Hurricane

Sally made landfall across FL and AL and surrounding states. This is a slow-moving storm and will cause localized flooding. Outside of the storm path taking shape to move across the southeast, and the far western US where wildfires are inflicting havoc,

rest of the US weather outlook looks good this week. NOPA

crush was perceived to be slightly bearish for the soybean complex. Grains were lower on technical selling.

USDA

announced additional sales

two

more…WASHINGTON, September 15, 2020–Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export

sales of 132,000 metric tons of soybeans for delivery to China during the 2020/2021 marketing year;

–Export

sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2020/2021 marketing year; and

–Export

sales of 120,000 metric tons of corn for delivery to unknown destinations during the 2020/2021 marketing year.

Weather

and Crop Progress

- Hurricane

Sally will bring torrential rain and serious flooding to the Mobile Bay area of Alabama with more than 24 hours of heavy rain also impacting areas east through the Florida Panhandle - Areas

from the western most part of the Florida to the Alabama/Mississippi border will experience the greatest rainfall with the excessive amounts extending inland 150 miles - Rain

totals of 10-20 inches and local totals to 30 inches were suggested by the National Hurricane Center near the Coast - Rainfall

of 3.00 to 9.00 inches will extend northeast from southwestern and south-central Alabama through northern Georgia, northern Alabama and into the Carolinas with 2.00 to 5.00 inches expected to the south in southern and central Georgia and southeastern Alabama - The

greatest rainfall should occur to the north and northeast of the center of the storm - Sally

will weaken to a tropical storm shortly after moving over land Wednesday and to a depression Thursday - Wind,

flood and storm surge damage will be greatest in far southwestern Alabama and extreme western parts of the Florida Panhandle - Cotton,

unharvested corn and soybeans will be threatened with damage from the storm, although only a small amount of lost production is expected

- Cotton

will be most impacted with some production loss and considerable quality declines because of too much rain - Wind

damage will be low - Significant

wind damage is also expected in the Mobile Bay area and widespread power outages are expected along with structural damage

- Hurricane

Paulette, Tropical Storm Teddy and Tropical Storm Vicky are over open water in the Atlantic Ocean and posting no threat to land - Tropical

wave west of Africa has potential to develop into a tropical cyclone later this week and it will move toward the northern Leeward Islands over the coming week - This

system will need to be closely monitored for possible influence on North America and the Caribbean Islands next week, although there is plenty of time for the system’s potential to change - Tropical

disturbance in the southwestern Gulf of Mexico will be wandering around off the coast of eastern Mexico the next few days and has some potential for becoming better organized over time - Most

likely this system will produce repetitive rainfall in eastern Mexico and in the southernmost tip of Texas for a while, but should not pose a big threat to agriculture – at least not through Thursday - Tropical

disturbance over Philippines will produce rain over the next couple of days - This

system will quickly evolve into a tropical storm and possible typhoon and may threaten central Vietnam with landfall late Thursday and especially Friday into the weekend - Flooding

rainfall and strong wind speeds may impact central and northern parts of Vietnam from this storm

OTHER

WORLD WEATHER ISSUES

- Argentina

rainfall will remain limited over the next ten days with very little potential for relief to drought conditions in the west

- Dryness

in southeastern Europe will prevail for the next week to ten days supporting good summer crop maturation and harvest conditions, but threatening winter crop planting - Some

relief is possible late this month and better weather is expected in October - France,

the U.K., Germany, Spain and Portugal will all get some welcome rainfall beginning this weekend and continuing through all of next week - Improved

soil moisture will occur for better winter crop planting and emergence conditions later this autumn will result - Some

slowing of summer crop maturation and harvesting is expected - Dryness

remains a concern in central and eastern Ukraine, parts of Russia’s Southern region and portions of Kazakhstan - Very

little rain will fall in these areas through the next ten days - Western

Australia rainfall will be limited to the far southwest where crop conditions will stay good - Dryness

in other Western Australia crop areas will raise concern over reproductive conditions if greater rain does not fall soon - Northern

crops in Western Australia will be reproducing through the end of this month - Eastern

Australia will receive significant rain later this week - South

Australia will get rain Wednesday with 0.60 to 2.00 inches possible in some winter crop areas - New

South Wales, Queensland and Victoria will receive rain Thursday into Saturday with 0.50 to 2.00 inches from northern New South Wales into Queensland

- Rainfall

of 0.60 to 1.75 inches will also occur in Victoria - The

precipitation will be extremely helpful in raising soil moisture for winter and spring crops, although wheat and barley in Queensland may be a little too far advanced to fully benefit - Center

West and southern parts of center south Brazil are advertised to receive scattered showers and thunderstorms Sep. 20-23 with some follow up rain periodically into the end of this month - The

precipitation might eventually help lift topsoil moisture for some early season soybean planting, but much more rain will be needed - Coffee

and citrus flowering “may” occur in a few areas from Sao Paulo into southern Minas Gerais and Rio de Janeiro while sugarcane and early corn experience a moisture boost to improve crop development; however, most of the region will fail to get quite enough moisture

to make big changes in crop or soil conditions without follow up moisture - Southern

Brazil rice, corn and wheat areas will get periodic rainfall through the next two weeks - Crop

and field conditions will either improve or continue good through the end of this month - China

rainfall Monday was good in areas from northern Shaanxi to Hebei for future wheat planting - Rain

totals varied from 0.50 to 1.77 inches most often, but one location in northeastern Hebei reported nearly 7.00 inches of rain which resulted in local flooding - Rain

also fell in the Yangtze River Basin with amounts of 1.00 to 3.50 inches - Rainfall

elsewhere was more sporadic and light with needed dry conditions in much of the northeast and some other areas - China

will experience a favorable mix of rain and sunshine in most grain, oilseed, cotton, rice and sugarcane areas during the next two weeks - Too

much rain may fall in some of southern China over the next two weeks - Local

flooding is possible - Heilongjiang,

Jilin and Liaoning will need additional drier biased weather soon to support summer crop maturation and harvest progress - The

mix of weather elsewhere will be good for ongoing summer crop development and helpful in ensuring good soil moisture for rapeseed and wheat planting later this autumn - India

weather over the next two weeks will continue wettest in central, southern and far eastern parts of the nation while net drying occurs in the north - The

environment will good for most crops and fieldwork - Western

Commonwealth of Independent States will experience periodic rain over the next two weeks with a few breaks in the precipitation

- Most

of this will occur north of a line from Belarus through southwestern Russia to northern Kazakhstan - Net

drying will occur farther to the south - Temperatures

will trend colder next week with frost and freezes possible in a part of the region west of the Ural Mountains - U.S.

weather over the next ten days - Favorable

summer crop maturation and harvest weather is expected due to restricted rainfall and mild to warm temperatures - Southeastern

U.S. rainfall will be excessive over the balance of this week due to Hurricane Sally, but after that some improved weather is expected; including net drying conditions - U.S.

hard red winter wheat areas will receive limited rainfall which may be good for summer crop maturation and harvest progress - Wheat

planting and emergence will continue, although there is need for greater rain to induce better emergence and establishment in the driest areas - West

Texas rainfall will be limited enough to support favorable crop maturation

- Northern

Plains will receive restricted rainfall and experience warm temperatures favoring a good crop maturation and harvest environment - U.S.

temperatures will slip to the frost and freeze threshold in the upper Midwest and northern Great Lakes region late this week with lows in the 30s Fahrenheit and with a few colder readings near the Canada border - Some

extreme lows in the upper 20s will occur in northern Minnesota, but key crop areas in the Midwest will not experience temperatures nearly as cold - Overall

temperatures in the coming week will be warmer than usual from the central and northwestern Great Plains through most of the western states while near to below average farther to the east - The

coolest conditions relative to normal this week will be in the eastern Midwest through the northeastern states - Temperatures

next week will be similar to those of this week, although a little warmer in the eastern Midwest and a little milder in the central Plains - Some

cooling is also expected in the Pacific Northwest and Rocky Mountain region - West-central

Africa will continue to experience periodic showers and thunderstorms over the next couple of weeks - Additional

improvement is expected to coffee, cocoa, rice and sugarcane production areas after rain fell significantly during the weekend - Cotton

areas will also continue to receive some rain for a while longer - All

crops receiving rain will likely benefit from the moisture - South

Africa weather will continue mostly dry over the next seven days with only a few showers in the far east and near the south coast expected - East

central Africa rainfall has been and will continue to be erratic and mostly beneficial over the next ten days - Canada

Prairies will experience scattered showers over the next two weeks while temperatures are near to above average in the southwest and more seasonable northeast

- Harvesting

and crop maturation should advance relatively well during the period with only a few delays likely - Xinjiang,

China weather will continue favorable for cotton and other crop maturation and early harvest progress - Alternating

periods of warm and cool weather will occur through the next ten days with restricted rainfall expected - The

environment will support crop maturation, leaf defoliation and early harvesting - Mainland

areas of Southeast Asia will experience periodic showers and thunderstorms over the next couple of weeks

- Late

season moisture boosting is extremely important since water supply has not been fully restored from last year’s low levels - Philippines

rainfall will increase over the next few days as a tropical disturbance moves through the nation - Locally

heavy rain is expected and most of the moisture will be welcome for crops throughout the nation - Improving

rainfall in Indonesia and Malaysia is expected over the next two weeks with some heavy rain and possible flooding expected in parts of Kalimantan and Papua New Guinea - Ontario

and Quebec rainfall will occur periodically over the next ten days alternating with periods of rain and sunshine; Temperatures will be seasonable to slightly cooler than usual -

New

Zealand rainfall will be near to above average during the coming week and temperatures will be a little cooler than usual -

Southern

Oscillation Index was +9.09 today and it will stay positive this week

Source:

World Weather Inc.

- Australia’s

Abares releases quarterly agricultural commodities report - Malaysia

palm oil export data for Sept. 1-15 - France’s

agriculture ministry to publish crop estimates - World

Agri-Tech Innovation Summit, Sept. 15-16 - New

Zealand global dairy trade auction - HOLIDAYS:

El Salvador, Guatemala, Honduras, Nicaragua

WEDNESDAY,

Sept. 16:

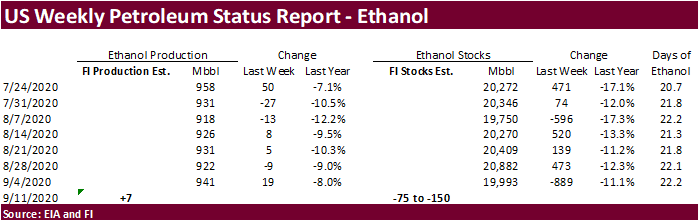

- EIA

U.S. weekly ethanol inventories, production, 10:30am - FranceAgriMer

supply and demand estimates - Future

Food-Tech conference, Sept. 17-18 - HOLIDAYS:

Malaysia, Mexico

THURSDAY,

Sept. 17:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA

total milk production for August, 3pm - Port

of Rouen data on French grain exports - Biosev

SA 1Q 2021 earnings

FRIDAY,

Sept. 18:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Macros

US

Import Price Index (M/M) Aug: 0.9% (exp 0.5%; prev 0.7%)

–

Import Price Index (Y/Y) Aug: -1.4% (exp -2.1%; prev -3.3%)

–

Export Price Index (Y/Y) Aug: -2.8% (exp -3.2%; prev -4.4%)

Canadian

Manufacturing Sales (M/M) Jul: 7.0% (exp 9.0%; prev 20.7%)

US

Industrial Production (M/M) Aug: 0.4% (exp 1.0%; R prev 3.5%)

–

Capacity Utilisation Aug: 71.4% (exp 71.4%; R prev 71.1%)

–

Manufacturing (SIC) Production Aug: 1.0% (exp 1.3%; R prev 3.9%)

-

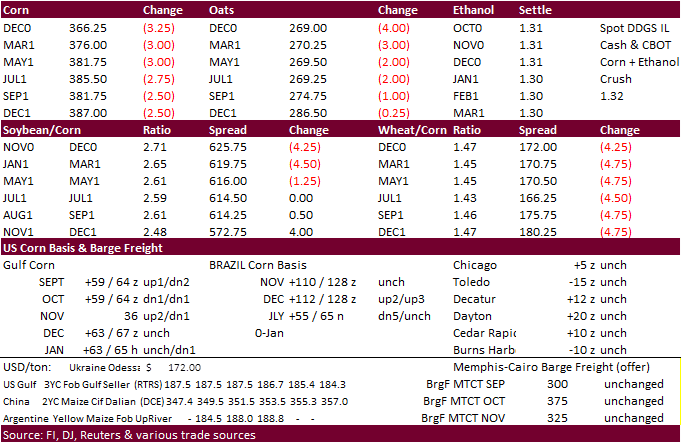

CBOT

corn traded

lower on technical selling and an increase in Argentina corn registrations. Lower wheat added to the negative undertone. US weather is mostly non-threatening this week and harvest progress is expected to advance throughout the country, with exception of

parts of the lower Delta and Southeast where heavy rain will occur. Some of the corn harvested south of KY has high moisture content. $3.70 is now a key resistance level for December corn.

-

USD

was up 4 points earlier and WTI crude oil up about $1.14 as of 2:20 PM CT.

-

Argentina’s

coop association booked a large 883,000 tons of Argentina’s export licenses overnight, busiest day since August 25.

Yesterday

Argentina offers were up 3 cents. -

More

dead wild boar have been discovered in the German state of Brandenburg, later to find out five additional cases of African swine fever (ASF) have been initially found in wild boars. German wholesale pig prices fell 14% on Friday.

-

China’s

August pig herd was up 31.3% from year ago and sow herd up 37%. Note ASF began in August 2018. -

We

are reading that the three storms across northeast China flattened 25 million tons of corn. Other circulations are talking up to 30-million-ton loss and/or deficit for 2020-21 but the fact remains no one knows how much corn is sitting in reserves. Note

they have inventories for the 2016 through 2019 crops. They sold 54+ million tons of 2014 and 2015 inventories this season already and bought around 10 million tons from Ukraine and US for 2020-21 delivery. China expanding TRQ requirements is a wild card.

http://www.feedandgrain.com/news/typhoons-flatten-chinas-northeast-grain-region#:~:text=Concerns%20are%20mounting%20over%20the,the%20South%20China%20Morning%20Post

-

We

estimate the US corn yield at 177.5 bushels per acre, 1.0 bushel below USDA. Our harvested area is 55,000 acres below USDA, resulting in a production of 14.807 billion bushels, 93 million below USDA’s September estimate. Soybean and Corn Advisory: 2020

U.S. Corn Estimate Unchanged at 176.0 bu/ac -

A

Bloomberg poll looks for weekly US ethanol production to be up 1,000 at 942,000 barrels (918-960 range) from the previous week and stocks to increase 345,000 barrels to 20.338 million.

-

Taiwan

seeks up to 65,000 tons of corn from the US, Brazil, Argentina, and/or South Africa, on Sep 16 for Nov-Dec shipment.

-

Under

the 24-hour announcement system, USDA announced private exporters sold:

–Export

sales of 120,000 metric tons of corn for delivery to unknown destinations during the 2020/2021 marketing year.

-

December

is seen in a $3.40-$3.85 range. 2020-21 to average $3.75 for corn and $2.85 for oats.