PDF Attached

USDA

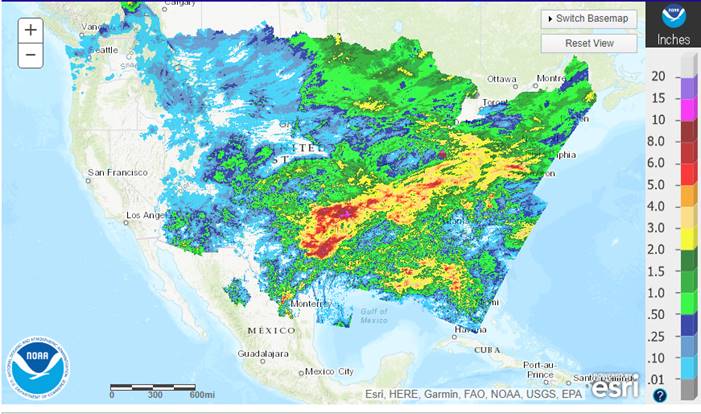

reported 318,000 tons of soybeans sold to China and 175,000 tons of soybean meal sold to the Philippines. The US will see wetter conditions for the Sunday/Monday period where rains in Iowa and Illinois occur, although this is too late. US markets are closed

on Monday for the Labor Day holiday. US holiday trading schedule in excel format

MORNING

WEATHER MODEL COMMENTS

NORTH

AMERICA

- Slightly

less threatening cold was noted for the upper Midwest during mid-week next week, although temperatures will still slip into the 30s Fahrenheit - Frost

and a couple of light freezes cannot be ruled out especially with the event still so far out in time - Damaging

freezes are expected in Montana and Wyoming’s dry bean and sugarbeet areas and in a few other late season crop areas - Freezes

will be most significant from Montana to Manitoba Tuesday with frost and light freezes expected from parts of Nebraska to northwestern and west-central Minnesota and the Dakotas Wednesday morning - Today’s

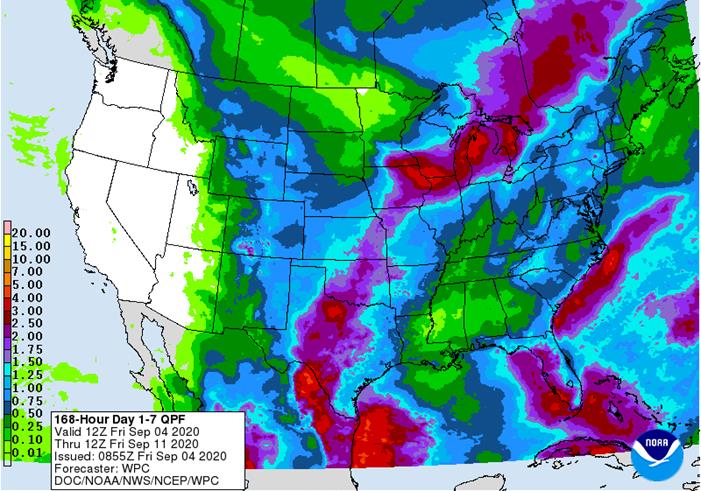

GFS model run is wetter for Iowa, Illinois, Missouri, southern Wisconsin and neighboring areas relative to that of Thursday morning, although the same area is advertised to be impacted by rain - Amounts

may be a little overdone, but it will rain and soil moisture improvements in some of the drier areas will result - Rain

and some wet snow is still expected to come out of Wyoming into eastern Colorado and a few northwestern Kansas locations Monday into Tuesday morning; rain also falls across other central Plains crop areas - The

moisture for hard red winter wheat areas will be welcome for early planting that is getting under way - GFS

model was wetter in Saskatchewan and a part of Manitoba for Sep 11-13 - Some

of this increase was overdone - GFS

suggested rain in the southwestern and central U.S. Plains Sep 14-16 - Some

of this may be overdone - GFS

reduced rainfall in the heart of the Midwest while increasing it in the southeastern states Sep. 14-16 - Both

changes may have been a little overdone, but trends may have been correct - GFS

reduced rain from the southern Plains through the Delta to the central Midwest for Sep. 17-18 - This

change was needed

Today’s

forecast model runs are still keeping the general theme on the cold similar to that of Thursday with the west-central and northwestern Plains into eastern Canada’s Prairies most vulnerable frost and freezes. The heart of the Midwest will see abundant rainfall

and that will help ease dryness in some areas and help hold temperatures up while the unusually cold airmass moderates. The second week of the outlook in key Midwestern locations is a little drier biased and warmer weather will return.

SOUTH

AMERICA

- Some

rain is expected Saturday in La Pampa with a little follow up precipitation during the middle to latter part of next week from La Pampa into western Buenos Aires - Otherwise

the model outlook for Argentina has not changed much today relative to that of Thursday; rainfall will be restricted over the next ten days especially in the drier areas of western and northern Argentina

EUROPE/BLACK

SEA REGION

- No

significant changes were noted for the coming ten days - France

and central Germany do not get an abundance of moisture and will remain in need of improved precipitation - There

is some potential for rain in western Europe’s drier areas after Sep. 14

Rain

is still expected from Italy into a part of Poland periodically in the coming week to ten days. Rain will also fall in northern parts of the U.K. and in the Baltic Sea region. Net drying occurs in France, Spain, central Germany and the middle and lower Danube

River Basin. Some showers will occur infrequently in central and eastern Ukraine into Krasnodar while much of Russia’s Southern region northeast of Krasnodar will be mostly dry along with western Kazakhstan

RUSSIA

NEW LANDS

- No

significant changes were noted during the coming ten days today - Rain

is still advertised to be most frequent in the easternmost New Lands where some concern over unharvest small grain and sunseed quality is expected - Most

of the key spring wheat and sunseed areas will experience a good environment for crop maturation and harvesting

CHINA

- Not

much change in the models today over the next week to ten days - Northeastern

China will get excessive another round of excessive rain from the remnants of Typhoon Haishen that will move through the Korean Peninsula late this weekend into early next week before reaching northeastern China early next week as well - Rainfall

to more than 8.00 inches fell in northeastern China Thursday from remnants of Typhoon Maysak and 4.00 to 8.00 inches and local totals to 10.00 inches will accompany Haishen

- Jilin

and Heilongjiang will be most impacted - Flooding

remains a serious problem in parts of northeastern China - East-central

China will experience a favorable drying environment over the coming week to ten days

- Southeastern

China will experience periods of rain and will stay wet especially in the southwest

INDIA

- No

changes overnight - Northern

India will be rainy through the weekend and then trend drier next week - Some

concern over cotton quality will remain in the north through the weekend and then conditions will improve - Drier

weather is expected in northern India next week - Gujarat,

western Rajasthan and central and southern Pakistan are already drying out will continue doing so over the coming week

- Some

increase in rainfall may impact southern and eastern Gujarat and far southern Rajasthan during the Sep. 12-18 period - India’s

wettest weather is expected in the central, south and eastern parts of the nation over the next ten days

AUSTRALIA

- Rain

was suggested to increase Wednesday into Thursday of next week in southeastern Queensland and New South Wales - The

increase may verify, although it is not a general soaking - Any

rain would be welcome to support reproducing winter crops - Not

much other change was noted in Australia through the coming week to ten days - Rain

continues mostly in the far south parts of the nation’s crop areas over the next two weeks

Bloomberg

Ag Calendar

FRIDAY,

SEPT. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC’s

monthly supply-demand report on Chinese feed grains and oilseeds - FranceAgriMer

weekly update on crop conditions - Statcan’s

data on Canada wheat, barley, soy, canola and durum stocks - HOLIDAY:

Thailand

MONDAY,

Sept. 7:

- China

trade data on soybean and meat imports - International

Grains Council secretariat briefing on trade - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - AB

Foods trading update - HOLIDAY:

U.S., Brazil, Canada, Thailand

TUESDAY,

Sept. 8:

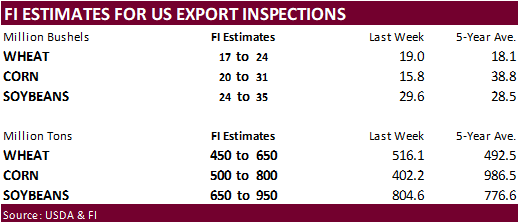

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop condition, harvesting progress for soybeans, corn, cotton, 4pm - Malaysian

Palm Oil Council webinar on Middle East, North Africa palm trade - Abares

Australian crop report

WEDNESDAY,

Sept. 9:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Brazil

Unica cane crush, sugar production (tentative)

THURSDAY,

Sept. 10:

- Malaysian

Palm Oil Board’s end-Aug. palm oil stockpiles, production, export data - Malaysia

palm oil export data for Sept. 1-10 - Conab’s

data on production, area and yield of soybeans and corn in Brazil

FRIDAY,

Sept. 11:

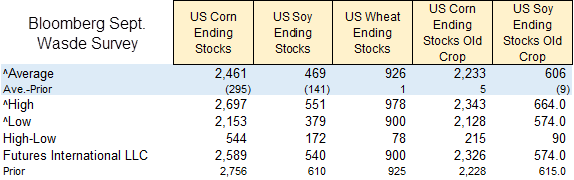

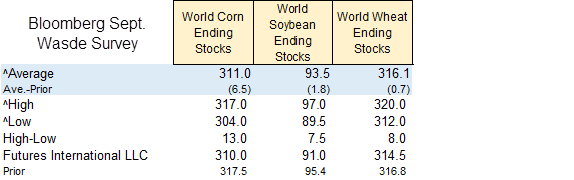

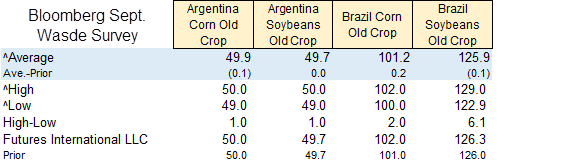

- USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - China

agriculture ministry’s (CASDE) monthly report on supply and demand - New

Zealand food prices

Source:

Bloomberg and FI

Source:

Bloomberg and FI

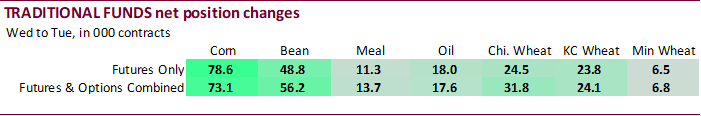

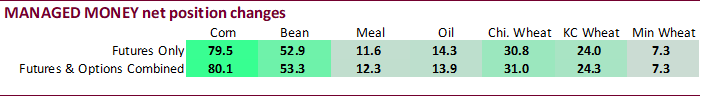

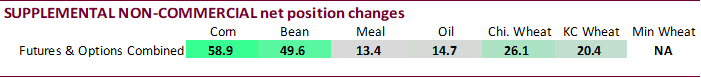

Commitment

of Traders

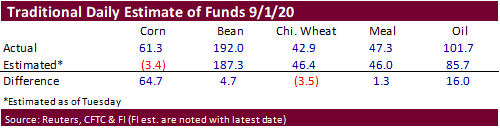

The

trade really missed the estimate for the traditional fund corn position. Traditional funds as of 9/1 were net long 61,300 contracts, instead of an estimated net short 3,400 contracts. They trimmed their net short position and went long by adding net longs

of 78,600 contracts in one week! December corn was around $3.5450 on August 25. On Tuesday (9/1) it settled at $3.58.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-27,974 58,895 332,723 15,690 -260,244 -57,092

Soybeans

126,786 49,564 190,245 3,837 -312,470 -49,344

Soyoil

60,263 14,701 110,338 972 -189,314 -22,593

CBOT

wheat 7,983 26,139 133,441 -105 -118,786 -22,620

KCBT

wheat -1,308 20,360 60,113 3,820 -63,228 -24,806

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

18,659 80,148 173,886 1,777 -220,849 -57,414

Soybeans

162,607 53,319 118,391 -7,786 -309,923 -44,380

Soymeal

15,871 12,311 81,849 -592 -138,772 -15,199

Soyoil

81,557 13,867 90,343 -2,964 -206,010 -21,602

CBOT

wheat 32,469 30,953 89,376 -7,902 -113,787 -20,495

KCBT

wheat 3,160 24,276 48,394 -1,983 -61,958 -22,723

MGEX

wheat -10,052 7,264 2,156 87 5,406 -4,821

———- ———- ———- ———- ———- ———-

Total

wheat 25,577 62,493 139,926 -9,798 -170,339 -48,039

Live

cattle 58,029 -4,073 83,430 -853 -145,455 5,033

Feeder

cattle 6,190 -986 4,632 -244 -5,696 182

Lean

hogs 28,777 1,575 48,031 21 -78,439 -1,133

Other NonReport

Source:

Reuters and CFTC

Total

stocks of principal field crops at July 31

July 2018 July 2019 July 2020 July 2018 to July 2019/

July 2019 to July 2020

thousands of tonnes % change

Total

wheat 6732 5891 5028 -12.5 -14.6

Durum

wheat 1476 1792 660 21.4 -63.2

Wheat

excluding durum 5256 4099 4368 -22 6.6

Barley

1244 863 957 -30.6 10.9

Canola

2506 4175 2741 66.6 -34.3

Dry

field peas 648 312 233 -51.9 -25.3

Flaxseed

127 60 64 -52.8 6.7

Lentils

873 716 61 -18 -91.5

Oats

778 397 426 -49 7.3

Rye

124 49 40 -60.5 -18.4

Source:

StatsCan, Reuters, and FI

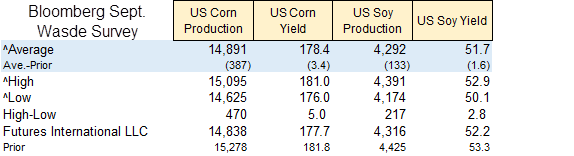

IEG

September update (harvest

area unchanged from August)

·

CORN 178.1 and 14.96 billion bushels for September (84.023 harvest). Last month 179.0 & 15.036 production (84.023 harvest area)

·

SOYBEANS 52.1 and 4.323 billion bushels (83.020 harvest). Last month 52.5 & 4,355 production (83.020 harvest area)

Highlighted

above is what we started the year off.

·

US Change In Nonfarm Payrolls Aug: 1371K (est 1350K; prevR K; prevR 1734K; prev 1763K)

·

US Unemployment Rate Aug: 8.4% (est 9.8%; prev 10.2%)

·

US Average Hourly Earnings (M/M) Aug: 0.4% (est 0.0%; prevR 0.1%; prev 0.2%)

·

US Average Hourly Earnings (Y/Y) Aug: 4.7% (est 4.5%; prevR 4.7%; prev 4.8%)

·

US Change In Private Payrolls Aug: 1027K (est 1325K; prevR 1481K; prev 1462K)

·

US Change In Manufacturing Payrolls Aug: 29K (est 65K; prevR 41K; prev 26K)

·

Canadian Net Change In Employment Aug: 245.8K (est 250K; prev 418.5K)

·

Canadian Unemployment Rate Aug: 10.2% (est 10.2%; prev 10.9%)

·

Canadian Full Time Employment Change Aug: 205.8K (prev 73.2K)

·

Canadian Part Time Employment Change Aug: 40.0K (prev 345.3K)

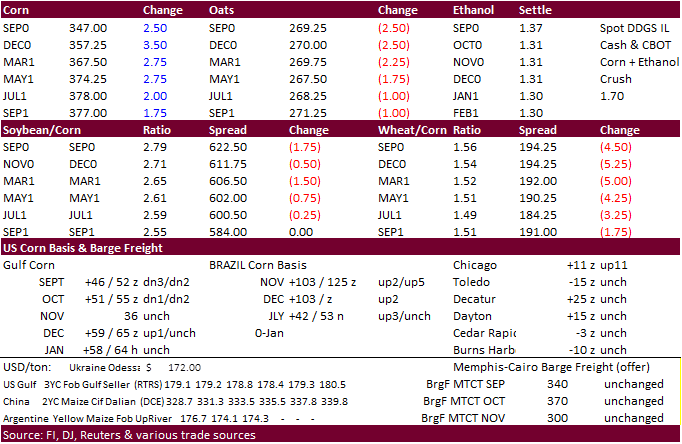

Corn.

-

CBOT

corn traded higher for much of the session on talk Brazil may buy corn from the US and expected decline in US crop ratings when updated Tuesday. December ended up 4.25 cents at $3.58/bu. Monday is a US holiday so some of the new shorts this week could have

been offsetting position. Note WTI crude oil fell $1.91 basis the November position.

-

After

selling an estimate 16,000 contracts on Thursday, funds bought an estimated net 15,000 corn contracts.

-

WCB

corn basis firmed. It was up 3 cents for at least three IA locations. Corn basis weakened at an Illinois river terminal.

-

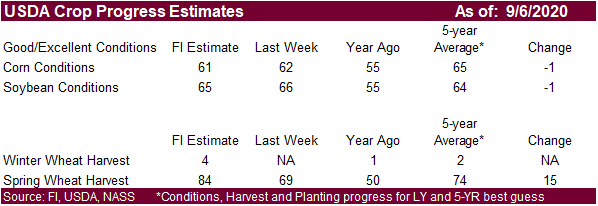

We

look for corn and soybean conditions to stabilize but when updated on Tuesday but still expect the combined good and excellent ratings to decline by one point each.

-

French

corn crop conditions declined slightly in the week to Aug. 31, to 61% from 62% previous week. This is the same compared to a year ago.

-

France,

parts of Germany, Spain, Portugal, the middle and lower Danube River Basin will experience restricted rainfall for the next ten days.

-

None

reported.

-

December

is seen in a $3.40-$3.85 range.