PDF Attached

Note

prices and basis can be found after the wheat section. We migrated to the cloud so it may take up to a month to get back up and running with multiple tables to support the reports that are issued on a daily basis

Calls:

(note

some are calling the market lower due to less than expected drop in crop conditions and StoneX survey results)

Corn

1-3 higher

Soybeans

2-4 higher

Wheat

steady higher

Volatile

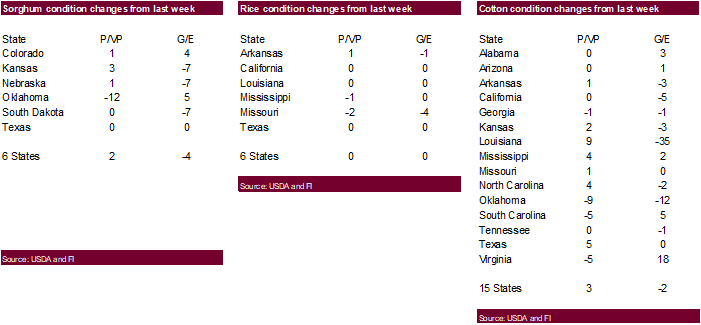

trade was seen today. U.S. Delta will receive additional rain this week keeping producers out of the fields while drier weather will occur in the Midwest and Delta late this week. USDA announced 596,000 tons of corn was sold to China for 2020-21 delivery.

Malaysia was on holiday. Egypt seeks soybean oil and sunflower oil for November shipment. Algeria seeks 50,000 tons of wheat and it was confirmed Pakistan added 320,000 tons of wheat to their 1.5-million-ton import tender. South Korea’s MFG is in for 70,000

tons of feed wheat.

·

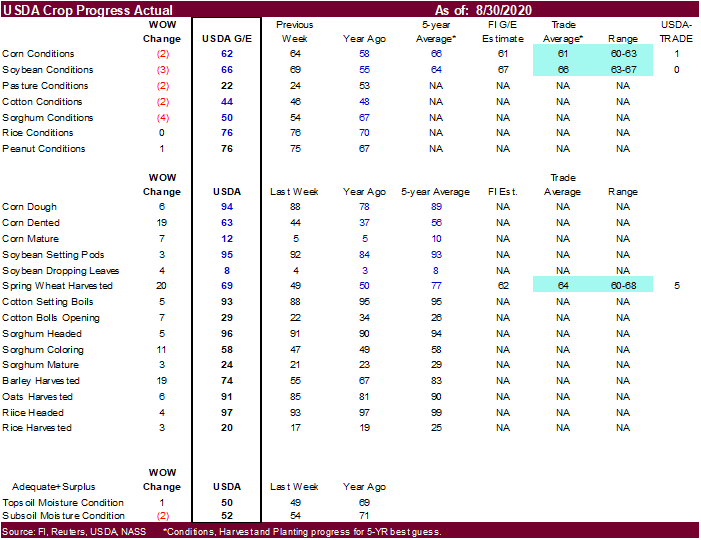

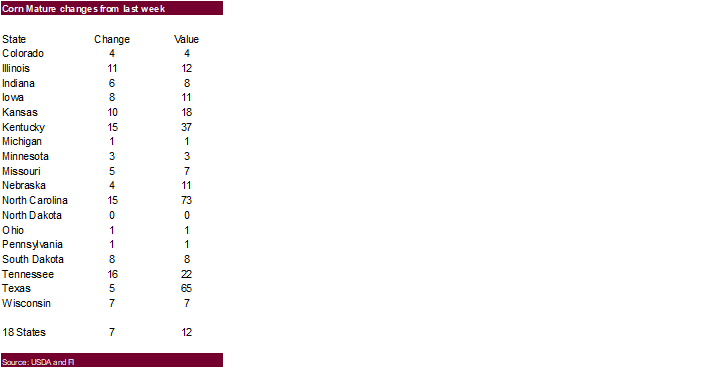

Corn 62% G/E down 2 pts (exp down 3pts), vs 64% last week, and 58% a year ago

·

Corn mature 12% vs 5% last week, and 5% a year ago

·

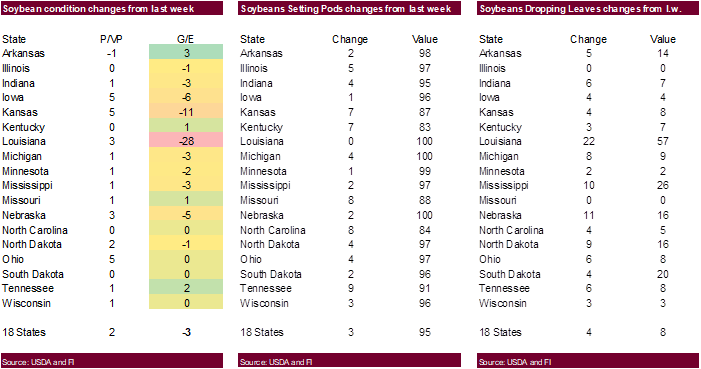

Soybeans 66% G/E down 3pts as expected, vs 69% last week, and 55% a year ago

·

Soybean drop leaves 8% vs 4% last week, and 3% a year ago

·

Louisiana Soy G/E down 28pts to 60% G/E on Hurricane Laura

·

Kansas Soy G/E down 11pts to 56% G/E on persistent dryness

·

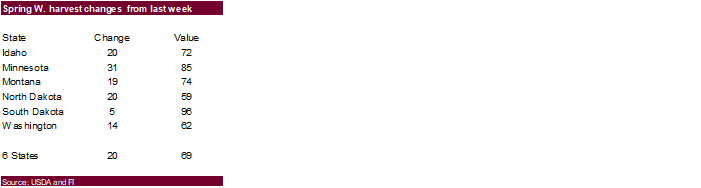

Spring wheat harvest 69% G/E vs 49% last week, and 50% a year ago

MOST

IMPORTANT WEATHER AROUND THE WORLD

- MAIN

THREATS AROUND THE WORLD - Typhoon

Maysak will bring horrific rain and wind to South Korea this week and heavy rain and flooding from North Korea into northeastern China; Wednesday through Friday will be stormiest

- New

tropical depression will form south of Japan this week and it will become a strong storm before moving across western Japan this weekend possibly causing some damage to agriculture and personal property - A

tropical depression may evolve this week in the Caribbean Sea and move toward Central America - Tropical

depression will form off the lower east U.S. coast early this week, but it will move away from land - Dryness

remains in portions of the western and central U.S. Corn Belt with only partial relief expected this week - Argentina’s

rainfall this week will not occur in the driest wheat areas, but some improved topsoil moisture will occur in the northeastern corn and sunseed areas

- Heavy

rain will continue in western and southern Mexico this week; flooding will be possible in Sinaloa, southwestern Chihuahua and western Durango and a few neighboring areas - Dryness

remains in Queensland, Australia and that may harm winter crop reproduction in the next two weeks - India’s

monsoon will begin to withdraw this coming weekend and next week - Heavy

rain will end in Gujarat, India and Sindh, Pakistan early this week with a little rain in southwestern Rajasthan as well

- Ivory

Coast and Ghana rainfall will slowly increase in the next two weeks; some beneficial rain occurred in Ivory Coast coffee and cocoa areas during the weekend - Western

Europe rainfall may increase after this workweek and into next week - Drought

will prevail in central and eastern Ukraine into Bulgaria and from eastern Ukraine into Russia’s Southern Region and western Kazakhstan - Frost

and freezes may evolve in parts of Canada’s Prairies during the weekend with some frost “possible” in the northernmost U.S. Plains and uppermost Midwest near the Canada border; confidence in the U.S. frost is still a little low, but Sep. 6-8 will be coldest

and a few light freezes cannot be ruled out

WEATHER

ISSUES IN DETAIL

- U.S.

weekend weather was mostly dry from portions of Iowa through much of northeastern Missouri to much of Illinois and parts of west-central and southwestern Indiana - Limited

rainfall also occurred in the northern Plains - Much

of central and southern Texas was dry along with central parts of the Delta and in the southeastern states from much of Georgia to central and eastern North Carolina and eastern Virginia - Rain

fell in Wisconsin, western and southern Michigan, northern Indiana and much of Ohio except the southwest - Amounts

ranged from 0.35 to 1.68 inches - Rainfall

in southern Michigan and northeastern Indiana to northern and eastern Ohio where 1.00 to 2.00 inches of rain resulted - Local

totals reached up to 3.00 inches - Remnants

of Hurricane Laura produced 1.00 to 3.00 inches and local totals over 4.00 inches from northeastern Arkansas to Kentucky, Tennessee, northeastern Mississippi and northern Alabama - Rain

fell across Kansas, the Texas Panhandle and eastern Oklahoma, Arkansas and western and southern Missouri

- Moisture

totals varied from 0.50 to 1.60 inches with locally greater amounts - Scattered

showers also occurred from eastern Texas through the central Gulf of Mexico coast to parts of Florida with 0.25 to 1.00 inch of rain with local totals of 1.00 to more than 3.00 inches

- Hot

weather occurred Friday from the central Plains into the Midwest with highest temperatures in the 90s

- Hot

weather occurred most of the weekend in the southern Plains with highs in the range of 100 to 111 degrees Fahrenheit

- Cooling

occurred in much of the northern and central Plains and Midwest during the weekend with highs Sunday afternoon in the 70s

- Lowest

morning temperatures were no cooler than the 40s and 50s in the northern states and were as warm as the 70s across the southern states - U.S.

Delta weather through mid-week will remain too wet for rice and cotton quality - Drier

weather is needed immediately to protect crop conditions - A

near daily rainfall pattern is expected over the next ten days which may prevent meaningful drying from occurring while cotton is in the open boll stage of development and which rice is being harvested - Frequent

showers and thunderstorms will also continue through the next ten days in the U.S. southeastern states there may also be some ongoing concern over crop quality

- U.S.

Midwest weather over the next two weeks will be well mixed with periods of rain and sunshine expected; however, some of the crop areas in Iowa and a few other areas in the west will experience net drying conditions - Milder

temperatures this week will conserve soil moisture through lower evaporation rates, but those areas suffering from dryness will continue stressed - Most

of the declines in production potentials will be slowed by the coming ten days of periodic showers and milder temperatures, but no reversal in the production cuts are likely in the western Corn Belt and until significant rain falls some further decline in

production may result even though it will be smaller than the previous losses - Eastern

and southern Midwest locations will receive plenty of moisture to support improved late season crop conditions - West

Texas may receive some rain Tuesday and Wednesday, but it will not soak the region - Temperatures

will gradually cool down from the hot readings of the weekend and will become more seasonable during the second half of this week

- Very

little rain will fall in the far western United States over the coming week and temperatures will begin trending warmer than usual as the week advances forward

- Far

southern Canada’s Prairies and the northwestern U.S. Plains will continue to experience restricted rainfall and net drying conditions for the next ten days - Other

areas in the Prairies will experience a mix of weather with rainfall sufficient to increase topsoil moisture; this may lead to a slowdown in crop maturation and harvest progress - The

drier areas will continue to experience faster crop maturation rates relative to normal and a quick harvest - Ontario

and Quebec will experience a good mix of rain and sunshine over the next two weeks; some drying will be needed thereafter to induce better crop maturation and harvest conditions - Mexico

rainfall will be greatest in the west and south this week bolstering soil moisture and inducing some local flooding - Some

areas are already saturated with moisture and will be succumb to the excessive moisture raising some concern over crop conditions - Central

America rainfall will be frequent and significant - Argentina

rainfall this week will be greatest Tuesday and Wednesday in the northeast and east-central parts of the country

- Entre

Rios, southern Corrientes and Santa Fe will be wettest with 0.40 to 1.50 inches and a few totals over 2.50 inches

- Rain

elsewhere will not be significant - Most

other areas will experience erratic rainfall over the next ten days with net drying most likely leaving moisture stress for Cordoba, many Santa Few locations and some other areas - Brazil

rainfall will be frequent in the far south during the next ten days followed by a drier biased environment after that - Rainfall

of 2.00 to 5.00 inches and locally more will occur from southeastern Parana to southern Rio Grande do Sul, Brazil with some lighter rain in northwestern Rio Grande do Sul - Net

drying is expected elsewhere except along the coast where rainfall may vary from 0.04 to 0.35 inch most days with a few totals over 0.50 inch - The

environment will be good for most crops, although a few wheat areas might become a little too wet; corn planting should advance in the drier areas and on the drier days - South

Africa will receive some rain east of Northern Cape Tuesday and Wednesday resulting in a short term boost in topsoil moisture for wheat and barley - More

rain will impact eastern wheat and barley production areas late in the coming weekend and early next week - Improved

wheat conditions will result, although more rain will be needed - Western

South Africa will also experience some light rainfall early to mid-week this week benefiting some wheat, barley and canola crops - A

few more showers will occur during the weekend - Other

showers will occur at times through next week, but the resulting rainfall will be erratic and light - West-central

Africa rainfall is expected to slowly ramp up over the next two weeks - Ivory

Coast and Ghana need rain after two months of mostly dry conditions - Rain

expected over the next two weeks will not be uniformly distributed, but it will prime the atmosphere with moisture needed to generate more generalized areas of rain later in September - Some

benefit will come from the next two weeks of showers, but greater rain will be needed - Europe

weather will remain drier biased for France and central Germany through Saturday, but after that rain is expected to bring relief to the dry region - The

moisture will be good for future autumn planting of winter crops, but may disrupt crop maturation and harvest progress early this autumn - Central

through northeastern Europe will be wettest this week with periods of rain continuing to maintain moisture abundance and a good environment for crop development - A

few days of drying will occur during the weekend and early next week only to be followed by waves of new rain later next week - The

environment will be good for late season crops, but may interfere with crop maturation and harvest progress - Southeast

Europe will be dry biased over the coming ten days to two weeks - Areas

from central and eastern Ukraine to central and eastern Bulgaria will see very little rainfall and temperatures will be warmer than usual - Crop

stress will continue high in this region with a further decline in summer crop yields and quality

- Faster

than usual crop maturation and harvest progress is expected this year as long as rainfall stays limited - Rain

fell from southern France through northern Italy to Czech Republic during the weekend with excessive rain and flooding in parts of northern Italy - Rain

totals varied from 2.00 to more than 5.00 inches in the Po River Valley with nearly 10.00 inches in the Swiss Alps - Rain

also fell in the U.K., northern France, Belgium and Netherlands - Drying

occurred in many other areas with drought conditions most serious in southeastern Europe - Warmer

than usual temperatures occurred from southern Spain through Italy to most of the Balkan Countries and southwestern Ukraine where highest temperatures were in the 90s Fahrenheit - Highs

in the 50s and 60s occurred in the U.K. while in the 60s and 70s elsewhere in northern Europe

- Scattered

showers and thunderstorms occurred across western Russia and in a part of the New Lands during the weekend while Ukraine and Russia’s Southern Region was relatively dry with mild to warm temperatures - Highest

temperatures were in the 50s and 60s Fahrenheit across the northern CIS while in the 80s and lower 90s farther to the south - Russia’s

New Lands will continue to experience some brief periods of drizzle and light rain over the coming week to ten days

- Most

of the precipitation will be very light, but there is some concern over unharvested small grain and sunseed quality - Dry

and warm weather is needed to induce the best maturation and harvest conditions - A

favorable mix of weather will occur over the next ten days in other western CIS locations, but net drying will continue in central and eastern Ukraine, Russia’s Southern Region and western Kazakhstan - Temperatures

will be very warm to hot in this region as well - Typhoon

Maysak threatens to damage rice, corn, soybeans and sugarbeets from South Korea to northeastern China Wednesday into Friday of this week - Torrential

rain and flooding are expected along with excessive wind and a notable storm surge in South Korea - Maysak

was located 144 miles south of Okinawa, Japan at 24.7 north, 127.3 east at 0900 GMT today moving northerly at 21 mph and producing maximum sustained wind speeds of 115 mph with tropical storm force wind occurring out 200 miles - Typhoon

force wind was occurring out 55 miles from the storm center - A

new tropical depression is forming south of Japan and it will be closely monitored this week as it moves northward and possibly runs across central Japan’s rice and citrus areas as a tropical storm.

- Tropical

Disturbance in far eastern Caribbean Sea may become a tropical depression storm in the next few days while moving west northwest toward Central America - A

tropical depression may evolve early this week off the southeastern U.S. coast and will move away from land, but could contribute to some coastal rainfall early this week - Two

other tropical waves are expected in the central and eastern tropical Atlantic Ocean this week and need to be closely monitored for further development - Interior

east-central China will experience net drying this week and weekend while showers and thunderstorms slowly return to the southern provinces where some locally heavy rain is possible - A

mix of rain and sunshine will return in the Yellow River Basin and North China Plain next week

- Temperatures

will be warm except in the south where readings will be near average - China’s

late summer crops will need more drying later this month to promote maturation and improved harvest progress, but the rain will be good in winter wheat production areas where planting occurs in late September and October - Xinjiang

China will continue to experience alternating periods of mild and warm weather with a few showers northeast

- Warm

and dry weather is desirable to help speed cotton and other crops toward maturity after a slightly cooler than usual summer - Flooding

on China’s Yangtze River will continue for a while as the region continues to drain surplus water from behind the Three Gorges Dam

- Freezing

temperatures in eastern Australia have mostly ended - Damage

occurred to some winter crops last week, although Queensland is the only state that will suffer some yield decline because of the combined impact of freezes and drought - Other

Australia crops are rated favorably, although rain is needed from Western Australia into South Australia and these areas may dry down for while - Australia

rainfall in the coming week to ten days will continue limited to coastal areas with Victoria wettest along with southwestern Western Australia - Greater

rain is needed prior to reproduction - Queensland

winter crops should be reproducing in the next two weeks and rain is needed - India

weekend rainfall was greatest in Madhya Pradesh, northern Maharashtra and Gujarat - Rainfall

ranged from 2.75 to more than 6.00 inches resulting in some local flooding - A

little more than 8.00 inches occurred in southern Gujarat - Rain

also fell in other northern and west-central India locations as well as the far eastern states, but rain amounts in most of those crop areas was not heavy enough to present serious issues for crops - Net

drying occurred in southern and interior eastern parts of India - Temperatures

were near to slightly above average - India’s

greatest rainfall this week will be today from Gujarat and Sindh, Pakistan into southwestern Rajasthan - Rainfall

will range from 1.00 to 3.00 inches with local totals to more than 5.00 inches - Some

heavy rain is also expected early this week in northern Pakistan, far southern and extreme eastern India where 1.00 to 3.00 inches and local totals over 4.00 inches will result - Net

drying will occur elsewhere - Rain

will fall in central, southern and eastern India later this week through next week while the monsoon pattern slowly begins to withdraw from the north of India - The

drier bias will be welcome especially to cotton harvesting which has experienced a threat to quality because of recent rain - Pakistan

cotton, rice and sugarcane in Sindh will receive more rain early this week and then monsoonal precipitation will begin to withdraw in the balance of the coming two weeks improving cotton maturation and harvest progress - Irrigated

rice, sugarcane and other crops will become more dependent upon irrigation water for late season crop development as seasonal drying begins - A

good mix of rain and sunshine is expected in mainland areas of Southeast Asia over the coming ten days - Indonesia

rainfall continues erratic - Sumatra

has been steadily drying recently and needs significant rain - Java

is also quite dry, but some of that dryness is seasonal - Rainfall

over the next ten days will continue erratic, but at least some rain will fall in each production area at one time or another - Rain

is needed most in parts of Sumatra and western Java -

Philippines

weather has been trending a little drier recently and this trend may continue for the coming week to ten days -

Temperatures

will be seasonable -

Mainland

Southeast Asia is getting enough rain to support summer crops, but there is a growing concern over off season water supply since summer rainfall has not been as great as needed to restore those supplies -

New

Zealand rainfall will be erratically distributed for a while and temperatures will be a little cooler biased -

Below-average

rainfall is expected in North Island and eastern parts of South Island -

Southern

Oscillation Index was +8.97 today and it will continue positive and will likely rise additionally early this week

Source:

World Weather

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions for soybeans, corn, cotton; wheat harvesting progress, 4pm - Statcan

data for Canada wheat, barley, soy, canola and durum production - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Holiday:

U.K., Malaysia

TUESDAY,

SEPT. 1:

- Australia

commodity index - U.S.

Purdue agriculture sentiment - USDA

soybean crush, 3pm - U.S.

corn for ethanol, DDGS production, 3pm - FO

Licht’s virtual Sugar and Ethanol Conference, Sao Paulo (Sept. 1-3) - Cotton

outlook update by International Cotton Advisory Committee in Washington - New

Zealand global dairy trade auction - Honduras,

Costa Rica coffee exports - Malaysia

palm oil export data for August 1-31

WEDNESDAY,

SEPT. 2:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - UkrAgroConsult’s

Black Sea Grain Conference in Kyiv (Sept. 2-3) - Russia’s

Agriculture Ministry holds annual conference to discuss production and the industry - HOLIDAY:

Vietnam

THURSDAY,

SEPT. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - New

Zealand commodity price

FRIDAY,

SEPT. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC’s

monthly supply-demand report on Chinese feed grains and oilseeds - FranceAgriMer

weekly update on crop conditions - StatsCan’s

data on Canada wheat, barley, soy, canola and durum stocks - HOLIDAY:

Thailand

Source:

Bloomberg and FI

StatsCan

July estimates of production of principal field crops

2018 2019 2020 2018-2019 2019-2020

thousands of tons % change

Total wheat

32201 32348 35740 0.5 10.5

Durum

wheat 5745 4977 6926 -13.4 39.2

Spring

wheat 23942 25670 25935 7.2 1.0

Winter

wheat 2514 1701 2879 -32.4 69.3

Barley

8380 10383 10546 23.9 1.6

Canary

seed 158 175 150 11.0 -14.4

Canola

20594 19477 19403 -5.4 -0.4

Chick

peas 311 252 205 -19.2 -18.6

Corn

for grain 13885 13404 13928 -3.5 3.9

Dry

beans 341 317 328 -7.1 3.5

Dry

field peas 3581 4237 4996 18.3 17.9

Fall

Rye 226 326 402 44.1 23.6

Flaxseed

492 486 553 -1.3 13.8

Lentils

2092 2242 2805 7.2 25.1

Mustard

seed 174 135 91 -22.5 -32.3

Oats

3436 4237 4498 23.3 6.1

Soybeans

7417 6045 5962 -18.5 -1.4

Sunflower

seed 57 63 95 9.8 51.5

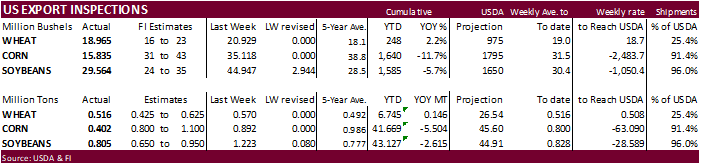

USDA

inspections versus Reuters trade range

Wheat

516,131 versus 400000-700000 range

Corn

402,216 versus 800000-1100000 range

Soybeans

804,591 versus 650000-1000000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 27, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 08/27/2020 08/20/2020 08/29/2019 TO DATE TO DATE

BARLEY

1,270 0 49 3,731 2,987

CORN

402,216 892,031 357,783 41,668,943 47,172,730

FLAXSEED

0 0 0 317 48

MIXED

0 0 0 0 0

OATS

100 0 0 900 299

RYE

0 0 0 0 0

SORGHUM

162,678 70,357 88,718 4,957,123 2,097,682

SOYBEANS

804,591 1,223,251 1,290,414 43,126,553 45,741,582

SUNFLOWER

0 0 0 0 0

WHEAT

516,131 569,593 558,523 6,744,636 6,598,431

Total

1,886,986 2,755,232 2,295,487 96,502,203 101,613,759

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

StoneX

Survey Numbers

Corn

179.6 from 182.4 last month

Prod

15085 from 15.320 billion

Soybeans

52.9 from 54.2

Prod

4388 from 4.496 billion

-

December

corn futures opened higher but turned lower by mid-morning day session on poor US corn shipments despite forward sales to China. September 1 marks a new-crop year, and some traders were booking end of month profits. December corn finished 1.50 cents lower

after hitting a 5-month high. -

US

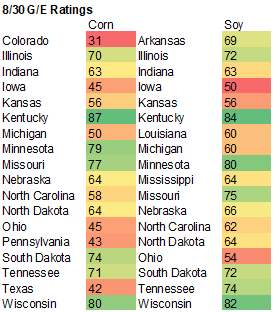

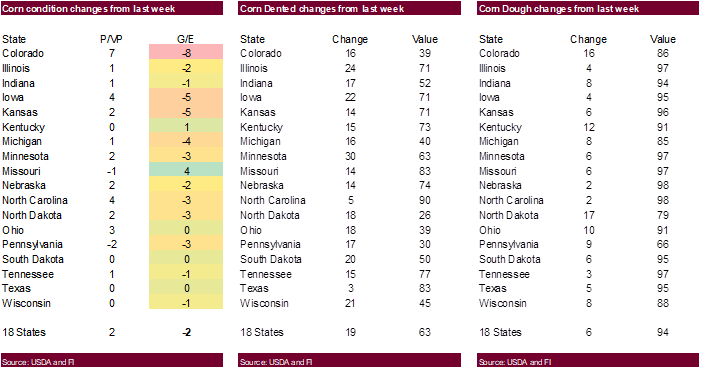

corn conditions declined by a less than expected 2 points (trade looking for 3) to 62 percent, compared to 58 percent year ago and 66 average. Colorado fell 8 points. Iowa and Kansas were down 5 points. Indiana fell 1 point and Illinois dropped 2 points.

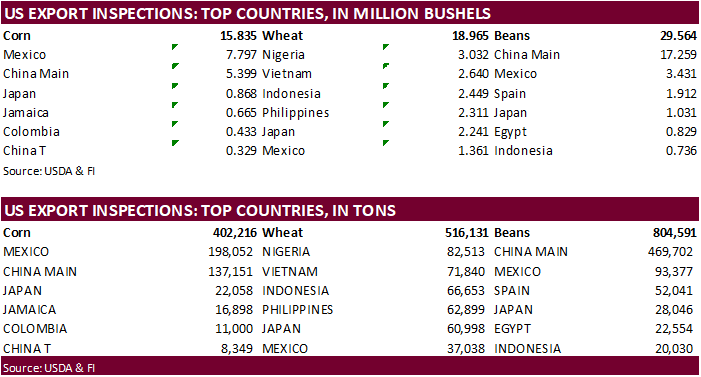

-

USDA

US corn export inspections as of August 27, 2020 were 402,216 tons, well below a range of trade expectations, below 892,031 tons previous week and compares to 357,783 tons year ago. Major countries included Mexico for 198,052 tons, China Main for 137,151 tons,

and Japan for 22,058 tons. -

The

low US Gulf corn inspection loadings were likely a result from disruption from the two storms and closures ahead of the hurricane shifting over TX. We think the low corn inspections supported soybean/corn spreading.

-

Funds

for corn were net even.

Corn

Export Developments

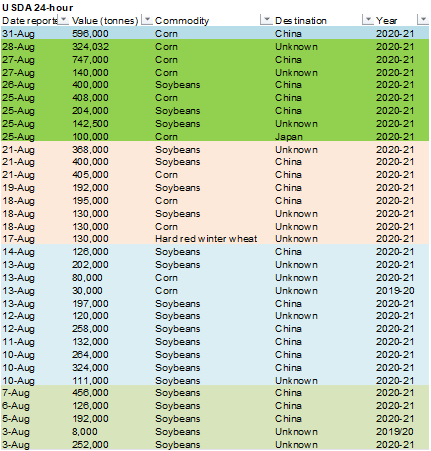

-

Under

the 24-hour reporting system, private exporters reported to the U.S. Department of Agriculture the following activity: -

Export

sales of 596,000 metric tons of corn for delivery to China during the 2020/2021 marketing year.

-

December

is seen in a $3.40-$3.85 range.

-

CBOT

November soybeans were sharply higher Sunday into Monday but paid most of its gains on end of month profit taking. November soybeans hit their highest level since January 15 and on a rolling basis were at a 1-year high. The November contract settled 3.00

cents higher. October soybean oil was up sharply as well but turned lower by mid-session, trading in a wide 123-point outside day range. October soybean oil settled 37 points lower. The crush was higher as October soybean meal ended higher by $2.80. During

the session the October soybean meal contract hit its highest level since March 31.

-

Funds

bought an estimated net 2,000 soybean contracts, bought 4,000 soy meal, and sold 4,000 soybean oil.

-

US

soybean conditions declined 3 points this week to 66 percent, as expected, and compares to 55 year ago and 64 percent average. Louisiana fell 28 points, Kansas was down 11, Nebraska down 5 and Iowa down 6. Soybeans dropping leaves were reported at 8 percent.

-

USDA

US soybean export inspections as of August 27, 2020 were 804,591 tons, within a range of trade expectations, below 1,223,251 tons previous week and compares to 1,290,414 tons year ago. Major countries included China Main for 469,702 tons, Mexico for 93,377

tons, and Spain for 52,041 tons. -

China

soybean purchases from the US for Q4 shipment has been slow since early last week amid increase in CBOT soybean futures.

-

China

sold all of its 76,035 tons of soybeans offered at auction at an average price of 3,171 yuan per ton.

-

Since

July 1, the EU imported 2.57 million tons of soybeans (2.43MMT year earlier) and 640,000 tons of rapeseed (1.26MMT year earlier).

-

StatsCan

estimated the 2020 Canadian canola crop at 19.4 million tons, below a Reuters average trade guess of 20 million.

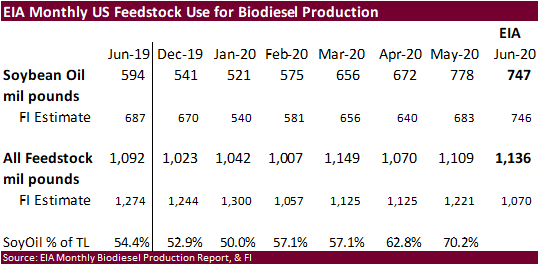

-

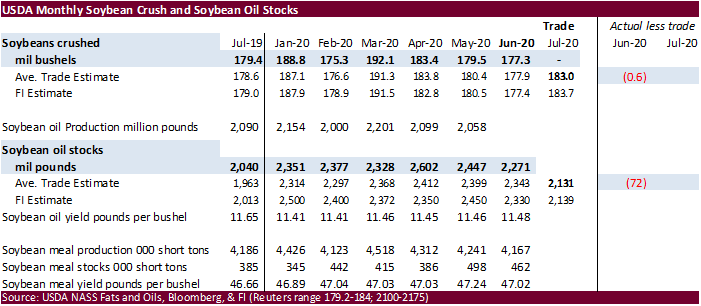

US

soybean oil for biodiesel production came in at our expectation, and we still look for use to end up 75 million pounds above USDA (see attached monthly soybean oil balance).

Reuters:

Brazil is unlikely to renew its non-tariff quota for ethanol imports that expires on Monday, forcing U.S. producers to pay a 20% tariff, a government official with knowledge of the matter told Reuters. Brazil’s foreign trade chamber Camex said that if the

quota is not renewed by the end of the day, the tariff will be re-imposed, affecting U.S. corn ethanol coming into Brazil.

-

Egypt’s

GASC seeks local soybean and sunflower oil on September 3 for November 1-25 delivery.

-

November

soybeans are seen in a $9.25-$10.00 range. -

December

soybean meal is seen in a $290-$325 range. -

December

soybean oil is seen in a 32.50-35.00 range.

-

US

wheat futures traded higher in Chicago and KC and two-sided in Minneapolis. Short wheat crops in Britain and France have supported prices over the past month. A surge in Russian wheat export commitments last week increased cash prices for Black Sea origin,

making US wheat a little more competitive. The weakness in Minn wheat relative to Chicago and KC reflected a larger than expected Canadian wheat crop estimated by StatsCan. The Canadian wheat crop was pegged at 35.7 million tons, a 7-year high, and up from

32.3 million tons a year ago. -

Funds

bought an estimated net 5,000 contracts. -

US

spring wheat harvesting progress advanced 20 points to 69 percent. This was 5 points above expectations and compares to 50 year ago and 77 average.

-

IKAR

reported Russian 12.5%5 Black Sea wheat at $211/ton at the end of last week, up $9.00/ton.

-

IKAR

also estimated the Russian wheat crop at 82.8 million tons, up 300,000 tons from previous.

-

USDA

US all-wheat export inspections as of August 27, 2020 were 516,131 tons, within a range of trade expectations, below 569,593 tons previous week and compares to 558,523 tons year ago. Major countries included Nigeria for 82,513 tons, Vietnam for 71,840 tons,

and Indonesia for 66,653 tons. -

Paris

December wheat was down 1.00 at 185.50 euros (5-week high). -

The

EU exported 2.47 million tons of soft wheat since July 1, down from 4.63 million tons a year earlier.

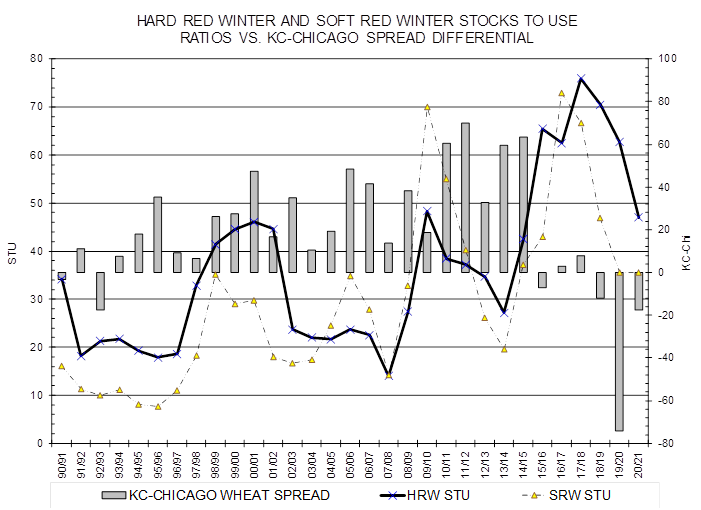

The

KC-Chicago wheat spread is expected to remain at traditional inverse levels this crop-year, due to a tighter HRW STU, unlike last year which was crushed due to a poor quality HRW wheat crop and abundant supplies.

-

South

Korea MFG seeks 70,000 tons of feed wheat for late Dec and/or early Jan shipment.

-

Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

-

Algeria

seeks wheat on Sep 2 for October shipment. -

Pakistan

bought at least 320,000 tons of wheat from their import tender for up 1.5 million tons.

-

Jordan

issued another import tender for 120,0,00 tons of wheat set to close Sep 2.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14. -

Results

awaited: Pakistan seeks 1.5 million tons of wheat. Lowest offer was $233.85/ton for 200,000 tons of milling wheat.

·

South Korea bought 60,556 tons of rice for Dec 31-Feb 28 delivery from Vietnam and India.

·

US rice traded higher on US crop concerns

Updated

8/31/20

- December

Chicago is seen in a $5.30-$5.75 range. - December

KC $4.50-$5.60. - December

MN $5.25-$5.70.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.