![]()

September

7 (Monday) US holiday trading schedule in excel format

Wheat

led the rally in all three major commodities. Soybean meal ended lower and soybean oil higher.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Super

Typhoon Maysak will bring horrific rain and wind to South Korea Wednesday and heavy rain and flooding from North Korea into northeastern China; Wednesday into Friday will be stormiest

- Tropical

Storm 11W has formed south of Japan and promises to become another very strong typhoon that may threaten western Japan late this weekend into early next week - The

remnants of this storm may also impact northeastern China - A

tropical depression may evolve this week in the Caribbean Sea and move toward Central America - Tropical

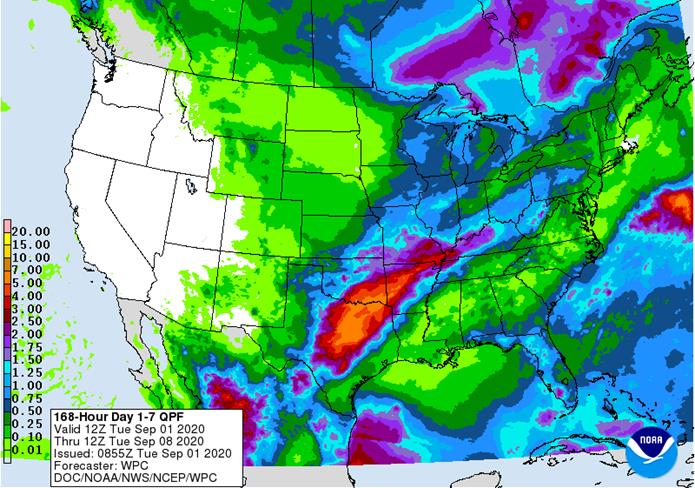

Depression Fifteen evolved off the lower east U.S. coast and was 100 miles southeast of Cape Hatteras early this morning moving east northeasterly overt the next couple of days taking the storm away from North America with very little intensification expected - Dryness

remains in portions of the western and central U.S. Corn Belt with only partial relief expected this week - Argentina’s

rainfall this week will not occur in the driest wheat areas, but some improved topsoil moisture will occur in the northeastern corn and sunseed areas

- Entre

Rios, Corrientes and parts of Santa Fe will be wettest over the next couple of days - Heavy

rain will diminish in northwestern Mexico over the next couple of days; Wet weather will continue in the west and south parts of the nation through the next ten days - Some

increased rainfall may occur in eastern Mexico late this week and into the weekend as the tropical wave from the Caribbean begins to influence the region - Dryness

remains in Queensland, Australia and that may harm winter crop reproduction in the next two weeks - India’s

monsoon will begin to withdraw next week - Rain

in northern India over the next several days will raise more concern over open boll cotton quality, but the moisture will be good for future winter crop use - Heavy

rain Gujarat, India and Sindh, Pakistan has ended, and these areas will dry out over the next week - Ivory

Coast and Ghana rainfall will slowly increase in the next two weeks; some beneficial rain occurred in Ivory Coast coffee and cocoa areas during the weekend - France

and parts of Germany are going to remain dry biased for the next ten days - Drought

will prevail in central and eastern Ukraine into Bulgaria and from eastern Ukraine into Russia’s Southern Region and western Kazakhstan - Frost

and freezes will evolve in parts of Canada’s Prairies during the weekend with some frost in the northernmost U.S. Plains and uppermost Midwest near the Canada border early next week; confidence in the U.S. frost is rising with Sep. 6-8 to be coldest and a

few light freezes cannot be ruled out - South

Korea will be seriously damaged by Typhoon Maysak Wednesday with some damage in North Korea expected too - Australia’s

rainfall during the next week will be mostly concentrated on the south and lower east and lower west coasts leaving interior crop areas in a drying trend - South

Africa rainfall may increase briefly this week to offer a little moisture for eastern wheat and barley production areas; more rain will be needed - Brazil

weather will remain wettest from southeastern Parana into Rio Grande do Sul and Uruguay during the coming week; the moisture will be good for winter crops - Ontario

and Quebec will experience a good mix of rain and sunshine over the next two weeks; some drying will be needed thereafter to induce better crop maturation and harvest conditions - Central

America rainfall will be frequent and significant - Central

through northeastern Europe will be wettest this week with periods of rain continuing to maintain moisture abundance and a good environment for crop development - Southeast

Europe will be dry biased over the coming ten days to two weeks - Areas

from central and eastern Ukraine to central and eastern Bulgaria will see very little rainfall and temperatures will be warmer than usual - Crop

stress will continue high in this region with a further decline in summer crop yields and quality

- Faster

than usual crop maturation and harvest progress is expected this year as long as rainfall stays limited - Russia’s

northeastern New Lands will continue to experience some brief periods of drizzle and light rain over the coming week to ten days

- Most

of the precipitation will be very light, but there is some concern over unharvested small grain and sunseed quality - Dry

and warm weather is needed to induce the best maturation and harvest conditions - A

favorable mix of weather will occur over the next ten days in other western CIS locations, but net drying will continue in central and eastern Ukraine, Russia’s Southern Region and western Kazakhstan - Temperatures

will be very warm to hot in this region as well - Tropical

Wave in eastern tropical Atlantic Ocean will likely move to the central Atlantic without a threat to land.

- Interior

east-central China will experience net drying this week and weekend while showers and thunderstorms slowly return to the southern provinces where some locally heavy rain is possible - Xinjiang

China will continue to experience alternating periods of mild and warm weather with a few showers northeast

- Warm

and dry weather is desirable to help speed cotton and other crops toward maturity after a slightly cooler than usual summer - Freezing

temperatures in southeastern eastern Australia this morning had no lasting impact on crops

- Indonesia

rainfall continues erratic - Central

and southern Sumatra has been steadily drying recently and needs significant rain - Java

is also quite dry, but some of that dryness is seasonal - Rainfall

over the next ten days will continue erratic, but at least some rain will fall in each production area at one time or another - Rain

is needed most in parts of Sumatra and western Java -

Southern

Oscillation Index was +9.74 today and it will continue positive with the recent rise slowly leveling off for a while

Source:

World Weather Inc.

TUESDAY,

SEPT. 1:

- Australia

commodity index - U.S.

Purdue agriculture sentiment - USDA

soybean crush, 3pm - U.S.

corn for ethanol, DDGS production, 3pm - FO

Licht’s virtual Sugar and Ethanol Conference, Sao Paulo (Sept. 1-3) - Cotton

outlook update by International Cotton Advisory Committee in Washington - New

Zealand global dairy trade auction - Honduras,

Costa Rica coffee exports - Malaysia

palm oil export data for August 1-31

WEDNESDAY,

SEPT. 2:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - UkrAgroConsult’s

Black Sea Grain Conference in Kyiv (Sept. 2-3) - Russia’s

Agriculture Ministry holds annual conference to discuss production and the industry - HOLIDAY:

Vietnam

THURSDAY,

SEPT. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - New

Zealand commodity price

FRIDAY,

SEPT. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC’s

monthly supply-demand report on Chinese feed grains and oilseeds - FranceAgriMer

weekly update on crop conditions - Statcan’s

data on Canada wheat, barley, soy, canola and durum stocks - HOLIDAY:

Thailand

Source:

Bloomberg and FI

Brent

Crude Oil Seen Averaging $42.75/Barrel In 2020 (Versus $41.50 In July Poll) – RTRS Poll

US

Crude Oil Seen Averaging $38.82/Barrel In 2020 (Versus $37.51 In July Poll)

-

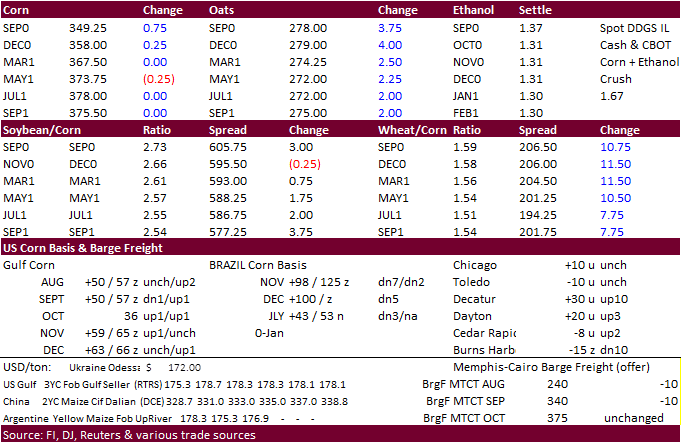

December

corn futures finished 0.25 cent higher at $3.58/bu. Earlier December

corn futures hit a one-week low from a less than expected drop in US crop ratings. The two-sided trade was in part to a lower USDA and higher wheat. Overbought conditions limited gains and the December failed to test its 200-day moving average as it did

yesterday, a bearish indicator for the short term, in our opinion. The December corn and November soybean spread sits at 2.67, highest since in more than a week. We think if the trade fails to extend short covering (managed money now about 47,000 net short),

and extend long positions in soybeans, the SX/CZ could widen back to 2.70-2.75 area sometime in September.

-

Funds

bought an estimate net 1,000 corn. -

Toledo,

OH, CBOT deliverable soybean and corn stocks are at zero. -

APK-Inform

estimated Ukraine’s corn crop could fall 8 percent to 35.1 million tons. Exports are seen at 28.5MMT, down 3 percent from 2019-20.

-

Brazil

failed to renew their zero-tariff ethanol import quota that will be a blow to US ethanol exporters. It will revert to 20% starting today. Later in the day a Reuters story noted they are relooking into temporary quota for tariff-free ethanol imports.

-

Brazil

exported 6.48 million tons of corn during the month of August, up from 7.3 million tons a year ago.

-

Indonesia

plans to cull 4.4 million chickens by September 13 to support depressed egg prices.

-

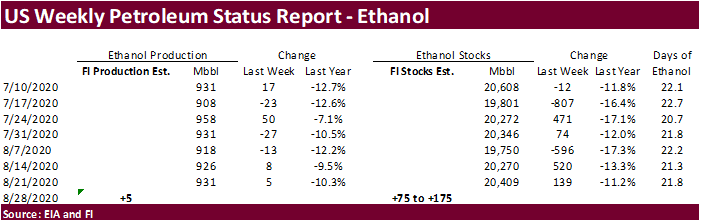

A

Bloomberg poll looks for weekly US ethanol production to be unchanged at 931,000 barrels (918-945 range) from the previous week and stocks to increase 239,000 barrels to 20.648 million. -

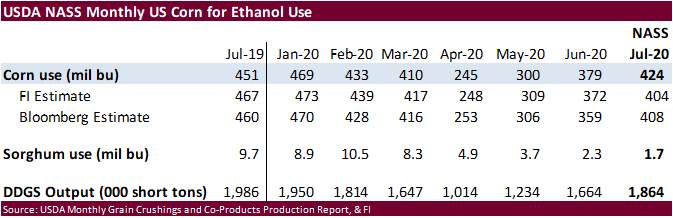

USDA

NASS reported the July corn for ethanol grind at 424 million bushels, well above a Bloomberg trade guess of 408 million bushels, higher than 379 million for June and 451 million during July 2019.

Corn

Export Developments

-

Under

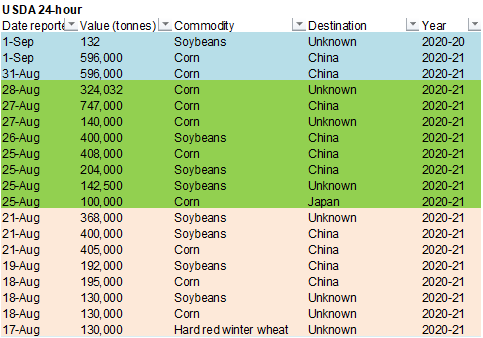

the 24-hour reporting system, private exporters sold 596,000 tons of corn to China, identical to yesterday’s announcement.

-

December

is seen in a $3.40-$3.85 range.

-

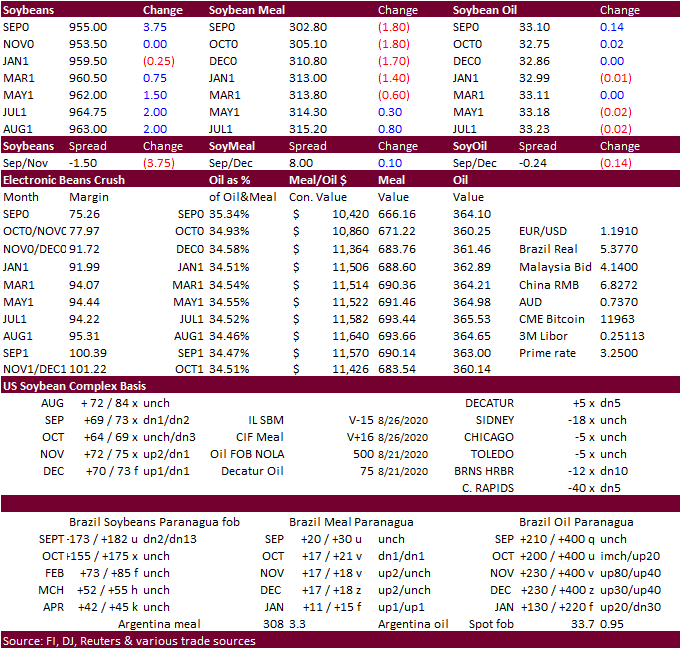

CBOT

November soybeans saw follow through selling at the day session open but turned higher on US weather concerns and additional 24-hour soybean sales to unknown. Soybean meal traded the day lower and soybean oil higher. Offshore values were favoring soybean

oil over soybean meal. November soybeans finished 1.25 cents higher (bear spreading), October meal $1.70 lower and October soybean oil 3 points higher. There was talk some Brazilian importers were checking on US prices.

-

Funds

bought an estimated net 1,000 soybean contracts, sold 2,000 soybean meal, and bought 1,000 soybean oil.

-

Brazil

exported 6.2 million tons of soybeans during the month of August, up from 5 million tons a year ago.

-

Brazil’s

2020-21 soybean crop is seen unchanged by StoneX from their previous estimate at 132.6 million tons with a planted area of 38 million tons.

-

Anec

estimated 2020 Brazil soybean exports at 82 million tons and corn between 31 and 33 million tons.

-

Manitoba,

Canada, was only 7 percent harvested for canola compared to 47 percent for the 3-year average. Dry bean and canola desiccation or swathing is occurring in much of the Eastern, Central and Southwest regions, according to a weekly AgMin report.

-

Ukraine’s

deputy minister projected sunflower production down 8.5 percent to 14 million tons from 15.3 million in 2019.

APK-Inform

reported earlier that Ukrainian sunflower oil export prices appreciated by $15-$25 per ton over the past week. Ukraine started harvesting sunflowers around mid-August.

-

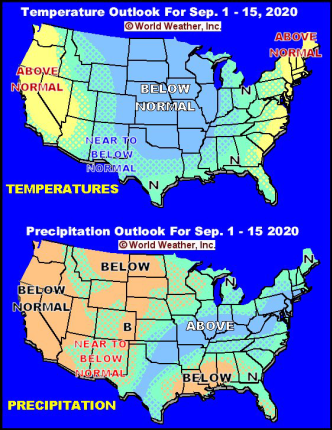

An

increase in rain forecast for later this week for the WCB will be too late to boost crop conditions.

-

U.S.

Delta will receive additional rain this week keeping producers out of the fields while drier weather will occur in the Midwest and Delta late this week.

-

AmSpec

reported August palm exports fell 15.1 percent from the previous month to 1.476MMT from 1.740MMT. ITS reported a 13.1 percent decline to 1.491 million tons.

-

Indonesia’s

2020 palm production was seen at 46.02 million tons, a sharp decline from 47.11MMT in 2019. Exports were projected to fall 18 percent from 2019, according to GAPKI.

-

After

a one-day holiday, Malaysian palm oil traded higher and was near a 7-monthg high.

-

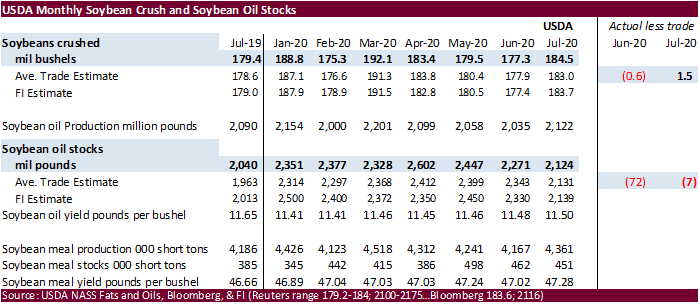

USDA

Nass reported the July crush at 184.5 million bushels, 1.5 million above a Reuters trade guess and above 179.4 million above July 2019. End of July soybean oil stocks came in at 2.124 billion pounds, 7 million below an average trade guess, below 2.271 billion

from previous month and above 2.040 billion year earlier. The soybean oil yield was 11.50 pounds per bushel, up from 11.48 for June.

Oilseeds

Export Developments

-

Under

the 24-hour reporting system, private exporters sold 132,000 tons of soybeans to unknown.

-

Results

awaited: Algeria seeks 30,000 tons of soybean meal for shipment by September 25, optional origin.

-

Egypt’s

GASC seeks local soybean and sunflower oil on September 3 for November 1-25 delivery.

-

November

soybeans are seen in a $9.25-$10.00 range. -

December

soybean meal is seen in a $290-$325 range. -

December

soybean oil is seen in a 32.50-35.00 range.

-

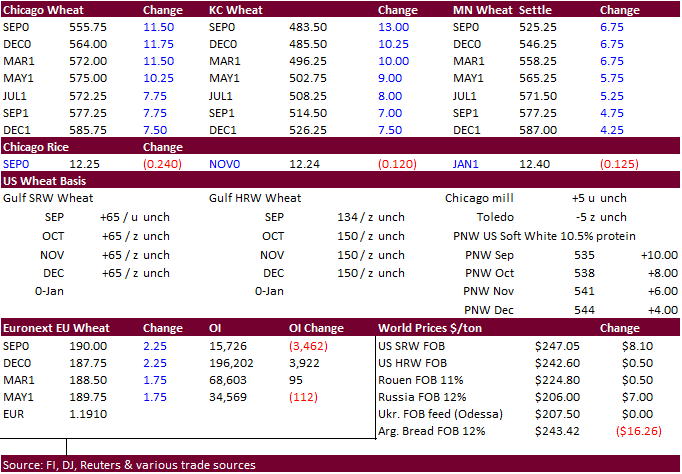

Wheat

traded two-sided on lack of direction earlier but fund buying (new month) lifted prices sharply higher. Bull spreading was a feature. Chicago December settled higher by 11.75 cents, December KC up 10.25 cents and December Minneapolis 6.75 cents higher.

During the session Chicago December reached its highest level since April 20.

-

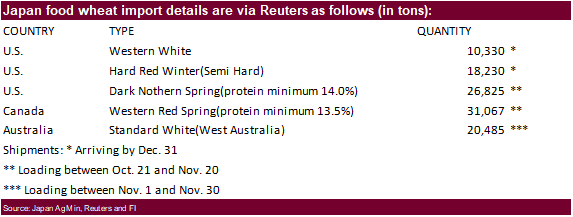

The

lower USD attracted some inflation hedging. Short covering KC wheat was noted. South Korea’s MFG passed on feed wheat overnight.

Japan

seeks 106,937 tons of food wheat later this week for arrival by December 31. There were Rumors China bought HRW wheat out of the PNW. Late last week U.S. Wheat Associates said, “that a grain variety yielded “stellar’ flour for noodles and pizza dough at

a test bakery in China.” (Bloomberg) -

Wheat

futures are vulnerable for volatile moves to the upside and downside as volume is lower than what could be seen in soybeans and corn.

-

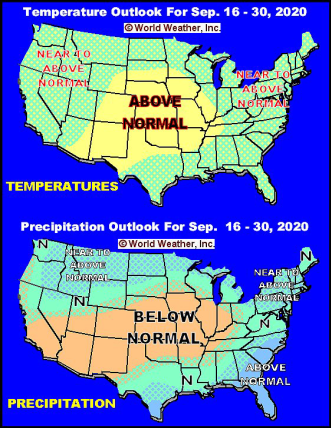

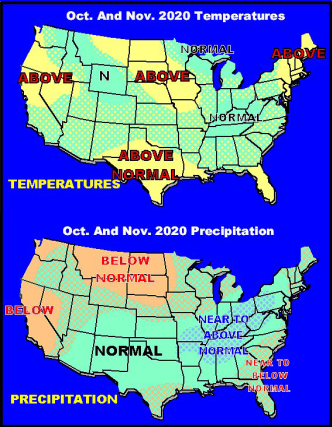

US

Great Plains remains too dry ahead of winter wheat plantings. Argentina’s rainfall this week will not occur in the driest wheat areas. More than a million acres of wheat in Argentina could be affected by drought. Dryness remains in Queensland, Australia.

-

Funds

bought an estimated net 11,000 contracts. -

China

suspended barley imports from Australia’s CBH group, the country’s largest exporter.

-

Paris

December wheat was up 2.00 at 187.50 euros tracking gains in the US markets.

-

South

Korea MFG passed

on

70,000 tons of feed wheat for late Dec and/or early Jan shipment. Lowest

offer was believed to be $249.80 a ton c&f. -

Japan

seeks 106,937 tons of food wheat later this week for arrival by December 31.

-

Results

awaited: Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

-

Algeria

seeks wheat on Sep 2 for October shipment. -

Jordan

issued another import tender for 120,0,00 tons of wheat set to close Sep 2.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14.

·

South Korea bought 60,556 tons of rice for Dec 31-Feb 28 delivery from Vietnam and India.

·

US rice traded higher on US crop concerns

Updated

8/31/20

- December

Chicago is seen in a $5.30-$5.75 range. - December

KC $4.50-$5.60. - December

MN $5.25-$5.70.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.