PDF Attached

- Additional

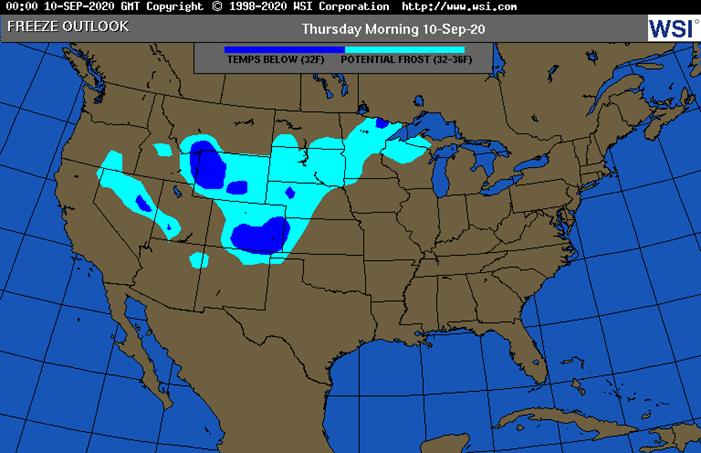

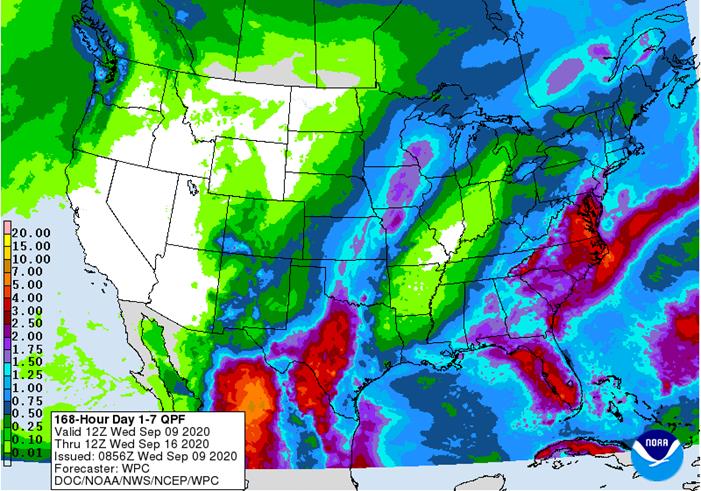

frost and freezes occurred this morning from eastern Canada’s Prairies through northern and west-central Minnesota, North Dakota and eastern Montana to eastern Colorado and Wyoming - Early

assessments of the past two days of frost, freezes and general cold suggest the following - Corn,

soybeans, flax and late canola were most seriously harmed by freezes in Saskatchewan and Manitoba Canada Tuesday - Dry

edible beans from Montana and Wyoming to northeastern Colorado and northeast into the northern Red River Basin were also seriously damaged - Sunseed,

sugarbeets were impacted, but sugarbeets will not experience a significant change in production and the cold may increase sugar levels in some of the crop - Cotton

boll lock is feared although not yet confirmed for crops produced from southwestern Kansas into western Texas

- Some

of the crop may come through the cold unscathed and a close watch is warranted - Drought

and dryness along with excessive heat in recent weeks in the northwestern and west-central Plains should have had many summer crops more advanced than usual which should have reduced the impact of recent cold on unirrigated crops - Damage

in the upper Midwest crops has been low so far with a quality decline expected to beans produced in eastern North Dakota and west-central and northern Minnesota - A

few of the most immature soybeans and corn in the Upper U.S. Midwest may have been more seriously impacted, but the impact on national production should be low - Another

cool night is expected tonight in the northern and west-west-central Plains as well as the upper Midwest and southwestern U.S. Plains - New

damage will be limited to parts of Wisconsin and Minnesota, but the impact will be low and similar to that noted above - Ongoing

concern over cotton bolls in the southwestern Plains will continue into Friday morning - Dryness

in central and eastern Ukraine, Russia’s Southern Region and western Kazakhstan remains quite serious and little to no relief is expected for at least ten days and more likely another two weeks - Dryness

also remains a serious concern in portions of southeastern Europe – mostly in the lower Danube River Basin, southeastern Roman and eastern Bulgaria - France

and Germany are in need for rain and very little is expected for at least a week

- Some

forecast models are suggesting some moisture will occur late next week and into the following weekend in parts of France and Germany - Russia’s

eastern New Lands will begin receiving rain again in the second half of next week - The

region will dry down for nearly a week - The

break from frequent rainfall will be good and should help get some fieldwork to advance - There

is some concern that West Siberian small grains and sunseed might have been negatively impacted by recent frequent rain - Northwestern

Russia precipitation is expected to occur periodically in the next couple of weeks resulting in some slowing of winter wheat and rye planting and establishment as well as some delay to 2020 harvesting - However,

favorable weather has occurred up until now supporting fieldwork and early winter crop emergence - Northeastern

China received additional heavy rainfall of 2.00 to more than 6.00 inches Tuesday from remnants of Typhoon Haishen - Flooding

remains a serious issues in northeastern China from too much rain since mid-August - Rain

will prevail in portions of northeastern China through the weekend delaying a much needed drying trend and leaving concern over soybean and corn conditions in eastern Liaoning and Jilin as well as a part of Heilongjiang - Too

much rain since mid-August has delayed crop maturation and induced some concern for crops produced in low-lying areas - Another

frontal system is expected early next week that will generate another wave of rain further delaying crop maturation and harvesting - East-central

China weather should be favorably mixed over the next ten days supporting late season crop development and allowing some crop maturation to take place - Soil

moisture will be good for early season wheat planting later this month and in October

- Xinjiang,

China weather will be mostly good for crop maturation and harvest progress over the next couple of weeks.

- Western

Argentina remains too dry with little change likely, although rain will fall in southern and northeastern Argentina over the coming week - Southern

Argentina will receive a few more light showers during mid- to late week this week, but the impact on soil moisture and crop conditions will be low - Moisture

totals will vary from 0.05 to 0.35 inch except near the Buenos Aires south coast where rainfall may range from 0.50 to 1.50 inches - Northeastern

Argentina will get some rain late this week benefiting a few grain and cotton areas with follow up rain in the same area during mid- to late-week next week - There

is still no relief expected for the drought areas of western Argentina during the coming ten days - Australia

still needs significant rain to support reproduction in Queensland, northern New South Wales and northern parts of Western Australia - Mexico

and Central America have trended much wetter recently and the trend will continue; relief from dryness in Honduras and Nicaragua is becoming more complete - West-central

Africa remains too dry especially in Ghana and eastern coffee and cocoa production areas of Ivory Coast - Tropical

Storm Paulette was over open water in the central Atlantic Ocean and will stay over open water through the next week posing no threat to land - Tropical

Storm Rene was west northwest of the Cabo Verde Islands this morning and it will stay over open water while intensifying over the next several days - The

storm may become a Hurricane later in the week - Rene

poses no threat to land - Tropical

Wave 400 miles southeast of North Carolina will move to the U.S. Carolina Coast Thursday - Some

development is possible into a tropical depression, although confidence is low and the impact on crop areas will be very low as well - Brazil

rainfall will continue greatest in the far south of the nation for at least the next ten days - Rain

is advertised from Parana to southern Minas Gerais Sep 21-23, but the event is too far out in time to have much confidence - The

moisture would reach into some citrus, sugarcane and coffee production areas and might be good for early corn, but early indications suggest only light rain - Center

west Brazil looks to be dry and very warm to hot through Sep. 23 - South

Africa will be mostly dry the remainder of this week except in a few coastal areas - More

rain is needed to support winter crop development and improve soil moisture for spring and summer crop planting next month - Northern

India will be dry this week while rain falls in central, southern and eastern parts of the nation - Cotton

conditions will improve after being too wet earlier this month - Improved

rainfall occurred in Indonesia and Malaysia recently - More

precipitation is needed in Sumatra and western Java where it has been driest in recent months - Some

erratic rainfall is expected over the next ten days with many areas getting additional moisture - Mainland

areas of Southeast Asia continued to report erratic rainfall recently - Crop

conditions are rated favorably, but greater rain is needed to ensure good water supply over the dry season - Water

supply has not been replenished very well this year and greater rain is needed

- Rain

has been greatest in northern Luzon Island recently while most other areas in the Philippines have experienced net drying - Philippines

rainfall should increase during the coming week - Australia

weather over the coming week will include some light rainfall over some of the nation’s winter crop region, but most of the rain will be a little too light to seriously bolster soil moisture

- Showers

will occur today into Friday from Eastern New South Wales into southeastern Queensland - Some

forecast models are increasing rain for New South Wales, Queensland and Victoria after Sep. 16, but confidence is low - Pakistan

weather is improving after flooding in late August - Central

and southern Pakistan was dry during the weekend - Very

little rain will fall over the next ten days - Ontario

and Quebec will experience a good mix of rain and sunshine over the next two weeks; some drying will be needed thereafter to induce better crop maturation and harvest conditions -

New

Zealand rainfall will be erratically distributed for a while and temperatures will be a little cooler biased -

Southern

Oscillation Index was +8.70 today and it will stay positive the remainder of this week, although some weakening will continue over the next few days

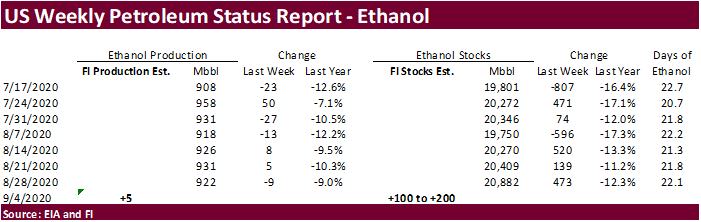

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s end-Aug. palm oil stockpiles, production, export data - Malaysia

palm oil export data for Sept. 1-10 - Conab’s

data on production, area and yield of soybeans and corn in Brazil

FRIDAY,

Sept. 11:

- (Overnight)

China agriculture ministry’s (CASDE) monthly report on supply and demand - USDA

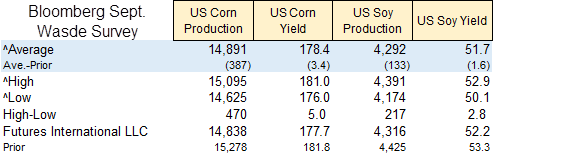

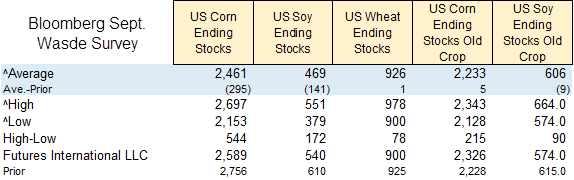

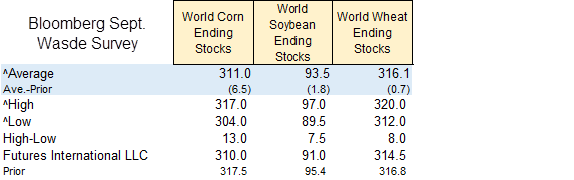

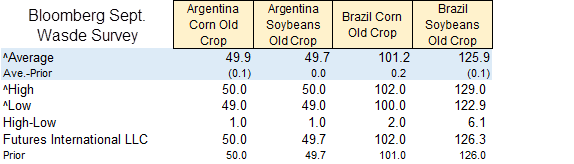

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand food prices

Canadian

Housing Starts Aug: 262.4K (exp 217.5K; prev 245.6K)

US

EIA Cuts Forecast For 2021 World Oil Demand Growth By 490K Bpd, Now Sees 6.53M Bpd YoY Increase

–

Cuts Forecast For 2020 World Oil Demand Growth By 210K Bpd, Now Sees 8.32M Bpd YoY Drop

Source:

Bloomberg and FI

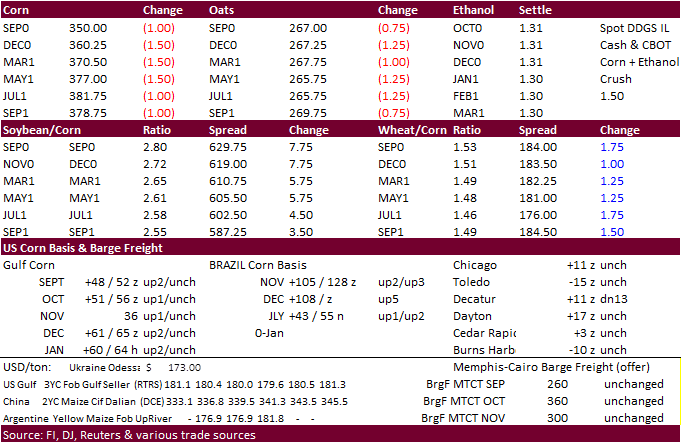

Corn.

-

CBOT

corn ended 1.0-1.50 cents on as expected US corn crop rating and wet weather for the Midwest.

-

The

USD traded down 20 points as of 2:00 PM CT. -

Apparently,

President Trump directed the EPA to deny dozens of refiner requests for retroactive waivers from concerns the issue was costing him politically, according to three sources via a Reuters article. E20 RINs were up to 55 early this morning vs. 47 yesterday.

-

China

cash corn prices bias northeastern region increased by nearly 30 percent from the start of the year to 2,355 yuan (HK$2,661) per ton at the beginning of August, before falling slightly to 2,274 yuan per ton at month’s end, according to the National Bureau

of Statistics data via Reuters article. Heavy flooding from three typhoons have supported prices and likely lowered production.

-

Europe

will see restricted rainfall this week and temperatures will be above normal.

-

BB

– AstraZeneca Plc stopped giving shots of its experimental coronavirus vaccine after a person participating in one of the company’s studies got sick, a potential adverse reaction that could delay or derail efforts to speed an immunization against Covid-19. -

USDA

reported US weekly broiler-type eggs set in the United States up 1 percent and chicks placed down 2 percent. Cumulative placements from the week ending January 4, 2020 through September 5, 2020 for the United States were 6.69 billion. Cumulative placements

were down 1 percent from the same period a year earlier.

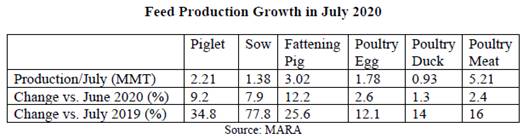

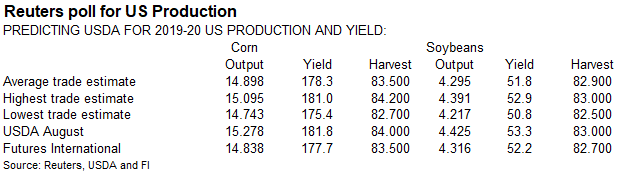

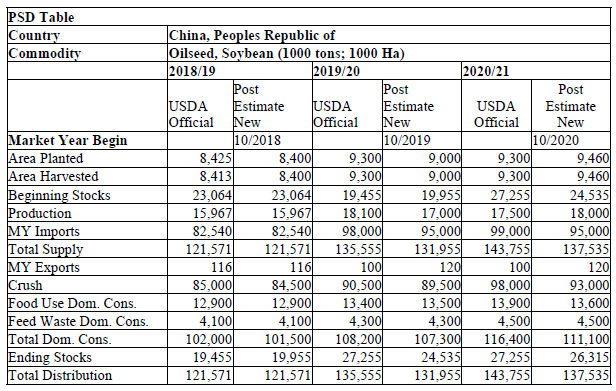

The

table above reflects China animal unit growth, for July versus previous month and year ago. I don’t think China is done buying corn. For soybeans, imports could top 100 million tons for 2020-21. USDA official is at 99 million tons (98MMT for 2019-20) while

FAS Attaché sees only 95 million tons. High internal China corn prices should shift some demand to soybean meal and feed wheat. Regarding corn stocks, no one knows. That’s why you need to remove China from the rest of the world.

USDA

Attaché – China soybeans

-

None

reported

-

December

is seen in a $3.40-$3.85 range. 2020-21 to average $3.75 for corn and $2.85 for oats.