PDF Attached

USDA

released it September report update

WASDE

Briefing

https://www.usda.gov/sites/default/files/documents/september-2020-wasde-lockup-briefing.pdf

NASS

Briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2020/09-11-2020.pdf

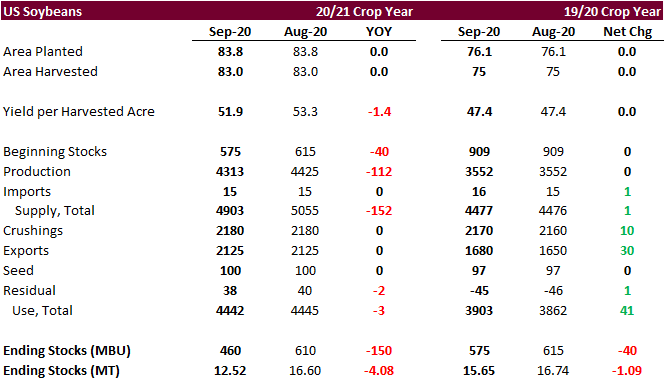

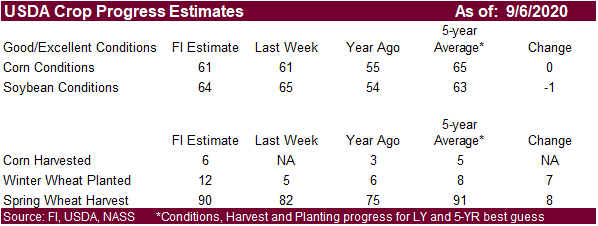

Bullish

soybeans but not so much bullish corn, and bearish to neutral wheat. What sticks out to us, is that USDA lowered US 2020 production for soybeans and corn by 2.5% each, but they went different directions in adjusting 2020-21 demand for each of the commodities.

USDA attacked domestic US corn usage by shaving off 200 million bushels, but they did raise exports by 100 million, which helped explain the bull spreading in corn post report as US corn exports are expected to front loaded. On the flipside, they virtually

left soybean demand unchanged, which explains the soybean/corn spreading. Therefore, the report was more influential for soybeans than corn.

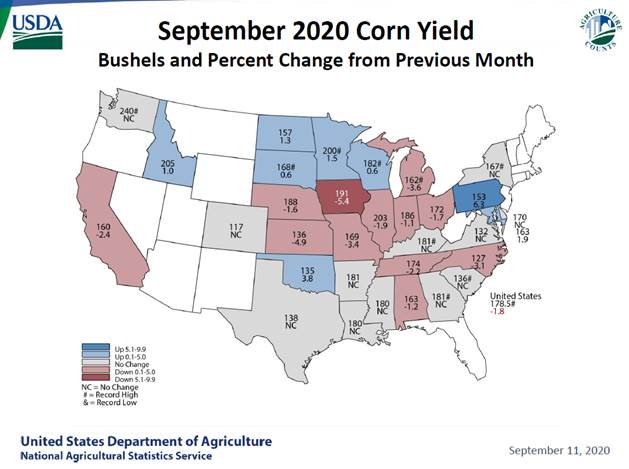

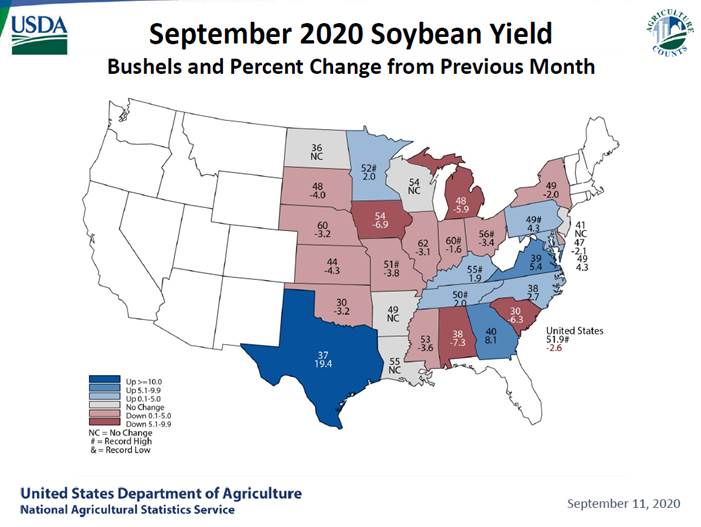

The

U.S. corn harvest was estimated at 14.900 billion bushels with a yield of 178.5 bushels per acre. Soybean production was 4.313 billion bushels with a yield of 51.9 bushels per acre. NASS lowered corn harvested acreage in Iowa by 550,000 acres. Soybean acres

were unchanged.

NASS

forecasts record-high yields in Georgia, Kentucky, Michigan, Minnesota, New York, South Carolina, South Dakota, Washington, and Wisconsin. Soybean yields were reported at a record high for Indiana, Kentucky, Minnesota, Missouri, Ohio, Pennsylvania, and Tennessee

will also be record high.

US

soybean, wheat and soybeans stocks did not deviate widely from expectations, but soybean stocks did drop in the right direction-tighter, which promoted futures buying after the report. US corn exports were up 100 (mil bu), ethanol down 100, feed down 100.

World corn production was down 8.6 MMT for 2020-21 and global stocks down 10.7MMT. There were no changes in China corn imports @ 7MMT, same as CASDE. World soybean stocks are down 1.8MMT. Brazil soybean production up 2MMT to 133MMT. Note USDA lowered their

estimates for Argentina exports for soybean oil and meal. USDA took 2020-21 world wheat production up 4.5MMT and stocks 2.6MMT, bearish in our opinion.

There

was little change in the US soybean meal balance sheet. US soybean oil supplies were lowered 215 million pounds. With no changes to US soybean oil demand, USDA lowered ending stocks accordingly, to 1.860 billion pounds from 2.075 billion previously, and

slightly above 1.845 billion pounds at the end of 2019-20. This is bullish, in our opinion, especially for those traders that benchmark 2.0 billion pounds as their indication for price direction. The reason for supply to be sharply lower for 2020-21 was

the downward revision to 2019-20 stocks after USDA boosted biodiesel by a needed 150 million pounds to 7.750 billion. Old crop exports were lowered 100 million pounds, but an upward revision of production by 135 million pounds (USDA took old crop crush higher

by 10 million bushels) partially offset the 450,000 million pounds increase in total domestic demand (food was up 300 million). See below and attached US and selected global FI snapshot.

Weather

and Crop Progress

WEATHER

ISSUES FOR THE WEEKEND AND NEXT WEEK

- Eastern

Australia rainfall will benefit many winter crop areas - Rain

is expected from South Australia into Queensland and New South Wales as well as Victoria during the second half of next week - The

moisture will be erratic, but still beneficial for any winter crop area impacted - Western

Australia will continue to dry out over the next ten days to two weeks raising concern over soil moisture in northern parts of the state where reproduction of wheat and barley is expected to begin soon if it has not already started - Southern

parts of Western Australia are much wetter than the north and winter crops will not be reproducing for a few more weeks

- La

Nina’s evolution improves confidence in potential rain for east-central and northeastern Australia this spring and summer which may lead to greater sorghum and cotton planting and much improved sugarcane production - South

Africa rainfall is expected to evolve significantly in some of its eastern wheat and barley production areas during mid-week next week which will lead to much improved soil moisture for crop development and production potential - Western

Europe is expecting some needed rain to develop during the middle to latter part of next week; this brings moisture to France, the U.K., Spain, Portugal and eventually to parts of Germany and Italy during the second week of the forecast

- The

moisture will improve winter crop planting and emergence conditions later this autumn, but will slow some summer crop maturation and harvest progress in a few areas - Eastern

Europe and the western CIS will be left dry including much of the already dry region from the Balkan Countries through Ukraine to Russia’s Southern Region, and western Kazakhstan - Significant

rain is needed in these areas to support winter crop planting, but the dry bias is great for summer crop maturation and harvest progress - Argentina’s

drought will not change in western crop areas through the next two weeks - Argentina’s

greatest rain will be in the northeastern parts of the nation during the coming week and that moisture will be good for cotton and early corn and sunseed planting - Argentina’s

soil moisture is still favorable for eastern and some central winter crop development, but the far west is still much too dry for normal crop development - Brazil

rainfall over the coming week will be greatest in the far south where wheat development and early corn planting and emergence will occur favorably - Center

west and center south Brazil may experience some erratic showers beginning near September 20 and continuing into late month, but the precipitation should be quite limited in coverage and intensity initially and the environment may not be ideal for early season

soybean planting - India’s

rainfall is still expected to be limited in the far north over the next ten days while it falls more abundantly and frequently in other areas of the nation; some local flooding may occur from Gujarat to Madhya Pradesh and southeast to northeastern Andhra Pradesh

and Telangana over the coming week to ten days, but no serious impact is expected on crops - Western

and southern Mexico and parts of Central America will receive heavy rainfall during the coming week resulting in at least some local flooding with areas from Durango and southern Sinaloa to Guerrero being one area of significant impact and another occurring

from Chiapas, Mexico to Honduras - West-central

Africa will see frequent rainfall over the next ten days, although there is some concern that this first week of the outlook will still generate only light amounts in Ivory Coast and Ghana - Recent

showers in these two countries have brought on some relief to dryness, but more rain is needed to support long term crop development; many areas are still considered drier than usual - The

longer-range outlook for Ivory Coast and Ghana is still wetter than usual for October and November - China

will continue to experience waves of rain and sunshine during the next week to ten days - No

area will be left too dry and many will have need for drier weather - Some

delay to summer crop maturation and harvest progress is expected to impact a part of northeastern China and in many areas from the Yangtze River Basin southward to the coast - The

best drying conditions will occur in the central Yellow River Basin - Xinjiang,

China weather is expected to be mostly good for this time of year with a limited rainfall pattern and mild to warm temperature regime supporting crop maturation and early harvest progress - Mainland

areas of Southeast Asia will experience increasing rain frequency and intensity during the next two weeks - Late

season moisture boosting is extremely important since water supply has not been fully restored from last year’s low levels - Philippines

rainfall will increase over the next week to ten days bringing some welcome moisture to central and some southern areas that have been relatively dry recently - Improving

rainfall in Indonesia and Malaysia is expected over the next two weeks with some heavy rain and possible flooding expected in parts of Kalimantan and Papua New Guinea - Pakistan

rainfall will be limited over the next ten days which is normal for this time of year - Tropical

Storm Paulette will reach Bermuda late Sunday and Monday as a hurricane possibly inducing some property damage over the island - The

storm will turn to the northeast after passing near or over the island and that will take the system away from North America - Tropical

Storm Rene will remain over open water in the central Atlantic through next week and poses no threat to land - Tropical

disturbance near the southeastern coast of Florida will move across Florida early this weekend and will produce some heavy rain in the region - The

system then moves over the eastern Gulf of Mexico and there is a relatively good chance a tropical depression or tropical storm will evolve and it may bring heavy rain to northwestern Florida, southern Alabama and some neighboring areas – this system will

need to be closely monitored during the weekend and next week - Vigorous

tropical wave in the eastern Atlantic Ocean (far from land) will intensify and organize this weekend and will be moving toward the Leeward Islands next week - This

system has much potential to become a significant tropical storm or hurricane and will need to be closely monitored - Another

tropical wave coming off the west Africa coast this weekend could impact the Cabo Verde Islands as another tropical depression or tropical storm early next week - Canada’s

Prairies will experience limited rainfall during the coming week and near to above average temperatures resulting in good field progress and mostly good late season crop development - Rain

will fall from central Alberta to central and interior southeastern Saskatchewan today into Sunday morning, but it will be a relatively narrow band of rain totals varying from 0.05 to 0.50 inch - Ontario

and Quebec rainfall will occur periodically over the next ten days alternating with periods of rain and sunshine; Temperatures will be seasonable - U.S.

temperatures in the next two weeks will trend warmer in the Great Plains and stay quite warm over the western states while seasonable readings occur in the east

- U.S.

rainfall outlook will be mostly good for late season crops with a few exceptions - Rain

will fall frequently in the Delta through the weekend, but it may diminish early next week depending on what happens to the tropical disturbance expected in the eastern Gulf of Mexico next week - Showers

in the Great Plains and western Corn Belt and Saturday will be followed by a welcome break from recent cold and wet weather - Crop

and field conditions will improve - U.S.

hard red winter wheat area will experience good drying conditions for a while starting this weekend and lasting through much of next week - Additional

rain is expected in central, southern and eastern Texas next week, but some of that forecast will also be dependent upon the future of the tropical disturbance expected in the eastern Gulf of Mexico this weekend and early next week - Dry

weather from the interior Pacific Northwest through the northwestern Plains and southward will be good for summer crop maturation and harvest progress - Only

one significant frontal system bringing rain is expected to move across the Great Plains and Midwest during the September 19-26 period and if that verifies good crop maturation and harvest conditions will result - West

Texas weather will return to normal this weekend with dry conditions expected and temperatures rising through the 70s and into the 80s followed by lows mostly in the 50s.

-

New

Zealand rainfall will be near to above average during the coming week and temperatures will be a little cooler than usual -

Southern

Oscillation Index was +8.75 today and it will stay positive the remainder of this week, although some weakening will continue over the next few days

Source:

World Weather Inc.

- (Overnight)

China agriculture ministry’s (CASDE) monthly report on supply and demand - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand food prices

MONDAY,

Sept. 14:

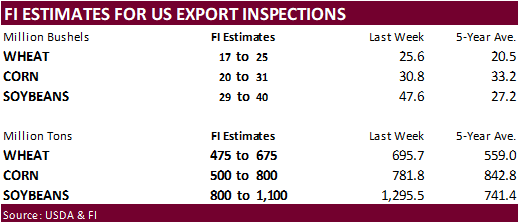

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions report, 4pm - Vietnam

Customs data on exports of coffee, rice and rubber - Monthly

MARS bulletin on crop conditions in Europe - Heilongjiang

Soy Association holds a summit in Harbin - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - International

Palm Oil Sustainability Conference, Sept 14-22 - HOLIDAYS:

Costa Rica, Nicaragua, Venezuela

TUESDAY,

Sept. 15:

- Australia’s

Abares releases quarterly agricultural commodities report - Malaysia

palm oil export data for Sept. 1-15 - France’s

agriculture ministry to publish crop estimates - World

Agri-Tech Innovation Summit, Sept. 15-16 - New

Zealand global dairy trade auction - HOLIDAYS:

El Salvador, Guatemala, Honduras, Nicaragua

WEDNESDAY,

Sept. 16:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - FranceAgriMer

supply and demand estimates - Future

Food-Tech conference, Sept. 17-18 - HOLIDAYS:

Malaysia, Mexico

THURSDAY,

Sept. 17:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA

total milk production for August, 3pm - Port

of Rouen data on French grain exports - Biosev

SA 1Q 2021 earnings

FRIDAY,

Sept. 18:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

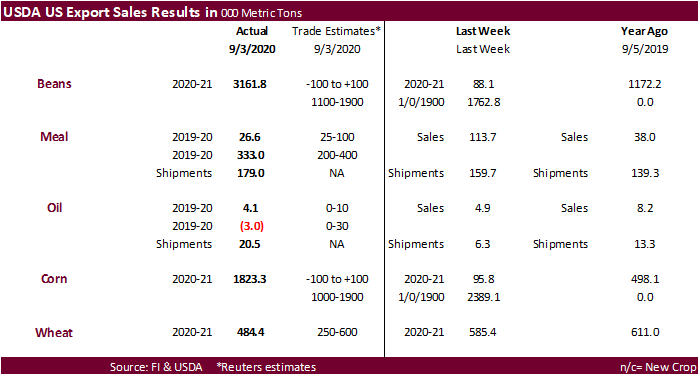

USDA

export sales.

New crop for corn and soybeans. Note soybean sales included a total of 2,538,200 MT in sales were carried over from the 2019/2020 marketing year, which ended August 31. Therefore,

soybean export sales were well below expectations. A total of 1,250,400 MT in corn sales were carried over from the 2019/2020 marketing year. Corn export sales were also ok to poor.

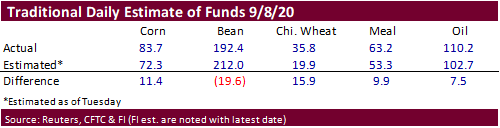

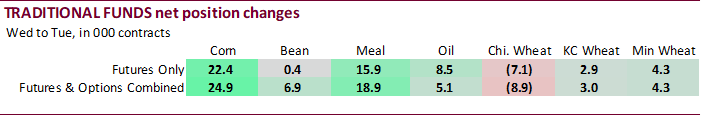

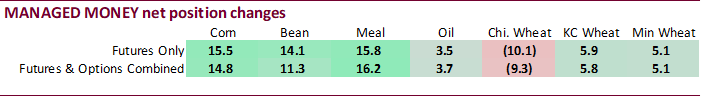

No

surprises in the traditional fund position estimates versus actual like what we saw last week in corn. Traders were again adding onto long futures and options managed money long positions in corn and soybeans, along with meal. We see no or little impact

on prices per the outcome of this report.

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 33,494 14,835 177,702 3,816 -240,885 -20,037

Soybeans 173,907 11,300 110,409 -7,983 -302,565 7,358

Soymeal 32,119 16,249 77,338 -4,511 -154,624 -15,852

Soyoil 85,299 3,743 91,639 1,295 -211,857 -5,847

CBOT wheat 23,175 -9,294 94,529 5,152 -113,712 77

KCBT wheat 8,923 5,764 46,280 -2,114 -61,160 798

MGEX wheat -4,921 5,131 2,239 82 1,307 -4,099

---------- ---------- ---------- ---------- ---------- ----------

Total wheat 27,177 1,601 143,048 3,120 -173,565 -3,224

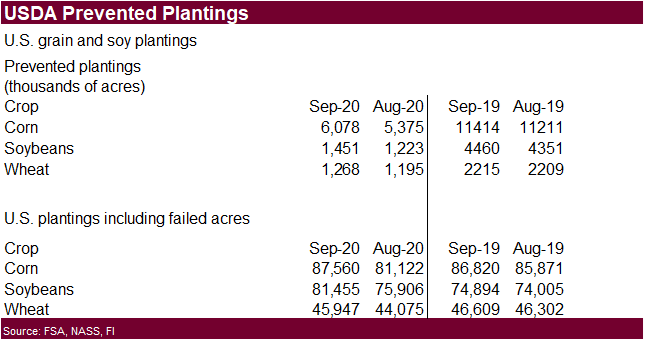

FSA

USDA

Sept

11 (Reuters) – Farmers participating in U.S. crop subsidy programs reported “prevented plantings” by Sept. 1 of 6.078 million acres of corn, 1.451 million acres of soybeans and 1.268 million acres of wheat and 10.072 million acres for all crops, the U.S. Department

of Agriculture said on Friday.

Producers

enrolled in subsidy programs as of Sept. 1 reported planted acreage, including failed acres, at 87.560 million acres of corn, 81.455 million acres of soybeans, 45.947 million acres of wheat and 241.718 million acres for all crops.

Macros

US

CPI (M/M) Aug: 0.4% (exp 0.3%; prev 0.6%)

–

CPI Ex Food And Energy (M/M) Aug: 0.4% (exp 0.2%; prev 0.6%)

–

CPI (Y/Y) Aug: 1.3% (exp 1.2%; prev 1.0%)

–

CPI Ex Food And Energy (Y/Y) Aug: 1.7% (exp 1.6%; prev 1.6%)

US

Real Average Hourly Earnings (Y/Y) Aug: 3.3% (prev 3.7%)

–

Real Average Weekly Earnings (Y/Y) Aug: 3.9% (R prev 4.2%)

Canadian

Capacity Utilisation Rate Q2: 70.3% (exp 70.7%; prev 79.8%)

US

Briefing 11/09/20: US Futures Rise Signalling Firm End To Unsteady Week; ECB Officials Highlight Risk From Strong Euro, Nuancing Message

–

Fed Seen Balking Again At Providing new Interest-Rate Guidance

–

Fed’s Emergency Loan Programs Shrinking Amid Calmer Markets

–

US GOP Skinny Bill On Stimulus Aid Blocked By Senate Democrats

–

China Takes Unspecified Retaliatory Measures on US Diplomats

–

China And India Deescalate By ‘Disengaging Troops’ In Himalayas

–

FDA Setting Higher Bar for Emergency Covid Vaccine Clearance

–

ECB Officials Highlight Risk From Strong Euro, Nuancing Message

–

Eurozone Ministers To Open Talks On Successor To ECB’s Mersch

–

Brexit Talks Fray, Growing Chances Of Chaotic UK-EU Trade Split

–

UK July Economic Growth Surges But Clouds Gather Over Brexit

–

UK Chancellor Urged To Extend UK Job Support, Help Indebted

–

UK Agrees Post-Brexit Trade Deal With Japan, Boosting Johnson

-

CBOT

corn started the day higher, eventually trading lower fueled by soybean/corn spreading, and ended higher (5-1/2 month high) on late session strength in soybeans.

We

hear there was some South American selling post USDA report. USDA (see text above) reported a neutral US S&D update. We did not change our medium-term price forecast but made a slight upward revision to the soybean complex. For the week December corn finished

10.50 cents higher, up 3%. Stabilizing prices was a 550,000-acre reduction to IA’s harvested area, but the yield of 178.5 bu/ac would be a record high.

-

Funds

bought an estimated net 11,000 contracts. -

In

its monthly S&D update, China’s corn production for 2020-21 was lowered by 1.8 million tons to 265MMT. They see corn imports at 7 million tons, up 2 million tons from earlier. Consumption was estimated at 288 million tons, unchanged from their earlier estimate.

Today’s talk was that China may seek 10 million tons of corn next week.

-

China’s

northeast and south regions will see heavy rains between Sept. 14-17. -

Germany

asked China to impose limited import restrictions amid ASF rather than ban pork imports from the entire country. Exporters can no longer carry on their labels “Germany is free from African swine fever”. German pig prices fell by 13.6% to 1.27 euros a kg

on Friday. Germany is EU’s largest pig producer. South Korea banned pork imports from Germany.

-

Ukraine

2020-21 to date grain exports are down 11 percent to 9.2 million tons from 10.3 million a year earlier. Corn exports are running at 608,000 tons, down from 1.9 million a year earlier. Ukraine started their corn harvest season. The grain crop is expected

to fall to 68 million tons from 75.1 million tons in 2019. UAC: Ukraine corn crop 36MMT, down from 35.3MMT.

-

Agritel

Sees Ukraine’s 2020 Corn Crop Falling to 33.5m Tons. -

Ukraine’s

Economy Ministry cut its forecast for corn crop to 33m tons -

French

corn crop conditions are down 1 point to 60 percent as of Sep 7 from the previous week and compare to 60 percent year earlier. 1 percent of the corn crop had been harvested.

-

China

sold 10,000 tons of pork out of reserves, if all completed today, making it 550,000 tons sold this year.

-

USDA

Attaché – Mexico Grain and Feed Update https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Update_Mexico%20City_Mexico_09-16-2020

-

None

reported

-

December

is seen in a $3.40-$3.85 range. 2020-21 to average $3.75 for corn and $2.85 for oats.