PDF Attached

Rumors

of China buying US soybeans sent prices higher. Corn followed while wheat traded low on lack of bullish news and less threatening weather forecast for the northern Great Plains and Canadian Prairies.

September

7 (Monday) US holiday trading schedule in excel format

MORNING

WEATHER MODEL COMMENTS

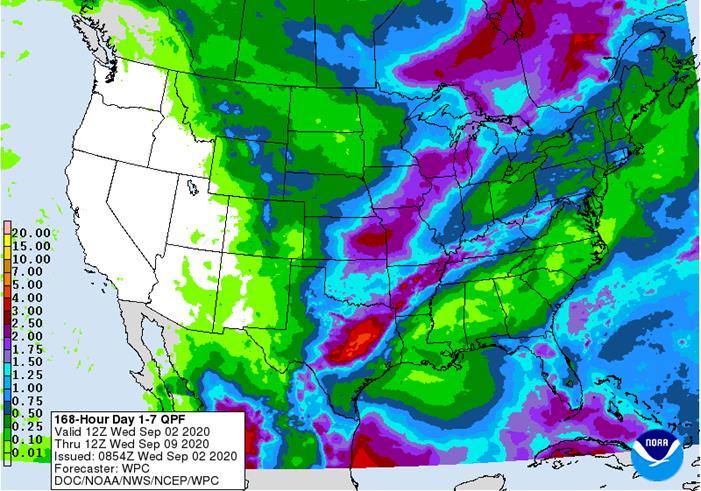

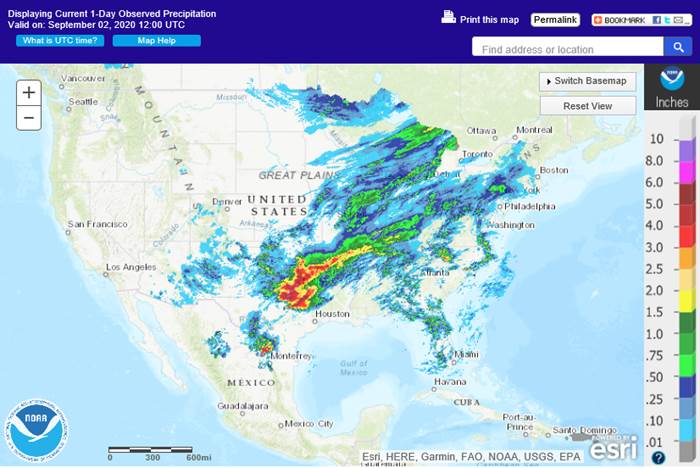

NORTH

AMERICA

- Cooling

advertised for next week was much less aggressive today relative to Tuesday’s forecast model runs and the change seems to have been needed - Sunday

will bring some frost to Alberta and northwestern Saskatchewan Canada - Monday

will generate similar conditions in northeastern Saskatchewan and northern Manitoba with a few light freezes possible in the northernmost crop areas - Tuesday

will bring frost and freezes to the eastern Canada Prairies possible ending the growing season for some areas and possibly pushing some frosty conditions into the northwestern Plains - Wednesday

of next week will bring some frost potential to western Nebraska and immediate neighboring areas as well as a few areas in the eastern Dakotas into Minnesota. A few freezes cannot be ruled out for the eastern Dakotas, the northwest half of Minnesota and possibly

in a couple of western Nebraska locations, but most other temperatures will be above the damage threshold - Most

of today’s models are quick in bringing back warmer air to North America late next week and into the following weekend - Rainfall

was increased from eastern Kansas through Missouri to the Michigan and southern Wisconsin early next week ahead of the mid-week cold - Some

of this increase was overdone - The

06z GFS model reduced rainfall in the central Plains for Tuesday and some reduction was needed - Rain

was also increased in western Tennessee and Kentucky for mid-week next week while some of the heavy rain suggested for northeastern Texas over the next several days was reduced

- The

increase was overdone, but less rain in Texas was needed - Rain

was increased from eastern Iowa to Wisconsin during mid-week next week - The

increase was overdone - Rain

was increased in southern Alberta and central Montana Sep 12-14 - This

was overdone - Rain

from Mississippi, Alabama and Georgia to Pennsylvania and New England was shifted farther to the east Sep 12-14 - The

change was needed - Showers

were increased in the northern Plains and parts of Canada’s Prairies Sep 15-16 - The

increase was overdone - Rain

in the interior southeastern states was reduced Sep. 15-16 - The

change was needed

World

Weather, Inc. would not be surprised to see a second shot of cool air put back into the models for a little later next week. It seems that the cold episode ends too quickly given the environment in which it evolves from. The rainfall increase in the Midwest

early to mid-week next week may be a little overdone, although some increase in rainfall was needed relative to yesterday’s forecasts. Too much moisture was returned to the northern Plains and Canada’s Prairies during the second week of the outlook.

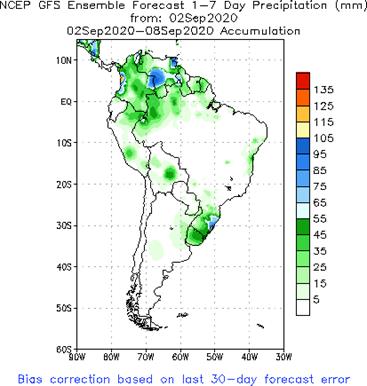

SOUTH

AMERICA

- 06z

GFS model run reduced rain from Cordoba and southern Santa Fe into La Pampa and Buenos Aires Sep 13-14; Rain was also reduced in Entre Rios Sep 15 - This

change was badly needed as the previous model run was much too wet - Rain

was reduced in Minas Gerais, Espirito Santo and Rio de Janeiro for Sep 12-15 - The

reduction was needed and the models may still be too wet for this area - Some

reduction in rainfall was suggested for far southern Brazil Sep. 15-16 - The

change was needed

Not

a lot of change was suggested during the first tend days of the outlook today relative to that of Tuesday for both Argentina and Brazil. Rain in the following five days was increased in southern Argentina and there is some potential for verification, but the

00z model run was much too wet and the 06z run was a little better. Brazil’s wetter bias will remain along the coast and in far southern parts of the nation which should prove to be correct.

EUROPE

- No

significant changes were noted during the coming ten days

RUSSIA

NEW LANDS

- No

significant changes were noted during the coming ten days

Rain

still falls too frequently in the far eastern New Lands where some concern over spring wheat and sunseed conditions remains and where some harvest delay is likely

CHINA

- Not

much change in the models today – it is all about the tropical cyclones in northeastern China - Northeastern

China will get excessive rain from Typhoon Maysak later today into Friday with flooding likely - Northeastern

China will also be impacted by Typhoon Haishen that will arrive late Sunday and continue into Tuesday bringing excessive rain and flooding once again

- If

both storms impact northeastern China some crop damage will come to the region because of excessive moisture and flooding - Delays

in crop maturation and harvesting will also be a serious threat - Some

serious property damage and crop impact is possible - The

Korean Peninsula will be inundated by excessive rain, flooding and strong wind today and early Thursday and again late Saturday into Monday - South

Korea will be most impacted, but both North and South Korea will experience serious flooding and considerable crop and property damage - These

areas have been flooded frequently in recent weeks and damage to personal property and agriculture will be extensive especially in South Korea where excessive wind is also expected and notable storm surges will come to the south coast in both events (today

and Sunday) - Western

Japan will also be impacted by Typhoon Haishen with damaging wind, severe flooding and a notable storm surge resulting in serious property damage for Kyushu - East-central

and interior southeastern China will experience a favorable drying environment over the coming week to ten days

INDIA

- No

changes overnight - Northern

India will be rainy through the weekend and then trend drier next week - Some

concern over cotton quality will remain in the north through the weekend and then conditions will improve - Gujarat,

western Rajasthan and central and southern Pakistan will be drying out in the coming week - Monsoonal

rains will begin drawing in the north next week while rain falls frequently in the south and east

AUSTRALIA

- No

change - Rain

will continue mostly confined to the south coast and lower east coast - Some

increase in rainfall occurred in southwestern Western Australia late next week, but it was likely overdone - Queensland

drought will remain a threat to reproduction - Rain

is still needed in South Australia and northern Western Australia as well

Source:

World Weather Inc.

- EIA

U.S. weekly ethanol inventories, production, 10:30am - UkrAgroConsult’s

Black Sea Grain Conference in Kyiv (Sept. 2-3) - Russia’s

Agriculture Ministry holds annual conference to discuss production and the industry - HOLIDAY:

Vietnam

THURSDAY,

SEPT. 3:

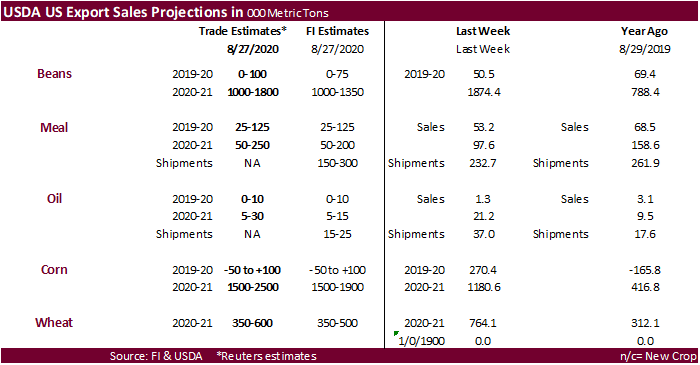

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - New

Zealand commodity price

FRIDAY,

SEPT. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC’s

monthly supply-demand report on Chinese feed grains and oilseeds - FranceAgriMer

weekly update on crop conditions - Statcan’s

data on Canada wheat, barley, soy, canola and durum stocks - HOLIDAY:

Thailand

Source:

Bloomberg and FI

US

2020 estimates from Allendale:

U.S.

corn yield 178.28 / production 14.980 billion

U.S.

soybean yield 51.93 / production 4.311 billion

Canadian

Labour Productivity (Q/Q) Q2: 9.8% (est 6.5%; prevR 4.5%; prev 3.4%)

US

Factory Orders (M/M) Jul: 6.4% (est 6.1%; prev R 6.4%)

–

Factory Orders Ex-Trans (M/M) Jul: 2.1% (prev 4.4%)

–

Durable Goods Orders (M/M) Jul F: 11.4% (est 11.2%; prev 11.2%)

–

Durables Ex-Transportation (M/M) Jul F: 2.6% (est 2.4%; prev 2.4%)

–

Cap Goods Orders Nondef Ex-Air Jul F: 1.9% (est 1.9%; prev 1.9%)

–

Cap Goods Ship Nondef Ex-Air Jul F: 2.4% (prev 2.4%)

US

DoE Crude Oil Inventories (W/W) 28-Aug: -9362K (est -2000K; prev -4689K)

–

Distillate Inventories: -1675K (est -1000K; prev 1388K)

–

Cushing OK Crude Inventories: 110K (prev -279K)

–

Gasoline Inventories: -4320K (est -3050K; prev -4583K)

–

Refinery Utilization: -5.30% (est -4.30%; prev 1.10%)

Corn.

-

December

corn futures started

lower but bounced higher after selling dried. A late session rally in soybeans help lift corn to close 0.75-1.50 cents higher. Gains were limited on lack of bullish news and higher USD. The US weather outlook looks a tad less threatening. US weekly ethanol

figures were perceived bearish. Today we heard Brazil’s president extended their tariff free exemption on ethanol imports by 90 days. It previously expired and reverted back to 20 percent yesterday.

-

Funds

bought an estimated net 1,000 corn contracts. -

Rainfall

was increased from eastern Kansas through Missouri to the Michigan and southern Wisconsin early next week ahead of the mid-week cold.

-

Brazil

exported 6.48 million tons of corn during the month of August, up from 7.3 million tons a year ago.

-

Ukraine

2020-21 grain exports are down 11.8 percent so far since July 1 to 7.73 million tons. Corn shipments are down sharply at 603,000 tons from 1.85 million tons. UGA recently downgraded the Ukraine corn crop to 35.2 million tons from 36.4 million tons.

-

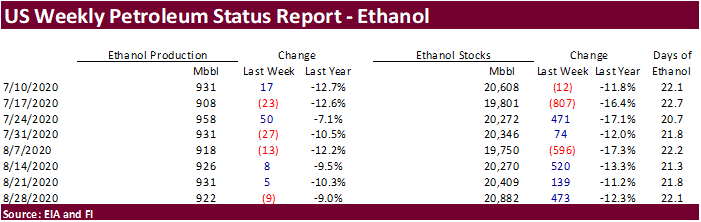

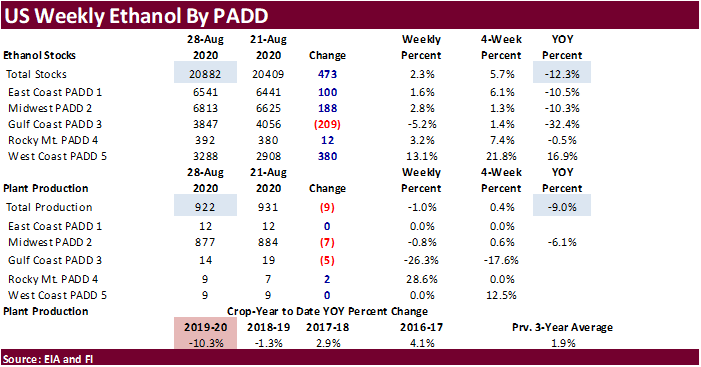

US

weekly ethanol

production came in below expectations at 922,000 barrels, 9,000 below the previous week, and stocks increased by a more than expected 473.000 barrels to 20.882 million.

-

None

reported.

-

December

is seen in a $3.40-$3.85 range.