PDF Attached

Soybeans

were supported by higher soybean meal while other agriculture commodity markets fell on lack of bullish news.

September

7 (Monday) US holiday trading schedule in excel format

![]()

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Typhoon

Maysak moved across the Korean Peninsula Wednesday and early today producing damaging wind and flooding rain - Initial

reports from the region are as expected with widespread power outages, considerable property damage and a few deaths in southern South Korea - Flooding

has been the biggest issue in eastern North Korea with more than 9.00 inches falling over saturated soil in a short period of time - Rice

damage has likely occurred along with other impacts on crops in both North and South Korea - Remnants

of Maysak will bring on some flooding in northeastern China today and Friday with 2.00 to 7.00 inches of fresh rain falling over saturated soil in Jilin, Liaoning and eastern Inner Mongolia

- Corn

and soybean crops are not expected to be seriously impacted, although the region is excessively wet and delays in crop maturation and harvesting are inevitable, especially with Typhoon Haishen headed into the same region for early next week - Typhoon

Haishen will become a super typhoon Friday and reach wind speeds of nearly 150 mph over open water south of the Ryukyu Islands of Japan Saturday - Haishen

was 646 miles east southeast of Okinawa, Japan at 20.9 north, 137.2 east moving northwesterly at 11 mph and producing maximum wind speeds to 109 mph - The

storm will pass to the west of Kyushu, Japan Sunday and reach southern South Korea Sunday into Monday.

- The

storm may make landfall very near to the same point that Typhoon Maysak moved inland Wednesday and the path northward will be very similar impacting South and North Korea as well as northeastern China in a very similar manner - Two

storms back to back of this intensity impacting the same areas is very rare and will have a huge impact on all three countries - Both

tropical cyclones noted above will dissipate over northeastern China where 4.00 to 12.00 inches of total rain may occur by Tuesday of next week that will result in serious flooding and some new crop and property damage from Liaoning into eastern Inner Mongolia,

Jilin and Heilongjiang - Corn

and soybeans should be maturing with some harvesting of corn usually under way at this time of year - Too

much rain in recent weeks and that which is coming through early next week will further delay harvest progress and flooding could raise concern over the quality of soybeans, sugarbeets and any other crop produced in the region.

- East-central

China has been and will continue to benefit from net drying conditions through much of next week - Southern

China will experience increasing rain and thunderstorm activity next week, but the precipitation will be greatest in southwestern China through the weekend - Xinjiang,

China will see a mix of weather during the next week that will support late season crop development, but some rain may raise a little concern over cotton fiber quality, but only in a few areas - Tropical

Storm Nana has moved into Belize and will produce heavy rain and flooding from there into Guatemala and southern Chiapas, Mexico - The

storm will also produce heavy rain in southern Veracruz and Oaxaca, Mexico over the next couple of days - Remnants

of the system will move into the eastern Pacific Ocean Friday - Flooding

rain will cause some landslides and may induce some crop and property damage in each of the areas noted above

- Tropical

Depression Omar and was well east of the U.S. this morning and northeast of Bermuda moving east away from North America - The

storm will slowly diminish over the next two days and will pose no threat to land and be a minimal threat to shipping - Tropical

Wave coming off the Africa west-central coast today will possibly become the next tropical depression, but it will stay over open water in the Atlantic for much of the next week without threatening land - Cold

air is advertised in North America early through mid-week next week that may induce some frost and freezes - Frost

and a few some freezes will occur Monday in northern Saskatchewan and northwestern Manitoba – damage to crops is possible, but unlikely to be very serious - Frost

and light freezes Tuesday will occur in the northwestern U.S. Plains across southern and eastern parts of Saskatchewan to Manitoba, Canada - Crop

damage in the Prairies will be low except for a few corn, soybean and flax crops in Manitoba and eastern Saskatchewan where some negative impact is expected since crops are not mature - Late

season canola in eastern Canada will be less impacted - Crop

damage in the northwestern U.S. Plains should be quite low if not minimal - Frost

and light freezes Wednesday and Thursday of next week may occur from western and a few central Nebraska locations to Montana and the eastern Dakotas as well as parts of Minnesota - Most

of the lowest temperatures will be in the 30s which should limit crop damage if that is as cold as it gets; however, some upper 20s will be possible near the surface high pressure center over western Nebraska

- Some

damage to immature corn and soybeans might occur in the far northwestern Corn Belt, but losses would be low and most of the impact would be on quality, but the event is nearly a week away which leaves plenty of potential for change and the situation will need

to be closely monitored - Some

soft frost will occur in southeastern Colorado and western Kansas with low temperatures in the middle and upper 30s in the Texas Panhandle during mid-week next week - Low

temperatures in west Texas will fall to the 40s after highs are in the 90s during the weekend - Some

cotton boll lock might occur, but the cold should not last long enough to be a serious threat.

- Argentina’s

rainfall this week did not occur in the driest wheat areas, but some improved topsoil moisture has occurred in east-central and northeastern parts of the nation

- Rainfall

overnight reached over 2.00 inches near the city of Buenos Aires while rainfall of 0.05 to 0.70 inch occurred in the remaining northeast half of the province - Rainfall

elsewhere varied from 0.05 to 0.57 inch some of that occurring in Santa Fe and Entre Rios where two-day rain totals have provided a short-term bout of relief from dryness - Argentina

rain chances are improving for September 13-16, although confidence is low; the event might be generalized enough to offer greater relief from persistent dryness in parts of the west, but the event is too far out in time to have high confidence - Mexico

rainfall will be greatest in western and southeastern parts of the nation in the coming week

- Some

flooding is possible, although the greatest risk of flooding will be from the remnants of Tropical Storm Nana as it moves from Belize to Chiapas, Mexico - Some

flooding rain will also fall indirectly from the tropical storm over southern Veracruz and in Oaxaca where rainfall of 4.00 to 6.00 inches and locally more than a10.00 inches may result - Dryness

remains in Queensland, Australia and that may harm winter crop reproduction in the next two weeks - Frost

and freeze damage already impacted the crop last week - Most

of Australia’s rain will fall in southern most parts of the nation during the next ten days and the moisture will be good where it occurs, but drying in interior South Australia and northern parts of Western Australia is worrying some wheat and barley producers - India’s

monsoon will begin to withdraw next week - Rain

in northern India over the next several days will raise more concern over open boll cotton quality, but the moisture will be good for future winter crop use - Heavy

rain Gujarat, India and Sindh, Pakistan ended earlier this week and the area is drying down favorably - The

drying trend will continue over the next week - Ivory

Coast and Ghana rainfall will slowly increase in the next two weeks, but near term rainfall will be sporadic and light - France

and parts of Germany are going to remain dry biased for the next ten days - Drought

will prevail in central and eastern Ukraine into Bulgaria and from eastern Ukraine into Russia’s Southern Region and western Kazakhstan - South

Africa rainfall began to increase Wednesday and it will continue today and Friday

- The

moisture will offer a little relief for the dry areas in western and central wheat and barley production areas; more rain will be needed - Brazil

weather will remain wettest from southeastern Parana into Rio Grande do Sul and Uruguay during the coming week; the moisture will be good for winter crops - Ontario

and Quebec will experience a good mix of rain and sunshine over the next two weeks; some drying will be needed thereafter to induce better crop maturation and harvest conditions - Central

America rainfall will be frequent and significant - Central

through northeastern Europe will be wettest this week with periods of rain continuing to maintain moisture abundance and a good environment for crop development, but drying is needed to mature crops - Southeast

Europe will be dry biased over the coming ten days to two weeks - Areas

from central and eastern Ukraine to central and eastern Bulgaria will see very little rainfall and temperatures will be warmer than usual - Faster

than usual crop maturation and harvest progress is expected this year as long as rainfall stays limited - Russia’s

far eastern New Lands will continue to experience some brief periods of drizzle and light rain over the coming week to ten days

- Most

of the precipitation will be very light, but there is some concern over unharvested small grain and sunseed quality - Dry

and warm weather is needed to induce the best maturation and harvest conditions - A

favorable mix of weather will occur over the next ten days in other western CIS locations, but net drying will continue in central and eastern Ukraine, Russia’s Southern Region and western Kazakhstan - Temperatures

will be very warm to hot in this region as well - Indonesia

rainfall continues erratic - Central

and southern Sumatra has been steadily drying recently and needs significant rain - Some

showers and thunderstorms have been noted in the past day or two, but more rain is needed - Java

is also quite dry, but some of that dryness is seasonal - Rainfall

over the next ten days will continue erratic, but at least some rain will fall in each production area at one time or another - Rain

is needed most in parts of Sumatra and western Java -

Philippines

weather has been trending a little drier recently and this trend may continue through the weekend and then greater rain may begin to evolve -

Mainland

Southeast Asia is getting enough rain to support summer crops, but there is a growing concern over off season water supply since summer rainfall has not been as great as needed to restore those supplies -

Wednesday’s

rainfall was a bit too erratic and light resulting in net drying conditions -

New

Zealand rainfall will be erratically distributed for a while and temperatures will be a little cooler biased -

Southern

Oscillation Index was +10.72 today and it will continue positive with the recent rise slowly leveling off for a while

Source:

World Weather Inc.

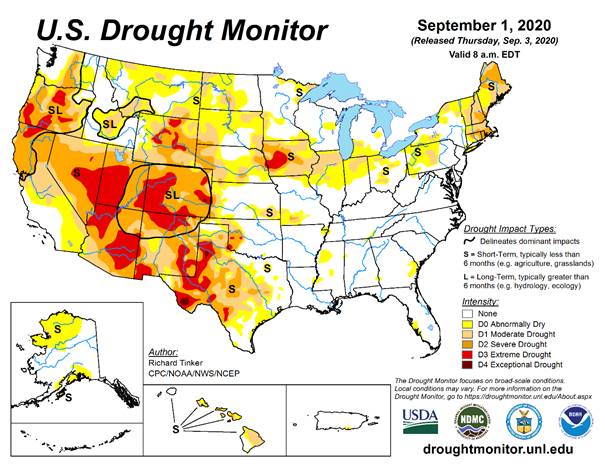

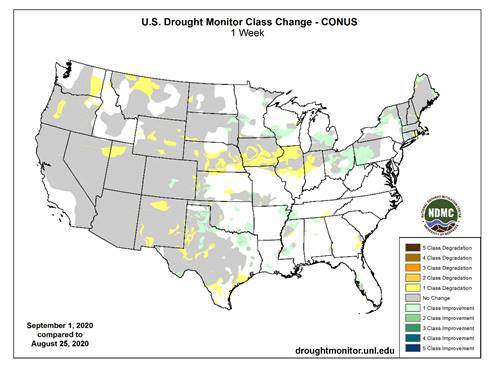

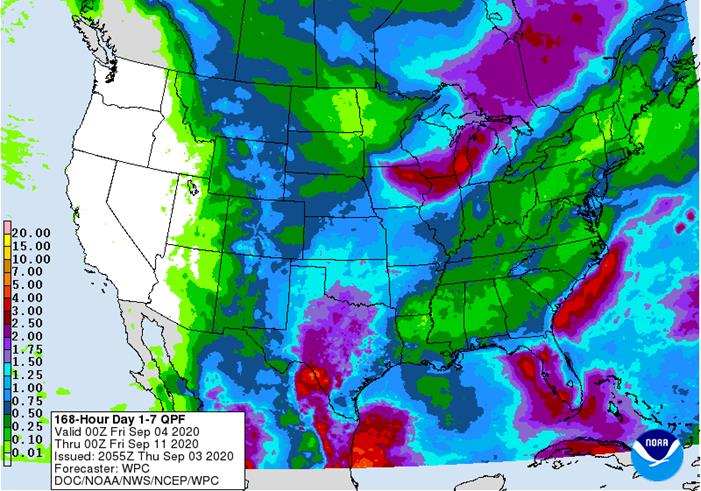

Much

of the rain for the Upper Midwest will occur mid next week

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - New

Zealand commodity price

FRIDAY,

SEPT. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC’s

monthly supply-demand report on Chinese feed grains and oilseeds - FranceAgriMer

weekly update on crop conditions - Statcan’s

data on Canada wheat, barley, soy, canola and durum stocks - HOLIDAY:

Thailand

MONDAY,

Sept. 7:

- China

trade data on soybean and meat imports - International

Grains Council secretariat briefing on trade - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - AB

Foods trading update - HOLIDAY:

U.S., Brazil, Canada, Thailand

TUESDAY,

Sept. 8:

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop condition, harvesting progress for soybeans, corn, cotton, 4pm - Malaysian

Palm Oil Council webinar on Middle East, North Africa palm trade - Abares

Australian crop report

WEDNESDAY,

Sept. 9:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Brazil

Unica cane crush, sugar production (tentative)

THURSDAY,

Sept. 10:

- Malaysian

Palm Oil Board’s end-Aug. palm oil stockpiles, production, export data - Malaysia

palm oil export data for Sept. 1-10 - Conab’s

data on production, area and yield of soybeans and corn in Brazil

FRIDAY,

Sept. 11:

- USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - China

agriculture ministry’s (CASDE) monthly report on supply and demand - New

Zealand food prices

Source:

Bloomberg and FI

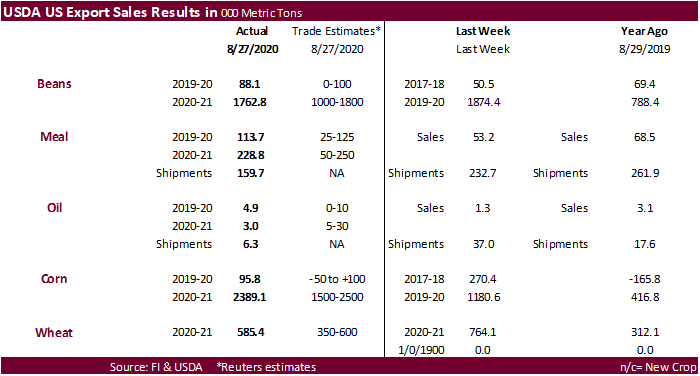

The

soybean complex came within expectations.

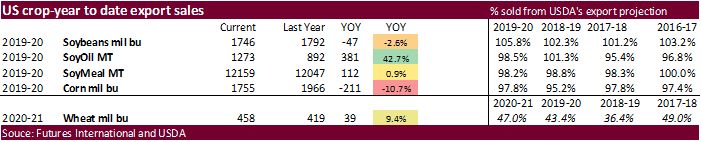

USDA

corn export sales were within expectation but near the top end reflecting the recent 24-hour sales. Sorghum sales were low at 11,900 tons.

USDA

all-wheat export sales were at the top end of expectations.

USDA

pork export sales were excellent at 53,600 tons.

US

Initial Jobless Claims Aug 29: 881K (est 950K; prevR 1011K; prev 1006K)

US

Continuing Claims Aug 22: 13254K (est 14000K; prevR 14492K; prev 14535K)

US

Non-Farm Productivity Q2 F: 10.1% (est 7.5%; prev 7.3%)

US

Unit Labour Costs Q2 F: 9.0% (est 12.0%; prev 12.2%)

US

Trade Balance Jul: -63.6B (est -58.0B; prevR -53.5B; prev -50.7B)

Canadian

International Merchandise Trade Jul: -2.45B (est -2.50B; prevR -1.59B; prev -3.19B)

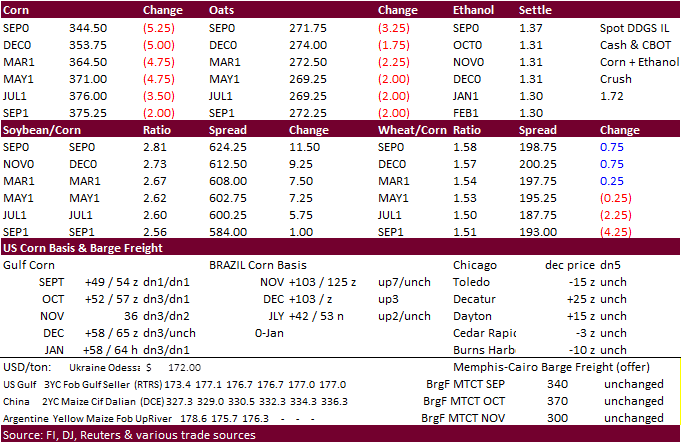

Corn.

-

December

corn futures ended

5.0 cents lower in part to lack of bullish news and improving US weather although any rain that occurs in the dry areas if the US Midwest will be too late for the crop, in our opinion. USDA export sales were excellent of over two million tons.

-

Funds

sold an estimated net 16,000 corn contracts. -

Reuters

noted the was limited available loading capacity at Louisiana Gulf grain terminals and some terminals were sold out of capacity through mid-October. -

China

sold 1.349 million tons of corn from state reserves at an average price of 2,072 yuan per ton. This represented only 34 percent of what was offered, lowest volume sold so far this season.

-

None

reported.

-

December

is seen in a $3.40-$3.85 range.