

From

trade sources

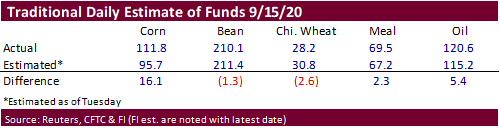

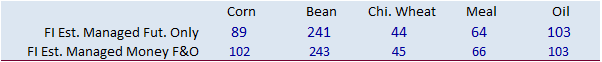

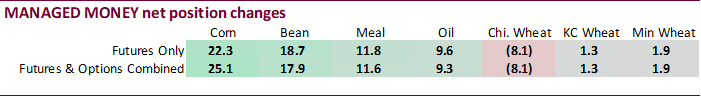

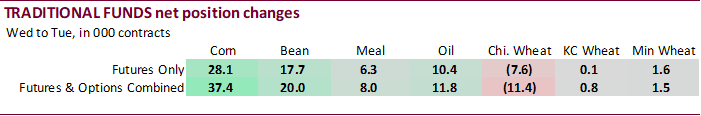

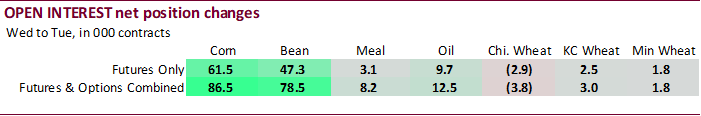

CFTC

Commitment of Traders

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

29,929 32,392 339,180 2,469 -306,024 -24,936

Soybeans

153,226 21,373 192,996 5,866 -329,058 -20,935

Soyoil

76,039 10,949 114,377 2,063 -208,945 -13,411

CBOT

wheat -13,484 -11,686 139,404 1,825 -106,869 9,967

KCBT

wheat 392 919 59,307 -754 -60,596 1,671

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

58,556 25,062 173,222 -4,480 -263,837 -22,952

Soybeans

191,774 17,868 118,964 8,555 -324,798 -22,233

Soymeal

43,697 11,578 76,571 -767 -165,156 -10,532

Soyoil

94,564 9,264 92,017 378 -224,445 -12,588

CBOT

wheat 15,112 -8,062 97,793 3,264 -105,520 8,191

KCBT

wheat 10,192 1,268 45,264 -1,016 -59,071 2,089

MGEX

wheat -3,008 1,913 2,159 -79 121 -1,186

———- ———- ———- ———- ———- ———-

Total

wheat 22,296 -4,881 145,216 2,169 -164,470 9,094

Macros

Canadian

Wholesale Trade Sales (M/M) Jul: 4.3% (exp 3.5%; prev 18.5%)

Canadian

Retail Sales (M/M) Jul: 0.6% (exp 1.0%; prev 23.7%)

–

Retail Sales Ex Auto (M/M) Jul: -0.4% (exp 0.5%; prev 15.7%)

Canadian

Teranet/National Bank HPI (M/M) Aug: 0.6% (prev 0.3%)

–

Teranet/National Bank HPI (Y/Y) Aug: 5.7% (prev 5.5%)

-

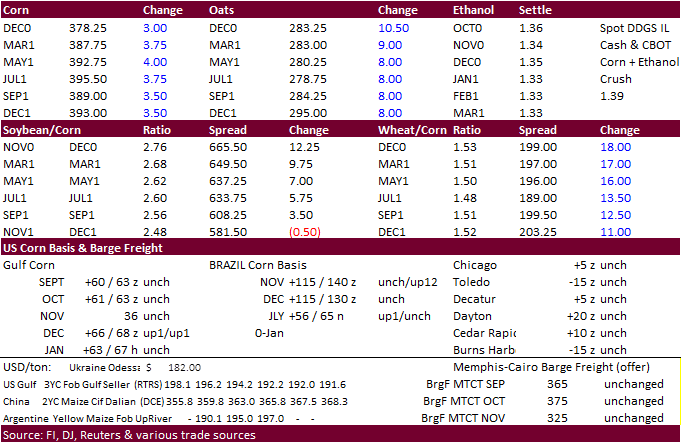

Corn

is at a six-month high with December up 3.25 cents today. US corn was higher following the soybean strength. For the week the nearby contract was up 2.7%.

-

Funds

bought an estimated net 10,000 contracts. -

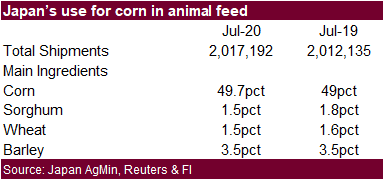

China

Dalian corn hit a fresh five-year high with January gaining 55 yuan (about 8.14 U.S. dollars) at 2,484 yuan per ton. China’s currency is strong. A ProFarmer story suggested China corn imports could range between 20-30 million tons. US commitments are already

running at just over 9 million tons for China. USDA will need to adjust their China corn import projection higher, currently at 7 million tons. We are using 12 million tons for Chinese corn imports, for now. TRQ for 2020 are at 9.2MMT. Note China reported

a good recovery in hog inventories from a year ago. Now that China is expanding their commercial hog production, demand for meal, corn and other feedgrains will naturally increase.

-

French

corn ratings declined to 59 percent good to very good as of September 14 from 60 percent previous week (year ago 59 percent). 4% of the corn crop had been collected.

-

Ukraine

grain exports are running 10.2 percent below year ago level (July-June season) at 10.33 million tons (11.5MMT year ago), according to the economy ministry, including 612,000 tons of corn (1.9MMT year earlier).

-

USD

was near unchanged and WTI crude oil down $0.13 as of 3:00 PM CT. -

The

Philippine Association of Feed Millers (Pafmi) said it was buying more local corn as reports of bumper crop from the ongoing harvest boosted its confidence in the availability of yellow corn. (Bloomberg)

-

Germany

confirmed six more ASF cases in wild boar on Friday. Pork prices plunged last Friday but stabilized this week.

European

Union: Livestock and Products Annual

-

Under

the 24-hour announcement system, USDA announced private exporters sold: -

Export

sales of 210,000 metric tons of corn received during the reporting period for delivery to China during the 2020/2021 marketing year

China

corn futures – monthly

-

December

is seen in a $3.40-$3.85 range. 2020-21 to average $3.75 for corn and $2.85 for oats.