PDF Attached

CPC

calls for a 75 percent chance for La Nina conditions through the 2020 winter for the Northern Hemisphere.

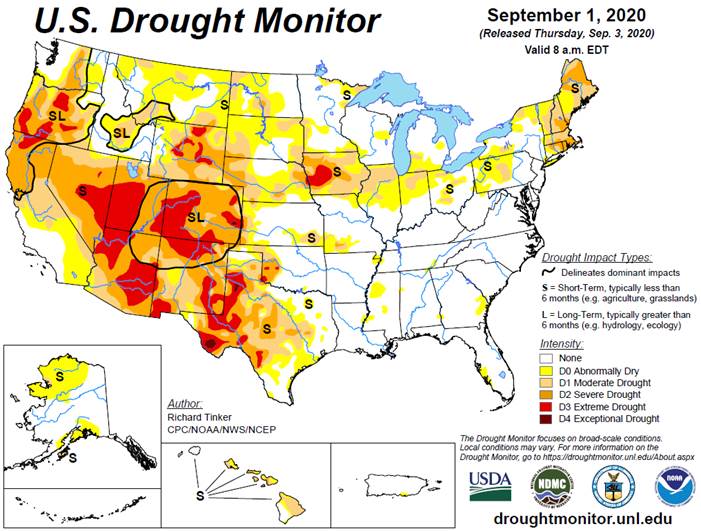

- Frost

and freezes occurred in northern and central parts of Minnesota, and northern Wisconsin Overnight as well as in extreme eastern South Dakota - Fog

was present in much of southern Minnesota and western Wisconsin which helped to hold temperatures up - Clear

skies were noted from northwestern and west-central Minnesota to western Nebraska and eastern Wyoming where additional frost and freezes occurred - Extreme

lows slipped to 26 at Alliance, Nebraska and Pine Ridge, South Dakota with numerous other readings in the upper 20s from eastern Wyoming and western Nebraska to southwestern South Dakota - A

few readings of 26-30 were also noted in small pocket in north-central Minnesota - Damage

to crops was low, but some additional impact may have occurred in western Nebraska where readings were colder today than earlier this week - Center

west Brazil and some center south crop areas have been advertised to receive a few showers after Sep. 20 - The

precipitation looks to be erratic and light, but it will be closely monitored since this would be the first rain for early season soybean areas of Brazil - Argentina’s

weather is still unfavorable for meaningful rain in west-central parts of the nation for at least the next 10 days - Western

Europe still has an opportunity to receive some rain in the second week of the forecast, but the significance of that event is low - No

change in the dry bias was noted overnight for central or eastern Ukraine, Russia’s Southern Region western Kazakhstan or southeastern Europe - Eastern

Australia’s crop areas are advertised wetter in the September 18-24 period - GFS

model was advertising greater rain in U.S. hard red winter wheat areas Sep 18-22 on the 00z model run and Sep 20-22 on the 06z model run, the latter of which has a better chance of verifying – confidence in this change is low - A

tropical wave expected to come off the west-central Africa coast this weekend may end up threatening the southeastern United States after September 20, but it is much too soon to have any confidence in the system since it has not evolved yet

WEATHER

TO WATCH

- Eastern

Australia will receive some needed rain next week to support reproduction in Queensland and northern New South Wales

- Some

rain fell in northern New South Wales Wednesday with amounts of 0.05 to 0.67 inch

- The

precipitation will shift into southeastern Queensland today - South

Australia, Victoria and southern New South Wales will receive some rain during the weekend and early to mid-week next week - A

boost in rainfall is expected in eastern Australia Sep. 17-20 with some follow up precipitation expected Sep 21-22 - The

moisture will be ideal for raising topsoil moisture for better reproductive and pre-reproductive conditions for winter crops in New South Wales and Queensland - Some

of the rain in Queensland may come a little too late to restore production potentials after recent dryness and frost and freezes - South

Australia topsoil moisture will improve easing long term dryness - Western

Australia may trend drier over the next couple of weeks while rain increases in eastern parts of the nation - North

America weather is expected get back to a more normal weather pattern this weekend and next week - Less

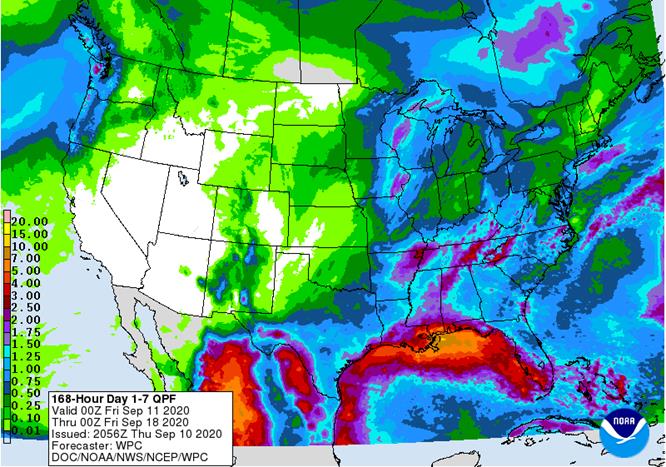

rain and warmer temperatures will impact the central United States - Upper

level low pressure center over central U.S. Rocky Mountains today will be ejected to the western Great Lakes region Friday through the weekend sending another wave of rain across the central and northeastern Plains and western Corn Belt in addition to that

which is present in the western Corn Belt today - Drier

weather will follow the upper level low pressure center and weekend precipitation so that much of the central and eastern United States experience nearly a week of limited rainfall and seasonably warm temperatures - Canada’s

Prairies will see near to above average temperatures and restricted rainfall, although not totally dry - Central

and eastern Midwest dryness and warmth recently will give way to some rainfall and cooling briefly Friday into the weekend, but resulting rainfall from the northern Delta to Indiana will continue very limited - West

Texas temperatures will slowly return to normal over the next few days rising from the 50s today to the 70s Friday and the 80s during the weekend and early next week - Boll

lock may have occurred to many cotton crops from western Texas to southwestern Kansas, but that cannot be determined until warming returns Friday through next week - Boll

opening will likely resume in the areas least impacted by recent cold - High

temperatures Wednesday failed to warm past the 40s Fahrenheit in many production areas from western Texas to Kansas - No

frost or freeze has occurred or is expected in the region - U.S.

hard red winter wheat areas have benefited from recent rain and planting should advance more favorably as drier weather evolves this weekend and next week - U.S.

northern Plains and Canada’s Prairies will experience more seasonable temperatures and relatively dry biased conditions for the next week to ten days allowing fieldwork to advance relatively well - Rain

is needed in the U.S. Pacific Northwest for future autumn planting - Damage

to dry edible beans has been significant in Wyoming from this week’s freezes with lighter damage in the northern U.S. Plains - Dryness

in central and eastern Ukraine, Russia’s Southern Region and - western

Kazakhstan remains quite serious and little to no relief is expected for at least ten days and more likely another two weeks - Dryness

also remains a serious concern in portions of southeastern Europe – mostly in the lower Danube River Basin, southeastern Roman and eastern Bulgaria - France

and Germany are in need for rain and very little is expected for at least a week

- Some

forecast models are suggesting some moisture will occur late next week and into the following weekend in parts of France, Germany and neighboring areas - Russia’s

eastern New Lands will begin receiving rain again in the second half of next week, but the precipitation will be brief and light - The

region will dry down for nearly a week - The

break from frequent rainfall will be good and should help get some fieldwork to advance - There

is some concern that West Siberian small grains and sunseed might have been negatively impacted by recent frequent rain - Western

portions of Russia’s New Lands will receive rain relatively frequently over the next week to ten days – this includes the Ural Mountains region - Northwestern

Russia precipitation is expected to occur periodically in the next couple of weeks resulting in some slowing of winter wheat and rye planting and establishment as well as some delay to 2020 harvesting - However,

favorable weather has occurred up until now supporting fieldwork and early winter crop emergence - Alternating

periods of rain and sunshine are expected which should limit the delays somewhat - Northeastern

China received additional rain from remnants of Typhoon Haishen Wednesday - Flooding

should have begun to subside - Additional

rainfall of 0.30 to 2.43 inches resulted with northern Jilin, western Heilongjiang and neighboring areas of Inner Mongolia wettest - Rain

will occur a little too often in parts of northeastern China through the next ten days maintaining wet field conditions - Too

much rain since mid-August has delayed crop maturation and induced some concern for crops produced in low-lying areas - East-central

China weather should be favorably mixed over the next ten days supporting late season crop development and allowing some crop maturation to take place - Soil

moisture will be good for early season wheat planting later this month and in October

- Xinjiang,

China weather in the northeast may not be ideal for harvest progress due to periods of light rain and cool weather into early next week - Southern

and western parts of Xinjiang will continue to experience good crop maturation conditions with some leaf defoliation getting under way - Western

Argentina remains too dry with little change likely, although rain will fall in southern and northeastern Argentina over the coming week - Southern

Argentina will receive a few more light showers today and in eastern areas Friday, but west-central areas will remain drought stricken for at least ten days - Northeastern

Argentina will get some rain this weekend and early next week benefiting some grain and cotton areas

- There

is some potential for improved rainfall in Argentina after Sep. 22, but confidence is low - Central,

western and southern Mexico and much of Central America will continue to receive frequent rain leading to saturated soil conditions and some flooding - the

moisture boost will be very good for improving water supply and easing long term dryness in Honduras, Nicaragua, Panama and parts of central through southwestern Mexico - West-central

Africa received some rain Wednesday - Amounts

of 0.27 to 1.34 inches occurred in Ivory Coast while amounts to 0.57 inch occurred in Ghana - Much

more rain is needed to ease long term dryness - Additional

precipitation is expected periodically over the next two weeks - Tropical

Storm Paulette was over open water in the central Atlantic Ocean and will stay over open water through the weekend - The

storm will move to near Bermuda by early next week and could be a hurricane at that time - The

storm poses no threat to North America - Tropical

Storm Rene was well west northwest of the Cabo Verde Islands this morning and it will stay over open water while intensifying over the next two days - The

storm may become a Hurricane by Friday night and then weaken during the weekend - Rene

poses no threat to land - Tropical

Wave near the North Carolina Coast will move to the U.S. Carolina Coast later today - The

system is not expected to evolve into an organized tropical cyclone before reaching land, but rainfall will be enhanced over the Carolinas and neighboring states through the weekend because of the event - Brazil

rainfall will continue greatest in the far south of the nation for at least the next ten days - Rain

is advertised from Parana to southern Minas Gerais and possibly northwest to Mato Grosso Sep 21-24, but the event is too far out in time to have much confidence - The

moisture would reach into some citrus, sugarcane and coffee production areas and might be good for early corn, but early indications suggest only very light rain

- Center

west Brazil looks to be dry and very warm to hot through Sep. 20 - South

Africa will be mostly dry through Monday - More

rain is needed to support winter crop development and improve soil moisture for spring and summer crop planting next month - Some

rain is expected during mid-week next week in eastern parts of the nation - Northern

India will be dry this week while rain falls in central, southern and eastern parts of the nation - Cotton

conditions will improve after being too wet earlier this month - Most

grain and oilseed crops as well as pulses are suspected of being in very good shape - Improved

rainfall has occurred in Indonesia and Malaysia recently - More

precipitation is needed in southern Sumatra and western Java where it has been driest in recent months - Some

erratic rainfall is expected over the next ten days with many areas getting additional moisture - Mainland

areas of Southeast Asia continued to report erratic rainfall recently - Crop

conditions are rated favorably, but greater rain is needed to ensure good water supply over the dry season - Water

supply has not been replenished very well this year and greater rain is needed

- Rain

has been greatest in northern Luzon Island recently while most other areas in the Philippines have experienced net drying - Philippines

rainfall should increase during the coming week - Pakistan

weather is improving after flooding in late August - Central

and southern Pakistan has been dry for a while and will continue dry - Very

little rain will fall over the next ten days - Ontario

and Quebec will experience a good mix of rain and sunshine over the next two weeks; some drying will be needed thereafter to induce better crop maturation and harvest conditions -

New

Zealand rainfall will be near to above average during the coming week and temperatures will be a little cooler than usual -

Southern

Oscillation Index was +8.43 today and it will stay positive the remainder of this week, although some weakening will continue over the next few days

Source:

World Weather Inc.

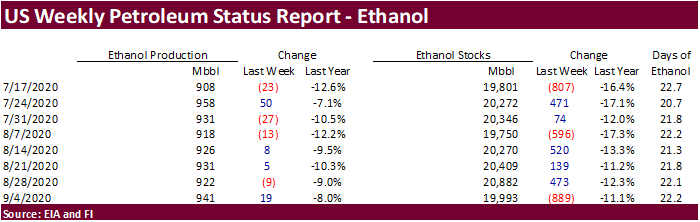

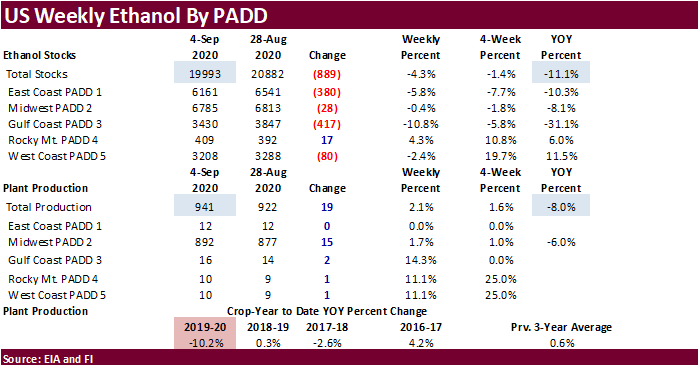

- EIA

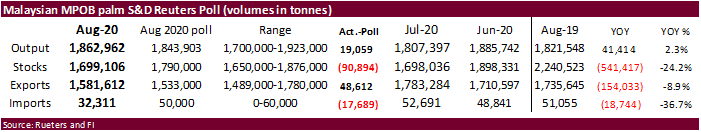

U.S. weekly ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s end-Aug. palm oil stockpiles, production, export data - Malaysia

palm oil export data for Sept. 1-10 - Conab’s

data on production, area and yield of soybeans and corn in Brazil

FRIDAY,

Sept. 11:

- (Overnight)

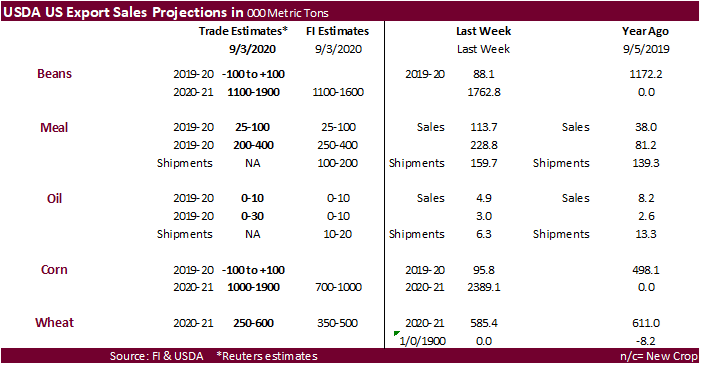

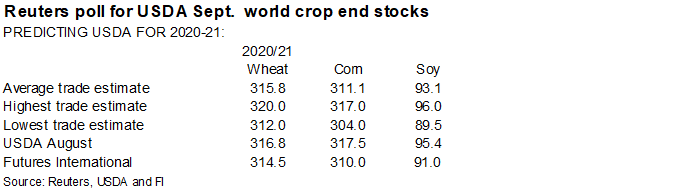

China agriculture ministry’s (CASDE) monthly report on supply and demand - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand food prices

US

Initial Jobless Claims: 884K (est 850K, prev 881K)

US

Continuing Claims: 13385K (est 12904K, prev 13254K)

US

PPI Ex Food and Energy (M/M) Aug: 0.4% (est 0.2%, prev 0.5%)

US

PPI Final Demand (Y/Y) Aug: – 0.2% (est -0.3%, prev -0.4%)

US

PPI Ex Food And Energy (Y/Y) Aug: 0.6% (est 0.3%, prev 0.3%)

-

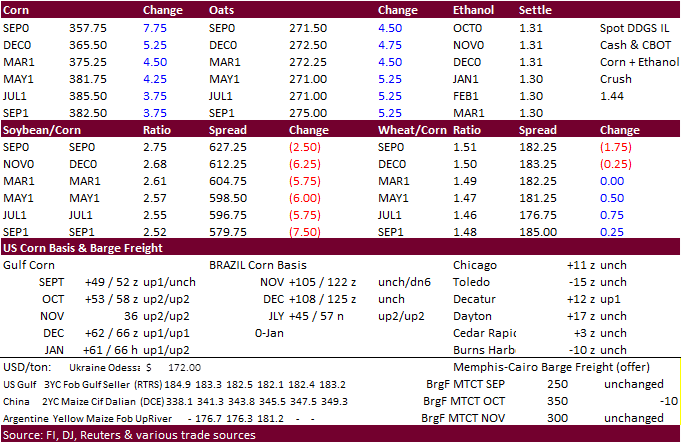

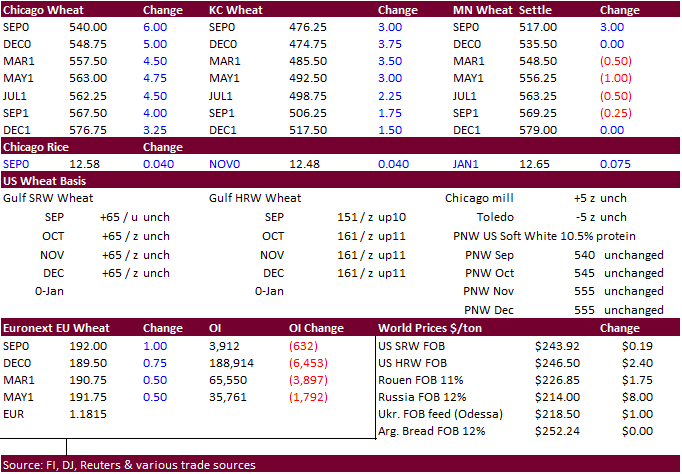

CBOT

corn rose today on fund buying and headline Chinese demand. There is more and more talk China will have to import well more than 10 million tons of corn this crop-year. A Bloomberg article noted China may need to import about 30 million tons of corn next

year. China corn futures hit their highest level since 2015. China did not offer any corn out of auctions this week following heavy sales since May where China government auctions sold nearly 57 million tons of corn. While no official statement has come

out about all the sovereign and state-owned company buying, the price-action and headlines support it.

-

Cash

basis markets were firm today as we approach harvest. -

Funds

bought an estimated net 18,000 contracts. -

Given

the price action over the last week and option flow seen in soy and corn, the market may be expecting a bullish report. -

Germany

reported a suspected case of African swine fever

in a wild boar in Brandenburg, near the German-Polish border. If verified, this is the first case for Germany in at least a few years. Cases ballooned in about 10 other EU countries over the past couple of years. Germany is EU’s largest pig producer. South

Korea banned pork imports from Germany. -

CME

hogs gapped higher. It’s seen supportive for US soybean meal and corn if other countries are added to the list banning Germany pork imports, such as China and Japan.

-

UAC:

Ukraine corn crop 36MMT, down from 35.3MMT.

o

Agritel Sees Ukraine’s 2020 Corn Crop Falling to 33.5m Tons

o

Ukraine’s Economy Ministry cut its forecast for corn crop to 33m tons

-

US

EIA weekly ethanol production increased a larger than expected 19,000 barrels and stocks decreased a large 889,000 barrels. A Bloomberg poll looked for weekly US ethanol production to be up 5,000 and stocks to increase 16,000 barrels to 20.898 million.

-

None

reported

-

December

is seen in a $3.40-$3.85 range. 2020-21 to average $3.75 for corn and $2.85 for oats.

-

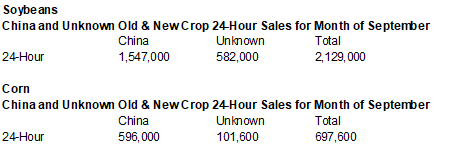

CBOT

November soybeans finished lower today on profit-taking, capping a 12-session rally. China bought an additional 195,000 tons of soybeans.

-

Funds

sold an estimated net 1,000 soybeans, sold 1,000 soybean meal and net even on soybean oil.

-

Conab

adjusted their 2019-20 Brazil soybean crop to 124.8 million tons, as expected after revising seven years of data late last month.

-

Brazil

may extend their zero-tariff past the US election, according to a Reuters story.

-

Argentina

2020-211 soybean production was seen at 50 million tons by the Rosario Exchange, first estimate of the crop year. Argentina corn production was projected at 48 million tons. Note soybean plantings were reduced from 17.4 last year to 17.3 million this year.

-

Ukraine

sunflower oil exports increased 10% during the 2019-20 September-August season to 6.68 million tons, – national sunoil producers association. -

We

heard China bought a few cargoes of US soybeans on Wednesday. -

AmSpec

1-10 September palm exports were 472,780 tons, up 10 percent from previous period last month. SGS reported a 26 percent increase to 467,420 tons from 372,067 tons month earlier. ITS showed a 10.3 increase in shipments.

-

Results

awaited: Algeria seeks up to 30,000 tons of soybean meal on September 9 for first half October shipment.

-

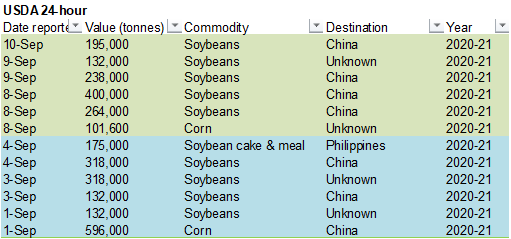

USDA

24-hour announced private exporters reported the following activity: -

Export

sales of 195,000 metric tons of soybeans for delivery to China during the 2020/2021 marketing year; and

Updated

9/9/20

-

November

soybeans are seen in a $9.50-$10.50 range. $9.60 average for 2020-21 -

December

soybean meal is seen in a $300-$330 range. $305 average for 2020-21 -

December

soybean oil is seen in a 32.50-35.00 range. 34.00 cents average for 2020-21

-

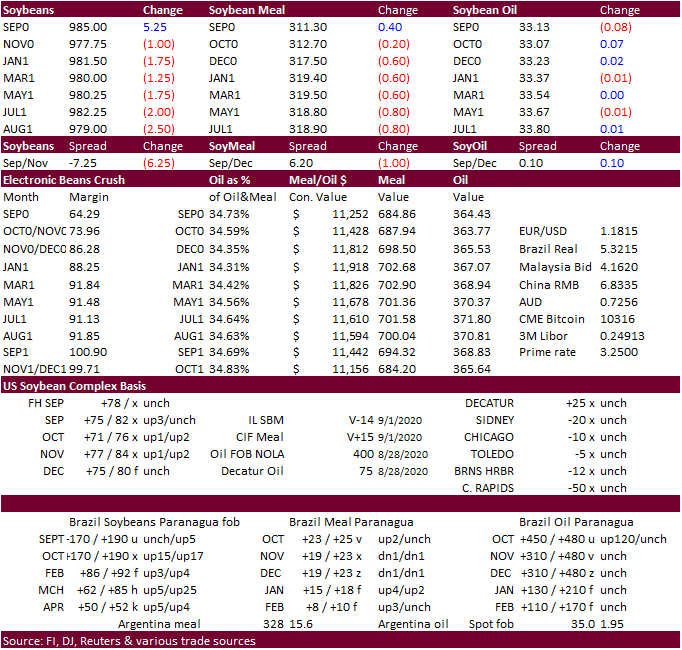

Wheat

closed higher on good global import demand, persistent dryness across the Black Sea region. -

The

USD was lower mid-session which lent support to wheat, the DXY climbed back to end marginally higher.

-

Wheat

looks like it is still trying to buy acres as the higher price will prompt the farmer to sow more area during this time of year.

-

Funds

bought an estimated net 5,000 Chicago wheat contracts. -

Paris

December wheat ended up 1.00 euro at 189.75 euros/mt. -

Russia’s

SovEcon estimated the wheat crop at 83.3 million tons from 82.6 million tons previously.

-

Czech’s

2020 grain harvest was reported at 7.35 million tons by the stats office, 4.8 percent higher than 2019 (7.02 million tons).

-

Tunisia

is tendering for 25,000 tons of durum and 42,000 tons of million wheat on September 11 for Oct/early Nov delivery.

-

Saudi

Arabia SAGO seeks 715,000 tons of 11 and 12.5 percent wheat on Friday for delivery between November and January.

-

Jordan

seeks 60,000 tons of wheat on Sep 16 for LH October shipment. -

Yesterday

Pakistan bought about 60,000 tons of wheat at around $248/ton c&f for October shipment.

-

Ethiopia

seeks 400,000 tons of wheat by October 13. -

Turkey

seeks 500,000 tons of milling wheat (min 12.5%) on September 15 for Sep 23-Oct 16 shipment.

-

Ethiopia

seeks about 80,000 tons of milling wheat on Sept. 30.

Rice/Other

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 113,999 tons of rice on Sep 16 for arrival in South Korea between Jan. 31, 2021, and June 30, 2021.

·

Syria is in for 39,400 tons of white rice on September 30.

Updated 9/9/20

- December Chicago is seen in a $5.35-$5.60 range. 2020-21 average $5.55

- December KC $4.55-$5.00. 2020-21 average $5.05

- December MN $5.25-$5.55.

2020-21 average $5.45

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.